Why Do Different Mortgage Types Have Different Rrates

Each type of mortgage has a different rate because they have varying levels of risk. One of the primary sources of income for lenders is the money they earn from the interest you pay on your mortgage. For this reason, lenders consider the amount of risk associated with each loan when they set the interest rate. This is referred to as risk-based pricing and is premised on the idea that riskier loans like 30-year mortgages should carry a higher rate.

One of the reasons for this is that its easier to predict what will happen in the economy in the short-term than it is in the long-term. Similarly, theres more risk that something will happen to negatively affect your ability to repay the loan, for instance, if you lose your job or theres an economic downturn.

How Do I Compare Current 30

The more lenders you check out when shopping for mortgage rates, the more likely you are to get a lower interest rate. Getting a lower interest rate could save you hundreds of dollars over a year of mortgage payments and thousands of dollars over the life of the mortgage.

With NerdWallets easy-to-use mortgage rate tool, you can compare current 30-year home loan interest rates whether youre a first-time home buyer looking at 30-year fixed mortgage rates or a longtime homeowner comparing refinance mortgage rates.

What Are The Pre

Your mortgage pre-payment option determines how you can increase the size of your monthly payments, or whether you can make a lump-sum payment directly towards the principal on your mortgage. Your options will be set out in your mortgage contract.

The first pre-payment option you have is to increase your monthly payment amount by a certain, set percentage. This increase in payment will reduce youramortization period and thus, the total interest paid on your mortgage.

A second option is to make a lump-sum payment directly towards the principal of your mortgage. The percentage amount by which you are allowed to make this lump sum repayment is based upon your mortgage’s initial principal value.

Recommended Reading: When Can I Drop My Mortgage Insurance

What Are Points On A Mortgage Rate

Mortgage points represent a percentage of an underlying loan amountone point equals 1% of the loan amount. Mortgage points are a way for the borrower to lower their interest rate on the mortgage by buying points down when theyre initially offered the mortgage.For example, by paying upfront 1% of the total interest to be charged over the life of a loan, borrowers can typically unlock mortgage rates that are about 0.25% lower.

Its important to understand that buying points does not help you build equity in a propertyyou simply save money on interest.

How Are Mortgage Rates Impacting Home Sales

Last week saw an uptick in the number of mortgage applications, with applications for both purchase and refinancing loans increasing by 1.2%.

While the number of applications still remains below 2021 levels, “lower mortgage rates, combined with signs of more inventory coming to the market, could lead to a rebound in purchase activity,” Joel Kan, associate vice president of economic and industry forecasting at the Mortgage Bankers Association , noted in a press release.

- Purchase applications increased by 1% week-over-week and 16% lower compared to the same week last year.

- Refinance applications were up 2% from the previous week but 82% lower than the same week a year ago.

Don’t Miss: How Does Reverse Mortgage Work After Death

How Some Lenders Can Offer Lower Mortgage Rates Than Others

Its always easier to find the lowest mortgage rates than to find the lowest borrowing cost. Thats because lenders like to add gotchyas to their mortgage agreements. These are surprises that boost your cost of borrowing later. Here are four examples of such pitfalls:

How Do I Qualify For A Mortgage

While itâs important to think about qualifying for the best rates, you should also give some thought to the basics that youâll need to qualify and get approved for your mortgage. To qualify for a mortgage, here are some of the most important things that prospective lenders will want to see.

A good credit score – You should have a credit score of 680 or higher to qualify for the best mortgage rates, but to qualify for a mortgage at all, youâll need a credit score of at least 560. In addition to looking at your credit score, prospective lenders will also consider any derogatory information from your credit report, such as any missed payments . If you have bad credit, generally defined as a credit score of less than 660, you are unlikely to qualify for the best mortgage rates, and instead youâll need to use a sub-prime mortgage lender like Equitable Bank or Home Trust. If your credit score is even less than 600, you will most probably need to use a private lender like WealthBridge. Sub-prime mortgage lenders are happy to work with people with a poor credit history, but they will charge higher mortgage rates. It’s a good idea to have a detailed understanding of how your affects your ability to obtain a mortgage.

Recommended Reading: How Much Is The Average House Mortgage

Whats The Difference Between An Adjustable And A Fixed

A fixed-rate mortgage has the same interest rate for the life of the loan. Adjustable-rate mortgages have a low fixed rate for an initial period, often one year. The terms of your loan indicate how and when the rate will adjust. For example, a 5/1 ARM has a low fixed rate for five years and then changes every year. It can go up or down.

One Expert Said That Mortgage Rates Are Likely To Stay Above 5% For Now

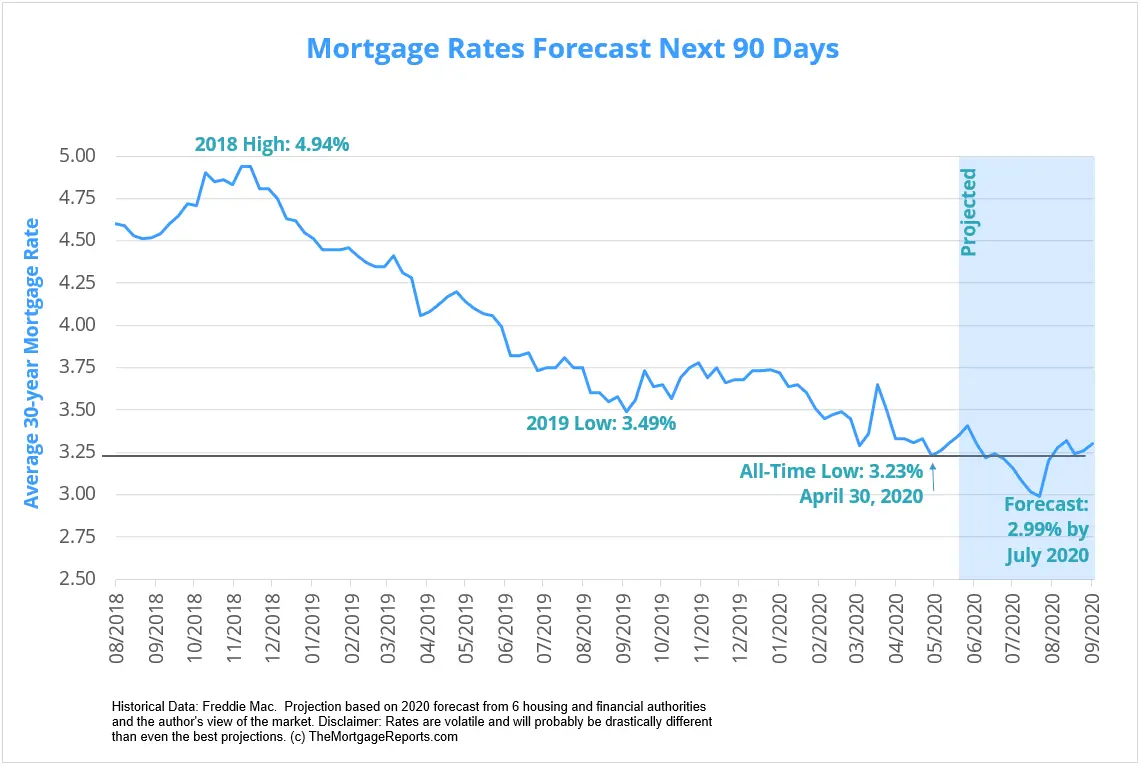

Rates for the 30-year mortgage continued to climb last week as the market anticipates further Fed action toward lowering inflation, according to Freddie Mac.

Rates for the 30-year mortgage rose to almost double what they were a year ago in response to the Federal Reserves efforts to lower inflation, Freddie Mac said.

The average rate for a 30-year fixed-rate mortgage increased to 5.66% for the week ending Sept. 1, according to Freddie Mac’s Primary Mortgage Market Survey. This is an increase from the week prior when it averaged 5.55%, and is significantly higher than last year when it was 2.87%.

Other loan terms also increased last week. The 15-year mortgage increased to 4.98%, up from 4.85% the week before and up from 2.18% last week. The five-year Treasury-indexed hybrid adjustable-rate mortgage also increased to 4.51%, up from 4.36% the week prior and up from 2.43% last year.

“The markets renewed perception of a more aggressive monetary policy stance has driven mortgage rates up to almost double what they were a year ago,” Sam Khater, Freddie Macs chief economist, said. “The increase in mortgage rates is coming at a particularly vulnerable time for the housing market as sellers are recalibrating their pricing due to lower purchase demand, likely resulting in continued price growth deceleration.”

Don’t Miss: What’s The Interest Rate On A 15 Year Mortgage

Should I Use A Mortgage Broker In Bc

Your mortgage is likely to be the biggest financial decision you ever make, and getting a great deal can save you thousands of dollars over time. Comparing rates and offers from different lenders is the best way to find your ideal mortgage.

Of course, with so many lenders, mortgages, and offers on the market, thatâs a daunting task. A good mortgage broker makes it more manageable, as they have access to, and knowledge of, multiple lenders and products on the market.

As well as being convenient, mortgage brokers often have access to exclusive offers and volume discounts, allowing them to get a better rate than whatâs advertised publicly – even from the big banks. BC mortgage brokers can also help by giving you advice on current mortgage deals, your credit history, or help you access a HELOC if you need one.

Mortgage brokers are also free for you to use, so thereâs no risk in speaking to one about your mortgage. At worst, youâll get free personalized advice on the mortgage process, and at best youâll get a great mortgage rate that saves you thousands.

Let us help you determine which rate best suits your individual needs by answering a few short questions about your home and financial history.

What Are Points On A Mortgage

Discount points are a way for borrowers to reduce the interest rate they will pay on a mortgage. By buying points, youre basically prepaying some of the interest the bank charges on the loan. In return for prepaying, you get a lower interest rate which can lead to a lower monthly payment and savings on the overall cost of the loan over its full term.

A mortgage discount point normally costs 1% of your loan amount and could shave up to 0.25 percentage points off your interest rate. The exact reduction varies by lender. Always check with the lender to see how much of a reduction each point will make.

Discount points only pay off if you keep the home long enough. Selling the home or refinancing the mortgage before you break even would short circuit the discount point strategy.

In some cases, it makes more sense to put extra cash toward your down payment instead of discount points if a larger down payment could help you avoid paying PMI premiums, for example.

You May Like: How To Calculate Home Mortgage Interest

How To Apply For A Mortgage Loan

First, youll need to submit personal and financial information to each lender. Most financial institutions now offer completely online applications, and you can even compare loan offers from multiple lenders on sites like LendingTree and Credible. However, you can usually access personal assistance by phone or even in-person if you choose a lender with traditional branches in your area.

Most mortgage applications ask you to input your Social Security number, income, assets, debts, address history, and other general information for a preapproval. This letter from the lender indicates your available loan terms, amount, and interest rate if you decide to move forward with the process. Some preapprovals require a credit check but others do not.

The lender must provide a loan estimate form within three business days of your application. This legal document indicates all costs related to the loan, including principal, interest, insurance, property taxes, closing costs and fees. Depending on this estimate, you can decide whether to move forward with the loan.

When you accept the terms of a loan estimate, you must provide documents to support your application. Examples include tax forms, proof of income such as pay stubs, bank statements for all accounts, investments, and credit cards, and information about your employment status. Many lenders assign a loan coordinator to guide you through the process of submitting your paperwork.

How Does Inflation Affect Mortgage Rates In Canada

To combat rising inflation, the Bank of Canada increases its target for the overnight rate . This in turn makes it more expensive to borrow money and incentivizes people to instead save. As a consequence of people spending less and saving more, demand in the market goes down, which then decreases the rate of inflation.

When the Bank of Canada increases its benchmark interest rate, banks and other mortgage lenders also increase their prime lending rates. Since variable mortgage rates are directly tied to a lenderâs prime rate , when the Bank of Canada hikes its key interest rate, variable mortgage rates consequently also go up.

Fixed mortgage rates, on the other hand, are not tied to the prime rate. Instead, they are directly related to 5-year bond yields. As bond yields increase, the cost to lend money also increases. As a result, lenders raise their fixed mortgage rates.

Given the Bank of Canadaâs outlook and surging inflation in 2022, bond yields have been steadily increasing for the most part since early March 2022. Consequently, so have fixed mortgage rates.

You May Like: How Are Mortgage Interest Rates Determined

Why Should I Compare Mortgage Rates

Choosing a mortgage is a major financial decision since it involves borrowing a significant amount of money. The mortgage interest rate is one of the factors that affects the total amount of money you will have to pay over the course of the amortization period. So, you could save money by finding the lowest rate. But, along with the mortgage rate, you should also compare the terms and conditions of each type of mortgage in order to find the right one for you.

What Is A Mortgage Loan

A mortgage is a type of loan that is used to finance the purchase of a property. This might be a single-family home, a condo unit, a multi-family dwelling or an investment property. Mortgages are also used on the commercial side to purchase industrial buildings, office space or other types of commercial property.

A mortgage is a loan that is secured by property that is being purchased. In the event the borrower cant repay the mortgage, the lender can use the underlying property to try and recoup the remaining balance on the mortgage.

Buying a home is generally the largest purchase that most people make. Understanding mortgage loans is critical. Getting the right mortgage for your situation can significantly impact your overall financial situation and can help you make the home of your dreams an affordable reality.

Don’t Miss: What Is The Payment On A 160 000 Mortgage

Are Variable Rates Better Than Fixed Rates

It depends. Fixed rates suit some people, while variable rates suit other people. Fixed rates are popular due to the stability they offer, but variable rates can offer more savings over time, depending on market conditions. When deciding, consider your appetite for risk, your financial situation, the market conditions, and the length of your mortgage term.

If you’re worried about rates rising, then fixed rates might be the right choice for you. However, if you’re sure rates will go down during your mortgage term – and your household budget can manage increases in your monthly payment – then variable rates could be more appealing.

When Is The Right Time To Get A Mortgage

Before you apply for a mortgage, you should have a proven reliable source of income and enough saved up to cover the down payment and closing costs. If you can save at least 20% for a down payment, you can skip paying for private mortgage insurance and qualify for better interest rates.

The best time to apply is when youre ready. But there are other details to consider when timing your home purchase. Home sales slow down during the winter and competition heats up in the spring which can affect prices. However, general nationwide trends dont always apply to every real estate market. Talk with local experts in your home shopping area to get a better sense of the market.

Read Also: How To Get A Mortgage On A Foreclosure

Decide Why Youre Refinancing

Refinancing is when you take out a new home loan to replace your old one. You might want to do that for a few reasons. If mortgage rates have dropped or your financial situation has improved significantly, you might be able to get a lower interest rate, meaning lower monthly mortgage payments. If your first loan was an FHA loan, you may have to refinance to a conventional mortgage to get rid of mortgage insurance. You may also want a cash-out refinance, in which you take out a loan for more money than you owe on the old loan to turn some of your equity into cash, maybe for home improvements or debt consolidation.

Whats A Good Mortgage Rate

Mortgage rates can change drastically and oftenor stay the same for many weeks. The important thing for borrowers to know is the current average rate. You can check Forbes Advisors mortgage rate tables to get the latest information.

The lower the rate, the less youll pay on a mortgage. Depending on your financial situation, the rate youre offered might be higher than what lenders advertise or what you see on rate tables.

If youre hoping to get the most competitive rate your lender offers, talk to them about what you can do to improve your chances of getting a better rate. This might entail improving your credit score, paying down debt or waiting a little longer to strengthen your financial profile.

Also Check: When Can A Mortgage Company Foreclose