Do You Pay Less Interest If You Pay Your Mortgage Twice A Month

Yes, ultimately, paying half of your current monthly principal and interest payment every two weeks will help a) reduce the interest paid and b) the time it takes to pay off the loan.

This payment schedule is known in the trade as a bi-weekly payment option. The reason you pay a reduced amount of interest when making biweekly mortgage payments is simply related to an imperfect calendar, which creates an extra monthly mortgage payment each year.

This strategy essentially forces the borrower to make an extra mortgage payment each year 13, not 12. These extra mortgage payments, over time, save several years and tens of thousands of dollars, depending on the loan size leaving you debt-free sooner.

The following examples clarify the concept of bi-weekly payments. Note, it is important to confirm that your mortgage lender accepts biweekly payments if you wish to pay off your mortgage with an extra mortgage payment.

For both scenarios, note that you currently have a $275,000 mortgage on your home with a fixed interest rate of 4.5%. Your monthly principal and interest payment for this fixed-rate mortgage is $1,393.38 per month.

Scenario #1 Pay the mortgage over the 30-year term, with twelve payments each year.

This requires a total interest payment of $226,616.80 over the life of the loan. This is calculated as follows

- Total payments $1,393.38 12 30 = $501,616.80.

- Interest Paid equals total payments minus original principal balance or $501,616.80 $275,000 = $226,616.80

The Bottom Line: Are Biweekly Payments Right For You

For the right type of borrower, biweekly payments can help you save on interest and quickly add equity into your home. As with any major financial decision, its important that you weigh the pros and cons of paying your mortgage more frequently.

If you have questions on how you can start biweekly payments through Rocket Mortgage, you can talk to a Home Loan Expert today for more information.

Check Your Loan Terms

The mortgage paperwork you signed when you took out your home loan should specify whether your lender will apply partial payments. Some lenders wont accept them at all, and others will hold them until youve sent in enough for a full payment. If your lender is going to handle your payment like that, youll need to use a different strategy, as discussed below.

Another concern you might have is whether your loan has a prepayment penalty. If you took out your loan before January 10, 2014, check your mortgage paperwork or contact your mortgage servicer to find out . If you took out your loan on or after January 10, 2014, your loan probably doesnt have a prepayment penalty. Even if it does, the penalty probably does not apply unless youre repaying the entire mortgage within three years of closing.

Recommended Reading: How To Calculate Interest Only Mortgage Payment

How Many Years Does 2 Extra Mortgage Payments Take Off

The general rule is that if you double your required payment, you will pay your 30-year fixed rate loan off in less than ten years. A $100,000 mortgage with a 6 percent interest rate requires a payment of $599.55 for 30 years. If you double the payment, the loan is paid off in 109 months, or nine years and one month.

Dont Let Biweekly Payments Slow Down Your Debt

Biweekly payments are no substitute for gazelle intensity. As soon as you hit Baby Step 5, its time for you to start sending as much as you can toward getting rid of that mortgage forever! If biweekly payments help you make that happen faster, so be it! Just dont confuse set-it-and-forget-it with focused intensity. Forcing yourself to send one extra monthly payment a year is one step you can take in the right directionbut its not an excuse to keep the mortgage around any longer than you have to.

Also Check: What Is The Maximum Reverse Mortgage Amount

So What Are The Benefits Of A Biweekly Mortgage Anyway

you can increase the amount of equity in your home at a faster rate you can save money by paying less interest on your mortgage you can reduce the term of your mortgage and own your home sooner your mortgage payments are automated and made simple more frequent payments decrease the outstanding principal loan balance faster

How To Set Up A Biweekly Mortgage Payment

If you want to pay your mortgage biweekly, there are several ways to do it, and one method to avoid.

- Check your mortgage servicers website. Some lenders offer an easy way for borrowers to make biweekly payments. But those systems dont always benefit borrowers as much as they could because the lender might only apply your payments when youve paid enough to make a full monthly payment. Youll still end up making extra principal payments, but theyll only be applied twice a year, with your 13th and 26th biweekly payments instead of a smaller amount every two weeks.

- Some mortgage servicers dont have sophisticated online systems. You might need to call to ask about their policy on applying biweekly payments and whether they have a plan you can enroll in. Get any agreement in writing.

- Do it yourself. You dont have to sign up for an official biweekly payment plan to save money on interest and pay off your loan sooner. You can send your lender extra money, but make sure its very clearly marked as an extra payment toward the principal amount. Your lenders online payment portal may even allow you to do this automatically if you want to make the same additional principal payment each month.

- Avoid third-party providers. Theres no reason to pay someone else to do what you can easily do for free. Plus, biweekly mortgage payment companies might just collect your money every two weeks and only send it to your lender monthly, bringing you little-to-no benefit.

Recommended Reading: How Long Do You Have To Pay Private Mortgage Insurance

How Can I Pay Off My 30 Year Mortgage In 10 Years

How to Pay Your 30-Year Mortgage in 10 Years

You May Like: How To Reduce Monthly Mortgage Payments

How To Set Up Your Own Biweekly Payments Schedule

If youre facing fees for getting on a biweekly payments schedule, you can do it yourself without involving the lender or a third party at all. Heres how:

Step 1 Divide your monthly payment by 12.

Step 2 Put that much money in a savings account each month and continue making your monthly payments normally.

Step 3 At the end of the year, make one extra principal-only payment in full with the money you saved.

Then you will have made the equivalent of 13 monthly payments all without needing to get on a special payment plan.

Don’t Miss: How To Qualify For Zero Down Mortgage Loan

Want To Make Irregular Payments Do You Need More Advanced Calculation Options

- Biweekly Payment Method: Please see our bi-weekly mortgage calculator if you are using biweekly payments to make an effective 13th monthly payment.

- Extra Payments In The Middle of The Loan Term: If you start making extra payments in the middle of your loan then enter the current loan balance when you started making extra payments and set the loan term for however long you have left in the loan. For example, if you are 3.5 years into a 30-year home loan, you would set the loan term to 26.5 years and you would set the loan balance to whatever amount is shown on your statement. If you do not have a statement to see the current balance you can calculate the current balance so long as you know when the loan began, how much the loan was for & your rate of interest.

- Irregular Extra Payments: If you want to make irregular extra contributions or contributions which have a different periodicity than your regular payments try our advanced additional mortgage payments calculator which allows you to make multiple concurrent extra payments with varying frequencies along with other lump sum extra payments.

For your convenience current Los Angeles mortgage rates are published underneath the calculator to help you make accurate calculations reflecting current market conditions.

What Is A Bimonthly Mortgage

A bimonthly mortgage payment is a mortgage plan in which half of the scheduled monthly payment is made twice a month. This plan is not to be confused with a biweekly plan, where half of the scheduled monthly payment is made every two weeks.

Sometimes spelled as bi-monthly mortgage payments, these plans are typically set up for the customer to pay on the 1st and the 15th of each month. Under some bimonthly plans, it is even possible to make extra payments on top of the bimonthly ones.

Read Also: Does Shopping For A Mortgage Hurt Your Credit Score

Research Options Before You Sign A Contract

There are two potential problems with going with a lender’s biweekly payment program.

First, the reason they want to sign you up for this type of plan is that there are often fees attached to it, and that equals revenue for the lender. They are charging you to give them a two-week loan.

Second, most consumers already have enough contractual payment obligations in their life. Especially for those without a lot of financial reserves, it may be better to keep some flexibility in your budgeting rather than committing to the biweekly payments.

You can always make extra payments when you get three paychecks in a month, receive a tax refund or come into unexpected money.

Calculating Your Mortgage Overpayment Savings

Start Paying More Early & Save Big

Want to build your home equity quicker? Use this free calculator to see how even small extra payments will save you years of payments and thousands of Dollars of additional interest cost. Making extra payments early in the loan saves you much more money over the life of the loan as the extinguised principal is no longer accruing interest for the remainder of the loan. The earlier you begin paying extra the more money you’ll save.

Use the above mortgage over-payment calculator to determine your potential savings by making extra payments toward your mortgage. Put in any amount that you want, from $10 to $1,000, to find out what you can save over the life of your loan. The results can help you weigh your financial options to see if paying down your mortgage will have the most benefits or if you should focus your efforts on other investment options. As you nearly complete your mortgage payments early be sure to check if your loan has a prepayment penalty. If it does, you may want to leave a small balance until the prepayment penalty period expires.

Read Also: What Do Lenders Look For When Applying For A Mortgage

Why Should You Make Biweekly Mortgage Payments

Anytime you can pay a little extra to lower your principal, youll owe less interest going forward, explains Glenn Brunker, a mortgage executive with Ally Home. Plus, as you pay down the principal balance, less of your payment will go to interest, and more will go toward the principal lowering it even more.

The caveat is that youll need to ensure that extra payment is actually being applied to the loan principal and not the interest.

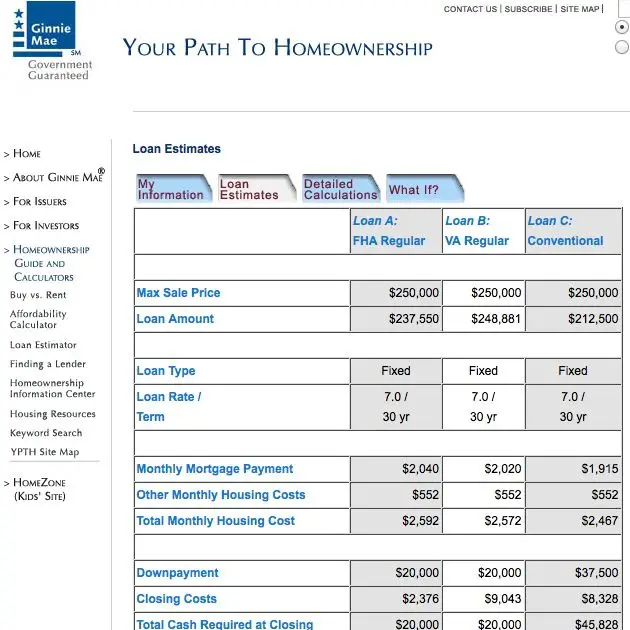

Lets say you have a 30-year, fixed-rate mortgage for $250,000 with a 3.2 percent interest rate. Your monthly payment would come to $1,081. Assuming you pay once a month, youd pay roughly $139,260 in interest over 30 years.

In the same scenario making biweekly payments or about $540 every two weeks youd cut your total interest down to $119,369, saving you more than $19,800. Youd also pay off the loan in 26 years, instead of 30.

Another reason to make that extra payment is to build equity faster. You can borrow against your homes equity for a variety of purposes and in different ways, such as with a cash-out refinance, home equity loan or home equity line of credit .

Aside from saving you money and attaining more equity sooner, it can make sense to make biweekly payments if you earn biweekly paychecks, Brunker says, noting that an adjusted payment schedule may better align with monthly cash flow.

Its Easier To Make Extra Payments

Most homeowners recognize the benefit of making extra mortgage payments. However, it can be difficult to actually find the funds to do so over the course of the year.

While this does require you to adjust your monthly budget slightly and ensure that your cash flow is set up to allow for biweekly payments the schedule makes it easier to contribute extra toward your mortgage principal each year.

Recommended Reading: Can You Refinance A Second Home Mortgage

What Is It Called When You Pay Your Mortgage Twice A Month

The practice is called bi-weekly mortgage payments, a strategy where mortgage loan customers pay their mortgage loan every two weeks, instead of once a month. The idea is to chop down your mortgage payment more quickly, and in the process, lower the amount of interest you pay on your mortgage overall.

Potential Issues To Watch Out For

Unfortunately, there are some pitfalls to this plan as well. Depending on the terms of your loan, you could see a prepayment penalty if you pay off your mortgage early. Talk to your lender to see what penalties exist, if any, before you start this plan.

If you use your lenders payment plan for twice-monthly or biweekly payments and it uses a third-party payment processor, that company may simply hold your payments until it has the full payment to sendessentially defeating the purpose of paying more often. Third-party payment processors might also charge a high fee, which could also eat into your repayment strategy.

Read Also: What Is The Amortization Schedule For A 30 Year Mortgage

What Are Biweekly Mortgage Payments And Are They A Good Idea

6 Min Read | Aug 30, 2022

Theres something simple you can do to cut years off your mortgage payoff date. Its called making biweekly mortgage payments! Its a smart way to add some speed as you dash out of debt. But before you set up biweekly payments on your mortgage, there are several things you should know. Lets see what they are.

Also Check: Should I Refinance With My Current Mortgage Company

How To Make Biweekly Mortgage Payments

To start biweekly payments, you can choose a day between the 1st and 14th of the month. This way, you can guarantee that every 14 days following, half of a mortgage payment will be withdrawn from your bank account. You also dont have to worry about sending a check each month, as biweekly payments can be automatically withdrawn from your account.

If youre a current Rocket Mortgage client, you can start making biweekly payments by signing into your account and adjusting your payment program. In fact, signing up for biweekly payments through Rocket Mortgage is completely free no extra fees involved.

Recommended Reading: How To Calculate Mortgage Payment In Excel

Transcript: How Paying Extra On Your Mortgage May Help You Pay Less Interest Over Time

At some point after you purchase your home, your financial situation may change. You may get a raise and have more income every month or you may pay off a credit card and have fewer monthly expenses. When this happens, you might consider paying more than your monthly mortgage bill to reduce your debt and gain equity in your home faster.

Making extra payments on your principal mortgage balance, which is the amount you borrowed, may help you reduce the amount of interest you pay over the life of your mortgage.

Its worth remembering, though, that your mortgage may have a lower interest rate than other types of debt, such as credit cards. So, paying extra on your mortgage may not always be the best way to use your extra income you may choose instead to pay off different credit accounts with higher interest rates or boost your emergency savings.

But what strategies are available if you do decide to try to pay down your mortgage faster?

Meet Ryan and Amber. Each of them purchased a home with a 30-year mortgage of $194,000 at a fixed rate of 4%, giving them a monthly principal and interest payment of $926.

For this hypothetical scenario, were not including potential additional costs, such as private mortgage insurance, taxes, or homeowners insurance. Were also assuming they make these decisions at the very start of their mortgage loan, and continue on with them every month.

Scenario 1: Paying more than is required each month.

Related articles

How Many Years Does Biweekly Payments Save On 20 Year Mortgage

Anything over that amount must be directed toward reducing your remaining principal balance. The bi-weekly scheme actually provides a 13th monthly payment each year, and that extra must be aplied to lowering your balance. At today’s mortgage rates, bi-weekly payments shorten your loan term by four years.

Recommended Reading: How To Mortgage Property In Monopoly

Biweekly Mortgage Payment Calculator For An Existing Mortgage

Hudson Valley Credit Union137 Boardman RdPoughkeepsie, NY 12603

Information and interactive calculators are made available to you only as self-help tools for your independent use and are not intended to provide investment or tax advice. We cannot and do not guarantee their applicability or accuracy in regards to your individual circumstances. All examples are hypothetical and are for illustrative purposes. We encourage you to seek personalized advice from qualified professionals regarding all personal finance issues.