How To Calculate Mortgage Payments

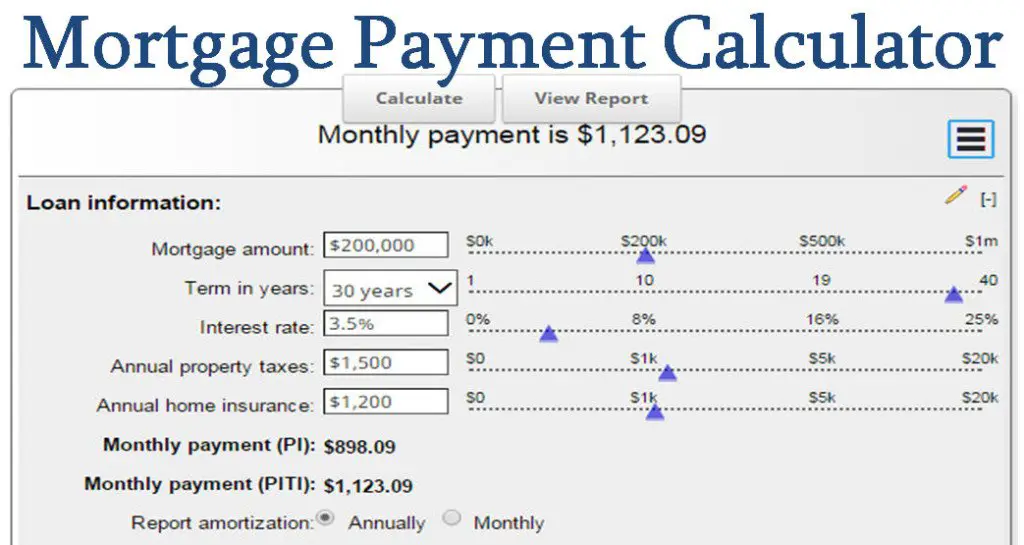

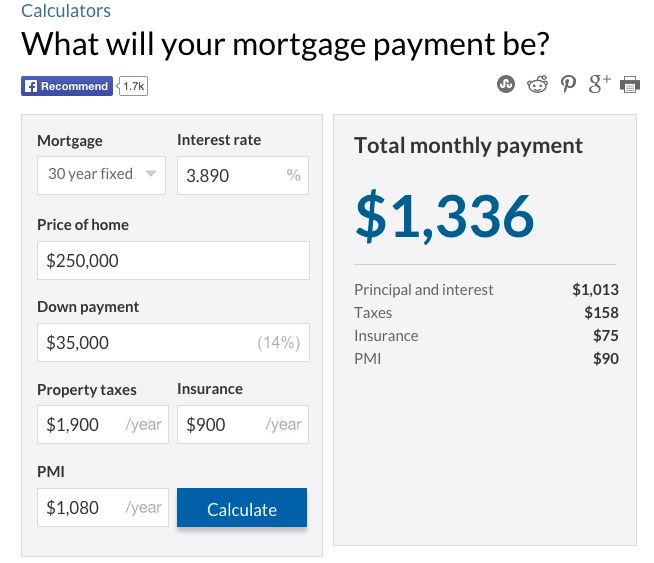

Zillow’s mortgage calculator gives you the opportunity to customize your mortgage details while making assumptions for fields you may not know quite yet. These autofill elements make the home loan calculator easy to use and can be updated at any point.

Remember, your monthly house payment includes more than just repaying the amount you borrowed to purchase the home. The “principal” is the amount you borrowed and have to pay back , and the interest is the amount the lender charges for lending you the money.

For most borrowers, the total monthly payment sent to your mortgage lender includes other costs, such as homeowner’s insurance and taxes. If you have anescrow account, you pay a set amount toward these additional expenses as part of your monthly mortgage payment, which also includes your principal and interest. Your mortgage lender typically holds the money in the escrow account until those insurance and tax bills are due, and then pays them on your behalf. If your loan requires other types of insurance like private mortgage insurance or homeowner’s association dues , these premiums may also be included in your total mortgage payment.

Changes In Mortgage Interest Rates

Most new mortgages are sold in the secondary market soon after being closed, and the prices charged borrowers are always based on current secondary market prices. The usual practice is to reset all prices every morning based on the closing prices in the secondary market the night before. Call these the lenders posted prices.

The posted price applies to potential borrowers who have been cleared to lock, which requires that their loan applications have been processed, the appraisals ordered, and all required documentation completed. This typically takes several weeks on a refinance, longer on a house purchase transaction.

To potential borrowers in shopping mode, a lenders posted price has limited significance, since it is not available to them and will disappear overnight. Posted prices communicated to shoppers orally by loan officers are particularly suspect, because some of them understate the price to induce the shopper to return, a practice called low-balling. The only safe way to shop posted prices is on-line at multi-lender web sites such as mine.

Whats Included In A Mortgage Payment

Your mortgage payment consists of four costs, which loan officers refer to as PITI. These four parts are principal, interest, taxes, and insurance.

- Principal: The amount you owe without any interest added. If you buy a home for $400,000 with 20% down, then your principal loan balance is $320,000

- Interest: The amount of interest youll pay to borrow the principal. If the same $320,000 loan above has a 4% rate, then youll pay $12,800 for the first year in interest repayment

- Taxes: Property taxes required by your city and county government

- Insurance: Homeowners insurance and, if required, private mortgage insurance premiums on a conventional loan

When determining your home buying budget, consider your entire PITI payment rather than only focusing on principal and interest. If taxes and insurance are not included in a mortgage calculator, its easy to overestimate your home buying budget.

Don’t Miss: What Does Mortgage Insurance Do

Find Out Whether You Need Private Mortgage Insurance

Private mortgage insurance is required if you put down less than 20% of the purchase price when you get a conventional mortgage, or what you probably think of as a “regular mortgage.” Most commonly, your PMI premium will be added to your monthly mortgage payments by the lender.

The exact cost will be detailed in your loan estimate, but PMI typically costs between 0.2% and 2% of your mortgage principal.

Oftentimes, PMI can be waived once the homeowner reaches 20% equity in the home. You also may pay a different type of mortgage insurance if you have another mortgage, such as an FHA mortgage.

How Much Are Pre

When you agree to a particular mortgage term, your are signing a contract for that amount of time, generally between 1 and 10 years. If you break your mortgage before that term is over, youll be charged a pre-payment penalty as a way to compensate the mortgage provider. How much this can cost varies wildly based on the type of mortgage you have, the time remaining on your term as well as your mortgage provider each lender has a different way to calculate pre-payment penalties.

The exact pre-payment penalty calculation that applies to you will be laid out in your contract, but there are two methods used, outlined below.

You May Like: Is A Home Equity Line Of Credit Considered A Mortgage

How Mortgage Payments Are Calculated

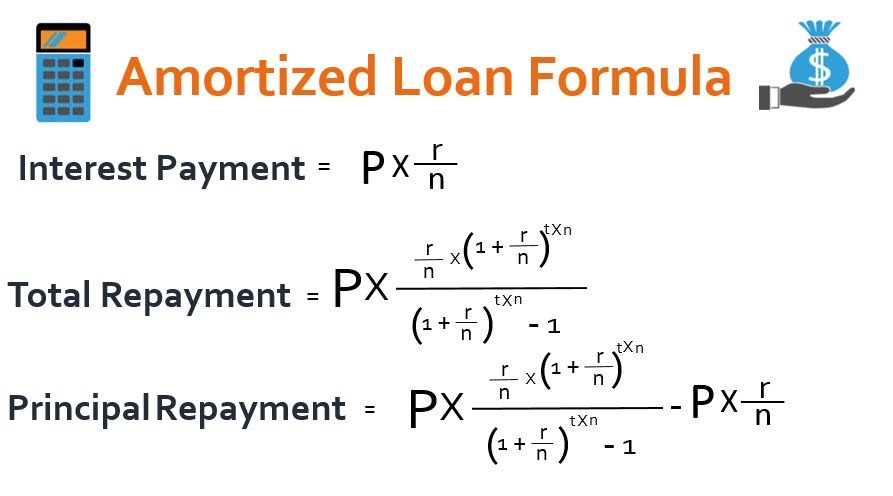

With most mortgages, you pay back a portion of the amount you borrowed plus interest every month. Your lender will use an amortization formula to create a payment schedule that breaks down each payment into principal and interest.

If you make payments according to the loan’s amortization schedule, the loan will be fully paid off by the end of its set term, such as 30 years. If the mortgage is a fixed-rate loan, each payment will be an equal dollar amount. If the mortgage is an adjustable-rate loan, the payment will change periodically as the interest rate on the loan changes.

The term, or length, of your loan, also determines how much youll pay each month. The longer the term, the lower your monthly payments will typically be. The tradeoff is that the longer you take to pay off your mortgage, the higher the overall purchase cost for your home will be because youll be paying interest for a longer period.

Conforming Loans Vs Non

Conforming loanshave maximum loan amounts that are set by the government and conform to other rules set by Fannie Mae or Freddie Mac, the companies that provide backing for conforming loans. A non-conforming loan is less standardized with eligibility and pricing varying widely by lender. Non-conforming loans are not limited to the size limit of conforming loans, like a jumbo loan, or the guidelines like government-backed loans, although lenders will have their own criteria.

Also Check: Should You Do A 15 Or 30 Year Mortgage

How Do Property Taxes Work

When you own property, youre subject to taxes levied by the county and district. You can input your zip code or town name using our property tax calculator to see the average effective tax rate in your area.

Property taxes vary widely from state to state and even county to county. For example, New Jersey has the highest average effective property tax rate in the country at 2.42%. Owning property in Wyoming, however, will only put you back roughly 0.57% in property taxes, one of the lowest average effective tax rates in the country.

While it depends on your state, county and municipality, in general, property taxes are calculated as a percentage of your homes value and billed to you once a year. In some areas, your home is reassessed each year, while in others it can be as long as every five years. These taxes generally pay for services such as road repairs and maintenance, school district budgets and county general services.

Understanding Your Mortgages Break

Once you calculate the cost of refinancing, determine how many years it will take to break even with the new monthly paymentâor recover the costs of refinancing your mortgage. This break-even point is the date on which you can actually benefit from your new lower payment, rather than covering refinancing fees. To calculate your mortgageâs break-even point, follow these calculations:

For example, if youâre refinancing a $300,000, 20-year, fixed-rate mortgage at 6% with a new 4% interest rate, refinancing will reduce your original monthly mortgage payment from $2,149.29 to $1,817.94âyielding a monthly savings of $331.35. Assuming a tax rate of 22%, the after-tax rate would be 0.78, which results in an after-tax savings of $258.45 . Finally, if you encounter $9,000 in refinancing costs, it will take almost 35 months to recoup the costs of refinancing .

Also Check: Who Benefits From A Reverse Mortgage

How Much Does It Cost To Refinance A Mortgage

Before you decide to refinance your mortgage, evaluate the cost of refinancing and whether itâs worth the long-term savings. In general, refinancing fees total between 3% and 6% of the outstanding principal on the original mortgage loan. This includes lender and attorney fees, title search and insurance costs and closing costs, like document preparation. Borrowers should also prepare to cover any necessary appraisal and inspection costs as required by the lending institution.

Some lenders offer âno-costâ refinancing that helps borrowers reduce up-front refinancing fees. Under this option, the borrower generally absorbs the fees through a higher interest rate or pays them over time as part of the loan principal. Either way, mortgage refinancing is never truly free.

Dont Miss: When Can A Mortgage Company Foreclose

How To Calculate The Total Cost Of Your Mortgage

Once you have your monthly payment amount, calculating the total cost of your loan is easy. You will need the following inputs, all of which we used in the monthly payment calculation above:

- N = Number of periods

- M = Monthly payment amount, calculated from last segment

- P = Principal amount

To find the total amount of interest you’ll pay during your mortgage, multiply your monthly payment amount by the total number of monthly payments you expect to make. This will give you the total amount of principal and interest that you’ll pay over the life of the loan, designated as “C” below:

- C = N * M

- C = 360 payments * $1,073.64

- C = $368,510.40

You can expect to pay a total of $368,510.40 over 30 years to pay off your whole mortgage, assuming you don’t make any extra payments or sell before then. To calculate just the total interest paid, simply subtract your principal amount P from the total amount paid C.

- C P = Total Interest Paid

- C P = $368,510.40 – $200,000

- Total Interest Paid = $168,510.40

At an interest rate of 5%, it would cost $168,510.40 in interest to borrow $200,000 for 30 years. As with our previous example, keep in mind that your actual answer might be slightly different depending on how you round the numbers.

Also Check: Can You Switch Mortgage Companies Before Closing

What Is An Interest

An interest-only mortgage is a home loan that allows you to only pay the interest for the first several years you have the mortgage. After that period, you’ll need to pay principal and interest, which means your payments will be significantly higher. You can make principal payments during the interest-only period, but you’re not required to.

How To Account For Closing Costs

Once you’ve calculated the total principal and interest expense on your mortgage, factoring in closing costs or fees will be straightforward. Since closing costs are paid in full when you close on the loan, you can simply add them to your overall loan cost without using any long formulas. Some examples of upfront closing costs include the following:

- Mortgage lender fees

- Third-party mortgage fees

- Prepaid mortgage costs

While there may be other categories of upfront fees, the process for calculating them remains the same: Just add them to the total cost of the mortgage loan. Keep in mind that this will exclude any added monthly expenses paid in escrow, like taxes or homeowner’s insurance. Our next section explains how to factor in monthly expenses.

You May Like: What Bureau Do Mortgage Lenders Use

Most Homeowners Now Get Nothing

The Tax Cuts and Jobs Act passed in 2017 changed everything. It reduced the maximum mortgage principal eligible for the deductible interest to $750,000 for new loans . But it also nearly doubled standard deductions when it eliminated the personal exemption, making it unnecessary for many taxpayers to itemize since they could not longer take both the personal exemption and itemize deductions at the same time.

For the first year following the implementation of the TCJA, an estimated 135.2 million taxpayers were expected to opt for the standard deduction. By comparison, 20.4 million were expected to itemize, and, of those, 16.46 million would claim the mortgage interest deduction.

The mortgage interest tax deduction is perhaps the most misunderstood aspect of homeownership. It has taken on near-mythical status to the point where many would-be homeowners are sold on the benefits before they even examine the math to determine their eligibility.

Underlying the myth are two primary misconceptions: The first is that every homeowner gets a tax break, and the second is that every dollar paid in mortgage interest results in a dollar-for-dollar reduction in income tax liability.

Reasons You Might Not Want To Refinance

Refinancing usually requires you to have a certain amount of equity in your home. If you dont have that, refinancing can be tough. The general refinancing rule of thumb is that lenders like you to have at least 20% equity in your home but there are exceptions.

Gone through some difficult financial times since you got your first mortgage? Say your credit has gotten worse since you first got your mortgage. You may not qualify for a refinance mortgage even if interest rates are available that are lower than what you have now.

Just like when you get a mortgage to first buy a home, there are some fees to refinancing your mortgage. The closing costs for a refinance cover things like application, loan origination and appraisal fees. If you dont have the money to pay for closing costs up front, there is an option to roll them into the new mortgage. But this isnt always the best decision. Sometimes adding those extra costs to your new monthly mortgage payments can negate any savings the refinance would otherwise get you.

Planning to move soon or have a job that uproots you regularly? Refinancing may not make sense because it generally takes some time to recoup those up-front closing costs.

And one more reason you might want to hold off on refinancing your mortgage: if you have to pay a penalty on your original mortgage. Some lenders will charge you a fee for paying off your mortgage early, even if youre refinancing. Again, this could totally negate the savings of the refinance.

You May Like: How Do I Get Mortgage Insurance

Whether The Home Is Too Expensive

Another thing a mortgage calculator is very good for is determining how much house you can afford. This is based on factors like your income, credit score and your outstanding debt. Not only is the monthly payment important, but you should also be aware of how much you need to have for a down payment.

As important as it is to have this estimate, its also critical that you dont overspend on the house by not considering emergency funds and any other financial goals. You dont want to put yourself in a position where youre house poor and unable to afford retiring or going on vacation.

Determine Your Mortgage Principal

The initial loan amount is referred to as the mortgage principal.

For example, someone with $100,000 cash can make a 20% down payment on a $500,000 home, but will need to borrow $400,000 from the bank to complete the purchase. The mortgage principal is $400,000.

If you have a fixed-rate mortgage, you’ll pay the same amount each month. With each monthly mortgage payment, more money will go toward your principal, and less will go toward your interest.

Read Also: Can You Get A Mortgage With A 550 Credit Score

Interest And Other Loan Charges

Interest is only one component of the cost of a mortgage to the borrower. They also pay two kinds of upfront fees, one stated in dollars that cover the costs of specific services such as title insurance, and one stated as a percent of the loan amount which is called points. And borrowers with small down payments also must pay a mortgage insurance premium which is paid over time as a component of the monthly mortgage payment.

Refinance Renew Or Switch

Every mortgage has a limited term in Canada. Only 4.8% of mortgages in 2018 had a term greater than 5 years. The CMHC found that the5-year fixed-rate mortgagewas the most popular in Canada in 2019. When the term is over then your mortgage term expires and you will either need to pay off your mortgage in full, or take one of the following actions:renew, refinance, orswitch mortgages.

Also Check: How To Modify Mortgage Loan

What Can A Mortgage Calculator Help Me With

Whichever mortgage calculator you use, its objective should always be to help you feel more informed on how to get a mortgage and your budget for buying a home, or to decide whether to move forward with a refinance. It all depends on your lifestyle and personal goals.

Below are some of the questions a mortgage calculator can answer.

Get A More Accurate Estimate

Get pre-qualified by a lender to see an even more accurate estimate of your monthly mortgage payment.

-

How much house can you afford? Use our affordability calculator to estimate what you can comfortably spend on your new home.

- Pig

Interested in refinancing your existing mortgage? Use our refinance calculator to see if refinancing makes sense for you.

- Dollar Sign

Your debt-to-income ratio helps determine if you would qualify for a mortgage. Use our DTI calculator to see if you’re in the right range.

- Award Ribbon VA mortgage calculator

Use our VA home loan calculator to estimate payments for a VA loan for qualifying veterans, active military, and military families.

Participating lenders may pay Zillow Group Marketplace, Inc. a fee to receive consumer contact information, like yours. ZGMI does not recommend or endorse any lender. We display lenders based on their location, customer reviews, and other data supplied by users. For more information on our advertising practices, see ourTerms of Use & Privacy. ZGMI is a licensed mortgage broker,NMLS #1303160. A list of state licenses and disclosures is availablehere.

Also Check: What Mortgage Lenders Use Vantagescore