You Can Determine How Much Youll Be Able To Borrow

Your lender will pre-approve you for a specific amount of money based on a number of factors, including:

- The size of your down payment

Once you know how much youre allowed to borrow, you can make sure youre being realistic about looking for homes within your budget. That way, you can avoid wasting time shopping for a property thats too expensive.

Remember, though, you dont have to borrow the full amount you are pre-approved for. This just sets an upper limit youll know you need to stick to.

How To Calculate Affordability

Zillow’s affordability calculator allows you to customize your payment details, while also providing helpful suggestions in each field to get you started. You can calculate affordability based on your annual income, monthly debts and down payment, or based on your estimated monthly payments and down payment amount.

Our calculator also includes advanced filters to help you get a more accurate estimate of your house affordability, including specific amounts of property taxes, homeowner’s insurance and HOA dues . Learn more about the line items in our calculator to determine your ideal housing budget.

Let’s Start With The Basics

Gross annual household income is the total income, before deductions, for all people who live at the same address and are co-borrowers on a mortgage. Enter an income between $1,000 and $1,500,000.

A down payment is the amount of money, including deposit, you put towards the purchase price of a property.

Minimum down payment amounts:

- For homes that cost up to $500,000, the minimum down payment is 5%

- For homes that cost between $500,000 and $1,000,000, the minimum down payment is 5% of the first $500,000 plus 10% of the remaining balance

- For homes that cost over $1,000,000, the minimum down payment is 20% or more depending on property location

For down payments of less than 20%, home buyers are required to purchase mortgage default insurance.

A down payment is the amount of money, including deposit, you put towards the purchase price of a property.

Minimum down payment amounts:

- For homes that cost up to $500,000, the minimum down payment is 5%

- For homes that cost between $500,000 and $1,000,000, the minimum down payment is 5% of the first $500,000 plus 10% of the remaining balance

- For homes that cost over $1,000,000, the minimum down payment is 20% or more depending on property location

For down payments of less than 20%, home buyers are required to purchase mortgage default insurance.

Selecting your province or territory helps us personalize your mortgage results.

Enter your total monthly payments towards any car loans, student loans or personal loans.

Recommended Reading: How Much Is A 180k Mortgage Per Month

Finding The Right Lender

One place to start is with Credible, a site that allows you to get quotes from three lenders in only three minutes. Theres no obligation, but if you see a rate you like for your mortgage or refinancing your mortgage, you can progress to the next step of the application process. Everything is handled through the website, including uploading documents. If you want to speak to a loan officer, you can, of course, but it isnt necessary.

As you shop for a lender, remember that every dollar counts. Youre committing to a monthly mortgage payment based on the rate you choose at the very start. Even small savings on your interest rate will add up over the years youre in your house.

Fiona is another great place to get started since they allow you to shop and compare multiple rates and quotes with minimal information, all in one place. Youll input the amount of the loan, your down payment, state, mortgage product type, and your credit score to get mortgage quotes from multiple lenders at once.

How Much Income Is Needed For A 250k Mortgage +

A $250k mortgage with a 4.5% interest rate for 30 years and a $10k down-payment will require an annual income of $63,868 to qualify for the loan. You can calculate for even more variations in these parameters with our Mortgage Required Income Calculator. The calculator also gives a graphical representation of required income for a wider range of interest rates.

You May Like: How Much Of My Net Income Should Go To Mortgage

How To Use The Mortgage Affordability Calculator

To use our mortgage affordability calculator, simply enter your and your partnerâs income , as well as your living costs and debt payments. The calculator can estimate your living expenses if you donât know them.

With these numbers, youâll be able to calculate how much you can afford to borrow. You can also change your amortization period and mortgage rate to see how that would affect your mortgage affordability and your monthly payments.

Find Out How Much Mortgage You Can Afford

Weâll help you figure out what home price you may be able to afford.

Ready to start looking for your dream home? Donât just dream about it â let the TD Mortgage Affordability Calculator help you begin your search. Enter a few key details and the calculator will guide you in determining, with confidence, what house price may be within reach.

Step 1 of 6

Read Also: How Can I Mortgage My House

Where Do You Want To Live

}, }

! Your browser does not support geolocation. Consider using another browser.

How much mortgage can I afford?

The first step in searching for your home is understanding how large of a mortgage you can afford. With a few inputs, you can determine how much mortgage you may be comfortable with and the potential price range of your future home. Knowing your total household income, how much youâve saved for a down payment, and your monthly expenses , plus new expenses youâd take on , you can get a reasonable estimate. Learn more about factors that can affect your mortgage affordability.

How to estimate affordability

To estimate mortgage affordability, lenders will use two standard debt service ratios: Gross Debt Service and Total Debt Service . According to the Canadian Mortgage and Housing Corporation¹Note 1:

-

– GDS is the percentage of your monthly household income that covers your housing costs . It should be at or under 35% of your pre-tax household income.

-

– TDS is the percentage of your monthly household income that covers your housing costs and any other debts . It should be at or under 42% of your pre-tax income.

How your down payment affects affordability

The amount you have saved for a down payment is also another important piece of information to help determine affordability. Depending on the purchase price of a home, there are minimum amounts required for your down payment²Note 2:

Step 2 of 6

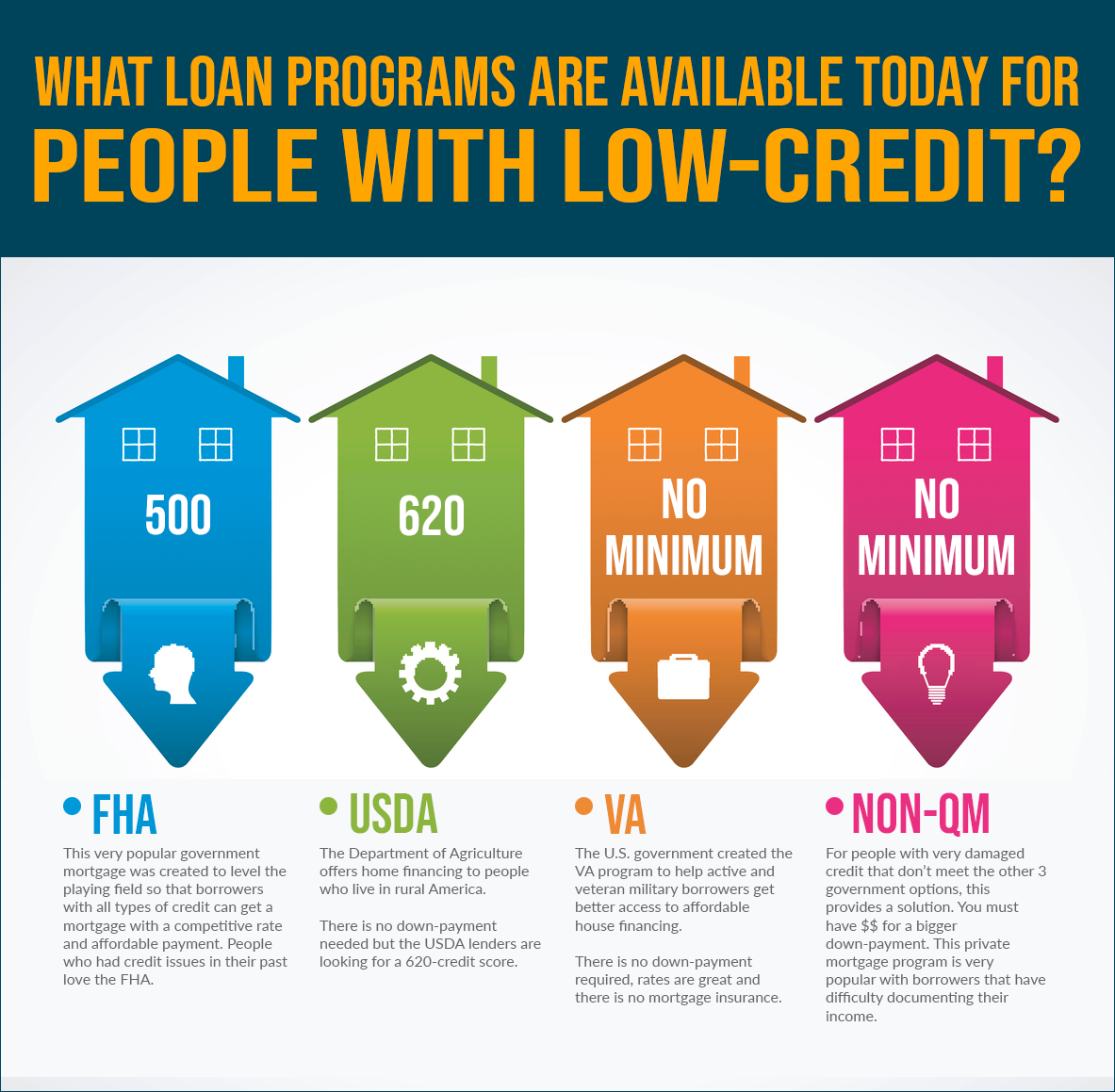

Raise Your Credit Score

A higher credit score helps you obtain not only a lower interest rate but also a slightly larger loan, in many cases.

Having a higher credit score may allow you to qualify for a higher mortgage , but only to a certain extent, says Matt Hackett, operations manager at Equity Now, a New York-based mortgage lender.

To boost your score, be sure to make all your payments on time, and dont max out the credit you have or apply for more credit while youre trying to get the mortgage.

Recommended Reading: Is It Better To Use A Mortgage Broker

Cleaning Up Your Creidt Profile

- Be sure you check your credit report 6 months in advance of purchase consideration so you can clear up any outstanding issues like missed payments or identity theft.

- If you have significant credit card debt lenders will presume you need to spend 3% to 5% of the balance to service the debt each month.

- If you have multiple credit cards with outstanding balances it is best to try to pay down your small debts and the cards with a lower balance in order to make your overall credit profile cleaner.

- If you decide to cancel unused credit cards or cards that are paid off be sure to keep at least one old card so you show a long opened account which is currently in good standing.

- Do not apply for new credit cards or other forms of credit ahead of getting a mortgage as changes to your credit utilization, limits and profile may cause your lender concern.

Major Factors That Influence Mortgage Eligibility

When qualifying for a mortgage, lenders rely on standard indicators that determine whether a borrower can repay a loan. These financial factors also influence how much they are willing to lend borrowers. Lenders will thoroughly evaluate your income and assets, credit score, and debt-to-income ratio.

Also Check: How Much Interest I Pay On Mortgage

How Much Income Is Needed For 500k Mortgage

Given what we know above, lets see how much income is required for a $500K home.

In this example, lets suppose you are putting the minimum down payment of 5% or $25,000. Because you have less than 20% down youll need to pay CMHC insurance. In this case the CMHC insurance adds an extra $19,000 to your mortgage for a total mortgage of $494,000.

Inevitably, you will have to pass the stress test when applying for a mortgage with any major lender. So first, lets see how much the required income for a 500K mortgage is while qualifying under the stress test.

How To Use The Maximum Mortgage Calculator

Not sure where to start? Let us help you:

Recommended Reading: How Many Times Can You Pull Credit For Mortgage

Standard Variable Rate Mortgage

Each lender sets their own standard variable rate on a mortgage. This is the default interest rate they charge if you do not remortgage after a particular type of mortgage ends. This includes fixed-rate mortgages, tracker mortgages, and discount rate mortgages. SVRs typically have higher interest rates than other types of mortgages.

A variable interest rate rises or decreases based on the UK economy and fluctuations in the Bank of England base rate. If rates increase, you must be ready for higher monthly payments. However, the extra money you pay will go toward the interest instead of the capital . In effect, you wont be paying your mortgage more quickly. So be sure to remortgage if you do not want to take an SVR. Note that lenders may also adjust their interest rate any time, especially if the BoE announces a possible increase in the near future.

Recommended Reading: What Score Do Mortgage Companies Use

Learn More About A Mortgage Pre

The first step in buying a property is knowing the price range within your means. You can get an estimate for this amount through a mortgage pre-qualification, or for more certainty, a mortgage pre-approval.

A mortgage pre-qualification is a rough estimate of your borrowing capacity to purchase a property. Its calculated based on your basic financial information such as your income and current debt. No credit check is involved, nor is it a guarantee of the approved financing which you may receive by National Bank.

A mortgage pre-approval certifies your borrowing capacity based on several criteria including your credit rating. It confirms the amount that National Bank agrees to lend you under certain conditions and protects the rate of this loan against potential rises for 90 days. A pre-approval demonstrates your seriousness to sellers and your real estate agent and does not impose any obligation for you to commit to the loan.

Start your pre-approval request online now. Our mortgage experts will then contact you to finalize your request.

Recommended Reading: Can You Refinance Mortgage Without Closing Costs

How Much House Can I Afford With A Va Loan

Veterans and active military may qualify for a VA loan, if certain criteria is met. While VA loans require a single upfront funding fee as part of the closing costs, the loan program offers attractive and flexibleloan benefits, such as noprivate mortgage insurance premiums and no down payment requirements. VA loan benefits are what make house affordability possible for those who might otherwise not be able to afford a mortgage.

With VA loans, your monthly mortgage payment and recurring monthly debt combined should not exceed 41%. So if you make $3,000 a month , you can afford a house with monthly payments around $1,230 .

Use ourVA home loan calculatorto estimate how expensive of a house you can afford.

Two Types Of Dti Ratios

- Front-end DTI: This is the portion of your income that pays for all housing costs. It includes monthly mortgage payments, property taxes, homeowners insurance, etc.

- Back-end DTI: This is the portion of your income that pays for housing expenses together with all your other debts. It includes your car loan, student loan, credit card debts, personal loan, etc.

Furthermore, expect conventional mortgages to have different DTI limits from government-backed loans. Lets review the different types of mortgages below.

Most homebuyers generally choose conventional loans, which are not directly financed by the government. Conventional loans are usually packaged into mortgage-backed securities that are guaranteed by Fannie Mae and Freddie Mac. These are available through private lenders such as banks, credit unions, and mortgage companies.

Don’t Miss: How Do You Figure Out Your Monthly Mortgage Payment

Additional Costs To Consider

In addition to your down payment and mortgage, there are other costs associated with buying a home that you should consider before signing a purchase agreement:

Closing Costs

Generally speaking, closing costs which are fees owed at the time of closing of a real estate transaction can add up to anywhere between 2% to 5% of the purchase price. These costs include any of the following:

- Property taxes owed to the seller

These costs must be paid upfront before the deal closes. That means youll need to have liquid capital readily available to cover these expenses before the deal is sealed.

Moving Costs

Whether youre moving from an existing home into your new home or are starting from scratch, youll still need to fill your home with furnishings and all of your belongings. Unless you tackle this on your own with a few helpers, youll need to hire a moving company. And if you need to buy all new furniture, youll need to budget for this expense, too.

Additional Savings

You may have just enough money to cover your mortgage and all other costs that come with buying and owning a home, but you might want to have a little extra leftover to put towards other financial goals, such as saving for retirement, college tuition for your kids, an emergency fund, or even a vacation. Mortgage affordability calculators dont take any other goals into consideration, so youll need to factor these additional savings on your own.

Household Budget

Additional Reading

I Dont Know What To Enter For Property Taxes Or Homeowners Insurance

You can leave these and most other boxes blank if you dont know what those costs might be, and the Mortgage Qualifying Calculator will generate an answer without them. The same for the inputs under Down Payment and Closing Costs, and Total Monthly Debt Payments. But your results will be more accurate and useful if you can provide these figures.

You May Like: How Much Money Can I Be Approved For A Mortgage

How Much House Can I Afford With A Conventional Loan

If you are taking out a conventional loan and you put down less than 20%, private mortgage insurance will take up part of your monthly budget. The PMIs cost will vary based on your lender, how much money you end up putting down, as well as your credit score. It is calculated as a percentage of your total loan amount, and usually ranges between 0.58% and 1.86%.

What Is A Good Income To Buy A House

Once again, the answer to this question will depend on where you want to buy and what kind of property you want. Your credit score and DTI will also be important factors in determining what interest rate and loan terms you get from the lender.

The higher your credit score, the better the interest rate you are offered therefore, you might be able to own a higher priced home than someone with a low credit score.

Recommended Reading: How Much Mortgage Can I Afford For 2500 Per Month

Extend Your Mortgage Term

Choosing a longer mortgage term spreads your loan balance over more total payments, reducing the amount of each payment individually.

But remember, extending your term comes at a cost, as youll ultimately pay more in cumulative interest over the life of your loan.

Read more:15-Year Mortgages vs. 30-Year Mortgages

Two Types Of Conventional Loans

- Conforming Conventional Loans: Conventional mortgages follow assigned loan limits established by the Federal Housing Finance Agency . In 2022, the maximum conforming limit for a single-unit home in the U.S. continental baseline is $647,200. If this is the maximum conforming limit in your area, and your loan is worth $600,000, your mortgage can be sold into the secondary market as a conventional loan. We publish maximum conforming limits by county across the country.

- Non-conforming Conventional Loans: Also called jumbo loans, non-conforming conventional mortgages exceed the assigned conforming loan limits set by the FHFA. These loans are used by high-income buyers to purchase expensive property in high-cost locations. The conforming loan limit for high-cost areas are 50% higher than the baseline limit, which is $970,800 for single-unit homes as of 2021. Jumbo mortgages have stricter qualifying standards than conventional loans because larger loans exact higher risk for lenders.

PMI on Conventional Loans

Private mortgage insurance or PMI is required for conventional mortgages when your down payment is less than 20% of the homes value. This is an added fee that protects your lender if you fail to pay back your loan. PMI is typically rolled into your monthly payments, which costs 0.5% to 1% of your loan per year. Its only required for a limited time, which is canceled as soon as your mortgage balance reaches 78%.

Don’t Miss: Can You Do A Quit Claim Deed With A Mortgage