Shop Around For A Great Pre

Just as youâll see several homes before settling on âthe oneâ, you should shop around for the best mortgage rate. Donât just go to your local bank branch and expect to receive a great deal. Do your research and compare mortgage rates, or use a mortgage broker who will negotiate on your behalf.

Even half a percentage point can make a huge difference in your regular payments and the amount of interest youâll pay over time. To see what we mean, plug your numbers into our mortgage payment calculator, then change the interest rate in small steps. Youâll very quickly see the difference!

What happens after your mortgage pre-approval? Generally, youâll have a 90 to 120 day period where your offered rate will be held for you. This is when you should begin house-hunting!

What Is A Credit Rating

Your credit rating is a ranking that indicates your financial health at a specific point in time. It compares the risk you pose for lenders to that of other Canadians.

Your overall credit rating is an important factor in determining the type and amount of credit you may be eligible to receive at any given time. That’s why it’s so important to establish and maintain the highest rating possible.

What Is The Mortgage Approval Process

The mortgage approval process is one of the most vital steps to your home purchase.U nfortunately, it can also feel the most daunting. In general, there are 6 steps to the process, which can take anywhere from several weeks to several months.

Before you apply for a mortgage, make sure you have the required employment history that lenders look for and that you can provide suitable proof of income.

Read Also: What Are Points Paid On A Mortgage Loan

How To Use A How Much Can I Borrow Mortgage Calculator

With this calculator, you can run some what-if scenarios. For example, you may consider:

-

How long will I live in this home? That can greatly impact your decision on whether to choose a 30-year fixed rate loan or a shorter term. The longer term will provide a more affordable monthly payment, but youll pay a lot more interest over the long term. A 15-year fixed-rate mortgage will cost you way less interest over the life of the loan, but your monthly payment will be considerably more.

-

Is an adjustable-rate mortgage a better option for me? If you plan on being in this home for just a few years, a 5/1 ARM could be a good option. Youll enjoy a lower initial interest rate thats fixed for five years, but the rate changes annually after that.

-

Am I trying to buy too much house? Sure, lenders may be more than happy to put your name on a big loan, but how do you feel about it? Are you comfortable with how it may impact your monthly budget, or are you feeling a bit stretched? Consider how your new home costs may impact your other spending goals, such as travel and savings.

-

How much of a down payment should I make? Its always the big question. Are you putting down as little as possible and having to make up for it with larger monthly payments and possibly having to pay mortgage insurance?

How Do I Know If Ill Get Approved For A Mortgage

You can usually get a feel for whether youre mortgage-eligible by looking at your own personal finances.

Youll have the best chances at mortgage approval if:

- Your credit score is above 620

- You have a down payment of 3-5% or more

- Your existing debts are low

- Youve had a stable job and income for at least two years

But keep in mind that rules for mortgage approval are not set in stone. Far from it.

In fact, every mortgage loan program has different eligibility requirements. And lenders can set their own rules, too some are far more lenient than others when it comes to loan approval.

So if youre not sure whether youd qualify, your best bet is to check in with a lender.

You can usually get an answer on your eligibility whats known as a mortgage preapproval for free within 1-3 days. That way youll know for sure which loan program youre qualified for and how much you can borrow for your home purchase.

Recommended Reading: How To Figure Mortgage Payment

Calculate How Much House You Can Afford

Before you get your sights set on your dream home, make sure you can afford it.

Estimate how much house you can afford to buy by using the 28/36 rule. This refers to your debt-to-income ratio, or the total amount of your gross monthly income thatâs allocated to paying debt each month. For example, a 50% DTI means you spend half of your monthly pre-tax income on debt repayment.

Ideally, your âfront-endâ DTI, which includes only your mortgage-related expenses, should be below 28%. Your âback-endâ ratio, which includes the mortgage and all other debt obligations, should be no more than 43%, though under 36% is ideal.

If your DTI is too high, youâll need to work on reducing or eliminating some existing debt before you apply for a home loan.

And remember, your monthly loan payment is just one piece of the puzzleâthereâs also interest, homeowners insurance, property taxes and, potentially, homeowners association fees. Youâll also need to consider how much of a down payment you can contribute, and whether youâll be required to pay private mortgage insurance .

There are also plenty of online calculators that can help you run the numbers.

How To Calculate Your Home Affordability

There are several methods for figuring out your home affordability. The easiest way is to enter your information into our calculator above. Our home affordability calculator works with either your debt-to-income ratio or your proposed housing budget.

For the first method, youll need your gross monthly income and monthly debts for the second, youll need your desired monthly payment amount. Both methods will require your down payment amount, state, credit rating, and home loan type.

Once youve input all the information according to the method you chose, our calculator will let you know the maximum amount you can pay for a house, as well as your estimated monthly payment.

Don’t Miss: How Much Is Monthly Payment On 600 000 Mortgage

Tips For Qualifying For A Mortgage

If youre considering a home purchase in 2022, heres a brief recap of which programs may be the best fit for your finances:

Qualifying for a conventional loan may be your best bet if:

- You have high credit scores

- You can make at least a 20% down payment

- You are eligible for the HomeReady or Home Possible loan programs

Qualifying for an FHA loan is a good choice if:

- You have credit scores between 500 and 619

- You have at least a 3.5% down payment and a 580 credit score

- You want to buy a two- to four-unit home with a 3.5% down payment

Qualifying for a VA loan may be a good option if:

- Youre an eligible military borrower

- You dont want to make a down payment

- You want to avoid mortgage insurance

Qualifying for a USDA loan is a good fit if:

- You havea low-to-moderate income

How Much House Can I Afford With A Usda Loan

USDA loans for qualifying rural areas are much more flexible than regular loans. They dont require a down payment and can include the mortgage insurance fee in the loan. This means you can actually finance 102% of the value of the house and avoid paying this fee upfront.

Keep in mind, however, that there are parameters for income eligibility and for the price and size of the house itself. Even if you can afford a certain amount, the eligibility might be for a less expensive home.

In order to see these requirements in detail, you can go to the USDA website and look at the qualifying areas and income by county.

Recommended Reading: What Does Refinancing Your Mortgage Mean

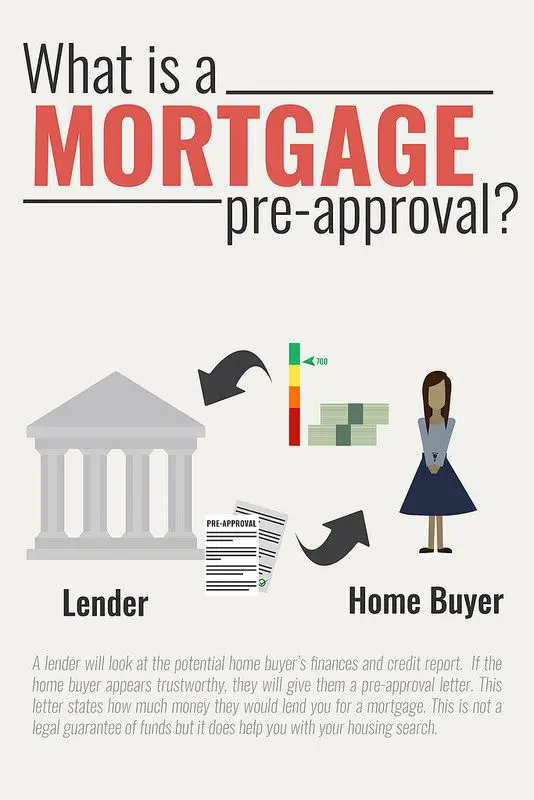

Apply For Mortgage Preapproval

Preapproval is the process of learning how much a lender is willing to lend to you. When you apply for a preapproval, lenders take a look at your income, assets and credit, and tell you how much they can lend you. Theyll also determine your interest rate.

Although similar in name, a preapproval shouldnt be confused with a prequalification. Prequalifications are less accurate than preapprovals because they dont require asset verification. While a prequalification can be helpful, it wont give you the most concrete idea of how much money youll be lent, whereas a preapproval can. Thats because lenders require you to provide documents for the preapproval that help prove your income and debt obligations to ensure youre eligible for the mortgage.

Getting preapproved for a loan and knowing the amount of money you will receive will help you narrow your property search, and make you more appealing to both sellers and real estate agents.

Check Your Credit Score

The first thing youll do when you apply for preapproval is answer a series of questions about yourself, your income, your assets and the home you want to buy. You’ll then give your lender permission to look at your credit report.

Your credit report is a record of your borrowing history from any lenders and creditors youve worked with in the past, including credit card companies, banks, credit unions and more.

Customize Your Personal Mortgage Solutions

What Is Mortgage Prequalification

Prequalification is an early step in your homebuying journey. When you prequalify for a home loan, youre getting an estimate of what you might be able to borrow, based on information you provide about your finances, as well as a credit check.

Prequalification is also an opportunity to learn about different mortgage options and work with your lender to identify the right fit for your needs and goals.

Read Also: Does Cash Out Refinance Increase Mortgage Payment

Calculating The Income Required For A Mortgage

You’ve got a home or a price range in mind. You think you can afford it, but will a mortgage lender agree? Our calculator helps take some of the guesswork out of determining a reasonable monthly mortgage payment for your financial situation.

Mortgage lenders tend to have a more conservative notion of what’s affordable than borrowers do. They have to because lends must ensure the mortgage gets repaid.

Lenders don’t only take into account the mortgage payments but must also look at the other debts you’ve got that take a bite out of your paychecks each month.

Determining this comes down to the debt-to-income ratio. DTI is the percentage of your total debt payments as a share of your pre-tax income. A common benchmark for DTI is not spending more than 36% of your monthly pre-tax income on debt payments or other obligations, including the mortgage you are seeking.

Some lenders and loan types may allow DTI to exceed 41%. In these cases, the borrower typically receives additional financial scrutiny.

When calculating your debt-to-income ratio, lenders also consider what makes up the entire mortgage payment, including property taxes, homeowner’s insurance, mortgage insurance and condominium or homeowner’s association fees.

Does Money Actually Talk

But what about big money and high credit scores? Dont they always mean instant mortgage approvals?

With big money, the issue is often big expenses. If you make $75,000 a year, but have $25,000 in credit card balances, $60,000 in student loans, and $30,000 in auto loans, youll make lenders wince.

If a lender allows as much as 43 percent of your gross monthly income for debts , it means you can spend $2,687 on credit card bills, car payments, student debts, and housing costs.

The chart below shows the average DTI of approved loans according to Ellie Mae:

With $25,000 in credit card balances, you might be required to repay two percent of the outstanding debt, a total of $500 a month. Add in one percent for student debt and a $475 monthly cost for an SUV, and that leaves $1,112 for housing a number that wont work for many borrowers.

Read Also: How Long Is The Mortgage Process

The Monthly Income Rule

If you want to focus your search even more, take the time to think about your monthly spending. While the Consumer Financial Protection Bureau reports that banks will qualify mortgage amounts that are up to 43% of a borrower’s monthly income, you might not want to take on that much debt.

“You want to make sure that your monthly mortgage is no more than 28% of your gross monthly income,” says Reyes.

So if you bring home $5,000 per month , your monthly mortgage payment should be no more than $1,400.

“With a general budget, you want to have 50% of your income going toward utilities, mortgage and other essentials,” says Reyes. Keeping your mortgage payment under 30% of your income ensures you have plenty of room for the rest of your needs.

Consider Locking In Your Rate

Usually, you can apply for whats called a mortgage rate lock a guarantee from a lender to honor a specified interest rate for a set period once a seller accepts your offer.

Some lenders will let you lock in a rate once youve been preapproved, although you may need to pay a fee to extend the rate lock if it expires before you buy a home.

Read Also: How Much Mortgage On 200k

Also Check: Can You Negotiate A Lower Mortgage Rate

Mortgage Required Income Calculator

The best way to think about how much home you can afford is to consider what your maximum monthly mortgage can be. As a general rule of thumb, lenders limit a mortgage payment plus your other debts to a certain percentage of your monthly income, which can be approximately 41%.

The amount a borrower agrees to repay, as set forth in the loan contract.

Estimate How Much House You Can Afford

To help you get started, you can use our calculator on top to estimate the home price, closing costs, and monthly mortgage payments you can afford based on your annual income. For our example, lets suppose you have an annual income of $68,000. Youre looking to get a 30-year fixed-rate loan at 3.25% APR. For your down payment and closing costs, youve saved $55,000. See the results below.

- Annual income: $68,000

| Total Monthly Mortgage Payment | $1,587 |

Based on the table, if you have an annual income of $68,000, you can purchase a house worth $305,193. You may qualify for a loan amount of $252,720, and your total monthly mortgage payment will be $1,587. Since your cash on hand is $55,000, thats less than 20% of the homes price. This means you have to pay for private mortgage insurance . Take note: This is just a rough estimate. The actual loan amount you may qualify for may be lower or higher, depending on your lenders evaluation.

The following table breaks down your total monthly mortgage payments:

| Monthly Payment Breakdown | |

|---|---|

| Total Monthly Mortgage Payment | $1,587 |

According to the table, your principal and interest payment is $1,099.85. When we add property taxes and home insurance, your total monthly mortgage payment will be $1,481.34. But because you must pay PMI, it adds $105.30 to your monthly payment, which results in a total of $1,587 every month.

Don’t Miss: What Does It Take To Qualify For A Mortgage

How Much Mortgage Can I Afford

Generally speaking, most prospective homeowners can afford to finance a property whose mortgage isbetween two and two-and-a-half times their annual gross income. Under this formula, a person earning $100,000 per year can only afford a mortgage of $200,000 to $250,000. However, this calculation is only a general guideline.”

Ultimately, when deciding on a property, you need to consider several additional factors. First, it’s a good idea to have some understanding of what your lender thinks you can afford . Second, you need to have some personal introspection and figure out what type of home you are willing to live in if you plan on living in the house for a long time and what other types of consumption you are ready to forgoor notto live in your home.

While real estate has traditionally been considered a safe long-term investment, recessions and other disasters can test that theoryand make would-be homeowners think twice.

How Is My Mortgage Pre

Your lender will take into account:

Your household income

Any outstanding debt you already have that you will still have including credit cards, loans, and student loans

Your savings and down payment amounts

Any dependents

How much you can afford monthly after food, utilities, entertainment, transport costs, and other living expenses

Recommended Reading: How Long Does It Take To Refinance A Mortgage

How Does Your Credit Score Impact Affordability

Your credit score is the foundation of your finances, and it plays a critical role in determining your mortgage rate. For example, lets say you have a credit score of 740, putting you in the running for a rate of 4.375 percent on a loan for a $400,000 property with a 20 percent down payment. If your credit score is lower 640, for example your rate could be higher than 6 percent. In that scenario, the monthly payment to cover the principal and interest could be $300 cheaper for the higher credit score.

To find out your score, check your credit report at one of the big three agencies: Equifax, Experian and TransUnion.

Two Smart Homebuying Moves: Mortgage Prequalification And Preapproval

Find out how much house you can borrow before you start looking and how you can make the strongest offer possible on the property you choose.

If youre ready to make your dream of owning a home a reality, youve probably already heard that you should consider getting prequalified or preapproved for a mortgage. Its time to understand exactly what each of those terms means and how they might help you. And when youre working toward a goal this big, you want every advantage.

Ready to prequalify or apply? Get started

Read Also: How Much Mortgage Do I Qualify For