Good Mortgage Rates Look Different To Everyone

What is a good mortgage rate? Thats a tricky question. Because many of the rates you see advertised are available only to prime borrowers: those with high credit scores, few debts, and very stable finances. Not everyone falls into that category.

Of course, you can look at average mortgage rates. But how reliable are those as a guide?

On the day this was written , Freddie Macs weekly average for a 30-year, fixed-rate mortgage was 5.55 percent. But the daily equivalent from The Mortgage Reports rate survey was 5.838% . So theres clearly some variance across the market.

How To Find A Good Mortgage Rate

Everyone wants the lowest mortgage rate possible. But whats a good deal? And how do you know youre getting the best rate available?

The first question is hard to answer because a good rate is different for everyone. It could be 4% for one borrower and 6% for another on the same day.

But the second question how to find your best rate is an easy one. All you have to do is check with a few different lenders. Their estimates will show you what a good rate looks like for your unique situation.

In this article

> Related: 7 Tips to get the best refinance rate

What Are Mortgage Rates

Mortgage rates are the rate of interest charged by a mortgage lender . The interest is charged by the lender as compensation for the money they have lent them in order to purchase a property.

Interest rates are determined by the lender in most cases, and can be either fixed or variable . Before you compare mortgages, you need to understand the different types. For more information see what type of mortgage should I get?

Recommended Reading: What Is Mortgage Insurance Vs Homeowners Insurance

Could Interest Rates Double Within A Year And Wholl Be Hit Worst

Another month where were left wondering: will there be another rise in the base rate? The Bank of Englands Monetary Policy Committee meets again on 15 September and many experts are predicting another increase to the base rate of interest will be announced.

Any increase would follow the announcement on 4 August which hiked interest rates from 1.25% to 1.75% their highest level since December 2008, as the Bank of England tries to curb surging inflation.

And it looks like further increases are on the cards with financial markets betting interest rates will more than double by next May to 4%.

Whenever interest rates are increased this has a knock on effect on mortgage rates so a rise to 4% would have a drastic impact if it happens. According to researchers at the IFS the impact of further interest rate rises may be felt worst by lower-income and older home owners, as they are more likely to be on a variable rate mortgage.

So it has never been more important to check how any increase will affect your mortgage.

Money’s Average Mortgage Rates For September 9 2022

Mortgage rate moved lower across all loan categories today. The average rate for a 30-year fixed-rate loan was down for the second day in a row, decreasing by 0.136 percentage points to 6.731%.

- The latest rate on a 30-year fixed-rate mortgage is 6.731%.

- The latest rate on a 15-year fixed-rate mortgage is 5.601%.

- The latest rate on a 5/6 ARM is 6.395%.

- The latest rate on a 7/6 ARM is 6.422%.

- The latest rate on a 10/6 ARM is 6.393%.

Money’s daily mortgage rates are a national average and reflect what a borrower with a 20% down payment, no points paid and a 700 credit score roughly the national average score might pay if he or she applied for a home loan right now. Each day’s rates are based on the average rate 8,000 lenders offered to applicants the previous business day. Your individual rate will vary depending on your location, lender and financial details.

These rates are different from Freddie Macs rates, which represent a weekly average based on a survey of quoted rates offered to borrowers with strong credit, a 20% down payment and discounts for points paid.

Read Also: How To Apply A Mortgage Loan

Whats A Good Mortgage Rate Today

Mortgage rates change all the time. So a good mortgage rate could look drastically different from one day to the next.

Right now, a good mortgage rate for a 15-year fixed loan is in the high-3% or low-4% range, while a good rate for a 30-year mortgage is generally in the high-4% or low-5% range.

At the time this was written in August 2022, the average 30-year fixed rate was 5.55% according to Freddie Macs weekly survey. That represents all sorts of borrowers, and those with strong finances can often get rates well below the average.

Of course, these numbers vary a lot from one home buyer to the next. Top-tier borrowers could see mortgage rates around 4% at the same time lower-credit and non-QM borrowers are seeing rates above 6 percent.

In addition, looking forward in 2022, interest rates are likely to increase. So a good mortgage rate later this year could be substantially higher than what it is today.

A 4% Mortgage Rate Use These Mortgage Charts To Easily Compare Monthly Payments Fast

One of the things prospective home buyers and existing homeowners seem to care most about is mortgage rates.

And for good reason the interest rate you receive on your home loan dictates what youll pay each month, sometimes for as long as the next 30 years. Thats 360 months until the year 2052!

The rate you receive can also completely make or break your home purchase, or sway the .

As such, I decided it would be prudent to create a mortgage rate chart that displays the difference in monthly mortgage payment across a variety of interest rates and loan amounts.

This is especially important now that mortgage rates have bounced off record lows and are above 4%, the highest levels since mid-2019.

Recommended Reading: What Are The Fees For A Reverse Mortgage

These Are Todays Mortgage Rates And Experts Weigh In: Is Now A Good Time For You To Buy A Home

Mortgage rates have ticked up a bit higher in the new year, though they still remain near historic lows: The average interest rate on a fixed rate 30-year mortgage now sits at 3.68% , and on a 15-year fixed rate mortgage is 3.03% , according to todays data from Bankrate. You can see what mortgage rates you qualify for here.

What do these mortgage interest rates mean?

Fluctuations in mortgage interest rates are common and can occur because of a variety of things, such as inflation, economic growth and monetary policy changes. Most fluctuations are small, but a quarter point move in the span of a couple weeks would be significant, explains Greg McBride, chief financial analyst at Bankrate.

How much does the interest rate really matter?

While a difference of 1% may not sound like a lot, it can add up to tens of thousands of dollars over the life of a loan. On a $300,000 30-year fixed rate mortgage with a 3% vs. a 4% APR, youd end up paying more than $60,000 more for the mortgage at the higher rate. Heres a guide on whether or not you should buy points to lower your mortgage interest rate.

Will mortgage rates increase soon?

Is now a good time to buy a home?

The advice, recommendations or rankings expressed in this article are those of MarketWatch Picks, and have not been reviewed or endorsed by our commercial partners.

Why Does My Mortgage Interest Rate Matter

Your mortgage interest rate impacts the amount youll pay monthly as well as the total interest costs youll pay over the life of your loan. While it may not seem like a lot, a lower interest rate even by half of a percent can add up to significant savings for you.

For example, say a borrower with a good credit score and a 20 percent down payment takes out a 30-year fixed-rate loan for $300,000. In this case, an interest rate of 4.75% instead of 5.25% translates to more than $90 per month in savings in the first five years, thats a savings of $5,500.

Its equally important to look at the total interest cost of your loan. In the same scenario, a half percent decrease in interest rate means a savings of almost $33,000 in total interest owed over the life of the loan.

You May Like: How Do You Get A 2nd Mortgage

Whats The Difference Between A Va Interest Rate And Apr

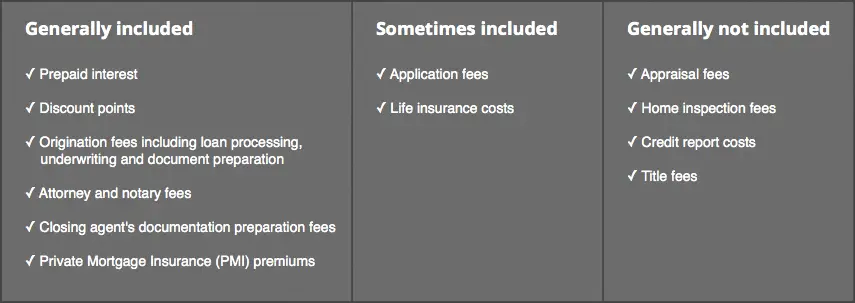

The interest rate is the percentage that the lender charges for borrowing the money. The APR, or annual percentage rate, is supposed to reflect a more accurate cost of borrowing. The APR calculation includes fees and discount points, along with the interest rate.

A major component of APR is mortgage insurance a policy that protects the lender from losing money if you default on the mortgage. You, the borrower, pay for it.

Lenders usually require mortgage insurance on loans with less than 20% down payment or less than 20% equity .

Top 5 Bankrate Mortgage Lenders In Illinois

- Fairway Independent Mortgage Corporation

- Cherry Creek Mortgage

Methodology

Bankrate helps thousands of borrowers find mortgage and refinance lenders every day. To determine the top mortgage lenders, we analyzed proprietary data across more than 150 lenders to assess which on our platform received the most inquiries within a three-month period. We then assigned superlatives based on factors such as fees, products offered, convenience and other criteria. These top lenders are updated regularly.

Also Check: Does Shopping For A Mortgage Hurt Your Credit Score

What Credit Score Do Mortgage Lenders Use

Most mortgage lenders use your FICO score a credit score created by the Fair Isaac Corporation to determine your loan eligibility.

Lenders will request a merged credit report that combines information from all three of the major credit reporting bureaus Experian, Transunion and Equifax. This report will also contain your FICO score as reported by each credit agency.

Each credit bureau will have a different FICO score and your lender will typically use the middle score when evaluating your creditworthiness. If you are applying for a mortgage with a partner, the lender can base their decision on the average credit score of both borrowers.

Lenders may also use a more thorough residential mortgage credit report that includes more detailed information that wont appear in your standard reports, such as employment history and current salary.

The Ascent’s Best Mortgage Lender Of 2022

Mortgage rates are at their highest level in years and expected to keep rising. It is more important than ever to check your rates with multiple lenders to secure the best rate possible while minimizing fees. Even a small difference in your rate could shave hundreds off your monthly payment.

That is where Better Mortgage comes in.

You can get pre-approved in as little as 3 minutes, with no hard credit check, and lock your rate at any time. Another plus? They dont charge origination or lender fees .

Recommended Reading: How Do I Become A Mortgage Loan Officer

Current Mortgage Rates: 30

- The 30-year rate is 3.591%.

- That’s a one-day increase of 0.05 percentage points.

- That’s a one-month increase of 0.183 percentage points.

The 30-year fixed-rate mortgage is the most popular type of home loan because its long payback time results in lower and more affordable monthly payments. The fixed rate also means no surprises. The interest rate will be higher than with a shorter-term loan, however, so you’ll pay more for a 30-year in the long run.

How Does A 15

A 15-year fixed-rate mortgage offers a generic, structured plan for financing a home: You get a mortgage for a set term at a set interest rate, and lenders require a down paymentusually between 520%.

The only thing that varies within fixed-rate mortgages is the length of the mortgage term. You can stretch your monthly payments anywhere from 10 to 50 years, but the two most common term options are the 15-year and 30-year fixed-rate mortgages.

There are two basic components to every fixed-rate mortgage loan: the principal and the interest.

- The principal is the amount you borrow to purchase your home.

- The interest is the amount you pay to compensate the lender for taking the risk of lending that money to you.

So, in order to borrow money, you have to spend more money. But if you opt for a 15-year fixed mortgage, there is a silver lining: Youll have fewer interest payments!

Read Also: How To Figure Mortgage Interest Rate

When You Apply For A Mortgage Theres One Factor That Could Save You Tens Of Thousands Of Dollars If You Play It Right: Your Interest Rate

Your interest rate impacts how much youll pay your lender over time. Fortunately, you may be able to influence the interest rate you get by taking steps to build your credit, saving for a big down payment and researching your options.

Mortgage experts predict that interest rates will jump by a half percentage point this year, which may seem trivial. But take a closer look: A 30-year, $250,000 mortgage with a 4.25 percent fixed interest rate will cost about $21,400 less over the life of the loan than the same mortgage with a 4.75 percent rate.

Whether youre planning on refinancing your current abode or purchasing a new home, heres what you can do to better your chances of scoring a great mortgage rate:

Mortgage Points Heres Why They Matter

In the mortgage world, there are these things called points. In the simplest terms, a point is an upfront fee paid to lower your interest rate by a fixed amount .

For example, if you take out a $200,000 loan at 4.25% interest, you might be able to pay a $2,000 fee to reduce the rate to 4.125%.

Paying points makes sense if you: 1) have the cash to pay them AND you 2) plan to hold the loan for a long time.

If you dont hold the loan long enough, the upfront cost of paying points often outweighs interest savings over time. Youll want to consider points carefully. If youre fairly certain that you will stay in your home for a long time and that you will not pay off the mortgage or refinance early, points can save you a good deal of money.

If, however, you pay points and, just a few years later, move, refinance, or pay off your mortgage, youll likely fare worse than if you did not pay points and instead took out a loan with a higher rate.

Recommended Reading: Where To Get A Mortgage With Low Credit Score

Save Up For A Bigger Down Payment

When you make a small down payment on a home, the lender considers you a higher-risk borrower than someone who makes a larger down payment.

One place where youll see lenders account for this risk is with private mortgage insurance . If you put down less than 20% on a conventional loan, youll usually have to pay PMI premiums. Until you have enough equity to cancel it, PMI will affect you the same way a higher interest rate would: by increasing your monthly payment and your total borrowing costs.

Saving up for a bigger down payment can help you avoid PMI altogether. Even if you cant put 20% down, you can pay less for PMI with a larger down payment. On top of that, a larger down payment can actually get you a lower interest rate.

The more of your own money youre willing to invest in the property, the less risky youll be for the lender, and they may be able to offer you a lower interest rate.

Having trouble saving up? Check Down Payment Resource to see if youre eligible for any down payment assistance programs in your area.

What if youre refinancing? This strategy still works. You can bring cash to closing to increase your equity.

Best 3 Year Fixed Rate Mortgage

While the best available rate on a 3 year fix this month is from Skipton Building Society for Intermediaries at 3.62%. Youll need a deposit of 40% and it has an arrangement fee of £995.

This is quite a big jump from the lowest rate on a 3 year fix last month which was from Buckinghamshire Building Society at 3.29%.

Also Check: Can I Be Added To A Mortgage

What Is A Good Interest Rate On A Mortgage

A good mortgage rate is one where you can comfortably afford the monthly payments and where the other loan details fit your needs. Consider details such as the loan type , length of the loan, origination fees and other costs.

That said, today’s mortgage rates are near historic lows. Freddie Mac’s average rates show what a borrower with a 20% down payment and a strong credit score might be able to get if they were to speak to a lender this week. If you are making a smaller down payment, have a lower or are taking out a non-conforming mortgage, you may see a higher rate. Moneys daily mortgage rate data shows borrowers with 700 credit scores are finding rates around 6.5% right now.

How To Find The Best Mortgage Rate For You

Different lenders will look at your financial circumstances in different ways.

For example, a lender that specializes in FHA loans will rarely raise an eyebrow if your credit score is in the 580 to 620 range. But one that caters to super-prime borrowers likely wont give you the time of day.

Ideally, you want a mortgage lender that is used to dealing with people who are financially similar to you. And the best way to find your ideal lender is by comparing loan offers. Heres how to do that.

Read Also: Can You Use Land As Collateral For A Mortgage