Mortgage Notes And Deed Of Trust

In some state, mortgages are called deeds of trust.

The two operate essentially the same way, but while mortgages have mortgage notes, which name two parties borrower and lender, deeds of trust have a separate promissory note that names three parties borrower, lender, and trustee.

When you take out a mortgage, you hold the property title. The mortgage note, filed with the local government, ensures that if you dont pay, the lender can sue you through the court system to start foreclosure. This is called judicial foreclosure.

If you have a deed of trust, instead of you holding the property title, the trustee hold the title until the loan is repaid. If you dont pay, the trustee may start the foreclosure process without going through court. This is called non-judicial foreclosure.

Ready to shop for life insurance?

Mortgage Note Vs Mortgage

Because both are part of the real estate buying process, it’s often easy to confuse a mortgage note with a mortgage, also commonly referred to as a mortgage deed. At their simplest, a mortgage note is a promise to pay back the loan whereas a mortgage is a document outlining the collateral that secures the loan.

Here, it’s important to remember that mortgage notes are usually:

- Not recorded with the local government using a deed. Here, the seller holds the mortgage note, and unlike mortgage loans, the contract is not recorded with any government agency.

- Repaid on a monthly or another fixed basis. Here, mortgage loans and mortgage notes are quite similar in that they require a regular payment from the buyer until the balance of the debt is paid off. The big difference is that, with a mortgage, the property can be sold to repay the debt. With a mortgage note, the seller can take legal action against the buyer to recover the losses, but this often takes time and a lot of resources.

- May contain an acceleration clause. To reduce the risk of mortgage notes, the seller might incorporate a clause into the contract that makes the buyer liable for the total amount outstanding if one payment is missed.

With a mortgage, there is just the lender and the borrower, while with adeed of trust there is a lender, a borrower, and a trustee who holds the property’s title until the loan is paid off. The trustee is typically a title company, bank, or escrow company.

Image viaPexels by Curtis Adams

Selling A Mortgage Note

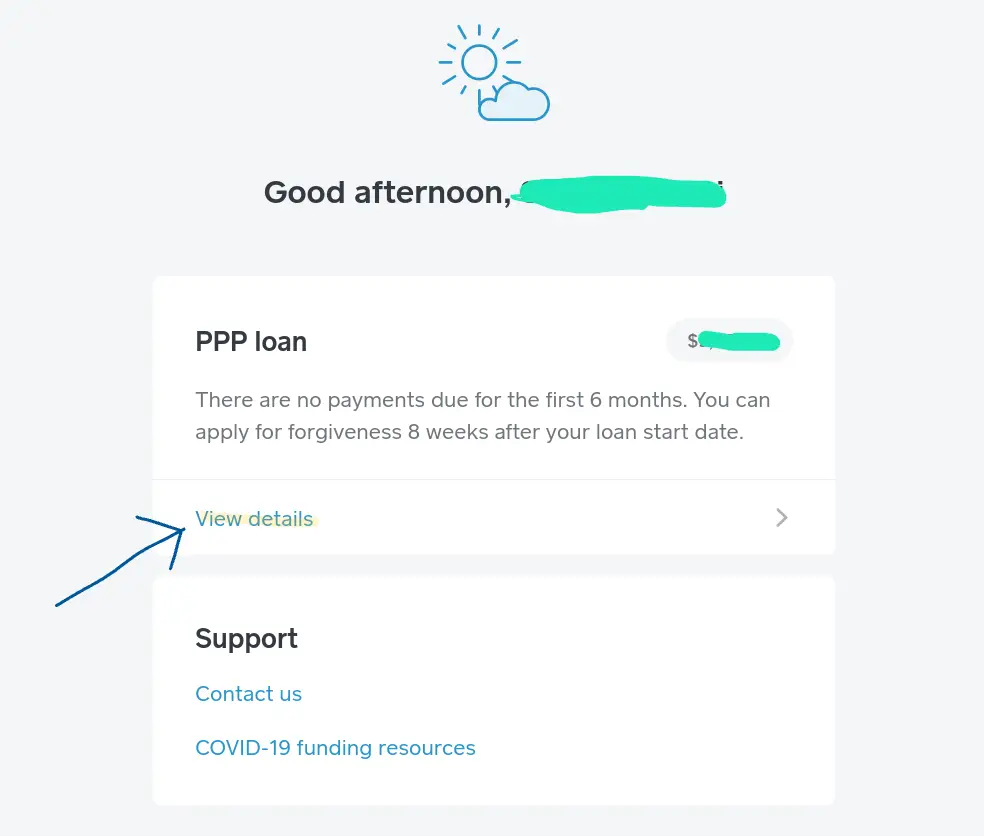

Selling a mortgage note is legal and can be done as long as the borrower is notified during the application for the loan. Whether the seller is an institution or private entity, they are legally required to notify the borrower of the change.

A mortgage note is usually sold to a buyer when the seller no longer wants to wait for the payments and needs a lump sum of cash immediately. In this case, the current owner of the mortgage note would sell the note, relinquishing his or her claim to the obligations of the borrower. The only difference to the borrower is where and to whom they send their payments.

Read Also: How To Buy A House At Auction With A Mortgage

Make Mortgage Notes Easier With Adobe Acrobat Pro With E

A mortgage is one of the most important documents in a home buyers life. Buying a single-family home is the largest financial transaction that most people will perform in their lives, and its essential that the information about that transaction be clear, easy for the borrower to access, and compliant with all relevant laws and regulations. Adobe Acrobat Pro with e-sign makes it easy to sign mortgage notes and other relevant documents. E-sign everything from prepayments to promissory notes safely and quickly with technology that cuts down on paperwork and gets the job done faster.

What Is A Mortgage

Again, by signing a mortgage, you put the home up as collateral for the loan. Here are some of the main features of a mortgage.

- A mortgage sets out your responsibilities for taking care of the property, like keeping the home in good shape and maintaining homeowners’ insurance.

- The lender records the mortgage in the county land records, creating a lien on the property. The mortgage contains the legal description of the property so that it attaches to that particular property.

- Along with standard covenants between you and the lender, the mortgage contains an “acceleration clause.” This clause permits the lender to demand that you repay the loan’s entire balance if you default, like by not making payments.

- If you don’t repay the entire loan amount after acceleration, the mortgage describes when and how the lender may foreclose.

- The mortgage doesn’t obligate you to repay the loan. You aren’t personally liable for repaying the debt if you sign the mortgage, but not the promissory note.

Some States Use a Document Other Than a Mortgage

Some states use mortgages, while others use deeds of trust or another similar-sounding instrument for securing home loans. In Georgia, for example, the most commonly-used contract that gives a lender a security interest in a property is called a “security deed.”

In this article, though, the term “mortgage” covers mortgages, deeds of trust, and other security instruments.

You May Like: What Is A Mortgage Bond

How To Find A Home’s Original Value

A mortgage promissory note is the agreement you sign at a mortgage closing which obligates both you and your lender to abide by the terms set out in the agreement. At a typical closing, three copies are usually signed: one for the lender’s records, one for your records and one that is to be recorded at your local registry of deeds. If you need additional copies of your mortgage note, there are a couple different ways to get them.

Mortgage Notes And Mortgages: Whats The Difference

When people are talking about buying a house with a mortgage, theyre talking about getting the money to buy a house through a loan. Legally, though, mortgage refers to the security instrument that allows the bank to take and sell your house should you default on the mortgage.

Although the mortgage note provides the financial details of the loans repayment, such as the interest rate and method of payment, the mortgage itself specifies the procedure that will be followed if the borrower doesnt repay the loan. For example, the mortgage loan explains that the lender can demand complete repayment if the loan goes into default or that the property can be sold if the buyer fails to repay the loan.

In the case of a home loan, the mortgage note is a private contract between the client and the lender, and the mortgage is filed in the regional government records office to create a mortgage lien on the home. Once youve paid off the loan, the lender will then record a document releasing the borrower from the liability of the mortgage or deed of trust and the promissory note.

Also Check: How Much Interest Is Charged On A Mortgage

Can I Get A Promissory Note Without A Mortgage

Yes, its possible to have a promissory note without a mortgage, if you are evaluating alternative forms of debt to finance your home purchase. In fact, a promissory note may be a way for someone who is unable to obtain traditional financing to still buy a home through what is called a take-back mortgage.

A take-back mortgage effectively allows the home seller to become a lender. If they have the means to do so, a seller can loan a buyer money to purchase the home. In order to do this, the home must be owned outright by the seller , and the buyer is required to make regular payments to the seller. Its the same structure as under a standard home loan through a bank, though typically these loans come at higher interest rate.

Under the terms of a take-back mortgage, the seller retains a proportionate share of equity in the home until the buyer pays back their home loan plus interest in full. As when applying for a traditional mortgage, a promissory note is signed which obligates the buyer to make principal and interest payments according to a preset schedule. Should the buyer default on payments, the seller can foreclose on the property and sell the home.

Secured vs. Unsecured

A promissory note can be secured or unsecured. A secured promissory note requires the borrower to safeguard the loan by putting up items of hard value, such as the home, condominium, or rental property itself as collateral to ensure that sums are repaid.

Master Promissory Note

Skipton Empowers Homeowners Faster With Adobe

Founded in 1853, the Skipton Building Society has connected thousands of first-time buyers with homes. By integrating e-signatures into their approval process, the U.K. company reduced the time to save a new deal by 97 percent, connecting lenders to deals more quickly, all while cutting down on paperwork errors and providing an audit trail that satisfies local legal regulations.

Recommended Reading: How Long For A Mortgage Pre Approval

What If The Borrower Prepays

If a borrower makes early payments in addition to their monthly payments, they may have to pay penalties. These penalties can vary among states. People choose to prepay so that they can pay off their mortgage early or make lower interest payments.

Be sure to investigate your state and local laws to understand if there are laws prohibiting loan prepayment penalties. It may not make financial sense to make early payments or prepay your mortgage.

Faster Contracts With Sony Bank

When Sony Bank was first established in 2001, the Tokyo-based institution often finalized contracts and loans in weeks. After digitizing their workflow and introducing e-signatures into their loan-processing system, contracts and documents that once took weeks could be processed in as little as an hour, benefiting borrowers and lenders alike.

You May Like: Who Is The Best Company To Get A Mortgage From

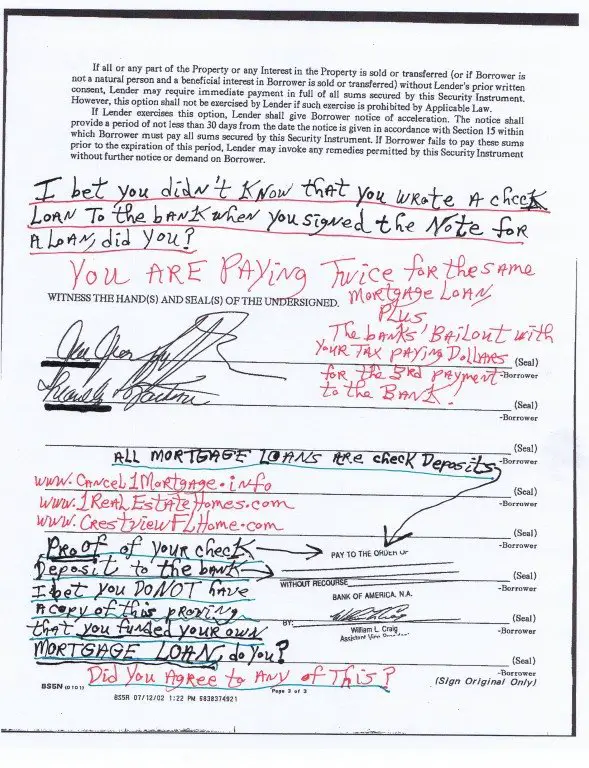

Origin Of Original Notes And Loan Papers

When you are closing on a home for which you require a mortgage, there are three main documents you should be looking for throughout the process. The first is your actual mortgage, also known as a deed of trust or security instrument. This document essentially secures your mortgage by permitting the lender to foreclose on and take possession of the real property interest at issue if you fail to make your mortgage payments as agreed. It is also called a security instrument because the real property is acting as the lenders security should you default on your mortgage loan obligations. The second document, which is often confused with a mortgage, is your promissory note. The promissory note is the actual legally binding document by which you, as the borrower, agree to repay your mortgage loan according to the agreed upon terms. The lender keeps the original promissory note until you have fulfilled all obligations, i.e., paid off, your mortgage. A promissory note will generally contain the following information:

- The total amount of money borrowed

- Your interest rate

- The date payments are due

- The length of time for repayment

- The place where payment is to be remitted and

- The consequences of late payment.

What Is A Mortgage Assignment

An “assignment” transfers the mortgage from one lender to another. Like a mortgage, the lender records an assignment in the county land records.

Generally, each assignment must get recorded. However, in some cases, the mortgage designates Mortgage Electronic Registration System, Inc. as a nominee for the lender. In that situation, MERS tracks the loan transfers in its computerized system, eliminating the need for separate assignments when the loan is transferred.

Don’t Miss: Can You Get A Mortgage With No Credit

Original Notes And Loan Papers: What Does A Lender Need To Foreclose

Especially for new homeowners, understanding the precise nature of every mortgage related document you sign throughout the closing process can be difficult. However, even though these original documents are the keys to ownership of your real property, the more a loan interest changes hands, the higher the likelihood that these original documents may be misplaced in the process. Because these original documents prove ownership of the mortgage, and thus the right to initiate the foreclosure process, the rules of evidence in New York State Supreme Court may require production of the original promissory note in order to proceed with foreclosure litigation. Without said note, a borrower in default may be entitled to defend against a foreclosure action for lack of authentic proof that the lender initiating the foreclosure actually owns the mortgage interest. Accordingly, it is essential to understand how and when to demand production of the original mortgage documents throughout the foreclosure litigation process.

Mortgage Notes As Investments

Another fun fact: You can buy other peoples mortgage notes. Mortgage notes can be good investments for those who want to get involved with real estate, but are not interested in the three Ts of landlording: tenants, toilets, and trash, according to real estate investment expert Joel Cone.

Mortgage notes can be purchased through mortgage note brokerages . They can also be purchased in shares of mortgage bundles through real estate investment trusts or other similar products. This is a fairly complicated venture, however, so youll want to do lots of research before you jump in.

Recommended Reading: What Is Mip On A Mortgage Loan

What Is The Difference Between A Mortgage Agreement And A Deed Of Trust

A mortgage agreement and a deed of trust are essentially the same documents. These documents are used when a borrower is using the property as security to acquire a loan. However, a mortgage creates a lien on the Mortgagors property, whereas, in a deed of trust, there is a third party called a Trustee involved. This third party will hold the title until the loan is repaid in full.

Contact Datafied Today If You Need A Copy Of Your Mortgage Agreement

If you do not have a copy of your Mortgage Agreement it is a good idea to obtain a copy. This is a document that you will not use often, but it important to have in certain circumstances. Thankfully, Datafied is here to help! We have been offering document management and retrieval services since 1993 and would be happy to help you obtain a copy of your Mortgage Agreement. Give us a call today at 800-765-7510 to get started with the ordering process!

To learn more about the reliable and quality document retrieval and management services that we offer, visit us on the web at Datafied.

Recommended Reading: How To Calculate P& i Mortgage

How Can I Obtain A Copy Of My Mortgage Agreement

A mortgage agreement is an important document that you likely dont think about often. If you purchase a home with a loan, you likely have a mortgage agreement. However, you probably do not know much about the physical document. Thankfully, Datafied is here to answer all of your questions about mortgages and mortgage agreements.

Why Do Lenders Use Promissory Notes

A promissory note is used by a lender as a way to ensure there is legal recourse in the event you do not repay the loan. While many homeowners think theyre paying off the mortgage loan to officially own their home, it is actually the promissory note the lender holds until the mortgage repayments are complete that gives them the power to foreclose in the event of default.

Without a legally binding promissory note, a financial institution may not have any legal recourse to foreclose on the home or attempt to get their money back. Often, promissory notes are sold on the secondary mortgage market. While a promissory note could get lost in the shuffle of institutions selling loans to secondary lenders, it doesnt mean youre off the hook for the amount, as the legal obligation to pay the loan still exists.

Laws vary by state, but a lender may reinstitute a promissory note in some instances.

Also Check: Do Mortgage Brokers Get Commission

How Do Promissory Notes Relate To Mortgages

Promissory notes are just one part of the complex financial and legal process of buying a home. While it may look like a simple stack of paper at closing, each document serves a purpose.

As part of the home loan mortgage process, you can expect to execute both a legally binding mortgage and mortgage promissory note, which work toward complementary purposes. Entering into a mortgage empowers your lender to hold a security interest in your real estate property in case the full amount of the loan plus interest is not paid back. A home mortgage effectively secures a promissory note with the title to the property in question in case the lender should need to foreclose and sell the property in event of nonpayment.

Your lender will keep the original promissory note until your loan is paid off. However, you will also receive a copy of your mortgage and your promissory note with the remainder of your closing documents when you close on the purchase.

Note: When applying for a mortgage online a promissory note will be called an eNote, but it is essentially the exact same thing.

Assignments Of Mortgages And Deeds Of Trust

An assignment transfers all the original mortgagee’s interest under the mortgage or deed of trust to the new bank. Generally, the mortgage or deed of trust is recorded shortly after the mortgagors sign it, and, if the mortgage is subsequently transferred, each assignment is recorded in the county land records.

The Role of MERS in the Assignment Process

Mortgage Electronic Registration System, Inc. , a company that the banking industry created, tracks the ownership of mortgage loans. MERS eliminated the need for separate assignments each time a loan is transferred because it tracks the transfers in its system.

Courts have dismissed some foreclosure cases when the foreclosing party didn’t have an assignment. But some states don’t allow borrowers to challenge the legality of assignments, saying they don’t have standing.

And certain states follow the general rule that “a mortgage follows the note.” So, a missing assignment of mortgage won’t necessarily stop a foreclosure. If the foreclosing party is clearly entitled to enforce the promissory note, the court may allow a foreclosure to go ahead even if a valid assignment doesn’t exist. Whether a written, recorded assignment is needed depends on state law.

You May Like: What’s A Conventional Mortgage