Some Lenders Also Offer Negative Mortgage Points

You also have the option with some lenders to apply negative points to your mortgage. Essentially, this means you increase your interest rate in order to get a credit you can use to cover closing costs.

For example, if you were taking out a $250,000 mortgage and you applied a negative mortgage point, your interest rate might rise from 3.00% to 3.25% — but you would get a $2,500 credit to cover costs at closing.

While negative points make your home cost more over time, they can sometimes make it possible to afford to close on a home when you otherwise would be tight on cash. Just be aware that it’s a costly option.

In the above example where you raised your rate from 3.00% to 3.25%, your $250,000 loan would result in a monthly payment of $1,088 and the total cost of your mortgage would be $391,686.

Compare that with a monthly payment of $1,054 and a total cost of $379,444 if you hadn’t applied negative points. You’d pay $34 more each month and $12,242 more over 30 years in exchange for having gotten $2,500 up front.

Advantages Of Buying Mortgage Points

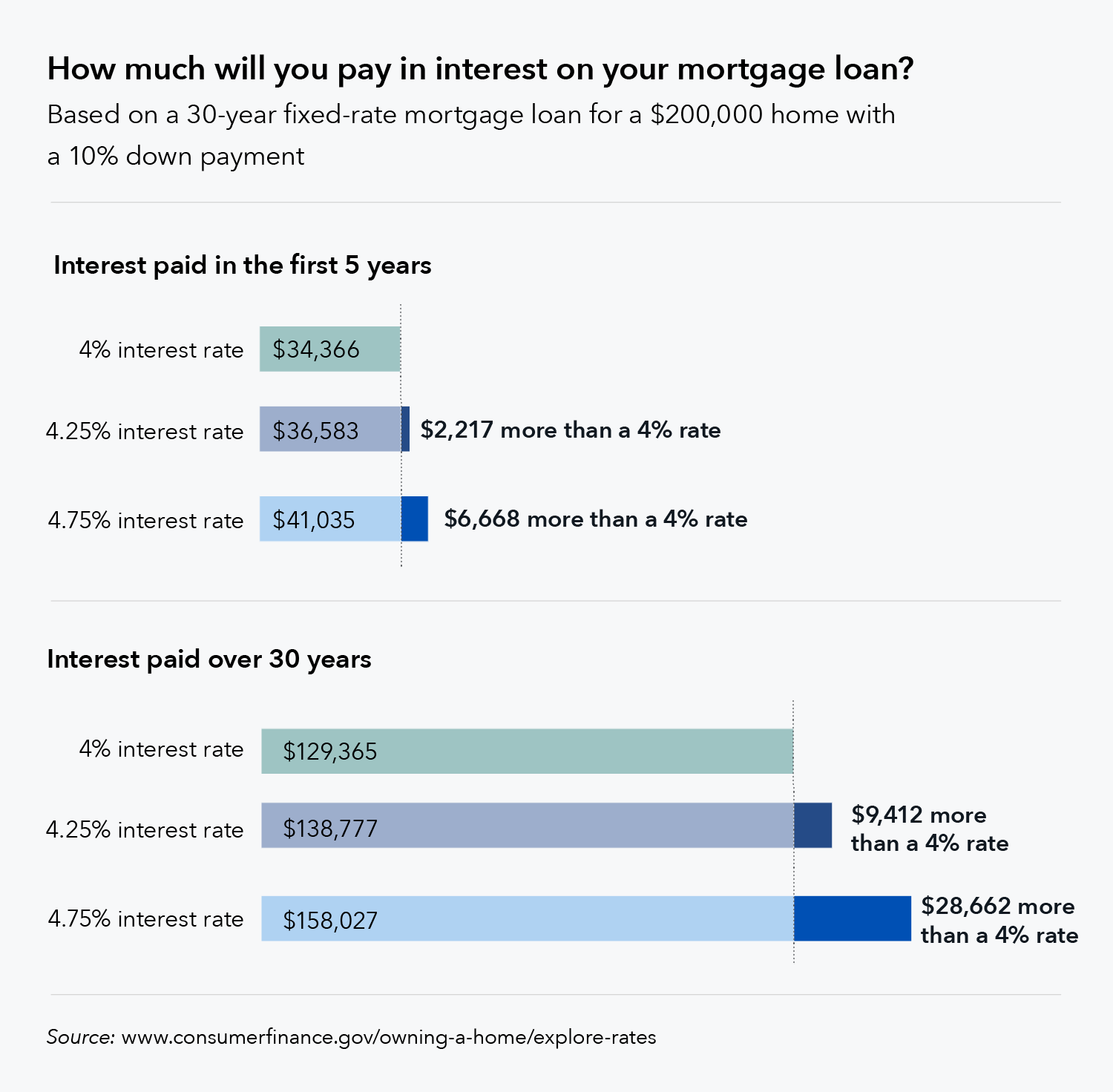

The biggest advantage of purchasing points is that you get a lower rate on your mortgage loan, regardless of your credit score. Lower rates can save you money on both your monthly mortgage payments and total interest payments for the life of the loan.

- If your income is too low for you to qualify for the house you want, you may be able to qualify with a reduced interest rate and payment

- If you have the cash available, or if you can convince a home seller to pay discount points for you, buying down your rate may help you qualify for your mortgage loan

- Purchasing points can save you money over the life of the loan, but typically when you dont sell or obtain a mortgage refinance for enough year to break even

- Understand, though, that the upfront cost of mortgage points can be substantial

How To Calculate Discount Points On A Va Mortgage

Say you’re preapproved for a 30-year VA loan of $250,000 at 5% and you buy 2 discount points. Again, those points usually cost 1% of your loan and lower your rate by 0.25%. In this case, 2 points would cost $5,000 and bring your rate down to 4.5%. That small-rate change would change your monthly payment from $1,342 to $1,266 and save you $26,864 in interest over the 30-year life of the loan.

To decide if it’s worth it, you’d want to be sure you kept the loan long enough to recoup that $5,000. Since you’re saving $76 per month , it will take you 66 months to break even on those discount points. If you don’t plan to refinance or move before then, it’s probably worth it.

Don’t Miss: How To Calculate Monthly Mortgage Payment

Are Mortgage Points Tax

Mortgage discount points, which are prepaid interest, are tax-deductible on up to $750,000 of mortgage debt for homeowners who bought property after Dec. 5, 2017, or up to $1 million for those who purchased before that date. Taxpayers who claim a deduction for mortgage interest and discount points must list the deduction on Schedule A of Form 1040.

That generally isnt a problem for homebuyers, as interest on your mortgage often is enough to make it more beneficial to itemize your deductions rather than taking the standard deduction, says Boies.

However, unless you can meet a host of IRS requirements, you cant take a deduction for all of the points you paid in the same tax year. Each year, you can deduct only the amount of interest that applies as mortgage interest for that year. The points are deducted over the life of the loan, rather than all in one year.

Origination points, on the other hand, are not tax-deductible.

Points that are not interest but are charges for services such as preparing the mortgage, your appraisal fee or notary fees cant be deducted, says Boies.

Consult a tax professional if youre not sure what home-buying expenses are tax-deductible.

Are Mortgage Points Worth It

Though money paid on discount points could be invested in the stock market to generate a higher return than the amount saved by paying for the points, the average homeowner’s fear of getting into a mortgage they can’t afford outweighs the potential benefit they may accrue if they managed to select the right investment. In many cases, paying off the mortgage is more important.

Also, keep in mind the motivation behind purchasing a home. Though most people hope to see their residence increase in value, few people purchase their home strictly as an investment. From an investment perspective, if your home triples in value, you may be unlikely to sell it for the simple reason that you then would need to find somewhere else to live.

If your home gains in value, it is likely that most of the other homes in your area will increase in value as well. If that is the case, selling your home will give you only enough money to purchase another home for nearly the same price. Also, if you take the full 30 years to pay off your mortgage, you will likely have paid nearly triple the home’s original selling price in principal and interest costs and, therefore, you won’t make much in the way of real profit if you sell at the higher price.

Don’t Miss: How To Lower Your Mortgage

How Much Does One Mortgage Point Reduce The Rate

When you buy one discount point, youll pay a fee of 1% of the mortgage amount. As a result, the lender typically cuts the interest rate by 0.25%.

But one point can reduce the rate more or less than that. Theres no set amount for how much a discount point will reduce the rate. The effect of a discount point varies by the lender, type of loan and prevailing rates, as mortgage rates fluctuate daily.

Buying points doesn’t always mean paying exactly 1% of the loan amount. For example, you might be able to pay half a point, or 0.5% of the loan amount. That typically would reduce the interest rate by 0.125%. Or you might be given the option of paying one-and-a-half points or two points to cut the interest rate more.

Mortgage Calculator: Should I Buy Points

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Recommended Reading: How Much Time Is Left On My Mortgage

Are Mortgage Points Right For You

Buying mortgage points is a way to pay upfront to lower the overall cost of your loan. It makes the most sense if you plan to be in the home for a long period of time. The amount youll save each month is likely to make the upfront cost worth it.

For many borrowers, however, paying for discount points on top of the other costs of buying a home is too big of a financial stretch, and buying points might not always be the best strategy for lowering interest costs.

It may make financial sense to apply these funds to a larger down payment, says Boies.

A bigger down payment can get you a better interest rate because it lowers your loan-to-value ratio, or LTV, which is the size of your mortgage compared with the value of the home.

Borrowers should consider all the factors that could determine how long they plan to stay in the home, such as the size and location of the property and their job situation, then figure out how long it would take them to break even before buying mortgage points.

What Is A Good Apr On A 30 Year Mortgage

What are today’s 30-year fixed mortgage rates? As of Tuesday, February 15, 2022, according to Bankrate’s latest survey of the nation’s largest mortgage lenders, the average 30-year fixed mortgage rate is 4,200% with an APR of 4,190%. The average 30-year fixed mortgage refinancing rate is 4,220% with an APR of 4,200%.

What is considered a good APR for a mortgage?

A low credit card APR for someone with excellent credit might be 12%, while a good APR for someone with more or less credit might be in their teens. If good means best available, it will be about 12% for credit card debt and about 3.5% for a 30-year mortgage.

Is a 2.75 interest rate good?

Is 2.875 a good mortgage rate? Yes, 2.875 percent is an excellent mortgage rate. It’s just a fraction of a percentage point higher than the lowest mortgage rate ever recorded on a 30-year fixed-rate loan.

Is 3.8 a good interest rate?

Anything at or below 3% is an excellent mortgage rate. If you get the same mortgage, but at a rate of 3.8%, you will be paying a total of $169,362 in interest over a 30-year payment term. As you can see, just one percentage point can save you nearly $50,000 in interest payments for your mortgage.

You May Like: When Is The Best Time To Close On A Mortgage

Mortgage Points: The Bottom Line

Homebuyers can lower their interest rate and pay less each month and over the life of their loan through mortgage points. Even so, buyers who plan to relocate or refinance soon should restrategize since they may not have enough time to break even and start saving.

Bear in mind that points also raise closing expenses. As such, if youre a home buyer paying points, be ready for the increased upfront fees. All in all, as long as a borrower has cash on hand, paying points can be a good method to save money if they plan on staying on their property for a long time.

Should You Pay For Discount Points

There are two primary factors to weigh when considering whether or not to pay for discount points. The first involves the length of time that you expect to live in the house. In general, the longer you plan to stay, the bigger your savings if you purchase discount points. Consider the following example for a 30-year loan:

- On a $100,000 mortgage with an interest rate of 3%, your monthly payment for principal and interest is $421 per month.

- With the purchase of three discount points, your interest rate would be 2.75%, and your monthly payment would be $382 per month.

You May Like: Is 730 A Good Credit Score For Mortgage

Upsides And Downsides To Paying Discount Points

Again, by lowering your interest rate, your monthly mortgage payments also go down. So, you’ll have extra money available each month to spend on other things. Also, if you pay for discount points and itemize your taxes, you can deduct the amount at tax time .

But the money you pay for points, like the $3,000 paid in the above example, might be better used or invested somewhere else. So, be sure to consider whether your expected savings will exceed what you might get by investing elsewhere.

What You Need to Knowand DoBefore Taking Out a Mortgage

Getting a mortgage isn’t too difficult, but it will involve some effort on your part. If you’re planning on taking out a loan to buy a home, you can take certain steps to ensure the process goes smoothly and that you fully understand the transaction.

Instead of buying points, some borrowers choose to make a larger down payment to lower the monthly payment amount. In some cases, making a down payment large enough so that you can avoid paying for private mortgage insurance might be money better spent than using your money on points.

Also, a larger down payment helps you build equity faster. However, buying mortgage rate pointsboth discount points and origination pointswon’t increase your equity in the home. Or, you could choose to make extra payments on your mortgage to build equity in your home quicker and pay off the mortgage early.

Who Would Most Likely Obtain A Blanket Mortgage

Lenders prefer borrowers with a higher down payment , a higher credit score, and a lower debt-to-income ratio. This may interest you : How much is a discount point worth?. The term for a general loan can be from 2 to 30 years.

How does a collective loan work? A general mortgage allows you to buy or refinance multiple homes under one loan so that each property can receive the same financing terms. Instead of paying all at once, you can be released from liability for individual properties as they are sold or refinanced on different terms.

Read Also: What Is Current Interest Rate On 15 Year Mortgage

Crucial Things To Know About Buying Mortgage Points

What Are Mortgage Points?

What are the benefits and drawbacks of buying mortgage points?

How can I benefit from mortgage points?

Are there any disadvantages of purchasing mortgage points?

Should You Buy Mortgage Points?

When do you reach break-even?

What percentage of your monthly payment can you reduce?

FAQ about Mortgage Points

How many points are you allowed to purchase?

The Bottom Line?

What Are Mortgage Points And How Do They Work

8 Min Read | Jun 21, 2022

Mortgage points are kind of like free throws in a basketball game. And points are how you win the game, so you want as many as you can get, right? Turns out, these points come at a cost. And its not always worth it.

Mortgage points can be super confusing, which makes it really hard to know whether or not theyre a smart choice for you. Are they really a money-saving deal?

Since buying a home is one of the most expensive purchases you might ever make, weve found out everything you ever wanted to know about mortgage points.

You May Like: Which Mortgage Lender Should I Use

Types Of Mortgage Points

So what types of points are we playing for here? Just like with basketball , there are different types of mortgage points: origination points and discount points.

Lets get origination points out of the way . This type of mortgage point is basically a fee that doesnt lower your interest rate. It just pays your loan originator. Trust us, youre better off paying out-of-pocket for their service. Skip origination points.

Next up , lets talk discount points. Lenders offer mortgage discount points as a way to lower your interest rate when you take out a mortgage loan. The price you pay for points directly impacts the total interest of the loan. And the more points you pay, the lower the interest rate goes.

That might sound all sunshine and roses at first, but get thisits going down because youre prepaying the interest. In reality, youre just paying part of it at the beginning instead of paying it over the life of the loan.

Are There Limits On Buydowns

If youre interested in a mortgage buydown, you should consult a lender, as some restrictions apply. Buydowns are only eligible when purchasing or refinancing primary residences and second homes. Typically, buyers must qualify for the standard interest rate of the zero-point loan to be able to buy down a home loan.

Read Also: Is Sebonic A Good Mortgage Company

Improve Your Credit To Save Money

Your credit scores can greatly affect your ability to get a mortgage and the interest rate you’ll receive on a new loan or when refinancing. You can check one of your credit scores, a FICO® Score 8, for free from Experian.

However, mortgage lenders will likely use different FICO® Scores to evaluate your application. With Experian CreditWorks Premium, which charges a monthly fee, you can also view the FICO® Score 2 score based on your Experian credit file as well as the factors affecting it. You can then start using this information to improve your credit scores and get your .

Is A Blanket Loan A Good Idea

The main advantage of general mortgages over conventional loans is that they can help preserve your cash flow as an investor. In that case, you only have to worry about paying a set of closing costs, where you would have to pay the closing costs at a time with individual mortgages.

Are blanket loans good?

One of the main benefits of a general mortgage is that it allows the borrower to have more cash on hand for example, a homeowner can save on the costs associated with applying for and closing multiple mortgages. Pitfalls for general mortgages include higher average costs than a traditional mortgage.

Is it hard to get a blanket mortgage?

Not all lenders offer them, but it can be much more difficult to find a good deal on a general mortgage. For starters, many lenders don’t offer them. You should explore your options with portfolio lenders as well as traditional and commercial banks.

Recommended Reading: How Much Is The Average Monthly Mortgage

When To Buy Mortgage Points

Buying mortgage points might make sense if any of the following situations apply to you:

- You want to stay in your home for a long time. The longer you stay in your home, the more it makes sense to invest in points and a lower mortgage rate. If youre sure youll have the same mortgage for the long haul, mortgage points can lessen the overall cost of the loan. The longer you stick with the same loan, the more money youll save with discount points.

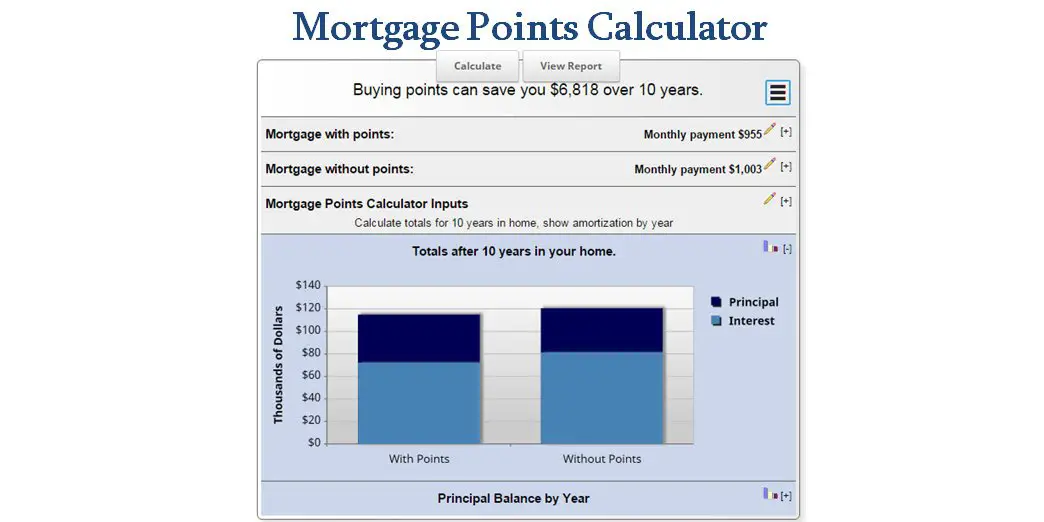

- Youve determined when the breakeven point is. Do some math to figure out when the upfront cost of the points will be eclipsed by the lower mortgage payments. If the timing is right and you know you wont move or refinance before you hit the breakeven point, you should consider buying points.

How do you calculate that breakeven point, you ask? Lets run through a quick example using the numbers referenced earlier.

If you have a $200,000 loan amount, going from a 4.125% interest rate to a 3.75% interest rate saves you $43.07 per month. As mentioned earlier, the cost of 1.75 points on a $200,000 loan amount is $3,500. If you divide the upfront cost of the points by your monthly savings, youll find that your breakeven point is about 82 months , which is equal to roughly 6 years and 10 months. So, if you plan to stay in your house for longer than that amount of time and pay off your loan according to the original schedule, it makes sense to buy the points because youll save money in the long run.