Drawbacks To Biweekly Payments

One drawback to biweekly mortgage payments is that some lenders may charge fees to enroll in their biweekly payment plan. When it comes to fees, you should crunch the numbers to confirm youll still get ahead financially by paying biweekly.

Another factor worth noting is that biweekly payments wont enhance your credit score. While they wont negatively affect your score, the credit bureaus use 30-day time frames when they analyze credit data to set ratings. Therefore, youll make out the same, credit rating-wise, with monthly or biweekly payments.

Dont Miss: Where To Prequalify For A Mortgage

How Biweekly Mortgage Payments Work To Help You Pay It Off Faster

If youd rather pay less interest AND pay off your house faster, youll want to know about biweekly mortgage payments.

Biweekly mortgage payments are an easy way to save massive money on interest without breaking the bank!

Especially since only making your standard house payment for 30 years can cost thousands of dollars in interest.

Should I Make Biweekly Mortgage Payments

Your home is likely the biggest purchase you will ever make. Even with an interest rate in the single digits, this can often mean tens or hundreds of thousands in interest charges over the life of your repayment a significant chunk of change that you probably wouldnt mind keeping in your pocket.

Luckily, lenders like Rocket Mortgage® make biweekly payments simple for clients. Thanks to Rocket Mortgage®, these borrowers can set up biweekly mortgage payments for free online. There are no prepayment penalties or fees for setting up a revised payment schedule, either, so youre able to automate the process and save yourself money with just a few quick clicks.

What could you do with those kinds of savings? For other articles like this one, check out our free personal finance resource center for more information.

Apply Online with Rocket Mortgage®

- Before you implement a biweekly payment plan

- Make sure the lender will accept partial payments

- Or that any extra payments beyond the total amount due

- Go toward the principal balance

One final note: Be careful not to make a partial mortgage payment to your mortgage lender as it could result in some unintended consequences.

At worst, the mortgage company may send your payment back if its not made in full. This could result in a late fee and a possible credit ding if you dont make the full payment in time.

Read Also: How Much Should Your Mortgage Payment Be Compared To Income

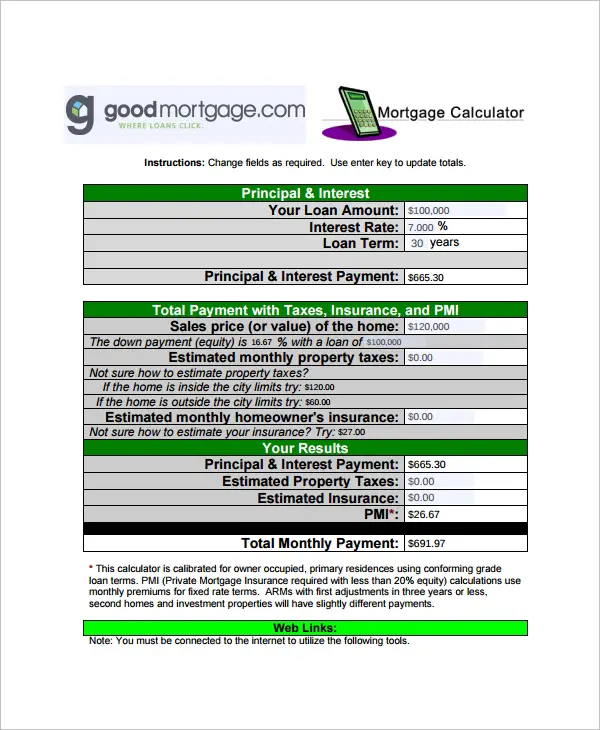

How To Calculate Mortgage Payments

Calculating mortgage payments used to be complex, but mortgage payment calculators make it much easier. Our mortgage payment calculator gives you everything you need to test different scenarios, to help you decide what mortgage is right for you. Heres a little more information on how the calculator works.

Mortgage Payments Rise In October Amid High Mortgage Rates: Mba

The national median mortgage payment increased in October, according to the Mortgage Bankers Association .

The median mortgage payment in the U.S. rose in October but at a slower rate of increase from the month before, according to the Mortgage Bankers Association .

In October, the national median mortgage payment increased 3.7% to $2,012, after having risen 5.5% to $1,941 in September, the MBAs Purchase Applications Payment Index said.

“Prospective homebuyers continued to feel the effects of higher mortgage rates in October, with the 70-basis-point jump in rates leading to the typical monthly mortgage payment rising to a new survey high of $2,012,” Edward Seiler, MBAs associate vice president of housing economics and the executive director of the Research Institute for Housing America, said.

These increases follow a three-month period over the summer where buying a home was more affordable, according to the MBA. The improvement in affordability seen in August was likely caused by “slightly lower mortgage rates amidst steady income gain growth,” Seiler said in September.

Don’t Miss: How To Become A Mortgage Broker In Florida

New Homebuyers Need Help Calculating Your Mortgage Payments

As a new homeowner, with one easy monthly payment, youll cover a number of expenses associated with your new home.

At Maple Tree Funding, we make sure that you completely understand every component of your monthly mortgage payment. Unlike other mortgage lenders, we will review everything with you thoroughly and disclose every cost you should expect ahead of time, so you dont encounter any surprises when it comes to paying for your home.

Wondering how much you can afford to spend on a home? Interested in a New York home and wondering what your monthly mortgage payment would be? We can help you figure it out!

At Maple Tree Funding, we have decades of experience helping first time homebuyers. We know the ins and outs of the mortgage process and can guide you every step of the way as you work to purchase your first home.

Interested in learning more? Give us a call at or contact us online to find out how we can help make the home buying process easier for you.

Looking for more information to guide you as you purchase your first home?Check out our First Time Homebuyer Resources!

Consider Your Other Debts

Lets say your mortgage interest rate is 4% and your other debts include an auto loan at 2%, a student loan at 6% and a at 16%. Putting extra money toward your mortgage wont save you as much as putting extra money toward your student loan or credit card which have higher interest rates. Retiring those debts faster will likely have a greater financial benefit in the near term.

Dont Miss: Can I Refinance My Mortgage With The Same Bank

Read Also: What Are The 3 Types Of Mortgages

How To Get More House For Your Money

There are a couple of ways to reduce parts of your mortgage payment and get more house for your money.

PMI is generally required when your down payment is less than 20 percent of the home value. You can avoid a PMIand reduce your mortgage paymentby saving more for a down payment before signing on the dotted line.

Another factor in your payment is your Higher scores can often mean lower interest ratesimproving your credit score before you get a mortgage can significantly reduce the amount you pay over time.

Find Out Whether You Need Private Mortgage Insurance

Private mortgage insurance is required if you put down less than 20% of the purchase price when you get a conventional mortgage, or what you probably think of as a “regular mortgage.” Most commonly, your PMI premium will be added to your monthly mortgage payments by the lender.

The exact cost will be detailed in your loan estimate, but PMI typically costs between 0.2% and 2% of your mortgage principal.

Oftentimes, PMI can be waived once the homeowner reaches 20% equity in the home. You also may pay a different type of mortgage insurance if you have another mortgage, such as an FHA mortgage.

You May Like: Does Capital One Offer Mortgages

How A Mortgage Calculator Can Help

As you set your housing budget, determining your monthly house payment is crucial it will probably be your largest recurring expense. As you shop for a purchase loan or a refinance, Bankrate’s Mortgage Calculator allows you to estimate your mortgage payment. To study various scenarios, just change the details you enter into the calculator. The calculator can help you decide:

Paying Ahead On Your Loan

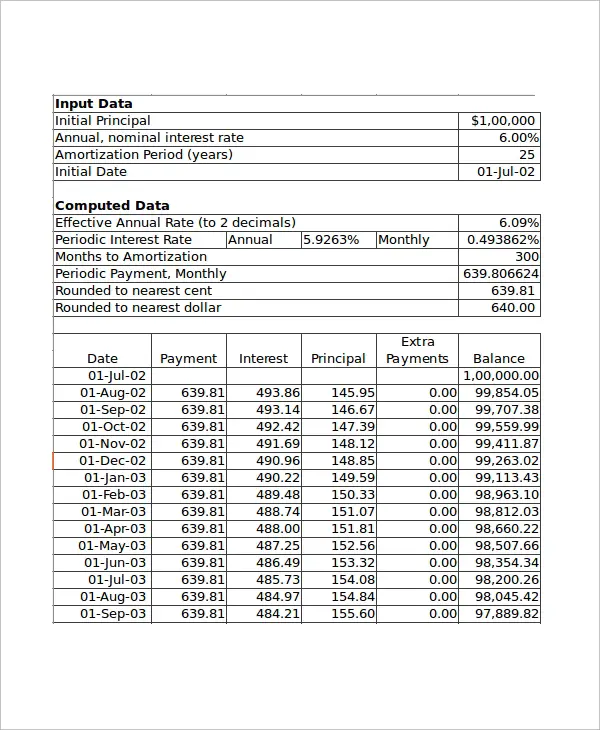

Your monthly mortgage payment can change if you make an additional payment on your loan. This is because you only need to pay interest on the amount of money you owe. Most of your monthly payment goes toward interest at the beginning of your loan.

Over time the amount you pay each month chips away at your principal and the amount of interest you owe. This process, called mortgage amortization, gradually reduces your principal and what you owe in interest.

Paying just a little extra money each month on your principal can save you a lot of money over your loan term, or the number of years until you have to pay it off. For example, lets say you have a $150,000 loan with a 4% interest rate and a 30-year term. Your monthly mortgage payment would be $716.12. Paying an extra $100 a month would reduce the amount of interest you pay over the course of your loan by $25,205.78. You would also pay off your loan 6 years earlier than you would if you made no extra payments.

You might consider budgeting some extra money each month to make an additional principal payment toward your principal balance. Be sure to tell your lender that you want the extra payment to go toward the principal only.

Read Also: What Is A Fha Mortgage Loan

When Mortgage Payments Start

The first mortgage payment is due one full month after the last day of the month in which the home purchase closed. Unlike rent, due on the first day of the month for that month, mortgage payments are paid in arrears, on the first day of the month but for the previous month.

Say a closing occurs on Jan. 25. The closing costs will include the accrued interest until the end of January. The first full mortgage payment, which is for February, is then due March 1. For example, lets assume you take an initial mortgage of $240,000 on a $300,000 purchase with a 20% down payment. Your monthly payment is $1,077.71 under a 30-year fixed-rate mortgage with a 3.5% interest rate. This calculation only includes principal and interest but does not include property taxes and insurance.

Your daily interest is $23.01. This is calculated by first multiplying the $240,000 loan by the 3.5% interest rate, then dividing by 365. If the mortgage closes on Jan. 25, you owe $161.10 for the seven days of accrued interest for the remainder of the month. The next monthly payment, the full monthly payment of $1,077.71, is due on March 1 and covers the February mortgage payment.

Determine Your Mortgage Principal

The initial loan amount is referred to as the mortgage principal.

For example, someone with $100,000 cash can make a 20% down payment on a $500,000 home, but will need to borrow $400,000 from the bank to complete the purchase. The mortgage principal is $400,000.

If you have a fixed-rate mortgage, you’ll pay the same amount each month. With each monthly mortgage payment, more money will go toward your principal, and less will go toward paying interest.

Don’t Miss: How Long Does It Take To Qualify For A Mortgage

How Smart Are Biweekly Payment Plans

A biweekly plan will save you a lot of interest over the life of your loan, but its only a smart move if the extra payments work for you. Youre essentially paying the equivalent of one additional mortgage payment each year, so you should be sure you can budget for that. Its also smart to compare your interest savings to what you could potentially earn by investing that extra payment instead.

Also Check: Is It Good To Pay Off Mortgage Early

How To Calculate Piti

When it comes to calculating what you can afford regarding your PITI, a good rule of thumb is that 28% of your gross monthly income is the maximum monthly cash outflow for costs associated with your house payments.

Tip: You can track your cash flow using Personal Capitals free and secure financial tools. Categorize expenses and income to get an organized, visual snapshot of your financial picture. When you sign up, you get access to the free Home Buying Guide with financial advisors insights into purchasing a house.

Heres one way to calculate the 28% rule.

Take the principal and interest of your monthly mortgage payment. Add 1/12 of your annual real estate taxes . Then add 1/12 of your annual homeowners insurance premium . Finally, add 1/12 of any annual association fees . Then divide this by your gross monthly income.

One variation of this is the 36% rule. This is calculated by taking your monthly PITI as calculated above, and then adding any homeowners-association dues or condo fees, credit cards, car loans, student loans, and any other personal loans. Then divide this by your gross monthly income.

So why the magic numbers of 28 and 36? This follows general guidelines on the amount of debt a person can take on while still maintaining enough cash for:

- Ongoing living expenses

- Retirement savings

Don’t Miss: Is It Worth It To Refinance To 15 Year Mortgage

Nper: The Number Of Payments Youll Make On A Loan

Once youve established your monthly interest rate, youll need to enter the number of payments youll be making. Since were calculating the monthly payment, we want this number in terms of months.

For example, a 30-year mortgage paid monthly will have a total of 360 payments , so you can enter 30*12, 360, or the corresponding cell *12. If you wanted to calculate a five-year loan thats paid back monthly, you would enter 5*12 or 60 for the number of periods.

You May Like: Can You Do A Reverse Mortgage On A Condo

What Else Is Included In Your Monthly Payment

Principal and interest make up the bulk of your mortgage payment. On some loans youll only need to pay principal and interest to your lender each month, but your loan might also involve taxes and insurance. You should note that regardless of whether taxes and insurance are included in your loan, lenders typically combine principal, interest, taxes and insurance when determining how much house they will approve you for.

Read Also: What Is Considered A Jumbo Mortgage Loan

The Three Numbers Youll Need

There are several factors that go into estimating how much your regular mortgage payments will be. These 3 numbers are particularly important:

1. The total mortgage amount: This is the price of your new home, less the down payment, plus mortgage insurance, if applicable.

2. The amortization period: This is the total life of your mortgage, and the number of years the mortgage payments will be spread across.

3. The mortgage rate: This is the rate of interest you pay on your mortgage.

Also Check: Does Rocket Mortgage Sell Their Loans

Whats Included In Your Monthly Mortgage Payment

If youve been renting, you pay your landlord a certain amount every month. That amount covers your cost to live in your rental unit, but it may also include water, pet rent, reserved parking, electricity, waste services, and maybe even something for access to the onsite fitness center, all depending on your lease.

Fast forward a bit to when you may decide to get a house. At closing, your loan paperwork will contain a payment amount based on interest rate, loan amount, and the term of repayment. Your closing paperwork will also include a payment letter that gives you all of the who, what, and where of your first mortgage payment.

The amount on your payment letter includes principal and interest, but it may also include several other items such as homeowners insurance, mortgage insurance and property taxes.

This is often referred to as PITI and is an important aspect of the breakdown of your monthly mortgage payment.

Recommended Reading: What Is The Current Interest Rate For Interest Only Mortgages

Get A Home Mortgage You Can Afford

There are many types of mortgages and they all charge different monthly payment amounts. But dont make the mistake of choosing a mortgage just because it has the lowest monthly payment. If you want to build wealth that lasts, focus on total cost. Hint: The mortgage with the lowest total cost is a 15-year fixed-rate conventional loan. A good gauge to tell if you can afford a mortgage is if the monthly payments are no more than 25% of your monthly take-home pay.

If youre buying a house and need help finding a great home in your price range, be sure youre working witha top-notch real estate professional who can help you find the house of your dreams. Since you want to get a mortgage the smart way, connect with our friends at Churchill Mortgage. Theyll walk with you every step of the way to put you on the best path to homeownership.

About the author

Ramsey Solutions

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners.Learn More.

What Happens If I Make A Large Principal Payment On My Mortgage

If you make a large payment on your mortgage, the extra payment goes toward paying down your principal. So in many cases, making a large payment is advantageous if you can afford it. It enables you to pay down your mortgage sooner and build equity faster.

And paying down the principal also helps you reduce your interest. The reason is that your lender calculates your interest from the amount of your principal. So if you lower your principal, youll lower your remaining interest as well.

With some mortgages, though, your lender will assess a prepayment penalty if you pay your mortgage down early. The prepayment penalty exists to compensate the lender for the interest it loses if you pay off your mortgage more quickly than expected. So youll probably want to sit down and do the calculations to figure out the best option for your finances. Determine whether your finances will benefit more if you pay your mortgage early and lower its overall cost or if you pay it slowly and steadily to avoid the prepayment penalties.

Recommended Reading: How Long To Get A Mortgage