How Much Does A 1% Lower Interest Rate Save

The monthly payments on this loan would be about $ 1,347. In this example, a 1 percent interest rate difference could save you $ 173 per month or $ 62,252 for the duration of your loan.

How much lower interest rate is worth refinancing?

Historically, refinancing has been a good idea if you can reduce your interest rate by at least 2%. However, many lenders say 1% savings is a sufficient incentive to refinance.

What is the difference in 1% interest rate?

Your mortgage rate is simply the amount of interest charged by the person with whom you took out a loan to buy your home. While the difference in monthly payments may not seem so extreme, a higher rate of 1% means youll pay about $ 30,000 more in interest over a 30-year period.

How much does a 1% mortgage reduction save?

While it may not seem like a big benefit at first, a 1% difference in interest savings can potentially save you thousands of dollars on $ 15 or $ 30. year mortgage.

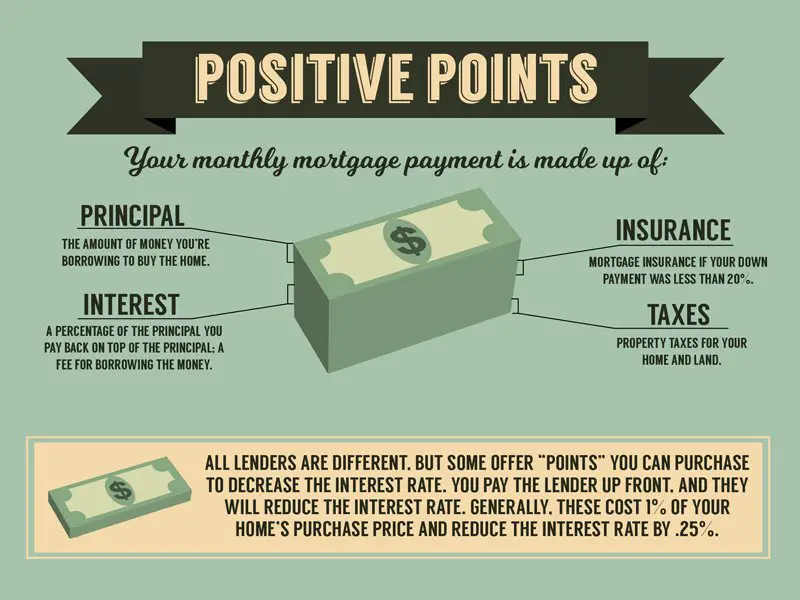

Is Buying Mortgage Discount Points A Smart Idea

As with much in life, the answer depends on the details. This rule of thumb may help: The longer you keep the mortgage, the more money you save by buying points.

Buying points could be helpful if:

-

Youre purchasing your forever home

-

You have enough cash upfront to make a large down payment and still have some left for lowering the rate. You expect to keep the loan long enough that youll exceed the break-even point in this calculator

But buying points can be a bad thing if:

-

Youll sell the home or refinance before youve hit your break-even point

-

You need the cash youll use to buy points

-

You reach the break-even point, but the monthly savings are so small that it doesnt make a meaningful dent in your budget

Should You Use Points On Your Loan

One of the key factors in understanding if you should use points is to understand your overall goals inbuying ahome. For many, purchasing a loan means paying for a loan for a set amount of years and owning the homefreeand clear after that time. For others, it is just a stepping stone to a different home or perhaps evenfor aninvestment. If you are planning on living in your home for the long haul, then paying points at thebeginningof your loan term can be very important. In fact, it can save you a good amount over the life of yourloan.

On the other hand, if you plan to live in your home for less than four years, it may not make any senseto put extramoney into the interest of your home. The fact is that this is a payment towards the interest only onyourhome, not the principle and for that reason you should take serious consideration over putting yourmoney towardsthe interest through points.

Recommended Reading: What Are The Fees For A Reverse Mortgage

How Many Discount Points Will A Lender Charge The Borrower

How many discount points will the lender charge the borrower if he wants a 15% loan and the current rate is 15.75%? As a rule, 8 discount points are needed to increase the yield percentage by a range of 1 percentage point. Therefore, 6 points will increase the percentage by 0.75%.

How many points can be charged on loan? At Better, borrowers can buy foreclosure discount points to lower the interest rate on any mortgage. Fannie Mae’s guidelines state that the maximum amount of points that can be charged to a client is 3% of the loan amount, but with Better Mortgage the points cannot exceed 2.5% of the loan amount.

Should You Buy Mortgage Points

You should buy mortgage points if you have the resources to pay for them and plan to stay in your home long enough to recoup them. There are a few other situations where it may make sense to pay points for a mortgage:

The seller has agreed to pay your closing costs. Some loan programs allow a seller to pay a percentage of your sales price toward your closing costs, which is commonly called a seller concession. If youre able to negotiate this into your purchase agreement, it may be worth it to use the sellers money to buy a lower interest rate. The table below gives you a snapshot of the maximum percentage of your purchase price the seller is allowed to pay on your behalf:

| Loan program |

- You may be able to deduct the cost of mortgage points at tax time.

Don’t Miss: What You Need For A Mortgage

How We Got Here

To use the Should I buy points? mortgage calculator, type your information into these fields:

-

Desired loan amount

-

Interest rate without points

-

Number of points

-

Interest rate with points This shows what your rate would be if you paid for points. In general, lenders drop the interest rate by a quarter of a percentage point for each point purchased, up to a limit. But maybe a lender has offered you a rate thats different for buying this number of points. If so, type in that rate to ensure the accuracy of your results.

Factor In Tax Bracket And Savings Rates To Calculate Break

- To properly determine the break-even point of paying mortgage points

- You need to take into account your individual tax bracket

- This way you can figure out the actual savings assuming you itemize your taxes

- You also need to look at savings account yields or what your money would earn elsewhere

The proper break-even point factors in your income tax bracket and current savings rates, not just the difference in monthly payment. It also accounts for faster principal repayment.

Of course, if you invest the money in stocks or bonds or whatever else, it could shift the break-even point tremendously.

If you want a good idea of when youll hit this magical point, look for a break-even calculator online that takes into account all those important details.

In our example, with a tax bracket of 25% and a current savings account yield of 1%, it would take roughly 51 months to break even, or for paying mortgage points to be worth it .

Simply put, if you dont plan on spending at least four years in your home, or more importantly, with the mortgage, its not worth paying the points.

However, if youre the type who wants to pay as little interest as possible over the life of your loan because youre in it for the long-haul, paying mortgage points can be a smart move.

In fact, if you see the mortgage out to its full term, youd pay roughly $10,000 less in interest versus the higher rate mortgage. Thats where you win.

Recommended Reading: Can You Get A Mortgage With 0 Down

Upsides And Downsides To Paying Discount Points

Again, by lowering your interest rate, your monthly mortgage payments also go down. So, you’ll have extra money available each month to spend on other things. Also, if you pay for discount points and itemize your taxes, you can deduct the amount at tax time .

But the money you pay for points, like the $3,000 paid in the above example, might be better used or invested somewhere else. So, be sure to consider whether your expected savings will exceed what you might get by investing elsewhere.

What You Need to Knowand DoBefore Taking Out a Mortgage

Getting a mortgage isn’t too difficult, but it will involve some effort on your part. If you’re planning on taking out a loan to buy a home, you can take certain steps to ensure the process goes smoothly and that you fully understand the transaction.

Instead of buying points, some borrowers choose to make a larger down payment to lower the monthly payment amount. In some cases, making a down payment large enough so that you can avoid paying for private mortgage insurance might be money better spent than using your money on points.

Also, a larger down payment helps you build equity faster. However, buying mortgage rate pointsboth discount points and origination pointswon’t increase your equity in the home. Or, you could choose to make extra payments on your mortgage to build equity in your home quicker and pay off the mortgage early.

Can You Negotiate Points On A Mortgage

You can decide whether or not to pay points on a mortgage based on whether this strategy makes sense for your specific situation. Once you get a quote from a lender, run the numbers to see if its worth paying points to lower the rate for the length of your loan.

Sometimes, origination points can also be negotiated. Homebuyers who put 20 percent down and have strong credit have the most negotiating power, says Boies.

A terrific credit score and excellent income will put you in the best position, Boies says, noting that lenders can reduce origination points to entice the most qualified borrowers.

Also Check: Is It Worth It To Refinance To 15 Year Mortgage

Are Points Tax Deductible

Home mortgage points are tax-deductible in full in the year you pay them, or throughout the duration of your loan.

The IRS guidelines list the following requirements:

- Your main home secures your loan .

- Paying points is an established business practice in the area where the loan was made.

- The points paid weren’t more than the amount generally charged in that area.

- You use the cash method of accounting. This means you report income in the year you receive it and deduct expenses in the year you pay them.

- The points paid weren’t for items that are usually listed separately on the settlement sheet such as appraisal fees, inspection fees, title fees, attorney fees, and property taxes.

- The funds you provided at or before closing, including any points the seller paid, were at least as much as the points charged. You can’t have borrowed the funds from your lender or mortgage broker in order to pay the points.

- You use your loan to buy or build your main home.

- The points were computed as a percentage of the principal amount of the mortgage, and

- The amount shows clearly as points on your settlement statement.

Using Apr To Compare Loans

Comparing different loans with varying interest rates, lender fees, origination fees, discount points, and origination points can be very difficult. The annual percentage rate figure on each loan estimate helps make it easier for borrowers to compare loans, which is why lenders are required by law to include it on all loans.

The APR on each loan adjusts the advertised interest rate on the loan to include all discount points, fees, origination points, and any other closing costs for the loan. This metric exists to make comparison easier between loans with wildly different discount points, interest rates, and origination fees.

Don’t Miss: How Do You Calculate How Much Mortgage You Can Afford

When Will You Break Even After Buying Mortgage Points

To determine if it’s a good idea to pay for points, compare your cost in points with the amount you’ll save with a lower interest rate and see how long it will take you to make your money back. If you can afford to pay for points, then the decision more or less boils down to whether you will keep the mortgage past the time when you break even. After you break even, you’ll start to save money. The break-even point varies, depending on your loan size, interest rate, and term.

Example. As in the example above, let’s say you get a 30-year loan of $300,000 with a 3% fixed interest rate. Your monthly payment will be $1,265. However, if you buy one point by paying $3,000, and your rate goes down to 2.75%, the monthly payment becomes $1,225. So, divide the cost of the point by the difference between the monthly payments. So, $3,000 divided by $40 is 75, which means the break-even point is about 75 monthsmeaning you’d have to stay in the home for 75 months to make it worth buying the point.

As you can see, the longer you live in the property and make payments on the mortgage, the better off you’ll be paying for points upfront to get a lower interest rate. But if you think you’ll want to sell or refinance your home within a couple of years , you’ll probably want to get a loan with few or no points. Check the numbers carefully before you pay points on a loan because you might not recoup the cost if you move or refinance within a few years.

How Much Money Do You Have To Put Down At Closing

If your down payment on a conventional loan is under 20%, you may be required to pay private mortgage insurance , which can cost about 1% of the loan amount annually. In the case of a conventional loan for $150,000, the PMI will cost $1,500 a year or $125 a month.

This is important for clients who are on the fence between paying for mortgage discount points or a larger down payment. If its between discount points and boosting your down payment to 20% or over, youll want to choose the down payment most of the time. Always do the math and consider if your discount points are costing you more or less than your monthly PMI fees.

PMI rates do vary from lender to lender, so this is a question worth asking if youre shopping for a conventional loan. Its also important to know that mortgage insurance guidelines will depend on the type of loan you have .

Also Check: When Can You Do A Reverse Mortgage

Rebates Can Be Good For Refinancing Too

Using rebates, a loans complete closing costs can be waived, allowing the homeowner to refinance without increasing their mortgage amount.

When mortgage rates are falling, zero-closing cost mortgages are an excellent way to lower your rate without paying fees over and over again.

You could potentially refinance three times in a year or more and never pay fees to the bank.

Considerations For Negative Points

When you obtain negative points the bank is betting you are likely to pay the higher rate of interest for an extended period of time. If you pay the higher rate of interest for the duration of the loan then the bank gets the winning end of the deal. Many people still take the deal though because we tend to discount the future & over-value a lump sum in the present. It is the same reason credit cards are so profitable for banks.

Buyers who are charged negative points should ensure that any extra above & beyond the closing cost is applied against the loan’s principal.

If you are likely to pay off the home soon before the bank reaches their break even then you could get the winning end of the deal. There are many reasons a buyer might repay the loan soon including stock options which are coming due soon, an inheritance in the near future, or a professional flipper who only needs financing in the short term while they rehab the home.

You May Like: How Much Is A 280k Mortgage

How Much Is A Mortgage Point

One point equals 1% of your loan amount. For example, one point on a $300,000 loan would cost you $3,000. Any points you find listed on Page 2, Section A of your loan estimate or closing disclosure must buy you a lower interest rate by law, according to the Consumer Financial Protection Bureau .

Shopping for the lowest rate for the mortgage points you pay is especially important. Lenders set their own interest rate pricing structures, so make sure you collect at least three to five rate quotes to compare.

Are Mortgage Points Worth It

Though money paid on discount points could be invested in the stock market to generate a higher return than the amount saved by paying for the points, the average homeowner’s fear of getting into a mortgage they can’t afford outweighs the potential benefit they may accrue if they managed to select the right investment. In many cases, paying off the mortgage is more important.

Also, keep in mind the motivation behind purchasing a home. Though most people hope to see their residence increase in value, few people purchase their home strictly as an investment. From an investment perspective, if your home triples in value, you may be unlikely to sell it for the simple reason that you then would need to find somewhere else to live.

If your home gains in value, it is likely that most of the other homes in your area will increase in value as well. If that is the case, selling your home will give you only enough money to purchase another home for nearly the same price. Also, if you take the full 30 years to pay off your mortgage, you will likely have paid nearly triple the home’s original selling price in principal and interest costs and, therefore, you won’t make much in the way of real profit if you sell at the higher price.

Don’t Miss: How To Get First Mortgage

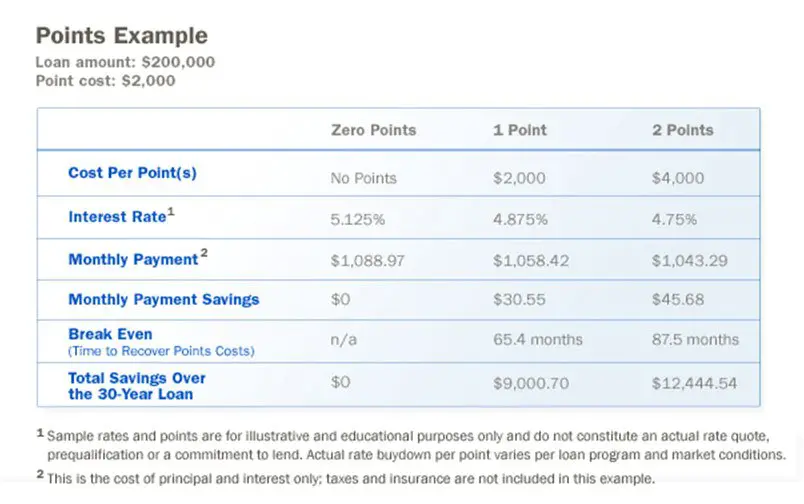

Comparing Monthly Mortgage Principal & Interest Payments With Discount Points

A home-buyer can pay an upfront fee on their loan to obtain a lower rate. The following chart compares the point costs and monthly payments for a loan without points with loans using points on a $200,000 mortgage.

| Points | |

|---|---|

| $9,072.22 | $17,997.21 |

Some lenders advertise low rates without emphasizing the low rate comes with the associated fee of paying for multiple points.

A good rule of thumb when shopping for a mortgage is to compare like with like. Shop based on

- annual percentage rate of the loan, or

- a set number of points

Then compare what other lenders offer at that level.

For example you can compare the best rate offered by each lender at 1 point.

Find the most competitive offer at that rate or point level & then see what other lenders offer at the same rate or point level.