How Do Assumable Mortgages Work

When you assume a mortgage, the current borrower signs the balance of their loan over to you, and you become responsible for the remaining payments. That means the mortgage will have the same terms the previous homeowner had, including the same interest rate and monthly payments.

If you assume the mortgage, youll need to pay off whatever equity the seller has, as well, either in your down payment or by using another loan.

Assumable Mortgages: When Can You Transfer Home Loans

See Mortgage Rate Quotes for Your Home

An assumable mortgage is a loan that can be transferred from one party to another with the initial terms remaining in place. For buyers and sellers in a rising interest rate environment, taking advantage of an assumable mortgage is a great option that makes financial senseif done properly.

Pros Of Assumable Mortgages

Assumable mortgage homes for sale have a significant marketing advantage. Buyers looking for a simplified home buying process and a potentially lower interest rate make assumable mortgages very attractive.

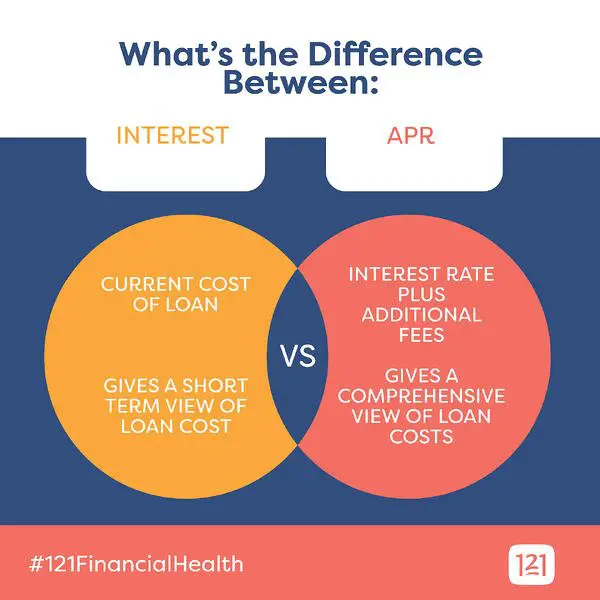

Lower interest rates mean higher savings for buyers, potentially in the thousands. Plus, without the need for an appraisal, buyers have the option of pocketing a few hundred dollars instead of paying additional fees.

Recommended Reading: How Much Would Mortgage Be On A Million Dollar House

The Bottom Line On Someone Taking Over The Mortgage Payments On Your Property

Many homeowners often think to themselves, Can I get someone to take over my mortgage? especially if they happen to be underwater on the payments. Luckily, in some cases, it is possible to have someone assume responsibility for the loan on your home.

If youre thinking of going this route, use the information above to help you make the best decision on how to move forward. While having someone take over the mortgage payments on their property may not be the right choice for everyone, for others, it can be a viable pathway toward financial freedom.

Breaking Up Is Complicated

Youre parting ways with a spouse or co-mortgage borrower. Youve agreed who will keep the house and take over the mortgage payments. But theres a problem.

In the eyes of your mortgage lender, the ties that bind arent legally severed until you remove your ex from the mortgage.

To solve this problem youll need to remove a name from your joint mortgage loan. There are a few ways to do this. The best way is usually to refinance, which may be less of a hassle than you think.

Heres what you should know.

In this article

> Related:Streamline Refinance: Get todays low rates with almost no paperwork

Don’t Miss: How To Refinance Mortgage And Get Money Back

Can You Take Over My Mortgage Payments

HomeTake Over Mortgage Payments

If youre looking to sell your house fast, you might want to know if a buyer can take over mortgage payments and keep you out of foreclosure.

A variety of unique situations can make getting your home sold now an urgent priority.

Maybe youre trying to avoid foreclosure. Perhaps you inherited property that you dont wish to keep. Short-notice job transfers, deferred maintenance, personal relationship changes, or financial reasons can come into play as well.

If any of these or other situations apply to you, we may be able to help with our Subject-To program.

What Is A Mortgage Transfer

A mortgage transfer is where a person is added, removed or replaced on an existing mortgage. This process is in fact called a transfer of equity.

A transfer of equity may be used in:

- Adding a person to a mortgage

- Removing a person from a mortgage

- Replacing an existing person on a mortgage with somebody else

A transfer of equity is common in the following scenarios:

- Adding or removing a family member from a mortgage

- Adding or removing a partner from a mortgage

- Family mortgage transfers

- Couples that want a sole mortgage as opposed to a joint mortgage

Certain lenders are more open to equity transfers than others. This is why an advisor can give you a more tailored answer and provide you with the right guidance based on your circumstances.

Please note, if you wish to transfer your mortgage to a different property, this is known as mortgage porting. Learn more about porting a mortgage here.

Recommended Reading: How Much Of My Mortgage Payment Is Interest

Allows Another Borrower To Take Over

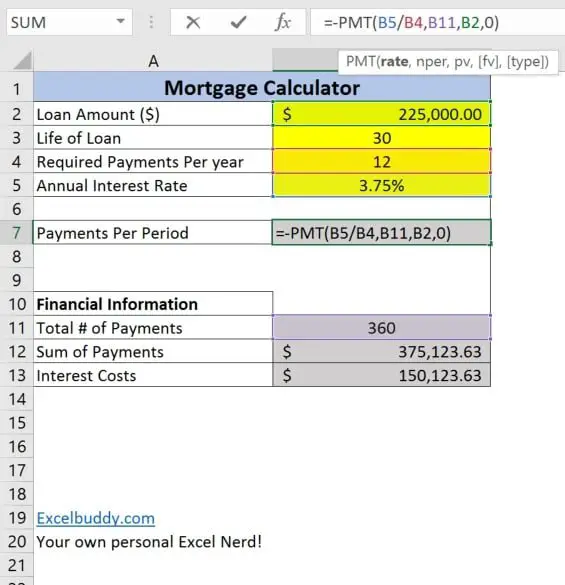

An assumable mortgage is, simply put, one that the lender will allow another borrower to take over or âassumeâ without changing any of the terms of the mortgage. For example, say you purchased a property for $200,000 with a mortgage of $150,000 and $50,000 of your own money. If part way through the mortgage term you decide youâd like to sell the home, you would have the option of essentially selling the mortgage as well. The person who buys the home from you could take over the balance of the mortgage and the associated payments and give you cash for the remainder of the value of the home. So, if your mortgage balance is now $140,000 and the home is now valued at $210,000, a buyer who is assuming the mortgage would need to pay you, the seller, $70,000.

In cases where a home and a mortgage are being sold together, the interest rate environment can affect the selling price of the property. If rates have risen since the mortgage term began, that mortgage is now more valuable because it comes with an interest rate lower than what you would find if you applied now. Thus the calculation of the homeâs value becomes a little more complicated as the beneficial interest rate needs to be taken into account.

What Is A Mortgage Assumption

A mortgage assumption is simply a transfer of responsibility. The seller hands over the responsibility of the mortgage payments to the buyer. In this type of a transaction, the seller usually receives the equity he has in the property as cash from the buyer. Upon this cash payment, the loan is transferred to the buyer without the need for any closing costs.

Read Also: How Much Does Mortgage Insurance Cost Per Month

How Do You Qualify For A Reverse Mortgage

Before you can take out a reverse mortgage, youll need to meet the following eligibility criteria:

- Be at least 62 years of age

- Live in a single-family home, multi-family home , manufactured home , condo or townhome

- Own your home outright or have at least 50 percent in equity

- Use your home as your primary residence

- Complete a reverse mortgage counseling session

- Not have any delinquent federal debt

- Have the means to afford payments for homeowners insurance, homeowners association fees and property taxes.

Be mindful that these requirements are general guidelines. Each lender has its own rules that could be more stringent than whats listed here.

Assuming A Loan That’s In Default

If a borrower is behind in mortgage payments at the time of the transfer, then the person assuming the loan could have to cure the default to prevent the foreclosure. Usually, the new owner will either pay the overdue amount in full, called “reinstating” the loan, or come to an agreement with the lender to catch up on the past-due amounts in a repayment plan or as part of a modification.

Also Check: How To Lock Mortgage Rate For 6 Months

Can I Just Take Over The Mortgage Title

Not generally.

The reason is that a bank cant simply approve a home loan with no property or security attached to it.

Since the property title is in your mum and dads name, the property will need to be used to pay out the existing mortgage.

The only exception to this rule is if the loan is an assumable mortgage by the banks definition.

This means the mortgage would have to be free of a due-on-sale clause and there would be a fee charged for assuming the home loan.

The problem is that due-on-sale clauses are on all modern-day home loans so assuming a mortgage is no longer possible.

How Does An Assumable Mortgage Work

An assumable mortgage works much the same as a traditional home loan, except the buyer is limited to financing through the seller’s lender. Lenders must approve an assumable mortgage. If entered informally, sellers run the risk of having to pay the full remaining balance upfront. Sellers also risk buyers missing payments, which can negatively impact their credit score.

One major advantage is that an appraisal is not required in these instances, which can potentially save buyers hundreds of dollars. Buyers should still order a home inspection to check for any signs of repair issues with the property. Once the buyer closes on the home, the seller will no longer be liable for the mortgage payments.

Get approved to buy a home.

Rocket Mortgage® lets you get to house hunting sooner.

Recommended Reading: Can You Cancel Mortgage Insurance

How An Assumable Mortgage Works

Mortgage assumption allows a buyer to take on the original loan balance at the original terms, but its important to note that it doesnt account for equity. If the house has gained value since the original loan was issued, the buyer will need to cover that difference also known as equity with cash or another loan.

For example, if the seller has a $200,000 loan balance on a $300,000 home, the buyer will need to bring $100,000 to the table to compensate the seller for the equity theyve built.

A home equity loan is a common second mortgage option for buyers who are assuming a mortgage and dont want to or cant put cash down to cover the equity. Although this second loan will likely have a higher interest rate than the assumed mortgage, the principal amount will be far lower than what is needed for a first mortgage.

There are two types of mortgage assumption: simple assumption and novation. Both types have different implications for the ongoing relationship between the buyer, seller and lender.

The Process Of Selling Your Home Is Much Simpler

You may log hundreds of hours trying to sell your home the traditional way. Listing, renovating, repairing, and showing your home requires a high level of commitment and effort. Is it worth it in the end? When you work with a house investor, you simply schedule a quick walkthrough and get an offer within 24 to 48 hours.

Don’t Miss: How Do You Buy Points On A Mortgage

Can You Transfer A Mortgage To Another Person

Insider’s experts choose the best products and services to help make smart decisions with your money . In some cases, we receive a commission from our our partners, however, our opinions are our own. Terms apply to offers listed on this page.

- You might be able to get a mortgage transfer depending on your circumstance and mortgage type.

- The due-on-sale clause lets you transfer a mortgage in specific circumstances.

- If you don’t have an assumable mortgage, refinancing may be a possible option to pursue.

Unplanned circumstances happen in life. If you’re going through a divorce or unexpected illness, you might not want to continue paying for a mortgage if it isn’t reasonable for your situation.

Some lenders permit a mortgage transfer if you have an assumable mortgage, and if your situation falls into one of the exceptions listed in the due-sale clause.

Here’s what you’ll need to check to see if your mortgage is transferable, and what to do if you can’t.

What Are The Potential Consequences Of Removing A Cosigner

Taking on sole responsibility for a mortgageeither by removing a cosigner or co-borrower or refinancing with a loan in your name onlyis a big commitment and comes with significant risk. If you’ve been paying your mortgage yourself all along, chances are good you fully understand what’s involved. If you’re taking over payments you previously shared with a co-borrower, the situation could be a bit dicier.

Some thoughts to bear in mind:

- A larger monthly mortgage obligation will increase your DTI ratio, and that could make it more difficult to qualify for credit or loans in the future. If you expect to finance a car or seek a student loan in the next few years, it’s worth calculating your DTI ratio to see what it will be with the new mortgage and whether that will affect your borrowing power.

- If any loss of income will put you at risk of missing a mortgage payment and, ultimately, of foreclosure, it becomes extra critical to have a solid emergency fund of six months’ to one year’s worth of monthly expenses available to get you through any rough patches.

Don’t Miss: Is A Heloc Considered A 2nd Mortgage

Seek Legal And Financial Advice

Taking over your parents mortgage, whether through buying the property below market value or helping out with the mortgage repayments, is a big decision to make.

Going about it the wrong way can prove costly in the long run with future legal disputes in the event of infighting, affecting your ability to borrow in the future and putting you under financial strain if you already have a home loan.

Speak to your mortgage broker or your lender first. They may be able to provide a solution.

After that, speak to a financial advisor and a solicitor about any other possible solutions.

Call us on 1300 889 743 or complete our and we can put you in touch with a bank representative or a solicitor who can help you.

How To Qualify For An Assumable Mortgage Loan

To qualify for an assumable mortgage, lenders will check a buyer’s credit score and debt-to-income ratio to meet loan requirements. Additional information such as employment history, income information, and asset verification for a down payment may be needed to process the loan.

It’s important to speak with a qualified mortgage expert regarding the specific documents necessary to qualify for an assumable loan. Although it’s up to the seller’s lender or agency to approve this type of loan, finding the right lender to buy a home can give you peace of mind.

You May Like: How Much Should You Put Down On A Mortgage

Why Do Sellers Offer Assumable Mortgages

Sellers in an environment of rising interest rates offer assumable mortgages as an incentive to prospective buyers. Historically, home sales slow with rising interest rates. If its a buyers market, you might be looking for those extras. If sellers can offer a mortgage at a lower interest rate to buyers, the savings could be substantial and cost sellers nothing.

Your Heirs And Their Inheritance

If you want your heirs to inherit the home, theyll have to repay the lender whats owed on the reverse mortgage to keep it. Otherwise, the property will be sold, and any remaining proceeds from the transaction will go to your estate. But if the home sells for less than its worth, your heirs wont be responsible for the difference.

You May Like: Does Making Biweekly Mortgage Payments Help

Consult A Specialist With Experience In This Field

Transferring a mortgage can be simple when the advice you receive is right. Often enough, a lack of experience or approaching an unsuitable lender can result in mortgages being declined.

Mortgage transfers are second nature to our specialists who deal with them on a daily basis and have been doing so for a number of years. Whether youre adding, removing or replacing someone on your mortgage, our advisors can guide you through the process.

Sometimes Lenders Won’t Enforce A Due

Sometimes a lender will agree to forgo the enforcement of the due-on-sale provision if it means it will start receiving a steady stream of payments from someone. The lender might also agree to an assumption if the current market value of the property is less than the outstanding indebtedness, and the purchaser is willing to make up the difference in cash.

Also Check: Can You Buy Two Properties With One Mortgage

How To Allow Someone Else To Take Over Mortgage Payments In Real Estate

If you think having someone else become responsible for the loan on your home may be a good idea, its important to have a clear idea of what the process entails before you decide to move forward.

With that in mind, here is a closer look at the steps that you need to take to complete to allow someone else to take over your mortgage payments:

Sell My House Fast For Cash In Cincinnati Ohio

If you are ready to sell your house fast, then now is the time. You dont have to wait for months to close on your house finally. Neighborhood Enrichment can make a cash offer and put cash in your hands in as little as seven days. Call to schedule a walkthrough of your property. Sell your house fast for cash in Cincinnati, Ohio.

Don’t Miss: What Is A Jumbo Mortgage Loan Amount

Encourage Your Parents To Downsize

Mums and dads are often very nostalgic and emotionally attached to their homes and will fend off downsizing as long as they can.

The other reason is that theyre waiting for the right time to sell to get a good price on the property.

If its clear that your parents are struggling with the repayments or theres no way they can keep working and earning an income past retirement age, you can help them along by trying to not to move back home all the time.

Another tactic you can try is to take all of your possessions out of the house as well as clearing out other clutter.

This can help ease them into the emotional struggle of selling the family home.