What Are Todays Mortgage Rates

On Thursday, December 23, 2021, according to Bankrates latest survey of the nations largest mortgage lenders, the average 30-year fixed mortgage rate is 3.190% with an APR of 3.350%. The average 15-year fixed mortgage rate is 2.500% with an APR of 2.710%. The average 5/1 adjustable-rate mortgage rate is 2.740% with an APR of 4.070%.

Time It Takes To Pay Off The Mortgage

The biggest difference between a 30-year and a 15-year mortgage is obvious: the length of time it takes to pay off your mortgage. With a 15-year term, youll be making half as many payments, so those payments will be higher. With a 30-year-term, youre spreading the amount over twice as many paymentswhich means youre paying more interest over time.

Overall, a 15-year term is a better deal. If someone has the financial capacity to take on a 15-year, its at least worth exploring, says James McGrath, a licensed real estate broker at Yoreevo, a New York City real estate brokerage.

The Advantages Of A 15

While the 15-year mortgage term isnt as popular as the 30-year option, it has several major advantages for people who can afford the higher monthly payments. The biggest benefit is that instead of making a mortgage payment every month for 30 years, youll have the full amount paid off and be done in half the time.

Plus, because youre paying down your mortgage more rapidly, a 15-year mortgage builds equity quicker. Equity is the value of your interest in your home, meaning the part you own outright, rather than it being subject to the lenders mortgage.

Having more equity in your home plays to your advantage if you sell your home before your mortgage is over, or if you need to take out an additional loan on your home, such as a home equity line of credit. Its also easier to refinance an existing mortgage if you have significant equity in your home.

Youll likely snag a lower interest rate

Lenders adjust their mortgage rates based on the riskiness of the loan. While there are many factors they use to make this calculation, if youre paying the principal back faster, this is typically seen as a less risky investment for the lender, and therefore youll be charged a lower interest rate, says Mescher.

Pay off your home prior to passing

Also Check: How Much Does Getting Pre Approval Hurt Credit

Got $1000 The 10 Top Investments Wed Make Right Now

Our team of analysts agrees. These 10 real estate plays are the best ways to invest in real estate right now. By signing up to be a member of Real Estate Winners, youll get access to our 10 best ideas and new investment ideas every month. Find out how you can get started with Real Estate Winners by .

Maurie Backman has been writing about personal finance for years. A firm believer in educating readers without boring them, she Learn More

How To Decide If Refinancing To A 15

Should you refinance to a 15-year mortgage? Again, that depends on your situation. If youre trying to save money right now, youll want to compare costs and do the math to make sure youre actually going to accomplish that especially if you dont plan on staying in the home for a long time. If youre looking to save money in the future and plan on living in your home for many years to come, refinancing to a 15-year may be a good option for you.

Here are a few ways to decide.

Read Also: Reverse Mortgage For Condominiums

What Is Cash Flow After Financing

Cash flow after financing is a little different than your standard cash flow, which simply calculate your net proceeds each month.

This metric takes financing expenses into account. In this case, because we are considering two financing optionsa 30- and a 15-year mortgageit is important to consider your cash flow after financing as opposed to before. That will help you understand the true bottom-line benefit of each option.

Cash flow after financing = Net operating income CapEx reserves financing costs

CapExor capital expendituresis where you budget for big-ticket system breakagelike replacing a roof or HVAC system. All investors should calculate this for their properties before buying.

But regular homebuyers should pay attention to CapEx, too. It will help you understand how much you need to keep in your savings. After purchasing a home, you should set cash aside for repairs or replacements, depending on the condition of the house.

Difference # : Cash Flow The Stock Market And The Power Of Leverage

As seen from the example above, a 15-year mortgage can help you to save on interest in the long-term. That said, however, you will have to make do with higher monthly payments with the shorter mortgage option. This would mean that your cash flow would be weaker, something that could be particularly concerning for those of you who are building your emergency fund or paying off debts.

Furthermore, with a 30-year mortgage, you could leverage on the power of its greater cash flow to help you grow your wealth. Confused as to how? Fret not!

Lets say you decide to choose the 30-year mortgage option for your million-dollar home. We have already established above that this would mean that each month, you will pay $2,756.23 less than if you were to take a 15-year mortgage. At the same time, you would be paying $125,095 more in interest.

Your investment savvy friend then encourages you to invest the $2756.23 monthly difference into an index fund that tracks the S& P 500. Conservatively, this should earn you about 7% return of investment annually, based on historical data and figures.

If you remain disciplined enough to put the monthly difference into the index fund, you would make $231,490 in just 15-years. If we take into account the full 30 years, it would mean even more earnings.

On the other hand, if you were deterred by the higher interest rates of a 30-year mortgage and decided to choose the 15-year mortgage, you would have saved $125,090.25, as mentioned above.

Recommended Reading: Reverse Mortgage Manufactured Home

Advantages Of Refinancing To Another 30

An estimated 19.4 million Americans with 30-year mortgages could refinance right now and save an average $308 a month, the mortgage data firm Black Knight recently said.

These refi candidates are sitting on loans with rates at least three-quarters of 1 percentage point higher than current rates on 30-year fixed-rate mortgages, which are averaging a record 2.67% in Freddie Mac’s survey. That’s just a hair above the recent record low of 2.66%.

“The cost to borrow has never been cheaper for homeowners,” says Grant Moon, the founder and CEO of the real estate technology company Home Captain.

At the start of 2020, the typical rate for a 30-year loan was 3.72%.

Fifteen-year fixed-rate mortgages come with even lower rates than 30-year loans. Rates on the shorter-term loans are now at a lowest-ever average of just 2.17%.

But Moon says you’re better off choosing a 30-year mortgage for a refinance in the current environment, because 15-year loans come with much stiffer monthly payments.

“Your payment would likely go up, and with uncertainty around the economy with millions of people receiving unemployment benefits, it could be a dangerous proposition if a borrower were to lose their job and be stuck with a higher payment amount,” he says.

A $250,000, 30-year fixed-rate mortgage at 2.67% has a monthly payment of $1,010. The same size mortgage for 15 years at 2.17% has a much steeper monthly payment: about $1,628.

What Is A Mortgage Rate Lock

Mortgage rates change daily, and that can be a problem when it can take more than a month to close a refinance loan. The solution offered by most lenders is a mortgage rate lock.

With a rate lock, your interest rate wont change for a set amount of time. If there are delays in closing your loan and your rate lock will expire before you can complete the refinance, you may be able to get an extension. If that happens, be sure to ask if there are fees for extending the rate lock.

Read Also: How Does The 10 Year Treasury Affect Mortgage Rates

Mortgage Rates: What The Experts Are Saying

With mortgage rates so low, most experts agree the only direction to go is up. The question now: how fast will it happen?

Experts have been saying all year that mortgage rates will continue ticking upwards through the end of 2021. News of the Omicron COVID-19 variant has created fresh economic uncertainty and is putting upward pressure on rates. At the same time, rates are getting downward pressure due to the highest inflation in nearly 40 years. The result is volatility. For example, since November 10th, rates have followed this up and down pattern each week: 3.15% 3.22% 3.24% 3.2% 3.24% and most recently 3.28%.

While experts still expect rates to increase as the economy recovers, the recent volatility could continue through the end of the year and into 2022. Most experts believe increases would be incremental. Were not expecting an overnight shoot up where all of a sudden mortgage rates are at 3.5% or 4%, says Ali Wolf, chief economist at Zonda, a California-based housing data and consultancy firm.

Despite the ups and downs, todays mortgage rates are still close to 1% lower than pre-pandemic levels. So, if you are in the market to refinance or purchase a home, now is a good time to take action. Here is everything you need to know about scoring the best rate and how much it can save you.

What Are The Different Types Of Mortgages

Mortgages come with all sorts of different interest rates and terms. These influence how long it will take to pay off your loan and how much your monthly payments will be.

These are some of the most common types of mortgages home buyers use:

Fixed-rate mortgage

A fixed-rate mortgage has a set interest rate for the life of the loan. With this type of loan, your mortgage rate will never change. Your overall monthly payments could still fluctuate based on property taxes or other factors. But a fixed rate locks in how much youll pay in interest over the course of your loan. And if interest rates drop to below your current rate, you can refinance to a lower rate.

Two of the more popular mortgage terms for fixed-rate loans are 15- and 30-year mortgages.

An ARM is usually a 30-year term loan with an interest rate that changes over time with market averages. When the interest rate changes depends on the loan. Common ARM terms are 5/1, 7/1, and 10/1. The first number designates the first year your interest rate will change, and the second number is how frequently the interest rate resets after the first time. So a 5/1 ARM adjusts the rate after 5 years and then annually after that. Most ARMs reset annually after the initial adjustment.

Government-backed loan

Read Also: How Does Rocket Mortgage Work

Difference # : Interest Accrued

The second difference that you will notice when it comes to deciding between a 15-year mortgage and a 30-year mortgage is the amount of interest that you will have to pay off along with your mortgage.

Taking the previous example of the $1,00,000 home, here is the math:

For a 15-year mortgage, you would have to pay off $117,337.50 in interest.

For a 30-year mortgage, you would have to pay off $242,432.75 in interest$125,095 more.

Basically, the longer you borrow the more interest you will pay. This is because the amount that you have to pay your interest on stays higher for a longer time in a 30-year mortgage. In addition, 15-year loans typically have lower interest rates than 30-year loans.

In the example above, you would have to pay $125,095 more in interest when you choose a 30-year mortgage over a 15-year one. Therefore, if looking for the option with the lowest interest rate is the one and only priority for you, you are better off choosing a 15-year mortgage.

Ces 202: Ces Confirms In

For example, borrowing $300,000 for 15 years at this week’s 3.25% average rate means you’ll have a $2,108 monthly mortgage payment .

That’s nearly 50% higher than the $1,441 you’d pay if you take out the same-sized loan for 30 years at today’s 4.05% average rate .

Not everyone can afford such higher payments — or convince the lender reviewing a mortgage application to “greenlight” such a loan.

You can check out your potential monthly payments by plugging in specifics from your own situation into

TheStreet

Your overall finances

Using a 15-year mortgage to pay off your home definitely saves money, but means you’ll have less cash each month for other financial goals that many people now skip.

For instance, McBride says less than one U.S. household in four has built up a six-month emergency supply of cash that experts recommend for emergencies. Even fewer are maxing out contributions to tax-advantaged retirement accounts such as 401s, he says.

“There are lots of people with sufficient cash flow to support a 15-year mortgage who really ought to have higher personal-finance priorities than pouring extra money into their homes each month,” McBride says.

The expert recommends taking a pass on a 15-year loan if getting one means not having enough money to max out contributions to your 401, individual retirement account and/or 529 college-savings plan.

Your age and job situation

A middle course

Still unsure which way to go?

Recommended Reading: Mortgage Recast Calculator Chase

Dont Forget About Retirement

Hows your retirement fund? Check on this and see if youre currently contributing enough. Instead of refinancing to a 15-year mortgage, you may be better off putting more money toward a 401 plan or an IRA account.

You also want to make sure youre maximizing your tax benefits in these and other types of programs, like health savings accounts and 529 college savings accounts. Compared to these plans, paying down a low-rate, potentially tax-deductible debt like a mortgage is a low financial priority.

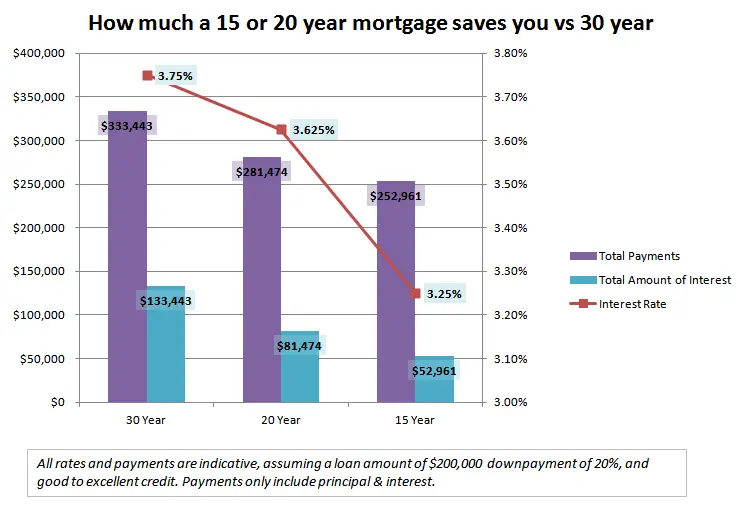

Should I Do A 15 Or 20 Year Mortgage

20year20year mortgagemortgage15year20year20yearyear

. Furthermore, which is better 15 or 20 year mortgage?

The monthly payment on a 20 year mortgage is 22.3% more than a 30 year payment, while a 15 year monthly payment is 46.2% more than a 30 year. This makes the added monthly cost of a 20 year loan only 48.3% the added cost of a 15 year loan. A 20 year loan saves $48,271 in interest, while the 15 year loan saves $70,346.

Subsequently, question is, do 20 year mortgages exist? A 20–year fixed rate mortgage is a home loan with an interest rate that remains the same throughout the 20–year duration of the loan. The borrower will be required to repay the principal and interest on the loan throughout the course of 20 years.

In this way, is a 15 year mortgage better?

A 15–year mortgage is designed to be paid off over 15 years. The interest rate is lower on a 15–year mortgage, and because the term is half as long, you’ll pay a lot less interest over the life of the loan. Of course, that means your payment will be higher, too, than with a 30-year mortgage.

Is it better to get a 15 year mortgage or pay extra on a 30 year mortgage?

On the other hand, a 15–year mortgage has higher monthly payments. But because the interest rate on a 15–year mortgage is lower and you’re paying off the principal faster, you’ll pay a lot less in interest over the life of the loan.

Don’t Miss: Chase Mortgage Recast

How To Decide Which Loan Term Is For You

A mortgage comparison calculator will show the effects of your mortgage term. This is valuable knowledge. But the calculator cant decide which loan term is best for you.

Youll have to do that for yourself. Keep these factors in mind as you decide:

- How long will you stay in the home? A 15-year loan lowers your mortgage debt a lot faster, especially in the early years. So youd have more to cash out if you sold the home within the first three to five years

- Just how tight is your budget? If youre not sure whether you can afford the payments on a 15-year loan, you probably shouldnt risk it. This is true even if your lender approves the loan. You know your personal finances better than anyone, so make sure the payment amount is comfortable for you

- Would you consider refinancing?Refinancing gives you a chance to change your loan term mid-stream. Youd pay closing costs on the new loan, but many homeowners find it worthwhile to revise their loans term or interest rate to save money once theyre several years into their mortgage. Knowing you can refinance takes some of the pressure off your loan term decision, knowing you can shorten it down the road

- How does your risk tolerance play out? Some consumers hate being in debt, so they prefer a 15-year mortgage that lowers their mortgage balance more quickly. Others get more stressed about making a 15-year loans more expensive payments and prefer a 30-year terms flexibility

Youll Pay Off Your House In Half The Time

Guess what? If you get a 15-year mortgage, itll be paid off in 15 years. Why would you choose to be in debt for 30 years if you could knock it out in only 15 years?

Just imagine what you could do with that extra money every month when your mortgage is paid off! Thats when the real fun begins! With no debt standing in your way, you can live and give like no one else.

Recommended Reading: Rocket Mortgage Payment Options

How Do I Get A Mortgage

Getting a mortgage is the most important part of the homebuying process. Its likely the largest loan youll ever take out. So finding the right lender and getting the best deal can save you thousands of dollars over the life of the loan.

Heres what you need to do.

There are lots of different types of lenders. Looking at the loans and programs that banks, credit unions, and brokers offer will help you understand all of your options.

If youre looking for a specific type of loan, like a VA loan or a USDA loan, then make sure that the lender offers these mortgages.

2. Apply for preapproval

Before you start shopping for a home, youll need a preapproval letter. A mortgage preapproval is different from a formal loan application in that it doesnt affect your credit and doesnt guarantee youre approved. But it does give you an idea of your likelihood of approval.

3. Submit an application

Once youre ready to start comparing loan offers, submit an application. Until you apply, the lender wont be able to give you an official estimate of the fees and interest rate you qualify for.

To find the lowest rate and fees, you should submit applications with two or three lenders. Once you have each Loan Estimate in hand, its easier to compare and determine which offer is best for you.

4. Underwriting and closing