How To Recast A Mortgage

We had to callIt took several minutes before I was connected to someone who both knew what recasting was and what our servicer’s process was. So pack your patience and choose a time when you have more than just a few minutes to spare if you can’t request paperwork online.

We had to give them info over the phoneOnce we were talking to the right person, they asked us how much we wanted to add to our principal. They confirmed my email address and my husband’s so they could send an agreement to us to sign.

We got an email confirmationThis message reiterated the lump sum we wanted to put toward our principal and what our new monthly mortgage payments would be. They were no longer gigantic.

We had to mail payments and a letterThe email confirmation contained info on where to mail the $250 processing fee check as well as the lump sum check that we wanted applied to our principal. We mailed a signed letter explaining our intentions and included the 2 checks in the envelope.

We had to e-sign some paperworkOnce I fished the email out of my spam folder, I electronically signed the required documents. I also needed to upload a picture of my government-issued photo ID. My signing prompted the mortgage provider’s system to email my signed documents to my husbandbecause he is also on the mortgage and needed to sign. This time, we knew to look in his spam folder right away.

Meredith BodgasSmart Money

Mortgage Recast Vs Principal Payment: Whats The Difference

Recasting a mortgage does require making a large payment toward your principal. However, you can make extra payments on your loan without recasting it. If you do this, you will have put yourself ahead of schedule, and youll have less mortgage payments until you are paid off. Your monthly payment remains the same.

Think about it like this: paying ahead of schedule without reamortizing/recasting is like driving faster along your usual route to work. Reamortizing/recasting is like taking a different route that uses less fuel but gets there at the same time as your old route.

Should I Recast My Mortgage

You should recast your mortgage if you have a large sum of cash and want to lower your mortgage payment without having to refinance your mortgage.

Here are some scenarios when recasting your mortgage makes sense:

You sold your previous home after buying your new one. If you had to take out a larger loan before your current home sold, you can recast your mortgage with the sale proceeds once your old home sells.

You want to get rid of mortgage insurance. If you havent yet built 20% equity in your home, you can use the lump-sum to pay your loan down to 80% of your homes value, and cancel the private mortgage insurance youre paying to protect the lender in case of default. Be sure to check with your servicer though they may also want to verify your homes value before they remove the PMI.

Youre getting ready to retire and want the lowest possible payment. A recast mortgage may help you budget for reduced retirement income.

You currently have a conventional loan, jumbo loan, home equity loan or a HELOC. If you have a loan backed by the Federal Housing Administration or the U.S. Department of Veterans Affairs , you will not be able to recast your mortgage.

Don’t Miss: What Mortgage Can I Afford Based On Salary

What Is Recasting Your Mortgage

When you recast your mortgage, you pay your lender a large sum toward your principal, and your loan is then reamortized in other words, recalculated based on your new, lower balance. Your interest rate and term stay the same, but because your principal has decreased, your monthly payments will be lower.

» MORE: What is mortgage amortization?

Its a move to make if you want to reduce your interest expense without shortening your loan term, says Eric Gotsch, a sales manager for Wells Fargo Home Mortgage.

The most common reason for recasting is if you’ve bought a home but not yet sold your previous one, says Jim Hettinger, executive vice president of operations at Guaranteed Rate, an online mortgage lender. Once the sale of the prior home is complete, the consumer may want to put the proceeds of the sale against the new mortgage, have the loan recast, or reamortized, and a new monthly payment set up, he says.

Recasting is also ideal for people who get a large sum of money and want to reduce their mortgage expenses, Gotsch says. This often happens when someone receives an inheritance, an investment distribution or a large bonus, or has a nontraditional income stream, he says. In most cases, youll need at least $5,000 to recast your mortgage.

MORE: Can you lower your interest rate? Use a refinance calculator to find out.

Move To Your New Repayment Schedule

After your recast is complete, your loan will be reamortized. Thats a fancy way of saying that you will get a new payment schedule reflecting the amount of money you need to pay each month.

Note that it is important to keep paying your regular mortgage payment amounts until you know for certain that the reamortization takes effect. You havent come this far only to get hit with a penalty!

Also Check: What Do I Need To Refinance My Mortgage

What Are The Disadvantages Of A Mortgage Recast

Below are some of the disadvantages of recasting your mortgage:

- If your current loan is new, you may have to wait. Before recasting your mortgage, most lenders want confirmation of six months worth of payments.

- You cant adjust your loan terms. You cant reduce the rate or shorten the repayment term even if current interest rates are lower.

- You may lose tax incentives. Less loan amount implies less interest deductible.

- No additional cash investing opportunities. The funds could be used for retirement, college, or stock funds.

- Your lender or servicer may not offer mortgage recasting. However, not all conventional or jumbo mortgage lenders and servicers provide recast mortgage services.

How Can I Pay Off My 30

How to Pay Your 30-Year Mortgage in 10 Years

Recommended Reading: What Happens If I Outlive My Reverse Mortgage

Differences Between Mortgage Recasting And Refinancing

changing your monthly payment

| Recasting | ||

|---|---|---|

| No, you cannot recast government-backed loans. | Yes, you can refinance virtually all mortgages. | |

| Will your loan term change? | No, the length of time you pay remains the same. | Yes, you can usually choose between a standard 15 or 30-year term. |

| Do you need to make a minimum down payment? | Most lenders require a lump-sum payment of at least $5,000. | No, refinances typically donât require a down payment. |

| Do you need to pay closing costs? | Thereâs typically an administrative fee of a few hundred dollars. | Yes, closing costs amount to 2% to 5% of the loan. |

Pro Tip If current interest rates are lower than when you first got a mortgage, refinancing might be a better choice. With a recast, you keep the same interest rate, but with refinancing, you typically get the current market rate.

MORE

Pros Of Recasting Mortgage

There are numerous pros to a recast mortgage, all of which may be appealing to homeowners . Here are a few of the benefits that may make a mortgage recast worth considering:

-

Lower Mortgage Payments: By making extra payments and recasting your mortgage, you can decrease your minimum payment moving forward. This is great for homeowners looking to use that extra money to invest or add to their savings. The timeframe of the original mortgage will remain the same, meaning you do not have to add time to your loan.

-

Simplicity: As you look into how to recast a mortgage, you may notice it is often much simpler when compared to refinancing a mortgage. Homeowners often need to meet eligibility requirements and meet with a lender to do so. The simplicity involved is great for homeowners looking to change the terms of their mortgage without re-qualifying for a loan.

-

Keep Your Interest Rate: Recasting a mortgage involves using the existing loan balance and the time frame left on the mortgage, and therefore will not change the interest rate. For homeowners with a favorable interest rate, a mortgage recast represents the opportunity to benefit from lower mortgage payments while keeping the same interest rate.

You May Like: Is A 10 Year Mortgage A Good Idea

Next Steps To Consider

The third parties mentioned herein and Fidelity Investments are independent entities and are not legally affiliated.

Views expressed are as of the date indicated, based on the information available at that time, and may change based on market or other conditions. Unless otherwise noted, the opinions provided are those of the speaker or author and not necessarily those of Fidelity Investments or its affiliates. Fidelity does not assume any duty to update any of the information.

Investing involves risk, including risk of loss.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

How A Mortgage Recast Works

For the borrower, the primary benefit of recasting a mortgage is to reduce monthly payments. Often, a mortgage lender will simply reduce the term of a loan if extra principal payments are made, but maintain the same fixed monthly amount duesimply by increasing the principal amount and reducing the interest portion of the payment.

Recasting can lower the amount of interest the borrower will pay over the life of the loan if a sufficiently large principal payment is made, reducing both the interest and principal remaining on the loan’s new monthly payments.

Read Also: Where To Find Mortgage Note

How To Qualify For Mortgage Recasting

The recast mortgage process has proven to be an invaluable tool for many homeowners. Unfortunately, however, mortgage recasting isnt made available to all homeowners. Mortgage recasting isnt universally offered by all lenders, nor are all mortgages eligible. Therefore, lets take a look at what you might need to qualify for mortgage recasting:

-

Many lenders require a minimum lump-sum payment of at least $5,000. However, others lenders will require the payment to represent a percentage of the remaining principal.

-

More often than not, participating lenders will require homeowners to have a certain amount of equity in the home before they can even consider a mortgage recast.

-

Mortgage recasting doesnt work on government-backed loans.

-

Most jumbo loans dont qualify to be recasted.

-

A great deal of lenders will require a clean history of timely payments.

How To Use A Mortgage Recast Calculator

Youll need to have some information handy to start the mortgage recasting process:

Current principal balance and interest rate: You should be able to find this on your most current mortgage statement.

Month and year of your next payment: This will most likely be your next payment due date from your mortgage statement.

Dollar amount you plan to pay down: Most mortgage servicers require at least a $5,000 lum-sum payment.

Recasting fee your servicer charges: Lenders and servicers may charge up to $500 for processing a mortgage recast. Call your current lender to find out their fee.

Heres how the calculator works: If you have $50,000 to pay down on a $300,000 mortgage balance on a 30-year fixed-rate mortgage, at a 3.25% interest rate with a $500 recast fee.

| Recast Comparison Example |

| Keep making regular payments until your recast is finished |

Recommended Reading: Does It Make Sense To Pay Off Mortgage Early

Mortgage Recast Vs Principal Payment

The nature of a mortgage recast will require borrowers to make at least one large payment to their principal ahead of schedule. However, it is worth noting that the addition of a single lump-sum payment doesnt initiate the mortgage recast process. It is entirely possible to make a large payment ahead of schedule without recasting the mortgage. A large payment can place borrowers ahead of schedule, but it wont change the schedule at all. Monthly payments will remain unchanged, despite the extra installment. On the other hand, a mortgage recast will simultaneously change the amortization schedule and the amount the borrower is expected to pay each month.

Is A Mortgage Recast Right For You

Under the right circumstances, recasting your mortgage might make sense. If you have extra funds available and the interest rate on your existing home mortgage is low, it could be helpful to recast your mortgage to get a lower monthly payment and avoid the expense of refinancing.

Another situation where a recast might make sense is if youve purchased a new home with a mortgage before selling your old home. Once your old home sells, you might want to use the funds to pay down your new mortgage and recalculate your monthly payments, if your loan servicer allows it.

Still, there are times when other options might be more beneficial, such as refinancing your mortgage when interest rates drop.

While Credible cant help you recast your mortgage, you can compare prequalified rates on a refinance loan from multiple lenders. That information could help you decide whether recasting, refinancing, or staying the course with your existing mortgage is the right decision for you.

Recommended Reading: Does Rocket Mortgage Do Manufactured Homes

Can You Extend Mortgage Amortization

Yes. However, it can be costly. This will generally mean refinancing into a longer loan, but it can also be done through loan modification. Through refinancing, you could reamortize a 15-year mortgage into a 30-year mortgage. However, if your mortgage comes with prepayment penalties, you will likely have to pay them. Refinancing pays off the original mortgage and triggers those penalties, even though it may seem as though you are merely extending the mortgage.

Through loan modification, you can extend a 30-year mortgage, which is often an attractive option for individuals who are struggling to make their payments. If you are considering this option, speak to your lender about whether this will result in additional interest.

Recasting A Mortgage Vs Paying Down The Principal

Simply making a larger-than-usual monthly payment will not count as a recast. You need to notify your lender ahead of time if you plan to recast your mortgage. If you donât, the lump sum payment wonât go towards the principal – itâll just be applied towards the following monthâs payment, and youâll eventually have to pay the same amount once the larger payment has been credited.

Paying more than your monthly payment or making an extra payment without recasting your home loan can be useful when you have a little extra money on hand or are forgetful about making payments, but in the long run they won’t bring down your principal any faster.

To help you figure out your potential savings by recasting, you can use a mortgage calculator. Input what your new loan balance would be after paying a lump sum to see what the monthly payment would be.

Read Also: Does Rocket Mortgage Use Fico 8

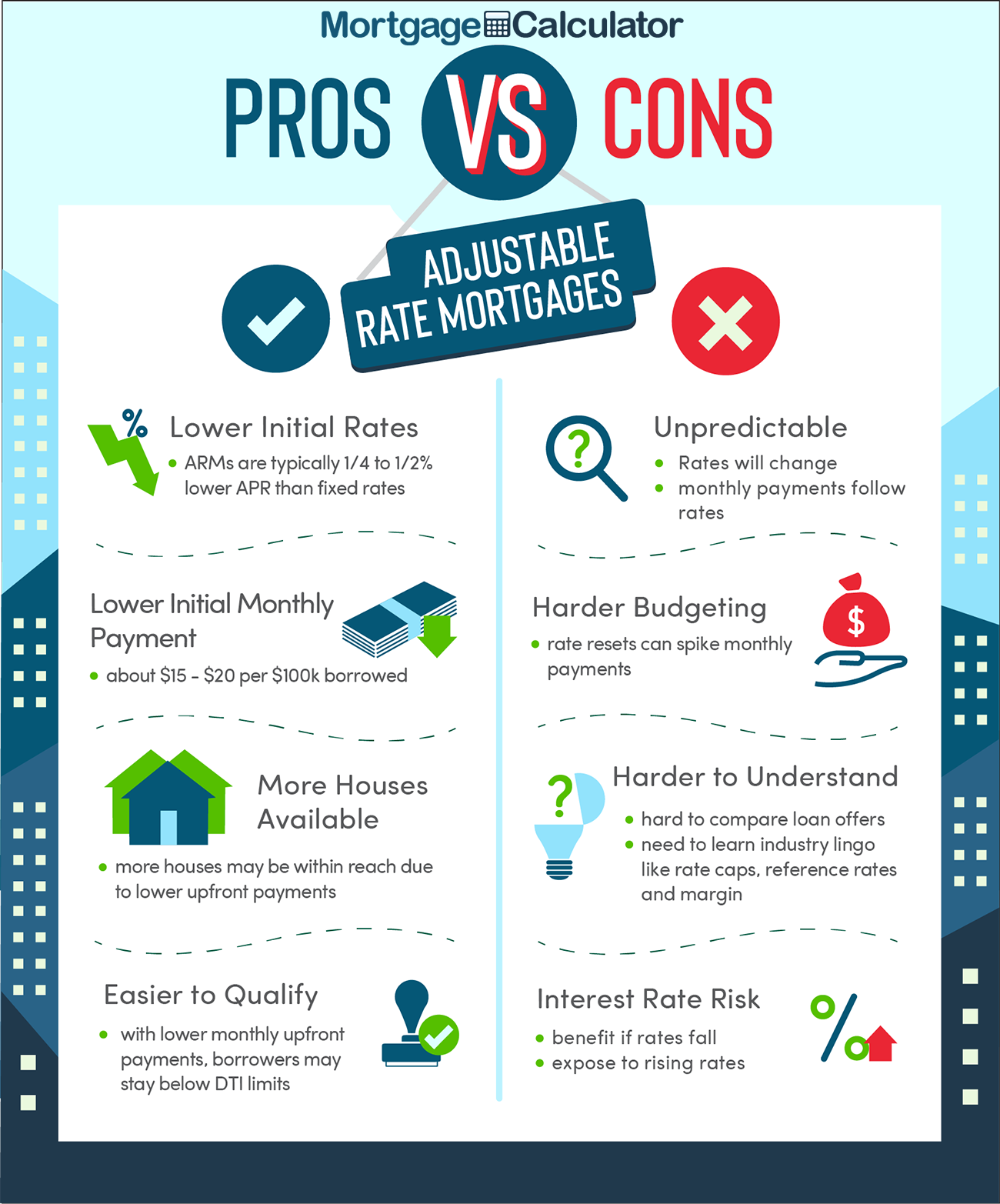

Mortgage Recasting Vs Refinancing: Which Is Better

A refinance loan is when you replace your current mortgage with an entirely new mortgage, usually at a lower rate. The table below shows you when it might be better to choose a recast mortgage or a refinance mortgage.

A mortgage refinance makes sense if:

|

A mortgage recast makes sense if:

|

When Does A Mortgage Recast Make Sense

The most common situation where people opt for a mortgage recasting is when they are buying a new house 1st, and then selling their existing home at a later stage.

That is basically buying a new house without a sale contingency. This way they dont have to move out of their current home, find somewhere to stay temporarily and then move into the new house.

If the borrower is qualifying for both the mortgage payments, they can use the strategy of recasting a loan once they sell the current home.

There are other reasons why you might want to get a mortgage recast like a bonus from work, inheritance money, etc.

Don’t Miss: How Much Is Mortgage On 1 Million

The Advantages Of A Mortgage Recast

Besides lower monthly payments, a mortgage recast has a few key advantages over other lending options. This includes:

- No credit check required. When you refinance a loan, your lender looks at your credit report and adjusts your terms based on your current creditworthiness. There’s generally no credit check with a recast.

- Less money paid towards interest. When you reduce your principal, your overall interest decreases over the life of your loan. This, in turn, reduces how much you pay for your loan overall.

- Keep your current interest rate. With a mortgage recast, it doesn’t matter what the current mortgage rates are. Even if the rates went up, you’ll keep your lower rate.

- No closing costs. When you refinance your loan, you’ll have to pay closing costs. Your lender may charge a fee to recast your loan, but it’s usually less than traditional closing costs.

- You don’t extend the remaining term of your loan. When you refinance a loan, you may have to increase your loan term. With a recast, the length of your loan doesn’t change.

- No lengthy application process. Refinancing a home involves a lot of the same processes as your original mortgage application. With a mortgage recast, there’s very little required so the process is much faster.