Payoff Letter As Verification

Another kind of payoff letter a homeowner might receive is the one from your lender verifying that the loan is paid in full and the mortgage lien can be cleared.

Should you receive this letter verifying the loan is paid off, dont simply file it away assuming everything is free and clear. The next step is to confirm if a mortgage release has been filed within your states required time frame. In most cases, the lien holder should send the release to be recorded within 30-90 days. If you arent sure what the requirements are in your area, reach out to your real estate agent, title agent, or real estate attorney for guidance.

Needing A Mortgage Liability Release

Aside from needing one once the property is paid off, several reasons exist for seeking a release, including a divorce or a belief the property will be sold for less than is owed and you don’t want to be responsible for the balance. Some states, including California, typically set mortgages up as no recourse loans. This means, even if your house sells for less than is owed, the lender is not allowed to come after you for the balance. However, if your house isn’t located in California, you could find yourself with a big bill at the end of the day, thus the need for a mortgage liability release.

Getting a release of liability from your mortgage means your lender has removed you from the loan and you are no longer responsible for the payments. If someone is left on the loan and defaults, the lender cannot legally come after you for the money once you have been released from liability.

Why Does My Satisfaction Of Mortgage Form Have A Large Blank Header

The Satisfaction of Mortgage will have a blank header that is necessary for the County Recorder. The County Recorder will in turn stamp the document with a filing number and any other form of information as deemed necessary, which will help identify and record the document. This space should be left blank and not tampered with.

Read Also: Chase Mortgage Recast Fee

The Lien Release Solution

We decrease the number of lien release rejections, reduce liability, satisfy borrowers, and ensure that the process is being done efficiently with a best practices approach honed over the last 25 years, including our acquisitions of Mortgage Compliance Advisors and Orion Financial Group. After all, as mortgage volumes increase, so do the risks of inefficiency, rejected filings and litigation.

We ensure that all the documents needed to successfully process lien releases are in your possession , title, etc.), that they are provided to the county with correct borrower information , and that the correct documentation is provided to the borrower to close the loop.

We also ensure a fully transparent process with our proprietary Lien Release and Assignment Software, EclipseTM. Eclipse provides real-time insight into file statuses, on-platform exception handling, automatic file and message logging, and other features that expedite the process and keep you in the know.

Where Do I Record My Satisfaction Of Mortgage When Complete

The Satisfaction of Mortgage should be filed with the County Recorder or City Registrar. This will acknowledge and document, that the previously obtained mortgage has been paid in full and there is no longer a lien on the property. Required documentation is dependent on state, some states may call for a Deed of Reconveyance as opposed to the Satisfaction of Mortgage. If the Satisfaction of Mortgage is not recorded the lien will remain on the Title of the property.

Don’t Miss: How Much Is Mortgage On 1 Million

The Balance On Your Mortgage Statement Is Not Your Payoff Amount

Due to the nature of interest charges, predicting exactly how much youll need to pay the remaining balance of your loan can be tricky. Writing a check using the loan balance shown on your last statement wont cut it. Theres a good chance that if you use this method to satisfy your mortgage, youll fail to pay everything you owe.

The first step in paying off the remainder of your loan early and getting a mortgage lien released is requesting a payoff letter from your lender. This helps you avoid any surprises or frustrations by providing all the information you need in one document.

During the sale of a home, this payoff letter is typically obtained by the title company or real estate attorney assisting in the closing. In order to transfer the title from the seller to the buyer, the current mortgage lien must be satisfied or released in the public record. Once the loan is paid off through the funds from the sale, a release or satisfaction will be filed with the same county clerk or recorder that files the new owners deed and mortgage. If the old mortgage isnt properly cleared from the title, it will remain a cloud or defect on the new owners title.

In addition to paying off your loan early and selling your home, a payoff letter is needed for refinancing your mortgage.

My Bank Went Out Of Business But I Need A Release Of My Mortgage From Them What Do I Do

The entity that took over your mortgage should have notified you. If you can’t find out which company took over, call the Federal Deposit Insurance Corporation’s lien release number at 206-4662 or visit the Closed Banks and Asset Sales section on the FDIC’s “Contact Us” page.

Last Reviewed: April 2021

Please note: The terms “bank” and “banks” used in these answers generally refer to national banks, federal savings associations, and federal branches or agencies of foreign banking organizations that are regulated by the Office of the Comptroller of the Currency . Find out if the OCC regulates your bank. Information provided on HelpWithMyBank.gov should not be construed as legal advice or a legal opinion of the OCC.

Read Also: How Does 10 Year Treasury Affect Mortgage Rates

Ive Sent You A Check To Pay Off My Mortgage Loan In Full Do I Need To Do Anything Else

No theres nothing more you need to do.

When we receive your payoff check, on behalf of your lender well mail a lien release document to your local county recorder or land records office within 30 business days after your payoff date . But depending on where you live, it may take more than 30 days for your local office to record the document and return it to us. Regardless of how long the recording process takes, well send you the recorded document after we receive it.

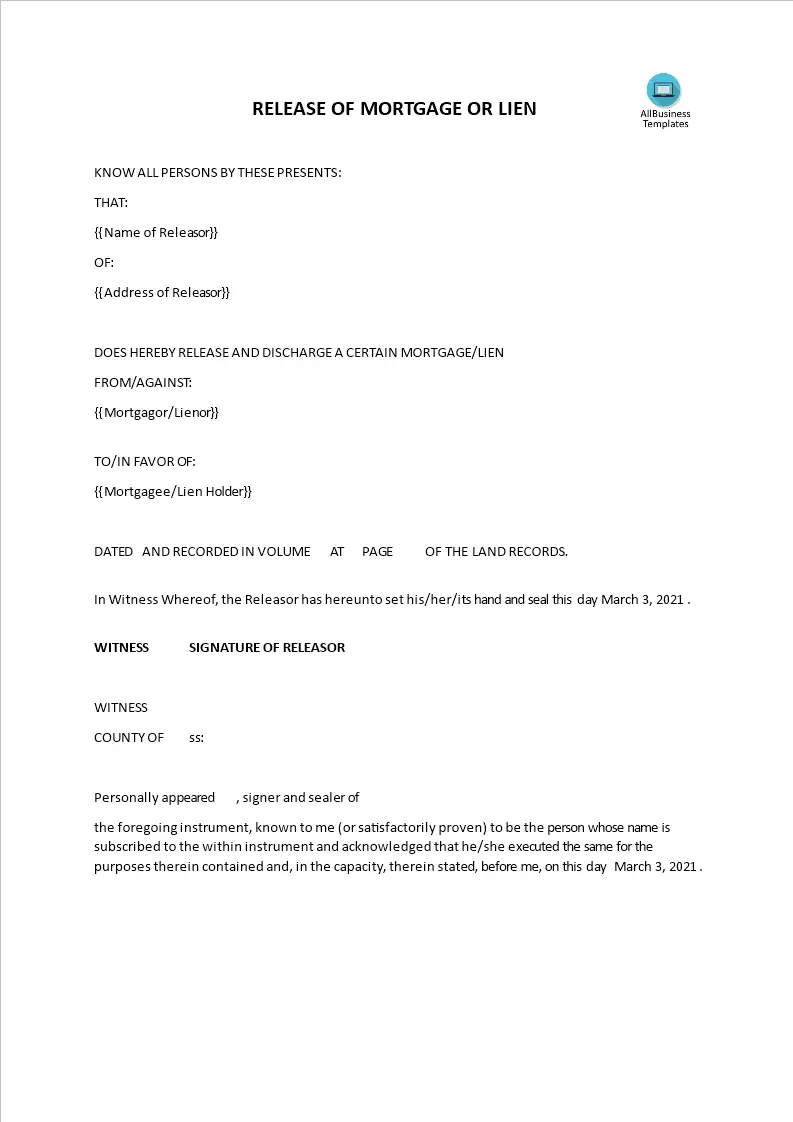

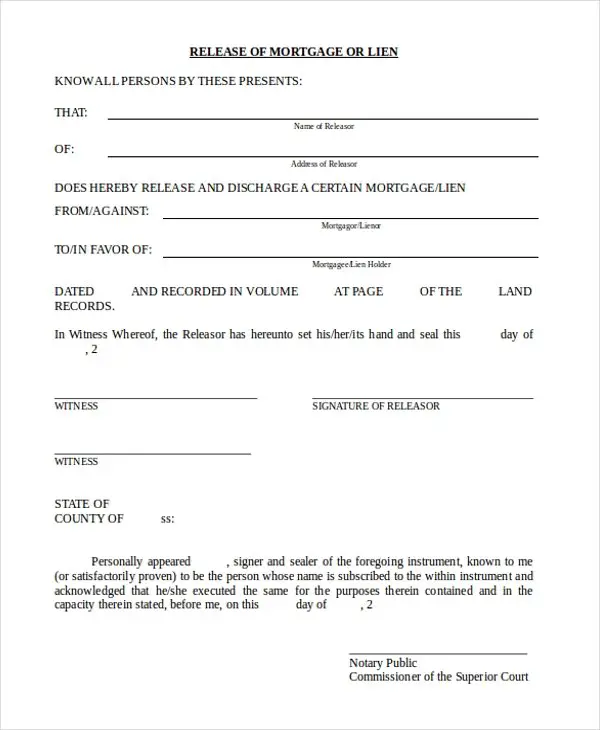

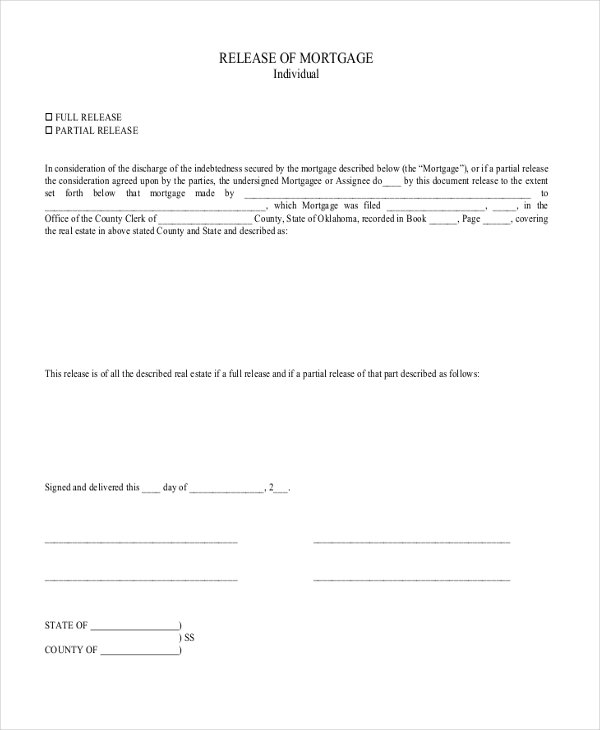

Add A Signature Block And An Area For The Notary Publics Acknowledgment And Seal

The signature block should be able to collect the signatures of the mortgagor, the mortgagee, and the witnesses or witnessing officer present in the execution of the release. The notary acknowledgment section of the form should contain statements indicating the notary publics affirmation to the identities of the involved parties and the legalities of the release. Another signature block should be placed below the notary acknowledgment statement which will be for the signature, title, seal, and name of the notary public.

After the contents of the basic mortgage release form are reviewed and finalized, the form should be saved and be printed to collect the signatures. Then, duplicates or copies of the signed basic mortgage release form should be distributed to every party who affixed their signatures in the form. The purpose of distributing copies is to allow each party to have their own reference and proof that the mortgage and the lien had been released legally by the mortgagee.

Read Also: Does Rocket Mortgage Service Their Own Loans

Mobile Or Manufactured Home: Required Documents For Obtaining A Lien Release

1. Title or Non-Negotiable Title or Inquiry Report

A copy of the Title or Non-Negotiable Title for the Mobile Home that you are requesting to be released. The copy must be legible and clearly show:

- Owner’s Name

- Make and Model

- Weight and Size

If the Title or Non-Negotiable Title has been lost or is unavailable, you will have to request a printout from the State containing the title information, and provide it to us. This printout is sometimes called an Inquiry Report or Title Report. Depending on the State in which you live, you may have to go to the Department of Housing and Community Affairs, Department of Motor Vehicles, Department of Public Safety, or the local Tax Office for this printout and there may be a small fee for it.

Please note that a registration certificate is not the same as a title report and is not acceptable.

2. Proof of Payoff

Proof that the loan was paid in full. Proof of Payoff may include such things as a copy of a “PAID” Note, copies of payment checks, or any other documentation that would indicate payment. This should greatly reduce the amount of research time and expedite our handling of your request.

The FDIC will not accept a copy of the borrowers credit report as proof of payoff.

What Is A Lien Release

A lien release takes place when your lender releases their claim to your property . Depending on where you live, the document that proves your lender has released their claim is called a release of lien or a certificate of satisfaction. By signing the lien release, your lender is confirming that they no longer have any legal claim to your property.

If you sell your property or legally transfer it to someone else, your loan servicer must be involved in the selling process to make sure the lien is properly released or transferred before you can complete the transaction.

You May Like: Can You Get A Reverse Mortgage On A Condo

Failing To File A Satisfaction Of Mortgage The Afterthought That Can Haunt Your Property

Following the acquisition or financing of a property, most parties to the transaction are happy to circulate the Congratulations! missives as soon as the closing has occurred the seller has their proceeds, the buyer/borrower has their property and/or the loan funds, and the prior financing have been paid off but the champagne corks shouldnt be popped quite yet. There is one crucial post-closing item that too often gets overlooked and, if not addressed, can cause headaches rivaling a hangover down the line recording the satisfaction or discharge of mortgage.

While it is the lenders burden to prepare and arrange for the filing of the document that evidences the mortgage satisfaction , it is the property owner who ends up feeling the pain if that fails to happen, particularly when it cant obtain clear title when it seeks to refinance or sell the property. And in many circumstances it can be costly and time consuming, even causing delays in closing, to chase the necessary discharge documents and get them on record in order to clear title. To avoid these issues it is good practice to ensure the mortgage satisfaction is timely recorded and, luckily, state legislatures have provided incentives for lenders to do just that

S We Follow In The Mortgage Lien Release Support Services

At Outsource2india, we prioritize making the service transparent end-to-end without grey areas. This would enable you to experience the quality of efforts we take to maintain compliance and bring you the satisfaction through a clean mortgage lien release support. The process involves is as follows –

Recommended Reading: Chase Mortgage Recast

General And Specific Liens

A lien can either be general or specific. These two different labels can tell you how a lien will impact you specifically, the scope of your property it will affect.

A general lien is a claim on all your property assets, including real estate and personal property . When you owe the IRS taxes, they can apply a claim on all of your property, not just your house, with a general lien.

In contrast, a specific lien is a claim on a particular piece of property or asset. For instance, a specific lien might be incurred when a property owner owes homeowners association fees or late mortgage payments on a specific property. A mortgage on a home is an example of a specific lien.

Simultaneous Release On Refinance

When you refinance your home, you will pay off your current loan. Your new mortgage lender cannot record its lien until the prior lender releases its lien. The closing attorney or escrow company should coordinate this release and record the new lien, reports Federal Title. If the lender does not provide a lien release ahead of closing, the closing agent should follow up and get it.

The agent cannot officially record your new mortgage until he records the former lender’s release of lien. Closing agents should record the lien release at the same time they record the new mortgage.

References

You May Like: Requirements For Mortgage Approval

What Is A Lien

A lien is a legal right or claim against a property by a creditor. Liens are commonly placed against property, such as homes and cars, so that , such as banks and credit unions, can collect what is owed to them. Liens can also be removed, giving the owner full and clear title to the property.

Liens limit what the owner can do with an asset, as creditors are given a stake in the property to compensate for what is owed to them. If a homeowner tries to sell a property before a lien is lifted, then it can present complicationsespecially if the lien is involuntary.

Liens give creditors certain legal rights, especially when a debtor hasnt paid or refuses to fulfill their financial obligation. In these cases, the creditor may choose to dispose of the property by selling it.

What Is A Mortgage Discharge

A mortgage is a loan secured by property, such as a home. When you take out a mortgage, the lender registers an interest in, or a charge on, your property. This means the lender has a legal right to take your property. They can take your property if you dont respect the terms and conditions of your mortgage contract. This includes paying on time and maintaining your home.

When you pay off your mortgage and meet the terms and conditions of your mortgage contract, the lender doesnt automatically give up the rights to your property. There are steps you need to take. This process is called discharging a mortgage.

You May Like: Rocket Mortgage Launchpad

Mortgage Lien Release Processing

As an experienced mortgage lien release services company we take care of the entire gamut of the release process. After receiving lien release requests through emails, fax and call centers, we prioritize the steps to speed up the process. These include retrieving documents, verifying assignments and validating them. We liaise with the concerned teams to complete all document verification steps that are a part of release request processing. We follow up with them and push for fast response times, to get the release request moving to other stages of the process.

Refusing To Grant A Release

Remember, your lender’s goal is to get the loan paid, therefore, if releasing you from liability threatens that goal, you are going to have an uphill battle. For example, if you ask to be removed, and your soon-to-be former spouse’s credit recently took a nosedive, the answer will most likely be no. The lender will take a hard look at your reasons for wanting a release, who will be holding the bag and what the chances are that person will continue paying the loan.

Recommended Reading: 10 Year Treasury Yield And Mortgage Rates

What Are The Benefits Of A Mortgage Release

- Eliminate your remaining mortgage debt

- Avoid the negative impact of a foreclosure

- May be eligible for relocation assistance in some cases

- Start repairing your credit sooner than if you went through a foreclosure

- May be eligible for a Fannie Mae mortgage to purchase a home sooner than if you went through foreclosure

- Flexible exit options let qualified homeowners leave the home immediately, or consider other ways to transition out

Voluntary And Involuntary Liens

When you have a lien placed on your property, it is also either voluntary or involuntary meaning you either agreed to it or it was put there against your will.

With a voluntary lien, the property owner gives consent for a claim to be placed on their property by the lender as collateral or security in exchange for repayment. This type of lien allows the lender to repossess the property and sell it if the owner doesnt repay their debts. One of the most common types of voluntary and specific liens is a mortgage, because a borrower freely enters into it.

An involuntary lien is a claim placed on the property without the owners consent. In most cases, involuntary liens happen because of the property owners lack of action or inability to pay their debts, such as their mortgage payments or property taxes. A lender can place a claim on the property to warn the owner that theyll lose legal ownership if the obligations aren’t paid.

Get approved to refinance.

You May Like: Who Is Rocket Mortgage Owned By

A Lien Holders Payoff Letter Usually Includes The Following:

- A good through date this is the deadline to make the specified payment, if missed, interest will cause the amount to change

- If paying by wire transfer, where to send the money

- If paying by check, who to make it out to and if a cashiers check is required

- Any charges to include in your payment for outstanding penalties or account closing fees

- Prorated amounts should you pay before or after the good through date

S We Follow In The Mortgage Lien Release Support Service

Our clients consider mortgage lien release support services because of the transparency in service and cost-effectiveness. We combine our skills, technology, and flexible pricing to bring you a favorable opportunity to work with us. The steps involved in the mortgage lien release and assignment processing are as follows –

Read Also: Recasting Mortgage Chase