What Doesn’t Hazard Insurance Cover

One of the major threats that hazard insurance does not cover is flood damage. That’s because distinct flood insurance policies are availableand perhaps even requiredfor homeowners in flood-prone areas. Making sure you have flood insurance when required is an important step when purchasing a home.

Floods aren’t the only thing that’s typically ignored by hazard insurance. Disasters like earthquakes, landslides and sinkholes typically don’t fall under the scope of basic home insurance. Homeowners may be able to purchase an additional policy if they live somewhere prone to these events.

Maintenance incidents that are under the control of the homeowner also are not typically covered by insurance. That means if a sump pump fails and leaves a basement in 3 feet of water or a septic tank backs up and spills sewage into a house, insurance will not pay out.

Similarly, dog attacks may not be covered under homeowners insurancedepending on the breed of the dog. In some cases, liability protection can be used to cover expenses from a dog bite on your property.

Policies are also unlikely to pay for catastrophes like war or nuclear accidents.

What Is Us Hazard Insurance

Hazard insurance is a type of insurance that covers the policyholder against physical damage to their property from hazards such as fire, wind, theft, and vandalism. It is typically required by lenders as part of a loan agreement.

In addition to helping to cover the costs of damage caused by fires, lightning, hail, wind, snow, and rain, hazard insurance is an important protection for homeowners. Aside from property damage, it can provide coverage for items such as cars parked near the residence and other structures within a certain distance. Physical harm can have a negative impact on both personal accident and liability insurance. Personal accident insurance, in general, includes a physical hazard that relates to a persons age, occupation, health, and physical condition. Physical hazard can be calculated by reviewing natural structures, occupations, and previous liability claims. A homes insurance protection is important, and it can cover a wide range of damages caused by events such as fires, lightning, hail, wind, snow, and rain. One of the most important factors to consider is personal hazard, which includes the applicants age, occupation, physical condition, and health and well-being, as well as liability hazard, which reflects the physical hazard of the property, the occupation of the premises, and the history of previous

Mortgage Insurance Vs Homeowners Insurance: How They Are Different

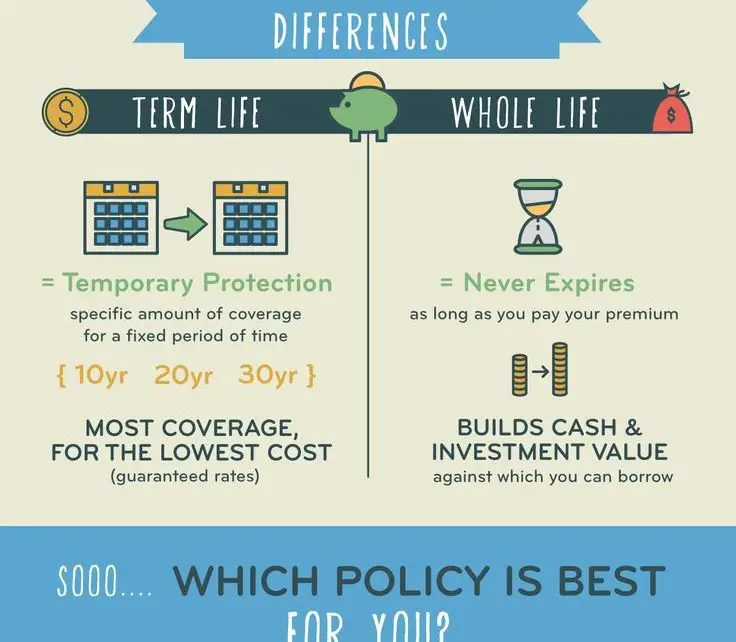

Buying a home is one of the biggest investments, and taking out insurance is an important way to safeguard your investment. There are two main types of home insurance, Mortgage and homeowners Insurance. Mortgage insurance, also known as private mortgage insurance , protects the lender if you default on your mortgage and cannot pay it back. Homeowners insurance or house insurance is meant to cover any damages and disaster damage that might happen in your home or property.

Many people confuse mortgage insurance with homeowners insurance. But theyre not the same, and they should be considered case-by-case.

Don’t Miss: Is It Good To Pay Off Mortgage

How Does Hazard Insurance Coverage Work

Hazard insurance pays for damage or loss to your home’s structure if it’s damaged due to a covered disaster, but the amount you’re reimbursed on a claim depends on which level of coverage you have.

There’s generally three levels of hazard insurance coverage: actual cash value, replacement cost value, and extended replacement cost.

While actual cash value hazard insurance is generally the cheapest, it offers the least amount of protection and most insurers don’t even offer this as a dwelling coverage option anymore.

On the other hand, replacement cost and extended replacement cost coverage offer the most comprehensive level of protection for your home.

What Is Not Protected By Most Homeowners Insurance

There are some circumstances that are left out of many homeowners insurance policies. Some of these exclusions are

- Damage caused by pests like termites

- Corrosion or rot

Mold is only covered if it is the result of a problem that is already covered under your policy. Higher risk items are often not included in basic homeowners insurance coverage either. Artwork, jewelry, or structures like a swimming pool often cost more to protect. You can keep track of what is and isnt covered on your policy on the homeowners insurance declaration page.

Read Also: Can You Mortgage A Boat

What If I Need Help Negotiating My Claim

You can hire a public insurance adjuster to help you. Public adjusters work for you, not the insurance company. Public adjusters charge fees for their services. Before you hire one, make sure you understand what youll have to pay.

Public adjusters cant give legal advice or take part in repairing your property. They also cant do anything that would be a conflict of interest. Public adjusters must have a TDI license. To learn whether a public adjuster is licensed, call our Help Line at 800-252-3439 or use the feature on our website.

Why Do Mortgage Companies Require Hazard Insurance

Because mortgage companies are lending you the money to pay for your home, they want to make sure their investment is protected. Therefore, they will ask for hazard insurance because that is the segment of your homeowners insurance policy that covers their investment: the home itself. Although a typical homeowners insurance policy also includes coverage for personal belongings and potential liabilities, the mortgage company is only concerned with the hazard insurance coverage.

Also Check: How To Check Eligibility For Mortgage

Replacement Cost Vs Actual Value

When you purchase a homeowners insurance policy you can choose to either cover the homes replacement cost or to cover the homes actual value. Covering the replacement cost, or 100% of the costs to rebuild, will have higher premiums. Actual value would pay out your homes depreciated value, which is unlikely to be enough to rebuild.

So What Is Mortgage Insurance

Mortgage protection insurance through a mortgage lender gives you coverage the same way life insurance would, but only for your mortgage debt. The lender owns the coverage and you pay for it, explains Wouters, so the lender gets the insurance proceeds when you die.

Mortgage insurance may be necessary in certain financial situations. For example, you may have to purchase it from the Canada Mortgage and Housing Corporation depending on the amount of your down payment. If you buy a home with a down payment of less than 20%, youll have to pay for mortgage loan insurance, says Wouters. This type of default insurance protects your lender in case you cant make your payments.

Recommended Reading: Rocket Mortgage Loan Types

Recommended Reading: Should I Split My Mortgage Payment

What Is Private Mortgage Insurance

Private mortgage insurance is not meant for home buyers and owners. Instead, PMI is how mortgage lenders protect themselves from borrowers who stop paying, default and foreclose on their homes.

PMI is typically required for borrowers who cant make a down payment on the home of 20 percent or more. But after youve paid down at least 20 percent of your mortgages principal, you should ask your lender to remove the PMI.

How Much Does Hazard Insurance Cost

The cost of hazard insurance differs depending on several factors. Some of these factors include where you live and your . Additionally, the deductibles and policy limits that you select will play a part in determining the cost of hazard insurance.

Your location can significantly alter your hazard insurance cost because of the risks associated with different areas. For example, if you live in a flood plain or an earthquake zone, you may have a higher risk of a natural disaster. However, these things might not be included in your hazard insurance policy.

Because hazard insurance is especially expensive in some areas, many mortgage lenders offer an escrow account that splits the cost of an annual insurance premium into monthly payments.

Don’t Miss: What Is P& i In Mortgage

Additional Living Expenses Claims

If you must move while your house is being repaired, your policy might pay for your additional living expenses, or ALE. Additional living expenses include rent, food, and other costs you wouldnt have if you were still in your home.

If your policy covers ALE, it might be limited to 10 to 20% of the amount of the dwelling coverage on your house.

Watch your expenses to make sure you dont run out of ALE.

Your insurance company will pay for your additional living expenses only up to your policys ALE dollar limits. Because repairs on your home can sometimes take months, watch your expenses to make sure you have enough ALE to cover the entire time youll be out of your home. If you reach your policys ALE dollar limits before your home is fully repaired, youll have to pay the rest of your additional living expenses out of your own pocket.

Is Mortgage Insurance Tax Deductible In Canada

Yes, Canadian homeowners can deduct their mortgage insurance premiums from their taxable income.

For those who are unaware, mortgage insurance is a niche type of coverage that financially protects you if you accidentally miss a mortgage payment.

The loan-to-value ratio of the property directly influences your mortgage insurance premium. If you make a high down payment , you will pay less for mortgage insurance. But, if you made a modest down payment , you will need to pay more for financial protection.

Additionally, even though mortgage insurance isnt legally required in Canada, your mortgage lender can ask you to obtain a mortgage insurance policy if you made a down payment of less than 20%.

This is something that you should keep in mind if you are thinking about buying a home in the near future.

You May Like: How Much Is Mortgage Insurance In Michigan

How Much Is Homeowners Insurance

The cost of homeowners insurance can vary on your coverage. When deciding on the policy thats right for you, you should consider the total value of your possessions and the risks to which your home may be exposed. Are tornadoes or wildfires a regular occurrence in your area? What about the crime rate? The frequency of these possibilities can help you determine which events need to be covered.

Homeowners insurance companies also take your homes location into account when determining their charges. They look at the size, age, condition and materials used to construct your home as well as its risk level.

If you own artwork, large musical instruments, or electronics, you may need to extend your policy to ensure all of your possessions are sufficiently protected. Its a good idea to create an inventory list of some of your items with photos. This will make filing a claim for reimbursement easier.

When you have a mortgage, you typically make payments for your homeowners insurance into your escrow account and your lender pays the premiums when they come due.

Whats Not Covered By Hazard Insurance

There are certain things that hazard insurance wont cover, such as:

- Damage to or theft of your personal property

- Injuries that occur on your property

- Damage from a flood or earthquake

Personal property and liability are included, though, in a standard home insurance policy. Mold damage can be covered if its caused by a peril covered by the policy.

Floods and earthquakes are not covered by homeowners insurance. You can buy flood insurance from the National Flood Insurance Program or a private insurer. You can pay to add earthquake insurance as well.

Read Also: What Is A Mortgage Inspection

Hazard Insurance Vs Homeowners Insurance: Cost

The national average cost for homeowners insurance in 2017 was about $101 per month, according to the Insurance Information Institute. Because hazard insurance is typically included in homeowners insurance, it doesnt have a specific cost.

Your insurance premium may be higher or lower depending on the following factors:

- Square footage of your home

Homeowners Insurance Vs Hazard Insurance

Hazard insurance is just one piece of your whole home insurance policy, but it is arguably the most important. When you purchase home insurance for your property, hazard insurance protects you from natural disasters and accidents that create damages and losses beyond your control.

As a homeowner, you must purchase the right amount of coverage to protect your home and belongings, no matter what happens. There is a lot of peace of mind knowing you will not be financially devastated by unexpected damages to your home.

Recommended Reading: How To Mortgage Rates Work

Using Home Insurance For Disaster Assistance

As many communities continue to recover from numerous natural disasters that impacted the U.S. in 2022 including hurricanes, tornadoes, wildfires and floods it shows the importance of making sure you are financially protected from devastating property losses. This starts with having the right level of replacement cost coverage for your home , said Insurance Information Institutes Director of Corporate Communications Mark Friedlander.

Replacement costs are running nearly double the U.S. Consumer Price Index, meaning it may cost 15% or more to replace your home today compared to just a year ago due to the rising costs of construction materials and labor. Additionally, based on the catastrophic flooding incurred in many parts of the country this year, we encourage all homeowners to consider flood insurance regardless of whether you live in a designated FEMA floodplain. As we have seen, 90% of natural disasters involve flooding and most Americans are not protected from this common hazard.

Mark FriedlanderTriple-I

Friedlander goes on to say, We strongly recommend homeowners conduct an annual review of their insurance coverage with their agent to ensure they have the right amounts and types of property insurance, close any gaps, and take steps to prevent a catastrophic financial loss from the wrath of Mother Nature.

What Kind Of Homeowners Insurance Do I Need

There are many things to consider, but for starters, you will probably want a homeowners insurance policy which typically covers:

- Your house: Homeowners insurance coverage can help pay to repair or rebuild your house and possibly other structures on your property, such as a detached garage or a storage shed, after damage from a covered loss.

- Your stuff: Homeowners insurance can help pay to replace your possessions, from your couch to your china, if they’re damaged or destroyed by a covered loss.

- A place to stay: Your homeowners insurance policy may include additional living expenses coverage to help cover the cost of a hotel or other lodging while your home is being fixed or rebuilt.

- Legal bills: If a guest slips on your walkway, you could be held liable. In this case, your homeowners insurance can help cover the related medical bills, your legal costs and potential court awards up to the dollar limit determined in the policy.

Generally, a typical homeowners policy does not include coverage for earthquakes or flood. Depending on the location of your home, your lender may require you to buy insurance that covers loss caused by earthquake or flood . And if you have valuable items that exceed the special dollar limits of your homeowners policy, such as an art collection or fine jewelry, you may want to purchase extra coverage, known as a Personal Articles Floater , for those items.

Recommended Reading: How To Get A Lower Mortgage Rate Without Refinancing

Do Mortgage Lenders Require You To Buy Hazard Insurance

Qualifying for a mortgage usually requires you to have a certain amount of hazard insurance under your homeowners insurance policy. A lender may require additional hazard coverages, such as tornadoes, depending on the number of natural disasters in your area. Every lender and location has different requirements therefore, this is a consideration when shopping for a mortgage.

Is Homeowners Insurance Included In Closing Costs

Your lender will require the first term of your homeowners insurance to be paid at closing. Most lenders will collect roughly 10% to 20% of your annual home insurance premium in your closing costs and deposit the funds into your escrow account for the next billing cycle. Without escrow, you’ll often have to pay the entire first year’s home insurance premium at the time of closing. Some lenders may also charge a nominal fee to waive your escrow requirement.

Also Check: What Is A Conforming Mortgage

What Does Hazard Insurance Not Cover

Since hazard insurance covers the structure of your house only, it wont cover things like liability, injuries to you or your guests, or damage to/theft of your personal belongings.

Heres a look at some items that wouldnt fall under your hazard insurance coverage:

- Injury or medical bills due to injury on your property

- Damage or theft of personal belongings

- Lodging, if an event displaces you

Your general homeowners policy may cover many of these items, though you can customize how much coverage you want. You can also add on coverage to protect your property from floods and earthquakes if those events are common in your area. In fact, your lender might even require earthquake or flood insurance before you can close.

Types Of Hazard Insurance

There are two broad types:

The events must occur accidentally and untimely for the policy to be valid. For example, if a short circuit occurs due to a wire that has been faulty for over a month, the owner will not be eligible for the claim.

It is also equally important to understand what the policy does not cover. The coverage changes depending on where the property owner lives. Damage to any personal or household items or injury sustained during a disaster is not covered under this insurance. It only protects the owners home and not its contents.

Certain high-risk areas come with their specific coverage. For example, the owner will have to purchase separate flood insurance if the area is prone to floods. Other situations where the policy may not apply are insect infestations, mold and fungus attacks, or general wear and tear of the house.

You May Like: What Does Qc Mean In Mortgage