Structural Mortgage Market Shifts: Increasing Loan Duration & Explicit Government Backing

While the stamp duty holiday was widely discussed, the UK also pushed through other structural shifts to the mortgage market in the wake of the COVID-19 crisis.

“In the UK, usually the longest term fixed mortgage you could normally get was five years. Boris Johnson has now. Nobody can pretend that this has anything to do with Covid, and in fact when Johnson announced it, his stated aim was to give young people access onto the housing ladder. This is a good example of how the magic money tree was discovered for Purpose A, i.e. Covid, and is being used for Purpose B, furthering social justice.” – Russell Napier

When governments guarantee loans they lower the risk of making the loans, which in turn increases the flow of capital into the associated market. That typically leads to faster appreciation.

Programs created to “help” people get into the market are initially effective, but after prices adjust to reflect said capital shifts and risk-free profits the market becomes structurally dependent on such programs & the incremental help they offer declines as prices rise.

The property market has been frenzied throughout the first half of 2021 with Rightmove stating the first half of the year has been the busiest since 2000. Average home prices across England, Wales and Scotland rose to £338,447, an increase of £21,389 or 6.7% since the end of 2020.

Whats My Minimum Down Payment

Yourminimum down paymentdepends on the purchase price of your property.

- If your purchase price is under $500,000, your minimum down payment is 5% of the purchase price.

- If your purchase price is $500,000 to $999,999, your minimum down payment is 5% of the first $500,000, plus 10% of the remaining portion.

- If your purchase price is $1,000,000 or more, your minimum down payment is 20% of the purchase price.

If youreself-employedor havepoor credit, your lender may require a higher down payment.

What Happens If You Skip A Payment

Skipping a mortgage payment doesn’t mean that the lender is giving it to you for free. Skipping a payment just means that you’ll be paying it back later. When you skip a mortgage payment, interest that would have been charged would be added to your mortgage balance instead of being paid off. This increases your mortgage balance, which means that you’ll be paying interest on your added interest.

If you dont repay the skipped mortgage amount plus accumulated interest, then youll be paying interest on the interest for the rest of your mortgages amortization. This could make skipping a mortgage payment a very costly option to take. Fortunately, many lenders allow you to repay your skipped payments without any prepayment penalties.

Recommended Reading: Monthly Mortgage On 1 Million

Get A More Accurate Estimate

Get pre-qualified by a lender to see an even more accurate estimate of your monthly mortgage payment.

-

How much house can you afford? Use our affordability calculator to estimate what you can comfortably spend on your new home.

- Pig

Interested in refinancing your existing mortgage? Use our refinance calculator to see if refinancing makes sense for you.

- Dollar Sign

Your debt-to-income ratio helps determine if you would qualify for a mortgage. Use our DTI calculator to see if you’re in the right range.

- Award Ribbon VA mortgage calculator

Use our VA home loan calculator to estimate payments for a VA loan for qualifying veterans, active military, and military families.

Participating lenders may pay Zillow Group Marketplace, Inc. a fee to receive consumer contact information, like yours. ZGMI does not recommend or endorse any lender. We display lenders based on their location, customer reviews, and other data supplied by users. For more information on our advertising practices, see ourTerms of Use & Privacy. ZGMI is a licensed mortgage broker,NMLS #1303160. A list of state licenses and disclosures is availablehere.

Where To Get A $ 200000 Mortgage

When you have a number of options it comes with a $ 200,000 mortgage. Here are a few of the most common:

- BanksGet a loan from your local bank. This can be a convenient way to get in-person service. However, be sure to watch out for lender fees, and compare the rates with other options.

- While banks are for-profit, credit unions are not-for-profit financial institutions owned by their members. They often offer lower rates than you would find at banks. But you may need a member to take out a mortgage, and membership can vary for qualifications.

- Online lenders A number of online lenders can lend across the country. Without a brick-and-mortar presence, some online lenders can afford lower rates and fees. But you need to make sure youre comfortable with the online application process and the lenders customer service.

You May Like: Can You Do A Reverse Mortgage On A Condo

Refinance Your Existing Mortgage

A more common and less restrictive way to borrow equity is a cash-out refinance. But like a standard mortgage, cash-out refinances have income and that may be out of reach for older homeowners.

Because a reverse mortgage is designed to convert equity into cash with the home itself as collateral, there generally are no income or credit requirements for borrowers. That makes reverse mortgages more viable for older homeowners.

Which Is Better?Reverse Mortgage vs. Cash-Out Refinance

Benefits Of Cmhc Insurance

Benefits of CMHC Insurance CMHC insurance allows you to make a down payment as low as 5% of the value of the home for homes less than $500,000, or 5% on the first $500,000 and 10% on the remainder for homes over $500,000 and less than $1 million. Since the mortgage is insured, mortgage lenders will often offer lower mortgage rates for insured mortgages.

You May Like: Does Rocket Mortgage Sell Their Loans

Mortgage Insurance Vs Life Insurance

Mortgage life insuranceis an optional insurance policy that you can purchase from your mortgage lender that protects your mortgage balance. If you pass away, a death benefit will be paid to your mortgage lender to pay off some or all of the mortgage balance. If you get a critical illness, disability, or lose a job, youll receive a payout that helps cover some or all of your monthly mortgage payments. In all of these cases, your lender is the one that receives the insurance payouts.

With life insurance, youre purchasing a policy with a beneficiary that you get to choose. You can also choose to purchase a policy with a certain payout benefit, rather than having it tied to the balance of your mortgage.

Mortgage life insurance premiums are based on the borrowers age and the balance of their mortgage. Premiums are charged as a certain rate per $1,000 of mortgage balance. Mortgage life insurance in Canada is completely optional. A lender cant force you to purchase mortgage life insurance, no matter your down payment. However, if you make a down payment less than 20%, your lender can require you to purchase mortgage default insurance.

Mortgage life insurance can be easier to obtain, but having a potential insurance benefit that gradually decreases as you make mortgage payments means that the benefit gets smaller while your insurance premiums stay the same.

My Mortgage Payment Plan

This line graph shows how your mortgage debt decreases over your amortization period. It also shows how much faster you’ll pay off your mortgage by increasing your mortgage payment or payment frequency.

Find out how much you can save by changing your payment frequency.

| Amortization |

|---|

* These calculations are based on the information you provide they are approximate and for information purposes only. Actual payment amounts may differ and will be determined at the time of your application. Please do not rely on this calculator results when making financial decisions please visit your branch or speak to a mortgage specialist. Calculation assumes a fixed mortgage rate. Actual mortgage rates may fluctuate and are subject to change at any time without notice. The maximum amortization for a default insured mortgage is 25 years.

** Creditor Insurance for CIBC Mortgage Loans, underwritten by The Canada Life Assurance Company , can help pay off, reduce your balance or cover your payments, should the unexpected occur. Choose insurance that meets your needs for your CIBC Mortgage Loan to help financially protect against disability, job loss or in the event of your death.

Recommended Reading: Rocket Mortgage Vs Bank

What Would You Like To Do

Your approximate payment is $*.

|

Mortgage default insurance protects your lender if you can’t repay your mortgage loan. You need this insurance if you have a high-ratio mortgage, and its typically added to your mortgage principal. A mortgage is high-ratio when your down payment is less than 20% of the property value. Close. |

|---|

The Three Numbers You’ll Need

There are several factors that go into estimating how much your regular mortgage payments will be. These 3 numbers are particularly important:

1. The total mortgage amount: This is the price of your new home, less the down payment, plus mortgage insurance, if applicable.

2. The amortization period: This is the total life of your mortgage, and the number of years the mortgage payments will be spread across.

3. The mortgage rate: This is the rate of interest you pay on your mortgage.

Recommended Reading: Chase Mortgage Recast

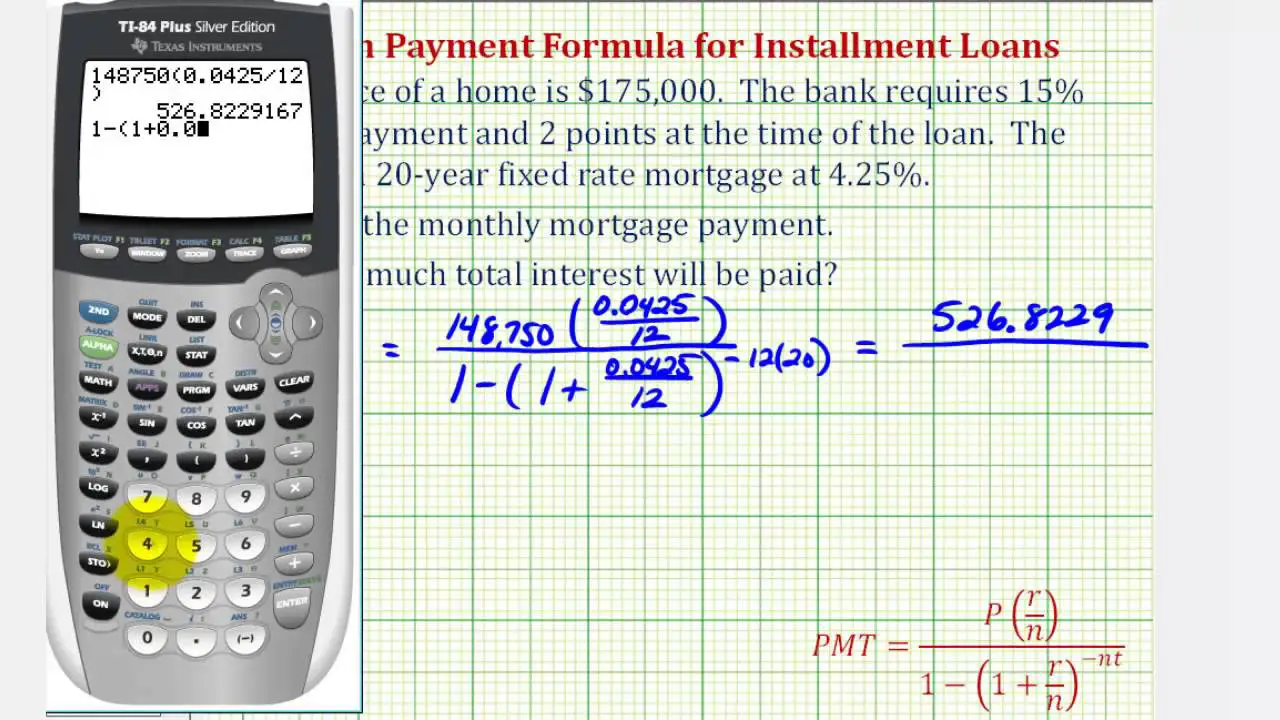

Fixed Monthly Payment Amount

This method helps determine the time required to pay off a loan and is often used to find how fast the debt on a credit card can be repaid. This calculator can also estimate how early a person who has some extra money at the end of each month can pay off their loan. Simply add the extra into the “Monthly Pay” section of the calculator.

It is possible that a calculation may result in a certain monthly payment that is not enough to repay the principal and interest on a loan. This means that interest will accrue at such a pace that repayment of the loan at the given “Monthly Pay” cannot keep up. If so, simply adjust one of the three inputs until a viable result is calculated. Either “Loan Amount” needs to be lower, “Monthly Pay” needs to be higher, or “Interest Rate” needs to be lower.

A Mortgage For Prequalify

Once youre in a good position to buy a home, you can approach a few different lenders with a mortgage. Run a credit check to give your lender a little bit of your personal information. The lender will then let you know the size of the loan you may qualify for and what the interest rate is. Prequalification usually only takes a few minutes.

A prequalification letter is not a lending to a firm, but it does give you a good idea of the mortgage you can afford.

Credible allows you to Multiple lenders from actual prequalified rates at once.

You May Like: Requirements For Mortgage Approval

How To Use The Mortgage Payment Calculator

To use the calculator, start by entering the purchase price, then select an amortization period and mortgage rate. The calculator shows the best rates available in your province, but you can also add a different rate. The calculator will now show you what your mortgage payments will be.

Our calculator also shows you what the land transfer tax will be, and approximately how much cash youll need for closing costs. You can also use the calculator to estimate your total monthly expenses, see what your payments would be if mortgage rates go up, and show what your outstanding balance will be over time.

If youre buying a new home, its a good idea to use the calculator to determine what you can afford before you start looking at real estate listings. If youre renewing or refinancing and know the total amount of the mortgage, use the Renewal or Refinance tab to estimate mortgage payments without accounting for a down payment.

Prevent Your Debt From Growing

A major concern for older Americans is not having saved enough to live comfortably in retirement. A modern retirement survey indicates 29% of seniors expect to outlive their money.

The cash that borrowers receive from a reverse mortgage increases their debt and reduces their equity. Making payments is one way to slow or reverse that equity drain, either to make it last longer or to reduce the amount owed when the loan comes due.

A common strategy is making interest-only payments. Such payments would be more affordable and keep the loan balance from increasing.

Related:How Do Interest-Only Mortgages Work?

Don’t Miss: 10 Year Treasury Yield Mortgage Rates

What Is Mortgage Insurance

Mortgages with adown paymentof less than 20% are required to be insured due to the higher level of risk that they carry. This insurance protects the mortgage lender should you default on the mortgage. Mortgage default insurance does not protect you or help you cover mortgage payments.

The largest provider of mortgage loan insurance in Canada is the Canada Mortgage and Housing Corporation , which is owned by the Government of Canada. Some mortgage lenders allow you to go through a private mortgage insurer instead, such as Canada Guaranty or Sagen.

Consider The Cost Of Homeowners Insurance

Almost every homeowner who takes out a mortgage will be required to pay homeowners insurance another cost that’s often baked into monthly mortgage payments made to the lender.

There are eight different types of homeowners insurance. The insurance policies with a high deductible will typically have a lower monthly premium.

Read Also: Bofa Home Loan Navigator

How To Calculate Mortgage Payments Using Our Calculator

Whether youre shopping around for a mortgage or want to build an amortization table for your current loan, a mortgage calculator can offer insights into your monthly payments. Follow these steps to use the Forbes Advisor mortgage calculator:

1. Enter the home price and down payment amount. Start by adding the total purchase price for the home youre seeking to buy on the left side of the screen. If you dont have a specific house in mind, you can experiment with this number to see how much house you can afford. Likewise, if youre considering making an offer on a home, this calculator can help you determine how much you can afford to offer. Then, add the down payment you expect to make as either a percentage of the purchase price or as a specific amount.

2. Enter your interest rate. If youve already shopped around for a loan and have been offered a range of interest rates, enter one of those values into the interest rate box on the left. If you havent prequalified for an interest rate yet, you can enter the current average mortgage rate as a starting point.

Does Mortgage Payments Include Property Tax

Many mortgage lenders require you to payproperty taxesthrough your lender in your regular mortgage payment, with your lender then paying your municipality. This is because failing to pay your property taxes can lead to your municipality placing a lien on your property, which will be placed in the front-of-the-line before your lender’s claim on your home.

If you pay your property taxes through your lender, then your lender will estimate an amount that would need to be paid every month in order to cover the total amount of property taxes for the entire year. If the amount that the lender collected is not enough to cover the actual property tax due, then the lender will advance the due amounts to the municipality and charge you for the shortfall.

Your lender may charge you interest on the amount of any shortfall. The lender may pay you interest if you have overpaid and have a surplus. Property tax bills or property tax notices are required to be sent to your lender, as failing to send it may mean the collected property tax amounts are not accurate.

Some lenders allow you to pay property taxes on your own. However, they have the right to ask you to provide evidence that you have paid your property tax.

If paying property taxes on your own, your municipality may have different property tax due dates. Property tax might be paid one a year, or in installments through a tax payment plan. Installments might be monthly or semi-annually.

Recommended Reading: Recast Mortgage Chase

Leave Your Home To Heirs Without Debt

Making reverse mortgage monthly payments and reducing the debt owed can make it easier to leave your home to your children or other heirs.

The less thatâs owed on the home when the reverse mortgage comes due, the easier it will be to repay the loan with cash or by refinancing to a standard mortgage â and keep the home.

Most reverse mortgages are repaid with the heirs selling the home because the loan comes due nearly right away, says Joshua Westreich, branch manager at U.S. Mortgage of New Jersey in Glen Rock, New Jersey. Making monthly payments on a reverse mortgage allows borrowers to reduce their debt and be more certain they can leave something of value to their family.

How Much Is Cmhc Insurance

![Mortgage Rates & Payments by Decade [INFOGRAPHIC] Mortgage Rates & Payments by Decade [INFOGRAPHIC]](https://www.mortgageinfoguide.com/wp-content/uploads/mortgage-rates-payments-by-decade-infographic-central-new-jersey.jpeg)

CMHC insurance premiums are a percentage of your mortgage and are paid by your mortgage lender.Provincial sales taxis added to premiums for mortgages located in Ontario, Quebec, Manitoba. and Sadkatachewan.

Premiums start at 2.4% of the mortgage amount for down payments of 20% or less, going up to 4% for a down payment of 5%. While your mortgage lender will pay the insurance premium, they will usually pass this cost indirectly onto you. However, you may still save money after these premiums through lower mortgage rates that insured mortgages usually have.

To find out how much CMHC insurance would cost for your home, visit ourCMHC insurance calculator.

Recommended Reading: How Does The 10 Year Treasury Affect Mortgage Rates