Changing The Title Deeds

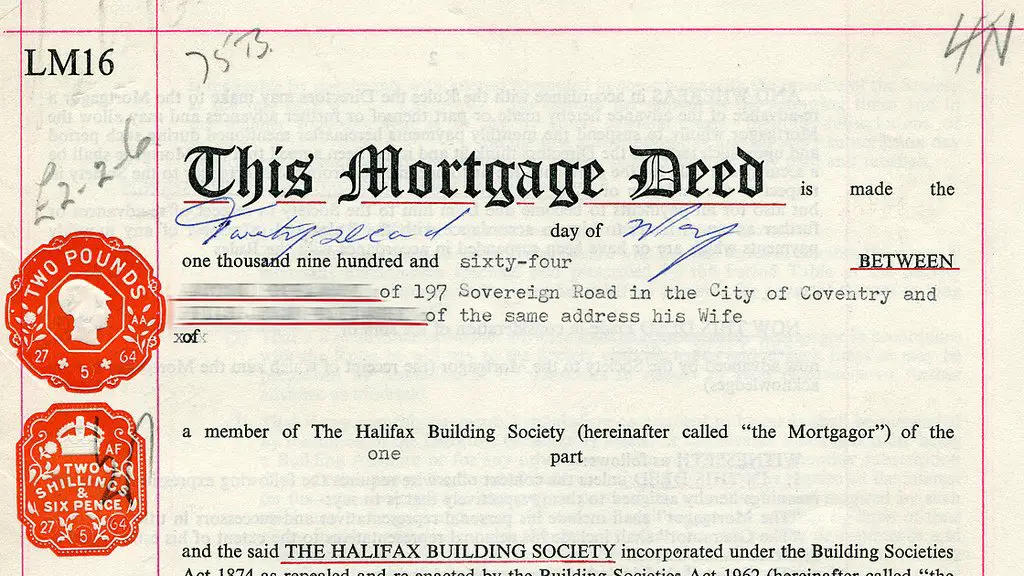

There are a number of reasons why an owner may want to change the title on property deeds, says Dyer. These could include if a co-owner sells or transfers their rights in the property, or if the owner wishes to sell their rights to the property.

He explains that a lawyer will be needed if the title deeds are to be changed, and there will be a fee for this service. If there is a bond on the property or if there are co-owners then the lender and the co-owners will need to agree to the changes, too, he adds.

Title deeds are extremely important documents used as evidence of proof of ownership, Dyer notes. Lawyers can be used when investigating the rights of ownership, but searches may also be made by the person who wishes to buy or find out who owns a property. If property is being considered for purchase then a check of the title deeds is always standard procedure and the sale should not go ahead without this information.

Title deeds become relevant later in the home-buying process, but if youre still in the hunt for a property, bear in mind that ooba home loans offer a range of tools that can help you with that as well. Start with their home loan calculators then use their free, online prequalification tool, the ooba Bond Indicator, to determine what you can afford. Finally, when youre ready, you can apply for a home loan.

Get a free home loan comparison

Multiple quotes from the big banks to compare.

Who Pays Escrow Fees Buyer Or Seller

Who Pays Escrow Fees Buyer or Seller? Typically, this cost is split between the buyer and seller, although it can be negotiated that one party will pay all or nothing. There is no specific rule for who pays the escrow fees, so speak to the seller of your future home or your real estate agent to work out who will pay.

What Happens If I Lose The Deeds To My House

The details of your ownership will have been recorded by the Land Registry in their register, under a specific title number. An Official Copy of the register is the equivalent of a title deed and so it will not matter if you lose this, a further copy can always be obtained from Land Registry, again for a small fee.

You May Like: How Much Is Mortgage On 1 Million

Why Title Vesting Is Important

The manner in which your title is held creates a road map for what happens to a property should one or multiple owners pass away. Here are some key reasons vesting in real estate is so important:

It guides the payment of home sale profits after you die. If you want your home sold after your death, the funds from the sale will be divided, in part, based on how you held title at your death. If you have a trust or a will, you can allocate a certain percentage of funds to different family members.

It indicates what happens with the property after your death. Whether you want your home to go to your spouse after you die or to a great-grandchild in the future, title vesting provides guidance to survivors about what should happen to the property.

It determines who gets tax benefits if one owner dies. This is most likely an issue with tenants in common title vesting , where title and interest to the property can be divided up unevenly. If you dont spell out the details, your heirs could end up fighting a court battle over who gets which ownership benefits.

It may prevent probate. One overall goal of choosing ownership vesting is to avoid probate, which involves a court deciding how to transfer ownership after the current owners die. In order to avoid probate after both owners die, its important to either add heirs with rights of survivorship to title before you die or have a trust prepared that outlines your last wishes.

When A Buyer Defaults On A Contract And The Seller Chooses To Receive The Earnest Money

When the seller is terminating the contract, or if both buyer and seller are in default, the buyer only gets the earnest money payment back if the both parties agree upon it. Otherwise, the contract will govern how the deposit shall be returned, if at all, without having to pursue a lawsuit in court.

Recommended Reading: Rocket Mortgage Loan Requirements

What You Need To Know

Here are some important considerations you should know about before buying a home on a contract for deed.

Full costs

Make sure you understand and can handle all of the costs you will be responsible for. In addition to monthly installment payments to the seller, you will have to pay for homeowners insurance, property taxes and repair and maintenance costs as specified in the contract for deed. Many contract for deed homes are sold as is and may need major repairs which become your responsibility. Depending on the terms of the contract, you could lose the home if you do not pay for repairs.

Balloon payment

As in a standard mortgage, a contract for deed typically has an agreed-upon price and payment schedule. But the payments are often not amortized evenly over a long period, meaning you will likely be required to make a large lump-sum balloon payment at a specific date to complete the purchase by covering the full balance due on the sale price. At that time, you will probably need to get a mortgage for the balloon payment. If you are unable to qualify for a mortgage or otherwise make the balloon payment when it is due, you will likely face cancellation of the contract and eviction.

Cancellation and eviction

Mortgage and property liens

Recording the contract for deed

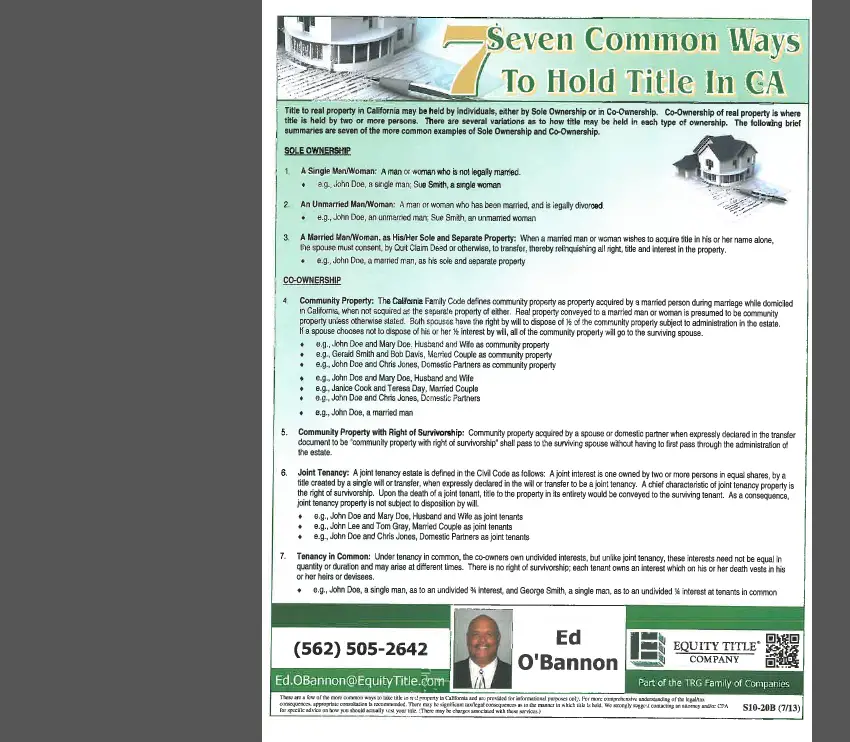

How Should You Hold Title To Your Home

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been reviewed, commissioned or otherwise endorsed by any of our network partners.

The manner in which your title is held, also known as title vesting, refers to your legal rights to the home you own. You might not think about title vesting amid so many other decisions to make during the homebuying process, but it affects your legal right to sell or refinance your home and what happens to the property after you die.

You May Like: Recasting Mortgage Chase

Review Your Estate Plan And Will

If you donât have a will, it should be one of your key priorities. If you die âintestateâ â that is, without a will â it creates a huge amount of complexity over your estate. The Court will appoint an administrator and this may not be the person who you would’ve chosen if a will was made. Itâs a much more expensive and time-consuming process.

Working with a financial planner can make the process of putting your will together easier.

Itâs also important to review your will and estate plan regularly and to update it if significant life events change your intentions regarding your estate.

These could include real estate purchases, marriage or divorce, the death of one of your beneficiaries or the birth of a potential new one. Developing an estate plan can help you protect and arrange the transfer of jointly held assets, trust assets, and superannuation benefits. These types of assets are not dealt with in a will. For example, your superannuation benefits can be distributed at the discretion of the superannuation trustee. You can put in place âdeath benefit nominationsâ to ensure super benefits go to the people or organisations you choose.

Youâve done so well with your mortgage â make sure you make it over the final hurdles easily.

Have confidence in your future with help from a financial adviser.

What Is A House Title Is It Different From The Deed

A house title is the bundle of rights that dictates who has legal or equitable interest in the property. In real estate, a document called a deed records a propertys title and the transfer of that title between two parties or individuals. Your county or municipal clerks office typically keeps a copy of deeds for all properties in its jurisdiction.

When you purchase a home, a title company conducts a title search to ensure that the seller is the sole owner of the home and no one else has any legal claim to or against the property. Lenders often require borrowers to purchase lenders title insurance, which protects the lender against loss for the loan amount if someone has a claim against the property.

If you dont have clear title to your home, someone else might be able to argue that theyre the legal owner of the property and that the person who sold it to you didnt have the right to do so. This can lead to major legal complications and headaches that you definitely want to avoid.

Recommended Reading: Monthly Mortgage On 1 Million

What Is A Mortgage Lien

Created by FindLaw’s team of legal writers and editors

A mortgage lien is a legal right the lender has to take your property if you fail to pay your debt. In common conversation, most people mix mortgages with the actual loans made to purchase the real estate. But, strictly speaking, a mortgage is not simply a loan. Instead, it is an interest in the real property held by the lender as protection in case the borrower fails to pay back the loan.

This article focuses on mortgage liens. For related articles and resources, see FindLaw’s Mortgages and Equity Loans section.

Power Of Sale And Trustee’s Sale

A deed of trust has a crucial advantage over a mortgage from the lender’s point of view. If the borrower defaults on the loan, the trustee has the power to foreclose on the property on behalf of the beneficiary. In most U.S. states, a deed of trust can contain a special “power of sale” clause that permits the trustee to exercise these powers. Here is the standard conveyance clause from a Freddie Mac “uniform instrument”:

Borrower irrevocably grants and conveys to Trustee, in trust, with power of sale, the following described property…

While true mortgages remain available in every state that enforces “power of sale” clauses, they are quite rare. Any prospective borrower who specifically asks for a true mortgage from a commercial lender in such a state necessarily brings his or her creditworthiness into question , and any rational lender willing to extend credit to less creditworthy borrowers will insist on harsher terms, including the use of a deed of trust with a “power of sale” clause.

Don’t Miss: Rocket Mortgage Conventional Loan

Determining Who Holds The Title

Its important to work with your title company to make sure that the wording on your title accurately describes who has the right to transfer ownership. Your title phrasing may also affect how you pay property taxes and fees if you sell your home in the future.

If youre not married and youre the only one on the title, its easy: you hold the title in sole ownership. But if youre married, or live in a community property state, it gets more complicated. Your title company will help you understand whats best for you and what the title should say.

How To Determine If You Have A Mortgage Or A Deed Of Trust

To find out whether a mortgage or deed of trust was used to secure your home loan, you can:

- look at the documents you received when you closed escrow on your house

- contact your loan servicer, or

- go to your local land records office and pull up the recorded document. Sometimes these records are available online.

To learn which foreclosure process is usually used in your state, check our Key Aspects of State Foreclosure Law: 50-State Chart or talk to a local attorney.

You May Like: Rocket Mortgage Payment Options

Does The Mortgage Hold The Deed

Title Types A mortgage is an agreement made between you and the lender. A mortgage grants ownership of your home to the lender which will transfer the title back to you after the loan is paid. With both mortgages and deeds of trust, the lender or trustee will release the title upon repayment of the loan.

Where Did The Register Of Deeds Go In Melbourne

Later, deeds went directly to local Receipt and Pay Offices. This series consists of the Registers of Deeds kept by the Receipt and Pay Office, Colonial Treasury and later, as that maintained for Melbourne. Records in this series may relate to both the whole of Victoria and the Melbourne Land District.

Also Check: How Does 10 Year Treasury Affect Mortgage Rates

The Three Theories Of Mortgages

There are three legal theories pertaining to mortgages: Title Theory, Lien Theory, and Intermediate Theory. These three theories pertain particularly to the operation of mortgages, and so provide the key to understanding the differences which exist in the operation of mortgages across jurisdictions.

Title Theory

Title theory is “the idea that a mortgage transfers legal title of the mortgaged property from the mortgagor to the mortgagee, which retains it until the mortgage has been satisfied or foreclosed. Only a few American States…have adopted this theory.” Under title theory, a mortgage has the effect of a deed passing legal title, though conditionally, of the mortgaged property to the mortgagee , with so-called “equitable title” being retained by the mortgagor . The fact of the mortgagor’s retaining of the “equity of redemption” is the fact which renders the passing of title under title theory conditional. Mortgages within title theory jurisdictions, then, may be viewed as having the action of what might be called “conditional deeds”. Though legal title is passed pursuant to a mortgage therein, the arrangement is generally construed by courts to recognize the mortgagor as “owner” of the mortgaged property within title theory jurisdictions. Even so, foreclosure of the property as a remedy for default under title theory is most often extrajudicial .

Lien Theory

Intermediate Theory, and general considerations

What Is A Title Company And What Does It Do

The title company is a third party that works on behalf of both the lender and the buyer. You hire them to research and insure the title of the home youre buying.

Why is that important? Lets say you buy a home without hiring a title company. Later on, you find out the seller inherited the home when his father died and actually only owns half of the home. The other half belongs to his brother, who turns up on your doorstep wanting his 50% of the property. You can imagine what an unpleasant situation that would be for everyone. The title company and the title insurance policy you purchase from them will protect you from any liability and is an important part of the closing process.

Now that you know what a title company is and why theyre important, heres what you can expect for your money.

You May Like: Can I Get A Reverse Mortgage On A Condo

Who Is Responsible For The Deed Of Trust

Unlike a mortgage agreement between a borrower and a lender, the deed of trust agreement involves a borrower, a lender and an independent third party known as a trustee. The trustee holds the deed on the property and has the power to sell the property at public auction if the borrower defaults on the loan.

Joint Tenancy With Right Of Survivorship

This is often touted as the best title vesting for most married couples, but it also applies to family members planning to own a property together. Joint tenancy with rights of survivorship gives everyone equal ownership rights that automatically pass on to survivors in the event of an owners death.

When you hold property title with someone who has the right of survivorship, you cant divide up the ownership unequally. Under this type of vesting, the owners dont have to be married, and any number of persons can own the property together.

Recommended Reading: Rocket Mortgage Loan Types

Foreclosures In Title Theory States Vs Lien Theory States

Foreclosure procedures are different in title theory states and lien theory states. In title theory states, foreclosure proceedings are a judicial process. The lender instigates a title theory foreclosure by filing a foreclosure lawsuit against the borrower. The court will then issue a foreclosure judgment. The property is then liquidated through a foreclosure auction by a designated representative or public official. In lien theory states, foreclosure proceedings are non-judicial processes handled by a trustee. The original mortgage agreements must include a power-of-sale clause granting the lender to proceed with a non-judicial foreclosure. These types of foreclosures are often resolved quicker than judicial foreclosures.

Ways Sellers Can Protect Themselves

As mentioned before, the legal paperwork required for seller financing should be drafted or at least reviewed by an attorney or qualified professional familiar with the process.

Even if you are selling to family, friends, or someone with a stellar credit score and long work history this is not a time to DIY legal documents and hope for the best.

You should also consider getting an appraisal on your house, so you understand the market value. This will help you negotiate purchase offers and determine what is an acceptable amount for a down payment.

Talk with your attorney or real estate agent about using a mortgage application and credit check.

Youll want to review the credit report carefully and verify the employment history and assets of potential buyers. Checking references is an integral part of the application process too.

Don’t Miss: Does Rocket Mortgage Service Their Own Loans