How Do Lenders Determine What I Can Afford

These are the major factors mortgage lenders weigh to determine how much mortgage a borrower can reasonably afford:

- Gross income Your gross income is your total earnings before taxes and other deductions are factored in. Other sources of income, such as spousal support, a pension or rental income, are also included in gross income.

- DTI ratio Your DTI ratio is your total monthly debt obligations divided by your total gross income.

- Your credit score is a major factor lenders look at when evaluating how much you can afford. In general, the higher your credit score, the lower your interest rate, which impacts how much you can feasibly spend on a home.

- Work history Lenders look for a stable source of income to ensure you can repay your mortgage. When you apply for a loan, youll be asked to provide evidence of employment from at least the past two years. If you work for yourself, youll be asked to provide tax returns and other business records.

Mortgage Payment Percentage Example

Lets take a look at an example. Imagine that your household brings in $5,000 in gross monthly income. Your recurring debts are as follows:

- Rent: $500

- Minimum student loan payment: $250

- Minimum credit card payment: $200

- Minimum auto loan payment: $300

In this example, your total monthly debt obligation is $1,250. With quick math, we find that 43% of your gross income is $2,150, and your recurring debts take up 25% of your gross income. This means that if you want to keep your DTI ratio at 43%, you should spend no more than 18% of your gross income on your monthly payment. Considering that you already spend $500 a month on rent, if you add that to the $900, you can estimate a maximum monthly mortgage payment of $1,400. Use a mortgage calculator and your estimated monthly payment to calculate how much money you can borrow and stay on budget.

Finding The Right Lender

One place to start is with Credible, a site that allows you to get quotes from three lenders in only three minutes. Theres no obligation, but if you see a rate you like for your mortgage or refinancing your mortgage, you can progress to the next step of the application process. Everything is handled through the website, including uploading documents. If you want to speak to a loan officer, you can, of course, but it isnt necessary.

As you shop for a lender, remember that every dollar counts. Youre committing to a monthly mortgage payment based on the rate you choose at the very start. Even small savings on your interest rate will add up over the years youre in your house.

Credible Operations, Inc. NMLS# 1681276, Credible. Not available in all states. www.nmlsconsumeraccess.org.

Fiona is another great place to get started since they allow you to shop and compare multiple rates and quotes with minimal information, all in one place. Youll input the amount of the loan, your down payment, state, mortgage product type, and your credit score to get mortgage quotes from multiple lenders at once.

In the market for a house sometime soon? Use our resources to target your searchand know well in advance what you can afford:

Don’t Miss: How Much Does Refinancing A Mortgage Cost

How Much House Can I Afford Based On My Salary

To calculate how much house you can afford, use the 25% rulenever spend more than 25% of your monthly take-home pay on monthly mortgage payments.

That 25% limit includes principal, interest, property taxes, home insurance, private mortgage insurance and dont forget to consider homeowners association fees. Whoathose are a lot of variables!

But dont worry, our full-version mortgage calculator makes it super easy to calculate those numbers so you can preview what your monthly mortgage payment might be.

Lengthen Your Mortgage Term

Instead of choosing a shorter mortgage term, you might want to opt for a lengthened mortgage term. For example, you may consider choosing a 30-year fixed-rate mortgage instead of a 15-year fixed-rate mortgage.

Lets say you borrow $200,000 to buy a home with an interest rate of 4%. Your mortgage payment would be $955 per month over the course of 30 years .

Now, lets say you keep the same loan amount and interest rate and consider a 15-year mortgage instead. Youd pay $1,479 per month .

Lengthening your mortgage term can make a big difference in how much you pay per month, though keep in mind that youll also pay interest for a longer period of time.

Don’t Miss: What Is The Longest Mortgage Term Available

Why Calculate Mortgage Affordability

When youre looking to buy a home, its handy to know how much you can afford. Being able to calculate an estimate of how much youre able to borrow is an important part of setting your budget.

You also need to determine if you have enough cash resources to purchase a home. The cash required is derived from the down payment put towards the purchase price, as well as the closing costs that must be incurred to complete the purchase. We can help you estimate these closing costs with the first tab under the mortgage affordability calculator above.

Taken together, understand how large a mortgage you can afford to borrow and the cash requirements will help you determine what kind of home you should be on the look out for. To learn more about mortgage affordability, and how our calculator works, have a read of the information below.

What Is Mortgage Required Income

Lenders consider two main points when reviewing loan applications: the likelihood of repaying the loan and the ability to do so .

Nerdwallet.com explains that mortgage income verification, even if they have impeccable credit, borrowers still must prove their income is enough to cover monthly mortgage paymen

Don’t Miss: What Is The Downside Of Refinancing Your Mortgage

Calculate Your Monthly Income

The first thing you need to do is to calculate your monthly income. A mortgage broker will usually look at your gross monthly income, or your income before taxes. If you are self-employed or work on commission, a broker may look at your adjusted gross income based on your tax returns. When calculating your income, a broker will usually review your past two years of W-2s and determine the average earned over these two years.

Example:

2015 $90,0002016 $98,000

Most brokers would compute this as an income of $94,000 per year, or $7,833 a month.

Dont Forget To Factor In Closing Costs

Alright, dont freak out here. But a down payment isnt the only cash youll need to save up to buy a home. There are also closing costs to consider.

On average, closing costs are about 34% of the purchase price of your home.1 Your lender and real estate agent buddies will let you know exactly how much your closing costs are so you can pay for them on closing day.

These costs cover important parts of the home-buying process, such as:

- Appraisal fees

- Home insurance

Dont forget to factor your closing costs into your overall home-buying budget. For example, if youre purchasing a $200,000 home, multiply that by 4% and youll get an estimated closing cost of $8,000. Add that amount to your 20% down payment , and the total cash youll need to purchase your home is $48,000.

If you dont have the additional $8,000 for closing costs, youll either need to hold off on your home purchase until youve saved up the extra cash or youll have to shoot a little lower on your home price range.

Whatever you do, dont let the closing costs keep you from making the biggest down payment possible. The bigger the down payment, the less youll owe on your mortgage!

Also Check: How To Improve Mortgage Fico Score

Types Of Mortgage Loans

In addition to your mortgage-to-income ratio, its also important to research different kinds of mortgages. There are many types of mortgage loans you can choose from, such as conventional mortgage loans, adjustable rate mortgages and affordable home loan programs, to name a few. Research the best loans interest rates, length and terms for you.

How To Calculate A Down Payment

The down payment is the amount that the buyer can afford to pay out-of-pocket for the residence, using cash or liquid assets. Lenders typically demand a down payment of at least 20% of a homes purchase price, but many let buyers purchase a home with significantly smaller percentages. Obviously, the more you can put down, the less financing youll need, and the better you look to the bank.

For example, if a prospective homebuyer can afford to pay 10% on a $100,000 home, the down payment is $10,000, which means the homeowner must finance $90,000.

Besides the amount of financing, lenders also want to know the number of years for which the mortgage loan is needed. A short-term mortgage has higher monthly payments but is likely less expensive over the duration of the loan.

Homebuyers need to come up with a 20% down payment to avoid paying private mortgage insurance.

Recommended Reading: Is Mortgage Insurance For The Life Of The Loan

What Are The Income Requirements For Refinancing A Mortgage

Mortgage refinancing options are reserved for qualified borrowers, just like new mortgages. As an existing homeowner, youll need to prove your steady income, have good credit, and be able to prove at least 20 percent equity in your home.

Just like borrowers must prove creditworthiness to initially qualify for a mortgage loan approval, borrowers have to do the same for mortgage refinancing.

Recommended Reading: How Does The 10 Year Treasury Affect Mortgage Rates

Mortgage Payments Arent Your Only Homeownership Cost

Theres more to homeownership cost than your monthly payment. More on that later. But what makes up your monthly payment itself?

Mortgage professionals use the acronym PITI to cover some of the main ones. That stands for:

- Principal: The amount by which you reduce the amount you borrowed each month.

- Interest: The cost of borrowing.

- Taxes: The property taxes you have to pay.

- Insurance: Homeowners insurance. Plus, depending on where you buy, possibly flood, earthquake or hurricane cover.

None of these is optional and if you fall far behind on any of them, youll be in breach of your mortgage agreement and subject to action by your lender.

Also Check: How Do Mortgage Lenders Make Money

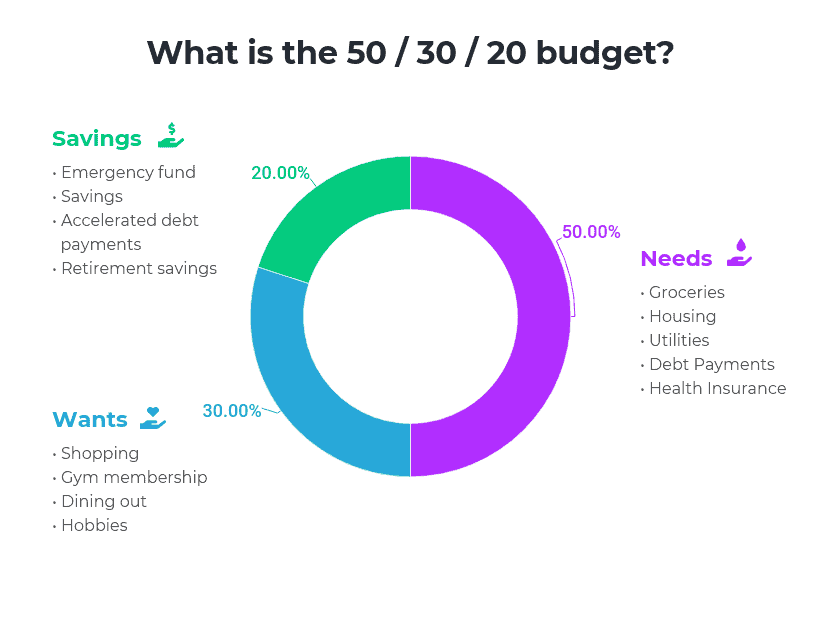

What About Your Other Goals

Its easy to get caught up in whether the down payment and ongoing costs are affordable but you also need to look at the opportunity cost.

While its classified as affordable to devote a full 30% of your income to your home, if you want to retire early or put five kids through college, this may be too large a portion of your income to spend.

Create a sample budget, factoring in housing costs and other expenditures, to see how much money youd have left over after paying for houses valued at different prices.

If youd scrimp to make payments on a $300,000 house and be unable to save for early retirement, you may only be able to afford a $200,000 house no matter what the experts say.

Only you know what your financial goals are which is why its important to decide for yourself how much house you can afford instead of just borrowing what a lender tells you that you can.

Also Check: What Is The Current Interest Rate On An Fha Mortgage

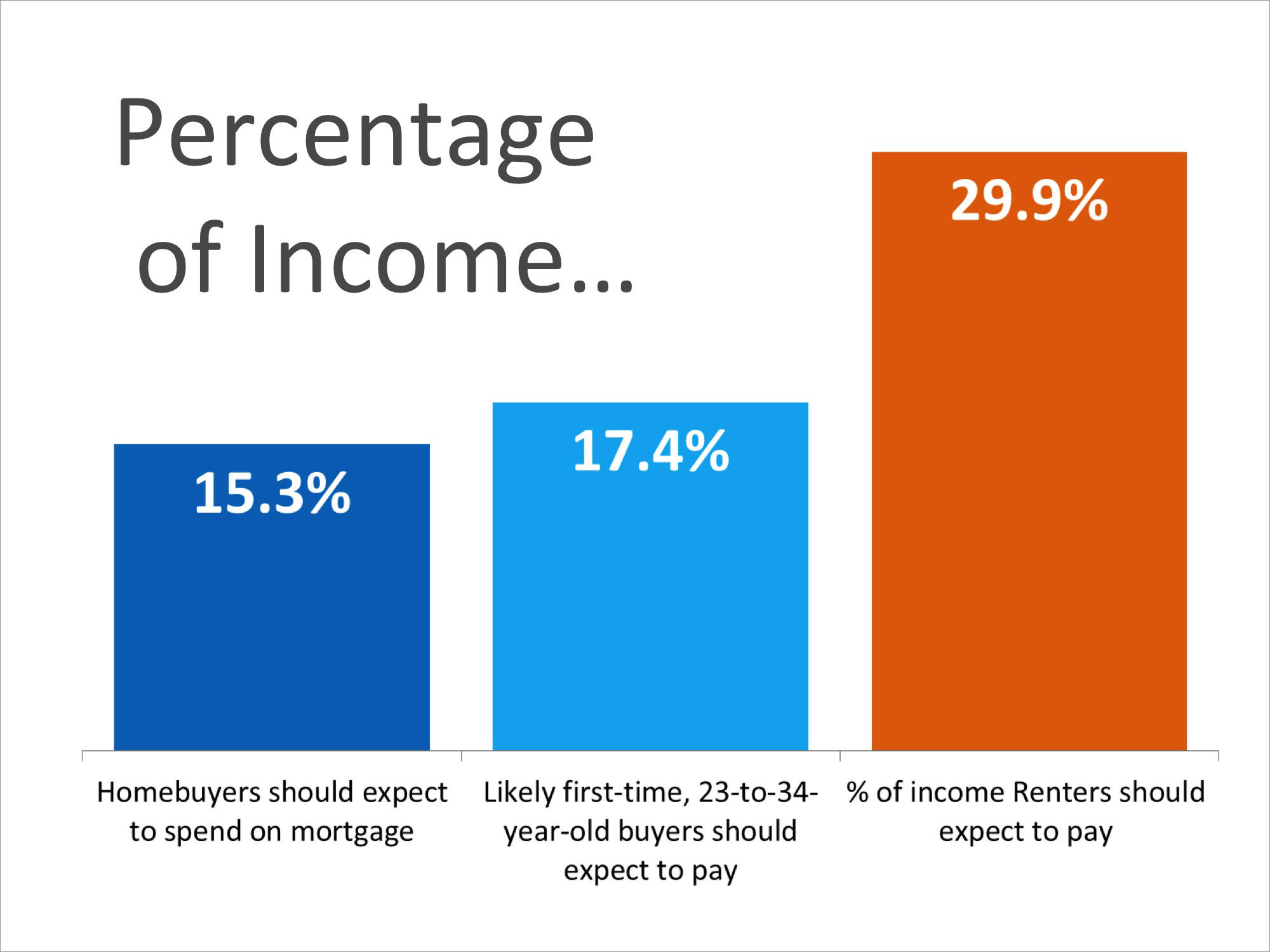

The Percentage We Recommend

At Rocket Mortgage®, the percentage of income-to-mortgage ratio we recommend is 28% of your pretax income. This percentage strikes a good balance between buying the home you want and keeping money in your budget for emergencies and other expenses. However, its important to remember that you dont need to spend up to your monthly limit. Think of 28% as the maximum amount you should spend monthly on your total mortgage payment. Remember to include your principal, interest, taxes, insurance and homeowners association dues in your total before you sign on a loan.

Don’t Miss: How To Get A Mortgage Lien Release

Follow The 25 Percent Rule

Theres a straightforward way to make sure you can afford your mortgage while managing your other goals, according to Eve Kaplan, a certified financial planner in New Jersey. Housingincluding maintenanceideally shouldnt consume more than 25 percent of a household budget. This goes for folks who rent, too, Kaplan says.

Mortgage bankers would disagree. They use various calculations to figure out how much you can afford, and the amount is often much higher than financial planners recommend. A common measure that brokers use is the debt-to-income ratio , which, for a qualified mortgage, limits your total debt payments, including your mortgage, student loans, credit cards, and auto loans, to 43 percent.

Lets say you and your spouse make a combined annual income of $90,000, or about $5,600 per month after taxes. Based on your DTI and depending on your other debts, you could be approved for a mortgage of $600,000. That might sound exciting at first, but with a monthly payment of about $3,225, it would eat up more than half your take-home pay.

Following Kaplans 25 percent rule, a more reasonable housing budget would be $1,400 per month. So taking into account homeowners insurance and property taxes, youd be better off sticking to a mortgage of $240,000 or less. If you have enough for a 20 percent down payment, the maximum house you can afford is $300,000.

How To Lower Your Monthly Mortgage Payment

Your monthly mortgage payment is going to take up a good chunk of your overall debt, so anything you can do to lower that payment can help. Consider some options, like:

- Find a less expensive house. While your lender might approve you for a loan up to a certain amount, you donât necessarily have to buy a home for the full amount. The lower the home price, the lower your monthly payments will be.

- Boost your down payment. The higher your down payment, the lower your monthly payment will be. So, if you can, save up so you can secure that lower payment.

- Get a lower interest rate. Most of the time, your interest rate is based on your credit score and DTI. Try to pay down outstanding debt, like credit cards, car loans or student loans. This not only lowers your DTI, but could also improve your credit score. A higher credit score means you could get a lower interest rate offered by your lender.

Recommended Reading: How Long After Getting A Mortgage Can You Refinance

Ugh This Is Making My Head Hurt

Yup. Mortgages arent fun. Still, a house is one of, if not the, most expensive thing youll ever spend money on so its best to give it a ton of consideration. Being saddled with an unruly mortgage will affect you for years and years. To that end, the more thought you give it now, the less worry youll have later. So remember, the question isnt just How much mortgage can I afford? but How much mortgage do I want? for the long term.

More from SmartAsset

Follow The 28 Percent Rule

Once you know your gross monthly income, you can use this number to determine what percentage of income should go to mortgage. While lenders can approve higher percentages, the law does not allow the approval of mortgages that would take up more than 35 percent of a persons monthly income. Most lenders must follow strict policies that limit a mortgage payment to a lower percentage, that commonly being 28 percent.

Example:

$7,833 x 0.28 = $2,193

Also Check: Rocket Mortgage Loan Types

You May Like: Can A Mortgage Be Transferred

Figure Out 25% Of Your Take

Lets say you earn $5,000 a month . According to the 25% rule we mentioned earlier, that means your monthly house payment should be no more than $1,250.

Stick to that number and youll have plenty of room in your budget to tackle other financial goals like home maintenance and investing for retirement.

Recommended Reading: Can You Get Preapproved For A Mortgage Without Hurting Your Credit

Realize That Other Expenses May Come Up

Even if your mortgage doesn’t stretch your budget, an unexpected job loss or other event could cause you to struggle to make your mortgage payments. The more affordable a home is in the first place, the better chance you’ll have of recovering.

Building up an emergency fund is easier if you limit your mortgage payment to 25 percent of your take-home pay. The more cash you have on hand, and the lower your monthly obligations, the better chance you’ll have of staying afloat if difficult times strike.

Recommended Reading: How Much Money Does It Cost To Refinance A Mortgage

What Percentage Of Your Salary Should Go For A Mortgage

Buying and owning real estate usually involves having a mortgage loan. If youâre contemplating becoming another happy homeowner, you should have an idea what mortgage lenders look for as a percentage of your compensation. Along with acting as a major qualification component, statistics prove that spending this percentage â or less â for your mortgage payment predicts your success at meeting your loan obligations.

What If You Just Dont Have Enough For A Down Payment

If you dont have enough savings for a 20 percent down payment, then you need to keep saving, Sethi says. If you are struggling to save, he advises creating a sub-savings account.

A sub-savings account is an automated account that directly deposits small amounts from your paycheck into a savings account, so you dont even have to think about it, he says.

A lot of people say Hey, Im cut to the bone, I cant really save, he says. Well, it turns out when you automate this money you never even see it. It actually adds up pretty quick.

And dont underestimate the power of the side hustle, he says.

Read Also: Will Mortgage Rates Keep Dropping