How Much Should You Put Down On A House

The right down payment for you depends on your goals and financial situation. While there are plenty of pluses with a larger down payment, putting down too much could leave you strapped for cash after you move in.

Conventional mortgages usually require you to pay for private mortgage insurance if you put down less than 20%. Once you start making mortgage payments, you can ask to cancel PMI after you have over 20% equity in your home.

Try out some different scenarios to help you better understand how changing the size of your down payment can affect other costs.

Money You Will Spend Beyond The Mortgage

When figuring out how much of a payment one can afford, there are other expenses that must be considered aside from the mortgage. These addition financial obligations can be:

- Home Maintenance: There will be some maintenance during ownership of the home. Appliances break down, carpet needs replaced, and roofing goes bad. Being overextended due to the mortgage can make repairs more of a burden.

- Utilities: These expenses keep the home heated, lit up, water running, and other items such as sewer, phone, and cable T.V. going.

- HOA Fees: If the community in which the borrower moves in has amenities, there may be Homeowners Association Fees that must be paid. The fees can vary based on what amenities the community is offering. Sometimes the price can be $100 per month or $100 per year.

What House Can I Afford With My Current Salary

To determine how much house can I afford, use the 28/36 rule, which states that you should not spend more than 28% of your gross, pre-tax, monthly income on home-related expenses and no more than 36% on total debt.

How Much Money Do You Need To Make Each Month To Afford A Home?

It is critical to consider your financial situation before purchasing a home. By using these guidelines, you can determine how much money you will need to make each month to buy a home in a certain price range. The cost of living in a $300,000 home will typically range between $50,000 and $74,500 per year. This is a guideline, and the salary will vary depending on your credit score, debt-to-income ratio, loan type, loan term, and mortgage rate. If you want to buy a $300,000 house, youll need to make between $50,000 and $74,500 a year, for example. If you have a good credit score, a lower debt-to-income ratio, or a longer loan term, you may be able to afford a home with a lower price tag. If you have a poor credit score, a high debt-to-income ratio, or a shorter loan term, you may need to make more money each month to afford the same home price as others.

Also Check: How To Get A Mortgage If Your Self Employed

Personal Criteria: Deciding How Much Mortgage You Can Afford

The borrower should consider personal criteria when purchasing a home in addition to the criteria of the bank when determining what kind of mortgage can be afforded. Although someone may be approved for a certain mortgage amount, that certainly does not mean the payments can be covered. The following is personal criteria to take into account along with the criteria of the lenders:

- The ability for the borrower to pay mortgage payments is dependent upon income. Questions to consider are whether or not two incomes are needed to pay bills, how stable the current job is, and how easy it would be to find another job if the current job is lost.

- The borrower must ask if they are willing to make changes in lifestyle in order to afford the home. If tightening the budget will not impact lifestyle, then having a higher back-end ratio might be the way to go. If there are little things within the budget that are too important to eliminate, it might be better to take a more conservative approach.

- The back-end ration contains most of the current debts, but there may be debts that come about in the future that are not considered in the back-end ration. Doing things such as buying a new car or boat, or a child who will attend college are things to consider.

- Then there is the borrowers personality. Some people are more comfortable making a specific payment amount than others.

Future Changes That Might Make An Impact

The lender will assess whether youd be able to pay your mortgage if:

- interest rates increased

- you or your partner lost their job

- you couldnt work because of illness

- your life changed, such as having a baby or a career break.

Its important that you also think ahead and plan how youd meet your payments.

For example, you can help to protect yourself against unexpected drops in income by building up savings when you can.

Try to make sure it contains enough for three months outgoings, including your mortgage payments.

Read Also: Can You Put Renovation Costs Into Your Mortgage

How Can I Avoid Hurting My Appraisal

Here are a few things you can do to make sure you dont hurt your appraisal:

- Clean your home. The cleaner it is, the more the great elements of the home will pop out to an appraiser.

- Double-check items that leave a first impression of your home. This could include the paint on the walls, handrails, railings on decks, plumbing, roof leaks and cracks in the walls, ceiling or foundation. Check on water intrusion anywhere in the home, particularly in the foundation.

- Make known repairs before an appraiser arrives. If you know the roof has some leaking issues or the basement is in need of repair, make those repairs ahead of time.

- Organize receipts and take photos of any renovations or improvements. New appliances and other new features, such as repairs to the leaky roof, should be kept as proof of the homes improvements.

Learn More About A Mortgage Pre

The first step in buying a property is knowing the price range within your means. You can get an estimate for this amount through a mortgage pre-qualification, or for more certainty, a mortgage pre-approval.

A mortgage pre-qualification is a rough estimate of your borrowing capacity to purchase a property. Its calculated based on your basic financial information such as your income and current debt. No credit check is involved, nor is it a guarantee of the approved financing which you may receive by National Bank.

A mortgage pre-approval certifies your borrowing capacity based on several criteria including your credit rating. It confirms the amount that National Bank agrees to lend you under certain conditions and protects the rate of this loan against potential rises for 90 days. A pre-approval demonstrates your seriousness to sellers and your real estate agent and does not impose any obligation for you to commit to the loan.

Start your pre-approval request online now. Our mortgage experts will then contact you to finalize your request.

Don’t Miss: What Is The Monthly Payment On A 500 000 Mortgage

How Do I Get The Best Mortgage Rate

Shopping around for the best mortgage rate can mean a lower and big savings. On average, borrowers who get a rate quote from one additional lender save $1,500 over the life of the loan, according to Freddie Mac. That number goes up to $3,000 if you get five quotes.

The best mortgage lender for you will be the one that can give you the lowest rate and the terms you want. Your local bank or credit union is one place to look. Online lenders have expanded their market share over the past decade and promise to get you pre-approved within minutes.

Shop around to compare rates and terms, and make sure your lender has the type of mortgage you need. Not all lenders write FHA loans, USDA-backed mortgages or VA loans, for example. If youre not sure about a lenders credentials, ask for its NMLS number and search for online reviews.

How Do Banks Make Money From Mortgage

Loans are sold to institutions such as an investment bank. When an investor buys a mortgage loan, he basically lends money to home buyers. This may interest you : Can you buy a house with a promissory note?. In return, the investor acquires the value of the mortgage, including interest and the principal payments made by the lender.

Who owns the most mortgage-backed securities?

Most mortgage support loans are provided by the Government Mortgage Association , a US government agency, or the Federal Loan Mortgage Corporation and the Federal Home Loan Mortgage Corporation , businesses that funded by the United States government. .

Why do banks issue mortgage-backed securities?

Basically, loan-backed security turns the bank into a mediator between the home buyer and the investment industry. The bank can lend to its customers and then sell it at a discount to add MBS.

How do banks make money off of mortgages?

Lenders can make money in a variety of ways, including basic fees, extension fees, discount points, closing costs, mortgage securities, and mortgage service. Lenders can also get money to pay off their mortgage loans and sell MBS.

Don’t Miss: What Documents Will I Need To Apply For A Mortgage

Consider The Ongoing Costs

Now you own your home. You love it. You never want to leave it, and then the roof begins to leak. When youâre deciding how much home you can afford, donât forget about ongoing repairs and maintenance.

A good rule of thumb is to set aside at least 1% of your homeâs value every year for repairs and maintenance. So, to keep a $250,000 home in great shape, that means you should plan to save $2,500 per year.

Also keep in mind that prices for everything tend to go up, not down. Property taxes, homeowners insurance and utilities â these are expenses that will continue as long as you own your home.

How Much Can I Borrow

We calculate this based on a simple income multiple, but, in reality, it’s much more complex.

When you apply for a mortgage, lenders calculate how much they’ll lend based on both your income and your outgoings – so the more you’re committed to spend each month, the less you can borrow.

This calculator provides useful guidance, but it should be seen as giving a rule-of-thumb result only. Read more about what lenders look at in theHow Much Can I Borrow? guide

Don’t Miss: How Much Does Biweekly Mortgage Payments Save

How Much Will A Bank Lend On A Property

Generally, we can expect a lender to lend up to 80% of the value or price of a house .

Often, lower percentages are loaned on properties outside urban areas and on apartments. These figures are sometimes called the loan to value ratio, or LVR.

It is possible to borrow up to 95% of a propertys value in some cases. But thats a big risk for both the borrower and the lender.

What Are Points On A Mortgage Rate

Mortgage points represent a percentage of an underlying loan amountâone point equals 1% of the loan amount. Mortgage points are a way for the borrower to lower their interest rate on the mortgage by buying points down when theyâre initially offered the mortgage.For example, by paying upfront 1% of the total interest to be charged over the life of a loan, borrowers can typically unlock mortgage rates that are about 0.25% lower.

Itâs important to understand that buying points does not help you build equity in a propertyâyou simply save money on interest.

You May Like: Can You Refinance Mortgage Without Closing Costs

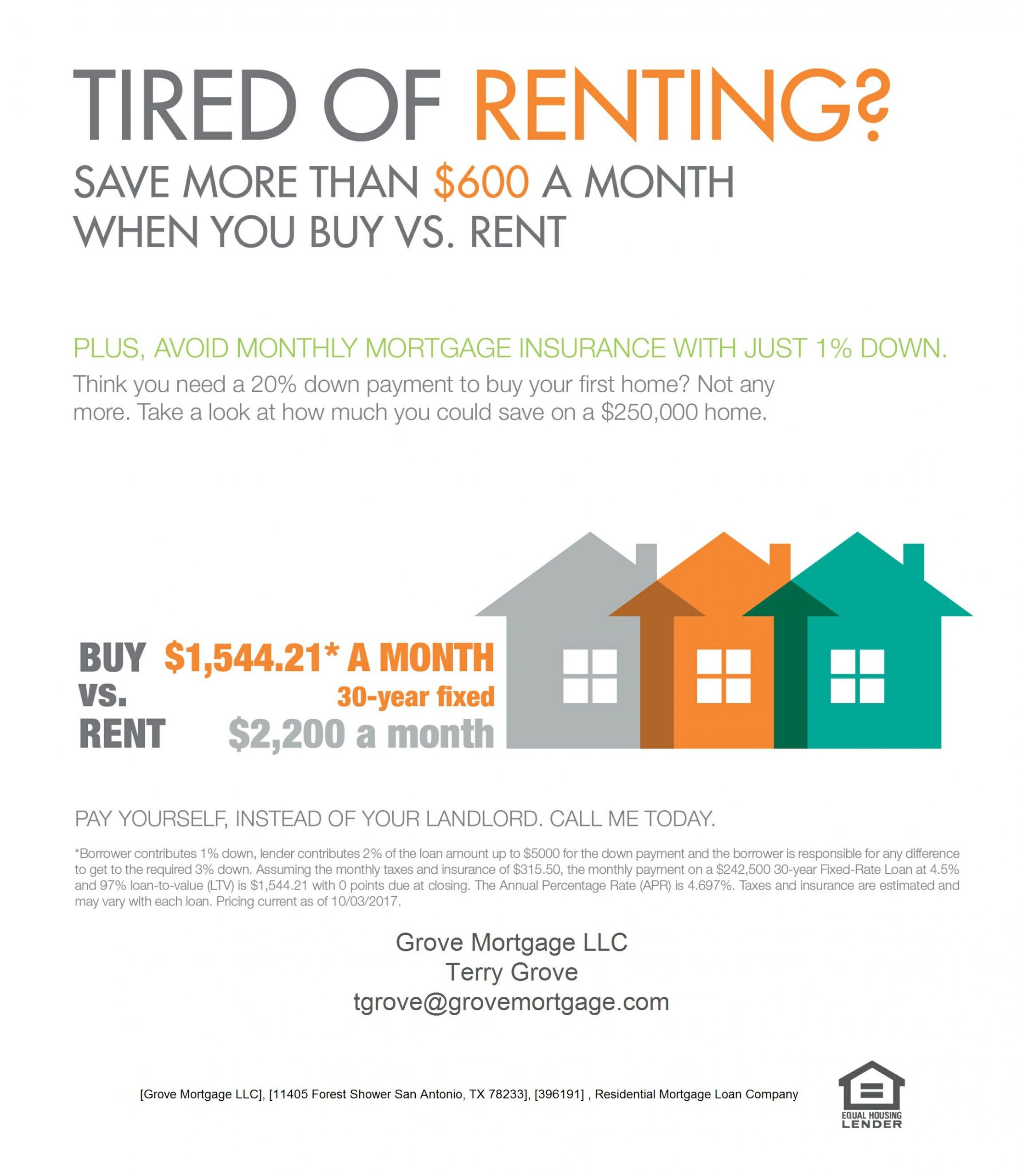

Low Down Payment Insured Mortgage

Most lenders now offer insured mortgages for both new and resale homes with lower down payment requirements than conventional mortgages-as low as 5%. Low down payment mortgages must be insured to cover potential default of payment as a result, their carrying costs are higher than a conventional mortgage because they include the insurance premium.

Mortgage default insurance is a one time premium paid when your purchase closes. You can pay the premium or add it to the principal amount of your mortgage. Talk to your mortgage specialist to find out which option is best for you

When Should You Lock In Your Mortgage Rate

When you receive a mortgage loan offer, a lender will usually ask if you want to lock in the rate for a period of time or float the rate. If you lock it in, the rate should be preserved as long as your loan closes before the lock expires.

If you donât lock in right away, a mortgage lender might give you a period of timeâsuch as 30 daysâto request a lock, or you might be able to wait until just before closing on the home.

Once you find a rate that is an ideal fit for your budget, itâs best to lock in the rate as soon as possible, especially when mortgage rates are predicted to increase. While itâs not certain whether a rate will go up or down between weeks, it can sometimes take several weeks to months to close your loan.

If you donât lock in your rate, rising interest rates could force you to make a higher down payment or pay points on your closing agreement in order to lower your interest rate costs.

Read Also: What Are The Typical Closing Costs For A Reverse Mortgage

Factors Affect Home Loan Eligibility

Some of the key factors that affect an individuals housing loan eligibility are stated below:

- CIBIL score: Applicants possessing an ideal CIBIL score above 750 are more likely to avail of a home loan at affordable terms that make repayment comfortable

- Fixed obligations to income ratio: Lenders are likely to offer housing loan options at favourable terms to individuals with a low FOIR. A low FOIR value indicates a higher disposable income, thereby increasing the chances of the borrower repaying the loan amount timely

- Age of the applicant: The age of the borrower dictates the tenor of loan repayment. An extended repayment tenor will have smaller EMIs, thereby making it easier for the individual to repay the loan without defaulting

Apart from these, employment status, monthly income, property details and loan-to-value ratio also affect home loan eligibility.

How Do You Shop For Mortgage Rates

First, start by comparing rates. You can check rates online or call lenders to get their current average rates. Youâll also want to compare lender fees, as some lenders charge more than others to process your loan.

Thousands of mortgage lenders are competing for your business. So to make sure you get the best mortgage rates is to apply with at least three lenders and see which offers you the lowest rate.

Each lender is required to give you a loan estimate. This three-page standardized document will show you the loanâs interest rate and closing costs, along with other key details such as how much the loan will cost you in the first five years.

Also Check: How To Pay House Mortgage Faster

Mortgage Rates Affect How Much You Can Borrow For A Mortgage

You dont have to be a math prodigy to work out that the less interest you have to pay on a loan, the more you can afford to borrow.

But lets look at some examples in action. Were making all the same assumptions we used in our earlier examples, except for your monthly inescapable expenses and the interest rates you qualify for.

All weve done is use our mortgage calculator to come up with the figures. And you can do that to match your own circumstances just as easily as we have.

How Much Mortgage Can I Afford Based On Income

How much mortgage can i afford based on income? The answer to this question depends on a number of factors, including your income, your debts, and the type of loan you are interested in. Generally speaking, you can expect to be able to afford a mortgage that is worth up to 28% of your gross monthly income. However, this is just a general guideline and you may be able to qualify for a higher or lower mortgage amount based on your specific financial situation. For instance, if you have a low debt-to-income ratio, you may be able to qualify for a higher mortgage amount. Alternatively, if you are interested in a more expensive home, you may need to put down a larger down payment in order to make up for your lower income. Ultimately, the best way to determine how much mortgage you can afford is to speak with a lender and get pre-approved for a loan.

It is critical to remember that if you want to buy a $350,000 to $500,000 home, you must adhere to the 28% rule. To purchase a home, youll need to spend about $2,300 per month on it, make a down payment of 5% to 20%, and have a good credit score.

You May Like: Should I Take Out A Mortgage At Age 60

How The Limits Work

There are 2 types of limit:

- Loan-to-value is based on the ratio of the size of the loan to the value of the home you want to buy

- Loan-to-income is based on ratio of the size of the loan to the income of the borrower

In general, you will have to meet both of these limits for your mortgage tomeet the Central Banks requirements. The lender must also assess each loanapplication on a case-by-case basis see Assessment by the lenderbelow. The regulations do allow lenders to be flexible in some cases seebelow.

How Much Money Do I Need To Buy A House For The First Time

As of October 2021, the median home price in the U.S. is around $404,700. Assuming a 20% down payment, you would need $80,940 for a down payment, plus several thousand more for closing costs and fees to your lender, realtor, lawyer, and title company. Still, no set amount is required and home prices vary state-to-state and city-to-city. It’s all dependent on what you’re looking for in terms of size and type of property, neighborhood, amenities, and any other details specific to your situation.

Read Also: How Interest Is Calculated On Mortgage