How Many Bank Statements Do Mortgage Lenders Require

Lenders typically request two months of statements for each of your bank, brokerage, and investment accounts.

Deposits made into your accounts prior to the most recent two months asset statement are considered seasoned and do not have to be sourced. The seasoning requirement for most lenders is typically statements covering the most recent 60 days prior to closing.

Theyre looking for where the cash came from, to determine whether you have received a gift or some other factor that will make you look good at that point in time but wont be available in the future to help you make your required mortgage payments.

The source of your funds is not necessarily where the funds are transferred from a savings account into a checking account, but they will look for more verification that the funds have been in your account, and can be documented on the most recent two months statements.

Deposits made into your account prior to the most recent two months asset statement are considered seasoned and do not have to be sourced. The seasoning requirement for most lenders is typically statements covering the most recent 60 days prior to closing.

What Credit Score Do I Need For A Bank Statement Loan

A credit score is one of the basic bank statement loan requirements for every lender.

Having a higher credit score is a good way to improve the chances of approval and keep your interest rates low on any type of mortgage including a bank statement loan. In order to qualify for bank statement loans with Griffin Funding, borrowers need a credit score of 620 or higher.

One Month Bank Statement Loans

In some cases it may be possible to use one months bank statements to get approved.

This loan type has more strict credit and down payment restrictions than other comparable bank statement loans.

For the one month bank statement loan: minimum 650 credit, 25% down payment , 30% equity , and no mortgage delinquency in the most recent 5 years.

In addition there can be zero NSFs on the month provided and year-to-date.

Lastly, there is zero tolerance for any new charge-offs, collections, or tax liens in the most recent 3 years for the one month bank statement loan program.

That program is meant to provide simplicity for the well qualified borrower.

In Summary

A bank statement mortgage loan is a fantastic alternative documentation loan for self-employed or private contractor borrowers.

If you have been told you dont qualify for a mortgage due to unique income circumstances on your tax returns, a bank statement mortgage may be your ticket to accomplish your home ownership goals.

Don’t Miss: What Is Mortgage Debt To Income Ratio

Bank Statements In The Mortgage Process: Printouts Versus Statements

If borrowers provide lenders two months work of bank statement printouts and not actual bank statements, there is no overdraft or YTD overdraft section on most bank statement printouts:

- Bank statement printouts are allowed in lieu of bank statements

- Borrowers need to go to their bank and see a teller

- Ask them to get you 60 days of bank statement printouts

- Borrowers need to get the printouts dated, signed, and stamped by the teller

- As long as there are no overdraft fees or overdrafts on bank printouts, which most do not have, borrowers will be safe during the mortgage approval process

I strongly recommend that all consumers get overdraft protection on all of the bank accounts.

Bank Statement Warning Signs

Overdraft charges

Having a long list of overdraft charges in your account isnt the best indicator that youll be a good borrower. No matter the circumstances, having a history of overdrafts or insufficient funds noted on your statement shows the lender that you might struggle at managing your finances. This isnt always a deal breaker, but an underwriter may request a written explanation.

Large deposits

Another red flag to lenders is when a bank statement has irregular or lump-sum deposits. We need to make sure your funds are coming from an acceptable source. A large deposit is the sum of all deposits, not including payroll, which exceeds 50% of your gross monthly income. So if you earn $5,000/month, then the sum of your deposits must be less than $2,500, otherwise well need to verify each of the deposits. Cash aka mattress money is not acceptable. Gifts and third party loans need to be explained, verified and documented appropriately. Unless you can provide acceptable documentation to paper-trail the large deposit, its likely well disregard those funds, lowering your bank account total of acceptable funds for your down payment.

Also Check: What Is Loan Servicing In Mortgage

What Lenders Look For On Bank Statements For Mortgages

Once you decide you want to get a home loan to buy the home of your dreams, there are a few documents that are always needed no matter what. These documents are your income documents, such as pay stubs, 2 forms of government issued ID , and your asset documents.

Your asset documentation that lenders require can vary depending on the loan program. You may only need just two most recent months of your main bank account for loans such as conventional or jumbo loans, or you may need 2 months of household bank statements for everyone over the age of 18 to qualify for a USDA loan.

Your bank statements tell a lender a lot about you as a prospective borrower. And fortunately, or unfortunately, your bank statements can tell a mortgage lender whether or not your loan should be approved when youre applying for a mortgage.

The underwriter can tell if youll be able to come up with closing costs, whether youre an employed borrower or self employed, how much youre paying to debts like credit cards, and if youll be able to handle the mortgage loans monthly payments.

Additionally, there are chances that the mortgage rates approved for the loan may put the borrower on the bubble, where clean bank statements with funds for closing can be the difference between approval and a statement of denial.

Bank Statements Show Responsibility

Bank Statements Confirm Debt Payments

Bank Statements Confirm Income

Why Do I Need To Provide Documents To Get A Mortgage

Understandably, lenders are unwilling to hand over tens or hundreds of thousands of pounds based on a mortgage in principle alone. So your mortgage application will usually be reviewed by the underwriters to assess the level of risk you pose to the lender. Underwriters run their assessments using the documents you provide as evidence of your finances.

They also need to verify your identity and make sure your deposit came from a legitimate source . Lenders must carry out all these checks to make sure theyre being a responsible lender.

Don’t Miss: Why Is My Mortgage So High

Bank Statement Loan Success Story

If youre self-employed, your income is typically difficult to document, and you have a significant amount of tax write-offs. This can be problematic when you are looking to buy a home, and it can be tough to qualify for a traditional home loan. However, bank statement programs allow mortgage lenders to make loans without having to follow the traditional route of providing tax returns. This type of loan is great for people who are self-employed, independent contractors, or those who earn a seasonal income. These would-be home buyers are often more qualified than salaried employees, but their tax returns are far from run-of-the-mill.

Ricardo is an excellent example of how a bank statement loan can help someone who is self-employed or who owns their own business. Ricardo, as a successful self-employed construction worker, he had a healthy and regular income each month, but after writing off his expenses, he was unable to report sufficient income to qualify for a traditional loan.

Thanks to a bank statement lending program, Ricardo was able to apply for a bank statement loan without having to show his tax returns, which meant that his business write-offs were not a problem. Ricardos monthly income bank deposits over the past 12 months were enough to qualify him for a bank statement loan. His bank statement showed:

- : $5,250

- May: $9,500

- : $5,300

What Do Mortgage Lenders Look For In Your Banking History

Below are the basics of your mortgage affordability and the key things lenders will look at in your bank statements.

- Confirm your income

Your mortgage lender will want to confirm the source, frequency and value of your income from your bank statements that contain your salary or other income sources.

Theyll also cross-reference your cashflow figures to your mortgage application, your latest P60 and 3 months of payslips.

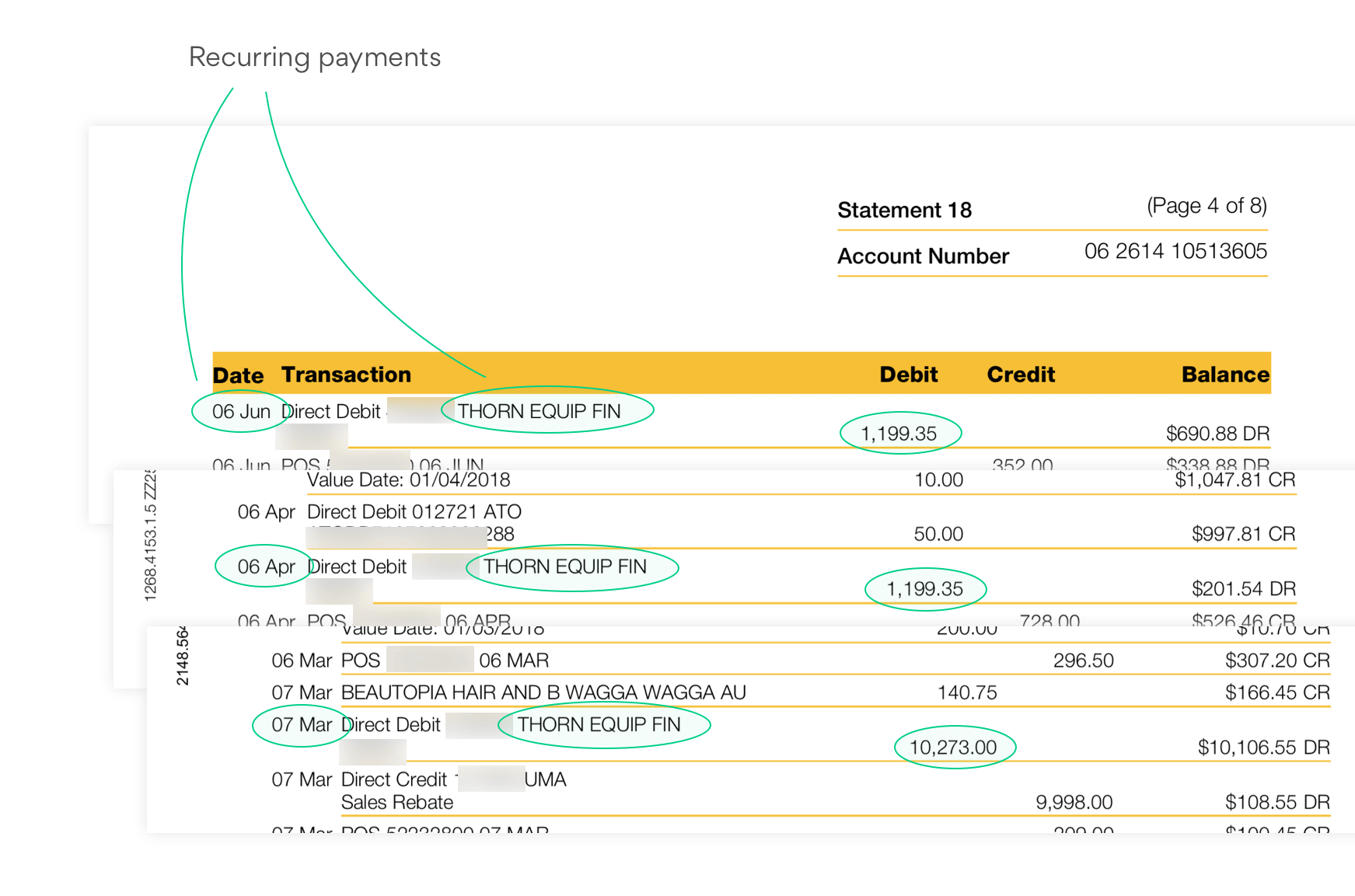

- Confirm your regular outgoings

Underwriters will look at any direct debits, financial commitments or regular spending habits from month to month in your bank statements to help calculate whether your mortgage is affordable.

- Verify your source of deposit

Your mortgage lender will want to confirm that your house deposit originates from your own funds or from a disclosed and verified source. If they see that its appeared in your account as a lump sum within the last few months and you havent disclosed this, theyll need to ask questions.

Its ok to get your deposit from a close family member, but you need to disclose this as a gifted deposit to your mortgage lender.

And you may also need to provide a signed gift letter from the person helping with your deposit, confirming that its not a loan and that they wont own part of your home.

Note: Gifted deposits are fine from close family, but when theyre from distant family members or friends, banks need to do extra checks to verify the source and legitimacy of the funds.

Read Also: What’s Happening With Mortgage Interest Rates

If You Meet The Following Criteria You May Be Eligible For A Bank Statement Loan:

- You must have been a business owner or self-employed for at least two years.

- You must have at least 10% down , as well as a 35% down payment for two-month bank statements.

- You must have four months of PITI reserves in the bank for loan amounts under $1 million and six months for loan amounts over $1 million.

- You may qualify with as little as 2-months bank statements.

- You must have a credit score of 620 or above to qualify.

- The minimum loan amount is $100,000, and the maximum loan is $5,000,000.

Think you qualify for a loan? Contact us today to find out!Contact Us

Think you qualify for a loan? Contact us today to find out!

How Long Should You Keep Your Mortgage Statements

The amount of time that you want to retain your mortgage documents depends on the item.

You should keep monthly statements for the shortest amount of time. Because the information on these statements gets outdated quickly, you dont need to keep them for long.

Most homeowners typically keep their statements for about 3 years. Even though your lender will have copies of your monthly billing statements, its a good idea to have the physical ones on hand. You may want to keep each one for a longer period of time if you notice a mistake on one of your statements. Rocket Mortgage® clients can access their statements online as well.

You should hold onto your Closing Disclosure, deed and promissory note as long as you have a mortgage loan. These documents tell you important information about your loan and property you may want to refer to them later. If you really want to get rid of your personal copy of your deed, make sure that you have a document labeled release or certificate of satisfaction. You can verify this with your title insurance company.

There are some documents that you should keep indefinitely. Hang onto your purchase contract, records of any renovations you make on your home and your home inspection. These contain important information on your propertys condition and can be invaluable when you sell your home or do maintenance. Keep your warranty until it expires.

Read Also: When Is A Mortgage Payment Considered Late

If Your Deposit Is A Gift

When you apply, youll need to let us know if someone has gifted you money in the last year. If your gift is more than £10,000, well need you to fill in a gifted deposit form. The person gifting you the money, also called the donor, may have to provide us with bank statements to prove that the deposit amount came from their account.

The number of bank statements well need to see depends on where your donors savings account is:

- Within the UK we wont need any statements.

- Within the European Economic Area well need 3 months of statements.

- Outside of the UK and EEA well need 6 months of statements.

Issues On Bank Statements Than Can Trigger Mortgage Rejection

If your finances dont convince the lender that your mortgage will be affordable or you dont have enough deposit, theres a good chance they will reject your application.

Mortgages can also be declined if the following is evident from the applicants statements

- Untraceable cash deposits: These are a big no-no for most mortgage lenders due to the potential risk of money laundering

- Employer-gifted deposits: Again, due to the risks of fraudulent activity

- Funds from overseas savings: It can be harder for mortgage providers to trace the origin of overseas savings, although some can be more flexible

- Gambling funds: While its possible to use gambling winning for a mortgage deposit, regular evidence of gambling on your bank statements will likely be treated with more suspicion

- Payday loan use: It can be much more difficult to get a mortgage after a payday loan, even if theyve already been paid off. Evidence of other forms of unsecured borrowing are also risky, but some providers can be more flexible

We know It’s important for you have complete confidence in our service, and trust that you’re getting the best chance of mortgage approval. We guarantee to get your mortgage approved where others can’t – or we’ll give you £100*

You May Like: How Much Per Month Is A 400 000 Mortgage

How Many Bank Statements Do I Need To Provide

Youll usually need to provide at least two bank statements. Lenders ask for more than one statement because they want to be sure you havent taken out a loan or borrowed money from someone to be able to qualify for your home loan. Two is typically the recommended number because any loans you take out beyond a 2-month timespan will have already shown up on your credit report.

A Bank Vod Wont Solve All Bank Statement Issues

Verifications of Deposit, or VODs, are forms that lenders can use in lieu of bank statements. You sign an authorization allowing your banking institution to hand-complete the form, which indicates the account owner and its current balance.

VODs have been used to get around bank statement rules for years. But dont count on them to solve the above-mentioned issues.

- First, the lender can request an actual bank statement and disregard the VOD, if it suspects potential issues

- Second, depositories are also required to list the accounts average balance. Thats likely to expose recent large deposits

For instance, if the current balance is $10,000 and the two-month average balance is $2,000, there was probably a very recent and substantial deposit.

In addition, theres a field in which the bank is asked to include any additional information which may be of assistance in determination of creditworthiness.

Thats where your NSFs might be listed.

There are good reasons to double-check your bank statements and your application before sending them to your lender. The bottom line is that you dont just want to be honest you want to avoid appearing dishonest.

Your lender wont turn a blind eye to anything it finds suspicious.

Read Also: How To Find A Mortgage Broker

Maintaining A Clean Bank Statement

How many months

When applying for a loan, we will request two months bank statements. We will ask for all pages, including the junk pages. If your statement says page 1 of 4, then we will require all 4 of the pages. Online statements are acceptable but screenshots are not.

Multiple account holders

Is your bank account held jointly? Is there somebody listed on the account that is not on the loan you are applying for? If so, well need a joint access letter from the other account holder stating that you has 100% access to all funds in the account.

Transfers from other accounts

The best thing you can do is limit the transfers. Any account you are transferring money from will have to be verified, especially if the transfers are large*. If you introduce another account, well need two months of that statement. If you have large transfers into this new account, well need to verify where those funds came from as well. The best thing you can do is limit the transfers over a 60 day period. *More on large deposits below.

How Do Mortgage Companies Verify Bank Statements

Taking out a mortgage is one of the biggest financial decisions youll ever make. To ensure that the process not only goes smoothly but that you successfully minimize the risk of default, lenders often request several financial documents before approving your loan.

Some of the information that they require pertains to your bank account and your savings account. But just how do mortgage companies verify bank statements and what do they hope to find there?

Recommended Reading: Are Online Mortgage Calculators Accurate

How Many Months Of Bank Statements For A Mortgage Do I Need To Provide

Typically, youll need to provide 2 months of your most recent statements for any account you plan to use to help you qualify. If the account doesnt send monthly reports, youll use the most recent quarterly statement.

Why do you need multiple statements? Lenders want to be sure that the money in the account belongs to you, and that you havent taken out a loan or borrowed money from someone to be able to qualify for the mortgage. If the money has been in the account for a couple of months, they assume that it belongs to you, as any loans you took out beyond the 2-month time span will have already shown up on your credit report. If any large, unexplained deposits appear on the bank statements you provide, youll need to be able to prove they came from an acceptable source.

Its all about ensuring you arent too risky for the lender to give you a mortgage. If potential borrowers are trying to make it look like theyre better qualified to handle a mortgage than they actually are, lenders want to know about it.

Although 2 months worth of statements is a fairly standard guideline, you may be required to provide between 6 12 months worth of statements if youre taking cash out with a higher debt-to-income ratio , if its a property with more than 1 unit or if its a jumbo loan. Finally, more statements may be required if the property is a second home or investment property.

A Home Loan Expert will be able to walk you through whats required.