Should I Choose A Long Or Short Loan Term

It depends on your budget and goals. A shorter term will allow you to pay off the loan quicker, pay less interest and build equity faster, but youll have a higher monthly payment. A longer term will have a lower monthly payment because youll pay off the loan over a longer period of time. However, youll pay more in interest.

Mortgage Insurance Vs Life Insurance

Mortgage life insuranceis an optional insurance policy that you can purchase from your mortgage lender that protects your mortgage balance. If you pass away, a death benefit will be paid to your mortgage lender to pay off some or all of the mortgage balance. If you get a critical illness, disability, or lose a job, youll receive a payout that helps cover some or all of your monthly mortgage payments. In all of these cases, your lender is the one that receives the insurance payouts.

With life insurance, youre purchasing a policy with a beneficiary that you get to choose. You can also choose to purchase a policy with a certain payout benefit, rather than having it tied to the balance of your mortgage.

Mortgage life insurance premiums are based on the borrowers age and the balance of their mortgage. Premiums are charged as a certain rate per $1,000 of mortgage balance. Mortgage life insurance in Canada is completely optional. A lender cant force you to purchase mortgage life insurance, no matter your down payment. However, if you make a down payment less than 20%, your lender can require you to purchase mortgage default insurance.

Mortgage life insurance can be easier to obtain, but having a potential insurance benefit that gradually decreases as you make mortgage payments means that the benefit gets smaller while your insurance premiums stay the same.

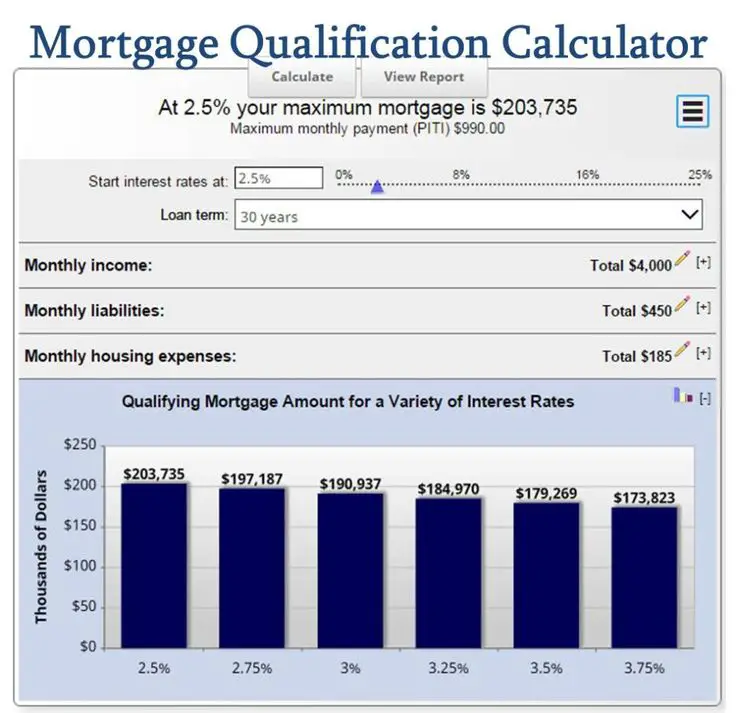

How Much House Can I Afford Calculator

Maximum Mortgage Payment

How Much House You Can AffordBased on a interest rate on a -year fixed mortgage.

Now that you know what you can afford, get your mortgage here or try our full mortgage calculator.

As you can see from our calculator, how much house you can afford really depends on the relationship between your income and mortgage.

To figure out how much mortgage you can afford with your income, different lenders use different guidelinesbut most lenders dish out mortgages that are way too expensive and keep borrowers in debt for decades!

We want to help you buy a home thats a blessing, not a burden. And the only way to do that is to calculate your home-buying budget the smart wayand stick to it!

Thats what our calculator does for you. How does it work? Well show youget ready for some math!

Recommended Reading: Can You Do A Reverse Mortgage On A Mobile Home

Personal Considerations For Homebuyers

A lender could tell you that you can afford a considerable estate, but can you? Remember, the lenders criteria look primarily at your gross pay and other debts. The problem with using gross income is simple: You are factoring in as much as 30% of your paycheckbut what about taxes, FICA deductions, and health insurance premiums, In addition, consider your pre-tax retirement contributions and college savings, if you have children. Even if you get a refund on your tax return, that doesnt help you nowand how much will you get back?

Thats why some financial experts feel its more realistic to think in terms of your net income and that you shouldnt use any more than 25% of your net income on your mortgage payment. Otherwise, while you might be able to pay the mortgage monthly, you could end up house poor.

The costs of paying for and maintaining your home could take up such a large percentage of your incomefar and above the nominal front-end ratiothat you wont have enough money left to cover other discretionary expenses or outstanding debts or to save for retirement or even a rainy day. Whether or not to be house poor is mostly a matter of personal choice getting approved for a mortgage doesnt mean you can afford the payments.

Have A Question About Our Mortgage Calculators

What is a mortgage calculator?

Its a tool that gives you an estimate of how much you could borrow from us or what your monthly repayments and other costs might be, for a mortgage in the UK.

We have different calculators that can help you in different ways each calculator does something slightly different.

Who is a mortgage calculator for?

Its for you if youre a first time buyer, youre looking to remortgage, move or buy an additional home, or youre a buy-to-let landlord.

What information do I need to use a calculator and how do you decide what I can afford?

When you apply for a mortgage or use our calculator, well ask you for information like

- How many people are applying

- Your income

- How much you regularly spend on things like your credit or store cards, loans, overdrafts, maintenance and pension

- Why youre applying for example, buying your first home, moving home, or buying a second home

We wont ask about groceries, utility bills or travel.

How much can I afford to borrow?

Our calculators give you a idea of what you might be able to borrow from us to buy a home, and what your monthly and total mortgage payments could be, for different types of mortgages.

Which mortgage calculator is right for me?

The most popular place to start is our borrowing calculator or our affordability calculator.

Read Also: Chase Recast Calculator

Mortgage Payment Calculator Canada

Looking to take out a mortgage sometime soon? Know what you’ll be signing up for with our mortgage payment calculator. Understanding how much your mortgage payments will be is an important part of getting a mortgage that you can afford to service long term.

The mortgage payment calculator below estimates your monthly payment and amortization schedule for the life of your mortgage. If you’re purchasing a home, our payment calculator allows you to test down payment and amortization scenarios, and compare variable and fixed mortgage rates. It also calculates your mortgage default insurance premiums and land transfer tax. Advertising Disclosure

| Select |

Comparing A $2000 Monthly Payment Frequency

| Payment Frequency | |

|---|---|

| $500 | $26,000 |

Monthly, semi-monthly, bi-weekly, and weekly all add up to the same amount paid per year, at $24,000 per year. For accelerated payments, youre paying an extra $2,000 per year, equivalent to an extra monthly mortgage payment. This extra mortgage payment will pay down your mortgage principal faster, meaning that youll be able to pay off your mortgage quicker.

This mortgage calculator allows you to choose between monthly and bi-weekly mortgage payments. Selecting between them lets you easily compare how it can affect your mortgage payment, and the amortization schedule below the Canada mortgage calculator will also reflect the payment frequency.

Read Also: Reverse Mortgage For Mobile Homes

How Do Payments Differ By Province In Canada

Most mortgage regulation in Canada is consistent across the provinces. This includes the minimum down payment of 5%, and the maximum amortization period 35 years, for example. However, there are some mortgage rules that vary between provinces. This table summarizes the differences:

| PST on CMHC insurance |

|---|

| YES |

What Are The Types Of Mortgages

In addition to there being multiple mortgage terms, there are several common types of mortgages. These include conventional loans and jumbo mortgages, which are issued by private lenders but have more stringent qualifications because they exceed the maximum loans amounts established by the Federal Housing Finance Administration .

Prospective homebuyers also can access mortgages insured by the federal government, including Federal Housing Administration , U.S. Department of Agriculture , U.S. Department of Veterans Affairs and 203 loans. Minimum qualifications for these mortgages vary, but they are all intended for low- to mid-income buyers as well as first-time buyers.

Read Also: 10 Year Treasury Yield Mortgage Rates

How To Afford A Bigger Mortgage

You can afford a more expensive home by following three simple steps as you prepare to apply for a mortgage:

Of course, these steps may be easier said than done, especially for a firsttime home buyer.

How are you supposed to pay down debt and increase your savings at the same time? Often its a struggle to even meet monthly expenses.

But nearly everyone at least, nearly everyone with homeownership plans can find some economies in their household budgets. And its surprising how often just a small improvement in your DTI, down payment, or credit score can make a big difference to the mortgage deal youre offered.

So do what you can. But if your financial situation isnt perfect, dont let that stop you. Mortgage programs today are flexible, and you might be surprised at what it takes to qualify.

What Is Your Remaining Mortgage Balance

You’ve paid into your mortgage for a few years.

But do you know your remaining mortgage balance?

This mortgage balance calculator makes the process of figuring your remaining mortgage balance easy.

Simply enter your original mortgage amount, annual interest rate, original term, monthly payment amount, and one of three other known variables. Instantly, you’ll have your estimated mortgage balance!

It is important to note, however, that this calculator only works with fixed-rate mortgages.

Here’s what you need to know about mortgage balances . . .

Recommended Reading: Reverse Mortgage For Condominiums

How Fast Can You Pay Off A 30 Year Mortgage With Double Payments

The general rule is that if you double your required payment, you will pay your 30-year fixed rate loan off in less than ten years. A $100,000 mortgage with a 6 percent interest rate requires a payment of $599.55 for 30 years. If you double the payment, the loan is paid off in 109 months, or nine years and one month.

What Happens At The End Of A Term

You will need to either renew orrefinance your mortgageat the end of each term, unless you are able to fully pay off your mortgage.

- Renewing your mortgage means that you will be signing another mortgage term, and it may have a different mortgage interest rate and monthly payment.Mortgage renewalsare done with the same lender.

- Refinancing your mortgagemeans that you will also be signing another mortgage term, but youll also be signing a new mortgage agreement. This allows you to switch to another lender, increase your loan amount, and sign another term before your current term is over. This lets you take advantage of lower rates from another lender, borrow more money, and lock-in a mortgage rate early.

Recommended Reading: Chase Recast

Can I Cancel My Mortgage Life Insurance

Canadas major banks all allow you to cancel your mortgage life insurance at any time, and to receive a refund if you cancel your plan within the first 30 days. This 30-day free look or 30-day review period is important as it lets you change your mind should you decide that mortgage life insurance isn’t right for you.

To cancel, you can call your lender’s insurance helpline, complete a form at a branch, or send a written request by mail.

How Your Credit Rating Affects Your Interest Rate

Lenders look at your credit report and credit score to decide if they will lend you money. They also use them to determine how much interest they will charge you to borrow money.

If you have no credit history or a poor credit history, it could be harder for you to get a mortgage. If you have good credit history, you may be able to get a lower interest rate on your mortgage. This can save you a lot of money over time.

Recommended Reading: Can You Get A Reverse Mortgage On A Mobile Home

How To Get A Lower Monthly Mortgage Payment

If youve got more debt, you might need to take on a lower monthly payment to keep your DTI ratio at 43%. Thankfully, there are a few strategies you can use to lower your monthly payment.

Although there are many tips and tricks to lowering your monthly mortgage payment, the top three are highly recommended and also effective: improving your credit score, taking a longer mortgage term and saving up for a 20% down payment.

Affordable Housing Projects Do Not Decrease Property Values

And if you are a homeowner or buyer worried about an affordable housing project being built in your area depressing your property value, research by the Urban Institute may put your mind at ease. Looking at housing prices in Alexandria, Virginia using Zillows assessor and real estate database between 2000 and 2020 to estimate the relationship between affordable housing developments and sales prices of an array of properties nearby found a small but statistically significant increase in property values. Those properties within 1/16 of a mile of an affordable development, a distance comparable to a typical urban block, on average rose in value by 0.09 percent.

- Tagged in:

Don’t Miss: Can You Do A Reverse Mortgage On A Condo

Purchasing A Second Home Or Vacation Residence

If you fancy buying a second home or a vacation property you can also expect to incur additional costs compared to your primary residence. Youll be asked to cough up a bit more for the down payment and have a slightly higher interest rate on your loan. Additionally, your lender may apply stricter requirements for cash reserves and debt-to-income ratio.

According to Bankrate, your second home mortgage interest rate could be between half a percent and one percent more. You might be asked to put down at least ten percent upfront, compared to just three to five percent for a primary residence.

The bank will likely ask, depending on your credit and financial profile, that you have two to six months of cash reserves to cover payments on both of your properties. While on your primary residence the lender may be flexible with your DTI, allowing a ratio of up to 50 percent, that may be as low as 36 percent in the case of a second home.

What Amortization Period Should I Choose

Here are some general guidelines for choosing an amortization period for your mortgage:

- Most mortgages in Canada have an amortization period of 25 years. Unless you require a longer amortization period due to cash flow concerns, or you can afford to shorten your amortization, a 25 year amortization works well in most cases.

- Choosing a shorter amortization means that youll be paying off your mortgage principal balance faster. This will lower your lifetime interest cost, but it will also result in a higher monthly or bi-weekly mortgage payment.

- Insured high-ratio mortgages cannot have an amortization that is over 25 years. If you choose an amortization period of over 25 years, you must make at least 20% down payment.

Recommended Reading: Can You Get A Reverse Mortgage On A Manufactured Home

How Do Property Taxes Work

When you own property, youre subject to taxes levied by the county and district. You can input your zip code or town name using our property tax calculator to see the average effective tax rate in your area.

Property taxes vary widely from state to state and even county to county. For example, New Jersey has the highest average effective property tax rate in the U.S. at 2.42%. Owning property in Wyoming, however, will only put you back roughly 0.57% in property taxes, one of the lowest average effective tax rates in the country.

While it depends on your state, county and municipality, in general, property taxes are calculated as a percentage of your homes value and billed to you once a year. In some areas, your home is reassessed each year, while in others it can be as long as every five years. These taxes generally pay for services such as road repairs and maintenance, school district budgets and county general services.

Close On Your Mortgage

Once your lender is ready to close on your loan, you’ll bring a check for your down payment and will sign the necessary documents to put your mortgage into place. You’ll also have to pay closing costs on your loan, which can amount to 2% to 5% of your mortgage amount. Most lenders let you roll your closing costs into your mortgage and pay them off over time.

Whether you’re a first-time home buyer or are moving from one home to another, it’s important to know how much house you can afford. Crunch those numbers carefully before you make an offer on a house so you don’t wind up overspending on a home and regretting it after the fact.

Also Check: Rocket Mortgage Requirements

Find A Real Estate Agent

You technically don’t have to use a real estate agent to find a home. But as a buyer, there’s no reason not to enlist an agent’s services, since you don’t pay a fee when you’re on the buying side. A real estate agent can help you navigate your local housing market and figure out what offer to make on the properties you’re interested in buying. An agent can also negotiate with sellers on your behalf.