Income Isnt The Only Factor For Mortgage Qualifying

Of course, mortgage lenders take your income into account when deciding how much they are prepared to lend you. But income is only one factor in a long list that lenders look at to approve your home loan amount.

Other important factors for mortgage qualifying include:

You dont need to be perfect in all these areas to get a home loan. But improving one area of your finances can often help make up for a weaker area .

How Loan Terms Affect 200k Mortgage Repayments

Generally, you can get a 5 to 30 years loan term to repay a 200k mortgage. The amount it will take you to pay off a 200k mortgage will depend on how much you can realistically afford to pay each month.

The length of the mortgage has a significant effect on repayments and how much you ultimately pay. Extended periods will have cheaper monthly repayments but a higher overall cost, while lesser periods will have higher monthly repayments but a lower total amount.

For example, a 200k mortgage over 30 years will cost you more than a mortgage for 25 years or less but will have cheaper monthly repayments that may be worth the extra cost.

Its advisable to base your decision on how much you can realistically afford to repay each month without financial strain. The table below can give you an idea of how the term affects the total amount and repayments for a 200k mortgage based on an interest rate of 3%.

| Term |

Can I Buy A House If I Make 25k A Year

HUD, nonprofit organizations, and private lenders can provide additional paths to homeownership for people who make less than $25,000 per year with down payment assistance, rent-to-own options, and proprietary loan options.

Also Is a mortgage 3 times your salary? Is a mortgage 3 times your salary? Not necessarily. Most lenders offer eligible borrowers mortgages based on 3-4.5 times their income, but others go higher than this, under the right circumstances. You can read more about this in our guide to income multiples.

What is the average mortgage payment?

State-By-State Average Mortgage Payments

| $ 190,846 |

Can I buy a house making 25k a year? HUD, nonprofit organizations, and private lenders can provide additional paths to homeownership for people who make less than $25,000 per year with down payment assistance, rent-to-own options, and proprietary loan options.

Also Check: What Will Mortgage Rates Do Next Week

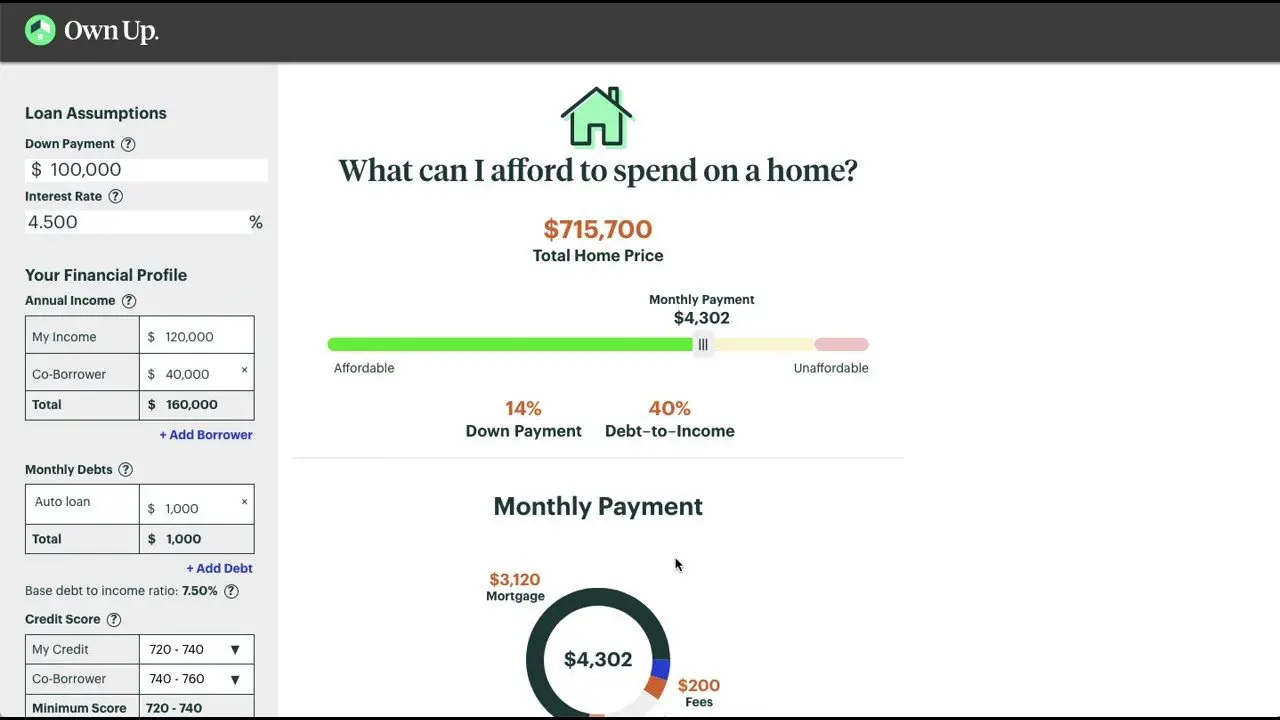

Estimating How Much House You Can Afford

How much house you can afford depends on several factors, including your monthly income, existing debt service and how much you have saved for a down payment. When determining whether to approve you for a certain mortgage amount, lenders pay close attention to your debt-to-income ratio .

Your DTI compares your total monthly debt payments to your monthly pre-tax income. In general, you shouldnt pay more than 28% of your income to a house payment, though you may be approved with a higher percentage.

Keep in mind, however, that just because you can afford a house on paper doesnt mean your budget can actually handle the payments. Beyond the factors your bank considers when pre-approving you for a mortgage amount, consider how much money youll have on-hand after you make the down payment. Its best to have at least three months of payments in savings in case you experience financial hardship.

Along with calculating how much you expect to pay in maintenance and other house-related expenses each month, you should also consider your other financial goals. For example, if youre planning to retire early, determine how much money you need to save or invest each month and then calculate how much youll have leftover to dedicate to a mortgage payment.

Ultimately, the house you can afford depends on what youre comfortable withjust because a bank pre-approves you for a mortgage doesnt mean you should maximize your borrowing power.

Mortgages And Monthly Repayments

If you want to borrow £200,000 to purchase a property, read our guide to see what your repayments could be.

Ask Us A Question

We know everyone’s circumstances are different, that’s why we work with mortgage brokers who are experts in all different mortgage subjects.Ask us a question and we’ll get the best expert to help.

No impact on credit score

4.8 out of 5 stars across Trustpilot, Feefo and Google! Our customers love Online Mortgage Advisor

Author:Pete Mugleston– Mortgage Advisor, MD

If you want to buy a property that requires a £200,000 mortgage, youll likely want to know how much that will cost you each month.

In this article, we look into what this level of borrowing will cost on a monthly basis as well as the factors that affect repayments. We identify how you could potentially minimise your borrowing costs in addition to other fees you should factor into your property purchase.

The following topics are covered below…

Don’t Miss: How Much Percent Of Income Should Mortgage Be

Percentage Of Income Toward Monthly Payment

While the 28% rule is a good starting guideline, there are other factors to think about. Lenders are legally obligated to learn about your assets, expenses and credit history before offering you a mortgage. How reliable your income is can also matter. If much of your earnings come from a source that varies from month to month, like commissions, a lender might not be willing to lend as much to you as it would to someone who earns a consistent salary.

Consider what you can comfortably afford to spend on a monthly basis without affecting other financial goals, such as saving for an emergency fund or investing toward retirement.

Your Monthly Mortgage Payment Will Depend On Your Interest Rate And The Loan Term You Choose

The monthly payment on a $200,000 mortgage will depend on your mortgage rate and loan term. Lower rates and longer terms mean lower payments.

Home prices have skyrocketed over the past year, with the median price for an existing home now exceeding $360,000, according to data from the National Association of REALTORS®. But home prices can vary widely, and you can find a house for significantly cheaper in many areas.

If youre looking for a $200,000 mortgage, the price you can afford depends on factors like your credit, the type of loan, and the interest rate. Lets go over what the monthly payment on a $200,000 mortgage could be, and what to know before closing on the loan.

Dont make the mistake of only getting one quote for a mortgage rate. Credible makes it easy to compare mortgage and mortgage refinance rates from multiple lenders.

Also Check: Is Meridian Home Mortgage Reputable

Why Should I Use A Mortgage Repayment Calculator

A home loan is the biggest expense most people will ever have. Thats why its important to use a mortgage repayment calculator to work out how much your potential home loan repayments could be before applying for a loan, so you know how much you can afford to borrow.

A home loan repayment calculator can help you compare the costs of taking out a home loan and give you an idea of what your monthly repayments could be. Having an understanding of what your monthly repayments could be can help you to work out whether the loan is something you can afford, and what the total cost of the loan will be over the full loan term.

Recommended Reading: Reverse Mortgage On Condo

Is A Fair Credit Score Good Enough For A Mortgage

There is no minimum for the credit score that you have to have in order to be approved for a mortgage. When you apply for credit, mortgage lenders will instead make their decision based on their companys lending criteria. The better your credit score is, the more likely you will be approved for a mortgage loan.

Also Check: Reverse Mortgage On Condo

Recommended Reading: How Does The 10 Year Bond Affect Mortgage Rates

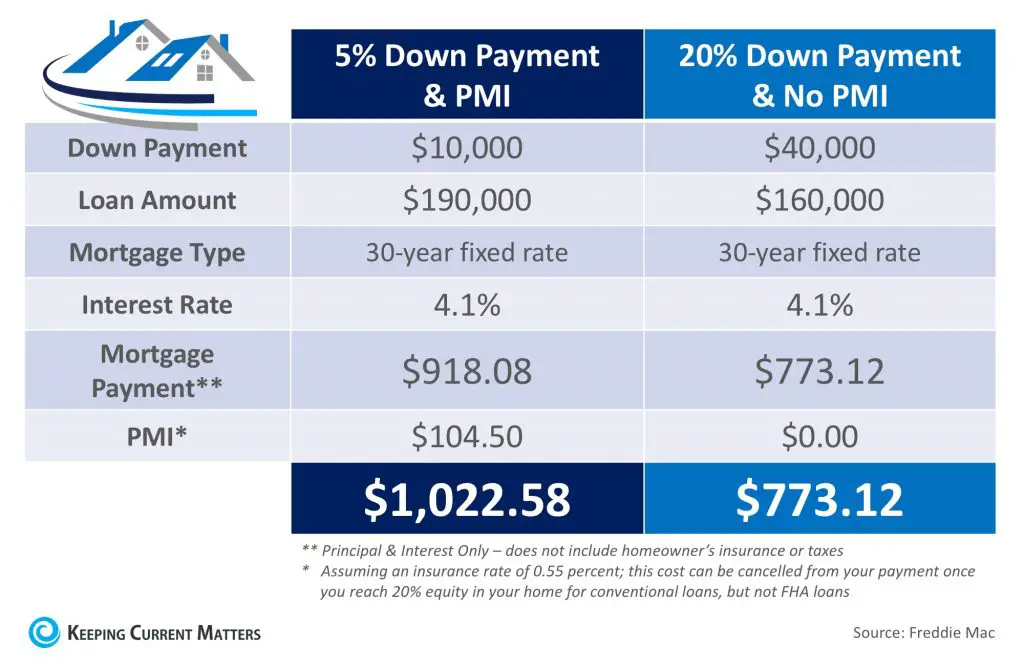

How The Deposit Can Affect 200k Mortgage Repayments

The more deposit you can put down, the better the rates and terms of the mortgage since lenders will see you as lower risk. Better rates translate to lower monthly repayments, so the higher the deposit, the better the deal.

The amount needed as a deposit will depend on the lenders loan to value ratio, your employment type, credit rating, and if youre after a buy-to-let or residential mortgage.

The rate will generally get better with a bigger deposit size. The higher the amount you can put down, the lower the interest and mortgage loan amount youll have to repay.

Know Whats Standing In Your Way

Unfortunately, not everyone is financially ready to buy a home. This Mortgage Income Calculator will show some people that buying, at least at this point, is not within their grasp and offer an understanding of what financial obstacles stand in the way.

This calculator may show you that not enough down payment is your problem. Or maybe its too much debt. Perhaps you simply need to earn more to buy the home you want and need. Or, if you reassess your ambitions, can you afford a less-expensive home?

Don’t Miss: How To Decide When To Refinance A Mortgage

How To Get A 200k Mortgage

The homeownership rate ticked up more than 2 percentage points in the last year, to 67.4 percent. And there are many renters eager to join the club, especially since mortgage interest rates dropped to all-time lows during the coronavirus pandemic.

For first-time homebuyers, the process of becoming a homeowner can be intimidating. Its a big purchase that comes with a host of responsibilities and costs. But, its also a long-term investment that can help secure your financial future.

For some, it might take longer to achieve the American dream especially if you have existing debt, live in an expensive area or are just starting your career whereas others may have all the pieces in place to buy a home already. Regardless of how much you earn or what you have in the bank, its always a good time to start thinking about buying a home.

Becoming a homeowner is one of the most important decisions people make in their lifetime. Its not easy, but it can be done with some hard work and dedication. Next, we will discuss how to become a homeowner from finding an affordable home to finally signing on the dotted line.

Here we break down what you need to do to become a homeowner in 2022 and get approved for that $200,000 mortgage loan.

Comparing Common Loan Types

NerdWallets mortgage payment calculator makes it easy to compare common loan types to see how each type of loan affects your monthly payment. We source the latest weekly national average interest rate from Zillow, so you can accurately estimate and compare your monthly payment for a 30-year fixed, 15-year fixed, and 5/1 ARM.

To pick the right mortgage, you should consider the following:

How long do you plan to stay in your home?

How much financial risk can you accept?

How much money do you need?

15- or 30-year fixed rate loan: If youre settled in your career, have a growing family and are ready to set down some roots, this might be your best bet because the interest rate on a fixed-rate loan never changes.

In general, for a 30-year fixed loan, you will have the lowest monthly payment but the highest interest rate. However, with a 15-year fixed, youll have a higher payment, but will pay less interest and build equity and pay off the loan faster.

If other fees are rolled into your monthly mortgage payment, such as annual property taxes or homeowners association dues, there may be some fluctuation over time.

5/1 ARM and adjustable-rate mortgages: These most often appeal to younger, more mobile buyers who plan to stay in their homes for just a few years or refinance when the teaser rate is about to end.

Don’t Miss: What Is The Monthly Payment On A 400 000 Mortgage

Is 200k A Year Middle Class

At $200,000 a year, you are considered upper middle class in expensive coastal cities and rich in lower cost areas of the country. After $19,000 in retirement contributions to your 401, you are left with $181,000 in gross income, leaving you with roughly $126,700 in after tax income using a 30% effective tax rate.

Most Affordable Markets For Homebuyers

According to 2020 data fromZillow Research, record low mortgage rates have helped to boost affordability for potential homeowners. The table below shows the top 10 most affordable markets to live in for December 2020 and is based on a typical home value of no more than $300,000 . The market and share of income spent on a mortgage may fluctuate based on the current mortgage rate, the typical local homeowners income and the typical local home value.

You May Like: Why Not To Refinance Mortgage

Home Affordability By Debttoincome Ratio

Your debttoincome ratio measures your total monthly debts including your mortgage payment against your monthly income. The higher your existing monthly debts, the less youll be able to spend on your mortgage to maintain a healthy DTI.

For example, say you make $50,000 a year and want to stay at a 36% DTI.

In that case, your total debts, including mortgage and any other debt payments cant exceed $1,500. Heres how that affects your home buying budget:

| Annual Income | |

| $1,000 | $180,406 |

The examples above assume a 3.75% fixed interest rate and 3% down on a 30-year mortgage. Your own rate and monthly payment will vary.

Recommended Reading: Who Has The Best Mortgage Loan Rates

Monthly Payments On A $200000 Mortgage

What is each mortgage payment made up of?

- Principal payment. This goes towards the amount you borrowed from the lender . As you gradually pay off the amount you borrowed, you will be paying interest on a smaller loan amount, so your interest payments will slowly reduce.

- Interest payment. This is the cost to borrow from the lender. The higher your principal and the higher your interest rate, the more interest youll need to repay.

$1,111.66$2,072.77

Monthly payments by interest rate

| Interest |

|---|

Read Also: Is A Mortgage A Line Of Credit

Should I Use The Mortgage Calculator Or Request An Agreement In Principle

Our mortgage calculator and Agreement in Principle both give you an indication of how much you may be able to borrow towards the purchase of a property, monthly repayments and potential interest rates. You can use both tools to help if youâre house-hunting or looking to remortgage.

We ask for a little more information as part of an Agreement in Principle application, but it does provide you with a more formal document that you can use with estate agents and sellers to show that you may be in a financial position to purchase a property. Therefore, it makes sense to have an Agreement in Principle when you are viewing properties with a potential intention to buy.

Read Also: Chase Recast Calculator

How Much Do You Have To Make A Year To Afford A $300000 House

What income is needed for a 300k mortgage? + A $300k mortgage with a 4.5% interest rate over 30 years and a $10k down-payment will require an annual income of $74,581 to qualify for the loan. You can calculate for even more variations in these parameters with our Mortgage Required Income Calculator.

Recommended Reading: What Is Rocket Mortgage Interest Rate

Amortization Schedule For A $250k Mortgage

Amortization for a mortgage shows the process of paying both the interest and principal off on a mortgage. Initially, you will pay mostly interest on your $250k mortgage and eventually pay mostly principal.

An amortization schedule shows each payment towards a mortgage until the predetermined term ends.

How Much A $200000 Mortgage Will Cost You

For a $200,000, 30-year mortgage with a 4% interest rate, youd pay around $954 per month. But the exact costs of your mortgage will depend on its length and the rate you get.

Edited byChris JenningsUpdated April 6, 2022

Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. By refinancing your mortgage, total finance charges may be higher over the life of the loan. Credible Operations, Inc. NMLS # 1681276, is referred to here as “Credible.”

Your mortgage size depends on the homes price and the down payment youre making. If you buy a home priced at $255,000, for example, and put down a 20% down payment , youll need a mortgage worth $200,000.

Youll then pay off that balance monthly for the rest of your loan term which can be 30 years for many homebuyers.

Before you start shopping around, though, youll want to get pre-approved. Getting pre-approved will let you know if you can afford a $200,000 mortgage and demonstrate to sellers that youre a serious buyer. Credibles pre-approval process is simple it only takes a few minutes to see if you qualify for a streamlined pre-approval letter, and it wont affect your credit score.

Learn more about what goes into those payments and how much a $200,000 mortgage loan will cost you:

Don’t Miss: Are There Zero Down Mortgages