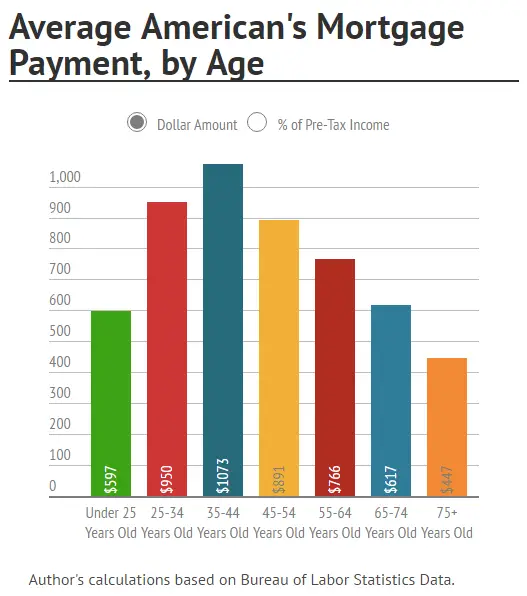

Average Monthly Mortgage Payments By Age Group

Until the 45 to 54 age group, borrower age had a positive correlation with the median size of mortgage payments in 2015. Median payments increased for each successive working-age group, reaching their peak among people between 35 and 44 and declining for age groups with more retirees.

| Age | |

|---|---|

| $27,122 | $71,000 |

Borrowers of working age, in the 25 to 64 year old range, made monthly mortgage payments of close to $1,000. Consumers under 25 are likely able to afford a less expensive home than older professionals, and make a median monthly mortgage payment of under $800. Mortgage holders over 64 are likely retired and have either paid down their mortgage or are spending on a less expensive home, leading to a lower median payment for this group.

How To Compare Mortgage Rates

Mortgage rates like the ones you see on this page are sample rates. In this case, they’re the averages of rates from multiple lenders, which are provided to NerdWallet by Zillow. They let you know about where mortgage rates stand today, but they might not reflect the rate you’ll be offered.

When you look at an individual lender’s website and see mortgage rates, those are also sample rates. To generate those rates, the lender will use a bunch of assumptions about their sample borrower, including credit score, location and down payment amount. Sample rates also sometimes include discount points, which are optional fees borrowers can pay to lower the interest rate. Including discount points will make a lender’s rates appear lower.

To see more personalized rates, you’ll need to provide some information about you and about the home you want to buy. For example, at the top of this page, you can enter your ZIP code to start comparing rates. On the next page, you can adjust your approximate credit score, the amount you’re looking to spend, your down payment amount and the loan term to see rate quotes that better reflect your individual situation.

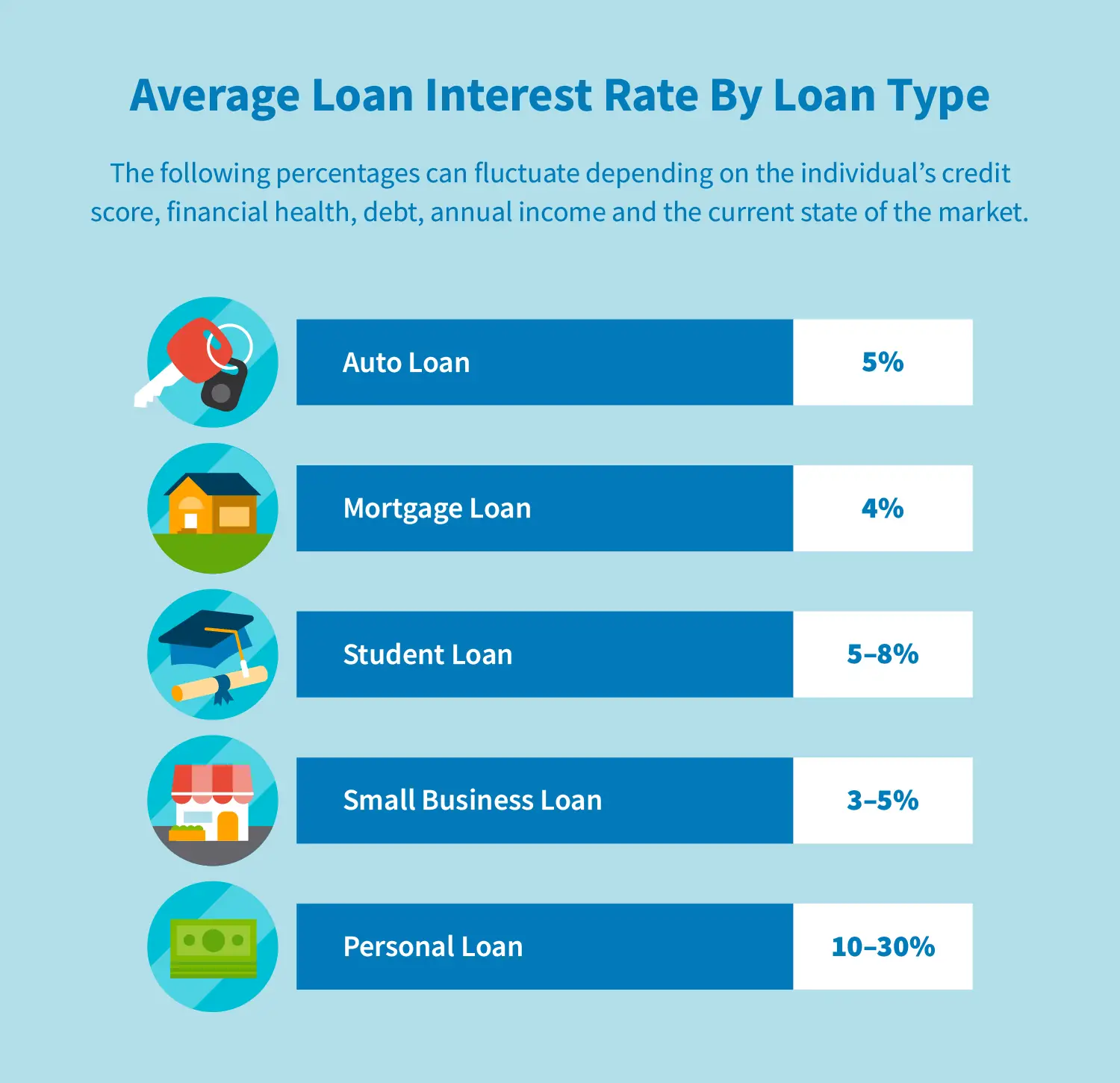

The interest rate is the percentage that the lender charges for borrowing the money. The APR, or annual percentage rate, is supposed to reflect a more accurate cost of borrowing. The APR calculation includes fees and discount points, along with the interest rate.

» MORE: Mortgage points calculator

Ology: How We Got Our Average Number

To determine how much the average borrower pays for their mortgage each month, we used the average home sales price according to data from the Census Bureau and the Department of Housing and Urban Development. In Q1 of 2022, the average price was $507,800. We then took the typical down payment of 13% to determine an average loan size. Freddie Mac data was also used to find average mortgage rates for 30-year and 15-year fixed-rate mortgages in Q1 of 2022: 3.82% and 3.04%, respectively.

Recommended Reading: Is 3.6 A Good Mortgage Rate

Mortgage Rates Average Loan Size Both Fall

According to the Mortgage Bankers Association’s Weekly Applications Survey, average mortgage rates fell last week for 30-year fixed-rate loans with both conforming and jumbo balances. Loans backed by the Federal Housing Administration and 15-year fixed-rate loans were mostly flat from the week before. Declining rates led to a bump in mortgage demand which increased 0.7 percent, with refinance activity rising 2 percent week-over-week.

Joel Kan, MBA’s associate vice president of economic and industry forecasting, says demand from home buyers, while up slightly from the week before, has slowed this spring. Overall purchase activity has weakened in recent months due to the quick jump in mortgage rates, high home prices, and growing economic uncertainty, Kan said. But while demand may be slowing, it may also be helping slow price increases. The report shows the average purchase loan amount fell to $413,500 last week, down from $460,000 in March, its all-time high. The MBA’s weekly survey has been conducted since 1990 and covers 75 percent of all retail residential mortgage applications.

Personal Considerations For Homebuyers

A lender could tell you that you can afford a considerable estate, but can you? Remember, the lenders criteria look primarily at your gross pay and other debts. The problem with using gross income is simple: You are factoring in as much as 30% of your paycheckbut what about taxes, FICA deductions, and health insurance premiums. In addition, consider your pre-tax retirement contributions and college savings, if you have children. Even if you get a refund on your tax return, that doesnt help you nowand how much will you get back?

Thats why some financial experts feel its more realistic to think in terms of your net income and that you shouldnt use any more than 25% of your net income on your mortgage payment. Otherwise, while you might be able to pay the mortgage monthly, you could end up house poor.

The costs of paying for and maintaining your home could take up such a large percentage of your incomefar and above the nominal front-end ratiothat you wont have enough money left to cover other discretionary expenses or outstanding debts or to save for retirement or even a rainy day. Whether or not to be house poor is mostly a matter of personal choice getting approved for a mortgage doesnt mean you can afford the payments.

Don’t Miss: Can You Refinance A Mortgage After Bankruptcy

Get A More Accurate Estimate

Get pre-qualified by a lender to see an even more accurate estimate of your monthly mortgage payment.

-

How much house can you afford? Use our affordability calculator to estimate what you can comfortably spend on your new home.

- Pig

Interested in refinancing your existing mortgage? Use our refinance calculator to see if refinancing makes sense for you.

- Dollar Sign

Your debt-to-income ratio helps determine if you would qualify for a mortgage. Use our DTI calculator to see if you’re in the right range.

- Award Ribbon VA mortgage calculator

Use our VA home loan calculator to estimate payments for a VA loan for qualifying veterans, active military, and military families.

Participating lenders may pay Zillow Group Marketplace, Inc. a fee to receive consumer contact information, like yours. ZGMI does not recommend or endorse any lender. We display lenders based on their location, customer reviews, and other data supplied by users. For more information on our advertising practices, see ourTerms of Use & Privacy. ZGMI is a licensed mortgage broker,NMLS #1303160. A list of state licenses and disclosures is availablehere.

How Piti Affects Your Mortgage Qualification

When lenders assess whether or not you can afford a mortgage loan, theyll compare your estimated PITI with your gross monthly income .

Your PITI, combined with any existing monthly debts, should not exceed 43% of your monthly gross income this is called your debt-to-income ratio .

Your DTI is a primary factor in whether or not youll qualify for a mortgage.

Recommended Reading: How To Report Mortgage Payments To Credit Bureau

The Average Mortgage Length In The Us

When deciding between certain products, it can be easy to just go with the most popular. But when it comes to choosing the right mortgage product to fit your goals, going with the most popular option may not be the best decision.

The average mortgage length is a good place to start. Learning more about other term length options and the benefits and drawbacks of each one will help you find the right mortgage for you.

How Long Does A Mortgage Take To Pay Off

When you sign up for a home loan, you usually sign up for a term of 25 or 30 years. What tactics can you use to pay yours off sooner?

18 Apr 2018

The information contained in this article is intended to be of a general nature only. It has been prepared without taking into account any personâs objectives, financial situation or needs. realestate.com.au recommends that you seek independent legal, financial, and taxation advice before acting on any information in this article.

realestate.com.au Pty Ltd ACN 080 195 535 is a credit representative of Smartline Operations Pty Ltd ACN 086 467 727 . Please refer to our for information relating to our activities.

About home loan specialists

The information provided on this website is for general education purposes only and is not intended to constitute specialist or personal advice. This website has been prepared without taking into account your objectives, financial situation or needs. REA can connect you with our referral partner ubank, part of National Australia Bank Limited ABN 12 004 044 937 , or introduce you to a mortgage broker accredited with either Mortgage Choice Pty Ltd ACN 009 161 979 or Smartline Operations Pty Ltd ACN 086 467 727 , who can talk to you about home loans from a range of lenders. Mortgage Choice and Smartline are wholly-owned subsidiaries of REA. Your broker will advise whether they are a credit representative of Mortgage Choice or Smartline.

Don’t Miss: What Can My Mortgage Be

What Does Average Represent

The U.S. Census Bureau reports both the mean and the median payment. The mean is the same as average. The median is the middle value in a set of numbers. It divides the lower and higher half of values in the set.

When figuring out a typical monthly mortgage payment, finding the median value can be more useful than finding the average value. Averages can get skewed by extremely high or low values. The median gives a better idea of where the middle is for a broad range of homeowners.

National averages: Looking at averages from another data source, the 2020 National Association of REALTORS Profile of Home Buyers and Sellers, shows a national median home price of $272,500. If we assume a down payment of 10% of the purchase price, we can calculate a loan size of $245,250. Applying current mortgage loan rates, you can estimate the following average monthly mortgage payments:

- $1,700 per month on a 30-year fixed-rate loan at 3.29%

- $2,296 per month on a 15-year fixed-rate loan at 2.79%

First-time homebuyers: The national averages include all homeowners, including those who have built up equity, worked their way up the pay scale and established high credit scores. Those folks are more likely to take on larger loans and get approved for them.

- $1,307 per month on a 30-year fixed-rate loan at 3.29%

- $1,760 per month on a 15-year fixed-rate loan at 2.79%

- $1,077 per month on a 30-year fixed-rate loan at 3.29%

- $1,466 per month on a 15-year fixed-rate loan at 2.79%

Most Expensive States For Home Buyers

The recent economic crisis may have dealt the US housing market a devastating blow, but it is slowly returning to form. Spurred on by a strengthening economy and record low interest rates, real estate markets across the country are returning to their pre-recession levels. But as consumers return to the market, housing costs have begun to rise, particularly in some of the most desirable regions of the nation. For a greater perspective on the rising cost of home-ownership, let’s take a quick look at the 5 most expensive states for home buyers in the U.S.

Recommended Reading: Is It Harder To Get A 15 Year Mortgage

What To Do If You Want More Home Than You Can Afford

We all want more home than we can afford. The real question is, what are you willing to settle for? A good answer would be a home that you wont regret buying and one that wont have you wanting to upgrade in a few years. As much as mortgage brokers and real estate agents would love the extra commissions, getting a mortgage twice and moving twice will cost you a lot of time and money.

The National Association of Realtors found that these were the most common financial sacrifices homebuyers made to afford a home:

These are all solid choices, except for making only the minimum payments on your bills. Having less debt can improve your credit score and increase your monthly cash flow. Both of these will increase how much home you can afford. They will also decrease how much interest you pay on those debts.

Consider these additional suggestions for what to do if you want more home than you can afford:

- Pay down debt, especially high-interest credit card debt and any debt with fewer than 10 monthly payments remaining

- Work toward excellent credit

- Ask a relative for a gift toward your down payment, especially if you can demonstrate your own efforts toward becoming an excellent candidate for a mortgage

How Much House Can You Afford

As a general rule, it’s a good idea to keep your monthly housing costs to 30% of your take-home pay or less. That way, you’ll leave yourself enough room in your budget to cover your remaining expenses.

That 30% threshold, however, is not meant to cover a mortgage payment of principal and interest alone. Rather, that 30% should include all predictable monthly housing expenses you’ll incur. These include:

- Homeowners insurance premiums

- Private mortgage insurance

- Homeowners association fees

To give yourself even more wiggle room in your budget, you may want to lob predictable home maintenance into that 30% threshold, too. As a general rule of thumb, home maintenance costs 1% to 4% of a home’s value each year, and the older your home, the more you’ll want to veer toward the higher end of that range. For example, say you buy a 100-year-old property that’s not very updated, and it’s worth $400,000. In that case, you could easily spend up to 4% of that amount, or $16,000 a year, on home maintenance. That’s a little more than $1,300 a month.

On the other hand, if you buy a new construction home worth $400,000, your yearly maintenance costs might amount to just $4,000, or $333 a month. It’s up to you whether you want to factor maintenance into your 30% calculation. If you do, you might stress less when other bills of yours climb.

Don’t Miss: What Is A Conversion Mortgage

Whats The Average Mortgage Payment

We dont want to waste your time, so lets get down to business. The median monthly mortgage payment is just over $1,600, according to the U.S. Census Bureau.1 That can vary of course, based on the size of the house and where you live, but thats the ballpark number.

If youre the kind of person who doesnt need to know how we came up with the number $1,600, feel free to skip to the next section. But if you want more detailsincluding how to calculate your own average paymentread on!

What Does It Mean To Be House Poor

House poor is a situation where most of your wealth is tied up in your house and much of your income goes toward servicing the mortgage debt and related expenses. An example would be if you had $100,000 in savings and used all of it to finance a $500,000 property with a $2,500 monthly mortgage payment when your net income is $3,000 per month.

Such a situation can give the illusion of economic prosperity but quickly unravel to foreclosure if things turn sour.

Don’t Miss: What Is Current Mortgage Refinance Rate

Should Brits Take A Mortgage Holiday

Our analysis looks at what repayment holidays might mean in the long term for mortgage holders in three different scenarios:

- Scenario 1: First-time buyer, 1 year into their 30-year mortgage of £170,000.

- Scenario 2: Mid-late 30s with a family, with a 20-year mortgage worth £220,000.

- Scenario 3: Older homeowner, with 7 years left to pay their remaining mortgage balance of £55,000.

| £788.72 |

Matthew Boyle, mortgage specialist, reflects on the the housing market through the pandemic

“The UK’s coronavirus lockdown saw the housing market and the mortgage market effectively paused during spring 2020. Many lenders cut the number of products they had on offer, particularly at higher LTVs, as they concentrated on their existing mortgage customers and dealing with mortgage holiday requests.

However, as property viewings and sale completions started to return post-lockdown, the housing market has shown to be surprisingly robust in terms of asking prices. In turn, we are beginning to see a larger number of mortgage deals become available to home buyers again. Despite a flat few years in the country’s house-selling sector, the size of the UK’s mortgage market has remained steady. In the third quarter of 2019, the outstanding value of all residential mortgage loans stood at £1.49 trillion 3.9% higher than it was a year earlier.

What is the size of the mortgage market?

Number Of Home Loan Borrowers

But while the total amount lent is up on March 2020s figures, borrower numbers have decreased pretty much right across the board. The only group that has increased is first home buyers with at least a 20% deposit. While their numbers are down 22% on last year, compared to pre-pandemic 2020 they are up slightly, by close to 10%.

| Total No. Borrowers |

|---|

| $672,102 | $3675 |

So, if youre looking to buy a property, how does your possible mortgage compare with the current averages, and what type of rate is your lender offering? Although the above repayment figures are based on the average fixed one-year rate in our database , there remains a wide disparity between the lowest rate on our tables, 3.75% , and the highest, 6.45% .

And its interesting to note that the minimum floating rate on our database now sits below many fixed-term interest rates. So for canny consumers who are prepared to do their homework and search out the lowest mortgage rates, there are still savings to be made.

Also Check: Can You Write Off Points On A Mortgage