Adjust Your Homebuying Budget

Instead of timing the mortgage rate market, find a rate youre comfortable with that fits into a monthly mortgage payment you can afford. When figuring out your homebuying budget, factor in potential rate increases so you can see how much a change could affect your monthly payment. Dont stretch your budget to make the rate fit, instead, lower your home purchase budget to accommodate a higher rate. Whatever happens with interest rates in the coming weeks, Derks says the most important thing is to ensure you can afford the home youre looking at. In this environment, if rates are a little bit higher, really reflect on needs versus wants so you get into a house you can afford, she says. Make sure you can afford it and enjoy your life and not be living for your house.

Increase Your Down Payment

Did you know that your down payment amount can have an impact on your mortgage rate? That’s because mortgage rates are generally tiered, and typically lower rates are available for those with a down payment of 20% or more. If possible, check with your lender to see if increasing your down payment will lower your mortgage interest rate.

Economic Reports Next Week

Its a big week for important economic reports. On Friday, theres the PCE inflation report I mentioned earlier. And, on Thursday, the first reading of gross domestic product in the second quarter.

As importantly, on Thursday, the Fed will announce by how much its hiking the federal funds rate, which will affect most forms of borrowing in America. Most expect a 0.75% rise. But one of 0.5% might pull mortgage rates lower, while one of 1% could push them higher.

Critical reports in the following calendar are shown in bold. Other reports next week are unlikely to move markets much unless they contain shockingly good or bad data.

- Tuesday July consumer confidence index. Plus May S& P Case-Shiller home price index

- Wednesday Fed rates announcement. Plus June durable goods orders and core capital equipment orders

- Thursday First reading of Q2 GDP. Plus weekly new claims for unemployment insurance to Jul. 23

- Friday June PCE inflation report. Plus July consumer sentiment index

Its a big week for economic numbers. And they might bring more volatile mortgage rates.

Recommended Reading: Are Cash Out Mortgage Rates Higher

Historic Mortgage Rates: Important Years For Rates

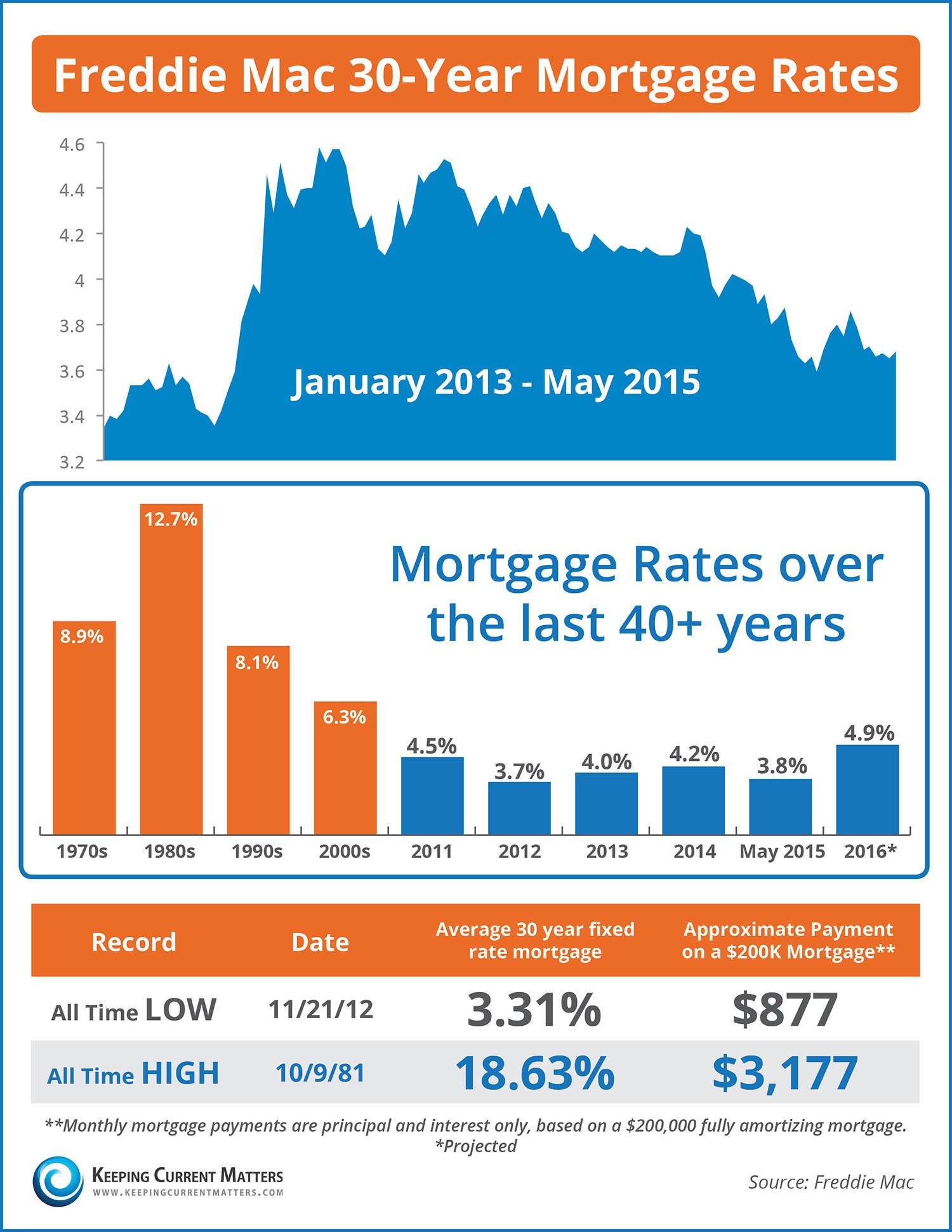

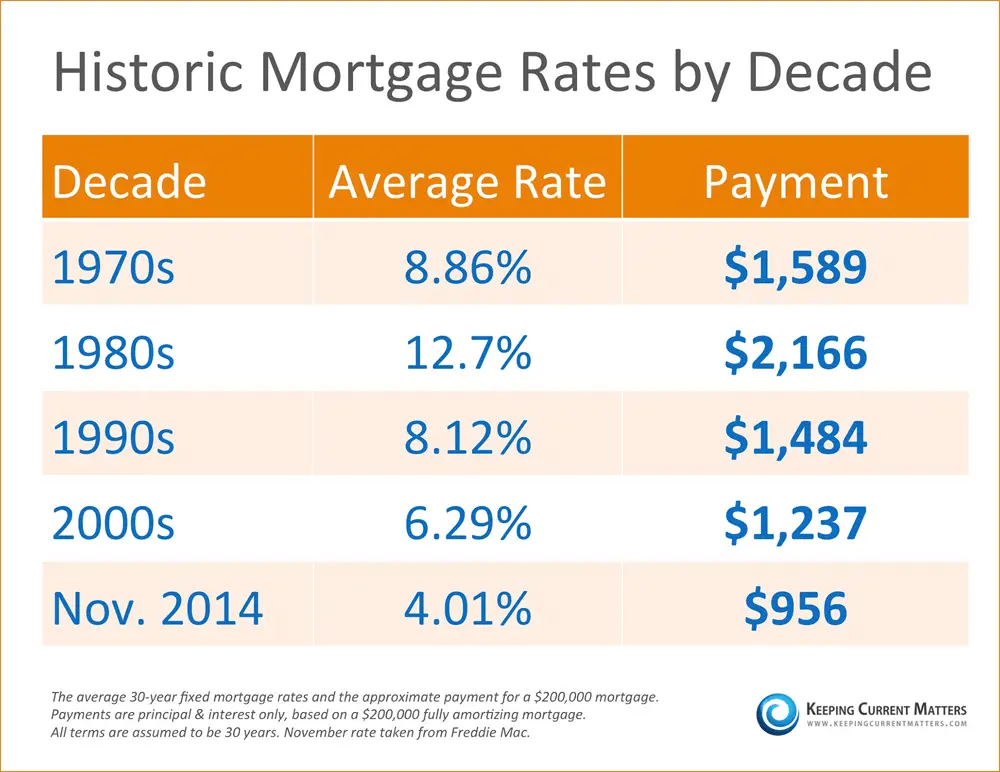

The longterm average for mortgage rates is just under 8 percent. Thats according to Freddie Mac records going back to 1971.

But mortgage rates can move a lot from year to year even from day to day. And some years have seen much bigger moves than others.

Lets look at a few examples to show how rates often buck conventional wisdom and move in unexpected ways.

How Are Mortgage Rates Impacting Home Sales

Mortgage applications were down for the fourth consecutive week. The overall volume dropped 1.8% week-over-week for the seven-day period ending on July 22, according to the Mortgage Bankers Association. This marks the lowest level of both purchase and refinance application activity since February 2000.

Increased economic uncertainty and prevalent affordability challenges are dissuading households from entering the market, Joel Kan, associate vice president of economic and industry forecasting at MBA, said in a press release.

For homebuyers, there could be a silver lining. Stabilizing interest rates and improving inventory may bring some buyers back to the market during the second half of the year, Kan added.

- The total number of purchase applications was down 1% from the previous week and 18% lower year-over-year.

- Refinance applications continue to slide, decreasing by 4% week-over-week and 83% lower compared to the same week a year ago.

Read Also: What Is The Lowest Fixed Rate Mortgage

What Are The Advantages Of A 30

A 30-year fixed mortgage gives you a more affordable monthly payment than a 15- or 20-year mortgage because it stretches the repayment over a longer period. But it also provides flexibility you can pay the mortgage off faster by making extra payments or adding to your monthly payment.

Unlike an adjustable-rate mortgage, a fixed-rate mortgage is predictable. The principal and interest portion of your mortgage payment stays the same, no matter what happens in the economy.

»MORE: See NerdWallets picks for best 30-year fixed-rate mortgage lenders

Whats Moving Current Mortgage Rates

Expectations of a recession in Europe and probably most of the rest of the world heightened this week. The European Union is, globally, the biggest trading bloc. And, when it gets sick, it tends to be infectious.

Last week, Russia turned back on one of its natural gas pipelines into the EU after scheduled maintenance. But the quantity flowing is down to 40% of normal. The International Monetary Fund suggested earlier this week:

The partial shut-off of gas deliveries is already affecting European growth, and a full shutdown could be substantially more severe.

Meanwhile, the eurozones European Central Bank hiked its interest rates on Thursday by 50 basis points , making borrowing there more expensive. The change helped mortgage rates here.

Theres still a reasonable chance that the US will escape a recession. The Fed hopes to create a soft landing, reining in inflation without contracting the economy too far. But it would be even harder for it to achieve that if most of the rest of the world were hurting economically.

Of course, a recession is typically good for mortgage rates, usually driving them lower. But it comes with a steep price tag in terms of higher unemployment and poverty.

Recommended Reading: How To Select A Mortgage Lender

The Great Socal House Hunt: A No

A no-BS guide to buying your first home in Southern California.

Now the Fed is going in the opposite direction. It stopped adding to its balance sheet in March and began to shrink its holdings through attrition: As the bonds it already owns mature or are redeemed by their issuers, the Fed will buy fewer new bonds to replace them. By September, it plans to shrink its holdings each month by $35 billion in mortgage-backed securities and $60 billion in Treasurys.

In other words, Single said, the Fed went from buying $120 billion worth of securities a month to allowing $95 billion a month to roll off its books. Thats more than $2.5 trillion a year in bonds that someone else would have to buy, Single said.

Robert Heck, vice president of mortgage for online mortgage broker Morty, said the Fed has been by far the biggest buyer of mortgage-backed securities over the past 15 years. Its decision to pull back from that market will greatly increase the supply of those securities, driving prices down and interest rates up, Heck said.

The Fed has been explicit about its plans, though, and securities prices now reflect the anticipated effects on supply and demand, Heck said. Still, he said, any change in how Fed leaders talk about their plans for mortgage-backed securities could cause more shifts in interest rates.

The Southern California housing market is cooling and forcing buyers and sellers to adjust. Here is what you should know if you are in the market.

Interest Rates And Apr Vary By Loan Type

30-year mortgage rates also vary by loan program.

If you look at interest rate alone, VA loans typically have the lowest rates, followed by USDA loans.

FHA mortgages also have below-market rates. But they charge expensive mortgage insurance premiums which push up the overall cost of the loan.

Similarly, conventional loans with less than 20% down can have expensive private mortgage insurance . Thats especially true for borrowers with lower credit.

But for borrowers with great credit, PMI is less expensive and wont have as big of an impact on monthly mortgage payments.

You May Like: Can You Get A Reverse Mortgage At Age 60

Why Apr Is Important

The APR, or annual percentage rate, is the all-in cost of your loan. It includes your loans interest and finance charges, accounting for interest, fees and time.

Since APR includes both the interest rate and certain fees associated with a home loan, APR can help you understand the total cost of a mortgage if you keep it for the entire term. The APR will usually be higher than the interest rate, but there are exceptions.

How Often Do 30

The interest rates of 30-year fixed-rate mortgages change frequently. There are a few factors that influence those changes, such as:

- The housing market: When demand rises, lenders increase their interest rates. Likewise, when demand is low, they drop interest rates.

- The federal funds rate: The Federal Reserve decides the federal funds rate, which is the rate financial institutions pay to borrow money.

But dont panic if interest rates increase between the time you start looking for a house and contact a lender. A slightly raised rate may not significantly impact your monthly payments.

In addition, you also want to consider the other terms or service a lender offers. You might find a low rate, but the lender may not provide support or other favorable terms.

Also Check: What Is The Mortgage On 1.4 Million

What Are Origination Fees

An origination fee is what the lender charges the borrower for making the mortgage loan. The fee may include processing the application, underwriting and funding the loan as well as other administrative services. Origination fees generally do not increase unless under certain circumstances, such as if you decide to go with a different type of loan. For example, moving from a conventional to a VA loan. You can find origination fees on the Loan Estimate.

How Big Of A Down Payment Do I Need

Depending on what type of loan you borrow, you may not need to pay a down payment. Some government-backed loans for veterans and farmers may not require a down payment, while conventional loans or Federal Housing Administration loans typically require 3% or more.

To see all your options, visit our loan types page to see what kind of mortgage may be best for you.

Read Also: What Is A Reverse Mortgage Canada

Todays Mortgage Rates And Your Monthly Payment

The rate on your mortgage can make a big difference in how much home you can afford and the size of your monthly payments.

If you bought a $250,000 home and made a 20% down payment $50,000 you would end up with a starting loan balance of $200,000. On a $200,000 home loan with a fixed rate for 30 years:

- At 3% interest rate = $843 in monthly payments

- At 4% interest rate = $955 in monthly payments

- At 6% interest rate = $1,199 in monthly payments

- At 8% interest rate = $1,468 in monthly payments

You can experiment with a mortgage calculator to find out how much a lower rate or other changes could impact what you pay. A home affordability calculator can also give you an estimate of the maximum loan amount you may qualify for based on your income, debt-to-income ratio, mortgage interest rate and other variables.

Other factors that determine how much youll pay each month include:

Loan Term:

Choosing a 15-year mortgage instead of a 30-year mortgage will increase monthly mortgage payments but reduce the amount of interest paid throughout the life of the loan.

Fixed vs. ARM:

The mortgage rates on adjustable-rate mortgages reset regularly and monthly payments change with it. With a fixed-rate loan payments remain the same throughout the life of the loan.

Taxes, HOA Fees, Insurance:

Homeowners insurance premiums, property taxes and homeowners association fees are often bundled into your monthly mortgage payment. Check with your real estate agent to get an estimate of these costs.

How Historical Mortgage Rates Affect Home Purchases

Lower mortgage interest rates encourage home buying. Low rates mean less money paid to interest. This translates to a lower payment. Mortgage lenders determine how much you can borrow by comparing your income to your payment. With a lower monthly payment, you may be able to afford more house.

Even if rates slightly rise, an adjustable rate mortgage can still offer extremely low mortgage rates. The interest rates on ARMs adjust over a period of time. You may be able to get into a lower rated ARM now, then change the loan before it adjusts. Talk to your lender about the possibility of converting your ARM to an FRM if rates go lower.

You May Like: What Are The Repayments On A 100k Mortgage

Comparing Mortgage Amortization Periods

| $165,315 |

When comparing 20-year and 30-year amortizations to the 25-year amortization at a 2% mortgage rate:

- A 20-year amortization increases your monthly mortgage payment by $412/month, but reduces your total interest cost by $28,116

- A 30-year amortization reduces your monthly mortgage payment by $269/month, but increases your total interest cost by $30,139

If you can handle higher monthly mortgage payments, a shorter amortization period can save you thousands of dollars. Many banks and mortgage lenders also allow you to shorten your amortization period by making additional mortgage prepayments, such as through lump-sum principal prepayments, doubling your regular payment amount, and increasing your payment schedule.

The payment frequency determines how often you will make mortgage payments.

Federal Housing Administration Loans

The FHA provides housing programs suitable for first-time homebuyers. It allows borrowers to qualify even if they have low credit scores. With FHA loans, you can make a smaller downpayment to obtain a 30-year fixed-rate mortgage. This makes it a popular financing option for buyers with tight finances. FHA loans come in 15 and 30-year fixed terms, as well as 20-year terms.

Qualifying for FHA Loans

Under the FHA program, if your credit score is 500, your downpayment should be 10% of the loan amount. But if your credit score is at least 580, your downpayment can be as low as 3.5 percent.As for DTI ratio requirements, your front-end DTI should not be lower than 31 percent. Your back-end DTI should not exceed 43 percent, though some borrowers qualify at 50 percent with compensating factors.

In the beginning, FHA loans are affordable for homeowners because of low rates. But after several years of payments, it gets costly because of mortgage insurance premium . In an annual basis, the MIP cost is around 0.45 percent to 1.05 percent of the loan amount. The rates increase as you gain more home equity.

How to Remove Mortgage Insurance Premium

You May Like: How Can I Lower My Mortgage Payment

How Popular Are 30

Thirty-year fixed-rate loans remain the most popular type of financing for homebuyers. Due to its low monthly payments, more people obtain 30-year fixed mortgages. Consumers are likely to qualify for this loan compared to shorter mortgage terms. Though its the longest loan-term available , people take advantage of this option to secure homes they need.

In a comprehensive report conducted by the Urban Institute, 30-year fixed rate loans accounted for 77 percent of new mortgage originations in April 2020. The chart below illustrates how 30-year mortgages take up most of the market share from 2000 to April 2020. The data is based on the Urban Institutes Housing Finance at a Glance: A Monthly Chartbook June 2020.

Thirty-year fixed mortgages are trailed by 15-year fixed-rate loans. According to the same report, it accounted for 14.2 percent of new mortgages in April 2020. Meanwhile, adjustable-rate mortgages represented 2.7 percent of new originations in April 2020. The Other category reflected around 6.1 of the market share. This includes loan options such as 10, 20, and 25-year mortgages.

The pie chart below represents the April 2020 mortgage product market share:

Fha 30 Year Fixed Mortgage Rates

With an FHA 30 year fixed mortgage, you can purchase a home with a lower down payment and flexible lending guidelines or streamline refinance with less documentation than a traditional loan.

FHA loans are backed by the Federal Housing Administration, that is, the federal government insures them. Rather than issuing mortgages, the FHA offers insurance on mortgage payments so that more people can get the financing they need to buy a house or refinance. However, borrowers are required to pay Upfront Mortgage Insurance and monthly mortgage insurance when obtaining an FHA loan.

Do I qualify for an FHA loan?

For FHA 30 year fixed rate loans, there are low down payment options, gifts are allowed, Streamline Refinances are permitted and there are no penalties for repayment.

You May Like: Can A Reverse Mortgage Be Refinanced

How To Compare Mortgage Rates

Mortgage rates like the ones you see on this page are sample rates. In this case, they’re the averages of rates from multiple lenders, which are provided to NerdWallet by Zillow. They let you know about where mortgage rates stand today, but they might not reflect the rate you’ll be offered.

When you look at an individual lender’s website and see mortgage rates, those are also sample rates. To generate those rates, the lender will use a bunch of assumptions about their sample borrower, including credit score, location and down payment amount. Sample rates also sometimes include discount points, which are optional fees borrowers can pay to lower the interest rate. Including discount points will make a lender’s rates appear lower.

To see more personalized rates, you’ll need to provide some information about you and about the home you want to buy. For example, at the top of this page, you can enter your ZIP code to start comparing rates. On the next page, you can adjust your approximate credit score, the amount you’re looking to spend, your down payment amount and the loan term to see rate quotes that better reflect your individual situation.