Benefits Of Breaking It All Down

Breaking down your interest payments in this way isn’t just an exercise in math. Getting this kind of analysis helps you to better understand how just the cost of your home can significantly impact how much you pay over the life of your loan. Of course, getting the best interest rate possible will help you to save money. However, if you aren’t able to lower your interest rate any further either because you haven’t been able to put together a larger down payment or because you haven’t been able to improve your credit score then focusing on finding the best price for the home of your dreams can help you save.

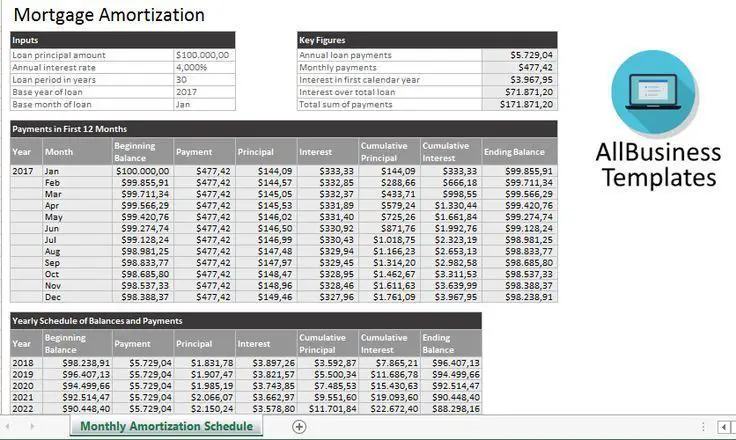

Use our easy calculator to get the information you need to put you in a stronger position to negotiate with the seller and to create the right budget for you while also buying the home of your dreams. Just plug in the amount of the loan, the interest rate, the length of the loan, and any loan points, origination fees and closing costs. We’ll mail you an easy-to-understand analysis of your interest charges by month and year in plain English. You don’t need to enter any personal information. Just put in your e-mail and get the results in moments!

Your Debt To Income Ratio Is %

Good news! Most mortgage lenders will class your debt-to-income ratio as low. Youre unlikely to be declined for a mortgage based on your outgoings, but speaking to a mortgage broker before applying is still recommended as they can improve your chances of getting the best deal.

Most mortgage lenders will class your debt-to-income ratio as moderate, which means some of them might view your application with caution. Some lenders are much more strict than others when it comes to affordability and debt, so its important for you to find a lender whos more lenient. You should speak to a mortgage broker before you apply to ensure youre matched with a lender whose criteria you fit.

Most mortgage lenders will class your debt-to-income ratio as high. But thats where we can help! With so much of your monthly income going towards debt repayments, you could struggle to get approved for a mortgage without the help of a mortgage broker. We can help you find a lender whos more lenient on debt and affordability, and could still secure a mortgage approval.

How Does The Mortgage Repayment Calculator Work

Your Mortgages mortgage calculator considers a variety of factors to determine how much your regular repayments will be over the loan term.

While there are many factors that can influence this calculation such as changes in interest rates, a decision to refinance, or using a redraw facility, the calculator will still be able to give you an estimate of how much your regular repayments could be and the total interest paid over the life of the loan.

By changing the interest rate, loan term, and repayment frequency fields, you can compare how these differences can impact your repayments.

Disclaimer: The results yielded by the calculator assume no changes in interest rates over the loan term. This means whatever interest rate you use will be applied for the whole loan term.

Recommended Reading: Why Do I Need Mortgage Insurance

What Is The Best Mortgage Term For You

A mortgage term is the length of time you have to pay off your mortgagestated another way, its the time span over which a mortgage is amortized. The most common mortgage terms are 15 and 30 years, though other terms also exist and may even range up to 40 years. The length of your mortgage terms dictates how much youll pay each monththe longer your term, the lower your monthly payment.

That said, interest rates are usually lower for 15-year mortgages than for 30-year terms, and youll pay more in interest over the life of a 30-year loan. To determine which mortgage term is right for you, consider how much you can afford to pay each month and how quickly you prefer to have your mortgage paid off.

If you can afford to pay more each month but still dont know which term to choose, its also worth considering whether youd be able to break evenor, perhaps, saveon the interest by choosing a lower monthly payment and investing the difference.

How Much Is A 100000 Mortgage A Month

When considering taking out a £100,000 mortgage, one of the key things to think about is how much it is going to cost you each month. Depending on the size of your deposit and the amount you borrow, your monthly repayments could vary quite considerably.

Of course, the size of your deposit and the length of time you borrow for will have a direct impact on your monthly repayments. So if you were to increase your deposit to 20%, your monthly repayments on a £100,000 mortgage would be lower than if you only put down a 5% deposit.

Similarly, the longer you borrow for, the more interest you will pay over the life of the mortgage but the cheaper it will be each month.

To give you an idea of how much a £100,000 mortgage might cost each month, weve put together some examples below.

As a guide only, the tables below provide an indication of monthly payments.

| INTEREST ONLY 100k |

|---|

The monthly cost of a £100,000 mortgage will vary according to three main factors:

Recommended Reading: What Direction Are Mortgage Rates Going

How Much Do I Qualify For Mortgage

This rule says that your mortgage payment should be no more than 28% of your pre-tax income, and your total debt should be no more than 36% of your pre-tax income.

Just so, how much can I borrow for a mortgage based on my income?

Four components make up the mortgage payment, which are: interest, principal, insurance, and taxes. A general rule is that these items should not exceed 28% of the borrowers gross income. However, some lenders allow the borrower to exceed 30% and some even allow 40%.

Also, how much do I need to make to afford a 300k house? The oldest rule of thumb says you can typically afford a home priced two to three times your gross income. So, if you earn $100,000, you can typically afford a home between $200,000 and $300,000.

Likewise, how much do I need to make for a 250k mortgage?

To afford a house that costs $250,000 with a down payment of $50,000, youd need to earn $43,430 per year before tax. The monthly mortgage payment would be $1,013. Salary needed for 250,000 dollar mortgage.

How much should I spend on a house if I make 100k?

Some experts suggest that you can afford a mortgage payment as high as 28% of your gross income. If true, a couple who earn a combined annual salary of $100,000 can afford a monthly payment of about $2,300/month. That could translate to a $450,000 loan, assuming a 4.5% 30-year fixed rate.

You May Like Also

Costs Associated With Home Ownership And Mortgages

Monthly mortgage payments usually comprise the bulk of the financial costs associated with owning a house, but there are other substantial costs to keep in mind. These costs are separated into two categories, recurring and non-recurring.

Recurring Costs

Most recurring costs persist throughout and beyond the life of a mortgage. They are a significant financial factor. Property taxes, home insurance, HOA fees, and other costs increase with time as a byproduct of inflation. In the calculator, the recurring costs are under the Include Options Below checkbox. There are also optional inputs within the calculator for annual percentage increases under More Options. Using these can result in more accurate calculations.

Non-Recurring Costs

These costs arent addressed by the calculator, but they are still important to keep in mind.

Recommended Reading: How To Get Preapproved For A Mortgage With Bad Credit

You May Like: How Long Are Condo Mortgages

How A Broker Can Help With A 100000 Mortgage

As there are so many lenders, and criteria vary so much between them, it would be incredibly labour intensive to establish which one would offer the income multiple necessary to achieve the mortgage you need. The brokers we work with are experts in this area and know how much each specific lender would expect you to earn in order to get a £100,000 mortgage.

As they have access to every lender on the market, they can ensure that you only approach those whose criteria you are likely to meet for this level of borrowing. Whether youre looking for a lender who will consider self-employed income more favourably or maximise the length of term available to you, we can match you with an expert who will tailor their advice to help you achieve the loan you need.

Can You Afford A 100000 Mortgage

This will depend on how the mortgage lender you approach calculates affordability. Most will base this on a multiple of your annual income, typically 4.5 or 5, though some go higher than this.

Try our mortgage affordability calculator below to work out whether youd qualify for a mortgage of this amount based on the standard income multiples that lenders use.

Recommended Reading: What Required To Refinance A Mortgage

Do Extra Payments Automatically Go To Principal

The interest is what you pay to borrow that money. If you make an extra payment, it may go toward any fees and interest first. But if you designate an additional payment toward the loan as a principal-only payment, that money goes directly toward your principal assuming the lender accepts principal-only payments.

How Much Does A 100000 Mortgage Cost Per Month

For purely example purposes, a £100,000 mortgage with a 25 year term and an interest rate of 2.75% would work out at £461 per month.

However, the exact figure will depend on the interest-rate and mortgage term available from the lender you choose to deal with. Small differences in your personal circumstances, or the options a lender offers, could all have an effect both directly and indirectly to the monthly repayment cost on a £100k mortgage.

If youd like to get an idea of your potential monthly repayments, just input the amount youre looking to borrow into our calculator below, along with an interest rate and preferred term for your mortgage.

Also Check: Is 4.5 A Good Mortgage Rate

How To Get A $100000 Mortgage

Getting a $100,000 mortgage isnt as complicated as it seems.

Once youre ready to apply, just follow this nine-step process, and youll be well on your way to buying the home of your dreams:

Learn More: How Long It Takes to Buy a House

Mortgage Monthly Repayments Table

The repayments have been calculated using our online mortgage calculator which you can use yourself or look at the tables below for the repayments on a £100,000 loan. It’s divided up into the length of the loan and the interest rate you will pay. These rates are applicable for new mortgages or remortgages and are on a repayment basis for a loan of £100,000 to repaid in the number of years shown.

| Rate | |

|---|---|

| £716 | £644 |

Please note these rates are for illustrative purposes only and you should not rely on these rates but get a professional financial quote for your £100,000 mortgage offer.

All the values are in pounds sterling for the years provided and this is the monthly repayment for each month of your £100,000 mortgage. Please see our mortgage calculator to see different rates, the total repayments you’ll make over the life of the loan and the total interest paid. You can also enter different interest rates and time and loan periods. See our mortgage calculator here for full information.

Whatever your reasons for needing a £100,000 mortgage be sure to seek professional advice either from a mortgage broker or an independent financial adviser who can help your find the right product whether on fixed rate, tracker rates or offset mortgages to fit your exact circumstances.

Most Popular

Also Check: Can You Transfer A Mortgage To Another Person

Total Interest Paid On A $100000 Mortgage

The amount of interest you pay on a mortgage loan depends on the interest rate your lender gives you.

Lower interest rates will mean fewer interest costs, while higher ones mean the opposite. This is why its important to compare several loan options using a tool like Credible.

How long your loan lasts will also play a role in your interest costs. Longer loan terms charge the most interest, while shorter ones reduce those costs.

Use the below calculator to see how much youll pay in interest, as well as what your home will cost you every month.

Enter your loan information to calculate how much you could pay

Is Gutting A House Worth It

Truthfully, theres a big difference between gutting a property and remodeling. By definition, gutting a home means bringing the entire interior down to the studs. For this reason, gutting a property is often more costly and labor-intensive than simply doing a remodel.

Is it worth renovating an old house? Old houses can be bought for less. If youre looking for a true fixer-upper, youll likely pay less than you would for a new home. And if you do the renovations yourself, you can save thousands of dollars in the long run and youll end up with a great investment. An old house has plenty of character.

How much would a 30 year mortgage be on 200 000?

On a $200,000, 30-year mortgage with a 4% fixed interest rate, your monthly payment would come out to $954.83 not including taxes or insurance. Monthly payments for a $200,000 mortgage.

| Interest rate |

|---|

| $1,073.64 |

How much income do you need to buy a $400 000 house? What income is required for a 400k mortgage? To afford a $400,000 house, borrowers need $55,600 in cash to put 10 percent down. With a 30-year mortgage, your monthly income should be at least $8200 and your monthly payments on existing debt should not exceed $981.

Recommended Reading: Rocket Mortgage Qualifications

Don’t Miss: How To Calculate Upfront Mortgage Insurance Premium

How Income Multiples Affect What You Could Borrow

This table demonstrates how much the income multiple used by your lender in their calculation can affect the amount you can borrow.

| Income | |

| £200,000 | £240,000 |

As you can see, an applicant earning £30,000 would be unable to afford £100,000 if the lender used a multiple of 3 x their income, as the maximum they could borrow would be £90,000. On the other hand, if you find a lender willing to offer a multiple of 4 x your income, you would only need to be earning £25,000 to achieve a £100,000 mortgage.

The absolute minimum amount that you could be earning to achieve a mortgage of £100,000 would be £16,700, however, this would require a lender to offer you a multiple of 6 x your income, which can be difficult to qualify for, especially given that this type of offer is generally reserved for professionals, who are likely to have a much larger income.

Getting Your First Mortgage

The traditional period for amortization of a mortgage is 25 years. But this is done in periods of five years at a time, though it is possible to pay the mortgage down in a shorter period, just not longer. The longer the amortization period, the smaller the monthly payments will be, but the more the loan will cost in total.

Most mortgages have a five year term, though shorter terms are possible. The five-year mortgage term is the amount of time a mortgage contract is in effect. At the end of each term, the mortgage must be renewed for another term, at which point there is an opportunity to consider making any changes. Possible changes include renegotiating the rate as well as other details of the contract for the next term. The agreed-upon interest rate remains in effect for the term.

It is possible to choose between an open mortgage, which provides a person the flexibility of being able to repay all or part of a mortgage at any time without a prepayment charge, or a closed mortgage, which limits prepayment options. The latter usually has a lower interest rate.

Traditionally, mortgage payments are made every month. It is possible to arrange biweekly payments which permit faster repayment and a lower loan cost. A biweekly payment means making a payment of one-half of the monthly payment every two weeks. This results in 26 payments a year instead of 24.

There are also options for flexible or skipped payments.

Read Also: How To Negotiate The Best Mortgage Rate