How Do You Lower Your Interest Expense

These are the most common ways to lower your interest costs. Some of these methods are similar to above and some are the exact opposite:

- Lower the purchase price

- Make a larger down payment

- Find a lower interest rate

- Reduce the amortization

- Choose accelerated payments

- Make lump-sum prepayments

Things that save you interest generally lower your amortization, resulting in you paying off your mortgage sooner.

Determining The Best Mortgage

Once you have a good idea of what your mortgage payments look like, try using the best Canadian mortgage rates to see how much you can save. Also explore our Mortgage Guides to learn more about mortgage payments and everything else you need to know when it comes to choosing the ultimate mortgage.

*Mortgage payment calculator disclaimer:

The mortgage payment calculator is intended to help you compare different mortgage options and understand your expected payment schedule. However, the mortgage payment calculation should not be used in isolation to influence your mortgage decision-making. Be sure to consult with a mortgage broker or lender about the various mortgage financing and payment options you can take advantage of. We’ll be happy to connect you with a licensed mortgage advisor. The best bet is to first start with analyzing different mortgages, which youcan do on RATESDOTCAhere.

Monthly Principal & Interest

The principal is the amount of money borrowed on a loan. The interest is the charge paid for borrowing money. Principal and interest account for the majority of your mortgage payment, which may also include escrow payments for property taxes, homeowners insurance, mortgage insurance and any other costs that are paid monthly, or fees that may come due.

Recommended Reading: How Much Would My Mortgage Payment Be

What Mortgage Payment Options Do I Have

The frequency of your mortgage payments can be monthly, weekly or bi-weekly, depending on your mortgage terms and conditions.

Mortgage payments can be made in the following ways:

- Monthly mortgage payments

- Weekly accelerated payments

- Semi-monthly (twice a month, e.g., on the 1st and 16th of each month.

Accelerated payments help you pay off your mortgage quicker compared to other payment schedules, helping you avoid thousands of dollars in interest. About 350,000 borrowers increased their payment frequency in 2019, found MPC.

When you choose to make accelerated mortgage payments, you end up making the equivalent of 13 monthly payments per year. The result is that you pay off the mortgage years earlier, saving thousands of dollars on interest.

Heres an example of how payments change based on frequency, assuming a $100,000 mortgage at 3% interest amortized over 25 years.

Can My Monthly Payment Go Up

Your monthly payment can rise in a few cases:

You have an adjustable-rate mortgage in which your payment stays the same for an initial term and then readjusts annually.

If you have an escrow account to pay for property taxes or homeowners insurance, because those taxes or insurance premiums may increase. Your monthly mortgage payment includes the amount paid into escrow, so the taxes and premiums affect the amount you pay each month.

You may have been assessed fees. Check your mortgage statement or call your lender.

Must reads

You May Like: What Is Monthly Payment On 300k Mortgage

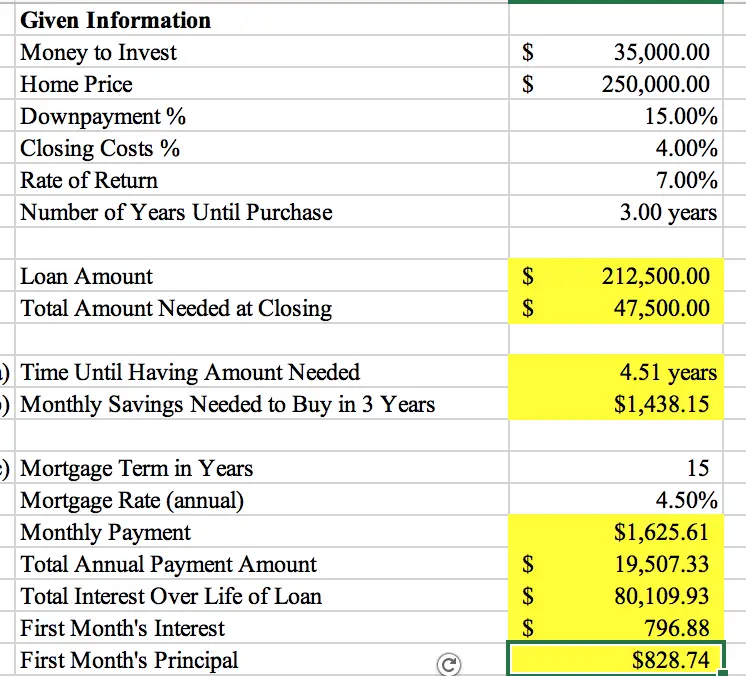

How Much Do You Need To Earn To Get A 250k Mortgage

Based on the standard income multiples that most lenders use, the combined income of everyone who will be involved with the mortgage would need to be just over £55,000, at least. Its difficult to give exact income amounts because there are a few different factors that affect your application and how much youll be able to borrow, namely:

- Your annual income

- The income multiple your lender offers

- Your outgoings

- Your general creditworthiness, as this will affect the number of lenders available to you

This is why getting a good mortgage broker on your side will make all the difference in how successful youll be in securing a £250k mortgage.

Understanding An Amortization Schedule

The easiest way to understand an amortization schedule is through an example using a mortgage. Lets say you want to purchase a $100,000 home so the bank agrees to provide with a loan at a fixed interest rate of 5% for 15 years. To better understand how you will pay off the loan, you create an amortization schedule.

Since it is a 15 year loan, the amortization schedule shows you will have to make 180 payments . If there was no interestrate, determining your monthly payment be simple: $100,000 divided by 180 payments = $555.56 per month. But with a 5% interest rate, themonthly payment turns out to be $790.79 .

Next you see that a portion of each payment is interest while the rest goes towards the loans remaining balance. The distribution ofthese two amounts in each payment varies with the interest portion declining with each payment. Understanding how the interest is determinedfor each payment is not a tricky as it seems.

The 5% interest rate is an annual interest rate. To determine the monthly interest rate, it must be divided by 12. Thenthe monthly interest rate is multiplied by the remaining balance to determine how much interest needs to be paid. Here is the process for determining the first months interest and portion that goes toward the loans remaining balance.

Step 1. 5% annual interest rate / 12 = 0.42% monthly interest rate

Step 2. 0.42% * $100,000 = $416.67

Step 3. $790.79 $416.67 = $374.13

Also Check: Can You Get A Mortgage With 0 Down

Calculate The Cost Of Borrowing

When you buy a home, you already know that you’re going to pay a lot of interest over the life of the loan. However, you may not be prepared for just how much you are going to have to pay. In many cases you could buy your house two or three times over with the amount you end up paying back to your loan.

A good mortgage calculator like the ones we offer at MortgageCalculator.org can help you determine your monthly payment and your total interest payments. However, looking at the total interest you pay may seem too abstract. For instance, if you pay 5 percent on a $250,000 30-year fixed loan, you will end up paying $233,139.46 in interest alone. Since this amount is spread out over 30 years, it may be harder to contextualize the impact of.

Understanding exactly how much you pay in interest each month and each year rather than cumulatively over several decades can help make the amount seem more concrete and immediate. Breaking it down further by every thousand dollars of your mortgage can help you how it all adds up.

On that same $250,000 loan with 5 percent interest, you would pay $5.41 in interest each month for every $1,000 of the loan. You would pay $64.91 each year for every $1,000 of the loan.

Is there something else you could or should have invested in which would have offered better returns?

Higher Returning & More Diversified Opportunities

Common Misconceptions About Homeownership

There are many misconceptions about how difficult it is to become a homeowner. Its important to understand the facts before you start and how they apply to your individual situation so that you dont get overwhelmed or discouraged.

If you have less than 20 percent saved for a down payment, you should add PMI to the list of housing costs when youre figuring your budget.

Low income families can get down payment assistance from the government and non-profits. Before you go all-in with your house hunting. Decide if now is the right time for you to buy a home.

In any event, mortgage rates are currently at a historic low, the average rate on 30-year mortgages stood at 3.04 percent this week, unchanged from last week, according to Bankrates weekly survey of large lenders. If youve been thinking about becoming a homeowner, it may be time to take the plunge and buy now before interest rates rise again.

Most first-time buyers have to dip into savings or investments to have enough for a down payment. And if you have or student loan debt, be aware that some lenders may not approve your mortgage application because of how high the total monthly payment is.

Dont wait to start saving for a down-payment on your home. The sooner you begin putting money towards this goal, the easier it will be for you to become a homeowner.

Don’t Miss: How Do Mortgage Interest Rates Work

Why Does Your Monthly Calculator Have Four Columns

We think it’s important for you to compare your options side by side. We start the calculator by outlining the four most common options for down payment scenarios, but you are not limited to those options. We also allow you to vary amortization period as well as interest rates, so you’ll know how a variable vs. fixed mortgage rate changes your payment.

Understanding Your Mortgage Payment

Monthly mortgage payment = Principal + Interest + Escrow Account Payment

Escrow account = Homeowners Insurance + Property Taxes + PMI

The lump sum due each month to your mortgage lender breaks down into several different items. Most homebuyers have an escrow account, which is the account your lender uses to pay your property tax bill and homeowners insurance. That means the bill you receive each month for your mortgage includes not only the principal and interest payment , but also property taxes, home insurance and, in some cases, private mortgage insurance.

You May Like: What Is The Average Mortgage Rate In Florida

Interest: The Difference 15 Years Can Make

The longer the term of your loan say 30 years instead of 15 the lower your monthly payment but the more interest youll pay.

Say youve decided to buy a home thats appraised at $500,000, so you take out a $400,000 loan with an interest rate of 3.5%. First, lets take a look at a 30-year loan. For quick reference, again, the formula is: M = P /

Our P, or principal, is $400,000.

Remember, with i, we must take the annual interest rate given to us 3.5%, or 0.035 and divide by 12, the number of months in a year. This calculation leaves us with 0.002917, or i.

Our n, again, is the number of payments. And with one payment every month for 30 years, we multiply 30 by 12 to find n = 360.

When alls said and done, for a 30-year loan at 3.5% interest, well pay $1,796.18 each month.

For a 15-year loan, the math is nearly identical. All thats different is the value of n. Our loan is half the length, and so the value for n is 180. Each month well pay $2,859.53, over 60% more than with the 30-year loan.

Over the length of the loan, though, the 15-year loan is a far better deal, considering the interest you pay $514,715 in total. With the 30-year, you pay $646,624 total over $100,000 more.

Your decision between these two, quite simply, hinges on whether or not you can float the significantly higher monthly payments for a 15-year loan.

A little math can go a long way in providing a how much house can I afford? reality check.

How Working With A Broker Can Maximise Your Borrowing

When it comes to knowing for certain whether you earn enough to get a £250k mortgage, the flexibility of lenders and the disparity between them can be confusing, but this ambiguity can also work in your favour. Working out how this lack of clarity can be beneficial to you, however, requires a professional pair of eyes.

When banks are adaptable, that means theyre more likely to view you on your unique circumstances, with more nuanced and holistic decisions made about your application. Without a good broker on your side with experience of the subtleties in the market though, it can be impossible to know who and where these amenable lenders and deals lie. It is also impossible to understand the vital actions you need to take that are required to get your application approved, and demonstrate your strengths and appeal as a customer.

For example, a highly trained broker, like the ones we work with, will be able to work around any variants within your finances that can boost your chances when approaching lenders, such as any supplemental income you may have. They will also know how to tackle issues such as bad credit, and have contacts with higher multiple income lenders should you need to stretch the confines of average borrowing limits to secure that £250k mortgage.

Recommended Reading: How Many Mortgages Can You Have For Rental Property

How To Use The Mortgage Payment Calculator

To use the calculator, start by entering the purchase price, then select an amortization period and mortgage rate. The calculator shows the best rates available in your province, but you can also add a different rate. The calculator will now show you what your mortgage payments will be.

Our calculator also shows you what the land transfer tax will be, and approximately how much cash youll need for closing costs. You can also use the calculator to estimate your total monthly expenses, see what your payments would be if mortgage rates go up, and show what your outstanding balance will be over time.

If youre buying a new home, its a good idea to use the calculator to determine what you can afford before you start looking at real estate listings. If youre renewing or refinancing and know the total amount of the mortgage, use the Renewal or Refinance tab to estimate mortgage payments without accounting for a down payment.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Mortgage payment calculator

Save & exit

Loan termThe amount of time you have to pay back the loan. Usually 15 or 30 years for common loan types.

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Recommended Reading: How Long Does A Pre Approval For Mortgage Last

Meet The Mortgage Payment Calculator

This mortgage payment calculator will estimate exactly that. You can set everything from your amortization and payment frequency to extra payments. The calculator then determines your monthly mortgage payment and provides an amortization schedule showing how fast it will take to whittle down your principal.

Can You Afford A 25000000 Mortgage

Is the big question, can your finances cover the cost of a £250,000.00 Mortgage? Are you sure you have considered all the costs? If you are increasingly answering ‘yes’ then it’s worth doing the final financial checks, review your monthly household budget (so you are ready to answer all the questions the mortgage advisor will ask and check that you have the deposit covered. See how much it will cost you to move home when buying a property worth £250,000.00

Do you need to calculate how much deposit you will need for a £250,000.00 Mortgage? Try our new Mortgage Deposit Calculator or quick on a deposit percentage below to see an illustration that you can tweak to suit your circumstances

Did you know that we review the UK’s leading mortgage providers each month and produce a comparative guide to the best mortgage deals? By collating the latest mortgage deals from each provider, we save you the time and effort of looking for and finding the best mortgage deals. We also provide regular mortgage updates, guides and mortgage news so you can make the right financial decision when choosing a mortgage.

Using an Independent Mortgage Advisor will saves you time and stress and affordability calculations and mortgage comparison can be completed centrally on your behalf. Use a mortgage broker which doesn’t charge you fees, so you get the best mortgage deals without the hassle.

Recommended Reading: How To Recruit Mortgage Loan Officers

How Do Property Taxes Work

When you own property, youre subject to taxes levied by the county and district. You can input your zip code or town name using our property tax calculator to see the average effective tax rate in your area.

Property taxes vary widely from state to state and even county to county. For example, New Jersey has the highest average effective property tax rate in the U.S. at 2.42%. Owning property in Wyoming, however, will only put you back roughly 0.57% in property taxes, one of the lowest average effective tax rates in the country.

While it depends on your state, county and municipality, in general, property taxes are calculated as a percentage of your homes value and billed to you once a year. In some areas, your home is reassessed each year, while in others it can be as long as every five years. These taxes generally pay for services such as road repairs and maintenance, school district budgets and county general services.

Read Also: Can You Do A Reverse Mortgage On A Mobile Home