What Are The Different Types Of Pmi

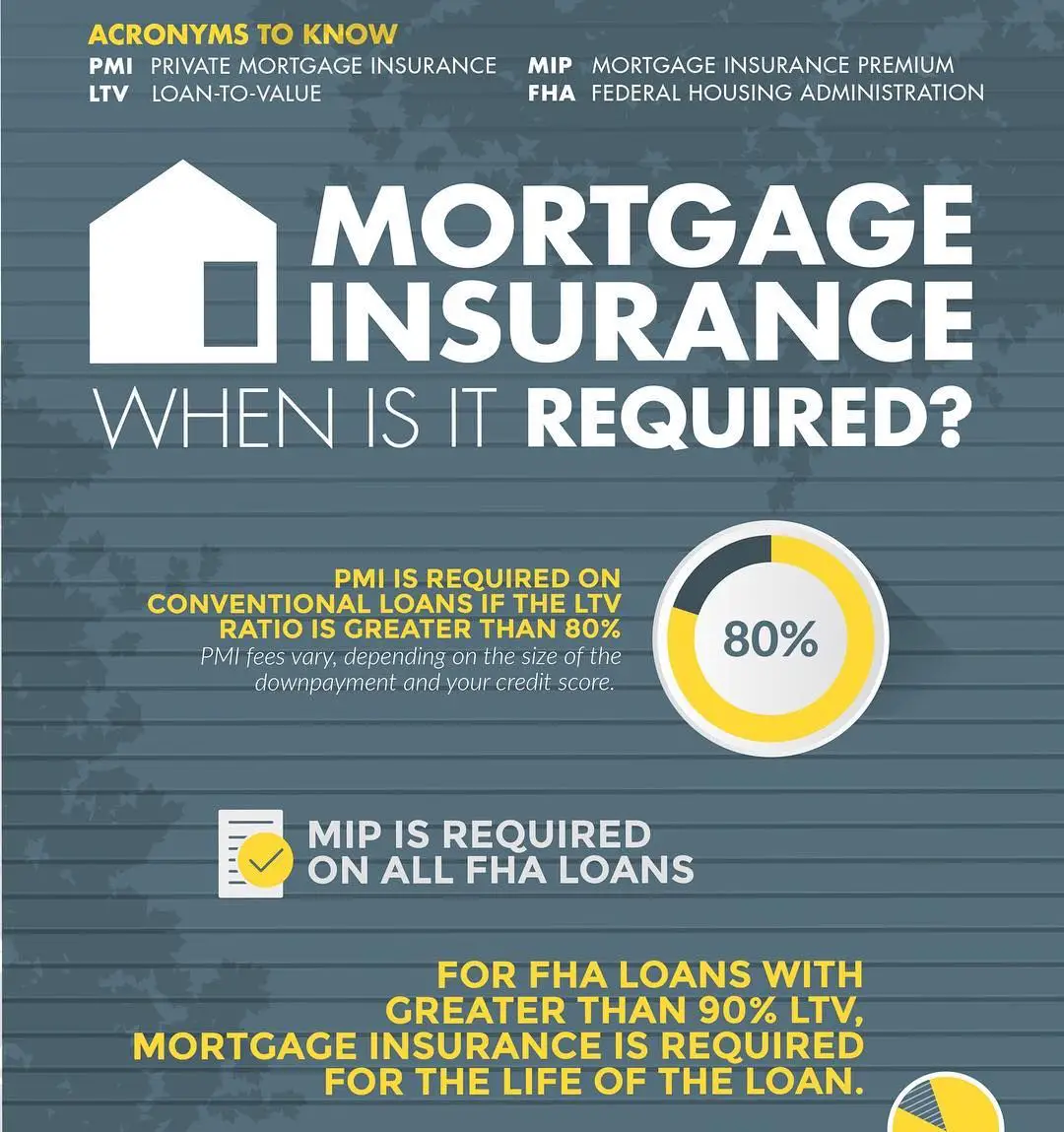

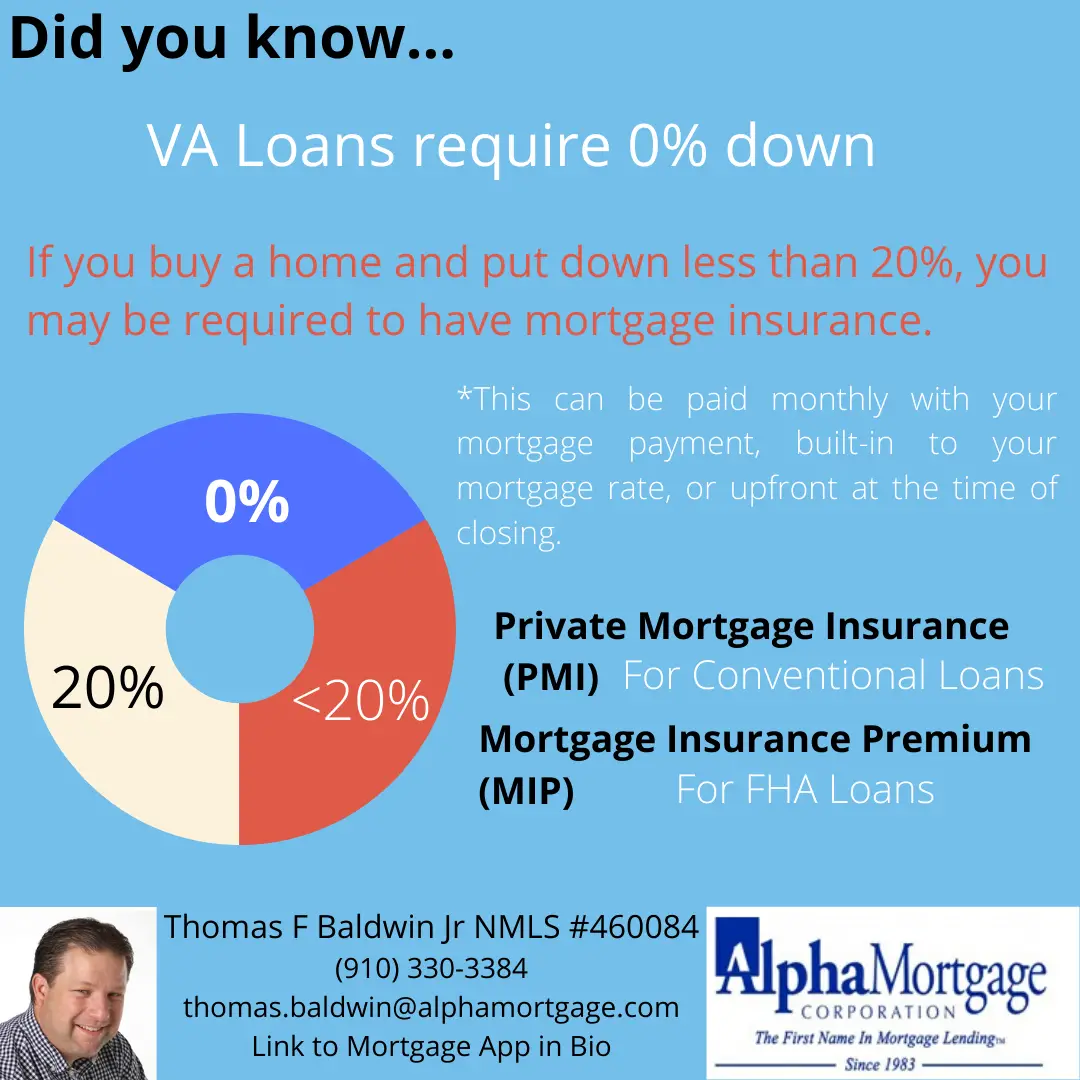

In general, there are two types of mortgage insurance: mortgage insurance bought from the government, designed for those with FHA loans or private mortgage insurance for conventional loans which is bought from the private sector . MIP for FHA and VA loans is run differently and managed internally than private mortgage insurance, and they have their own set of rules.

Basically, the type of mortgage insurance required will depend on the type of mortgage loan you get.

How Long Do I Need To Have Mortgage Insurance

The good news about PMI is that in most cases, you wont have to continue paying it for the entire length of your home loan. Most mortgage insurance plans allow you to cancel your policy once youve paid off more than 20% of the full loan amount of your home.

Typically, your lender would remove it once you have 22% equity. We suggest looking ahead to find out when youll have made it to the 20% benchmark to request a PMI cancellation and avoid paying unnecessary premiums.

Some mortgage insurance types require upfront payments that are also refundable when your mortgage insurance is canceled.

Which Type Of Property Is Eligible For Hecm

The houses that can qualify for an FHA-sponsored reverse mortgage must meet all the property standards and flood requirements. These include:

- Single-family homes or 1-4 unit homes out of which one unit should be occupied by the money borrower.

- Condominiums that are approved by the U.S. Department of Housing and Urban Development or HUD.

- Manufactured homes that adhere to the FHA standards.

Recommended Reading: What Lender Has The Lowest Mortgage Rates

Federal Housing Administration Loan

If you get a Federal Housing Administration loan, your mortgage insurance premiums are paid to the Federal Housing Administration . FHA mortgage insurance is required for all FHA loans. It costs the same no matter your credit score, with only a slight increase in price for down payments less than five percent. FHA mortgage insurance includes both an upfront cost, paid as part of your closing costs, and a monthly cost, included in your monthly payment.

If you dont have enough cash on hand to pay the upfront fee, you are allowed to roll the fee into your mortgage instead of paying it out of pocket. If you do this, your loan amount and the overall cost of your loan will increase.

What Is Mortgage Insurance And Why Do You Need It

Insurance. We get it for our cars. We get it for our health. We get it for our homes. Why? For peace of mind. Having insurance helps us sleep a little better and worry a little less about unexpected mishaps in life. We pay our premiums each month so that if something does happen, we can file a claim, take care of the issue and get on with our lives.So, lets talk about mortgage insurance. Following the above thinking, it would be easy to think that the point of mortgage insurance is to protect your mortgage in the event you cant make payments. Unfortunately, that isnt the case with mortgage insurance.

Mortgage insurance protects your lender if you cant make mortgage payments.

When your lender loans you the money to buy a house, they place a lien against the property in the event you stop making payments. They can then legally take the property to make up for the unpaid loan balance if you default. Thats called foreclosure, and lenders dont like to pursue foreclosure because its costly and time-consuming.

When they give you the loan, they anticipate that you would be making payments for the entire term of your loan. However, sometimes things happen and you cant make payments. Lenders take a risk when they loan money. One of their biggest fears is that your home wont be worth enough to cover the outstanding balance if they foreclose. One of the ways they get some peace of mind for themselves is mortgage insurance.

You May Like: How Many Years Can I Knock Off My Mortgage Calculator

How To Avoid Borrower

Borrower-paid PMI is the most common type of PMI. BPMI adds an insurance premium to your regular mortgage payment. Lets take a look at what home buyers can do to avoid paying PMI.

Make A Large Down Payment

You can avoid BPMI altogether with a down payment of at least 20%, or you can request to remove it when you reach 20% equity in your home. Once you reach 22%, BPMI is often removed automatically.

Take Out An FHA Or USDA Loan

While its possible to avoid PMI by taking out a different type of loan, Federal Housing Administration and U.S. Department of Agriculture loans have their own mortgage insurance equivalent in the form of mortgage insurance premiums and guarantee fees, respectively. Additionally, these fees are typically around for the life of the loan.

The lone exception involves FHA loans with a down payment or equity amount of 10% or more, in which case you would pay MIP for 11 years. Otherwise, these premiums are around until you pay off the house, sell it or refinance.

Take Out A VA Loan

The only loan without true mortgage insurance is the Department of Veterans Affairs loan. Instead of mortgage insurance, VA loans have a one-time funding fee thats either paid at closing or built into the loan amount. The VA funding fee may also be referred to as VA loan mortgage insurance.

Take Out A Piggyback Loan

What Is Homeowners Insurance

Homeowners insurance, also known as home insurance, is coverage that is required by all mortgage lenders for all borrowers. Unlike the requirement to buy PMI, the requirement to buy homeowners insurance is not related to the amount of the down payment that you make on your home. It is tied to the value of your home and property.

You May Like: How Much Mortgage Will I Qualify For

Whats The Difference Between A Home

Home-equity loans and HELOCsor home-equity lines of creditare similar, but not quite the same. While both let you borrow against your home equity, there are a few key differences.

With home-equity loans, you get a lump-sum payment. Then you repay the money via fixed monthly payments over an extended period .HELOCs, on the other hand, give you a line of credit to pull from, similar to a credit card. You can then withdraw money as needed for the next 10 or so years. Interest rates tend to be variable on HELOCs, so your interest rate and payment can change over time.A home-equity loan is a good option for those who desire the consistency of a fixed rate and a set repayment schedule, while a HELOC provides the flexibility to use funds as needed.

Lenders Mortgage Insurance Exemptions

Even if your Loan to Value Ratio is over 80%, your LMI could be waived if you meet some specific conditions. While these are rare and have strict qualifiers, if you are able to prove that you meet the conditions, you could have the opportunity to either receive a discount on your LMI or even have the LMI waived.

This is examined on a case-by-case basis, but some of the conditions could include:

- The LVR is only slightly over the 80% threshold

- No LMI payable for loans up to 90% LVR for certain professions

- Your lender has an internal LMI substitute

For most applicants, the maximum LVR before LMI needs to be paid is 80%. However for certain professions, LMI may be waived for LVRs up to 90% and are assessed on an individual basis.

These professions include:

- Medical professionals: doctors, dentists, veterinarians, optometrists

- Lawyers, solicitors and barristers

An expert mortgage broker can tell you whether you are eligible for LMI exemption or discount.

Read Also: How To Eliminate Mortgage Insurance

What About Fha Mortgage Insurance

If youre getting a loan thats backed by the Federal Housing Administration , mortgage insurance is handled a little differently. The premium is paid directly to FHA and its required for all FHA loans, regardless of your credit score or down payment. FHA mortgage insurance includes an upfront premium which is included in your closing costs and a monthly premium, which is added to the principal, interest, real estate taxes, and homeowners insurance that make up your mortgage payment.It still works the same as private mortgage insurance and protects your lender in the event you stop making payments on your mortgage loan.For FHA, if you cannot afford the upfront premium, you can include that in your loan, but youll still have monthly premiums. The rates for FHA insurance are based on your term and down payment. Talk to your lender about what the current rates are for FHA loans.

Unless you got your FHA mortgage before June 3, 2013, FHA mortgage insurance does not have an automatic cancellation once you reach 78% loan-to-value.

As with any insurance, we all hope we dont need it, but its one way to have peace of mind. If you have any questions or concerns about mortgage insurance, talk to your lender.

When Do I Pay Pmi Premiums

When you are required to pay your private mortgage insurance premium depends on your specific loan policy. But typically, paying your mortgage insurance premiums monthly happens right along with your mortgage payment for your current loan . Lenders may also have a policy that allows you to pay your PMI on a lump sum basis either in cash at closing or finance the premium in your loan amount.

Recommended Reading: How Much To Pay Mortgage Off Early

Pmi For Conventional Mortgages

Many lenders offer conventional mortgages with low down payment requirements some as low as 3%. A lender likely will require you to pay for private mortgage insurance, or PMI, if your down payment is less than 20%.

Before buying a home, you can use a PMI calculator to estimate the cost of PMI, which will vary according to the size of your home loan, credit score and other factors. Typically, the monthly PMI premium is included in your mortgage payment. You can ask to cancel PMI after you have over 20% equity in your home.

» MORE:Calculate your PMI costs

What Factors Should I Consider When Deciding Whether To Choose A Loan That Requires Pmi

Tip

You may be able to cancel your monthly mortgage insurance premium once youve accumulated a certain amount of equity in your home. Learn more about your rights and ask lenders about their cancellation policies.

Like other kinds of mortgage insurance, PMI can help you qualify for a loan that you might not otherwise be able to get. But, it may increase the cost of your loan. And it doesnt protect you if you run into problems on your mortgageit only protects the lender.

Lenders sometimes offer conventional loans with smaller down payments that do not require PMI. Usually, you will pay a higher interest rate for these loans. Paying a higher interest rate can be more or less expensive than PMIit depends on a number of factors, including how long you plan to stay in the home. You may also want to ask a tax advisor about whether paying more in interest or paying PMI might affect your taxes differently.

Borrowers making a low down payment may also want to consider other types of loans, such as an FHA loan. Other types of loans may be more or less expensive than a conventional loan with PMI, depending on your credit score, your down payment amount, the particular lender, and general market conditions.

You may also want to consider saving up the money to make a 20 percent down payment. When you pay 20 percent down, PMI is not required with a conventional loan. You may also receive a lower interest rate with a 20 percent down payment.

Read Also: What Would A 100 000 Mortgage Cost

How To Avoid Mortgage Insurance

If youâre getting an FHA loan, you canât avoid mortgage insurance. If youâre getting a conventional loan, youâll typically need to put down 20% to avoid insurance. You also have the option to save up a larger down payment and buy later, or buy a less expensive home.

An alternative to paying PMI on a conventional loan is to take out two mortgages instead of one. The first will cover 80% of the purchase price. The second will cover 10% to 17% of the purchase price and will have a higher interest rate. Youâll make a down payment of 3% to 10% to cover the rest of the purchase price.

These loans are sometimes called 80/10/10 loans or piggyback loans. Donât assume that it will be less expensive to go this route youâll need to compare actual mortgage quotes to find out.

You may find special programs through your state or city for first-time homebuyers that can help you avoid PMI. Through certain lenders, you may also find low down payment mortgages that donât require PMI.

For example, you may be able to put down just 3% without paying PMI if you have a modest income or are a first-time homebuyer, thanks to down payment and closing cost assistance. In exchange, you may have to complete a homebuyer education program.

If youâre a qualifying military service member, surviving spouse or member of the National Guard or reserves, you may qualify for a VA loan, which doesnât charge insurance despite allowing a down payment as low as 0%.

Why Mortgage Insurance It Required

The first reason that all home buyers should consider purchasing mortgage insurance is the safety factor. Also you will be able to purchase a home with less than 20% down.

When you get yourself a Mortgage Insurance, the risk that your lender takes on is lowered because there is more assurance that their money will be paid back. This means that you can qualify for a higher loan than you would normally be able to get.

Read Also: What Can I Do To Lower My Mortgage Payments

How Are Homeowners Insurance And Mortgage Insurance Different

It’s easy for new homebuyers to get overwhelmed by the swirl of terms and requirements thrown out by lenders, especially ones that sound similar. But don’t let the names fool youhomeowners insurance and mortgage insurance aren’t the same thing. What’s more, they can affect your budget in very different ways.

While homeowners insurance covers you in the event of physical damage to your home, among other things, mortgage insurance is designed to protect the lender if you fail to make good on your payments.

| Homeowners Insurance vs. Mortgage Insurance | |||

|---|---|---|---|

| What do I need to know? | Who does it cover? | Is it included in the mortgage? | |

| Homeowners insurance | It typically protects against property damage, stolen or damaged belongings, or an injury that occurs on the property. | The homeowner | Sometimes. Many lenders fold the cost into the monthly mortgage payment, but you may also be able to pay it yourself. |

| Mortgage insurance | Designed for borrowers who put down less than 20% of the home’s value, it guarantees that the mortgage will be paid. If you default on your loan, your insurer will pay the lender. | The lender | Mortgage insurance premiums are included in the monthly mortgage payment. In some instances, borrowers are also required to make a payment at closing. |

Let’s take a deeper dive into the difference between homeowners insurance and mortgage insurance.

How Does Lmi Work In Practice

Well use an example to explain how it works.

- Lets say you default on your home loan and theres still $600,000 owing.

- Your lender then sells the property to recover this amount but they only recover $550,000 when the property is sold.

- That means theres a shortfall of at least $50,000.

In this case, your lender may claim the shortfall from the LMI provider. The LMI provider may seek to recover the $50,000 shortfall from you. In other words, LMI protects the lender it doesnt protect you at all.

Make sure you dont confuse LMI with mortgage protection insurance this is a completely different insurance product altogether. Mortgage protection insurance is designed to help you meet your mortgage repayments in the event that you become seriously ill or incapacitated and are unable to work.

You May Like: Why Do Banks Sell Mortgages To Freddie Mac

How Is Lmi Calculated

LMI is calculated as a percentage of the loan amount and your LMI will vary depending on your Loan to Value Ratio as well as the amount of money you wish to borrow.

The percentage youre required to pay increases as the LVR and loan amount increase, and usually goes up in stages.

Lenders’ Mortgage Insurance costs differ depending on the loan, lender and the LMI provider. The factors that determine the cost of your LMI can also include:

- Whether your property is owner occupied or not – it is believed that you are less likely to default on a loan if the property is also your residence.

- If you are self employed or paid as a PAYG employee.

- Whether or not you have genuine savings.

Risk Fee An Lmi Substitute

Whilst most lenders generally rely on lenders mortgage insurance if the LVR is above 80%, some lenders have created their own alternative risk process. In these cases, the lender will charge a one off risk fee as an alternative to LMI.

There are several advantages to a risk fee:

- The fee is often less than the standard LMI for that loan amount

- There are no insurance taxes to be paid as a ‘risk fee’ is not an insurance cover. These savings are generally passed on to the applicant

Lenders that waive LMI in favour of their own risk fee have the ability to keep the loan process internal using their own policies.

Risk fees will normally also apply to non-traditional loans, for example those borrowers who have had past credit issues. These may be payable regardless of LVR.

If you would like to explore LMI alternatives and find out if you are eligible, contact us today to speak with one of our expert mortgage brokers who will assess your individual situation and provide you with tailored advice.

You May Like: How To Remove A Co Borrower From A Mortgage