What Is Homeowners Insurance

Homeowners insurance is a policy you purchase from an insurance provider that covers you in case of theft, fire or storm damage to your home. Flood or earthquake insurance is generally a separate policy. Homeowners insurance can cost anywhere from a few hundred dollars to thousands of dollars depending on the size and location of the home.

When you borrow money to buy a home, your lender requires you to have homeowners insurance. This type of insurance policy protects the lenders collateral in case of fire or other damage-causing events.

Why You Should Consider Buying Below Your Budget

There is something to be said for the idea of not maxing out your credit possibilities. If you look at houses that are priced somewhere below your maximum, you leave yourself some options. For one, you will have room to bid if you end up competing with another buyer for the house. As an alternative, youâll have money for renovations and upgrades. A little work can transform a home into your dream house â without breaking the bank.

Perhaps more importantly, however, you avoid putting yourself at the limits of your financial resources if you choose a house with a price lower than your maximum.

You will have an easier time making your payments, or you will be able to pay extra on the principal and save yourself money by paying off your mortgage early.

Recommended Reading: Who Is Rocket Mortgage Owned By

Your Deposit And Loan

This will make a big impact on how far your £1,500 per month can stretch but wont really impact the maximum borrowing amount allowed from lenders as the affordability assessment will only focus on your annual income and outgoings.

If you put down a larger deposit, this naturally reduces the size of the mortgage. Borrowing a smaller sum can reduce your monthly payments. And, a larger deposit also reduces your LTV ratio which can give you more borrowing options or better rates as a wider group of lenders will consider your application.

So, the size of your deposit can make £1,500 a month payments more realistic if youve got a smaller loan and a cheaper interest rate.

Read Also: How Much Salary For Mortgage Calculator

How Does A Mortgage Work

A mortgage is a secured loan that is collateralized by the home it is financing. This means that the lender will have a lien on your home until the mortgage is paid in full. After closing, youll make monthly paymentswhich covers principal, interest, taxes and insurance. If you default on the mortgage, the bank will have the ability to foreclose on the property.

About Your Maximum Home Price

Your maximum home price is calculated by looking at the maximum mortgage you can afford, your loan terms and your .

Once you know how much house you can afford, be sure to look at your loans amortization schedule here.

Tip: Dont overlook PITI when determining what you can afford each month. For example: if you can afford $2,400 per month, this must include your principal, interest, AND taxes and insurance.

Don’t Miss: What Is Considered Monthly Debt For Mortgage

How Much House Can I Afford With An Fha Loan

Depending on your current financial situation and your credit score, a loan insured by the Federal Housing Administration known as an FHA loan can give you the opportunity to purchase a home with less restrictions than a regular mortgage.

FHA loans feature maximum qualifying ratios of 31/43 for most applicants with a credit score higher than 500 this means that no more than 31% of your income should go to housing costs while 43% should be allocated to total debt. Most loans require a 28/36 ratio. This makes FHA loans ideal for those who might have less income or a shorter credit history.

If your credit score is over 580, you may be allowed to have a ratio as high as 40/50 with this type of loan, as long as you meet other requirements.

Borrowers with a credit score of 580 and above could also pay as little as 3.5% as a down payment, lower than the typical 5% or higher with a non-FHA loan.

A Word Of Caution: Youll Be Tempted By Bidding Wars And Homes Out Of Your Price Range

Houses are notorious budget busters. A study in Australia showed that 44% of homebuyers paid more for a house because they really liked it. Whats more, one-third of buyers said they spent more than they planned to on a house during the first quarter of 2019, according to research from CoreLogic. In the hot sellers market of 2018, those buyers who overspent went $16,510 over budget on average to compete for houses.

The temptation is real. However, life is a series of trade-offs. The more your housing costs take over your budget, the less money youll have to spend on dinners out, vacations, and furniture to fill your empty home. Keep your eyes open to the hidden costs of homeownership and get to know your own finances to set financial boundaries that will stick.

Then you can go nuts and obsess over new listings from your amazing real estate agent guilt-free. Happy shopping!

*This information is for educational purposes only and not intended to illustrate available APRs or mortgage-related marketing under the Truth-in-Lending Act Section 1026.24.

Also Check: Does Ally Bank Do Mortgages

Upfront Costs To Expect

Buying a home requires a lot of money from the get-go. Here are three factors to consider:

- Down payment: Do you have the minimum down payment amount your mortgage requires? You’ll need 3% for a conforming mortgage backed by Freddie Mac or Fannie Mae, 20% for a jumbo mortgage, and 3.5% for an FHA mortgage. You might not need any down payment for a USDA or VA mortgage.

- Closing costs: Closing costs include expenses like an application fee, appraisal fee, and settlement fee. According to mortgage technology company ClosingCorp, the average closing costs in 2021 were $6,905 including transfer taxes, or $3,860 without taxes.

- Remaining savings: You probably don’t want to drain 100% of your savings to buy a home, only to find yourself in a bind if a financial emergency occurs. Think about how much money you want to have left in savings once you’ve made the down payment and covered closing costs.

How To Calculate Affordability

Zillows affordability calculator allows you to customize your payment details, while also providing helpful suggestions in each field to get you started. You can calculate affordability based on your annual income, monthly debts and down payment, or based on your estimated monthly payments and down payment amount.

Our calculator also includes advanced filters to help you get a more accurate estimate of your house affordability, including specific amounts of property taxes, homeowners insurance and HOA dues . Learn more about the line items in our calculator to determine your ideal housing budget.

Don’t Miss: How Much Money Should Go To Mortgage

Is There A Disadvantage To Paying Off A Mortgage

A: Paying your mortgage off early and closing out an account could impact your credit score. Mortgages are considered “good debt,” and paying it off extremely early could negatively affect your score. But, remember, you can alwaysrefinance to a shorter-termif you are determined to pay it off sooner. In addition, you could possibly get a lower interest rate in the process and be able to pay your loan off sooner.

Related Articles

Make Yourself A Competitive Buyer

Don’t spend all your time daydreaming about listings you find on Zillow. Do research to learn what kinds of mortgage loans are out there, including FHA, conventional, VA and USDA loan programs. Get pre-approved by a lender before you start shopping, so you know your price range, and you’ll be ready to make an offer on the spot if need be.

It’s also important to know your credit score. Having a score of 760 or higher will qualify you for the best mortgage rates, so take a few months and build your credit if you can. And then do everything you can to keep it in good standing.

If you’re not sure where your credit score currently stands, sign up for a free or paid to check your score.

is a free credit monitoring service that anyone regardless of whether they are Capital One cardholder can use. Receive an updated VantageScore credit score from TransUnion every week and credit report updates from TransUnion and Experian in real time. Use the credit score simulator to check the potential effect that certain actions, such as paying off debt or closing a credit card, may have on your credit score. In the months leading up to applying for your mortgage, you’ll want to be extra careful about closing accounts and racking up debt, as it can decrease your score and make your mortgage more expensive.

Don’t Miss: How To Get A House Without Mortgage

Work With A Local Real Estate Agent Connect To Local Resources

Working with a local real estate agent is a valuable asset when buying real estate. You could say, real estate agents are a conduit of information for buyers and sellers. Agents work closely with title companies, mortgage lenders, inspectors, appraisers, and so on.

If you’re thinking about buying or selling, start by contacting a local agent. They can give you direction to get started, resources to find our how much mortgage you can afford, and get set up with listing alerts for the market you’re interested in buying or selling.

How Affordability Is Calculated

Mortgage providers use income multiples, rather than a set monthly budget -whether for £1,000 or any other amount, as part of their affordability calculations to determine the maximum amount they will extend to you.

Usually, providers will lend between 4-4.5 times a households annual income. However, some lenders are happy to go up even to 6 times your annual income.

Strong applications high deposit, good credit history and strong income levels will find that they are more likely to be eligible with mortgage lenders who use higher income multiples.

Thats not to say that all lenders will always loan at least 4 times a households income. Lenders want to know that what they extend is affordable to you in terms of monthly repayments.

If you have large amounts of outgoings each month , providers may calculate you can only afford an amount lower than a 4 time income multiple. Plus they will want to apply a stress test to ensure you can afford any increases in interest rates in the future.

To find out how this may work out for yourself, take a look at our mortgage affordability calculator and input your own income:

Don’t Miss: Where Can I Get Mortgage Life Insurance

How To Lower Your Monthly Mortgage Payment

If the monthly payment you’re seeing in our calculator looks a bit out of reach, you can try some tactics to reduce the hit. Play with a few of these variables:

- Choose a longer loan. With a longer term, your payment will be lower .

- Spend less on the home. Borrowing less translates to a smaller monthly mortgage payment.

- Avoid PMI. A down payment of 20 percent or more gets you off the hook for private mortgage insurance .

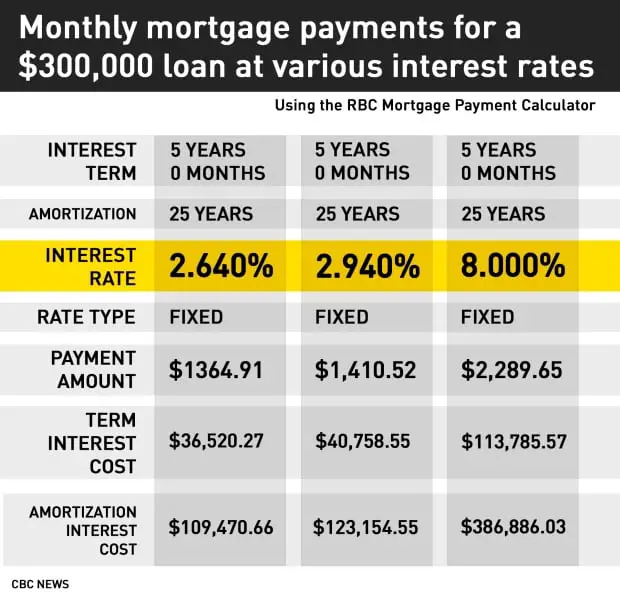

- Shop for a lower interest rate. Be aware, though, that some super-low rates require you to pay points, an upfront cost.

- Make a bigger down payment. This is another way to reduce the size of the loan.

What Mortgage Can I Afford On 1400 A Month

$1,400 per month qualifies to borrow a mortgage of $204,913 add your $20,000 down payment to this, and you can purchase a home of $224,913. Your debt load as a percentage of your income is low enough so that the back-end cap of 36% of your monthly gross income doesnt come into play.

How much house can I afford for $1800 a month?

With a $1,800 payment and $0 down you can afford a maximum house price of $300,826 with these loan terms.

Read Also: How Do You Buy Down A Mortgage Rate

How Much Mortgage Can I Get For 900 A Month

A payment of $900 would have a mortgage balance of $191,976. If you include your monthly taxes, insurance and mortgage insurance payment of $300 a month, you now have a payment of $1,200 a month.

How much is a mortgage per 1000?

Have you ever wondered how much you pay for every $1,000 of your mortgage loan?Payment per Thousand Financed.

| Total Closing Costs |

|---|

| $1,741.90 |

How much house can I afford if I pay 1400 a month?

$1,400 per month qualifies to borrow a mortgage of $204,913 add your $20,000 down payment to this, and you can purchase a home of $224,913. Your debt load as a percentage of your income is low enough so that the back-end cap of 36% of your monthly gross income doesnt come into play.

Aim To Put 20 Percent Down

The amount of mortgage you can afford also depends on the down payment you make when buying a home. In a perfect world, we recommend a 20 percent down payment to avoid paying mortgage insurance, Neeley says.

When your down payment is less than 20 percent, your costs rise. You typically have to pay private mortgage insurance, which can cost up to 1 percent of the entire loan amount each year until you build up 20 percent equity in your home. On a $240,000 mortgage, thats $200 per month.

Keep in mind that you will have other ongoing costs related to homeownership as well, including taxes, insurance, and utilities. All of these expenses need to be estimated before you settle on a monthly mortgage payment.

Don’t Miss: Do Mortgage Companies Accept Credit Card Payments

How To Use The Maximum Mortgage Calculator

Not sure where to start? Let us help you:

What Is A Fixed Rate Mortgage

If you have a fixed rate mortgage, your payments and interest rate will stay the same throughout the life of the loan. If your monthly payment is $1500, that’s what you will pay every single month for 15 or 30 years.

You should keep in mind that even though your monthly payment stays the same if you have an FRM, property taxes and insurance rates are not fixed. When you calculate these amounts, you should give yourself some leeway to allow for insurance and tax increases in your budget.

Don’t Miss: How Much Income For A 600k Mortgage

How Much Mortgage Can I Afford

Even though Martin can technically afford House #2 and Teresa can technically afford House #3, both of them may decide not to. If Martin waits another year to buy, he can use some of his high income to save for a larger down payment. Teresa may want to find a slightly cheaper home so sheâs not right at that maximum of paying 36% of her pre-tax income toward debt.

The problem is that some people believe the answer to âHow much house can I afford with my salary?â is the same as the answer to âWhat size mortgage do I qualify for?â What a bank is willing to lend you is definitely important to know as you begin house hunting. But ultimately, you have to live with that decision. You have to make the mortgage payments each month and live on the remainder of your income.

So that means youâve got to take a look at your finances. The factors you should be looking at when considering taking out a mortgage include:

- Private mortgage insurance

- Local real estate market

Plugging all of these relevant numbers into a home affordability calculator can help you determine the answer to how much home you can reasonably afford.

But beyond that youâve got to think about your lifestyle, such as how much money you have leftover for travel, retirement, other financial goals, etc. You might find that you donât want to buy the most expensive home that fits in your budget.

How Much Is An Extra 10k On A Mortgage

To determine how much you can afford using this rule, multiply your monthly gross income by 28%. For example, if you make $10,000 every month, multiply $10,000 by 0.28 to get $2,800. Using these figures, your monthly mortgage payment should be no more than $2,800.

How much can I afford for 1000 a month?

In case someone is available to pay over the next 30 years $900 on a monthly basis, for a loan lets figure out how much house he can afford at different interest rate percents: How much house can I afford for 1000 a month?

How much can I afford on a monthly mortgage?

For an individual willing to pay over the next 30 years $1,300 on a monthly basis, lets estimate how much house he can afford by certain interest rates: How much house can I afford for 1400 a month?

How much house can I afford for 600 a month?

In case someone is able to pay over the next 30 years a monthly payment $500 for a mortgage loan lets assume different interest rate levels and see how much house he can afford: How much house can I afford for 600 a month?

How much can you pay for a house on Trulia?

Affordability Calculator. See how much house you can afford with our easy-to-use calculator. You can afford a home up to $380,955. Get Pre-Qualified. You can afford a home up to: $380,955. Debt-To-Income Ratio: 36%. Monthly Payment: $2,250.

Also Check: How Much Is Mortgage On 1 Million