Youll Pay More In Interest

Over the course of 30 years, you are likely to pay considerably more in interest on your mortgage than you would on a loan with a shorter term. For example, if you borrowed $160,000 with a 3.37% interest rate, you would pay $94,726.03 in interest over the 30 years. If you borrowed the same amount with the same interest rate for 15 years, you would pay $44,086.16 in interest over 15 years.

How To Pay Off A Reverse Mortgage Without Losing Your Home

In most cases, a reverse mortgage is paid off with the sale proceeds of the home when the borrower moves out or they pass away. There are some protections in place, including a non-recourse clause that prevents borrowers or their heirs from having to repay more than the value of the home when its sold.

Unfortunately, because reverse mortgages are usually paid off with the sale of the home, homeowners often arent able to get out of the loan or leave it to their heirs when they die. The only way to keep the home is to find another way to repay the loan.

Is A Fixed Interest Rate Right For You

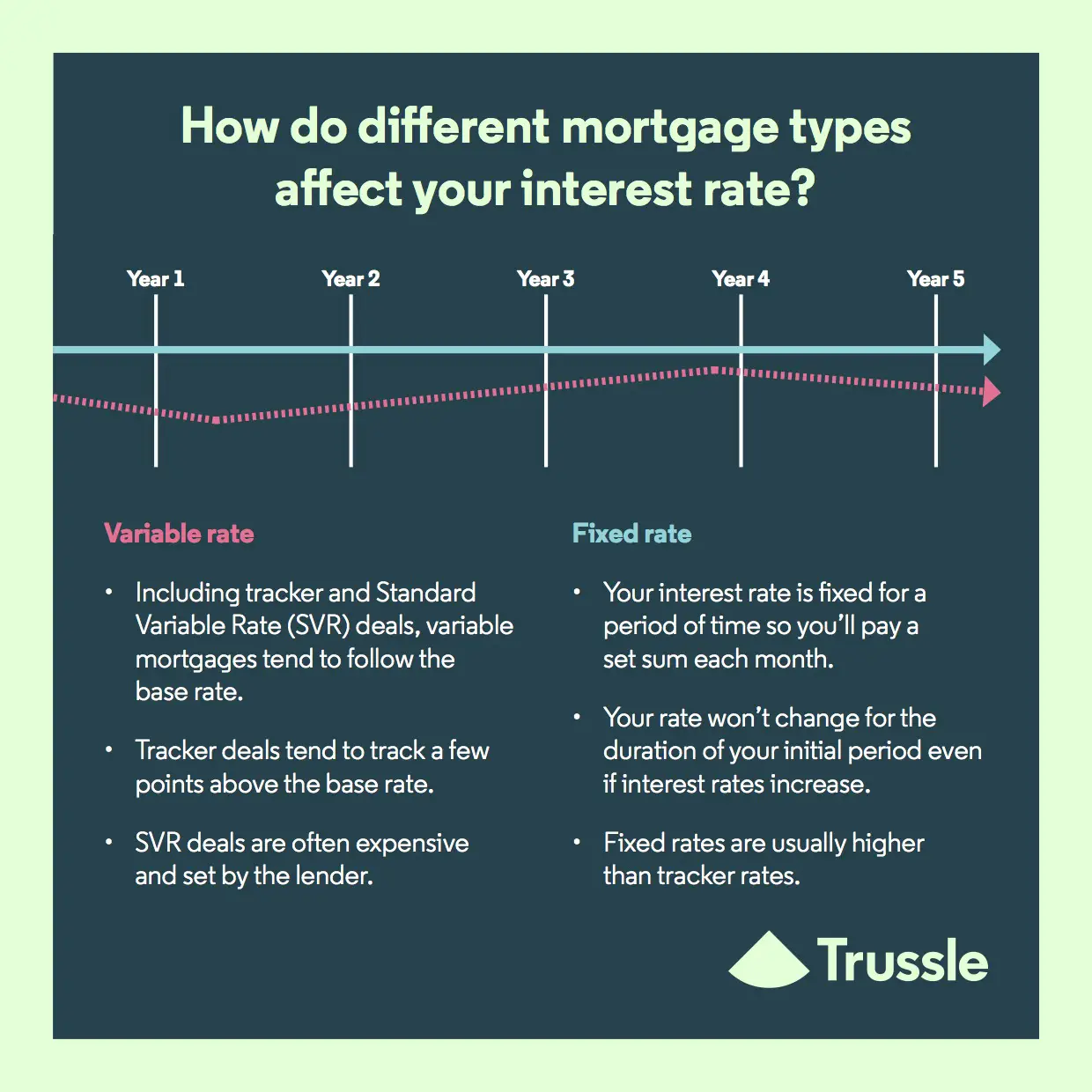

Before you decide whether to go with a variable or fixed interest rate, lets look at how each rate can affect your loan.

Lets say you take out a 60-month $20,000 loan on a new car at a fixed interest rate of 3.99%, with monthly payments of about $368. Your total repayment amount with interest would be $22,094.

But if the loan has a variable rate, and the interest rate goes up, your payments and the total repayment amount could increase. Conversely, if the interest rate happens to drop, you may save money overall.

Choosing between a fixed or variable interest rate may come down to your comfort level with risk. While you may be able to find a variable-rate loan with lower initial interest rates than a fixed-rate option, you run the risk of the variable rate increasing before youve paid off your loan. If you like the security of a loan payment that wont fluctuate according to the prime rate or other index rate, you may prefer a fixed interest rate.

Recommended Reading: What Is Considered Good Credit Score For Mortgage Loan

Explore Your Options With Total Mortgage

Finding a mortgage that fits your specific requirements and circumstances can be just as complicated as the search for the perfect home. The right mortgage lender can help ease your stress by taking the time and effort necessary to guarantee a seamless transaction.

If you have questions about the 2/1 buydown loan or if youre ready to take the first step toward finding the right mortgage, consider your options with Total Mortgage. Start your application with Total Mortgage today and get your free rate quote after answering a few questions.

Types Of Mortgage Rates

As weird as it sounds, there are actually different types of mortgage rates that may affect you in some ways.

- Prime rate. Known as the prime lending rate, or overnight rate, this rate is set by the Bank of Canada and used by financial institutions to set interest rates for loans.

- Posted rate. These rates are what lenders publicly announce. Theyre used mainly to calculate interest rate differential if you break your mortgage.Discounted rate. This is the actual interest rate you pay when getting a mortgage.

What many homeowners dont realize is that the posted rate is just a sticker price. Sure, you could get a mortgage for that amount right away, but why would you do that when you can negotiate a discounted rate instead?

Many financial institutions are banking on the fact that you may not be aware that discounts are available or youre too lazy to shop around. However, as a consumer, its in your best interest to negotiate your mortgage rate since it could save you thousands of dollars.

Best Mortgage Rates in Canada

Compare Canadas top mortgage lenders and brokers side-by-side and find out the best mortgage rates that will meet your need

Don’t Miss: What Is Considered A High Interest Rate On A Mortgage

What Is A Mortgage

This piece was originally published in November 2016, and was updated on October 25, 2022.

What is a mortgage? Itâs a question weâve all asked at some point, and itâs one that we can answer. A mortgage is a major financial commitment, so the more you know about them, the more prepared youâll be if you decide to get one for yourself.

Read on for a short answer to the âwhat is a mortgageâ question, as well as some further information about how a mortgage works.

Fixed Versus Adjustable Interest Rates

A mortgage on which the interest rate is set for the life of the loan is called a fixed-rate mortgage or FRM, while a mortgage on which the rate can change is an adjustable rate mortgage or ARM. ARMs always have a fixed rate period at the beginning, which can range from 6 months to 10 years. The rate adjustment feature of an ARM makes it a lot more complicated than an FRM, which is why many borrowers wont consider an ARM.

Recommended Reading: How Much Do You Save By Paying Off Mortgage Early

Mortgage Rates And The Pandemic

It looked like a puzzle: As the COVID19 pandemic spread, central banksincluding the Bank of Canadaquickly cut interest rates to cushion the blow. But rates on new mortgages didnt decline much, and some actually went up. Why?

Remember that your lenders funding cost determines most of the mortgage rate. The cost of funding jumped in the early days of the pandemic as investors became nervous. Many simply wanted to hold on to their cash given how uncertain everything was. So, the funding that is normally easy for lenders to get slowed to a trickle. This drove up the funding cost, even as the Bank of Canadas policy interest rate fell.

The Bank of Canada has taken many steps to help financial markets work better during the pandemic, along with the federal government and other public authorities. The goal is to ease strains in funding markets, so lenders can keep supplying credit to households and businesses.

These steps include launching programs to make sure lenders can access the funding they need. As a result of these actions, funding costs fell and some mortgage rates on new loans started to decline.

Keep in mind: existing mortgages didnt become more expensive during the pandemic. They either have an interest rate that is fixed until its next renewal, or a variable interest rate that declined along with the Bank of Canada policy rate.

Why Its Important To Shop For Multiple Quotes

When youre getting a mortgage, its important to compare offers from a variety of lenders. Every lender will evaluate your financial situation differently. So getting multiple quotes will allow you to choose the offer with the best rate and fees. The rate difference between the highest and lowest rates lenders offer you could be as high as 0.75%, according to a report by the fintech startup Haus.

However, the interest rate isnt the only factor you need to consider when comparing mortgage lenders. The fees each lender charges can vary just as much as the interest rate. So the offer with the lowest rate may not be the best deal if youre paying excessive upfront fees. To compare rates and fees, take a look at the Loan Estimate form that lenders are required to provide within three business days of receiving your application. The Loan Estimate is a standardized form, which makes it easy to compare quotes.

Also Check: Can You Get Preapproved For A Mortgage Without Hurting Your Credit

Also Check: What Does A Mortgage Lawyer Do

How Your Lender Sets Your Interest Rate

Lenders set the interest rate for your mortgage. They consider factors to help them determine your cost.

These factors can include:

- the length of your mortgage term

- their current prime and posted interest rate

- if you qualify for a discounted interest rate

- the type of interest you choose

- your credit history

- if youre self-employed

Lenders typically offer higher interest rates when the term length is longer. Its not always the case.

What Is A 3

DONT LET TODAYS INTEREST RATES KEEP YOU FROM BUYING A HOME

Were expanding our Temporary Mortgage Rate Buydowns to help you receive even bigger savings of up to 3% off your initial rate. Choose from 3-2-1, 2-1, 1-1 and 1-0 buydowns, available immediately!

Theyre available for conventional, FHA and VA borrowers who need a lower rate at the start of their loan or additional money for expenses like furniture or upgrades.

Recommended Reading: What Is The Current Interest Rate For A Reverse Mortgage

The Smart Trick Of What Are The Different Types Of Home Mortgages That Nobody Is Discussing

HECMs are guaranteed by the FHA. There are no limitations on what HECM funds can be utilized for. Some state and city government companies may provide these kinds of reverse home mortgages, but the funds can only be used to meet particular needs such as fixing a house or paying past-due real estate tax.

Private business might provide their own reverse home mortgages at loan amounts higher than HECM loan limitations. You may also have the ability to get a bigger initial advance from an exclusive reverse home loan, however these loans also wont have the federal support from the FHA and could be more costly. Pros Youll have more options to use your house equity as your needs change You can supplement a portion of your retirement income You can use the reverse home mortgage funds as you want You wont leave a time share cancellation monetary concern to your beneficiaries Your qualified non-borrowing spouse can stay in the home after you pass away or move out You may reduce your regular monthly real estate expenses Cons Your loan might be foreclosed if you do not live in the house full-time Your loan balance rises gradually Your equity drops over time You may decrease the quantity youre eligible to receive for other advantages Youre reducing the inheritance value of your home Youll pay more for reverse home mortgage closing expenses Financial abuse of elders has actually become a multibillion-dollar issue in the United States.

Dont Miss: What Does Gmfs Mortgage Stand For

How Do Points Work In A Mortgage

A mortgage point is equivalent to 1% of your total loan amount. Therefore, on a $100,000 loan, one point would be $1,000.

You can choose to pay mortgage points up front in exchange for a lower interest rate and monthly payments. This is known as buying down your interest rate.

Your monthly mortgage payment will depend on your home price, down payment, loan term, property taxes, homeowners insurance, and interest rate on the loan .

Your loan officer can provide additional expertise and help take the guesswork out of mortgage interest rates. Contact them today for help on finding the right loan.

© 2022 Newrez LLC, 1100 Virginia Dr., Ste. 125, Fort Washington, PA 19034. 1-888-673-5521. NMLS #3013 . Equal Housing Opportunity. Doing business as Newrez Mortgage LLC in the state of Texas. Alaska Mortgage Lender License #AK3013. Arizona Mortgage Banker License #919777. Licensed by the Department of Financial Protection & Innovation under the California Residential Mortgage Lending Act. Loans made or arranged pursuant to a California Finance Lenders Law license. Massachusetts Lender #ML-3013. Licensed by the N.J. Department of Banking and Insurance. Licensed Mortgage Banker-NYS Banking Department. Additional licenses available at www.newrez.com.

You May Like: Can My Mom Cosign On A Mortgage

Why Your Interest Rate Matters

A difference in just 1% on your interest rate can account for thousands of dollars over the life of your home loan.

Locking in a rate as soon as you can and owning assets like real estate and other commodities may safeguard you from rising rates and prices in the future. Plus, youll be able to achieve the American dream of homeownership at a more affordable price.

in your area to discuss todays interest rates and how you can achieve your homeownership goals.

Make A Sizeable Down Payment

The down payment is the amount that you pay up front for your loan. The size of the down payment can end up affecting the mortgage rate. Typically, the bigger the down payment you make, the lower the mortgage rate. Keep in mind, however, that the exact impact of the down payment will depend on your unique financial situation.

20% of the total loan amount is a typical down payment, but paying either more or less can affect your monthly mortgage payment amount. You can see how different down payment amounts affect your monthly payment by punching your numbers into a mortgage calculator.

You May Like: What Is The Cost Of Mortgage Insurance

What Is A Variable

If you take out a variable-rate mortgage, this means your interest rate and therefore your monthly payments can rise or fall.

There are three main types of variable-rate mortgages: standard variable rate , tracker rate, and discounted rate mortgages.

How does a variable rate mortgage work?

With a variable-rate mortgage, your monthly payments can change, as your interest rate can go up or down over time.

The variable rate you pay will be decided by your lender. This wont necessarily fluctuate in line with the Bank of England base rate unless youve chosen a tracker mortgage. If you find yourself on your lenders SVR, youll usually have the freedom to remortgage to a different deal without having to pay an early repayment charge.

Pay Down Mortgage Points

You may be able to buy a lower rate by prepaying some of the interest, known as points depending on the lender you work with. The more points you buy, the lower the interest rate you can get on your loan.

While it might seem appealing to buy a lower rate, dont forget that it actually might not be worth the expense depending on how soon you sell or refinance your home.

Recommended Reading: Does Wells Fargo Recast Mortgages

Are Points Right For You

To find out whether points could work for you, determine whether you have the cash available to buy points up front, in addition to your down payment, closing costs and reserves. Also, consider how long you plan to own the home.

Buying points to lower your rate may make sense if you select a fixed-rate mortgage and you plan on owning the home after youve reached the break-even period.

Under certain circumstances, buying mortgage points when you purchase a home can save you significant money over the course of your loan. But its important to understand how they work and how long it takes for the additional upfront cost to be worthwhile.

You May Like: Is 720 A Good Credit Score For Mortgage

How Does Refinancing A Mortgage Work

Similar to when you first applied for your mortgage, a lender will review your finances to assess your level of risk and determine your eligibility for the most favorable interest rate. Its an entirely new loan, and it could be with a different lender than the one you originally worked with to buy your home.

Your new loan might also reset the repayment clock. Say youve made five years of payments on your current 30-year mortgage. That means you have 25 years left on the loan. If you refinance to a new 30-year loan, youll start over and have 30 years again to repay it. If you refinance to a new 20-year loan instead, youll pay your loan off five years earlier.

Refinancing comes with closing costs, which can affect whether getting a new mortgage makes financial sense for you. These costs can be between 2 percent and 5 percent of the amount you refinance. Common closing costs include discount points, an origination fee and an appraisal fee. Youll need to calculate the break-even point to determine whether youll stay in your home long enough to recoup the closing costs and benefit from the savings of the refinance.

Also Check: What Is The Mortgage Calculator

Mortgage Fees And Charges

Mortgage lenders dont just make their money from the interest they charge on the loan most products come with an application or product fee too.

These are often around £1,000, and can be paid either up-front or added to your mortgage balance, though doing the latter will cost you more as you’ll pay interest on it.

Lenders may also offer fee-free deals – but you’ll usually pay for this through a higher interest rate.

For example, a mortgage deal might have a 2.09% interest rate and come with a £999 product fee. However, there may also a fee-free version available at 2.39%.

In this particular example, the version with the fee would be cheaper over the long term. But that won’t always be the case.

It will all depend on the size of the fee, and the difference between the two interest rates.

You can calculate the difference between fee-free and fee-paying mortgage deals yourself with our mortgage repayment calculator.

Get A Free Australian Mortgage Assessment Today

- N: Frequency of compounding period

Compounding interest is more complex than simple borrowers may find it confusing to calculate. Its easier to use a loan amortisation calculator, which breaks down your initial principal amount and interest amount over the loan term. As your loan balance decreases, youll pay more towards the original principal balance and less interest.

Recommended Reading: Do I Own My Home If I Have A Mortgage