Economic Recovery On The Horizon

In 2020, the pandemic-induced recession and the resulting economic uncertainty caused some homeowners to hold off on refinancing. Because the refinancing process can take several months to complete, those worried about job stability may have felt it best to wait until things were more stable. Economic recovery is on the horizon. Those who might not have been in a position to refinance last year may now have the chance.

What Do All These Refinance Terms Mean

When it comes to refinancing, there are a number of words and terms that you should become familiar with when learning how to refinance your mortgage. Many of them are key variables that youll want to take into consideration to determine whether refinancing makes sense for you.

Heres a glossary of the most important refinancing terms:

Interest rate: This is the amount of money that your bank or credit union charges each year for lending you money in a mortgage. Its expressed as a percentage . The lower your interest rate, the less youre paying in interest. When you begin the process of refinancing your mortgage, you can typically get a mortgage rate lock, which guarantees that youll be able to get the current interest rate on your new mortgage while you proceed through the refinance process.

In some cases, you may be able to pay extra for a float down rate option, which protects you if market interest rates fall while youre in the middle of refinancing by allowing you to release your rate lock and re-lock at a lower rate.

Annual percentage rate : This is the actual cost of a loan to a borrower. It differs slightly from the interest rate as it includes not just interest, but also additional costs charged by the lender. Again, its expressed as a percentage, and lower is better.

Refinancing To Consolidate Debt

If you have enough equity in your home, you might be able to use built-up equity in your home to pay-out high-interest debt through a mortgage refinance. For example, if you have a number of outstanding debts, such as a car loan, a line of credit, or credit card bills, you may be able to consolidate this debt through the variety of mortgage refinance options available.

Also Check: Reverse Mortgage On Condo

Calculate Your Mortgage Refinancing Savings

To calculate your monthly savings from refinancing, use a mortgage calculator to enter these numbers and get your new monthly payment:

- Amount to refinance

- New interest rate

- New loan term

Compare your new monthly payment to your old monthly payment. The table below shows how grabbing a lower interest rate could save you $204 per month, or $2,448 per year.

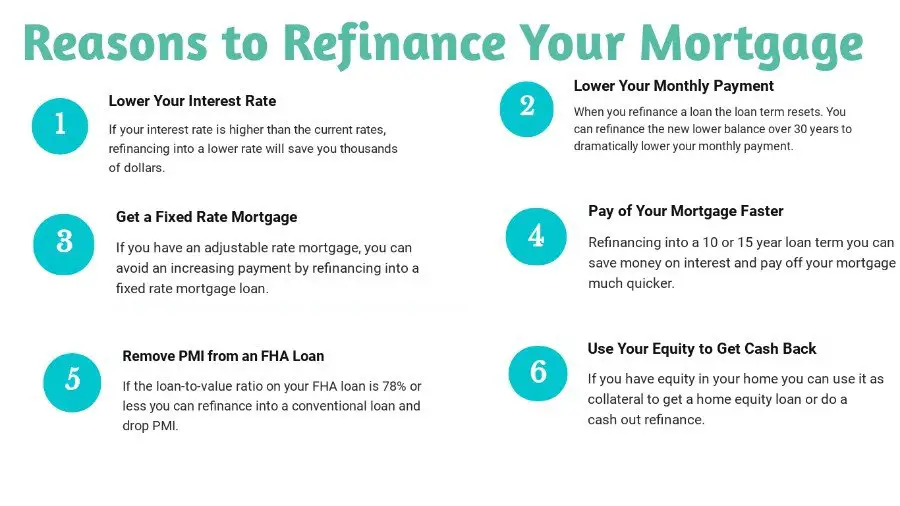

More Manageable Lower Monthly Payments

Lower monthly payments can come with lower interest rates, but you can also lower your payments and have extra cash each month for other expenses by lengthening the term of your loan when you refinance the loan on your house. In that scenario, you would also be paying less toward principle every month, which means your expenses over the life of your loan would be higher. Youll need to crunch the numbers based on your own situation to see what makes sense. A reputable lender will walk you through the scenarios so you understand all the options before you make a decision.

Recommended Reading: Can You Do A Reverse Mortgage On A Mobile Home

Get A Lower Interest Rate

If mortgage rates have dropped since you received your loan, you’re in luck. You can take advantage of reduced interest ratesOpens a popup. and lower monthly payments by refinancing your mortgage. Refinancing your balance with a lower interest rate is called rate-and-term refinancing. Even a slight reduction in the interest rate can lower your monthly payments.

What Does It Mean To Refinance Your House

Related Articles

People get mortgages to make home purchases possible, but falling interest rates and other economic factors might spur borrowers to look for ways to save money on the loans. Refinancing provides an option for homeowners to reduce monthly payments or pay less interest over the course of the loan.

Recommended Reading: Reverse Mortgage For Condominiums

Change Your Term Or Get A Different Mortgage

Sometimes your needs change and you may have to pay off your mortgage faster or switch your mortgage type. If you get a bonus at work and want to put it towards your mortgage, consider refinancing into a term with more prepayment privileges, such as an open mortgage. Or, if interest rates have dropped, and you plan to stay in your home for the long haul, you can refinance to a fixed-rate mortgageOpens a popup. to lock in the lower rates.

What Lenders Look For The Three Ps Of Lending

Lenders are generally interested in three things, sometimes known as the three Ps.

What is the general reason you want to refinance? Are you looking for a better rate or extra features? This information lets the bank suggest the right kind of features and product youre looking for and assess the relevant risks.

Are you someone whos likely to pay back their loan?

Potential lenders use a credit report to help them decide whether to offer you credit and at what terms. As well as providing a summary of how youve handled your credit accounts, it also includes any red flags or indications of poor repayment history. Have a look at your credit report to check whats on it and whether its factually accurate and complete.

Your credit report contains many details about you, including:

- Personal details for identification

- Current credit card, debt, and loans

- Repayment history

- Defaults, bankruptcies, debt agreements and credit infringements

- Payments missed over 60 days for utilities and phone .

Check it carefully. If you spot something thats inaccurate or incomplete, arrange to have it corrected before applying to refinance your home loan.

You can get a credit report from Equifax, Illion or Experian, among others.

Can you afford the repayments? Should something go wrong, how would the bank be able to recover the loan?

Recommended Reading: Rocket Mortgage Requirements

Costs Of Refinancing Your Mortgage

The cost to refinance your mortgage depends on the strategy you use to access equity or lower your interest rate. No matter which strategy you use you will always incur legal costs, as a lawyer must change the financing on title. The good news is if your mortgage balance is greater than $200,000, many brokers and/or lenders will cover this cost.

If you are breaking your mortgage in the middle of your term to access equity or lower your interest rate, your lender will charge you a prepayment penalty. For fixed mortgage rates this penalty is the greater of three months interest or the interest rate differential payment . For variable mortgage rates this is simply three months interest.

Find Out How Much Equity You Have In Your Home

If you want to make some home improvements, using your home equity can be a good idea. Or if you need to pay for other larger expenses, you can use your home equity to get cash through a cash-out mortgage refinance.

To calculate how much equity you have, research your homes value, then subtract your mortgage balance from the amount. For example, if your home is worth $300,000 and your mortgage balance is $200,000, your homes equity is $100,000.

Learn More: Home Refinance Options

Recommended Reading: Can You Get A Reverse Mortgage On A Mobile Home

Do The Math And Prepare

Before you refinance your mortgage, its important to be sure that refinancing is a financially sound move based on your situation. Use Bankrates break-even calculator to understand how long it will take you to make the costs of refinancing pay off. If it makes sense, its time to dig deeper into your own finances:

- Check your credit to make sure you can qualify for a new loan.

- Make sure you have enough equity in your home usually at least 20 percent.

- Check current interest rates to see whats available.

- Make sure you can fit the new payment in your monthly budget.

Pay Off Your Home Loan Early

Some borrowers are able to reduce the term of their loan by refinancing. If you are a borrower who has had your loan for a number of years, a reduction in interest rates can allow you to move from a 30-year loan to a 20-year loan without a significant change in monthly mortgage payments. Because the loan is paid off in a shorter period of time, you may benefit from a reduced interest expense.

Don’t Miss: Rocket Mortgage Conventional Loan

Expert Insight On Mortgage Refinancing

To help answer all your questions, MoneyGeek spoke with industry leaders on refinancing and home lending. This panel will help you identify what to look for, when you should consider refinancing and how to avoid scams in the process.

Break Your Existing Mortgage Contract Early

You would consider breaking your mortgage early if you wanted to obtain a lower interest rate or access equity from your home. In this case, you eliminate your existing mortgage and take on a brand new one with any lender. Breaking your mortgage will incur a prepayment penalty from your bank, which is normally equal to around three months worth of interest charges. If you can justify the cost of the prepayment penalty with your new mortgage rate, then breaking your mortgage can still be worth it.

Read Also: Does Rocket Mortgage Sell Their Loans

Refinance Into A Fixed

When interest rates are on the rise, homeowners with ARMs get nervous. If your interest rate can increase, and you plan to keep your home more than a couple of years, consider refinancing.

As an example, exchanging your adjustable-rate 30-year mortgage for a 30-year fixed-rate loan can provide peace of mind with regular monthly mortgage payments, if not a lower interest rate.

What Does It Mean To Refinance

Mortgage refinancing means choosing a new loan to pay off your old mortgage loan. The major reason most homeowners in the U.S. refinance is to take advantage of the new lower interest rate and get a better affordable loan.

For instance, if you took a mortgage loan 20 years ago at an interest rate of 8%. You can refinance it today with the current interest rate which is below 4% which can save you lots of dollars a month.

Before you dive into refinancing your mortgage, lets see the good and bad sides of refinancing.

Don’t Miss: How Much Is Mortgage On 1 Million

Whats The Difference Between Refinancing Vs Renewing Your Mortgage

Renewing your mortgage means staying with your current lender for another term. Youll have an opportunity to renegotiate your interest rate and term, and you wont need to re-apply.

When you refinance, you are paying out your existing mortgage in order to negotiate a new mortgage loan agreement. This is usually because you want to access the equity in your home or lower other borrowing costs. There may be prepayment charges depending on when you choose to refinance.

Reasons Not To Refinance Your Home

Refinancing your home is not always the best option. Your personal situation should be the biggest factor to consider. Some reasons not to refinance your home are:

- You Do Not Plan To Stay in Your Home For Long

When you are considering refinancing your home, one of the major things to note is how long it takes to recover the new loan closing costs. This is known as the break-even period. It is after this period that you start to save money on your new mortgage. You need to know the closing costs and the interest rate on your new loan to calculate the break-even point. If you plan on moving before the break-even period ends, refinancing your property is not a good option for you.

- You Can’t Afford Closing Costs

If you cannot afford to pay the closing costs out of pocket, it is not a good idea to refinance your mortgage. There is an option to add the closing costs to your loan and pay it back monthly. Doing this could make your monthly payments so high that you dont end up making any savings.

- Higher Long-term Costs

Consider what the long-term cost of refinancing is if most of the payment you’ve made on your 30-year mortgage covers the interest. Refinancing into a shorter-term mortgage could increase your monthly payments and make it unaffordable for you. Refinancing into another 30-year mortgage would reduce your monthly payment, but the long-term cost could remove any savings you hope to make.

Don’t Miss: Reverse Mortgage Mobile Home

Accessing Equity In Your Home

By refinancing your mortgage, you may be able to access the equity in your home. You could potentially access up to 80% of your home’s value, less any outstanding debt. Thatâs extra money for investment opportunities, home renovations, or your childrenâs education. There are several ways to access this equity including breaking your mortgage, taking on a home equity line of credit , or blending and extending your mortgage with your current lender.

How To Refinance Your Mortgage In 6 Easy Steps

Refinancing your mortgage can help you get a lower interest rate or lower monthly payment, depending on your goals.

Edited byChris JenningsUpdated December 17, 2021

Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as “Credible.”

A home loan can be the biggest debt youll ever have, so knowing how to refinance your mortgage is important in helping you meet your long-term financial goals. And whether youre refinancing your mortgage to get a lower rate, or cashing out some home equity, it can be a much simpler process than when you first bought your home.

Heres how to refinance your mortgage in just six steps:

Read Also: How Much Is Mortgage On A 1 Million Dollar House

A Lower Interest Rate On Your Mortgage

When interest rates go down, refinancing picks up. Depending on the length of your loan and how long you plan to stay in the home, refinancing your house for a lower rate could save you thousands over the term. But theres no need to wait for falling rates if youve improved your credit. Sometimes credit can improve enough that you can refinance at a lower rate based on having a better credit score.

The Pitfalls Of Refinancing Your Mortgage

While refinancing has many positive benefits, it could come with pitfalls if you’re not prepared.

To begin with, refinancing loans have closing costs just like a regular mortgage. The mortgage lender Freddie Mac suggests budgeting about $5,000 for closing costs, which include appraisal fees, credit report fees, title services, lender origination/administration fees, survey fees, underwriting fees and attorney costs. It all depends on where you live, the value of your house and the size of the loan you’re taking out.

Some lenders might offer a no-cost refinance, but that usually just means the closing fees are being wrapped up into the amount of your loan. If you refinance with your existing lender, you may get a break on mortgage taxes, depending on your state’s laws.

“That’s a carrot that they dangle,” says English. However, you should always compare rates, terms and programs.

Once you calculate your closing costs, do some quick math to make sure that you’ll make that money back by saving on your new monthly payment. If your closing costs are $5,000 and you save $500 per month on your new mortgage, it would take 10 months to break even. However, if you only saved $200 per month, your “break-even point” would be 25 months . Stay in the home for less time than that, and you won’t truly be saving money long-term.

Don’t Miss: Can I Get A Reverse Mortgage On A Condo

Closing On Your New Loan

Once underwriting and home appraisal are complete, its time to close your loan. A few days before closing, your lender will send you a document called a Closing Disclosure. Thats where youll see all the final numbers for your loan.

The closing for a refinance is faster than the closing for a home purchase. The closing is attended by the people on the loan and title, and a representative from the lender or title company.

At closing, youll go over the details of the loan and sign your loan documents. This is when youll pay any closing costs that arent rolled into your loan. If your lender owes you money , youll receive the funds after closing.

Once you’ve closed on your loan, you have a few days before you’re locked in. If something happens and you need to get out of your refinance, you can exercise your right of rescission to cancel any time before the 3-day grace period ends.

Get approved to refinance.

Here Are Some Mortgage Refinance Options That May Suit Your Unique Needs

Tags:Mortgage,Home,Refinance,Loans

Refinancing your mortgage could save you money, help you pay off your home faster or unlock the equity in your home if the time is right. Knowing your refinancing options is key to gaining the maximum benefit from your decision. Learn whether home mortgage refinancing is right for you.

There are many mortgage refinancing options for many needs, but whatever your goals are, a mortgage loan officer can answer your questions and help you find the home mortgage refinancing thats right for you!

Mortgage and Home Equity products are offered by U.S. Bank National Association. Loan products are offered by U.S. Bank National Association and subject to normal credit approval.

Investment and Insurance products and services including annuities are:Not a Deposit Not FDIC Insured May Lose Value Not Bank Guaranteed Not Insured by any Federal Government Agency

U.S. Wealth Management U.S. Bank and U.S. Bancorp Investments is the marketing logo for U.S. Bank and its affiliate U.S. Bancorp Investments.

U.S. Bank, U.S. Bancorp Investments and their representatives do not provide tax or legal advice. Your tax and financial situation is unique. You should consult your tax and/or legal advisor for advice and information concerning your particular situation.

For U.S. Bank: Equal Housing Lender.

U.S. Bank is not responsible for and does not guarantee the products, services or performance of U.S. Bancorp Investments, Inc.

Recommended Reading: Chase Recast Mortgage