Why Is Your Dti Ratio Important

A DTI is often used when you apply for a home loan. Even if youre not currently looking to buy a house, knowing your DTI is still important.

First, your DTI is a reflection of your financial health. This percentage can give you an idea of where you are financially, and where you would like to go. It is a valuable tool for calculating your most comfortable debt levels and whether or not you should apply for more credit.

Mortgage lenders are not the only lending companies to use this metric. If youre interested in applying for a credit card or an auto loan, lenders may use your DTI to determine if lending you money is worth the risk. If you have too much debt, you might not be approved.

Whats An Ideal Dti Ratio For A Mortgage

The choice of an ideal debt-to-income ratio for a mortgage is highly dependent on the lender, type of loan, and other mortgage requirements. However, most lenders prefer borrowers with a front-end ratio of not more than 28% and a back-end ratio not higher than 36%. In most cases, you will need to have a DTI score of not more than 50% to qualify for a home loan.

Whats Included In Your Debt

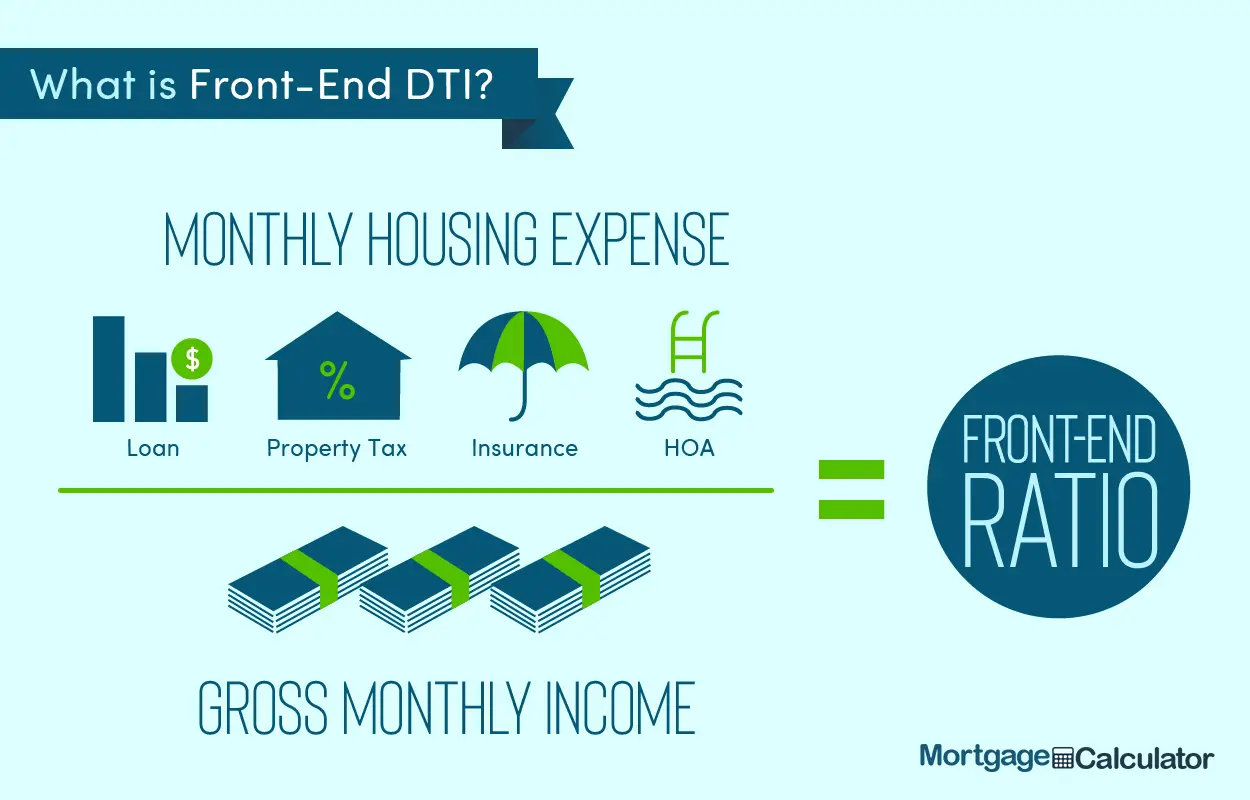

Mortgage lenders actually calculate your debt-to-income ratio twice, because they look at a front-end DTI and a back-end DTI.

Calculating the front-end DTI is easy because the focus is only on the new mortgage obligations. Lenders look at your new housing payment, including principal, interest, taxes, and insurance, and they compare total housing costs to gross income. Most lenders like this ratio to be below 28%.

Calculating your back-end DTI becomes a little more complicated, though. This time, lenders look at all of your current debt obligations when they decide whether or not to approve you. That means a lot more debts count, including:

- Your new monthly mortgage payments

- Minimum monthly payments on medical debt

- Your monthly car loan payment

- The monthly payments on any personal or business loans you may have

- Alimony or child support payments

- Any other required monthly payments

Lenders will take a close look at your and may ask for financial account statements in order to determine all of the obligations you have.

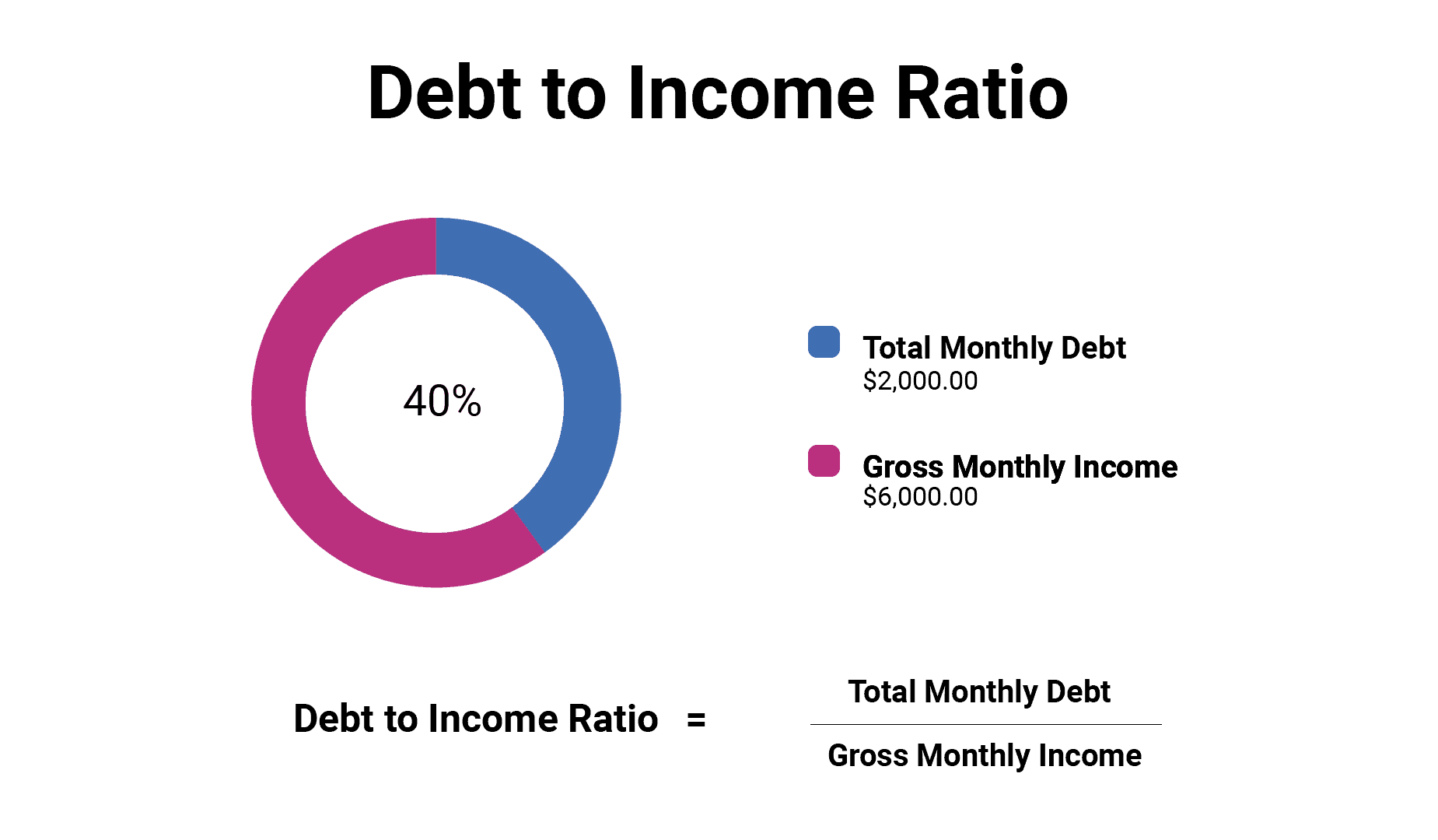

Theyll add up the monthly payments for all of these different expenses and then compare that to income. For example, say that your total monthly obligations add up to $2,000 when taking into account all your minimum payments and your new mortgage and say your income is $6,000. Youd divide $2,000 divided by $6,000 to see your DTI is .333 or 33.3%.

Read Also: How To Figure Mortgage Payment

What Is A Debt

Your debt-to-income ratio is all your monthly debt payments divided by your gross monthly income. This number is one way lenders measure your ability to manage the monthly payments to repay the money you plan to borrow.

Different loan products and lenders will have different DTI limits. To calculate your DTI, you add up all your monthly debt payments and divide them by your gross monthly income. Your gross monthly income is generally the amount of money you have earned before your taxes and other deductions are taken out. For example, if you pay $1500 a month for your mortgage and another $100 a month for an auto loan and $400 a month for the rest of your debts, your monthly debt payments are $2,000. If your gross monthly income is $6,000, then your debt-to-income ratio is 33 percent.

Open A Debt Consolidation Loan Or Balance Transfer Credit Card

Debt consolidation may help you get a better interest rate and pay down your balances sooner, ultimately helping you bring down your debt-to-income ratio.

Two common strategies of consolidating debt is with a personal loan or a balance transfer credit card:

| Debt consolidation vs. balance transfer |

| Debt consolidation loan |

Recommended Reading: Can You Get A Mortgage If You Filed Bankruptcy

How Can I Improve My Debt

If youre having trouble getting approved for a mortgage or simply want a better rate, there are a few ways to improve your DTI:

- Pay off debt. The simplest way to lower your DTI is to reduce your debt. You can do this by paying down your current debts faster which will raise your DTI initially, but significantly reduce it in the long run.

- Postpone large purchases. If you know youll be applying for a mortgage soon, try to postpone any large purchases, as theyll increase your DTI.

- Refinancing. Refinancing high-interest debts reduces your interest rate, meaning more of your money goes towards the principal and the debt will be paid off sooner.

- Increase your income. A part-time job, pay raise, or any other increase to your monthly earnings reduces your debt relative to your income.

- Consolidate. If you have debts, consider consolidating to reduce your monthly minimum payment.

Dont apply if your DTI is high

Your DTI is the most important factor when determining your mortgage rate but your credit score and other expenses matter, too. DTI calculations dont include monthly obligations such as insurance and utility payments, or food and entertainment costs. A high DTI could mean struggling to cover your mortgage payments and monthly expenses. So wait until your have a lower DTI ratio to get a good rae and avoid taking out a loan you cant afford.

What Should You Do To Make Sure Your Dti Ratio Doesnt Derail Your Mortgage Application

Although a lower DTI is better, some lenders are more flexible than others. In fact, you may be able to find loan options with a DTI as high as 50% in some cases. If you have a high ratio, youll need to shop around more carefully to find a lender willing to work with you.

Another option may be to pay off debt. If youre able to reduce what you owe and eliminate some debts or lower your monthly payments, you should hopefully be able to get your DTI to a level that makes you a more competitive borrower.

Since this can also help your , you may just find that youre offered a much better deal on a mortgage if you work to pay down some of your debt before applying for one. The savings on interest over time can be considerable, so its worth working on debt paydown if you can.

Read Also: How Do I Get A Mortgage Statement

Real World Example Of The Dti Ratio

Wells Fargo Corporation is one of the largest lenders in the U.S. The bank provides banking and lending products that include mortgages and credit cards to consumers. Below is an outline of their guidelines of the debt-to-income ratios that they consider creditworthy or needs improving.

- 35% or less is generally viewed as favorable, and your debt is manageable. You likely have money remaining after paying monthly bills.

- 36% to 49% means your DTI ratio is adequate, but you have room for improvement. Lenders might ask for other eligibility requirements.

- 50% or higher DTI ratio means you have limited money to save or spend. As a result, you wont likely have money to handle an unforeseen event and will have limited borrowing options.

If Youre Applying For A Mortgage There Are Two Types Of Debt

If youre in the market for a mortgage, you should also consider front and back end debt-to-income ratios. When youre applying for a mortgage, lenders will likely look at debt-to-income ratio in two ways.

- The front-end ratio is used to determine if you can repay your mortgage. A front-end DTI ratio includes your projected monthly mortgage payment, insurance, property taxes, homeowners association fees, but does not include other monthly expenses like student loans or credit card debt. You should only have to worry about your front-end ratio when youre applying for a mortgage.

- The back-end ratio is an overall measure of debt compared to your income. It includes all of your monthly debts, like credit cards and student loan debt, in addition to any household payments. As such, this number tends to be higher than front-end ratios, but it is the more common measure of your DTI.

Also Check: Which Mortgage Lenders Use Transunion

How To Get Around A High Dti

The easiest way to lower your debt-to-income ratio is to pay off as much debt as you can but many borrowers dont have the money to do that when theyre in the process of getting a mortgage, because much of their savings are tied up in a down payment and closing costs.

If you think you can afford the mortgage you want but your DTI is above the limit, a co-signer might help solve your problem. Unlike with conventional loans, borrowers can have a relative co-sign an FHA loan and the co-signer wont be required to live in the house with the borrower. The co-signer does need to show sufficient income and good credit, as with any other type of loan.

Sometimes, though, a co-signer isnt the answer. If your DTI is too high, for example, you should consider focusing on improving your financial situation before committing to a mortgage.

Calculating Your Gross Income

Your income does not only include your regular job salary it also constitutes bonuses, regular income from dividends and interest, assistance or support payments, such as alimony or child support, and payment from tips or commissions. Adding the total will give you your gross annual income, and then dividing by 12 will yield your monthly gross income.

You May Like: What Is Loan To Value Mortgage

You May Like: How To Buy A House Without A Mortgage

What Is My Debt

You may hear two terms related to the debt-to-income calculation for mortgages: front-end DTI and back-end DTI.

Heres what they mean:

- Front-end DTI: Your mortgage payment divided by your gross income.

- Back-end DTI: Your total monthly debt payments, including your new mortgage payment, divided by your gross income .

How To Qualify With A High Dti

If you have a DTI above 43%, you may find it more difficult to qualify for a mortgage loan. And if you are approved, your loan may be subject to additional underwriting that can result in a longer closing time.

Overall, higher DTI ratios are considered a greater risk when an underwriter reviews a mortgage loan for approval.

In some cases, if the DTI is deemed too high, the lender will require other compensating factors to approve the loan, explains DiBugnara.

He says compensating factors can include:

- Additional savings or reserves

- Proof of on-time payment history on utility bills or rent

- A letter of explanation to show how an applicant will be able to make payments

A higher credit score or bigger down payment could also help you qualify.

Cook notes that, for conventional, FHA, and VA loans, your DTI ratio is basically a pass/fail test that shouldnt affect the interest rate you qualify for.

But if you are making a down payment of less than 20 percent with a conventional loan, which will require you to pay mortgage insurance, your DTI ratio can affect the cost of that mortgage insurance, adds Cook.

In other words, the higher your DTI, the higher your private mortgage insurance rates.

Also Check: What Is Reverse Mortgage Meaning

What Is A Good Debt To Income And How To Lower It

Any DTI above 43% the lenders see it as a red flag and wont lend any more debts if your DTI is above 43%. This ratio depends on the lender to lender and programs to programs.

Some mortgage programs may have a maximum DTI at 55%. And some lenders may consider a maximum DTI at 50%. Any DTI lower than 36% is regarded as an excellent debt to income ratio.

Obviously, the lower the better, but 36% is counted as ideal DTI. Lenders might also consider not more than 28% of it to be coming from mortgage payments.

Hypothetically, let us say your DTI is above the 43% mark, there are only two simple solutions to lower your DTI, make more money, or reduce your debts.

To make more money, you can always work part-time or open a small side business which would help you to not only increase your monthly income but also keep your debts to a minimum.

Any financial advisor will suggest not to get into unnecessary debts. Avoid getting unnecessary appliances, electronics, or any things that do not have a good depreciation value.

This way, you can always keep your debts to a minimum, and making sure you qualify for bigger loans when you actually need it.

Whats Considered A Good Debt

The lower the DTI, the better. More specifically, a DTI of 36% or below is generally considered good, while a DTI of 37-42% is considered manageable. A DTI of 43% or higher will likely mean you wont qualify for a loan, as anything 43% or higher is considered cause for concern. A DTI of 50% or higher is considered dangerous.

Why 43%? Lenders came up with this number as a result of mortgage-risk studies that analyzed the type of borrowers who are most likely to have trouble making repayments and ultimately default on their loans.

Your DTI is a factor lenders consider when determining the rates and terms of your loan. In general, youre more likely to get a better rate with a lower DTI.

You May Like: How Much Do You Pay Back On A Mortgage

Also Check: How Much Do Mortgage Brokers Charge

How Does The Debt

Sometimes the debt-to-income ratio is lumped in together with the debt-to-limit ratio. However, the two metrics have distinct differences. The debt-to-limit ratio, which is also called the credit utilization ratio, is the percentage of a borrowers total available credit that is currently being utilized. In other words, lenders want to determine if you’re maxing out your credit cards. The DTI ratio calculates your monthly debt payments as compared to your income, whereby credit utilization measures your debt balances as compared to the amount of existing credit you’ve been approved for by credit card companies.

A High Dti May Make It Difficult To Juggle Bills

Spending a high percentage of your monthly income on debt payments can make it difficult to make ends meet. A debt-to-income ratio of 35% or less usually means you have manageable monthly debt payments. Debt can be harder to manage if your DTI ratio falls between 36% and 49%.

Juggling bills can become a major challenge if debt repayments eat up more than 50% of your gross monthly income. For example, if 65% of your paycheck is going toward student debt, credit card bills and a personal loan, there might not be much left in your budget to put into savings or weather an emergency, like an unexpected medical bill or major car repair.

One financial hiccup could put you behind on your minimum payments, causing you to rack up late fees and potentially put you deeper in debt. Those issues may ultimately impact your credit score and worsen your financial situation.

Also Check: Is 5.375 A Good Mortgage Rate

What Happens If My Debt

If your debt-to-income ratio is higher than the widely accepted standard of 43%, your financial life can be affected in multiple waysnone of them positive:

- Less flexibility in your budget. If a significant portion of your income is going towards paying off debt, you have less left over to save, invest or spend.

- Limited eligibility for home loans. A debt-to-income ratio over 43% may prevent you from getting a Qualified Mortgage possibly limiting you to approval for home loans that are more restrictive or expensive.

- Less favorable terms when you borrow or seek credit. If you have a high debt-to-income ratio, you will be seen as a more risky borrowing prospect. When lenders approve loans or credit for risky borrowers, they may assign higher interest rates, steeper penalties for missed or late payments, and stricter terms.

What Are The Limitations Of The Debt

The DTI ratio does not distinguish between different types of debt and the cost of servicing that debt. Credit cards carry higher interest rates than student loans, but they’re lumped in together in the DTI ratio calculation. If you transferred your balances from your high-interest rate cards to a low-interest credit card, your monthly payments would decrease. As a result, your total monthly debt payments and your DTI ratio would decrease, but your total debt outstanding would remain unchanged.

Also Check: Is Reverse Mortgage Worth It

How Can You Improve Your Debt

Fortunately, there are a handful of ways you can lower your debt-to-income ratio if its not as good as youd like it to be.

Lowering your debt-to-income ratio comes down to one of two things: Making more money, lowering your debt, or a combination of both, Rosa said.

Below are a handful of ways you can improve your DTI:

Now that you know what a good debt-to-income ratio is, you can take steps to improve it before applying for new credit. Pushing your DTI in the right direction can help you ensure youll not only secure a loan, but youll get one with optimal terms.

Dti And Your Mortgage

Lenders must evaluate your financial health before deciding to give you a loan to make sure you will be able to repay it. When your DTI is evaluated, lenders typically dont want to see anything too much higher than 43%, though there are exceptions. You can sometimes still get a loan with a high DTI, but you will likely need to have other factors working in your favor to balance out the larger amount of debt, such as a significant amount of savings or a high credit score.

If your DTI is low enough to qualify you for a loan but still on the higher end, keep in mind that you might qualify for higher interest rates than someone with less debt. The lower your score, typically, the better loan you will qualify for.

Don’t Miss: How Much Will I Be Loaned For A Mortgage