Consider Making A Larger Down Payment Instead

Rather than purchasing points, some borrowers make a larger down payment to reduce their monthly payment amount. Also, if you make a down payment large enough, you can usually avoid paying for private mortgage insurance . The extra money you put towards the down payment might be money better spent than using your money on points.

In addition, putting more money down helps you build equity in the property faster. You could also decide to use the money to make extra payments on your loan and gain equity in your home quicker that way.

There Are Two Types Of Mortgage Points

- The word points can be used to refer to two completely different things

- Either the loan officer or mortgage brokers commission for providing you with the loan

- Or discount points, which are entirely optional and can lower your interest rate

- Know what theyre actually charging you for to ensure you make the correct decision

There are two types of mortgage points you could be charged when obtaining a mortgage.

A mortgage broker or bank may charge mortgage points simply for originating your loan, known as the loan origination fee. This fee may be in addition to other lender costs, or a lump sum that covers all of their costs and commission.

For example, you might be charged one mortgage point plus a loan application and processing fee, or simply charged two mortgage points and no other lender fees.

Additionally, you also have the choice to pay mortgage discount points, which are a form of prepaid interest paid at closing in exchange for a lower interest rate and cheaper monthly payments.

They are used to buy down your interest rate, assuming you want a lower rate than what is being offered. Generally, you should only pay these types of points if you plan to hold the loan long enough to recoup the upfront costs via the lower rate.

You can use a mortgage calculator to determine how many monthly mortgage payments itll take for buying points to make sense. This is essentially how long you need to keep the home loan to come out ahead.

What Are Negative Loan Points

Some lenders offer negative or reverse loan points, where they give the borrower cash to offset closing costs in exchange for a higher interest rate. Negative loan points are essentially a rebate.

Oftentimes, lenders who offer zero closing cost loans use negative loan points. In most cases, negative loan points are capped at 5, or 1.25% of the loan amount. Each point rebated to the borrower increases the mortgage interest rate by 0.25%. These arrangements are typically paired with low down payment mortgages or refinance loans.

You May Like: What Are The Best Mortgage Lenders

Points May Be Tax Deductible

When you buy points on your mortgage, it’s considered to be prepaying interest. As a result, you are typically able to deduct the amount you paid for the points from your federal taxable income.

However, the amount you’re allowed to deduct will vary based on how much your mortgage is. In some cases you might be borrowing too much money to fall within the IRS limits. In this case, your mortgage is not fully tax deductible and you’ll only be able to take a partial deduction.

For all mortgages obtained after December 15, 2017, the maximum loan value in order for interest to be fully deductible is $750,000. If you borrow more than this amount, you’ll only be eligible for a partial deduction.

The IRS also indicates you must meet certain requirements to take either a full or partial deduction for the mortgage points you buy. You can deduct points in the tax year they are paid if:

- The mortgage is for your primary home, or the home you live in most of the time.

- You didn’t overpay for points and paying for points is an established business practice in your area.

- The money you brought to closing, including any seller-paid points, was at least as much as the cost of the points. You aren’t able to deduct the cost of points if you borrowed the money to pay for points from your lender or mortgage broker.

- Points were calculated as a percentage of your mortgage amount and your mortgage settlement statement shows clearly how much the points cost.

What Do Points Mean On A Mortgage

You have to pay for discount mortgage points at the loan’s closing you can’t buy them afterward. Again, one point is typically equal to 1% of the loan principal and generally reduces the rate by .25%. However, one point might lower the rate by more or less than 0.25%, depending on the loan and lender. The more discount points you buy, the lower your interest rate will be, but you usually can’t purchase more than four. Most lenders offer two or three points on a loan.

Don’t Miss: What Is Rocket Mortgage Fieldhouse

Discount Points Vs Origination Points

There are two different types of mortgage points: origination points and discount points. Discount points represent prepaid interest that can be used to negotiate a lower interest rate for the term of a loan.

Origination points, on the other hand, are lender fees that are charged for closing on a loan. Origination points donât save borrowers money on interest, although they can sometimes be rolled into the balance of a loan and paid off over time. Discount points, however, have to be paid up front.

Why Would Investors Accept A Negative Return

Mortgage investors seek both income and the preservation of their capital so why would an investor accept negative rates? Why not just stick the money under a mattress?

The mattress is not a realistic alternative for storing and handling large amounts of cash, said Swedens Riksbank. Costs for storage, security and handling imply that the public may be willing to accept a slightly negative interest rate or account fees equivalent to a negative return.

Getting negative mortgage rates may be a bad option, but it may not be as bad as falling stock and bond prices.

Mattresses aside, the real issue for investors is that alternative investments may be worse. Getting negative mortgage rates may be a bad option, but it may not be as bad as falling stock and bond prices.

The big worry is that interest rates are falling because theres little demand for capital. That suggests stagnant global growth, something which can impact stock values, employment, and political outcomes.

Read Also: What Drives Mortgage Rates Up Or Down

Benefits Of Purchasing Mortgage Points

It goes without saying that paying points comes with some benefits. Here are some of them:

Reduced Interest Rate

If your credit score is low, youll almost certainly pay a higher interest rate on your loan. As such, you should strategize to improve your credit before applying for a mortgage.

This helps lower your rate. Nevertheless, if youd like to buy a house immediately, all hope is not lost. You could still lower your rate by paying points.

Reduced Monthly Payments

Because interest is a core component of your monthly payments, getting a lower interest rate means having a smaller monthly mortgage payment. As such, housing expenditures will occupy less space in your budget. Best part? You can save money faster or spend more on other vital aspects of your life!

Overall, Youll Pay Less.

Are Mortgage Discount Points Tax

Mortgage discount points are deductible for taxpayers who itemize. To get the deduction, you have to meet specific criteria, like your main home has to secure the loan. Generally, you must deduct the points over the life of the loan. But sometimes, you can deduct the points in the year you pay for them. But you can usually only deduct points paid on up to $750,000 of mortgage debt . Home sellers sometimes agree to pay for points to provide an incentive to a potential buyer. The buyer can deduct points in this situation, too.

According to the IRS website, you can also deduct origination fees. But you can’t deduct points paid for items that are usually listed separately on the settlement sheet, like appraisal fees, inspection fees, and attorney fees.

Don’t Miss: When Is A Mortgage Payment Considered Late

How Are Mortgage Points Calculated

Did you know that mortgage points can lower your interest rate? It’s true!Here’s how mortgage points work: Lenders need to earn a certain amount of interest on a loan. Your lender could offer you a 5% interest rate on the loan amount of $100,000 for 30-years â which means you’d pay $93,256 in interest over the life of the loan. Ouch!

But if you’re willing to prepay some of the interest at the settlement, your lender can offer you a lower interest rate.

Can I Get The Interest Rate I Want Without Buying Points

Your credit history has a direct impact on the interest rate the lender will offer you. If you have low credit scores, the lender will likely give you a higher interest rate than what’s available to those with good credit. So, if your aren’t good, it might make financial sense to pay points for a lower rate after considering all other factors. Or you might consider taking steps to improve your credit before you apply for a mortgage loan.

You May Like: Can You Add Renovations To A Mortgage When Purchasing

You May Save On Taxes

Since mortgage interest is tax-deductible and points are considered prepaid mortgage interest, you may be able to deduct the cost of the points on your taxes. To understand the deductions you may be eligible for, check out the IRS rules on mortgage point benefits and speak with a qualified tax expert

What Are Mortgage Points

When you buy mortgage discount points, you pay a specific amount of money to your lender in exchange for an interest rate reduction. Typically, each point you buy costs 1% of the total loan amount. If you’re borrowing $200,000, you’d pay $2,000 for one point.

Each point you buy generally reduces your interest rate by 0.25%. For example, your interest rate might go from 3.00% to 2.75% if you paid for one point. However, the specific amount your interest rate is reduced will vary depending upon your lender and loan program.

If paying 1% of your mortgage to buy a point seems unaffordable, your lender may also allow you to buy half-points. These obviously cost less, but also reduce your interest rate by less. Buying half a point would cost you 0.5% of the loan amount and would reduce your interest rate by 0.125%.

Recommended Reading: What Is The Monthly Payment On A 150 000 Mortgage

Buying Points May Save You Serious Money

Points can increase your closing costs by thousands of dollars, but the large upfront cost might be worth it if you stay in the home long enough to see savings from the reduced interest rate. Paying an extra $2,000 upfront could mean tens of thousands of dollars in savings over the course of your mortgage. However, if you plan to sell your home or refinance before you break even, paying for points might not be worth it.

What Is A Good Apr On A 30 Year Mortgage

What are todays 30-year fixed mortgage rates? As of Tuesday, February 15, 2022, according to Bankrates latest survey of the nations largest mortgage lenders, the average 30-year fixed mortgage rate is 4,200% with an APR of 4,190%. The average 30-year fixed mortgage refinancing rate is 4,220% with an APR of 4,200%.

What is considered a good APR for a mortgage?

A low credit card APR for someone with excellent credit might be 12%, while a good APR for someone with more or less credit might be in their teens. If good means best available, it will be about 12% for credit card debt and about 3.5% for a 30-year mortgage.

Is a 2.75 interest rate good?

Is 2.875 a good mortgage rate? Yes, 2.875 percent is an excellent mortgage rate. Its just a fraction of a percentage point higher than the lowest mortgage rate ever recorded on a 30-year fixed-rate loan.

Is 3.8 a good interest rate?

Anything at or below 3% is an excellent mortgage rate. If you get the same mortgage, but at a rate of 3.8%, you will be paying a total of $169,362 in interest over a 30-year payment term. As you can see, just one percentage point can save you nearly $50,000 in interest payments for your mortgage.

You May Like: When Is The Best Time To Close On A Mortgage

Recommended Reading: Is A Mortgage Public Record

Finding Your Break Even Point

Home finance experts call this period of time needed to recover your upfront cost the break even point.

Every mortgage loan will have its own break even point for buying points.

If you plan to stay in your home beyond the break even point and this is key! if you dont think youll refinance before the break even hits, paying points may be a good idea.

The longer you stay in the home beyond the break even point, the more youll save because the interest rate reduction continues generating monthly savings as long as you have the loan.

Mortgage Points: What Are They

Mortgage points are a one-time cost paid to the lender in exchange for a lower interest rate on a home loan. Because the homebuyer is required to pay more money upfront, points raise the closing expenses. At the same time, however, they lower the monthly mortgage payment and lower the total amount of interest paid throughout the loans term.

You May Like: Are Mortgage Interest Rates Rising Or Falling

How Much Is A Mortgage Point

- Its just another way of saying 1% of the loan amount

- So for a $100,000 loan one point equals $1,000

- And for a $200,000 loan one point equals $2,000

- The higher the loan amount, the more expensive a point becomes

Wondering how mortgage points are calculated? Dont worry, its actually really easy. You dont even need a mortgage calculator! Or a so-called mortgage points calculator, whatever that is

When it comes down to it, a mortgage point is just a fancy way of saying a percentage point of the loan amount.

Essentially, when a mortgage broker or mortgage lender says theyre charging you one point, they simply mean 1% of your loan amount, whatever that might be.

How Discount Points Affect Your Mortgage Rate

When discount points are paid, the bank collects a one-time fee at closing in exchange for a lower interest rate over the life of the loan.

However, the size of your interest rate reduction will vary by bank.

This is one of the reasons why its important to shop for your best mortgage rate. Different banks will offer different rate reductions in exchange for paying points.

As a rule of thumb, paying one discount point lowers a quoted mortgage rate by 25 basis points .

Different banks will offer different rate reductions in exchange for paying points. So shop around carefully.

However, paying two discount points will not always lower your rate by exactly 50 basis points , as you would expect. Nor will paying three discount points necessarily lower your rate by 75 basis points .

In addition, banks consider discount points to be a form of prepaid interest, which is tax-deductible for eligible tax filers.

So for some mortgage borrowers, theres an added tax advantage to buying points, as well discuss more below.

However, you dont pay for discount points to get the IRS tax break. You pay to get the mortgage rate break.

For more information about the discount point mortgage tax deduction, speak with a professional tax advisor.

You May Like: What Is The Monthly Payment On A 75000 Mortgage

How To Shop For A Mortgage With Points

When youre looking at a rate quote that includes points, youd have to pay extra money upfront to actually get the rate shown.

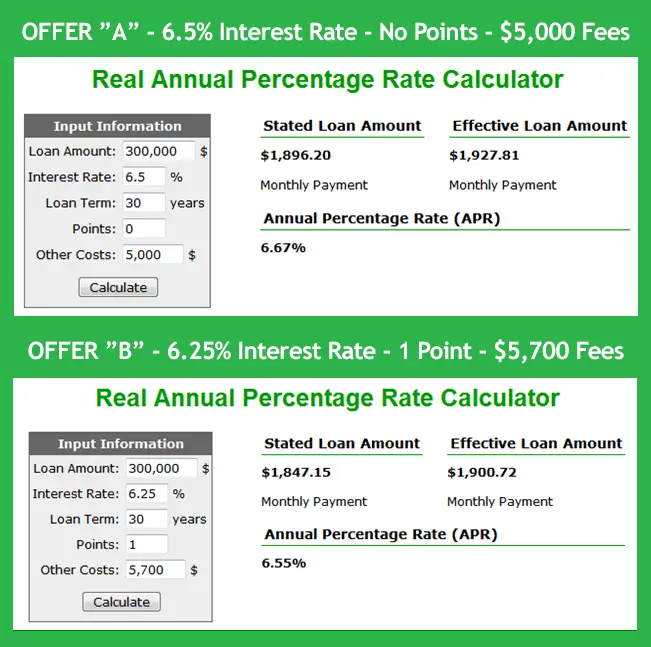

For example, imagine youre taking out a $300,000 mortgage loan. Heres how your interest rate might look with and without mortgage points:

| Mortgage Points | Upfront Cost To Buy Points | Interest Rate | Total Interest Paid Over 30 Years |

| 0 | |||

| 3.0% | $155,300 |

Interest rates shown are for sample purposes only. Your own mortgage rate and fees will vary. Get a custom rate estimate here.

The cost of buying mortgage points adds up quickly. But as you can see in the example above, the long-term savings built into your monthly mortgage payment can be substantial.

Discount Points For Fixed

One percent of the loan amount is equal to one whole point. You can purchase parts of a point, such as a half point, a quarter point, or even a point and a half. For example, 1 point on a $300,000 loan is equivalent to $3,000. A half point is equal to $1,500, and a quarter point is equal to $750. Given this example, if you want to purchase a point and a half, you must pay $4,500 upfront to your lender. If your original rate is 5% APR, this lowers your rate to 3.5% APR.

Again, paying discount points to a lender decreases your interest rate compared to a zero-point loan of the same type. A lender may structure your $300,000, 30-year fixed-rate loan with choices including paying zero points, paying 1 point, or paying 2 or more points at closing.

Typically, you can get an APR reduction of 0.25% per point on fixed-rate mortgages. But note that it usually varies per lender and offer. The deals offered should reflect an interest rate on the loan that decreases with each additional point thats been prepaid. How discount points impact APR depends on the loan amount, type of mortgage, as well as the length of the term.

Recommended Reading: How Much Would An 85000 Mortgage Cost