Mortgage Rates Held Steady Over The Weekend

After rising by a very small amount on Friday, Mortgage Rates begin the current week in roughly the same territory. The changes taking place over the past few days have been small enough that, in most cases, the actual interest rates going out on estimates or being locked are unchanged and only the costs involved in obtaining those interest rates have changed.

In fact, on any given day, the same interest rates as the previous day are almost always available but the costs for a particular rate may have risen so much that the next 0.125% higher in rate could be a more efficient combination of closing costs and monthly payment. We talked more in this post about that efficient combination, aka “best-execution.”

Although best-execution rates remain at 3.875% on average, the back-to-back days of marginal weakening have us inching our way somewhat closer to 4.0%. Some lenders are best-priced at 4.0% even today. In general, offerings between lenders are slightly more diverse than normal.

- 30YR FIXED – Down to 3.875%, but some 4.0’s

- FHA/VA -Back firmly to 3.75%

- 15 YEAR FIXED – 3.375%

- 5 YEAR ARMS – 2.625-3.25% depending on the lender

Lock/Float Considerations

The Best Time To Lock A Mortgage Rate

Whether you’re getting ready to buy your first home or you’ve done this before, you’ll benefit from discovering the best time to lock in a mortgage rate. Understanding how it works and what it’s for can help make the homebuying process a little easier.

When paying off a mortgage, buyers need to pay interest on the money borrowed. The money that you borrow initially is called the principal, and the interest gets charged as a percentage of that principal.

The interest rate for your mortgage will ultimately determine how much interest you’ll pay over the life of the loan. Therefore, the lower the mortgage interest rate is, the better.

Can I Get A Lower Interest Rate

You may be able to lower your interest rate by making changes that lower your risk factors described above. Here are some of the things you may want to consider:

- Putting more money down and lowering the LTV ratio.

- Clearing any errors on your credit report.

- Adding a co-signer with additional income and/or a higher credit score to support the loan.

- Changing the number of years of your loan term.

You also may be able to lower your rate by paying discount points.

You May Like: How Much Mortgage Can I Afford For 1400 A Month

Current Mortgage Refinance Rates

The average rates for 30-year loans, 15- year loans and 5/1 jumbo ARMs are:

- The refinance rate on a 30-year fixed-rate refinance is 3.529%.

- The refinance rate on a 15-year fixed-rate refinance is 2.577%.

- The refinance rate on a 5/1 jumbo ARM is 2.664%.

- The refinance rate on a 7/1 conforming ARM is 3.816%.

- The refinance rate on a 10/1 conforming ARM is 3.964%.

What Is The Difference Between The Interest Rate And Apr On A Mortgage

Borrowers often mix up interest rates and an annual percentage rate . Thats understandable since both rates refer to how much youll pay for the loan. While similar in nature, the terms are not synonymous.

An interest rate is what a lender will charge on the principal amount being borrowed. Think of it as the basic cost of borrowing money for a home purchase.

An represents the total cost of borrowing the money and includes the interest rate plus any fees, associated with generating the loan. The APR will always be higher than the interest rate.

For example, a $300,000 loan with a 3.1% interest rate and $2,100 worth of fees would have an APR of 3.169%.

When comparing rates from different lenders, look at both the APR and the interest rate. The APR will represent the true cost over the full term of the loan, but youll also need to consider what youre able to pay upfront versus over time.

Recommended Reading: How To Get The Pmi Off My Mortgage

Are Mortgage Rates Lower On Mondays

- Post published:August 14, 2019

- Post category:Loans

Lock your mortgage rate on a Monday! You’ll get a lower interest rate!

You may have heard this suspect advice at an office party or family gathering, possibly uttered by a sketchy uncle or co-worker who has had one too many. Could your sketchy uncle be right? It seems far-fetched but unless you are one of the wizards who hold the keys to the financial system, everything about interest rates and financial markets may seem like sorcery.

Is it really smart to get your loan on a Monday? Will your interest rate really be lower? The answer is that Monday doesn’t necessarily offer a better interest rate – but it does offer more stability throughout the day. Which means you may want to lock your interest rate on a Monday. Read on as we explain how mortgage rates are calculated throughout the week, to see if Monday is indeed the right day for you to close that deal.

Work For A Lower Interest Rate

One of the biggest parts of home buying is the mortgage rate youre able to lock into. Everyone wants the lowest possible interest rate they can get but thats mostly determined by what the lending market offers on a given day. Unfortunately, timing isnt always in every borrowers favor.

Thats where mortgage discount points come in. Its a lever borrowers can pull to decrease their monthly mortgage costs and paying down your rate could save thousands of dollars over the life of your home loan.

Rather than asking the seller to drop their price, a buyer can leverage a seller concession to buy down their mortgage rate via points, said Taylor Marr, deputy chief economist at Redfin. This will have a much greater impact on lowering their monthly mortgage payment than a lower price would.

Although, paying for mortgage points adds more upfront costs at closing, which could be a barrier to entry for some borrowers. Shopping your rate around by contacting multiple lenders to see if they can offer a lower one only requires time and effort. Given how lenders differ and how volatile interest rates tend to be, taking your first offer could be a mistake.

You May Like: Who Pays Mortgage Broker Fees

Does My Loan Type Affect The Mortgage Rate Lock

Different types of mortgages may affect the specifics around your mortgage rate lock, including whether theyre eligible for a lock and if the lock can be extended. Although your loan type can impact aspects of your mortgage, deciding when to lock in your interest rate is part of the mortgage process regardless of the loan product you choose.

Why Monday Is The Best Day To Lock

The best day of the week to lock in a mortgage rate is Monday. This is because the history of mortgage rates shows its the least volatile day of the week when it comes to the mortgage market. Potential homebuyers will want to avoid volatility.

But what does all of this mean and why does it matter when it comes to your homes mortgage rate?

According to The Mortgage Reports, Monday is your best day of the week to get the mortgage rate you desire because history shows that its the calmest day for mortgages. The reasoning behind this is that its because there isnt as much news reported about the markets at the beginning of the week compared to the end of the week. This leads to market rates being calmer and more predictable at the very beginning of the week compared to the middle or end of the week where they can be volatile and unpredictable. Aiming to lock-in your mortgage rate on a Monday is your best bet to get a calm rate compared to other days of the week.

You May Like: What Does Buying Points On Mortgage Mean

How Long Can You Lock In A Mortgage Rate

When you lock your rate, itll be stable for a specified period of time. The exact lock period varies based on your loan type, where you live, the loan terms and the mortgage lender you choose. Most rate locks have a rate lock period of 15 60 days. If the rate lock expires before your loan closes, you may have the option to pay a fee to extend the lock period. Otherwise, youll get the interest rate thats available when you lock it before closing.

If things change concerning your mortgage application or financial situation, your lender might void your rate lock. Since your interest rate is based on factors like your income and credit, changes to your situation may mean youre no longer eligible for the rate that was originally offered. Opening a new line of credit while youre getting a mortgage, for example, could result in a change to your debt-to-income ratio or credit score, which means your lender will need to reevaluate your eligibility for the loan and interest rate.

What Happens If My Loan Requires A Longer Than Average Rate Lock Period

Longer rate lock periods may be required for things like new construction or a condo that needs board approval. An extended rate lock fee may apply.

- Rate lock fees will vary based on the length of your rate lock period and interest rate chosen.

- We will refund the rate lock fee if your application is denied.

- If you withdraw your loan application or it is cancelled, the upfront extended rate lock fee may not be refunded unless the application is for a VA loan.

We’ll let you know if your situation requires a longer than normal rate lock period and if any rate lock fees apply. If you choose a longer rate lock period option, you will receive a separate disclosure with detailed information.

Recommended Reading: Can You Get A Mortgage With A New Job

Understand Inflation And How It Affects You

- Social Security: The cost-of-living adjustment, which helps the benefit keep pace with inflation, will be 8.7 percent next year. Here is what that means.

- Food Prices: Amid growing concerns of a possible recession, some food companies and restaurants are continuing to raise prices even after their inflation-driven costs have been covered.

- Tax Rates: The I.R.S. has made inflation adjustments for 2023, which could push many people into a lower tax bracket and reduce tax bills.

- Your Paycheck: Inflation is taking a bigger and bigger bite out of your wallet. Now, its going to affect the size of your paycheck next year.

Demand has dropped swiftly. Mortgage applications were largely flat for the week that ended Sept. 9, rising 0.2 percent from the previous week, according to data from the Mortgage Bankers Association. But applications were down nearly 29 percent from a year earlier.

Refinancing demand has also plummeted: Applications to refinance home loans were down about 4 percent from last week, but dropped 83 percent from the same week a year earlier.

Home sales are down 13 percent year to date, said Selma Hepp, lead economist at CoreLogic, a real estate data analytics firm. Further increases in mortgage rates, beyond 6 percent, on a 30-year fixed rate mortgage will exacerbate affordability challenges, she said.

There could be other ripple effects. With fewer home sales, more people will continue to rent, potentially causing rent costs to go up.

Consequences Of Failing To Lock In Your Mortgage Rate

If you donât lock in your interest rate, rising interest rates could force you to make a higher down payment or pay points on your closing agreement. When you pay an up-front feeâor mortgage pointsâto a lender, youâre providing more money initially in order to get a lower interest rate.

For example, the cost for a $200,000 loan at a 30-year fixed rate could go up by more than $60 per month if the rate goes up from 5% to 5.5%, resulting in $22,000 more in interest over the loan term.

âRate locks provide consumers certainty when it comes to the economic terms of their loanâmost importantly, their monthly payment,â says Sebastian Hart, capital markets associate at online homeownership company Better. âWithout rate locks, borrowers would not know the final terms of their loan until the very end of the process.â

Also Check: What Documents Will I Need To Apply For A Mortgage

Can I Return My Loan To A Floating Interest Rate

If your closing date becomes unknown or uncertain and it wont occur on or before the rate lock expiration date, you may have the option to unlock and float your rate.

Some common reasons for an unknown or uncertain closing date may include circumstances such as:

- Departure home sale falls through

- Legal action pending on the purchase property title

You can relock in 14 calendar days or less at your original rate and loan terms.

- If you relock after 14 calendar days, youll receive a new current market interest rate and rate lock expiration date.

There is no fee to return your loan to float.

If you believe you have an unknown or uncertain closing date, please contact your home mortgage consultant or private mortgage banker.

Note: If you’re using a Bond program and your rate lock expires, returning to float is not available. Contact your home mortgage consultant with any questions.

Mortgage Rate Sheets Are Printed Monday Through Friday

- New lender rate sheets are released daily throughout the week

- Monday through Friday unless its a holiday

- Sometimes interest rates will be different, sometimes theyll remain unchanged

- Depending on what transpired the day before or the morning of

Each morning, Monday through Friday, banks and their loan officers get a fresh mortgage rate sheet that contains the pricing for that day.

I know because when I first started in the industry, I got tasked with handing them out to fellow employees .

Ill never forget kicking the printer every time it broke, which as far as I can remember was also Monday through Friday.

Anyway, these rate sheets contain the days current mortgage rates, which are critical to anyone working in the biz.

Without them, loan officers cant provide quotes to borrowers unless theyre using some sort of computer system, which some of the big retail banks probably rely upon.

All loan programs offered by a given bank will be featured, including fixed rates like the 30-year fixed, 20-year fixed, and 15-year fixed, along with other loan types offered such as adjustable-rate mortgages.

Expect fixed mortgages to move more than ARMs on a daily basis, seeing that ARMs come with short-term promo rates that adjust over time, whereas mortgage bankers are taking a bigger risk by offering a rate that will never change.

There will also be a section for jumbo loans, FHA loans, VA loans, and other government loans offered such as an FHA streamline.

Also Check: How To Find Out If A Home Has A Mortgage

Summary Of Current Mortgage Rates

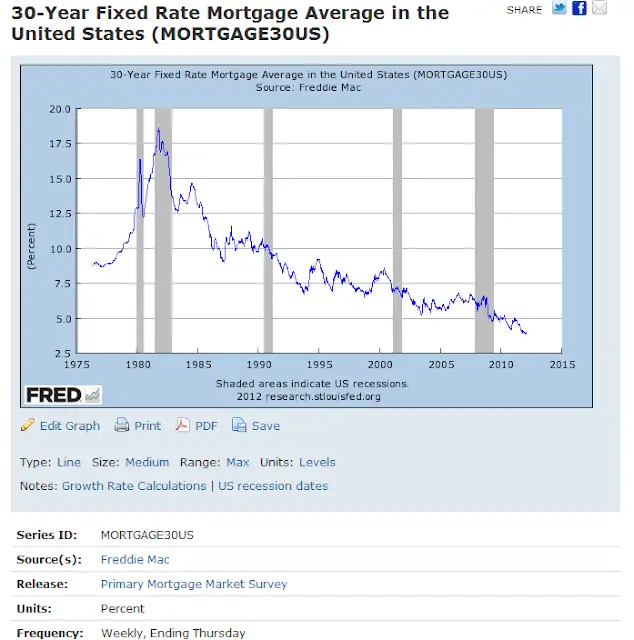

Mortgage rates were higher this week

- The current rate for a 30-year fixed-rate mortgage is 5.89% with 0.7 points paid, an increase of 0.23 percentage points from a week ago. This week last year, the 30-year rate averaged 2.88%.

- The current rate for a 15-year fixed-rate mortgage is 5.16% with 0.8 points paid, 0.18 percentage points higher week-over-week. The 15-year rate averaged 2.19% a year ago this week.

- The current rate on a 5/1 adjustable-rate mortgage is 4.64% with 0.4 points paid, up by 0.13 percentage points from a week ago. The average rate on a 5/1 ARM was 2.42% this week a year ago.

Do Weekends Have An Impact On Your Trading Strategy

Thats right, they do. Saturday and Sunday markets might act strangely because large market participants spend their income on Saturday and Sunday. Volatility and volume will rise.

All of this implies youll need to adjust your approach in order to keep up with the changing market. The other option is a weekend trading strategy thats all your own.

In this weekend gap trading forex and options method, the market circumstances are perfect for this approach. A gap is just an increase in the price of a product. When the market changed, the price went up or down without taking into account the prices in between.

Who causes the gaps first? From novel motions to faster movements, a variety of factors might contribute to this. They do, however, demand a lot of volumes. As most of the major players will be out of the game over the weekend, it will be more difficult to locate these holes. Instead, youll see holes that need to be filled.

Just a few trades can close the gaps. Several people invest in the same direction for whatever reason. As a result, the market explodes, leaving everyone scratching their heads. As a result, they trade in the other way, hoping to capitalize on the miscalculation.

Your weekend arsenal should include Bollinger Bands. Using Bollinger Bands, you can identify a price channel that the market shouldnt stray from. These prices can be quite accurate on the weekends. You may use this as a springboard to plan your weekend activities.

Read Also: How Much Are House Mortgages

What Else Can Impact My Rate

Getting a good mortgage rate has to do with building credit but also managing it well, including saving for a down payment and keeping additional savings on hand to cover unexpected expenses.

In most cases, you don’t want to stretch so far with your down payment that you are left without cash reserves when you move into your home, and keeping some liquid savings may help your lender’s confidence in your ability to pay back the loan, potentially lowering your rate.

“Banks are very keen on making sure that borrowers have sufficient savings in reserve post-closing. A good rule of thumb is six months of mortgage/tax and insurance for loans under $750,000 and 12 months for jumbo loans,” says Melissa Cohn, an executive mortgage banker at Connecticut-based William Raveis Mortgage.

Keep in mind that credit scoring services like FICO adjust your credit based on mortgage inquiries Lotz has a good piece of advice for those who are shopping around for the best rate at different lenders.

“The FICO company allows multiple mortgage inquiries within a 10-day period to be counted as one,” says Lotz. “This allows a borrower to compare offers and rates from different lenders, but borrowers need to make sure they are within that one-day window, otherwise their scores will start to go down from excessive inquiries.”