Lenders Who Accept High

Several lenders do not have a maximum debt-to-income ratio, meaning that your application will not automatically be declined on this basis. Instead, they will review applications on their individual merits, based on a wider range of affordability factors. These lenders include Leek United Building Society, Foundation Home Loans, and Metro Bank.

What Salary Do You Need To Buy A $400000 House

Now lets take what weve learned and put it into an example. Lets say you want to buy a $400,000 house. First, youll need to do the hard work of saving up $80,000 in cash as a 20% down payment. Or if you already own a home, make sure you have enough equity to pay off your current mortgage and cover your down payment when you sell it.

With a 15-year mortgage at a 5% interest rate, your monthly payment would be around $2,500 . To cover that payment, youd need to earn a monthly take-home pay of at least $10,000 .

So, to buy a $400,000 home, your annual take-home salary would have to be more than $120,000 . But youd actually need more than that after adding in the cost of property taxes and home insurance.

If that doesnt sound like you, dont worry. You have a few options. You could save a bigger down payment to lower your monthly mortgage until its no more than 25% of your take-home pay. Or look for a smaller starter home in a more affordable neighborhood.

Save For A 20% Down Payment

You dont need to pay for private mortgage insurance when you put 20% down on your loan. PMI can add quite a bit of money to your monthly payment, so avoiding it can significantly reduce what you pay each month. You may also be able to avoid paying for mortgage insurance if you qualify for a VA loan and pay the funding fee upfront .

Also Check: What Banks Look At When Applying For A Mortgage

How Much Of Your Income Should Go Towards A Mortgage Payment

When considering how much you can spend on a mortgage, you will need to calculate your income. Find your monthly gross income and monthly net income, as you will need both these numbers to help with these calculations.

Its important to note that the amount of mortgage you can afford depends on more than just your income, so these are just guidelines to help. Youll notice that the numbers will end up being different depending on which calculation you use.

How To Lower Your Dti

If your DTI is not within the recommended range, you can attempt to lower your DTI through a number of techniques. The preferred option is to pay off as much of your debt as you can manage, but you can also try restructuring your loans. Seek out options for lowering the interest rate on your debt or attempt to lengthen the duration of the loan through refinancing options. Look into loan forgiveness programs that may help to eliminate some of your debt entirely.

If youre unable to refinance your loans, focus on paying off the high-interest ones first. These carry a heavier weight in your DTI calculation, so paying them off first will improve the ratio.

If you can, seek out an additional source of income. This additional stream of income will help to improve your DTI ratio.

Don’t Miss: Does Navy Federal Sell Their Mortgages

Good Centsmyths Lies And Bad Advice You’ve Been Told About Real Estate And The Value Of Your Home

If you dont truly understand what you can safely afford, he says, you may end up with a mortgage that will financially drain you. Many home buyers, he explains, get so excited about a house that they dont think about how they might struggle to pay for it if they lose their job or come down with a major illness.

For that reason, he says to be conservative.

Being conservative means you save up for a 20 percent down payment, being conservative means you take a straightforward 15 or 30-year loan, and it means that you calculate these basic numbers and know that youre under the 28/36 rule very comfortably, Sethi says.

How Can I Save For A House Quickly

If you want to save for a house fast, you need to be debt-free and have an emergency fund of 36 months of expenses saved. With your income freed from debt payments and an emergency fund to protect you from lifes unexpected surprises, you can save for a house much faster. Here are some other ideas to help you save money fast.

You May Like: Can You Get Pre Approved Mortgage Online

What Factors Help Determine ‘how Much House Can I Afford’

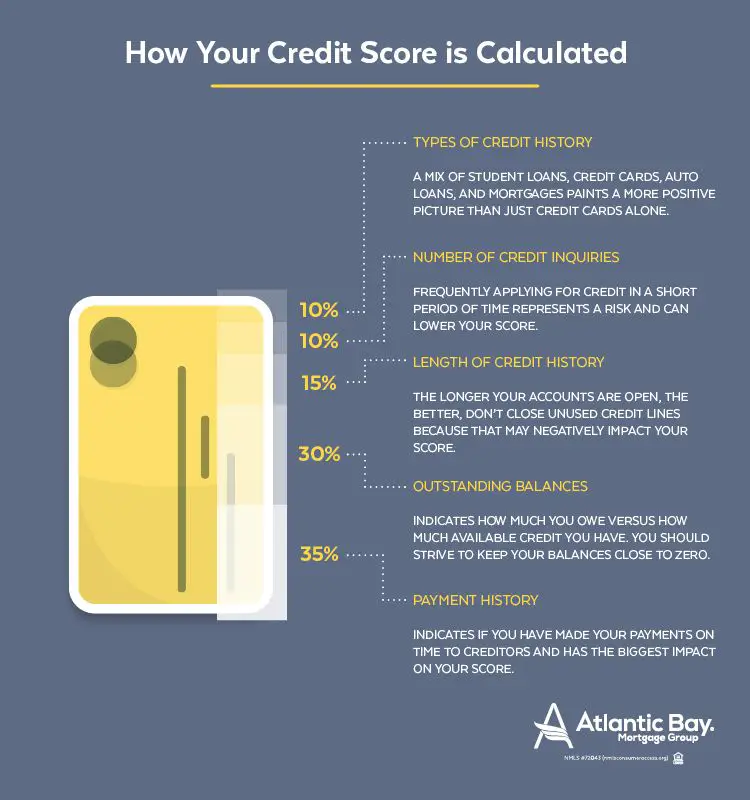

Key factors in calculating affordability are 1) your monthly income 2) cash reserves to cover your down payment and closing costs 3) your monthly expenses 4) your credit profile.

-

Income Money that you receive on a regular basis, such as your salary or income from investments. Your income helps establish a baseline for what you can afford to pay every month.

-

Cash reserves This is the amount of money you have available to make a down payment and cover closing costs. You can use your savings, investments or other sources.

-

Debt and expenses Monthly obligations you may have, such as credit cards, car payments, student loans, groceries, utilities, insurance, etc.

-

Credit profile Your credit score and the amount of debt you owe influence a lenders view of you as a borrower. Those factors will help determine how much money you can borrow and the mortgage interest rate youll earn.

Is All Debt Treated The Same In My Debt

Ultimately, your total recurring debt influences your debt-to-income ratio and can improve or lower your chances of getting qualified for a mortgage. The ratio doesnt weigh the type of debt differently. The more debt you have, the higher your DTI and the harder it may be to qualify for a great loan.

You May Like: Does Wells Fargo Recast Mortgages

Check Your Mortgage Eligibility

Estimating your DTI can help you figure out whether youll qualify for a mortgage and how much home you might be able to afford.

But any number you come up with on your own is just an estimate. Your mortgage lender gets the final say on your DTI and home buying budget.

When youre ready to get serious about shopping for a new home, youll need a mortgage pre-approval to verify your eligibility and budget. You can get started right here.

Va Loan Requirements On Debt To Income Ratios On Va Loans

The Veterans Administration has no maximum debt to income ratio caps on VA loans as long as borrowers can get an approve/eligible per automated underwriting system. However, most lenders have maximum caps on debt to income ratios on VA loans of 41% or 45% DTI. This is why it is important to fully understand the debt to income ratio agency mortgage guidelines on government and/or conventional loans. If you get denied for a mortgage due to having a high debt to income ratio but meet the agency mortgage loan guidelines on the loan program you are applying for, you can go to a different lender with no lender overlays on DTI and apply there. Gustan Cho Associateshas no lender overlays on debt to income ratio on government and conventional loans.

You May Like: How To Calculate What Mortgage You Can Qualify For

How Does The 28/36 Rule Of Thumb Work

So, how do mortgage lenders use the 28/36 rule of thumb to determine how much money to lend you?

Lets say you earn $6,000 a month, before taxes or other deductions from your paycheck. The rule of thumb states that your monthly mortgage payment shouldnt exceed $1,680 and that your total monthly debt payments, including housing, shouldnt exceed $2,160 .

A mortgage lender may use this guideline to gauge or predict that youll be able to take on a certain monthly mortgage payment for the foreseeable future, Andrina Valdes, COO of Cornerstone Home Lending in San Antonio, told The Balance by email. The 28/36 rule answers the question: How much house can you afford to buy?

The rule of thumb should be something you calculate before you start shopping for homes, as it gives you an accurate estimate of how much home you can afford.

How To Lower Your Monthly Mortgage Payment

Your monthly mortgage payment is going to take up a good chunk of your overall debt, so anything you can do to lower that payment can help. Consider some options, like:

- Find a less expensive house. While your lender might approve you for a loan up to a certain amount, you donât necessarily have to buy a home for the full amount. The lower the home price, the lower your monthly payments will be.

- Boost your down payment. The higher your down payment, the lower your monthly payment will be. So, if you can, save up so you can secure that lower payment.

- Get a lower interest rate. Most of the time, your interest rate is based on your credit score and DTI. Try to pay down outstanding debt, like credit cards, car loans or student loans. This not only lowers your DTI, but could also improve your credit score. A higher credit score means you could get a lower interest rate offered by your lender.

Recommended Reading: How Long Does Refinancing A Mortgage Take

How Do You Calculate Debt To Income Ratio On Conventional Loans

Debt to income ratio is the total amount of minimum monthly payments a borrower has which includes all of the borrowers minimum monthly payments divided by monthly gross income. The following are included as monthly borrower debts:

Proposed monthly housing payment that consists of:

Any other minimum monthly credit payments reporting on credit bureaus. Taking the total of borrowers minimum monthly payments and dividing by the borrowers gross monthly income will yield the debt to income ratio. The percentage get is the debt to income ratio.

How Much House Can I Afford With A Va Loan

With a military connection, you may qualify for a VA loan. Thats a big deal, because mortgages backed by the Department of Veterans Affairs typically dont require a down payment. The NerdWallet Home Affordability Calculator takes that major advantage into account when computing your personalized affordability factors.

Remember to select ‘Yes’ under ‘Loan details’ in the ‘Are you a veteran?’ box.

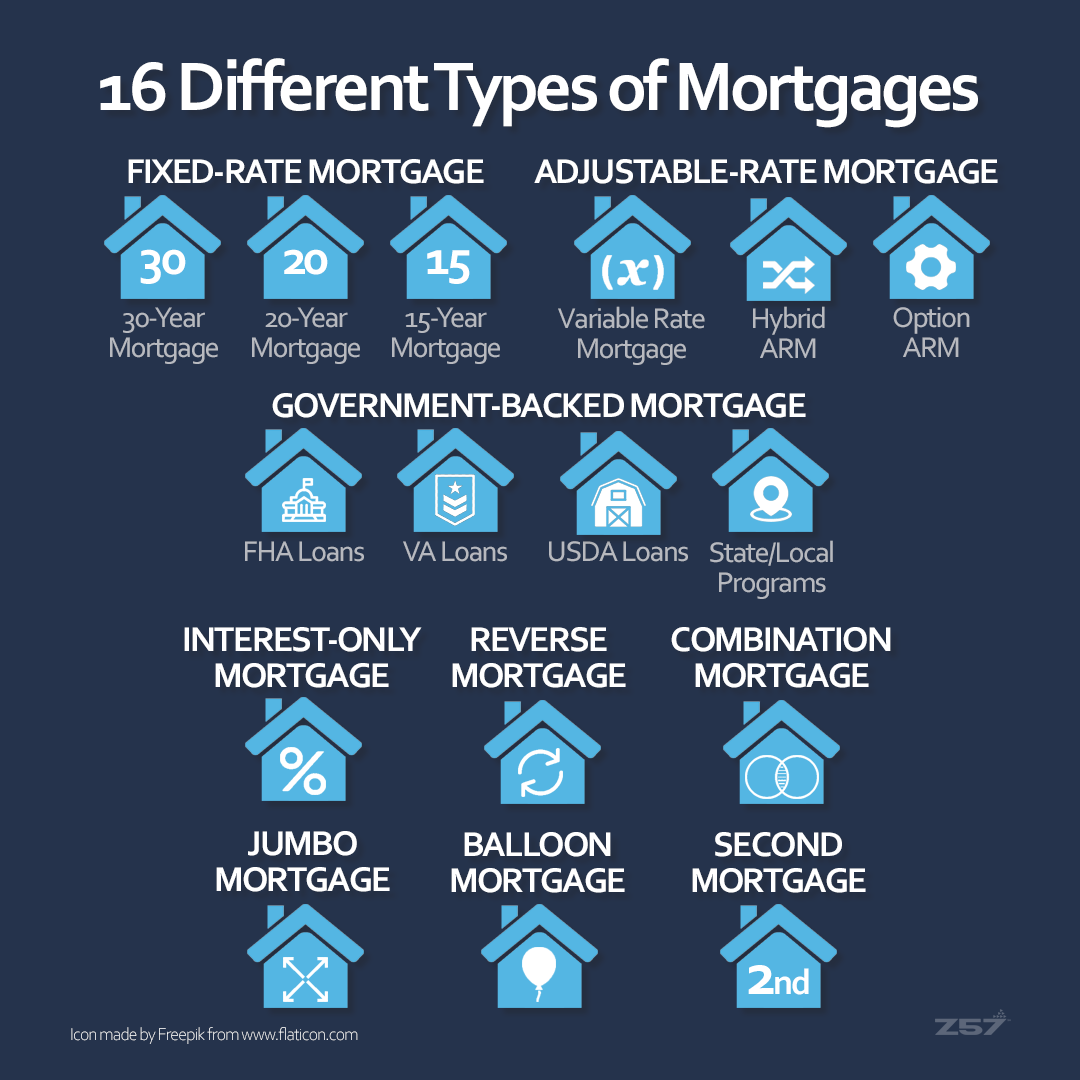

For more on the types of mortgage loans, see How to Choose the Best Mortgage.

Read Also: How Does Filing Bankruptcy Affect Your Mortgage

Divide Your Monthly Payments By Your Gross Monthly Income

Your gross monthly income is the total amount of pre-tax income you earn each month. Whether you should include anyone elses income in this calculation depends on whos going to be on the loan. If someone else is applying with you, then you should factor their income, as well as their debts, into the calculation. Once youve determined the total gross monthly income for everyone on the loan, simply divide the total of your minimum monthly payments by your gross monthly income.

How To Calculate Your Debt

To calculate your debt-to-income ratio, add up your recurring monthly debt obligations, such as your minimum credit card payments, student loan payments, car payments, housing payments , child support, alimony and personal loan payments. Divide this number by your monthly pre-tax income. When a lender calculates your debt-to-income ratio, it will look at your present debt and your future debt that includes your potential mortgage debt burden.

The debt-to-income ratio gives lenders an idea of how youre managing your debt. It also allows them to predict whether youll be able to pay your mortgage bills. Typically, no single monthly debt should be greater than 28% of your monthly income. And when all of your debt payments are combined, they should not be greater than 36%. However, as we stated earlier, you could get a mortgage with a higher debt-to-income ratio .

Its important to note that debt-to-income ratios dont include your living expenses. So things like car insurance payments, entertainment expenses and the cost of groceries are not included in the ratio. If your living expenses combined with new mortgage payments exceed your take-home pay, youll need to cut or trim the living costs that arent fixed, e.g., restaurants and vacations.

Read Also: What Is A Good Ltv For Mortgage

Get Matched With A Broker Experienced In Complex Debt

If you have a high debt-to-income ratio, i.e. over 50%, it could be a huge benefit to work with a broker who specialises in high-DTI applications. Their advice, expertise, and lender relationships could make all the difference in securing the mortgage you need.

We offer a free service that matches you with the right broker for your circumstances. To try it out, and connect with a specialist broker for a free, no-obligation chat, you simply need to call us on 0808 189 2301 or make an enquiry online.

How Do I Budget For A House

The first step to budgeting for a house is to know how much down payment you need. Ideally, youll want to save a down payment of at least 20%. For first-time home buyers, a smaller down payment like 510% is okay toobut then youll have to pay PMI. Whatever you do, never buy a house with a monthly payment thats more than 25% of your monthly take-home pay on a 15-year fixed-rate mortgage . And stay away from expensive loans like FHA, VA and USDA.

After youve set your savings goal, here are some tips on how to save for a house: Pay off all your debt, tighten your spending, hold off on your retirement savings , start a side job, and sell stuff you dont need.

Lets say you want to buy a $200,000 house. Your down payment savings goal is $40,000 . To budget for this house in two years, youd need to set aside $1,700 each month .

You May Like: Is It Easier To Get A Mortgage The Second Time

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our mortgage reporters and editors focus on the points consumers care about most the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more so you can feel confident when you make decisions as a homebuyer and a homeowner.

Tips To Keep Your Debt

Are you worried that your debt-to-income ratio will make you ineligible for a mortgage loan?

You can follow these tips to lower your DTI and improve your chances of mortgage approval:

Even if your DTI is within the good range for mortgage qualifying, it doesnt hurt to try to lower it before you apply.

The lower your existing debts, the more youll be able to spend on your mortgage.

Working to improve your debt-to-income ratio before you apply for a home loan can make you eligibile for a bigger, more expensive home.

Don’t Miss: How To Hire A Mortgage Broker

Your Student Loan Debt Matters

For the millennial generation, saddled with student loan debt and more than half unsure how long it will take to become debt-free, obtaining a mortgage can be a trickier process. This is because your student loan debt is factored into your debt-to-income ratio. For example, home loans insured by the Federal Housing Administration actually requires your student loan debt to be factored in one of two ways:Your lender must use:

-

Your anticipated monthly student loan payment , or

-

The greater of: one percent of your outstanding student debt balance can be used if you dont know your anticipated monthly payment, or the monthly payment as reported on the credit report

Even if your loans are currently in deferment, they will be counted as part of your debt-to-income ratio. So, as you can see, your student loans can have a big impact on your ability to borrow money to purchase a home. Each program varies, so dont forget to check with your lender about student loan guidelines.

Don’t max out your credit cards

How Much House Can I Afford

Gabriel RodriguezCarlos SilvaTaína CuevasCarlos Silva17 min read

How much house you can afford is directly related to the size and type of mortgage you can qualify for. Understanding how much you can comfortably spend on a new mortgage while still meeting your existing obligations is crucial during the home-buying process.

Read on to learn about home affordability, and use our home affordability calculator to find out if you can afford the house of your dreams.

Recommended Reading: What Day Of The Week Are Mortgage Rates Lowest

What Is Monthly Debt

Monthly debts are recurring monthly payments, such as credit card payments, loan payments , alimony or child support. Our DTI formula uses your minimum monthly debt amount meaning the lowest amount you are required to pay each month on recurring payments. Whencalculating your monthly debts, you can exclude:

- Monthly utilities like water, garbage, electricity or gas bills

- Car insurance expenses

- Health insurance costs

- Groceries, food or entertainment expenses

To calculate your total minimum monthly debts, add up each minimum payment. If you pay more than the minimum amount on your credit cards, this does not count against your DTI, since only the minimum amount you’re required to pay is included in the total. For example, if you owe $5,000 on a high-interest credit card and your minimum monthly payment on that card is $100, then $100 is the minimum monthly debt amount used for your DTI.