How Do I Calculate My Gross Monthly Income For Self

Add up all your income for the previous two years and then divide that number by 24 to see your gross monthly income. To count as income for your lender, your income should come from a source thats at least two years old and you should have proof you expect the income to continue at least three more years.

Can 1099 Workers Qualify For Mortgages

The first question is can 1099 workers get mortgages? The short answer is, yes. But its a bit more complicated than just a simple yes. Dont worry though, because after this youll understand how to get your mortgage.

The first step to getting mortgages for 1099 employees is prequalification. This is as simple as phoning your bank or completing an online questionnaire with the basic information on your Form 1099 income report, debt, and assets. These details should be able to give you a quick estimate of the amount you can afford to borrow to buy your home with.

Please note though, prequalification does not mean you are approved for a loan. It only helps you gather an estimate for the amount you can borrow. For instance, a real estate agent may ask for your pre-qualification letter from a lender to find homes that fit your budget. Once youve found the home you want, you can get your things in order to mortgage the property.

How Can I Get A Loan With A 1099

3 Simple Steps to Apply for a 1099 Loan

You May Like: Is Sebonic A Good Mortgage Company

How To Show Proof Of Income If Paid In Cash

If employers paid you in cash, it is possible to get bank statements showing deposits. The statement should show the exact amount you deposited into your bank account. Note that the bank statement does not have to show a direct deposit from your employer. In addition, a proof of income letter from your employer will also support your proof of income application.

Is It Hard To Get A Mortgage When You Are Self

There’s a stereotype that self-employed borrowers have less predictable income when compared to the stability afforded by salaried employment. Because of this, self-employed mortgage applicants usually have to meet a higher threshold of lender requirements to secure a mortgage loan. But, it is not impossible.

Also Check: How Much Should Your Mortgage Payment Be Compared To Income

Who Needs To File A 1099 Form

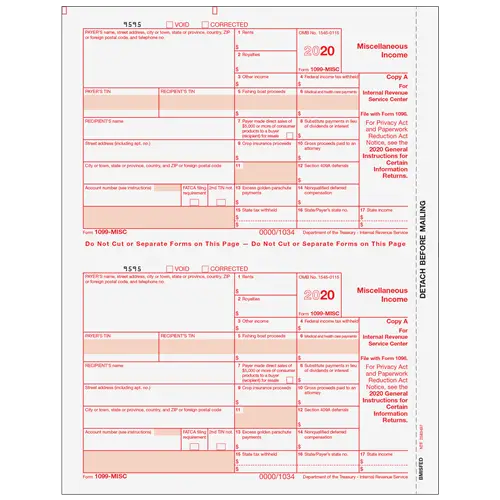

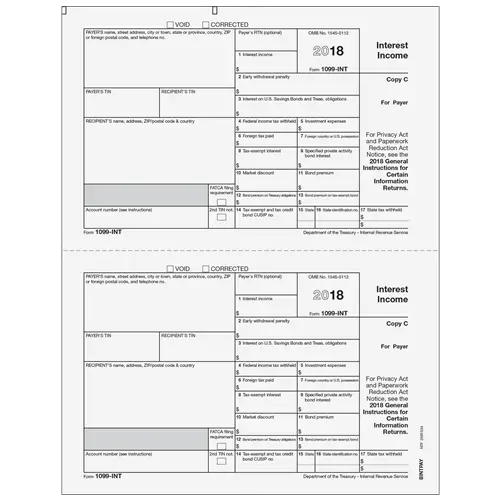

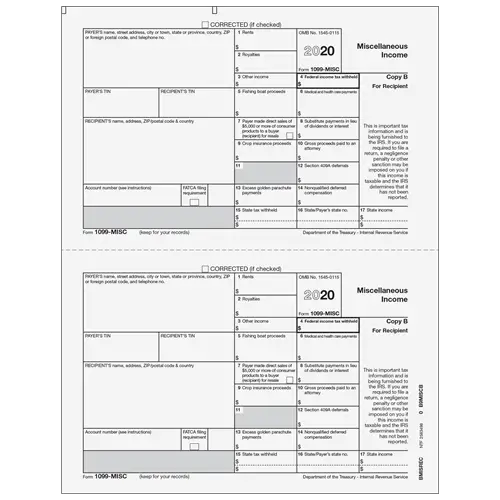

A 1099 form reports income from freelance work, rentals, investments, and other alternative sources. In most instances, if you earned more than $600 from any of these sources during the year, the person who paid you must send you a 1099 form by January 31st. You will then use this form to complete your taxes.

When reporting your income on your taxes, use the correct 1099 form.

For example, if you received payment from freelancing, you should generally fill out a 1099-MISC.

Note that you’re responsible for paying taxes on all of your income, regardless of whether or not you receive a 1099 form.

Speak to a tax professional if you have any questions about whether or not you need to file a 1099 form. They can guide you through all the reporting requirements and help keep you above board.

Related: How Do I Give a Temporary Employee a 1099 Form?

How Can You Prove An Oral Contract

Unfortunately, without solid proof, it may be difficult to convince a court of the legality of an oral contract. Without witnesses to testify to the oral agreement taking place or other forms of evidence, oral contracts wont stand up in court. Instead, it becomes a matter of he-said-she-said which legal professionals definitely dont have time for!

If you were to enter into a verbal contract, its recommended to follow up with an email or a letter confirming the offer, the terms of the agreement , and payment conditions. The more you can document the elements of a contract, the better your chances of legally enforcing a oral contract.

Another option is to make a recording of the conversation where the agreement is verbalized. This can be used to support your claims in the absence of a written agreement. However, its always best to gain the permission of the other involved parties before hitting record.

You May Like: How Do Second Home Mortgages Work

Get Ready For Take Off

Rocket Mortgage® is an online mortgage experience developed by the firm formerly known as Quicken Loans®, Americas largest mortgage lender. Rocket Mortgage® makes it easy to get a mortgage you just tell the company about yourself, your home, your finances and Rocket Mortgage® gives you real interest rates and numbers. You can use Rocket Mortgage® to get approved, ask questions about your mortgage, manage your payments and more.

You can work at your own pace and someone is always there to answer your questions 24 hours a day, 7 days a week. Want a fast, convenient way to get a mortgage? Give Rocket Mortgage® a try.

What Types Of Income Do Mortgage Companies Look At For Self

Mortgage lenders will generally consider any source of steady income that is stable, consistent, and ongoing.

That means all kinds of self-employment income are eligible for mortgage financing, including :

- Business owners

- Gig work and side jobs

These types of income can be considered on their own, or as additional funds on top of a primary income source.

Lenders will sometimes even count unemployment income for contract or seasonal workers with a regular, documented history of receiving unemployment in the off-season.

For any source of income, your loan officer must determine it will be ongoing.

Generally, this means the income seems likely to continue for at least three years after loan closing. So your business prospects need to look good. A history of declining income will not improve your chances with a mortgage lender.

For self-employed borrowers, a loan officer may conduct a review of the borrowers business to determine its stability and the likelihood their income will continue at the same level.

If youre in a declining industry such as a hotel owner during the coronavirus pandemic or a builder during a housing crash this could pose problems with your approval.

Read Also: How Do Mortgage Brokers Make Money

Can I Get A Mortgage Without Proof Of Income

For a while it was entirely possible to get a mortgage with no proof of income in the UK. These mortgages were known as self-cert or self-certification mortgages. However, these products were banned following the credit crunch. However, it is still possible to get a self-certified buy-to-let mortgage from a small handful of lenders.

How To Get A Mortgage When You’re Self

Lucas Horton didn’t expect problems when he applied for a mortgage. After all, his credit score was in the 800swhich is excellent. And, as the owner of a custom jewelry story in Dallas, Horton earned a good income.

Nevertheless, he was turned down for a mortgage.

Many self-employed workers, like Horton, struggle to get approved for mortgages. The reasons are numerous, but mainly boil down to this: Many self-employed workers don’t have a traditional salary, and so must often work harder to prove their earnings. With that in mind, here are a few tips to help you get approved for a mortgageeven if you’re your own boss:

Recommended Reading: What House Mortgage Can I Afford

What Is A 1099 Income

A 1099 income is income that is not subject to payroll taxes. This means that the income is not reported on a W-2 form. Instead, it is reported on a 1099 form. 1099 income is typically earned by self-employed individuals, but it can also be earned by those who work on a contract basis. If you work as an independent contractor, own a business, you are a real estate agent, lawyer, dentist or accountant you are probably getting paid via 1099 and you are treated as a self-employed individual.

Mortgages And 1099 Income: What Independent Contractors Need To Know

Freelancers and independent contractors face extra scrutiny when applying for a mortgage. Lenders view 1099 income as less reliable than W2 wages. To convince lenders of their creditworthiness, self-employed borrowers must jump through additional hoops to verify their income.

How do independent contractors verify 1099 income?

For W2 employees, proving gainful employment is as simple as providing pay stubs. However, demonstrating creditworthiness is harder for self-employed home buyers.

- Lenders first verify that a business is open and operating. Verification of employment from a CPA and notarized client letters authenticate a business in the absence of a business license.

- Next, borrowers need to prove stable income using copies of business bank account statements, profit and loss statements, and tax returns.

- Loan-eligible income is typically calculated by averaging 24 months of net income excluding any depreciation expense. However, declining income or changes in tax status may affect how lenders treat self-employment income.

What are the top challenges for self-employed home buyers?

Documentation isnt the only hoop to jump through. These are the challenges that most often hinder self-employed buyers.

How can freelancers plan ahead for mortgage approval?

Getting a great mortgage as a freelancer requires planning ahead, starting with these key steps.

Dont Miss: Can I Get A Reverse Mortgage On A Condo

You May Like: What Is The Benefit Of Refinancing A Mortgage

What Are 1099 Workers

In short, these are individuals who are classified as non-employees. They generally work as independent contractors, seasonal workers, vendors or freelancers. Gig workers and individuals who complete side jobs are also considered non-employees. Regardless of the type of work thats done, the earnings should be deemed as ongoing by the lender to qualify for consideration during the mortgage application process.

What Are Lenders Looking For When Theyre Considering My Mortgage Application

Basically, theyre trying to determine what it is you do and whether youll be able to repay them. There is no third party like an employer to help them decide. So theyll want to know about your business and how much youve made in the past few years, plus theyll be trying to figure out your likelihood of continuing to earn that income.

Don’t Miss: What Is A Great Mortgage Rate

How Does A 1099 Employee Buy A House

The first step to getting mortgages for 1099 employees is prequalification. … For instance, a real estate agent may ask for your pre-qualification letter from a lender to find homes that fit your budget. Once you’ve found the home you want, you can get your things in order to mortgage the property.

Learn How Lenders Calculate Self

Most lenders analyze self-employment income based on some version of Fannie Maes cash flow analysisForm 1084. The method lenders use to determine your qualifying income varies, depending on whether your business is a sole proprietorship, partnership or corporation.

To decide whether you qualify for a self-employed mortgage, a lender will consider your net income your gross income minus the costs you incur for doing business.

Note: Self-employed borrowers are sometimes confused by the term gross income, which is calculated somewhat differently for people who are self-employed compared to those who earn W-2 wages. For salaried or hourly workers, gross income is the amount of money thats earned before taxes and other deductions are taken from a paycheck. But if youre self-employed, youre responsible for your own self-employment taxes as such, your gross income is simply the amount of money you made before taking into account expenses.

For example, if youre a self-employed contractor, you might file an IRS form Schedule C, which asks you to deduct business expenses like advertising, utilities or office supplies from your total gross income. The amount of income you have leftover after you deduct expenses is considered your net profit or loss. This figure is what a lender uses for loan qualification purposes.

Read Also: What Is Hazard Insurance On A Home Mortgage

Do I Have To Report Self

If you have a self-employed side gig for instance, if youre a W-2 employee but you drive rideshare or freelance for some extra cash you might not have to report self-employment income to your lender.

Fannie Mae and Freddie Mac say that for conventional loans, self-employed income does not need to be reported if its not used to qualify for the mortgage.

In other words, if you can qualify based on W-2 income and personal savings alone not using funds in a business account then your lender can ignore the self-employment income and you dont need to document it.

This provision applies to borrowers living off retirement income, social security income, pension payments, and/or dividends as well.

Note that these rules apply to conforming home loans. Guidelines for other loans may be different

Why Mortgage Lenders Get Skittish Around 1099 Contractors

If W-2 employees fit neatly inside the box occupied by typical, salaried employees, 1099 contractors present a bit like wild cards.

While the former have signed a contract and work regular hours according to their employer’s needs and schedule, the latter function as independent contractors who work job to job.

The boxy conventions don’t stop there: W-2 employees are paid via their employer’s payroll, participate in employee benefit programs, and have payroll taxes withheld throughout the year. On the other hand, 1099-contractors constitute any self-employed worker hired to complete particular assignments according to a mutual agreement.

In the big scheme of things, 1099 contractors have a lot more freedom than their W-2 counterparts unless they are new to their respective field, have been earning from the same source for fewer than two years, and are keen on getting approved by either of the aforementioned federally-backed home mortgage companies, Fannie Mae and Freddie Mac, created by the United States Congress in 1938 and 1970 respectively.

Recommended Reading: Is 4.625 A Good Mortgage Rate

Tips For Qualifying For A Mortgage As A 1099 Worker

Now that youve got your down payment sorted, lets look at 7 more tips that will help you get approved for mortgages for 1099 employees:

I Was Declined Because Ive Only Been Trading For 1 Year

Its common for high street lenders to decline applicants who are self-employed with 1 years accounts. Prior to the credit crunch, self-employed borrowers were able to self-certify their mortgages. Self-certifications were only designed to be used in certain circumstances but were used a lot more than anticipated.

Self-certified mortgages are said to be one of a number of reasons that contributed to the crash in 2007. Fast forward to now and lenders are extremely careful when assessing mortgages for the self-employed.

Dont Miss: Reverse Mortgage On Condo

Recommended Reading: What Is Congress Free Mortgage Relief Program

Providing Proof Of Income

To verify your income, your mortgage lender will likely require a couple of recent paycheck stubs and your most recent W-2 form. In some cases the lender may request a proof of income letter from your employer, particularly if you recently changed jobs. Another form of income verification will be your last two years of federal tax returns, which the lender will obtain directly from the IRS. Youll be asked to sign a Form 4056-T to authorize the IRS to release them to your lender.

Your lender will want to see at least two years of steady income before theyll authorize a mortgage. That means no gaps in employment during that time. Its ok if youve changed jobs, but only if you stay in the same field. If you recently made a major change say, leaving a sales job to become a teacher or vice versa you may be turned down if youve been there less than two years. These days, mortgage lenders are all about stability and theyll want to be assured that your new career is working out before approving your loan.

Requirements To Get A 1099 Income Loan With Angel Oak

- A maximum LTV of 90% with a 700 credit score or a maximum LTV of 80% with a 640 credit score

- 1-2 years of 1099 forms or a year-to-date earnings statement

- The borrower must purchase an owner-occupied home, second home, or non-owner-occupied home.

- The borrower must be self-employed and working for the same employer for at least two years

Also Check: Where Can I Apply For A Reverse Mortgage

What Documentation Will I Need To Show Lenders

When applying for a mortgage, expect lenders to request and review the following employment and income documents:

Employment verification

- A copy of your business license

- Proof of business insurance

- A letter from a CPA verifying that youve been in business for at least two years

Income documentation

- Two years of federal income tax returns

- Recent business bank statements