Some Things To Consider Before Taking Out A Second Mortgage

Before you take out a second mortgage, check if you can get a further advance on your existing mortgage first and get advice from a suitably qualified adviser.

Theyll be able to help you find the loan best suited to your needs and financial situation.

Theyll have to follow the rules set out by the Financial Conduct Authority when dealing with you. These rules are designed to protect you.

If you choose not to get formal advice, you run the risk of taking out an unsuitable loan for your circumstances. If this happens, you might find it difficult to make a successful complaint.

When youre looking into a second mortgage, make sure you:

- shop around make sure you get the best rate by comparing lenders APRC , the duration of the loan and the total amount youd have to pay back

- find out the exact mortgage terms, fees, early repayment charges and rates of interest.

To see if a firm is regulated, check the Register on the Financial Conduct Authority Register website

Find out more in our guide Mortgage advice should you use a mortgage adviser?

How To Get A Mortgage For A Second Home

The process of getting a mortgage for a second home is not dissimilar to getting a first residential mortgage.

First, work out what kind of mortgage you need, and then you need to find a bank or building society thats happy to lend you the cash.

As with any mortgage, youll want to shop around to get the best deal. For a second-home mortgage, you should consider speaking to a specialist broker who can help you find the right lender for your circumstances and the best rates.

You need to answer questions about the intended use of the property, so the lender can ensure that youre applying for the right product.

You also have to meet strict affordability criteria, as you did with your primary residence. If youre still paying off your first mortgage, these repayments will be taken into account by lenders. You won’t be approved if you cant afford to make the repayments on top of your existing mortgage.

A deposit for a second-home mortgage is likely to be higher than for a first home. For instance, most lenders want you to have at least 15% and some ask for even more.

If you want a buy-to-let mortgage, you typically need a deposit of at least 25%. If you want a holiday-let mortgage, you might need as much as 30% as a deposit.

There are other costs too. Youll have to pay second home Stamp Duty which is an additional 3% on top of what youd pay for a first home. Interest rates are typically higher too, which means your borrowing will be more expensive.

Second Mortgages Vs Second Home Mortgages: Rates And Differences

A second mortgage taken out to purchase a second home is not the same as the more frequently used term second mortgage. Confusing, right?

A second mortgage is a loan that uses your current home as collateral, leveraging existing equity that can then be used for a variety of purposes, including renovations, debt consolidation, large purchasesand yes, even helping you purchase a second home.

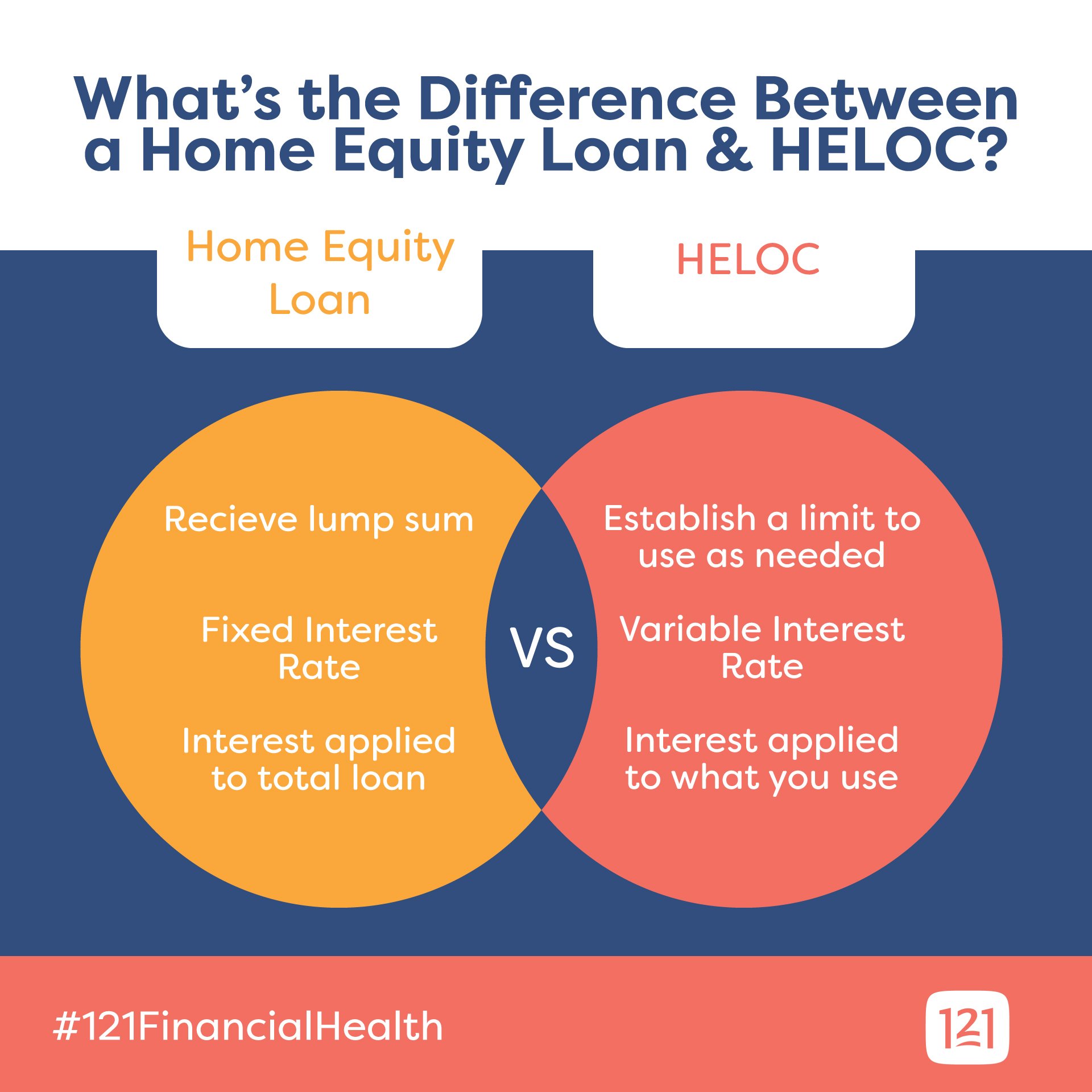

A second mortgage: in the form of a HELOC or a home equity loan describes a lien in the second positionsecond because the original mortgage on your home qualifies as your first mortgage. A second mortgage can provide funds for you to use as you see fit. Depending on the size of the loan taken out, these funds can be used as a down payment or to purchase your second home outright

According to the Consumer Credit Financial Bureau, the term second derives from the idea that if you can no longer afford your mortgages and your home has to be sold to pay off the debts, the newer loan is paid off second. This is due to the lien position.

As part of the mortgage process, a lien is placed against your property by your lender. This simply means they have the legal right to seize your property in the event you don’t meet the terms of your mortgage agreement. First lien positionfirst mortgageis paid off first. A HELOC or a home equity loan would fall into the second positionto be paid off only after the initial mortgage is accounted for .

Recommended Reading: Does Prequalifying For A Mortgage Hurt Your Credit

What Affects Whether Im Approved For A Second Home Mortgage

All banks, building societies and any other mortgage providers will view your current mortgage deal as paying for your main home.

If you buy another home you want to apply for a mortgage on, your mortgage provider will view that as your second home.

Even if you plan to live in the second home your application will be treated as a second home mortgage because you already have a mortgage you are currently paying for.

Its worth checking with your current mortgage provider whether it would be willing to offer you a second home mortgage as better deals may be available to existing customers and your application could be more straightforward.

All mortgage providers offering second home mortgages generally have stricter criteria when you apply compared with first mortgages though. Youll usually need a larger deposit of at least 15% of the propertys value. Second home mortgage deals are also likely to have higher interest rates than standard ones.

Find A Real Estate Agent

The best way to go about buying a second home is to find a real estate agent whos plugged into your desired location. The right agent can fill you in on price histories and how comparable sales have fared, as well as resale prospects.

A good agent knows market trends, says Nathan Zeder of The Jills Zeder Group with Coldwell Banker in Miami Beach and Coral Gables, Florida, including how long homes have been on the market if there are homes not currently on the market that might be available why one side of the street could be worth 5 percent more than the other if the direction of the backyard gets better sun and how close the schools, restaurants, city centers, airports, country clubs and marinas are.

Putting all of that together, Zeder says, allows the buyer to make the best decision, not only about the home but about the location they are choosing in their new community.

When youre interviewing potential agents, Zeder recommends asking questions about how long the agent has lived and worked in the area and how he or she is involved in the community.

You May Like: How Do Mortgage Brokers Make Money

Mortgages For Second Homes Or Holiday Homes

If you wish to buy a holiday home to enjoy with your family and have no plans to rent it out regularly, you should be able to take out a straightforward, residential mortgage on the second property. The new lender will want to make sure you can afford both your current mortgage repayments as well as those on a new mortgage. Therefore, youll probably need a larger deposit often a minimum of 15% of the property’s value and you might encounter slightly higher interest rates and fees than on your current residential mortgage, but thats not always the case. You also have to pay additional Stamp Duty on Second Homes.

Alternatively, those planning to regularly let out a holiday home when it would be otherwise unoccupied need to apply for a specific, holiday home mortgage. Certain building societies and lenders will underwrite these mortgages on a case-by-case basis. If you want to let out your property as an Airbnb you need explicit permission from your lender.

Taxation On Investment Properties And Second Homes

Investment properties and second homes have different tax benefits. For example, expenses usually aren’t deductible for personal residences, like second homes. Associated costs with these properties are nondeductible personal expenses. But if you have an investment property, say a rental, you can write off expenses, like maintenance costs.

For tax purposes, if you rent out your property, including a second home, for 14 days or fewer each year, the income isn’t usually taxable at the federal level. But if you rent out your property for more than 14 days per year, you’ll have to pay federal income tax on your net rental income.

Mortgage interest is deductible for a second home in some cases. For an investment property, it can be deducted as a business expense to lower taxable income.

Read Also: How To Calculate What Mortgage You Can Qualify For

Reasons To Buy A Second Home

Buying a second home might be a great way for you to be closer to the people you love and places you enjoy, or it might help you accomplish your financial goals. Here are some of the biggest reasons for buying a second home:

- Designated vacation spot: If you and your family love the mountains but are tied to the city for work, you might be able to spend more time getting away if you have a vacationhouse in a place that you love to be. The same goes for if you have people or other places you want to establish a home near.

- A place to retire: If you plan to move after you retire, you can get a head start on creating a community in a place you love by purchasing a second home. You can use the home as a retreat for now and retire to it later.

- Diversifying your assets: Homes tend to increase in value, so you can use your second home as a means of diversifying your investments. You can choose to keep or sell your home down the road.

- Rental income: If you decide to rent your home, you can earn rental income to help cover the expenses of owning a second home. If you want to vacation at your home, you can rent it out short-term. If you decide to have it only as an investment property, you can rent to individuals or families on annual leases.

- Potential tax breaks: Many people choose to leave their second homes unoccupied when theyre not using them. If this is the case, the interest and property taxes may be fully deductible from your gross income.

What About Stamp Duty On Second Homes

If youre thinking of buying a second home in England or Wales, either as an investment or as a holiday home, youll be required to pay both standard Stamp Duty and an additional 3%. This is because youll be buying a second residential property and these come with a Stamp Duty surcharge.

However, you can apply for a Stamp Duty refund if your second home ends up becoming your primary residence and you sell or give away your first property within 3 years of buying your second home.

Recommended Reading: Should I Get A 30 Year Mortgage

Buying A Second Property With A Mortgage

If you decide to rent out the property later, youll need to get permission from the lender, so if you think you might want to do this in the future check that your lender would allow it and what would be involved. There may be extra costs.

If you buy a second property that becomes your main home, you should inform HM Revenue and Customs within two years. This is to ensure you avoid paying capital gains tax on it if you sell the property later. CGT is a tax that applies when you sell a property that’s not your ‘main home’ so would still have to pay it on your other home if you sold it.

You could also get a mortgage to buy a second property abroad to use as a holiday home. However, you would need to speak to a broker specialising in overseas mortgages as most UK lenders dont lend on properties outside the UK. You may also now find it harder to get a mortgage to buy a property in the EU as a result of Brexit.

Second Home Mortgage Property Requirements

In addition, the property itself needs to meet certain guidelines. It must be:

- Occupied by the owner for some portion of the year

- A one-unit home

- Suitable for year-round use

- Owned solely by the buyer

- Not rented full-time or operated under a timeshare arrangement

- Not operated by a property management company that has control over occupancy

That first rule, which states you must occupy the home part time, is the most important.

Also Check: Will Mortgage Rates Continue To Rise

Tax Benefits Of Second Homes Vs Investment Properties

The tax benefits of a second home are very different from those associated with an investment property. The table below shows important differences:

Attn formatting: Please create an HTML table with the information below:

| Tax benefit | |

|---|---|

| Not usually taxable if property is rented less than 14 days per year | Must be reported if property is rented more than 14 days per year |

One important reminder about the 2018 tax rule changes: You can only deduct mortgage interest for up to $750,000 worth of total mortgage debt, including loans on primary residences, second homes and investment properties. However, that limit increased to $1 million if the property was purchased prior to Dec. 15, 2017.

Its always best to consult with a tax professional to get tax advice to maximize the tax benefits of your second home or investment property.

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.

Turning Your Second Home Into An Investment Property After Closing

Its not uncommon for someone to decide to convert a second home to an investment property at some point. Its best to read your mortgage paperwork to verify there arent any restrictions on how long the home has to be used as a second home to avoid an investigation for occupancy fraud.

Dont forget to report rental income to the IRS when you file taxes. If you decide to refinance, youll be subject to investment property guidelines and interest rates on the new mortgage. That means youll need more equity to refinance and will likely pay a higher rate than you did when the home was classified as a second home.

Also Check: How Calculate Pmi In A Mortgage

Is A Second Mortgage Right For Me

consider the risksPros

- Second mortgages can help pay for big-ticket items like college tuition or medical procedures

- Interest rates on second mortgages are typically lower than most credit cards

- Second mortgages allow you to access unused equity in your home

- The interest paid on mortgages may be tax-deductible

Cons

- Closing costs can run about 3% to 6% of the total loan amount

- If you default on payments, the bank can foreclose on your home

- You may not qualify for the amount you want if your equity isnât high enough or your credit isnât up to par

- If your home depreciates, you may end up owing more than itâs worth

Key Takeaway Think again if youâre planning on taking a second mortgage to pay for a vacation, car, or another luxury item. If you end up not being able to make payments or your home depreciates, and you lose equity, the loan will do your finances more harm than good.

MORE

How Do You Get A Second Mortgage

Getting a second mortgage is fairly similar to getting a primary mortgage, though there are a few differences.

You won’t have a real estate agent, and you won’t need an inspection. You will, however, need a home appraisal, since the current value of your home plays a major role in determining how much you can borrow.

Here’s an overview of the steps you’ll take to get a second mortgage:

Calculate your approximate home equity and determine how much you want to borrow.

Gather documentation of your current income and debts.

Compare second mortgage lenders.

Apply for the second mortgage.

Review the disclosure documents. Verify that the terms are what you expected and that you can afford the second mortgage payments.

Provide any additional documentation needed for underwriting.

Close on the second mortgage.

Recommended Reading: What Would My Payment Be On A 15 Year Mortgage

Get Preapproved For A Mortgage

When you were buying your first home, getting preapproved for a mortgage showed you were a serious buyer. Buying a second home is no different. A preapproval shows that youve already done some work to move the transaction forward and that a lender is ready to help you make the purchase.

Shop around for rates, too. If you can shave off a few points from your interest rate, you can save thousands of dollars in the long run, which means you can enjoy being in your second home knowing youre paying less.

What Are The Affordability Criteria

Affordability criteria for a second home mortgage are usually harder to meet than for a primary mortgage. This is because if youre already paying the mortgage on your first home, lenders will view you as a higher risk. Fewer lenders offer second mortgages as a service, so you may find it harder to get competitive rates.

Your current mortgage will always be considered when lenders assess your new application. Income and affordability will be assessed in the same way, but because you already have one loan to repay, the lender will need to ensure you can afford both repayments.

A second home mortgage will often require a higher deposit. You are likely to need at least 25% to get the best mortgage deals.

Your lender may also be interested in why you are buying a second home and will be more likely to accept your application if they can see a clear benefit. One example that most lenders look favourably on is if your main residence is a family home and your second home is intended for living in during the working week.

Buying a second home overseas is often harder because lenders view currency fluctuations and foreign property markets as a higher risk.

The easiest way to get the best rates for your second mortgage is to access as many lenders as possible.

Read Also: What Is The Best Mortgage Company To Refinance With