What Navy Federal Offers

Navy Fed members across the U.S. can apply for conventional and VA home loans to buy a home or refinance an existing mortgage. The credit union also offers mortgages for second homes and investment properties plus home equity loans.

Unfortunately, Navy Federal doesnât provide new construction loans. But once your construction is completed, you can refinance your loan with Navy Federal.

Most Navy Federal home loans have a fixed interest rate and repayment terms up to 30 years. Adjustable-rate mortgages with a lower initial rate are also available and have a term from 10 to 30 years.

You can view the lowest rates on the Navy Federal website, but you must start the preapproval process to see a personalized rate.

Navy Federal also offers a couple of benefits to help you potentially save money.

- Freedom Lock: You can adjust your rate up two times between your initial application and closing if market rates fall. This feature is for purchase and refinance loans only.

- Rate match guarantee: Receive $1,000 if you close with another lender when Navy Federal cannot match the competing rate. You must lock in your rate with Navy Federal first to qualify.

- RealtyPlus: Using a participating real estate agent lets you receive from $400 to $9,000 in the form of cash, a gift card or commission reduction after closing in qualifying states.

What If I Find A Lower Rate With Another Lender

Navy Federal offers a rate match guarantee,3 which means that if you find a better rate at another lender, well match it. If we arent able, well give you $1,000 after you close with the competing lender. To qualify for our rate match guarantee, youll need to lock in your rate with us before you submit your rate match request. A Loan Estimate and the rate lock disclosure from the competing lender must be received within 3 calendar days of locking with Navy Federal. The rate must be locked with the competing lender. The date of the Loan Estimate and the lock effective date with the competing lender must be within 3 calendar days of the rate lock with Navy Federal. Loan terms on the competing loan must be identical to the terms of your Navy Federal loan.

If we cant match the competing rate and you qualify to receive $1,000, you must provide a signed executed copy of the final Closing Disclosure from the competing lender and a copy of your final mortgage note within 30 calendar days of your loan closing. Once approved, $1,000 will be automatically deposited into your Navy Federal account within 30 days of receiving the necessary documentation.

Navy Federal Mortgage Refinance

Navy Federal mortgage refinance options include:

- Standard VA loan refinance

- Adjustable-rate refinance

Refinancing your home loan can reduce your mortgage rate and monthly payment, as well as decrease your loan term. You can even borrow cash from your equity.

Refinance terms range from 10 to 30 years, and you may be eligible with a loan-to-value ratio of up to 95 or 100 percent .

Recommended Reading: What Is Considered A High Interest Rate On A Mortgage

Special Benefits For Veterans With Navy Federal

NFCU, a full-service credit union, has a network of 30,000 fee-free ATMs. Their banking products benefits include competitive rates for share certificates, no monthly fees on a basic savings account or specific checking accounts, and their term-based savings and money market accounts pay higher rates than most. Members pay no service fees on credit card balance transfers or foreign transactions. Navy Federals Optional Overdraft Protection Service goes by the title, OOPS.

If you decide on a Navy Federal home loan, they take care of most everything you need including title services and loan servicing.

How We Chose The Best Va Loan Rates

We researched and reviewed 18 lenders to arrive at the best loan rates and terms for VA loan programs. The key criteria we reviewed were the length of the loans, the rates, the minimum lenders accept, the application process, autopay features, and the customer service channels available.

Recommended Reading: How Late Can You Be On Your Mortgage

/10 Lendingtrees Mortgage Lender Rating

LendingTrees mortgage lender rating is based on a 10-point scoring system that factors in several features, including digital application and closing processes, available loan products and online and in-person accessibility. LendingTrees editorial team calculates each rating based on a review of information available on the lenders website. Lenders receive a half-point on the standard product offerings criterion if they offer at least two of the four standard loan programs . In some cases, additional information was provided by a lender representative.

= 1 pt = 0 pts

Compare To Other Lenders

| NerdWallet rating NerdWallet’s ratings are determined by our editorial team. The scoring formula takes into account loan types and loan products offered, online conveniences, online mortgage rate information, and the rate spread and origination fee lenders reported in the latest available HMDA data. | NerdWallet rating NerdWallet’s ratings are determined by our editorial team. The scoring formula takes into account loan types and loan products offered, online conveniences, online mortgage rate information, and the rate spread and origination fee lenders reported in the latest available HMDA data. | NerdWallet rating NerdWallet’s ratings are determined by our editorial team. The scoring formula takes into account loan types and loan products offered, online conveniences, online mortgage rate information, and the rate spread and origination fee lenders reported in the latest available HMDA data. |

|

Purchase, Refinance, Jumbo, Fixed, Adjustable, FHA, VA |

Loan types and productsPurchase, Refinance, Home Equity, Reverse, Jumbo, Fixed, Adjustable, FHA, VA, USDA |

Loan types and productsPurchase, Refinance, Fixed, Adjustable, FHA, VA, USDA |

Get more smart money moves straight to your inbox

Become a NerdWallet member, and well send you tailored articles we think youll love.

You May Like: How Much Would A Mortgage Be For 250 000

Navy Federal Mortgage Rate Match

- Navy Federal appears to be confident that they offer some of the lowest rates around

- Thats why they offer a $1,000 rate match guarantee

- If you find a lower mortgage rate and Navy Federal is unable to match it they may compensate you

- But you have to prove it with documentation and jump through some hoops to qualify

One neat perk the company offers is its so-called Mortgage Rate Match, which as the name implies will match the interest rate of a competitor.

So if youre able to find a lower mortgage rate while comparison shopping, Navy Federal will match that rate or give you $1,000.

Of course, the typical restrictions apply and youll need to lock your rate with Navy Federal before submitting the rate match request.

Additionally, youll need to provide a Loan Estimate from a competing lender within three calendar days of locking your rate, and the terms have to be identical.

In other words, there are probably a lot of outs for Navy Federal, but if youre able to muster all that and they cant/wont go any lower, you might be able to snag $1,000.

Speaking of locks, Navy Federal also offers a Freedom Lock Option for home purchase loans that lets you lower your rate up to 0.25% if rates improve up to 14 days prior to closing.

Its basically a free one-time re-lock option offered on all loan types.

Is Now A Good Time

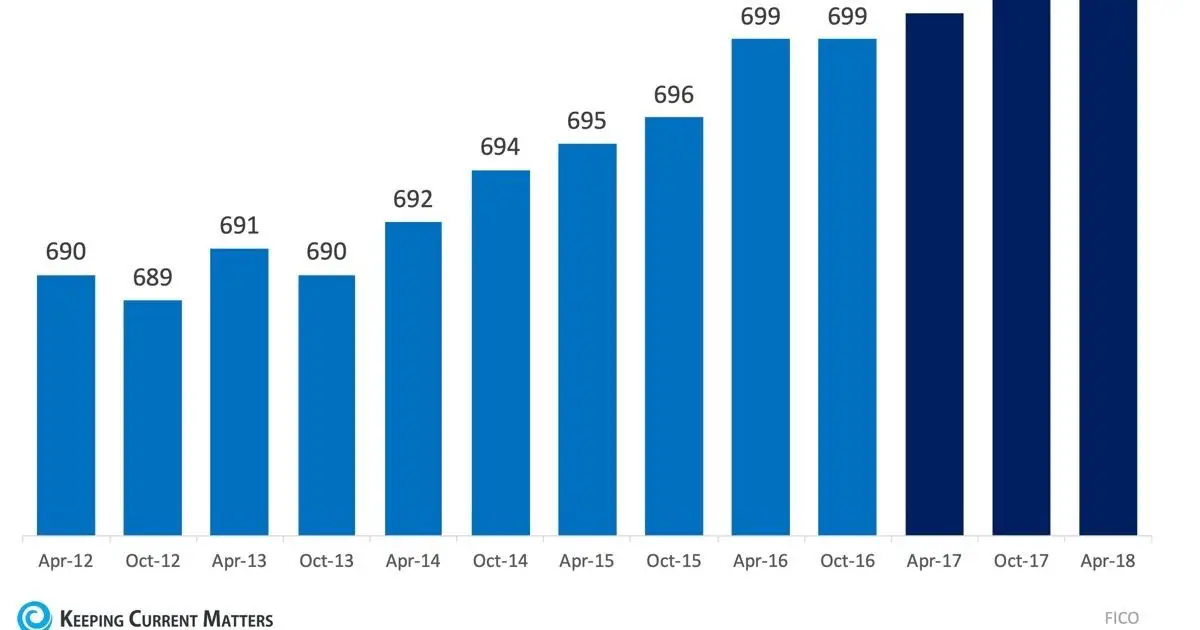

Most mortgage experts agree, with rates expected to rise in the coming years, now is still a good time to lock in relatively low mortgage rates.

Mortgage rates are near 40-year lows. If youre thinking of buying a home, or looking to refinance an existing mortgage to lock in a lower rate, experts agree: now is a great time.

Realistically, mortgage rates are forecasted to rise. Experts recommend locking in rates now while theyre still low.

For 2022, New American Funding is our top-rated choice for all of your mortgage needs.

Also Check: How Does Usda Mortgage Work

Can Closing Costs Be Rolled Into The Mortgage Loan

Typically, closing costs on purchase loans cannot be rolled into your mortgage. However, the funding fee for certain loans may be included as long as the total mortgage amount doesnt exceed the loan-to-value ratio. If youre refinancing a mortgage and have enough equity in your home, closing costs can be included in the loan amount. Check with your home loan advisor for more information.

Navy Federal Mortgage Review For 2022

Navy Federal Credit Union isnt only committed to helping its members find the right mortgage the lender also strives to help borrowers save money.

Down payments and closing costs are two of the biggest obstacles to homeownership, but Navy Federal can lessen these financial burdens.

Zero-down home loans

Its notable that Navy Federal offers other zero-down mortgage options in addition to the federally-backed VA loan.

The Homebuyers Choice Loan is a zero-down mortgage for military borrowers who have already exhausted their VA home buying benefit.

Rates run about 1% higher than the standard VA loan, and the credit union charges one-half percent in discount points. Still, this is a great deal for veterans who do not have VA loan entitlement remaining.

Keep in mind that this loan does not require private mortgage insurance . This lowers the mortgage payment considerably compared to an FHA or conventional loan.

There are even refinance and jumbo loan options available. Few other lenders go this far to ensure the availability of home financing for veterans.

Navy Federal rate match guarantee

Navy Federal Credit Union also has a rate-match guarantee that can be helpful to borrowers who shop around.

If another lender offers a lower rate on your mortgage, Navy Federal will match this rate or give you $1,000.

No minimum credit score

Whats noteworthy, too, is that Navy Federal doesnt set a minimum credit score for mortgage approval.

According to a credit union representative:

You May Like: Is It Good To Pay Off Mortgage Early

Quick Facts About Navy Federal Credit Union Debt Consolidation Loans

- 7.49% – 18%

- Loan amount: $250 to $50,000

- Payoff period: up to 60 months

- Not disclosed

Keep in mind that a debt consolidation loan from Navy Federal Credit Union will be worthwhile if it saves you money compared to the interest rates you are paying on your existing debts. In addition to the loan’s APR, you should also consider any potential fees, as well as the available loan amounts and payoff periods.

Before you apply for a Navy Federal Credit Union debt consolidation loan, it’s a good idea to compare it to WalletHub’s editors’ picks for the best debt consolidation loans. That way, you’ll be able to see how the offer stacks up against loans from leading competitors.

The Navy Federal credit card approval requirements include a credit score of at least 700, in most cases this is considered good credit. Other Navy Federal credit cards require a credit score of 750, i.e. excellent credit. Ultimately, Navy Federal also offers options for people with bad credit. You also have to be an NFCU member to apply for one of their credit cards.

Perhaps most importantly, Navy Federal will also verify your credit history and ability to pay. Your credit score, income, debt level and other factors will help determine if you’re approved. This information will also play a role in setting your interest rate and credit limit.

About Navy Federal Credit Union

Established in 1933 with only seven members, Navy Federal now has the distinct honor of serving over 10 million members globally and is the worlds largest credit union. As a member-owned and not-for-profit organization, Navy Federal always puts the financial needs of its members first. Membership is open to all Department of Defense and Coast Guard Active Duty, veterans, civilian and contractor personnel, and their families. Dedicated to its mission of service, Navy Federal employs a workforce of over 22,000 and has a global network of 343 branches. For more information about Navy Federal Credit Union, visit navyfederal.org.

Also Check: Is Quicken Loans Same As Rocket Mortgage

Navy Federal Mortgage Rates And Fees

One of the most important considerations when choosing a mortgage lender is understanding what the loan will cost. In order to provide consumers with a general sense of what a lender might charge, NerdWallet scores lenders on two factors regarding fees and mortgage rates, according to the most recently available Home Mortgage Disclosure Act data:

-

Navy Federal earns 2 of 5 stars for average origination fee.

-

Navy Federal earns 4 of 5 stars for offered mortgage rates compared with the best available rates on comparable loans.

Borrowers should consider the balance between lender fees and mortgage rates. While it’s not always the case, paying upfront fees can lower your mortgage interest rate. Some lenders will charge higher upfront fees to lower their advertised interest rate and make it more attractive. Some lenders just charge higher upfront fees.

You can decide to buy discount points a fee paid with your closing costs to reduce your mortgage rate.

Deciding whether to pay higher upfront fees is a matter of considering how long you plan to live in your home and how much cash you have to apply toward closing costs when you sign the loan paperwork.

» MORE:’Should I buy points?’ calculator

Navy Federal Credit Union Mortgage Reviews

One of the best ways to research mortgage lenders is by reading third-party reviews. You can discover what actual customers are saying about them before you choose to do business with them.

Navy Federal Credit Union currently has a Better Business Bureau rating of A+, indicating excellent customer service. They also have very few complaints. You can find more Navy Federal Mortgage reviews at other review sites as well.

Recommended Reading: Who Should I Get Mortgage Pre Approval From

How To Bank Through Navy Federal Credit Union

To bank at Navy Federal requires membership, which isnt open to everyone. To become a member of Navy Federal, you must be an active duty, retired, or veteran member of the armed forces, which includes:

- Army

- National Guard

- Space Force

Family members of military members, including minors, are eligible to become members of the credit union, too. Membership is also an option for the Department of Defense civilians, including retirees and annuitants, and other select citizens.

You can apply for a membership only on the Navy Federal website or by calling 888-842-6328. Youll need to have personal information on hand to verify your identityincluding your Social Security number, driver’s license, or other valid IDas well as a credit card or bank account routing number to fund your Navy Federal account.

If youre someone who is eligible for membership, Navy Federal Credit Union offers enough accounts and services to meet most banking needs. Its a full-service credit union that rivals national banks. If you prefer a credit union to a bank, Navy Federal may be the best place to keep your savings. Its not for everyone, though, especially if you dont qualify for membership. Despite its size, it still doesnt have enough local branches to offer in-person services to all of its members. You may find better rates on most deposit accounts at an online bank.

Jg Wentworth Review Streamlined Home Loans

About Ryan Guina

Ryan Guina is The Military Wallet’s founder. He is a writer, small business owner, and entrepreneur. He served over six years on active duty in the USAF and is a current member of the Illinois Air National Guard.

Ryan started The Military Wallet in 2007 after separating from active duty military service and has been writing about financial, small business, and military benefits topics since then. He also writes about personal finance and investing at Cash Money Life.

Ryan uses Personal Capital to track and manage his finances. Personal Capital is a free software program that allows him to track his net worth, balance his investment portfolio, track his income and expenses, and much more. You can open a free Personal Capital account here.

Featured In: Ryan’s writing has been featured in the following publications: Forbes, Military.com, US News & World Report, Yahoo Finance, Reserve & National Guard Magazine , Military Influencer Magazine, Cash Money Life, The Military Guide, USAA, Go Banking Rates, and many other publications.

Read Also: Does American Express Do Mortgages

Navy Federal Credit Union Review Vs Usaa Review

USAA normally provides conforming and jumbo mortgages, but at the time of writing this review, the lender has halted these products. Its only originating VA mortgages right now, but it has plans to reintroduce conforming and jumbo mortgages in the future. So if you want a conventional loan, youll want to go with Navy Federal.

Navy Federal is probably the better choice if you have a low or no credit score. It accepts alternative credit data, like utility bills, whereas USAA does not.

Read Also: What Is Congress Mortgage Stimulus Program

Navy Federal Credit Union Q& a

Yes, Navy Federal does have an American Express credit card: the Navy Federal Credit Union More Rewards American Express® Credit Card. This card offers 3 points per $1 spent at supermarkets, food delivery, gas, transit and restaurants, and 1 point per $1 spent on all other purchases. Plus, you earn . On top of that, this card has a $0 annual fee.

It’s also worth noting that you’ll also need at least good credit to have high odds of approval for the Navy Federal Credit Union More Rewards American Express® Credit Card.

Also Check: Can You Mortgage A House You Own

Navy Federal Credit Union Va Loan Programs

Given all the benefits provided by VA loans, they should be the first choice in home financing for service members and veterans.

Navy Federal Credit Union offers one of the widest varieties of VA loans of any lender in the country.

VA loans are available for purchase and refinance, and credit union personnel will help walk you through the entire process.

Some of the more specific loan programs available to veterans include the following:

Streamline Refinance

More specifically referred to as Interest Rate Reduction Refinance Loans, or IRRRL loans, theyre designed to make refinancing as simple as possible.

Theyre available only to refinance an existing VA mortgage. They do not require a new Certificate of Eligibility, and most dont require a new appraisal either.

IRRRLs are used to lower your interest rate or monthly payment, or to refinance from an ARM it to a fixed rate loan.

Military Choice

This is another veteran-specific loan program, but it offers more relaxed guidelines, like financing for second homes.

Like regular VA loans, theyre fixed rate and can provide 100% financing up to $484,350. However, the program also offers jumbo loans for up to $1 million.

100% Financing Home-Buyers Choice

This is a special program created by Navy Federal Credit Union for current service members and veterans.

It also offers 100% financing, with loan amounts up to $484,350, but jumbo financing is also available for up to $1 million.