When Are Mortgage Points Worth It

If you are buying a home and have some extra cash to add to your down payment, you can consider buying down the rate. This would lower your payments going forward. This is a particularly good strategy if the seller is willing to pay some closing costs. Often, the process counts points under the seller-paid costs. And if you pay them yourself, mortgage points usually end up tax deductible.

In many refinance cases, closing costs are rolled into the new loan. If you have enough home equity to absorb higher costs, you can pay mortgage points. Then you can finance them into the loan and lower your monthly payment without paying out of pocket.

In addition, if you plan to keep your home for a while, it would be smart to pay points to lower your rate. Paying $2,000 may seem like a steep charge to lower your rate and payment by a small amount. But, if you save $20 on your monthly payment, you will recoup the cost in a little more than eight years.

The lower the rate you can secure upfront, the less likely you are to want to refinance in the future. Even if you pay no points, every time you refinance, you will incur charges. In a low-rate environment, paying points to get the absolute best rate makes sense. You will never want to refinance that loan again.

But when rates are higher, it would actually be better not to buy down the rate. If rates drop in the future, you may have a chance to refinance before you would have fully taken advantage of the points you paid originally.

Can You Buy Mortgage Points For Adjustable

While it is possible to buy mortgage points for adjustable-rate mortgages , it only provides a discount on the initial fixed period of the loan and isnt generally done.

So, buying mortgage points for an ARM may not be the wise thing to do. However, it would be best you discuss this with your lender for proper guidance.

When You Take Out A Mortgage Your Lender Offers You An Interest Rate Based On Several Factors Including Market Rates And Your Credit Profile

Lenders also offer you the opportunity to pay for a lower your mortgage rate by buying mortgage points, sometimes called discount points.

Points are priced as a percentage of your mortgage cost. Each point you buy reduces your interest rate by a certain amount that will vary by lender. Buying points makes financial sense when you stay in your home long enough, because you can save more on interest over time than you paid for the point.

Keep reading to learn how mortgage points work so that you can decide if buying points makes sense for you.

Don’t Miss: What Would My Mortgage Rate Be

Interest Rates And Mortgages

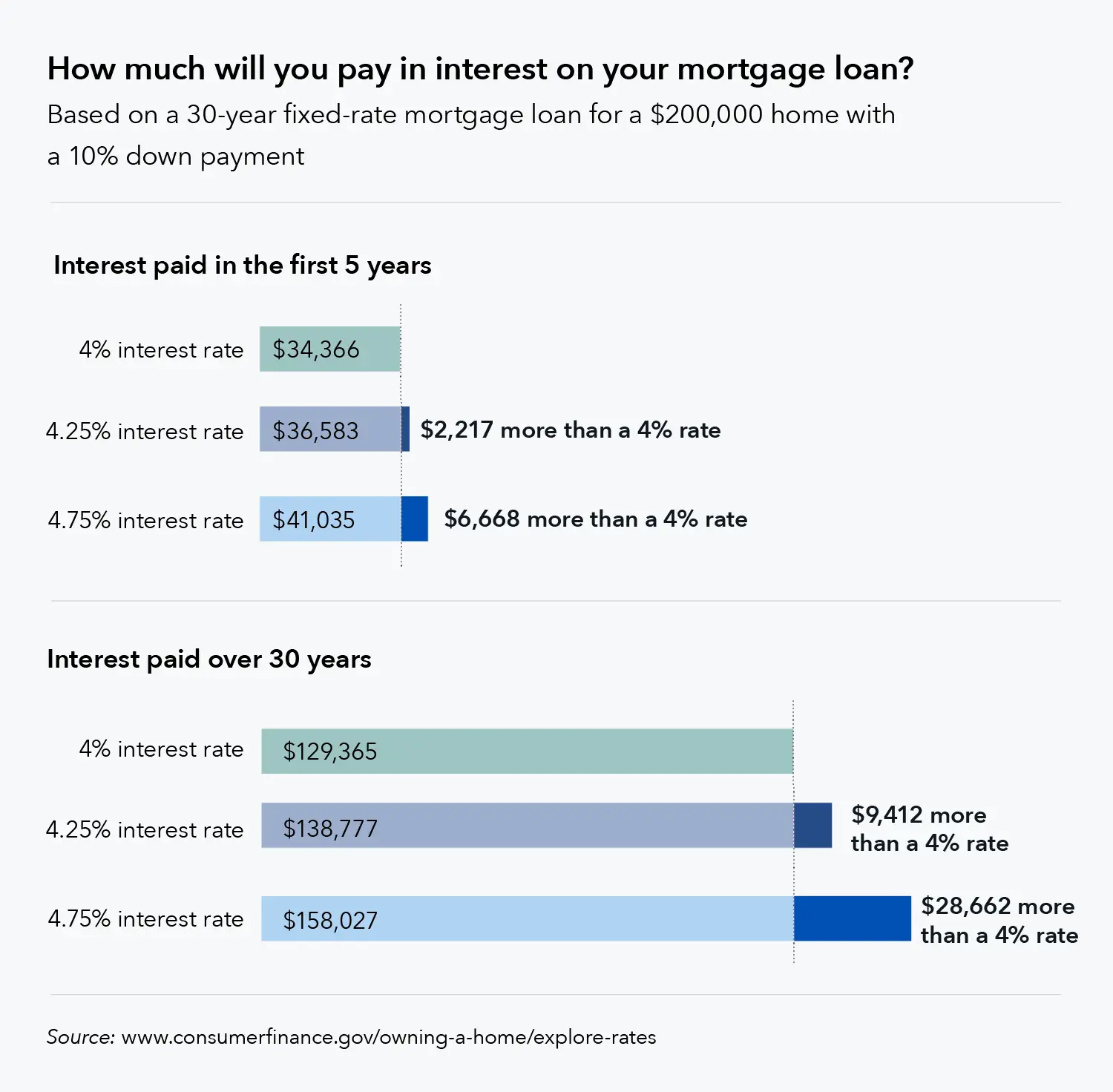

So what do climbing interest rates mean for the cost of mortgages so far?

The estimated two million homeowners on variable rate deals, such as base rate trackers, will see an almost immediate rise in their monthly repayments following the recent Bank rate rise to 3.0%. As an example, a tracker rate rising from 3.5% to 4.25% will cost around an extra £80 a month on a £200,000 loan.

Someone with a £250,000 mortgage over 25 years at the Moneyfacts average two-year fixed rate of 6.46% would see a rise in monthly payments from £1,520 to £1,643 thats up £123 .

Remortgagers and first-time buyers will also be faced with much higher mortgage costs when they come to source a deal as set out above with the cost of new fixed rates having already factored the latest rise into the price.

You can work out the monthly cost of a mortgage against various interest rates with our Mortgage Calculator.

When Buying Mortgage Points Could Make Sense

If you want to build equity faster or pay off the principal balance of your loan sooner, mortgage points arent typically the way to do it. To accomplish either of those goals, make a larger down payment or higher monthly mortgage payments.

But there are a few scenarios where buying mortgage points may make sense:

- You plan to live in your new home long enough to make it past the breakeven point.

- You want to reduce your monthly mortgage payment.

- You have a low credit score and a lot of cash saved up and cant qualify for lower interest rates.

- You have extra cash to spend, and you want to take advantage of tax deductions.

Recommended Reading: When Should I Refinance My Mortgage Dave Ramsey

How Mortgage Points Affect Apr

Banks will sometimes use a mortgage shopping tool known as APR to make a loan with discount points look more attractive than it really is.

APR, which stands for Annual Percentage Rate, is a calculation that shows the long-term cost of holding a mortgage.

But APR also assumes youll hold your loan for 30 years and pay off the total loan amount on schedule. Very often, you will not, which nullifies the APR math.

This is why its important to remember that your APR is not your mortgage rate.

Comparing loan estimates using the lowest APR method is rarely a good plan. It uses discount points against you.If youre not clear how much youll pay to borrow, ask your loan officer to walk you through your Loan Estimate or a truth-in-lending disclaimer.

Maintain Good Credit After Your Home Purchase Or Refinance

It’s important that you take the time to improve your credit before buying a home or refinancing an existing mortgage loan. But even if you don’t plan to borrow money again in the near future, it’s critical that you stay on top of your credit for when you do need it.

Experian’s free credit monitoring service allows you to keep track of your credit file through real-time updates. You’ll also be able to view your FICO® Score powered by Experian data and your Experian credit report at any time.

Using this free service will make it easier to spot potential issues, including fraud, before they do some serious damage. It’ll also give you the information you need to maintain a good credit score and make adjustments to your financial habits as needed.

Also Check: What Is Current Commercial Mortgage Rate

Deducting Mortgage Points On Your Taxes

If youve decided to buy down your interest rate, you might wonder if mortgage points are tax deductible. After all, homeownership does offer a few tax deductions.

You can deduct mortgage discount points on home loans of up to $750,000.

But before you start filling out your tax return, get familiar with the IRS mortgage interest deduction requirements to get the most out of your returns.

Most homeowners can only claim deductions for points paid toward that calendar years mortgage interest, so this tax deduction may need to be claimed annually for as long as youre in the home .

Lenders typically send borrowers a Form 1098 before tax season starts. The form details how much you paid in mortgage points and interest for the year. You can record this information on Schedule A of the Form 1040, which is your itemized deduction form.

How Do You Calculate Mortgage Points

Here are a few examples to show how to calculate discount points, assuming your loan is $200,000:

- 1 discount point would cost $2,000

- > 0.5 discount points would cost $1,000

- > 0.25 discount points would cost $500

In turn, buying those points would help lower your monthly mortgage payments. For a more personalized mortgage points calculation using your own numbers, use a discount points calculator.

You May Like: What Is Loss Mitigation Mortgage

How Much Do Discount Points Cost

The price for discount points is always the same, regardless of lender: 1 percent of the loan amount for each point. That’s where the name comes from in financial terminology, 1 percent is commonly referred to as a “point.” So if you have a $300,000 loan, one point will cost $3,000.

How much a discount point will reduce your rate varies from lender to lender, but is often between one-eighth to one-quarter of a percent. So buying one point might reduce a 5 percent rate to 4.875 percent or 4.75 percent, for example.

You can buy multiple points, fractions of a point and even negative points . How many you can buy depends on the lender and your loan. Some lenders may let you buy 3-4 points others may limit you to only one or two. That’s something you want to check into when shopping for a mortgage and comparing offers.

You can pay for discount points up front if you wish, but they’re often rolled into the loan. So you start with a somewhat higher balance but the lower rate means your monthly payments are less.

Autumn Budget 202: What It Means For You

14 November 2022, 15:18 | Updated: 17 November 2022, 09:25

Chancellor Jeremy Hunt is set to make his Autumn Statement today.

Listen to this article

It is his and Prime Minister Rishi Sunak’s opportunity to lay out their financial plans for the country as they aim to plug a £50bn hole in Britain’s finances.

Here’s what we can expect from the statement.

Recommended Reading: Can A Mortgage Loan Be Used For Renovations

Not Points: Funding Fees Mip And Participation Fees

There are programs that have charges that are based off loan amounts but these are NOT mortgage points. Each program has unique name for these charges. FHA has an Upfront MIP , VA home loans have a funding fee, Texas Vet and Bond programs have participation fees. In conclusion, these fees are not tax deductible.

Are Mortgage Points Worth It

Though money paid on discount points could be invested in the stock market to generate a higher return than the amount saved by paying for the points, the average homeowner’s fear of getting into a mortgage they can’t afford outweighs the potential benefit they may accrue if they managed to select the right investment. In many cases, paying off the mortgage is more important.

Also, keep in mind the motivation behind purchasing a home. Though most people hope to see their residence increase in value, few people purchase their home strictly as an investment. From an investment perspective, if your home triples in value, you may be unlikely to sell it for the simple reason that you then would need to find somewhere else to live.

If your home gains in value, it is likely that most of the other homes in your area will increase in value as well. If that is the case, selling your home will give you only enough money to purchase another home for nearly the same price. Also, if you take the full 30 years to pay off your mortgage, you will likely have paid nearly triple the home’s original selling price in principal and interest costs and, therefore, you won’t make much in the way of real profit if you sell at the higher price.

Recommended Reading: How Much Is Mortgage Tax In Ny

Mortgage Points Vs Origination Fees

As mentioned above, mortgage points are tax deductible. Loan origination fees are not.

Loan origination fees can be expressed in Dollar terms or as points. A $200,000 loan might cost $3,000 to originate & process. This can be expressed either in Dollars or as 1.5 origination points.

Origination fees are negotiable but they help a lender cover their basic overhead & mitigate the risk a consumer may pre-pay their mortgage before the overhead is covered. On conforming mortgages this fee typically runs somewhere between $750 to $,1200.

These fees are typically incremented by half-percent. The most common fee is 1%, though the maximum loan origination fee is 3% on Qualified Mortgages of $100,000 or more.

- Smaller homes may see a higher origination fee on a percentage basis since the mortgage broker will need to do a similar amount of work for a smaller loan amount. On loans of $60,000 or below the cap can be as high as 5%.

- VA loans have a 1% cap on origination fees.

- FHA reverse mortgages can charge a maximum of the greater of $2,500, or 2% of the maximum mortgage claim amount of $200,000 & 1% of any amount above that.

What Might The Reaction Be

Some Conservatives have warned that hiking taxes will not help grow the economy, with the UK teetering on the brink of recession after the economy contracted in the last quarter.

Mr Kwarteng argued that growth would not stem from “putting up our taxes”.

There are also likely to be growing concerns from charities and members of the public about how poorer households will cope with the tightening financial squeeze.

Read more:

But Mr Sunak said the decisions were “difficult but necessary” to bring inflation back to manageable levels.

He also said the financial stability the UK now has – in comparison to the weeks after Ms Truss and Mr Kwarteng’s mini Budget – was only because of the expected financial measures.

“Stability has returned to the United Kingdom, but that’s because the expectation is that the government will make those difficult but necessary decisions to ensure that we can get a grip of inflation, reduce it for people with the cost of living, also limit the increase in mortgage rates,” he said.

Recommended Reading: How Is A Home Appraised For Mortgage

What Are The Advantages Of Mortgage Points

Below are some advantages of paying for mortgage points on your mortgage:

- The most significant advantage of paying for mortgage points is that it gets you a lower interest rate regardless of your credit score and down payment. And if you plan to keep the mortgage for a long time, a lower interest rate can save you loads of money over time.

- Another key advantage is that mortgage points are tax-deductible. If you decide to itemize your deductions instead of the standard deductions, you can deduct these points from your taxable income.

- Paying for mortgage points can offer you a lower monthly mortgage payment over the life of the loan. Like in our example above, you can see the impact of mortgage points on mortgage payments.

Buy Down Break Even Point Calculator

You dont need a special points calculator to determine the amount of mortgage points being charged. There are three steps to determine if is it worth paying points:

Recommended Reading: What Would The Mortgage Be On A 250 000 House

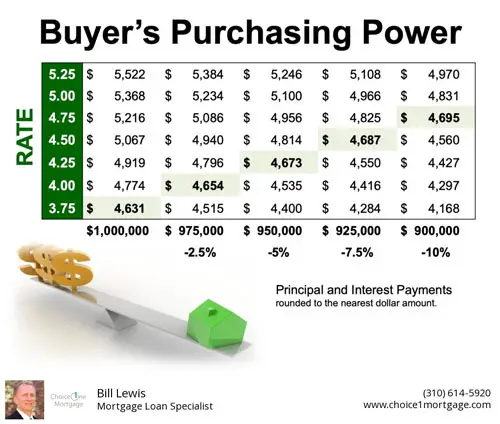

Should I Pay Discount Points To Get A Lower Rate

That depends. Paying for discount points to get a lower interest rate could be a good financial strategy if you plan to live in the home long enough to cover the breakeven period. The upfront costs need to bake out before the savings can kick in. If you move or refinance before that period is up, they are worthless.

This article was updated on Sept. 4, 2020, to remove comments made by a source whose credentials do not meet NextAdvisor editorial standards.

How To Shop For A Mortgage With Points

When youre looking at a rate quote that includes points, youd have to pay extra money upfront to actually get the rate shown.

For example, imagine youre taking out a $300,000 mortgage loan. Heres how your interest rate might look with and without mortgage points:

| Mortgage Points | Upfront Cost To Buy Points | Interest Rate | Total Interest Paid Over 30 Years |

| 0 | |||

| 3.0% | $155,300 |

Interest rates shown are for sample purposes only. Your own mortgage rate and fees will vary. Get a custom rate estimate here.

The cost of buying mortgage points adds up quickly. But as you can see in the example above, the long-term savings built into your monthly mortgage payment can be substantial.

Also Check: Does Mortgage Pre Approval Cost Money

How Buying Mortgage Points Work

Lets rewind.

Youve applied for a mortgage and got approved . Next, youll receive several loan offers from your lender with different terms and interest rates.

This is the moment of truth. This is when youll decide whether to buy discount points. Its also when youll decide between a fixed or adjustable-rate mortgage .

Whether its a good idea to buy mortgage points will usually depend on the type of mortgage youre applying for.

If you go with a fixed-rate mortgage, your mortgage point will keep your interest rate lower for the life of the loan. If you go with an ARM, your point will keep your interest rate lower until the ARMs introductory interest rate period ends, which is typically 5 7 years.

If youre considering an ARM, youll need to know your breakeven point to decide whether buying a mortgage point is worth it.

Your breakeven point is the amount of time you need to live in the house to recover the cost of the mortgage point. To calculate this, divide the total cost of your point by the reduction in your monthly mortgage payment.

How Much Is A Mortgage Point

One point equals 1% of your loan amount. For example, one point on a $300,000 loan would cost you $3,000. Any points you find listed on Page 2, Section A of your loan estimate or closing disclosure must buy you a lower interest rate by law, according to the Consumer Financial Protection Bureau .

Shopping for the lowest rate for the mortgage points you pay is especially important. Lenders set their own interest rate pricing structures, so make sure you collect at least three to five rate quotes to compare.

Read Also: What Is Your Mortgage Rate