What Type Of Spouse Is Eligible For A Va Loan

If a service member dies before she or he uses this benefit, the eligibility will be passed onto the un-remarried spouse .

To be eligible, the surviving spouse, of a service member that has passed away, must have:

- Died due to service-connected disability

- Died while on active duty

- Been MIA , or a POW , for a minimum of 90 days

- Been a completely disabled veteran for a minimum of 10 years before their death

- Remarried spouses are also eligible if they marry after turning 57 after or on December 16, 2003.

In the above cases, surviving spouses are allowed to use VA loan eligibility if they want to purchase a house without a down payment, just as veterans would have.

Connect With A Va Loan Officer Online Today

If youre wondering about how to obtain a VA loan or have any questions about your eligibility, Assurance Financial is here for you. We offer a free rate quote to help you understand how affordable a home could be.

Our helpful staff can also help you find mortgage products that could be a match for you. Assurance Financial is a VA-approved lender and also has many types of home loans for virtually every situation. Whether you want to build a home, access home equity, buy your first home or have another need, our loan officers will work to find your solutions.

To get started applying for a VA home loan, contact your local Assurance Financial loan officer or apply online with our virtual assistant, Abby. The process to pre-qualify can take as little as 15 minutes and could be the first step you take to move into your own home.

How Do You Apply For A Va Home Loan

The very first step in applying for a VA home loan is securing your COE from the VA. A COE is necessary to prove your VA loan eligibility. While it might sound intimidating, this portion of the process is fairly simple and can often be completed in just a few minutes. You can apply for a COE with your lender, by mail, or online through the eBenefits portal.

While there are a variety of lenders who provide VA home loans, Griffin Funding is dedicated to providing our veterans with unparalleled service and the most favorable terms. And, our application process has been streamlined to be as efficient as possible so you do not miss out on the home of your dreams.

You May Like: Which Credit Score Do Mortgage Companies Use

Next Steps For Getting A Va Direct Or Va

Requesting a COE is only one part of the process for getting a VA direct or VA-backed home loan. Your next steps will depend on the type of loan youre looking to getand on your lender .

The lender will request a VA appraisal of the house. An appraisal estimates the houses market value at the time of inspection. An appraisal isnt a home inspection or a guaranty of value.

The lender reviews the appraisal and your credit and income information and decides if they should accept your loan application.

If they decide to accept your application, the lender will work with you to select a title company to close on the house.

Va Loan Property Requirements

The home you want to buy must meet the VA’s minimum property requirements. The standards ensure that homes financed by VA loans are safe, structurally sound and sanitary.

After you’re under contract to buy a home, the lender will hire a VA-approved appraiser to estimate the home’s market value and make sure it meets the minimum property requirements. A VA appraisal may also be required when refinancing a VA loan.

Recommended Reading: Is Ally Bank Good For Mortgages

What Va Loans Options Does Griffin Funding Offer

Griffin Funding offers VA home loans for active-duty military personnel and veterans in Arizona, California, Colorado, Florida, Georgia, Hawaii, Idaho, Maryland, Michigan, Montana, Tennessee, Texas, Virginia, and Washington. Our VA Home Loan Programs include:

- VA Purchase Loan: If you have had trouble qualifying for a traditional mortgage, a VA home loan is an alternative for buying a new home.

- VA Cash-Out Refinance Loan: Replace your current mortgage or a VA loan with a loan that has a lower rate while simultaneously turning equity in your home into cash.

- VA Streamline Refinance: Refinance your current VA loan with another VA loan that has a lower monthly payment. With an IRRRL, you can also roll closing costs and other fees into the new loan balance.

Our loan officers can direct you to the best loan product for your needs. Our services are tailored to your unique situation to make the application process as simple and stress-free as possible.

What Is The Minimum Service Term Required For Va Mortgages

VA loans are typically made available to veterans, active-duty service members , and in certain cases, surviving spouses or family members.

In order to qualify, you are required to meet specific service requirements. These include:

- You have served active duty over 90 days during wartime

- You have served active duty over 181 days during peacetime

- You have served for 6 years with either the National Guard or Reserves

- You havent remarried and your spouse died while on active duty

Once you are eligible for a VA loan program, your eligibility never expires. The veterans that have earned VA entitlement many years ago, still use these benefits to purchase homes.

Read Also: How To Sue A Mortgage Lender

Lender Processes Application And Orders Va Appraisal

A signed purchase contract is the document youll need to finish your initial application. Once your lender has the contract, they will order the VA appraisal. Here again, not just any appraiser will do. Only a professional who is certified to perform appraisals to VA standards can evaluate the home being considered for VA financing. The VA appraiser will make sure the price youve agreed to pay for the home corresponds with the current value. Another very important part of the VA appraisal is to inspect the home to make sure it meets the VA minimum property requirements . However, the VA appraisal does not take the place of a home inspection, which focuses on code violations, defects and the condition of the property. While many borrowers have heard horror stories about the length of the VA appraisal process, the Department of Veterans Affairs gives the appraisers 10 days from order to completion barring extenuating circumstances. While youre waiting for appraisal documents, youll be busy submitting documents of your own to your VA-approved lender to show you have the ability to qualify for the loan. If the home passes appraisal for value and VA minimum property requirements, and its verified by the lender that you qualify for your loan, the underwriter will give his or her stamp of approval.

How To Get Preapproved For A Va Loan

When youre ready to get started on your VA loan preapproval, contact an approved VA home loan lender to start the process. Top VA loan lenders are able to confirm your VA loan eligibility by pulling your Certificate of Eligibility through the VAs automated system.

Assuming you meet VA service requirements, lenders will gather the following to complete your VA loan preapproval:

- Employment history

- Current income and financial assets

- Current monthly debt

For preapproval to happen, lenders need an array of documents to verify a borrowers financial information. Such documents can include, but are not limited to:

- Copy of government-issued photo ID such as a drivers license

- Recent pay stubs

- W-2 statements and federal tax returns from the last two years

- Divorce decree and/or child care statement specifying costs

Of course, if you dont have these documents right away, your lender can give you a checklist of what they need to issue your preapproval.

Also Check: What Does A Fixed Rate Mortgage Mean

Our Top Picks For Best Va Loan Lenders

- Quicken Loans by Rocket Mortgage – Best Online Loan Lender

- USAA – Best for Low Fees

- Veterans First Mortgage – Best for Online Loan Accessibility

- Lending Tree – Best for Comparing VA Loan Rates

- Freedom Mortgage – Best for Streamline Refinancing

- Borrow money to pay for energy-efficient improvements

- No-obligation credit counseling service

- Access to over 6,000 real estate agents

- In-person service in 18 states

- Minimum Down Payment

- $0 for qualifying borrowers

Veterans United offers every mortgage loan product available under the VA loan program fixed and adjustable loans, IRRRL loans, cash-out refinance loans, and jumbo loans except home equity loans and HELOCs. The lender also offers VA energy efficient mortgages, allowing veterans to borrow additional money to pay for qualified improvements like solar heating, cooling systems and storm or thermal windows.

Lender fees and rates are slightly higher than other lenders. To get a rate quote, you can fill out an online form or call Veterans United to speak to a loan specialist. You can also check your eligibility for $0 down payment on the lenders Complete Guide to VA Home Loan section one of the many educational features available on the website.

Why we chose it: We chose Veterans United for its wide array of loan products, online approvals and 24/7 help over the phone.

- Minimum Down Payment

- 0% on VA loans

- $0 for qualifying borrowers

USAA charges no fees, except for the VA-mandated 1% origination fee on home loans.

Why Do Sellers Seem To Dislike Va Loans

The VA has what are called minimum property requirements. These include non-negotiable items like construction defects, termite infestation, leaks, decay, dampness, and continuing settlement in or near the foundation. While sellers engaged with buyers who bring a non-VA loan to the purchase can negotiate the repair costs of these types of items, the VA program requires these items to be fixed before they will give the lender the approval to back the lenders mortgage loan to the borrower. That puts pressure on the seller to fix these issues primarily at their cost if they want to be able to sell their home to the buyer who presents with a VA loan in their pocket.

Don’t Miss: How Much Mortgage Can I Afford With 120k Salary

What If I Dont Meet The Minimum Service Requirements

You may still be able to get a COE if you were discharged for one of the reasons listed here.

You must have been discharged for one of these reasons:

- Hardship, or

- The convenience of the government , or

- Early out , or

- Reduction in force, or

- Certain medical conditions, or

- A service-connected disability

What You Need To Know

- A Department of Veterans Affairs loan preapproval may take as little as one business day depending on the VA mortgage lender

- You get preapproved by filling out an application and providing information about your income, assets and credit history

- VA loans have no limits. Lenders set limits for VA loan preapproval based on the information you provide to your loan officer

Don’t Miss: What Would A Mortgage Be On A 400 000 House

What Is A Va Construction Loan

A VA construction loan is a short-term loan allowing Veterans to purchase land and build a custom home as their primary residence.

In some cases, the construction loan and permanent financing are handled with a single loan at closing before construction commences. This is called a one-time close or single close VA construction loan.

Other times, there are separate closings for both the VA construction financing and for the permanent mortgage.

Keep in mind, it may be difficult to find a true VA construction loan. Contact an experienced home loan specialist to explore loan options when building a home with a VA loan.

Does Your Credit Score Affect Your Va Loan Interest Rate

Your credit score can affect the VA loan interest rate you are offered. When you have a lower credit score, you may be offered a higher rate by VA lenders. Similarly, a higher credit score might help you earn a lower rate. VA loans often have competitive interest rates because they are backed by the Department of Veterans Affairs. Ask us what interest rate we may be able to offer you – even if your credit is less than perfect!

Recommended Reading: Do Usda Loans Have Mortgage Insurance

How To Find A Va Lender

There are many ways for veterans and military personnel to find a VA lender, such as getting recommendations from friends, or searching on the VA website. And just like conventional loans, it can pay to shop around and talk to several different lenders.

Zillow helps make it easy to find a VA lender in your area. Use this link to answer a few questions about the home you want to buy, and youll find a VA lender in minutes. You can also shop for live, custom VA loan mortgage quotes anonymously on Zillow, and then contact the lenders whose quotes you are interested in. Be sure to check the Military/Veteran? box so that VA loans will come up in your search results.

Related Topics

Va Loan Guide: What It Is And How It Works

9 Min Read | Jun 21, 2022

Buying a home is hard work. And if youre a veteran or serving in the military it can be more of a challenge compared to folks who arent.

Thats why the U.S. Department of Veterans Affairs created the VA loan as a mortgage option specifically for veterans.

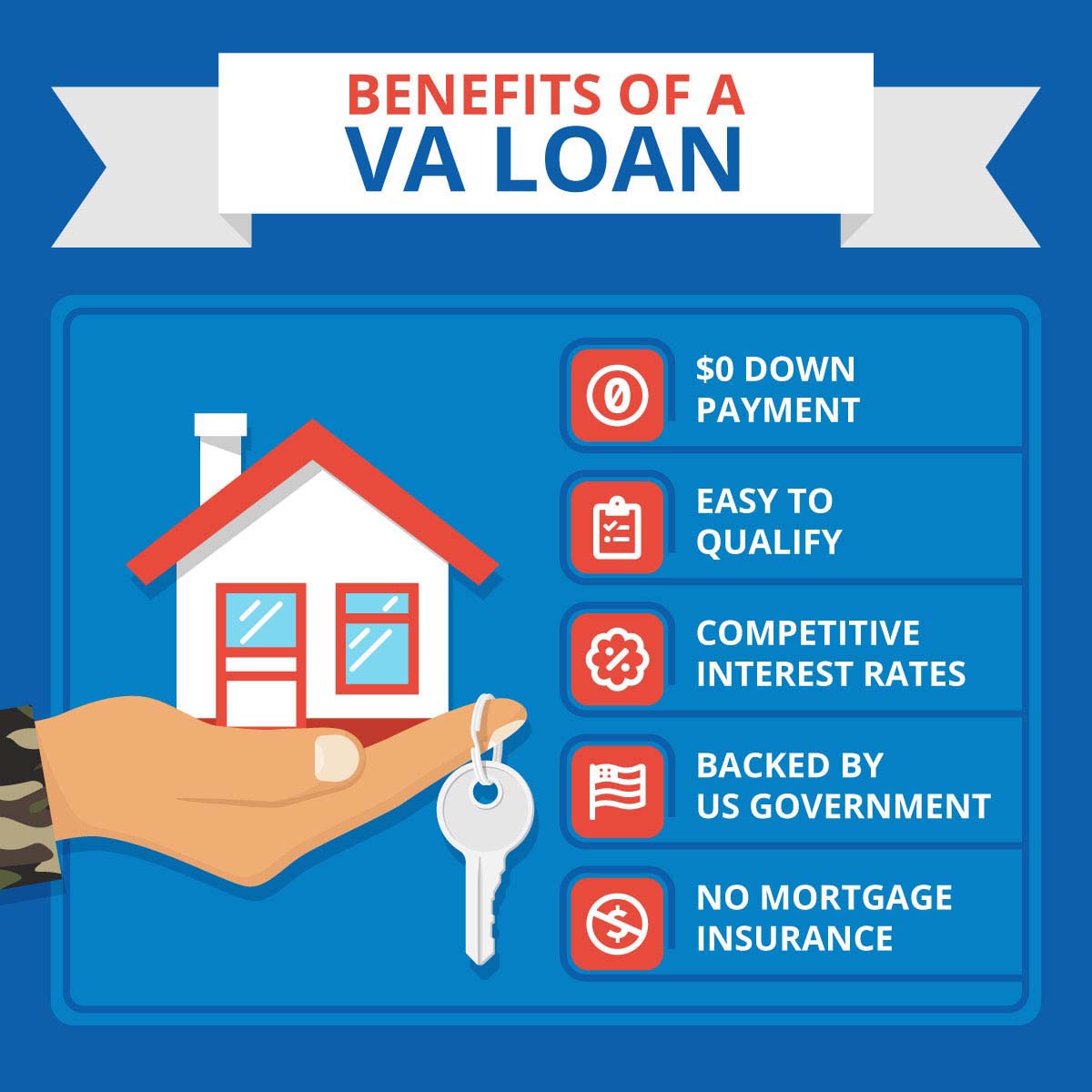

Before we unpack what it is exactly, lets cover the top reasons why some veterans like VA loans:

- Zero down payment required

- No PMI fees

- You can use the loan multiple times

Sure, those points make the VA mortgage loan sound nice. But its not all sunshine and rainbows when you take a closer look at what the VA loan really is and how it all works.

Recommended Reading: Is A Heloc Considered A 2nd Mortgage

S To Buying A Multifamily Home With A Va Loan

Contact A Va Loan Lender

Its important to contact a VA home loan lender early on in the process, so you can start the preapproval process. Having a preapproval letter from a lender will help tremendously when it comes time to place an offer on a home.

Important Tip: Check out this list of the top VA loan lenders, so you can compare and choose the right lender for you.

Recommended Reading: What Is The Recommended Percentage Of Income For Mortgage

Start With A Construction Loan

Veterans unable to find a lender willing to do a VA construction loan can look to get a traditional construction loan and transition that to a VA loan after closing.

Getting a traditional construction loan often requires a down payment. However, it may be possible to recoup the down payment in some cases.

When searching for a construction loan, it can pay to shop around. Talk with multiple builders and financial institutions and compare down payment requirements, closing cost estimates and more.

Some builders may have programs or deals, especially for Veterans and military families. Do your homework and make sure you’re working with a legitimate builder with a track record of success and satisfied homeowners.

Veterans and military members who own the land they want to build on may be able to use any equity they have toward down payment requirements for construction financing.

Veterans who don’t already own land can often include purchasing it in their overall construction loan.

It’s important to understand that construction loans are short-term loans. That means Veterans and military members must start working on the permanent financing as early as possible.

Va Loans For Second Homes

The federal regulations have put a limit on the loans that the Department of Veterans Affairs guarantees to only primary residences.

A primary residence is defined as the property that you will reside in most of the year. In other words, if your residence is out-of-state and you live there for over 6 months in a year, then this property, regardless of whether it is a retirement property or vacation home, is considered as your official primary residence. This is why VA loans have become so popular for senior military borrowers.

Also Check: How Much Does A Mortgage Payment Increase For Every 100000