Texas Private Mortgage Insurance

If you take out a conventional mortgage loan in Texas, you may be required to pay private mortgage insurance. Known as PMI for short, this insurance protects the lender from making a loss in case you fail to make your mortgage payments. Typically, Texas private mortgage insurance is usually required if you put less than 20% down payment for the home of if you are refinancing and your equity is less than 20% of the homes value.

Try Our Down Payment Calculator to See Which Loan Programs Might Work for You!

More often than not your Texas lender will add the PMI premium to your monthly mortgage payment. But you can opt to pay it as an upfront lump sum or a combination of both. While an upfront payment will ease the burden, in case you refinance or move you may not be entitled to a refund. If you want to know more about strategies for paying PMI in Texas talk to us and our experts here at Moreira Team will guide you.

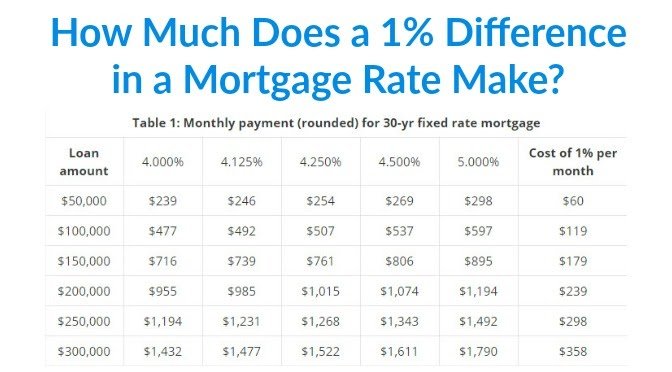

How much should you expect to pay on your Texas private mortgage insurance? Generally, costs range between 0.5 and 1% of the total loan amount per month. So for a $150,000 loan, you may have to pay as much as $1,500 per year, or about $125 per month. It may seem like a lot, but there are actually some benefits of paying PMI.

Mpi Vs Fha Mortgage Insurance

MPI also isnt the same thing as the mortgage insurance you pay on an FHA loan. When you take an FHA loan, you must pay both an upfront mortgage insurance premium and a monthly premium. Like PMI, FHA insurance payments protect against default on mortgages. However, FHA mortgage insurance affords you no protection as the homeowner.

Regardless if your loan has PMI or FHA insurance, it can be a good idea to buy an MPI policy if you cannot afford a traditional life insurance policy and want to ensure your home goes to your heirs.

How To Decide Whether You Need Mortgage Protection Insurance

Youre not required to purchase mortgage protection insuranceits up to you to decide if this coverage is a worthwhile investment.

A policy may make sense if your finances arent in tip-top shape and you dont have enough life insurance to cover the mortgage payments or pay off the loan if you pass away. However, you may not need mortgage protection insurance if you have a life insurance policy that can pay off the loan, cover your final expenses and replace your income for a set period. It also may not be a smart financial move if, on top of having adequate life insurance, you have job security and are in good health.

If youre undecided, consult with insurance professionals to learn more about your options and decide if mortgage protection insurance is a good fit for you, or if another type of coverage makes more sense.

You May Like: What’s Needed To Apply For A Mortgage

Can You Reduce Or Eliminate Pmi

If you’re concerned about this extra expense, you’ll be relieved to know that PMI usually ends before your loan does since lenders only require you to pay PMI while your LTV is above 80%. Once your LTV is below 80%, you can request to stop paying PMI.

To determine when your loan will reach the point where you no longer need PMI, lenders use an amortization schedule. If you opted to pay PMI at closing, your lender already used this schedule to calculate your total PMI amount. In most cases, you can’t reduce or get a refund for part of your upfront premium.

If you pay a monthly premium, you may be able to eliminate PMI a little early since lenders end PMI automatically when you’re scheduled to reach the 78% LTV point. You may qualify for early PMI termination if you meet the following criteria:

- Your LTV is 80% or lower

- Your loan started on or after July 29, 1999, when the Homeowners Protection Act began

- You’re current on your mortgage payments

Call your lender to cancel PMI early if you meet these qualifications. Typically, your lender will request a broker price opinion to confirm the current market value of your home. Your lender needs this data to calculate your current LTV. If the value of your home has decreased significantly, your LTV may have increased, which could disqualify you for early PMI termination.

How To Avoid Borrower

Borrower-paid PMI is the most common type of PMI. BPMI adds an insurance premium to your regular mortgage payment.

You can avoid BPMI altogether with a down payment of at least 20%, or you can request to remove it when you reach 20% equity in your home. Once you reach 22%, BPMI is often removed automatically.

While its possible to avoid PMI by taking out a different type of loan, FHA and USDA loans have their own mortgage insurance equivalent in the form of mortgage insurance premiums and guarantee fees, respectively. Additionally, these fees are typically around for the life of the loan.

The lone exception involves FHA loans with a down payment or equity amount of 10% or more, in which case you would pay MIP for 11 years. Otherwise, these premiums are around until you pay off the house, sell it or refinance.

The only loan without mortgage insurance is the VA loan. Instead of mortgage insurance, VA loans have a one-time funding fee thats either paid at closing or built into the loan amount. The VA funding fee may also be referred to as VA loan mortgage insurance.

The size of the funding fee varies according to the amount of your down payment or equity and whether its a first-time or subsequent use. The funding fee can be anywhere between 1.4 3.6% of the loan amount. On a VA Streamline, also known as an Interest Rate Reduction Refinance Loan, the funding fee is always 0.5%.

Also Check: Can I Have Multiple Mortgages

Expert Insight On Affordable Homeowners Insurance

MoneyGeek teamed up with experts to get insight on how consumers can find affordable home insurance with the right coverages. These experts offer tips and advice for purchasing home insurance on a new home or comparing quotes on your existing home.

What Affects The Cost

When it comes to protection insurance, its not simply a case of signing up to the cheapest policy.

Theres no one size fits all and your monthly payments also known as premiums will depend on a number factors. These include:

- the product youre taking out

- how long youre taking it out for

- age

- whether you smoke or have smoked

- lifestyle for example, do you do extreme sports?

- health your current health, weight, family medical history

- job some professions are higher risk than others

- any add-ons that you want to include

- whether youre taking out a single or joint policy.

How much cover you might need will depend on:

- your take-home pay

- debts

- mortgage/rent.

Its useful to weigh up the costs of a policy against the risks of being uninsured. For example:

- how much would you lose if you became ill and found yourself unable to work?

- how would you cover your essential costs, such as mortgages or rent?

- how would your family cope financially after you die if theres no life insurance in place?

Recommended Reading: What Is A Residential Mortgage Loan Originator

Level Term Life Insurance

Most agents are now selling level term life insurance policies to clients looking for mortgage protection.

this was the second old-fashioned type of mortgage life insurance we discussed above.

This is not a bad solution, because it will provide enough coverage to pay off the mortgage should the insured die before its paid off. The excess death benefit can be used by the beneficiary for other needs and expenses at their discretion.

This policy does not decline, so the value of the purchase remains constant. So it is indeed a better choice than the old-fashioned mortgage protection insurance described above.

However, it may result in over-insurance, which can be costly if not needed. If the balance on your mortgage is only $14,242 when you die, and the death benefit is over $500,000, you may have been paying too much for more coverage than you need.

Why Pmi Is Required

If a borrower defaults on their home loan, its assumed the lender will be set back about 20% of the homes purchase price.

If you put down 20%, that makes up for the lenders potential loss if your loan defaults and goes into foreclosure. Put down less than 20%, and the lender is likely to lose money if the loan goes bad.

Thats why mortgage lenders charge insurance on conventional loans with less than 20% down.

The cost of PMI covers that extra loss margin for the lender. If you ever default on your loan, the lender will receive a lump sum from the mortgage insurer to cover its losses.

Don’t Miss: How Much Can I Mortgage My House For

Guaranteed Level Term Mortgage Life Insurance

It didnt take the life insurance industry long to figure out that the traditional mortgage life insurance policy seen above, with increasing premiums, and decreasing benefits, could easily be beaten by a straight guaranteed level term policy.

MOST agents will sell you this type of life insurance for mortgage protection.

For example, if you have a 30 year mortgage, most agents will try to automatically sell you a 30 year term policy, whose death benefit stays level during the entire 30 years.

Its All About You We Want To Help You Make The Right Coverage Choices

Advertiser Disclosure: We strive to help you make confident insurance decisions. Comparison shopping should be easy. We are not affiliated with any one insurance provider and cannot guarantee quotes from any single provider.

Our insurance industry partnerships dont influence our content. Our opinions are our own. To compare quotes from many different insurance companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

Editorial Guidelines: We are a free online resource for anyone interested in learning more about insurance. Our goal is to be an objective, third-party resource for everything insurance related. We update our site regularly, and all content is reviewed by insurance experts.

You probably already know you should think about life insurance if you have a mortgage.

There are two traditional ways companies have historically tried to sell you mortgage life insurance but theyre both antiquated and expensive.

In this article, Ill show you a better way to use life insurance to cover your mortgage

One unique life insurance company has stepped up and developed a brand new custom solution to cover your mortgage life insurance needs. A cheaper and more effective way, one that will neither over or under insure you.

This you gotta see!

You May Like: Is Quicken Loans Same As Rocket Mortgage

How Much Does Term Life Insurance Cost

Term life insurance is generally cheaper than mortgage life insurance/mortgage protection insurance.

What is term life insurance?

- Term life insurance is a type of life insurance that offers coverage for a fixed period, usually 10 or 20 years.

- You pay premiums during the policy term.

- If you pass away during the policy term, your loved ones receive the death benefit as a tax-free payment.

Term life insurance tends to be the most affordable type of policy. And it allows you to adjust the amount of insurance coverage to what you need as your life changes over time.

Example

Not sure how much this will cost you? Our life insurance calculator lets you input your remaining mortgage balance and monthly payments to help figure out exactly how much life insurance you need, and what it’ll cost you per month.

Life insurance is actually more affordable than you may think, especially with PolicyMe. We’ve used technology to cut inefficient steps and costs from the application process, which lets us offer some of the lowest rates in Canada.

Top 5 Cheapest States For Homeowners Insurance

The least expensive states for homeowners insurance are Hawaii, New Jersey, Oregon, Utah, and New Hampshire. The average annual premium in these states is $855 around 45% less than the national average.

| State |

|---|

| $81 |

Your rates may be higher if you need extra coverage

Keep in mind the above rates dont tell the full story, as they dont take into account coverage add-ons or separate policies you may need to purchase for protection against earthquakes, wildfires, hurricanes, or windstorms.

For example, while rates are extremely low in Hawaii, this doesnt factor in the cost of separate hurricane insurance youll be required to purchase if you have a mortgage.

And homeowners in Oregon who live in areas at high risk of wildfires may be denied coverage from a standard home insurance company altogether. In this case, youd be forced to find coverage through a specialty insurer or the Oregon FAIR Plan, which are both typically more expensive.

Recommended Reading: How Do I Know If My Mortgage Is Fha

Do I Need Condo Insurance For Airbnb

The simple answer is yes. While Airbnb does provide host protection, it may not be enough. You should always contact your insurance provider and your condo corporation before listing your property on the platform. Not all home insurance providers offer short-term rental insurance, so you may need to find a new insurer before you start making some income.

How To Get Rid Of Pmi

If you opt for BPMI when you close your loan, you can write to your lender in order to avoid paying it once you reach 20% equity. If you’re a Rocket Mortgage® client, you can avoid the process of finding a stamp altogether and just give us a call at 508-0944.

Your letter should be sent to your mortgage servicer and include the reason you believe youre eligible for cancellation. Reasons for cancellation include the following:

- Reaching 20% equity in your home.

- Based on significant improvements to your home. If youve made home improvements that substantially increase the value of your home, you can have mortgage insurance removed. If your loan is owned by Fannie Mae, you must have 25% equity or more. The Freddie Mac requirement is still 20%.

- Based on increases in your home value not related to home improvements. If youre requesting removal of your mortgage insurance based on natural increases in your property value due to market conditions, Fannie Mae and Freddie Mac require you to have 25% equity if the request is made 2 5 years after you close on your loan. After 5 years, you only have to have 20% equity. In any case, youll be paying for BPMI for at least 2 years.

For your request to cancel mortgage insurance to be honored, you have to be current on your mortgage payments and an appraisal has to be done to verify property value.

You May Like: How To Take Out A 2nd Mortgage

Does Where You Live Affect Your Insurance Premiums

Is there a price difference between home insurance in Ontario and home insurance in British Columbia? There most certainly is. Where you live in Canada will have a bearing on your premiums, but its not as simple as looking up rates in your province.

While its true that rates in Ontario are generally higher than rates in B.C., home insurance quotes do get a lot more specific than that. The precise region, city and neighbourhood you live in can affect your premiums. A home in a dense urban area of Toronto, for example, may be seen as more of a risk than a home in the Ontarian countryside, so the insurance rate might be higher. On the other hand, if the house in the country is in an earthquake zone, the home owner may need to pay for additional earthquake coverage.

How To Calculate Pmi

Example 1: Calculating PMI cost with PMI rate

Assuming you want to purchase a home for $100,000 and you can make a $12,000 down payment. You can calculate your PMI amount as follows:

Step 1 â Determine your loan-to-value ratio.

LTV = mortgage loan / home purchase priceMortgage loan = $100,000 â $12,000 = $88,000LTV = $88,000 / $100,000 = 0.88LTV = 0.88 * 100 = 88%

It means you have 88% of the home amount left to pay off.

Step 2 â Multiply the mortgage loan amount by your specific PMI rate according to the lender’s chart. You can look up the PMI rate or ask your lender directly. Let’s assume your LTV of 88% tallies a PMI of 1.2 %.

PMI = $88,000 * 1.2/100

You will owe an annual PMI of $1,056.

Step 3 â Divide annual PMI by 12 to find the monthly PMI amount.

Monthly PMI = $1,056 / 12

Monthly PMI = $88

Example 2: How Credit score, LTV, and Adjustments can affect PMI cost

Two friends, Clyde and Trent, each wants to buy homes valued at $500,000 and $200,000, respectively. Clyde is purchasing the house as his second home, and he can make a down payment of 5% of the purchase price. While Trent is buying the house as an investment, and he can make a 10% down payment.

- We can assume Trent will get a better deal on PMI rate than Clyde based on his down payments or LTV ratio.

But if Clyde has a FICO credit score of 720 and Trent has a credit score of 630, their PMI can differ significantly depending on how the mortgage insurer prices the policy.

The OMNInsure PMI chart

Recommended Reading: Does Mortgage Pre Approval Cost Money