Fha Supports Fair Housing And Equal Opportunity

HUD is committed to enforcing the Fair Housing Act and to ensuring that people are not discriminated against when they seek housing or housing-related services. If you need assistance in determining your rights under the Fair Housing Act or applicable laws, or believe you have been a victim of housing discrimination and need assistance, we encourage you to review the information on HUD’s Office of Fair Housing and Equal Opportunity webpage.

Is It Harder To Buy A House If I’m Using An Fha Loan

Only if the seller’s agent has an inaccurate view of FHA loans. Some think that FHA requires higher property standards and requires sellers to pay buyers’ costs, which is not true. Others don’t like the FHA Amendatory Clause, which allows buyers to cancel a purchase if the home does not appraise for at least the sales price. This is not an issue unless the property is overpriced. Some perceive FHA borrowers as borderline and harder to approve, an impression that can be overcome by getting loan approval before shopping for a home.

Downsides Of Fha Loans

- Mortgage insurance can be costly. You may pay a price for making a small down payment. Youll have to pay a one-time upfront mortgage insurance premium, as well as an annual premium thats collected in monthly installments. The one-time premium is generally equal to 1.75% of the home purchase price and can be financed in the mortgage or paid for in cash but not a combination. The annual premium depends on your loan amount and loan-to-value ratio.

- Theres a limit to how much you can borrow. The FHA establishes loan limits based on median home prices in metro areas and counties. As of July 2020, the FHA maximum for a single-family home in a low-cost area is $331,760 while its $765,600 in a high-cost area. Alaska, Hawaii, Guam and the Virgin Islands are exceptions with a maximum of $1,148,400 for a single-family unit. These loan limits change periodically, so be sure to check for updated information. The Department of Housing and Urban Development has a search tool on its website to identify mortgage limits by county and state, so you can find out how much youre able to borrow where you live.

- Good credit? Consider other options. If you have strong credit and dont have enough money for a large down payment, you still might want to consider other options because of FHA loans mortgage premiums. Just keep in mind that if you dont put at least 20% down, youll likely have to pay private mortgage insurance, or PMI.

Read Also: Why Does My Mortgage Payment Keep Going Up

A Short Word On Down Payments

The major reason most people seek out an FHA loan is they dont have a down payment. With conventional mortgages often demanding upwards of 20% down , more and more middle class citizens are priced out of home ownership. An FHA loan can help alleviate those concerns, as they typically require a much lower down payment.

However, you should be aware of the cost. If you can manage a 20% down payment for a conventional mortgage, you wont be forced to pay for PMI premiums. Over the lifetime of a mortgage, not forking out extra money for insurance can save you thousands. It might even save you enough to offset the larger down payment you had to make. Be sure to consider this in your calculations if you are trying to decide between an FHA loan or a conventional mortgage. An FHA loan might get you into your own house faster, but at a greater cost than if you spent another year or two building your down payment fund.

Understanding Fha Loan Mortgage Insurance

FHA borrowers have to pay two types of FHA mortgage insurance to protect FHA-approved lenders from the financial risk of defaults. The first is an upfront mortgage insurance premium of 1.75% of your loan amount, which is charged at closing and typically added to your mortgage balance.

The second is an ongoing annual mortgage insurance premium that ranges from 0.45% to 1.05%, depending on your down payment and loan term. Its charged annually, divided by 12 and then added to your monthly payment. Heres an example of how much FHA mortgage insurance youd pay on a $300,000 loan amount, assuming you make a 3.5% down payment with an 0.85% annual MIP charge.

Upfront MIP CALCULATION:

- Convert 1.75% to the decimal

- Multiply by the loan amount: 0.0175% x $300,000 = $5,250 FHA UFMIP charge added to your loan amount

Annual MIP CALCULATION:

- Convert 0.85% to a decimal

- Multiply by the loan amount 0.0085% x $300,000 = $2,550

- $2,550 divided by 12 = $212.50 monthly MIP charge added to your monthly payment

There are some important differences between FHA mortgage insurance and conventional private mortgage insurance :

Youll typically pay FHA MIP for the life of your loan. This is true if you make a minimum FHA 3.5% down payment. However, if you can make at least a 10% down payment, MIP drops off after 11 years. You can get rid of conventional PMI once you can prove you have 20% equity.

Read Also: Is Carrington Mortgage A Good Company

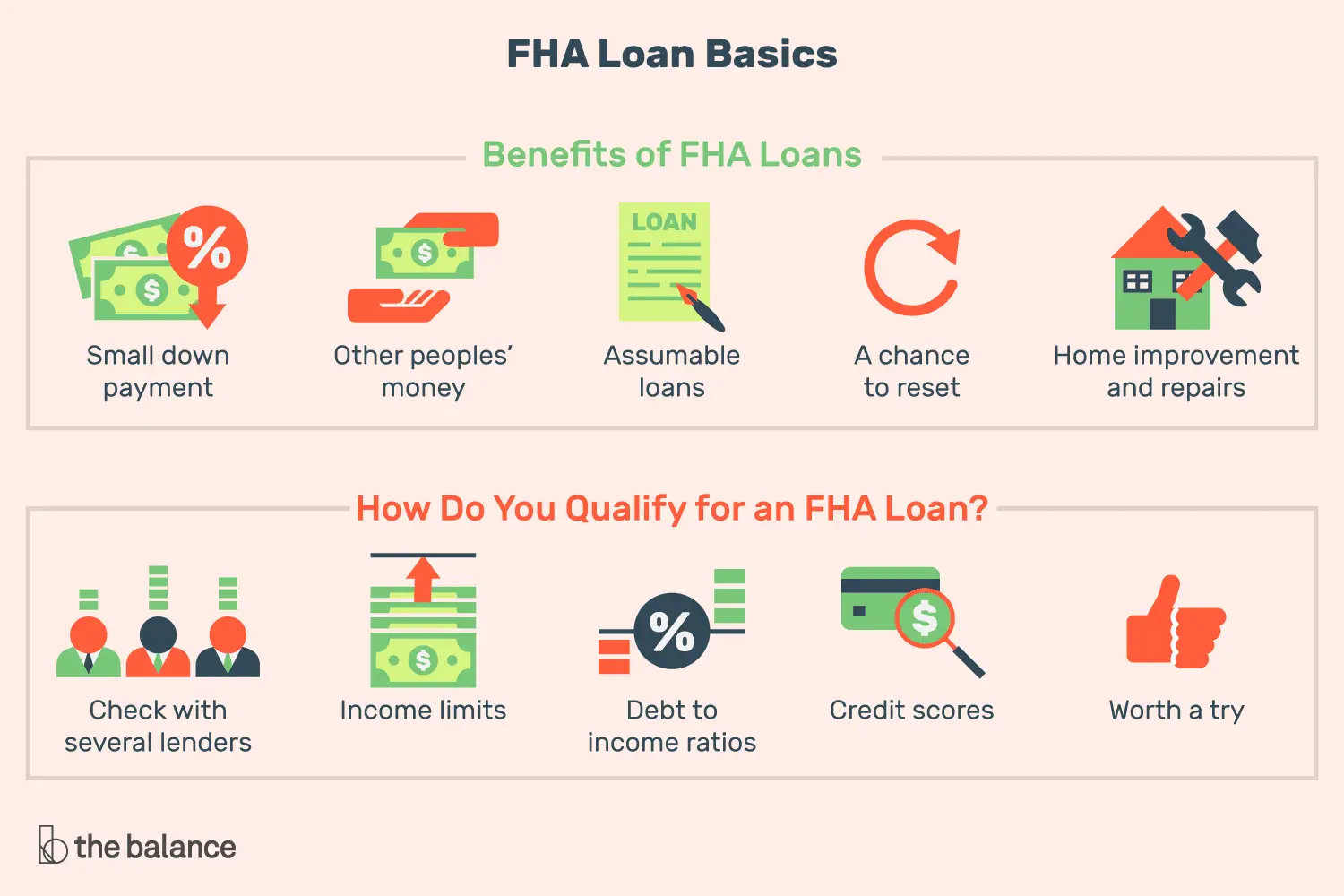

Pros & Cons Of Fha Loans

FHA loans have a lot of benefits, but they may not be the best option for every borrower. Explore the different pros and cons of FHA loans below.

Benefits of FHA Loans

FHA loan limits vary by county. To find out your limits, visit the Department of Housing and Urban Development s website and use their FHA Mortgage Limits tool. This allows you to check what the limits are in each county. Simply input your state, county and county code, select FHA Forward, and leave all other forms blank. Once you hit Send, the details under One-Family show the limits in your county.

Drawbacks of FHA Loans

Regardless of whether you intend to get an FHA loan, its wise to improve your credit score. A high credit score will allow you to get more competitive rates from private lenders, some of which may be better than what an FHA loan offers.

The Hybrid Adjustable Rate

FHA administers a number of programs, based on Section 203, that have special features. One of these programs, Section 251, insures adjustable rate mortgages which, particularly during periods when interest rates are low, enable borrowers to obtain mortgage financing that is more affordable by virtue of its lower initial interest rate. This interest rate is adjusted annually, based on market indices approved by FHA, and thus may increase or decrease over the term of the loan. In 2006 FHA received approval to allow hybrid ARMs, in which the interest is fixed for the first 3 or 5 years, and is then adjusted annually according to market conditions and indices.

The FHA Hybrid provides for an initial fixed interest rate for a period of three or five years, and then adjusts annually after the initial fixed period. The 3/1 and 5/1 FHA Hybrid products allow up to a 1% annual interest rate adjustment after the initial fixed interest rate period, and a 5% interest rate cap over the life of the loan. The new payment after an adjustment will be calculated on the current principal balance at the time of the adjustment. This insures that the payment adjustment will be minimal even on a worst case rate change.

Don’t Miss: How To Choose A Mortgage Refinance Lender

Fha Vs Conventional Mortgage: Pros And Cons

Are you trying to decide between an FHA and a conventional mortgage for your home loan?

The easy answer is to find the loan that best fits your particular situation and needs! Heres information to help you with the pros and cons of FHA loans and conventional mortgages. Weve also included a comparison chart between the two types of loans at the end of the blog.

How Does A Fha Home Loan Work

You can get an FHA loan are at most U.S. financial institutions that have mortgage lending operations, including our best mortgage lenders, as well as other mortgage lenders. They are guaranteed by the FHA through mortgage insurance that the borrower is required to purchase.

Since FHA loans are designed to help everyday Americans buy homes, there are limitations to the amount of money that can be borrowed. In most areas of the U.S., the FHA loan limit for a single family home or condominium is $331,760 in 2020. This can be as high as $765,600 in certain high-cost real estate markets and is even higher in Alaska and Hawaii. There are also higher limits for multi-unit properties.

Buyers can use FHA loans to purchase properties with one to four housing units. There is an owner occupancy requirement, meaning that the buyer must live in the property. FHA loans can’t be used to buy a vacation home.

An FHA loan can also cover the cost of a single unit of a condo or townhouse. Approval in these cases depends on whether or not the condo or townhouse is governed by a particularly restrictive HOA.

Read Also: What Is The Current Rate For A 30 Year Mortgage

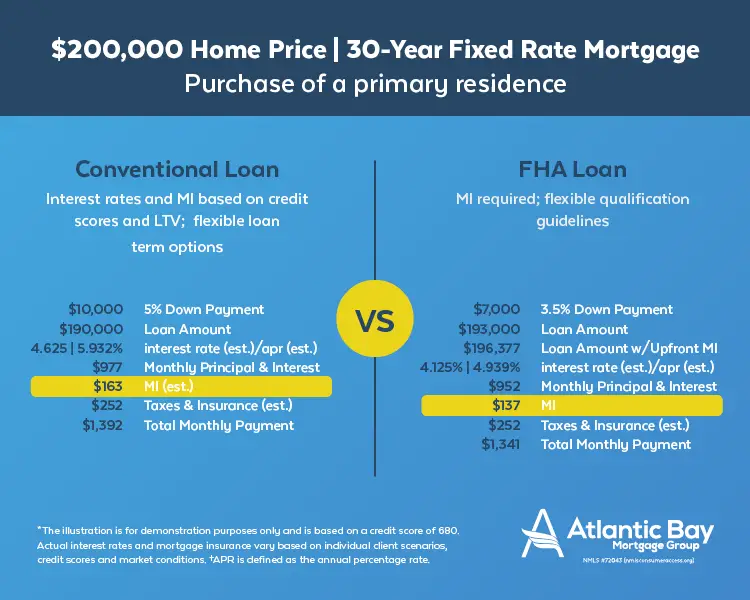

Fha Loans Vs Traditional Mortgages

So how exactly does the FHA loan differ from a typical mortgage?

Most people differentiate between the two based on the insurance you pay on the loan. Traditional mortgages often require private mortgage insurance . According to Investopedia, the cost of PMI varies depending on the size of the down payment and loan, but typically runs about 0.5 percent to 1 percent of the loan. That might not seem like much, but even 1% of a $500,000 loan is $5,000. Thats quite a bit of money to pay in just insurance premiums.

Alternatively, FHA loans require a mortgage insurance premium . Both PMIs and MIPs cover the lender in case of default. However, there are two mortgage insurance premiums youll have to pay under an FHA loan. Theres one upfront at the closing of your new home, and then another one youll payannually for as long as you repay your FHA loan, in most cases. This means you should leave room for both of these MIPs in your calculations.

In most cases, MIP upfront costs are equal to 1.75 percent of the loan amount,according to Bankrate.com. Thats what youll need to account for, in addition to annual mortgage insurance premiums, which are equal to .45 percent to 1.05 percent of the loan amount each year of your loan term. Besides these insurance premiums, there are different ways you can qualify for an FHA loan. Lets take a look at those next.

What Is A Federal Housing Administration Loan

A Federal Housing Administration loan is a home mortgage that is insured by the government and issued by a bank or other lender that is approved by the agency. FHA loans require a lower minimum down payment than many conventional loans, and applicants may have lower credit scores than is usually required.

The FHA loan is designed to help low- to moderate-income families attain homeownership. They are particularly popular with first-time homebuyers.

You May Like: How Do You Apply For A Mortgage

How Long Do Borrowers Have To Pay Fha Mortgage Insurance

The duration of your annual MIP will depend on the amortization term and LTV ratio on your loan origination date.

For loans with FHA case numbers assigned on or after June 3, 2013:

Borrowers will have to pay mortgage insurance for the entire loan term if the LTV is greater than 90% at the time the loan was originated. If your LTV was 90% or less, the borrower will pay mortgage insurance for the mortgage term or 11 years, whichever occurs first.

| Term |

|---|

How Much Money Do I Need For A Down Payment

The larger the down payment you are able to make, the less youll have to finance when you purchase a home. On a conventional mortgage, making a down payment of at least 20% will prevent you from having to pay for private mortgage insurance. The minimum down payment required varies based on the type of mortgage you obtain. In 2019, the median down payment for first-time buyers was 6%.

Recommended Reading: How Do I Get My Mortgage Fico Score

Where Do I Get Started If I Want To Get An Fha Loan

First, its a good idea to obtain a few FHA mortgage quotes from competing lenders by checking online, contacting companies by phone or visiting them in person. Next, follow up with a couple of the lenders to get the most competitive quotes and speak to the loan officers. This helps you judge the lender’s service and ensure you qualify for its FHA program. Individual lenders can add stricter requirements to FHA’s basic underwriting restrictions, so it’s good to ask about this upfront.

Finally, your loan pro should walk you through the application process. Most lenders interview applicants, complete the forms online, submit the application electronically and have a decision in a few minutes. You’ll then get a list of items needed to finalize the approval.

How Hard Is It To Qualify For An Fha Loan

FHA mortgage underwriting is some of the most forgiving in the business. You need an acceptable credit history, which means no serious derogatory events in the most recent 12 months, a credit score above 579 , verifiable income that is ongoing, sufficient and stable, funds to cover the down payment and closing costs, and a debt-to-income ratio that doesn’t exceed 43%. Higher DTI ratios of up to 56.9% may be allowed on an FHA loan, depending on personal factors.

Those are the basics. Applicants who exceed these minimum qualifications have a better chance at loan approval, and those who barely meet guidelines may have to work harder to get a loan.

Also Check: What Would My Mortgage Be On A 300 000 House

Fha Loan Limits In 2022

Each year, the FHA updates its loan limits based on home price movement. For 2022, the floor limit for single-family FHA loans in most of the country is $420,680, up from $356,362 in 2021. For high-cost areas, the ceiling is $970,800, up from $822,375 a year ago.

FHA is required by law to adjust its amounts based on the loan limits set by the Federal Housing Finance Agency, or FHFA, for conventional mortgages guaranteed or owned by Fannie Mae and Freddie Mac. Ceiling and floor limits vary according to the cost of living in a certain area, and can be different from one county to the next. Areas with a higher cost of living will have higher limits, and vice versa. Special exceptions are made for housing in Alaska, Hawaii, Guam and the Virgin Islands, where home construction is generally more expensive.

How Do You Get An Fha Loan

A lender must be approved by the Federal Housing Authority in order to help you get an FHA loan. You find FHA lenders and shop for mortgage quotes for an FHA loan quickly and easily on Zillow. Just submit a loan request and you will receive custom quotes instantly from a marketplace filled with hundreds of lenders. The process is free, easy and you can do it anonymously, without providing any personal information. If you see a lenders loan quote that you are interested, you can contact the lender directly.

Recommended Reading: How Much Interest Do I Pay On A Mortgage

What Are Fha Loans

An FHA loan is a mortgage offered by private lenders but regulated and insured by the Federal Housing Administration . Requirements for FHA loans are more relaxed, like down payments as low as 3.5%, credit score requirements lower than conventional loans and a higher loan amount, depending on your location.

Compared to traditional loans, FHA loans have more relaxed requirements, making them a popular option for first-time homebuyers. FHA loan borrowers have a choice between a 15- and 30-year term with fixed interest rates and a maximum loan amount that varies based on their state and county.

While FHA loans have many benefits that make them more accessible, FHAs guidelines require you to carry mortgage insurance. Mortgage insurance protects the lenders financial interest in case you default.

How Do I Get Preapproved For A Mortgage

Mortgage preapproval represents a lenders offer to loan the buyer money based on certain financial circumstances and specific terms. Start by gathering documents your lender will need, including a copy of your Social Security card and recent W-2 forms, pay stubs, bank statements and tax returns. The lender you select will then guide you through the preapproval process.

Don’t Miss: How Do I Know If My Mortgage Is Fha

Why Is My Credit Score Important

Your is not only important for qualifying for a mortgage, but its also the key to getting a lower interest rate. The better your credit score, the lower your interest rate will be, which can save you quite a lot of money.

Consider that a borrower with a $300,000, 30-year mortgage with a 3% interest rate will pay $29,635.90 less over the life of the loan than a borrower who has a 3.5% rate. On a monthly basis that equals $82 in savings.

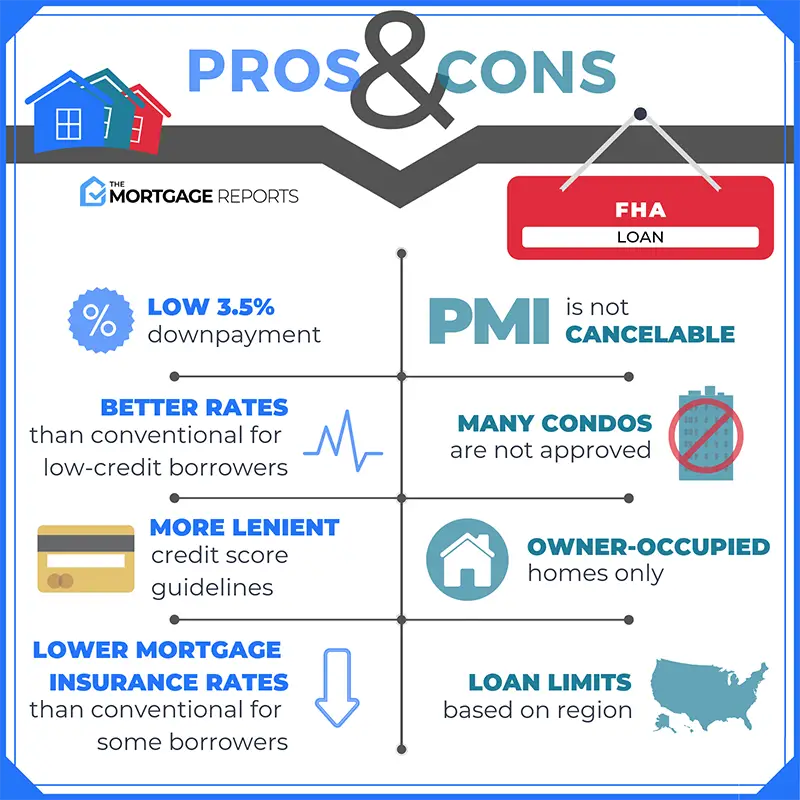

What Are The Pros And Cons Of Fha Loans

Life is filled with choices and its usually our own experiences and circumstances that will influence what we choose: Whether you prefer sweet or savory eats, staying in or going out, or if you were team Iron Man or Captain America it all comes down to you and your personal preferences.

The same goes for deciding what kind of mortgage option is right for you especially because not all mortgages are created equal, and while some might be a good fit for your financial situation, others may not. The best way to rest easy knowing youve found a loan option which works for you is by doing your research and learning what each type of loan can offer borrowers. In this article, well explore the pros and cons of FHA loans so that you can make the best and most informed choice for you.

Recommended Reading: How Much Do Mortgage Underwriters Make