How Do You Calculate A Mortgage Payment

In addition to your principal and interest payments, a monthly mortgage payment may also include several fees, like private mortgage insurance , taxes and homeowners association fees.

Your lender will be able to provide you with a line-item breakdown of your mortgage payment. Using a mortgage calculator is an easy way to find out what your monthly payments will be. You can also look at an amortization schedule, which shows you how much youâll pay over time.

Strong Economic Growth Means More Demand For Money

In general, strong economic growth tends to lead to higher interest rates, while weak growth leads to low interest rates. Heres why: When the economy is strong, more companies want to borrow from investors to expand their business. So, a mortgage provider has to pay a higher interest rate to get investors to lend to it. And when the economy is weak, the reverse is true.

Is A 4625 Around Average For A Mortgage Interest Rate

House price around 300k Credit around 780-800 Down 25%

I know online lenders seem to be lower but Id kind of prefer someone I can meet face to face.

Thanks

We just got preapproved for 4.5 percent with excellent credit scores so sounds about right. Im so bitter bc my sil bought a house 2 yrs ago with a 3.5 percent rate!

Just purchased a house last month, qualified for 4.625 and bought down the rate to 4.50

769 credit score and 20% down

Financed 272000

Right now 4.625 seems right for 0pts.

Keep in mind the value of knowing who is servicing your loans and the quality of service you get from them. My first mortgage was with a major US bank and they serviced it themselves, but it was on the expensive side and a pain to actually pay the mortgage online. My second mortgage is from the local credit union – it was very inexpensive and extremely easy to pay online. The online people typically just sell mortgages – who knows where yours will end up being serviced or how much of a headache it will be.

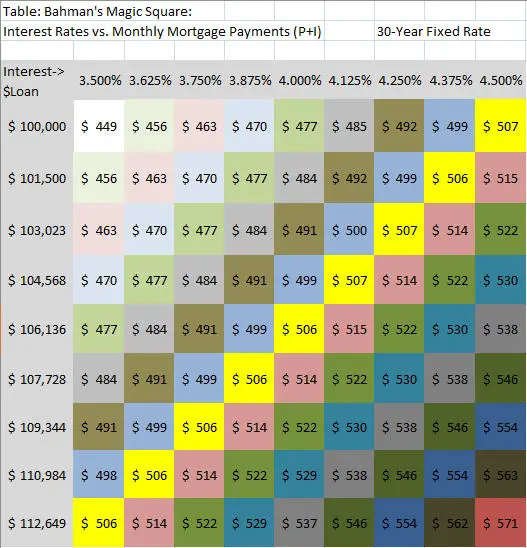

You could probably get at least a 4.25% by comparison shopping online. For a 225k loan on a 300k house that would save you $600 every single year for the life of your loan. You could also buy a house that is ~$11,000 more expensive and pay the same monthly amount by using an online lender.

Read Also: How To Understand Mortgage Payments

What Is The Best Type Of Mortgage Loan

âThe best type of mortgage loan depends on your personal financial profile, lifestyle goals and the type of property you want to own.

For example, a 30-year mortgage might be better for someone who prefers the lowest monthly payments and plans to live in the house for a long period of time. However, if you want to pay off the home quickly, you can opt for a 10-, 15- or 20-year mortgage. The monthly payments will be higher, but the house will be paid off faster.

If interest rate cost is an important factor for you, you might also consider an adjustable-rate mortgage . The most popular ARM is called the 5/1 ARM, which has a fixed rate for the first five years of the loan and then switches to an adjustable rate for the remainder of the 30-year loan term. When the loan hits the adjustable-rate period, it typically adjusts annually.

This can be a good option if you feel ARM rates are likely to stay lower than fixed rates in the future. For example, the 30-year fixed rate has dramatically increased since the start of 2022, which has made the ARM rate a lower, more attractive option right now.

Related: Current ARM Rates

However, if ARM rates exceed fixed rates in a couple years, it could mean you face higher mortgage payments when the 5/1 mortgage reaches the adjustable-rate period. So itâs important to be prepared for changes in mortgage costs when applying for a 5/1 ARM or other ARMs.

Whats A Good Mortgage Rate Today

Mortgage rates change all the time. So a good mortgage rate could look drastically different from one day to the next.

Right now, good mortgage rates for a 15-year fixed loan generally start in the 5% range, while good rates for a 30-year mortgage generally start in the 6% range.

At the time this was written in Nov. 2022, the average 30-year fixed rate was 6.61% according to Freddie Macs weekly survey. That represents all sorts of borrowers, and those with strong finances can often get rates well below average.

Top-tier borrowers could see mortgage rates under 6% at the same time lower-credit and non-QM borrowers are seeing rates above 8 percent. In addition, interest rates could keep rising in 2023. So a good mortgage rate next year might be substantially higher than what it is today.

Recommended Reading: What Is The Average Mortgage Interest Rate In Massachusetts

What Else Might You Get Hit For

- Adjustments for an interest-only option

- Or to remove impounds from you loan

- Costs to extend a rate lock if necessary

On top of all these possible costs are smaller hits for add-on items such as interest-only and mortgage impounds.

Borrowers must pay a small premium to enjoy the benefits of an interest-only option or to avoid an impounded account.

Usually the small adjustment is worth the flexibility of taking such an option if youre interested in it.

There are also small pricing adjustments for things like lock extensions, if youre unable to close your mortgage on time and the lender wont absorb the cost.

Any or all of these adjustments will affect your mortgage rate, and move it accordingly or change the costs of obtaining the loan.

Say your total adjustments add up to 1.125. This would effectively move your rate in the above example rate sheet to 4.75% for the 30-year fixed with a 30-day lock.

Keep in mind that you could also buy the rate down if you wanted a lower rate, as mentioned, but youd have to pay points upfront out-of-pocket to get the loan at the lower price.

For example, if you wanted an interest rate of 4.625%, youd have to pay 0.74% to get that rate, which using our $200,000 loan amount, would be $1,480.

In summary, the more risk you present to the lender, the more adjustments youll have. And the more adjustments, the more expensive your loan and/or higher your interest rate will be.

Our Mortgage Rate Methodology

Moneys daily mortgage rates show the average rate offered by over 8,000 lenders across the United States the most recent business day rates are available. Today, we are showing rates for Friday, May 20, 2022. Our rates reflect what a typical borrower with a 700 credit score might expect to pay for a home loan right now. These rates were offered to people putting 20% down and include discount points.

Read Also: Where Can I Apply For A Reverse Mortgage

How To Compare Mortgage Rates

Borrowers who comparison shop tend to get lower rates than borrowers who go with the first lender they find. You can compare rates online to get started. However, to get the most accurate quote, you can either go through a mortgage broker or apply for a mortgage through various lenders.

The advantage of going with a broker is you do less of the work and youâll also get the benefit of their lender knowledge. For example, they might be able to match you with a lender whoâs suited for your borrowing needs, this could be anything from a low down payment mortgage to a jumbo mortgage. However, depending on the broker, you might have to pay a fee.

Applying for a mortgage on your own is straightforward and most lenders offer online applications, so you donât have to drive to an office or branch location. Additionally, applying for multiple mortgages in a short period of time wonât show up on your credit report as itâs usually counted as one query.

Finally, when youâre comparing rate quotes, be sure to look at the APR, not just the interest rate. The APR reflects the total cost of your loan on an annual basis.

Fifth Third Bank 30 Year Mortgage Rate 4625% Apr

| Fixed 30 Year | |

| 37-360 | $1,984.76 |

Also Check: How Much Does Mortgage Insurance Cost Per Month

Mortgage Rate Trap Is Making The Housing Market Worse

One big factor that helped numerous homeowners save money is ultimately hurting homebuyers. Call it the interest rate trap.

Years of historically low rates, especially in the last two years, have helped millions of homeowners refinance into mortgages with rates between 2% and 4%, lowering their monthly payment by hundreds of dollars.

Now as mortgage rates near 5%, these same homeowners are thinking twice when it comes to trading up, adding to the inventory shortage that is creating an affordability crisis for buyers.

Existing homeowners have a disincentive to sell because every dollar borrowed costs more, Mark Fleming, chief economist at First American Financial Corporation, told Yahoo Money. The financially rational decision is not to sell.

This week, the mortgage rate on the 30-year fixed mortgage hit 4.72%, the highest level since December 2018, according to Freddie Mac.

A year ago, that rate was at 3.13%. It reached an all-time low of 2.65% in January of last year. During that time, millions of homeowners jumped on the chance to snag a historically low rate.

Otherwise, the remaining 86% of homeowners are sitting tight with a mortgage rate of 4.625% or lower.

There is greater disincentive to move and replace their current mortgagee that likely has a lower fixed rate, lowering housing turnover, according to a BofA Global Research note.

How big is the disincentive?

And thats what happening would-be sellers arent selling.

The result?

The Latest Rates On Adjustable

- The latest rate on a 5/1 ARM is 4.29%.

- The latest rate on a 7/1 ARM is 4.625%.

- The latest rate on a 10/1 ARM is 4.77%.

The interest rate on adjustable-rate mortgages will be fixed at first, before eventually becoming adjustable and resetting at specific intervals. A 5/1 ARM, for instance, will have a fixed rate for five years that will reset every year after it becomes adjustable.

An ARM could be a good option because the fixed interest rate is typically lower than the rate on longer-term fixed-rate loans. However, the rate could increase dramatically once it starts adjusting.

Read Also: Can You Get A Mortgage With A 550 Credit Score

Current Mortgage Rate Trends

The mortgage or refinance rate you get depends a lot on your personal finances. But the overall market provides context for your personal rate.

Average mortgage rates bottomed out in 2020 and 2021. This climate allowed the most qualified borrowers to access historically low rates. But rates have risen in 2022 and could potentially go even higher by the end of the year.

To see where 30-year mortgage rates may be going, lets check where theyve been.

How Do I Get The Best Mortgage Rate

To get the best mortgage interest rate for your situation, its best to shop around with multiple lenders.

According to research from the Consumer Financial Protection Bureau , almost half of consumers do not compare quotes when shopping for a home loan, which means losing out on substantial savings.

Interest rates help determine your monthly mortgage payment as well as the total amount of interest youll pay over the life of the loan. While it may not seem like much, even a half of a percentage point increase can amount to a significant amount of money.

Comparing quotes from three to four lenders ensures that youre getting the most competitive mortgage rate for you. And, if lenders know youre shopping around, they may even be more willing to waive certain fees or offer better terms for some buyers. Either way, you reap the benefits.

Also Check: How To Figure Out The Mortgage Payment

The Bank Of Canada Influences Interest Rates

The Bank of Canada also affects interest rates, mainly through changes in our policy interest rate.

The Bank of Canada doesnt set mortgage rates. But it does have some impact on them.

When the economy is strong, we may raise this rate to keep inflation from rising above our target. Likewise, when the economy is weak, we may lower our policy rate to keep inflation from falling below target. Changes in the policy interest rate lead to similar changes in short-term interest rates. These include the prime rate, which is used by the banks as a basis for pricing variable-rate mortgages. A policy-rate change can also affect long-term interest rates, especially if people expect that change to be long-lasting.

In the past, high and variable inflation eroded the value of money. In response, investors demanded higher interest rates to offset those effects. This increased funding costs for mortgage lenders. But since the Bank of Canada began targeting inflation in the 1990s, interest rates and uncertainty about future inflation have declined. As a result, funding costs are now much lower.

How Are Mortgage Rates Determined

Multiple factors affect the interest rate you’ll pay on a mortgage. Some are outside of your control. Others you can influence.

For instance, the federal funds rate the interest rate banks charge when they lend to each other has an influence on all sorts of other interest rates, including those on mortgages. The Federal Reserve adjusts the federal funds rate as part of its effort to control inflation. Therefore, it’s a factor that is beyond your control.

Key determining factors that you do have control over include:

Recommended Reading: What Is One Mortgage Point

How To Find The Cheapest Mortgage

Mortgage rates have risen sharply. Here’s how to shop for one now.

With mortgage interest rates hitting heights not seen for years, home buyers are going to have to think and act more strategically than ever to get a deal on that all-important loan, experts say.

Average 30-year fixed mortgages recently exceeded 5 percent, according to Mortgage News Daily, which tracks daily, real-time changes in lenders rates. Thats an interest rate not seen since 2011, save for a couple of days in 2018. And that rate is 1.75 percentage points higher than it was at the beginning of the year.

This has been the fastest and sharpest run-up in mortgage rates in 28 years, says Greg McBride, chief financial analyst at Bankrate, a financial information website. Its akin to a 17 percent increase in home prices, just since January.

Those higher rates, spurred by inflation, the Russia-Ukraine war, and recent moves by the Federal Reserve, might be enough to deter some would-be home shoppersespecially when combined with an average 32.3 percent increase in home prices since last year, as reported by Zillow. But McBride and others say theres still plenty of appetite in the real estate market, so if you want to stay in the game, youll need tactics to get the best mortgage possible.

Here are the steps you should take to find the lowest-priced loan available.

Mortgage Rates For Dec 15 202: Rates Climb

Today a few notable mortgage rates climbed higher. As interest rates surge, it’s getting more expensive to buy a house.

A number of principal mortgage rates are higher today. The average 15-year fixed and 30-year fixed mortgage rates both saw an increase. For variable rates, the 5/1 adjustable-rate mortgage also rose.

Mortgage rates have been increasing consistently since the start of 2022, following in the wake of a series of interest rate hikes by the Federal Reserve. Interest rates are dynamic and unpredictable — at least on a daily or weekly basis — and they respond to a wide variety of economic factors. But the Fed’s actions, designed to mitigate the high rate of inflation, are having an unmistakable impact on mortgage rates.

If you’re looking to buy a home, trying to time the market may not play to your favor. If inflation continues to increase and rates continue to climb, it will likely translate to higher interest rates — and steeper monthly mortgage payments. As such, you may have better luck locking in a lower mortgage interest rate sooner rather than later. No matter when you decide to shop for a home, it’s always a good idea to seek out multiple lenders to compare rates and fees to find the best mortgage for your specific situation.

You May Like: Can You Roll A Home Equity Loan Into A Mortgage

How Much Does A 1% Difference In Your Mortgage Rate Matter

The interest rate on your mortgage tells you how much youre paying each year to your lender for just having the loan.

If you want numbers specific to your home purchase, you can use an online mortgage calculator to customize your costs.You can also insert what youre looking for below and find the perfect loan type for you.

Basically, a lower interest rate means a lower overall cost of your investment.

For example, consider a mortgage loan for $300,000 with a fixed interest rate of 4.5 percent and 30-year terms. Over the life of your loan, youll pay a total of $547,220 . Monthly payments on this loan would be about $1,520.

If you get the same loan at 3.5 percent, the cost of your investment over 30 years will be $484,968 . Monthly payments on this loan would be about $1,347.

In this example, a 1 percent difference in interest rate could save you $173 per month or $62,252 over the life of your loan.

When youre shopping for a home loan, mortgage lenders that offer lower mortgage interest rates can lead to lower monthly mortgage payments and save you over the life of your investment.

If you own a home, it may be a good time to look at refinancing your home loan. Refinancing your loan now is especially valuable if you have an adjustable-rate mortgage and your introductory rates will expire.