All The Training You Need To Build The Foundation Of A Successful Banking Career

At Texas Security Bank, we seek to optimize your training experience to make you successful in your career and ready to take on future opportunities. You will have the opportunity to help people achieve the American dream of owning a home. Texas Security Bank offers a comprehensive Residential Mortgage Professional Training Program which provides extensive knowledge to become a successful mortgage professional. Our training series covers multiple essential topics and is completed while working in the role.

In addition to the training outlined above, our Residential Mortgage Professionals are provided a high level of exposure to our top executives and on-the-job training opportunities. Periodic Lunch and Learn training sessions are scheduled using a formal curriculum on topics related to running a business, as well as individual book studies.

Let’s Start a Conversation

What Does A Mortgage Loan Processor Do

The main benefit of a loan processor is that they help streamline the process of applying for a home loan. The steps can be quite complex, but the loan processor helps you find the right loan for your budget and needs.

Here are some of the core tasks a mortgage processor performs:

Get approved to buy a home.

Rocket Mortgage® lets you get to house hunting sooner.

Mortgage Lender Training For California

California Bureau of Real Estate1651 Exposition Blvd.

California Department of Financial Protection and InnovationOne Sansome St, Suite 600San Francisco, CA 94104-4428

To register for a California NMLS licensing class phone 415-587-5435 or 650-294-8750

California Mortgage Loan Officers can be licensed through either The California Bureau of Real Estate or The California Department of Financial Protection and Innovation Both agencies require the national 20-hour class. Department of Financial Protection and Innovation regulated loan officers require 2 hours of CA state law.

All states require a national exam for licensing. California does not require an additional state test, requires 2 hours of CA state law for those that are currently NMLS-licensed elsewhere, and requires 8 hours of continuing education annually for NMLS-licensed mortgage loan officers, 1 of which must be state law.

Don’t Miss: Can You Get A Mortgage Loan On Unemployment

Maintain Your Mlo License

To maintain your North Carolina MLO license, you must complete at least 8 hours of NMLS-approved continuing education courses and apply for license renewal each year. Annual CE must include:

- 3 hours of Federal law

- 2 hours of ethics

- 2 hours of non-traditional mortgage lending

- 1 hour of NC-specific education

Now that you know how to become a mortgage loan officer in North Carolina, lets get started! Superior School of Real Estate and Learn Mortgage have joined forces to bring you the very best in mortgage education. We offer a full, national catalog of high-quality, online, webinar, and live courses in both pre-licensing and continuing education. View North Carolina MLO pre-licensing course packages.

How To Become A Mortgage Loan Officer In North Carolina

Interested in starting a career in mortgage lending? You may be wondering how to become a mortgage loan officer in North Carolina. Many people choose this career path because of its flexibility, high earning potential, and quick start-up time. So, what does it take to become a mortgage loan officer? This article has everything you need to know about how to get your mortgage loan officer license in North Carolina.

FREE GUIDE:Learn everything you need to know to start a successful career as a mortgage loan officer in North Carolina.

Read Also: Who Should You Get A Mortgage From

Advanced Mortgage Loan Processor: Essential Skills Training

- Learn how to calculate a salaried borrowers income.

- Learn how to read and understand an appraisal and how property values are obtained.

- Become a pro at locking rates and understanding how rates affect a loans approval.

- Develop a deeper knowledge of verifications of employment to get more loans approved.

- Learn how to become more valuable as a processor by completing more of the necessary task to close more loans.

- Read and know what to request on a homeowners declaration page to get more loans closed.

- Understand the importance of a survey and when it should be ordered and by who.

- Learn how to obtain invoices for third party fees so that you loan is compliant and the lenders clears your loan to close.

Clear To Close Timeline

How many days before closing do you receive mortgage approval? Clear to close timelines vary by lender and even underwriting team. There are also unique conditions that could extend the clear to close timeline. Unusual aspects on a loan application or spikes in mortgage team workloads can cause the process to take longer.

Also Check: What Is 10 Over 30 Mortgage

How To Mortgage Loan Originators & Real Estate Agents Work Together

While mortgage loan originators and real estate agents have different roles, they both work to educate the client and help them buy the house of their dreams. Throughout the mortgage process, realtors will likely be communicating with the mortgage loan originators on behalf of the client.

They will be checking on the status of the loan, facilitating back and forth questions, and keeping the clients from experiencing a lot of stress. Mortgage loan originators and real estate agents are resources for borrowers, during both pre-closing and post-closing.

For this reason, they need to be familiar with each others roles so they can support each other throughout the process. At the end of the day, both parties want the home seeker to find a home they like and that they can afford and receive a home loan for.

Mortgage Processor Defined Plus How To Become One

A mortgage processor, or loan processor, is responsible for assembling, administering and processing your loan application paperwork before it gets approved by the loan underwriter. They play a key role in getting your mortgage loan request to the final close.

Home buying statistics show that about 26% of home buyers cite paying down debt as the largest struggle when it comes to affording their first home. If youre currently planning on buying a home or youre in the process of doing so, its important to know what the responsibilities of a mortgage processor are and what they will provide during these crucial steps.

Recommended Reading: Is It Better To Get Mortgage From Bank Or Broker

Featured Resources For Lenders

Guides, online learning, and other helpful resources for lenders covering qualifying borrowers, appraisal flexibilities, condo project policy updates, and more.

Resolutions for Common DU Error Codes

Common error messages, what they mean, and ways they can be resolved.

Condo Projects Operated as Hotels or Motels

This video covers information and resources to help more clearly identify condotels and transient use criteria.

PE Whole Loan Quick Start

An Interactive guide to get up and running quickly with the PE Whole Loan application.

Information and resources to help you understand todays ever-changing servicing landscape.

- Resource spotlight

- Additional resources

Master Servicing Simplification Changes homepagePrepare for the upcoming cash simplification and guaranty fee relief changes by viewing these tools and resources. Each of these tools are designed to help you prepare and seamlessly implement these required changes.

Mortgage Insurance Claims Portal online learningThis eLearning module provides an overview of acknowledging requests, attaching documents and comments, and submitting mortgage insurance claims through Fannie Mae’s Mortgage Insurance Claims Portal.

Homeowner Retention Options online learningA microlearning series for servicers to help determine the best retention option for homeowners in relation to their hardship.

Changes to 24-Month Delinquent MBS Loan Reclassification webinar

Our Program Will Give You The Introductory Knowledge And Skills Necessary To Perform Your Duties In Loan Processing

- The program is divided into classes that give a comprehensive overview on a variety of pertinent topics.

- Each class is taught by recognized professionals in the industry who will share their knowledge and insights.

- Mortgage Brokers are interested in hiring knowledgeable, qualified Loan Processors this course will enable you to obtain the needed information.

- This program will help you identify and develop your strengths for the Mortgage industry.

- Our easy to follow format helps make this program a very desirable career enhancement opportunity.

Course Registration and Payment are required 48-hours prior to your class start date to guarantee a seat in the course. Any registration taken less than 48-hours, will be subject to availability.

Don’t Miss: Why Is Rent Higher Than Mortgage

How To Become A Mortgage Underwriter

What Is Mortgage Underwriting? How Does Information Get To The Underwriter?What Does A Mortgage Underwriter Do?

- Calculating Income, DTI, And LTV

Why A Mortgage Underwriter Certification?

- Increased knowledge, skills, and competency

- Improves your understanding of how to apply various mortgage rules and regulations

- Enables you to stay up-to-date on the changes in mortgage regulations, policies, and procedures that impact your job function

- Exemplifies your commitment to your career in the mortgage industry

- Career advancement

- You earn more! Individuals who hold certifications generally earn up to 15% more!

How To Become A Mortgage Loan Officer: The Definitive Guide

Are you interested in learning about how to become a mortgage officer? Known in the industry as a mortgage loan originator, or MLO, these professionals play a key part in the process of helping buyers find homes that are right for them typically, they are the primary contact person when a borrower completes a mortgage transaction.

More specifically, they help buyers find home loans that are right for them mortgages that fit their budget and will allow them to stay in the homes they purchase for the long term.

MLOs do all of the following:

- Identify potential homebuyers through advertising, connections, seminars, and other means

- Compile all the borrower information necessary for a loan application

- Present borrowers with loan options that make sense for them

- Keep accurate, thorough records on mortgage transactions

- Coordinate with other mortgage professionals like underwriters and appraisers

Not only do MLOs support homebuyers, they serve a vital function in the real estate industry. With responsible MLOs, mortgage fraud and foreclosures drop significantly. Great MLOs are on the front lines in maintaining a stable home-buying market.

Many people find this to be an attractive career path. Mortgage loan officer is listed #14 in U.S. News & World Report’s rankings for business jobs. The median salary for the position is $64,660 and it doesn’t require any graduate-level education.

You May Like: What Was The Mortgage Interest Rate In 2017

Loan Processor Vs Underwriter

Although both the loan processor and the underwriter are involved in the mortgage application process, the two roles have separate duties. The loan processor makes sure you have all of the proper documentation organized to apply for the loan. The underwriters role is to analyze whether youll be able to make the necessary monthly mortgage payments and decide if the loan will be approved.

What Is A Mortgage Loan Processor

A mortgage processor, also known as a mortgage loan originator or loan processor, sets up the borrower with the proper documents for the loan program they want to use. They guide the borrower through the first step of loan processing. Once the paperwork is finalized, the mortgage processor then passes it through to the underwriter.

Don’t Miss: What Is The 30 Year Fha Mortgage Rate

Do You Have Questions About The Mortgage Loan Process

Hopefully, you now better understand how the mortgage process works. Do you still have questions? Dont hesitate to contact us. Were here to help the process and to provide the kind of personal service you deserve.*

*Guaranteed Rate cannot guarantee that an applicant will be approved or that a closing can occur within a specific timeframe. All dates are estimates and will vary based on all involved parties level of participation at any stage of the loan process.Applicant subject to credit and underwriting approval. Not all applicants will be approved for financing. Receipt of application does not represent an approval for financing or interest rate guarantee. Restrictions may apply.

Disclaimer

Applicant subject to credit and underwriting approval. Not all applicants will be approved for financing. Receipt of application does not represent an approval for financing or interest rate guarantee. Restrictions may apply, contact Guaranteed Rate for current rates and for more information.Guaranteed Rate does not provide tax advice. Please contact your tax adviser for any tax related questions.

- Manage your mortgage

Top 5 Things To Know About Becoming A Mortgage Loan Officer

Becoming a mortgage loan officer, or MLO, specifically with an independent mortgage broker in the wholesale channel, is a promising career path that offers flexibility, unlimited earning potential, and growth. Mortgage loan officers or mortgage loan originators are representatives of independent mortgage brokerages that evaluate and originate residential home loan approvals for borrowers and often facilitate the process through approval and closing.

Once you know what a mortgage loan officer does, you may have more detailed questions about the path to becoming one. If youre interested in joining the wholesale mortgage industry, read on for answers to some frequently asked questions on becoming and excelling as a mortgage loan officer.

You May Like: How Quickly Will I Pay Off My Mortgage

Save 20% Off Oncourse Learning Continuing Education

Expires in 13 daysSave 20%

They also offer live webinar style courses to those who prefer that type of format. By allowing students to interact with an instructor from home, they open up the courses to a wider student pool. Because of this, you can get the best of both worlds as far as course options go.

In a few states, they also offer in-person courses. These are a great option if you are the type of student who benefits from live interaction. If you happen to live near one of these locations, it is a highly recommended course format.

How To Become A Loan Processor With Our Loan Processor Training Courses

What Is A Loan Processor? What Does A Loan Processor Do?

- Organizing the loan application’s documentation and makes sure it is in order

- Reviewing the loan package as given by the lender for completeness and accuracy

- Verifying the borrower’s credit history in terms of debts and payments

- Checking appraisal and property issues requiring further justifications

- Determining if the application and ensuring requirements and paperwork comply with the lender’s standards

- Contacting the borrower if information is missing or if additional information or documentation is required

Also Check: What Should Your Credit Score Be For A Mortgage

What Is A Mortgage Loan Originator

The mortgage process can be a daunting one, but a mortgage loan originators job is to help borrowers navigate the process and choose a lender. Those seeking mortgages not only have a lot of decisions to make and plenty of paperwork to fill out, but they also have to worry about getting approved by the lender.

Thankfully, they will have a mortgage loan originator to help them on their journey. Below we will explain in detail what a mortgage loan originator is and how real estate agents partner with them to make their clients home buying process that much simpler. Lets dive in!

How Do I Become A Mortgage Loan Processor

Lets review the steps you should take to become a loan processor:

Also Check: How To Get Someone Off A Mortgage

Loan Processor Job Description Example

At Unified Mortgage LLC, we strive to put our customers first and help them get a loan so they can live in their dream house. The ideal candidate will have a high school diploma/GED or a certificate in a loan processing program from an accredited university. Current students working towards an associate or bachelors degree in finance or a related field will also be considered.

The loan processor candidate should have excellent oral and written communication skills, be highly-organized and detail-oriented, and have the ability to work under pressure. A successful applicant will manage both residential and commercial real estate loan documents and be a quality reviewer for completeness and complacency with banking regulations. Our company is currently experiencing rapid growth and would like you to join our dynamic organization today.

How Do I Become A Certified Loan Processor

You can earn a Loan Processor certification by completing the Certified Loan Processor Certification course, passing the affiliated exam, and passing the criminal background check. Our Certified Mortgage Processor program is ideal for loan processors looking to advance their mortgage processing career.

Also Check: What Would Be The Mortgage Payment On 250 000

What Does A Loan Processor Do

When someone applies for a loan application, their information and application get sent to a loan processor. The loan processor is responsible for processing mortgage applications and getting them prepared for the mortgage underwriter. The loan processor gathers all the necessary documentation required to receive the loan, including employment verification, bank statements, monthly bills and other income information, if applicable. They then organize the information in the customers file so the underwriter can locate the information quickly. Other duties include:

-

Collecting and organizing the required documentation and place it in a file for submission to the underwriter

-

Making sure all conditions are satisfied with the underwriter

-

Communicating with the title company, county clerk, attorneys or other professionals as required

-

Making sure the approval is within lending guidelines

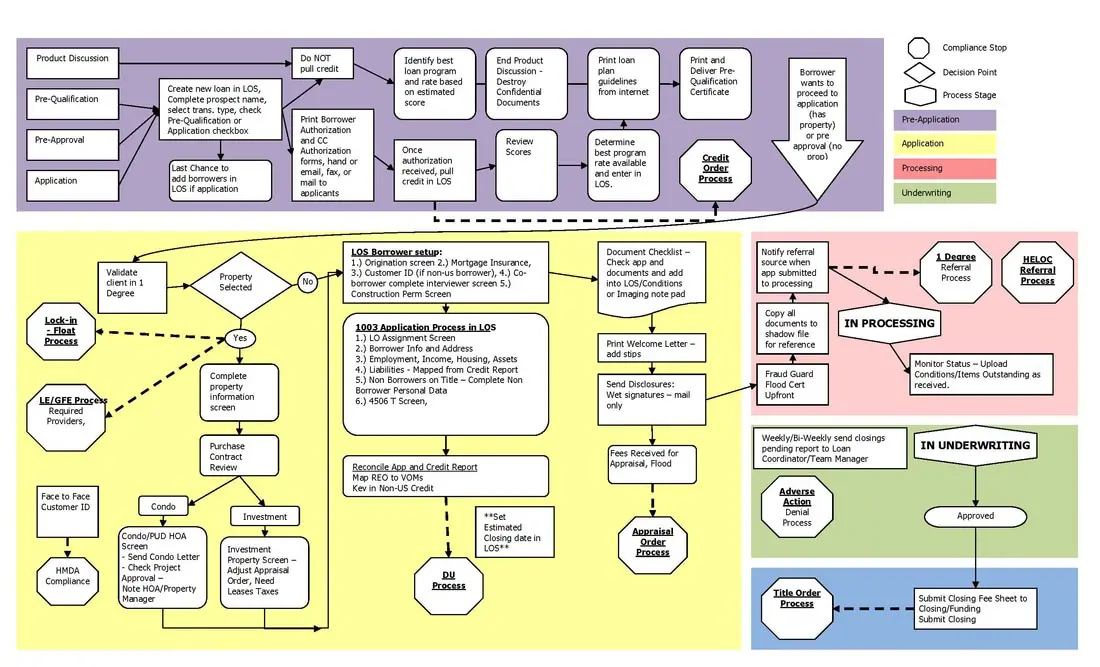

Basics Of Mortgage Processing

The role of loan processors in the overall mortgage loan process, and strategies on how best to communicate with them are covered in this course. It also focuses on the importance of the Uniform Residential Loan Application as a central and vital document.

Produced by Ellie Mae/AllRegs

After completing this course, students will be able to:

- Identify the steps in the mortgage loan process

- Recognize the roles of key people in the loan rocess

- Distinguish various job descriptions and best practices for processors

- Complete the Uniform Residential Loan Application

- Recognize the importance of communication

Don’t Miss: What Documents Are Needed For Mortgage Pre Approval