Whats The Difference Between A Hard And A Soft Credit Inquiry

A hard inquiry is when a lender checks your credit because you applied for a loan. A soft inquiry occurs without a loan application, like when companies send you promotional offers.

Soft inquiries dont affect credit scores. Hard inquiries will decrease your and are only affected for a few months.

Soft credit inquiry: Soft inquiries dont impact your credit score. An example of a soft inquiry is an employer conducting a financial background check on a potential new employee candidate.

These inquiries dont submit a new credit application, as they are just looking at your overall credit score. You can perform a soft inquiry and look up your credit score.

Hard credit inquiry: When an individual pursues an application for a new loan or line of credit, the lender performs a more in-depth assessment. This assessment looks at the buyers credit score and credit report to determine if theyre suitable for the credit or loan request.

This comprehensive assessment looks at an individuals credit history reported by the three main credit bureaus,Equifax, TransUnion, and Experian.

Get pre-approved for a mortgage today.

How To Get Pre Approved For A Mortgage Step : Check Your Credit

At least three months before you reach out to a lender for a pre-approval, its a good idea to review your credit report. This way, youll have an idea of what your lender will see and how that might influence your odds of obtaining a pre-approval.

Look for any errors or inaccuracies that could be hurting your credit score. Take steps to dispute the errors, and then follow up one to three months later to verify that they have been corrected. Disputes can take time to resolve.

Different Lenders May Request Different Levels Of Information And Documentation

Some lenders base preapproval letters solely on the information you provide. Other lenders dig into the details with you now to make certain you have all the documentation you need and prevent delays and surprises later. Ask questions. All lenders will require documentation at some point if you decide to apply for a loan. Its better to know now that you need an additional document than when youre about to close.

You May Like: Does Freedom Mortgage Accept Credit Card Payments

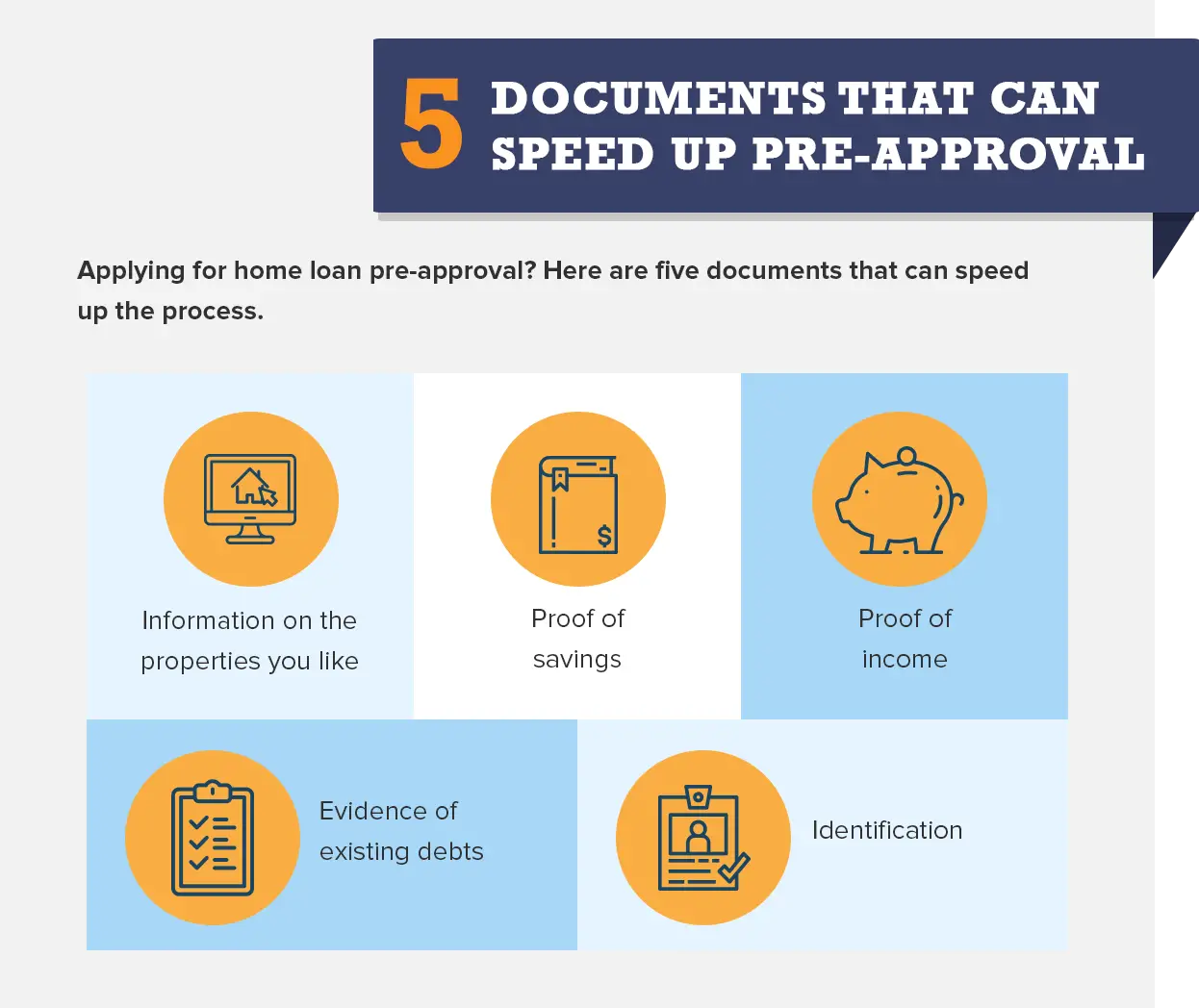

Put Your Documents Together

To determine your eligibility for a mortgage, a lender will want to see your pay stubs, tax returns, W-2 forms, and proof of funds for your down payment. A lender will also do a hard , which will have a small impact on your credit score.

When youre getting a mortgage when self-employed, be prepared to provide a two-year history of earnings to show lenders your long-term averages.

If you have your paperwork in order, you can get preapproved quickly. Many mortgage lenders offer preapproval to buyers within 24 hours of a mortgage application submission. Some online-only lenders, such as Quicken Loans and Better Mortgage, say they provide preapproval in minutes.

Preapproval letters are typically valid for 60 to 90 days. Most lenders will allow you to get an extension, but you may need to resubmit some documents.

Other documents you should check off your preapproval checklist are:

- A drivers license or U.S. passport

- A Social Security number or card. If not a U.S. citizen, a copy of the front and back of your green card

- Verification of employment

How Fast Can You Get Pre

Unlike pre-qualification, which can be acquired in as little as an hour, pre-approval can take as long as 7-10 days. A lot of that depends on you, and a lot depends on your lender.

On your end, you not only have to fill out an application, you also have to produce all the required documentation. Most lenders will demand proof of income, which means tax returns and payroll stubs. You also must provide proof of employment, and a detailed list of all debts youâre currently repaying, including car and home loans, credit card bills, and student loans youâll also need supporting documents for each loan. On top of all that, you must provide recent bank statements detailing all your assets.

A few other documents could make the difference between a speedy pre-approval, or one that drags on. If a friend or family member will help you with the down payment, acquire a signed gift letter from them that spells out your arrangement. Appending marriage or divorce documents to your application could add further clarity to your financial situation and including a complete credit history might also speed things up.

While a fast pre-approval is important, it’s also important to ensure you’re getting a good deal. It pays to shop around for a lower interest rate – especially if you’re searching well in advance. Fill out the form below to get instantly matched with licensed local lenders in your area.

Also Check: Is A Hecm The Same As A Reverse Mortgage

Can I Get Mortgage Pre

Its unlikely. Initial qualification without a full credit check may be possible with some lenders at that point, they may be interested simply in whether you have both the income to pay back a mortgage and no credit red flags. However, to get full-scale pre-approval will likely require a credit check.

Its important to know how long pre-qualification and pre-approval will be in effect. Different lenders assign different times for which their letters of pre-qualification or pre-approval are good, from 30 to as many as 120 days.

Remember that multiple checks for credit history can negatively affect your credit rating, so you dont want to have them repeated often. For the same reason, you shouldnt apply for it until youre ready to start seriously home shopping. Many lenders and real estate agents can help you get a range of what you can afford in a general sense, so that you can avoid going through the pre-qualification or pre-approval process only to learn that theres nothing in your market that you can realistically afford or want.

What Are The Chances Of Getting Denied A Mortgage After Pre

Not high, if youve stayed within your budget, but it does happen. Remember that pre-approval is a statement that you are considered generally qualified to pay back a mortgage, whereas the actual mortgage approval is on a specific purchase. The lender may believe that you are paying too much or may have uncovered liabilities that they did not find in the pre-approval. Also, if you are not able to pay a certain percentage of the cost in a down payment, typically 20%, then you may have to purchase mortgage insurance, which increases your costs.

You dont have to stay with the lender that gave you pre-approval, so you can consider applying elsewhere, which is a good idea in any case.

Also Check: What Income Needed For Mortgage

What Is A Mortgage Loan

A mortgage is a type of loan that is used to finance the purchase of a property. This might be a single-family home, a condo unit, a multi-family dwelling or an investment property. Mortgages are also used on the commercial side to purchase industrial buildings, office space or other types of commercial property.

A mortgage is a loan that is secured by property that is being purchased. In the event the borrower cant repay the mortgage, the lender can use the underlying property to try and recoup the remaining balance on the mortgage.

Buying a home is generally the largest purchase that most people make. Understanding mortgage loans is critical. Getting the right mortgage for your situation can significantly impact your overall financial situation and can help you make the home of your dreams an affordable reality.

What Are The Steps To Getting A Preapproval

As discussed above, the biggest steps of the preapproval process are when your lender:

- Reviews your documents on income and assets

- Performs a credit check

- Writes a preapproval letter stating how much you can afford

From there, your preapproval will typically be good for a few months. If you dont purchase a home within that time, youll need to repeat these steps to renew your preapproval.

Don’t Miss: What Documents Do Mortgage Lenders Require

Understand How Long Preapproval Lasts

Preapproval doesn’t last forever. Check your expiration date and keep it in mind as you look at homes. Though it varies from lender to lender, preapproval is typically valid for 60 90 days. If you haven’t settled on a house, you can request a renewal by giving your lender your most up-to-date financial and credit information.

Take the first step toward the right mortgage.

Apply online for expert recommendations with real interest rates and payments.

What Can You Not Do After Mortgage Pre

What Not to Do During Mortgage Approval

- Don’t apply for new credit. Your credit can be pulled at any time up to the closing of the loan. …

- Don’t miss credit card and loan payments. Keep paying your bills on time. …

- Don’t make any large purchases. …

- Don’t switch jobs. …

- Don’t make large deposits without creating a paper trail.

Recommended Reading: What Is My Monthly Payment On A 250 000 Mortgage

Review Your Financial Situation

Before you apply for preapproval, it’s a good idea to assess your current financial situation.

Pull your credit report: Under normal circumstances, you’re entitled to one free report from each bureau every 12 months, but you can now get a free credit report every week through April 2021. Review your credit history to make sure everything is accurate you can reach out to lenders and the credit bureaus to make corrections if need be.

Calculate your debt-to-income ratio: A key factor in getting prequalified for a mortgage, your DTI ratio represents your total monthly debt payments as a percentage of your monthly income. Most lenders won’t offer a loan that will put your DTI above 43%. So, if you currently have an auto payment of $300, monthly minimum credit card payments of $65 and a monthly income of $5,000, your lender will only approve you for a mortgage with a monthly payment of $1,785.

Mortgage Preapproval: Everything You Need To Know

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been reviewed, commissioned or otherwise endorsed by any of our network partners.

If youre thinking about owning a home, youll likely need a mortgage preapproval. A home loan preapproval gives you a snapshot of what you can afford based on the program you apply for.

A preapproval letter shows sellers youre solid financially, and if theres a lot of competition for homes in your area sellers wont consider your offer without one. Knowing the ins and outs of a mortgage preapproval will give you the edge you need to compete against other less prepared homebuyers.

Things to know first

Knowing how to get preapproved for a mortgage gives you an edge before you start house hunting

Many sellers wont consider an offer without a mortgage preapproval letter

Theres a big difference between a prequalification and a preapproval

Make sure you pick the right loan type for your mortgage preapproval

Have your financial paperwork ready before you apply for a preapproval

Learn what steps to take if youre denied for a preapproval

Also Check: How Much Does Mortgage Coach Cost

How Long Does A Preapproval Last

Many mortgage preapprovals are valid for 90 days, though some lenders will only authorize a 30- or 60-day preapproval.

If your preapproval expires, getting it renewed can be as simple as your lender rechecking your credit and finances to make sure there have been no major changes to your situation since you were first preapproved. Just keep in mind that this might count as another hard pull against your credit, dropping your score by a few points.

Does It Cost To Get A Mortgage Pre

You should not have to spend any money in order to get a pre-approval. There are some lenders who will charge and application fee or even as much as $500 upfront. They are able to get around current mortgage laws by crediting that amount to your appraisal.

If a lender charges you money up front to do a pre-approval, just know the purpose is to dissuade you from shopping them. You should be very hesitant to work with any lender that needs to take money from you upfront in order to get you to do business with them.

You May Like: How Much Does A 200 000 Mortgage Cost Per Month

How Long Does Getting A Home Loan Preapproval Take

Once the lender has all of your information, the preapproval process can take as little as a few days. In fact, most Verified Approvals from Rocket Mortgage are accomplished in around 24 hours.

Sometimes the lender will require more information, which can take more time. Thats why its a good idea to make sure that your documents are all in order before you start the home buying process.

Does Preapproval Affect My Credit Score

A mortgage preapproval can have a hard inquiry on your credit score if you end up applying for the credit. Although a preapproval may affect your credit score, it plays an important step in the home buying process and is recommended to have.

The good news is that this ding on your credit score is only temporary. If you keep paying your monthly bills on time and keep your credit card debt low, your score will recover quickly from whatever small drop it suffers.

You dont have to worry about shopping around for a mortgage, either. If you apply for a mortgage loan with several lenders in a short period, your score wont drop every time these lenders check your credit. Because you are searching for just one loan, each of the credit pulls from different lenders will count as just one hard inquiry. So even if you get preapproved with, say, three lenders, your credit score will drop by just a small number of points.

Just make sure to apply for all your preapprovals within a few days of each other. That way, each hard inquiry will be counted as a single inquiry for credit-scoring purposes.

And dont let that small credit drop prevent you from getting preapproved. The benefits of getting preapproved, such as knowing how much home you can afford, far outweigh the tiny drop your credit score will take.

Read Also: How Long Does A Pre Approval For Mortgage Last

Complete A Preapproval Application

To get preapproved, you need to fill out a mortgage loan application. Most lenders let you complete the app online, over the phone, or in person. Online applications typically take 10-20 minutes to complete. The loan application, also known as Form 1003, asks for your personal information, Social Security number, financial information, and loan details.

After your application is completed, the lender will pull a three-bureau credit report known as a tri-merge. This report shows your and credit history from the major credit-reporting agencies: TransUnion, Equifax, and Experian.

Note, you can apply and get preapproved with any lender you wish. You can even get preapproved by more than one lender to find the best offer. Preapprovals are non-binding, and youre free to switch lenders before taking out the loan.

What Is Preapproval For A Mortgage

With a mortgage preapproval, the lender examines your finances and credit history to determine how much house you can afford. Theyll use this information to decide how large of a loan theyre willing to give you and what interest rates you may qualify for. Its effectively due diligence that youll qualify for a set loan amount and interest rate before you purchase a home assuming your finances remain stable. Once youre done with the preapproval process, your lender will send you a preapproval letter. This letter is a document from a mortgage lender telling you how much you can afford based on your credit report, income and assets. You can use the letter to make your home offers stand out since it shows sellers that youre already qualified for a mortgage.

Your preapproval is one of the first steps in your relationship with your lender. If you get preapproved before finding a home, you wont have to start the whole mortgage application process once youve signed the purchase agreement. And many sellers and real estate agents wont work with a buyer whos not preapproved.

Recommended Reading: How To Become A Mortgage Broker In Massachusetts

Is Mortgage Preapproval Worth It

Mortgage preapproval comes with several benefits. First, it gives you an idea of how much you can borrow, which will help narrow down your search to houses in your price range. But remember that just because youve been preapproved for an amount doesnt mean you have to borrow the maximum. In many cases, its probably a good idea that you dont. Thats because many mortgage lenders use your gross monthly income as a factor in determining how much you qualify for.

Your lender generally doesnt consider your daily living expenses things like groceries, utilities, childcare, healthcare or entertainment or monthly debts in its calculations. Its up to you to review your budget to make sure youre comfortable with the loan amount. Dont rely on your lender to tell you what you can afford.

The preapproval process could also uncover potential issues that would prevent you from getting a mortgage, so you can work them out before setting your heart on a house.

Lastly, a mortgage preapproval lets sellers know you have the borrowing power to back up an offer you make to buy their home, which could make your offer more competitive. It tells real estate agents, who typically work on commission, that spending time on you could well pay off with a transaction. And it alerts lenders that youre a savvy borrower who may soon be taking out a mortgage loan.

In short, getting preapproved for a mortgage signals that youre a serious buyer.