Mortgage Loan Officer Licensure And Certification

Whether you graduate with a bachelors degree or go the working route, you must obtain a mortgage loan originator license to become a fully qualified mortgage loan officer. To get your MLO, youll have to complete 20 hours of pre-licensure education and pass the Nationwide Multistate Licensing System & Registry exam.

You must also submit to a background and credit check and renew your MLO license each year by following the licensure requirements in your state.

While its not required, you may want to obtain a mortgage loan officer certification to propel yourself to the top of a prospective employers list. Several postsecondary schools and banking associations, such as the American Bankers Association and the Mortgage Bankers Association, offer courses, training programs, and certifications.

Are Licensure Or Certifications Needed

The licensure and certification requirements for loan officers can vary by state. Typically a Mortgage Loan Originator license is required for processing mortgage loans. The American Bankers Association offers that will need to be renewed every three years. Common loan certifications to obtain are as follows.

-

Certified Financial Marketing Professional

-

Certified Lender Business Banker

-

Certified Trust and Financial Advisor

How To Become A Mortgage Loan Officer In Oklahoma In 6 Steps

Step #1

Create an account and register with Nationwide Multistate Licensing System & Registry and obtain an ID number.

Step #2

You must complete 20 hours of education either online or in person:

To View your state specific packages and hours breakdown, visit Learn Mortgage.

Step #3

Pass the NMLS Mortgage licensing exam

Step #4

Read Also: What Is A Mortgage Quote

How To Become A Mortgage Loan Officer

This article was co-authored by Ryan Baril. Ryan Baril is the Vice President of CAPITALPlus Mortgage, a boutique mortgage origination and underwriting company founded in 2001. Ryan has been educating consumers about the mortgage process and general finance for almost 20 years. He graduated from the University of Central Florida in 2012 with a B.S.B.A. in Marketing.There are 8 references cited in this article, which can be found at the bottom of the page. This article has been viewed 76,292 times.

Loan officers help people procure loans for houses and businesses helping people buy houses and other types of real estate. All mortgage officers must be licensed by the federal and state governments, which requires extra educational coursework and testing. Applying your knowledge gained through certification and licensing, as well as getting the necessary experience, will help you become a mortgage loan officer.

How To Get Started As Anew Hampshire Mortgage Loan Officer

Weve compiled the six steps youll need to take to enroll in New Hampshire Pre-Licensure Education and start your new career as a Mortgage Loan Officer . Weve also answered some of the most common questions that prospective New Hampshire Loan Officers have as they consider this exciting new career.

Also Check: Can You Get A 30 Year Mortgage On Land

How To Become A Mortgage Broker In Virginia

Complete the necessary coursework. Before applying to become a mortgage originator in Virginia, you need at least 20 hours of pre-licensure courses, including three hours of federal law, three hours of ethics, and two hours of non-traditional mortgage lending. The other 12 hours of courses are electives.

How to become a licensed mortgage loan officer?

Applicants should refer to their respective states guidelines on how to become a licensed loan officer. Applicants for MLO licensure are required to pass the SAFE MLO test with a score of at least 75%. The test evaluates candidates on their knowledge of state and federal mortgage lending law.

Is Mortgage Broking A Good Career

Rewarding: Mortgage broking is a rewarding career as youll be helping Australians achieve the dream of owning their own home or building their business. Mortgage brokers help their clients feel at ease by finding a loan thats best suited to their financial circumstances.

Don’t Miss: How To Pay Off Mortgage In 10 Years Calculator

S In Becoming A Mortgage Loan Officer

A mortgage loan officer is an attractive career that provides numerous opportunities for flexibility, unlimited earning potential, and growth. In the United States, the average annual income for a Mortgage Loan Officer is $73,756 – yet those who really work hard can reach income levels of $300,000+.

With such appealing financial and professional opportunities, one would anticipate a difficult entry into the industry. The good news is that the process of becoming a Mortgage Loan Officer is quick and simple, and the requirements for obtaining a license are not too difficult to obtain.

The Best Books And Educational Products To Help You Succeed As A Mortgage Loan Officer

There are many books available that can help you in your journey to becoming a mortgage loan officer. They are usually written by people who have been working in the business for a long time. Because of this, you can benefit from this advice and apply it to your own work.

Here is a list of some of the best books and educational products on becoming a mortgage loan officer:

Read Also: Should You Refinance To 15 Year Mortgage

How To Become A Mortgage Loan Officer In North Carolina

Interested in starting a career in mortgage lending? You may be wondering how to become a mortgage loan officer in North Carolina. Many people choose this career path because of its flexibility, high earning potential, and quick start-up time. So, what does it take to become a mortgage loan officer? This article has everything you need to know about how to get your mortgage loan officer license in North Carolina.

FREE GUIDE:Learn everything you need to know to start a successful career as a mortgage loan officer in North Carolina.

Pass The Safe Mlo Test

To receive your mortgage loan officer licensure, you must also pass the SAFE MLO test with a minimum score of 75%. This exam measures your knowledge of both federal and state mortgage lending laws. You may retake the test, although there is a 30-day waiting period for retakes. If you take the SAFE MLO test three times, you must wait 180 days to retake it.

The SAFE Act and the NMLS require mortgage loan officers to:

-

Register with the NMLS

-

Provide authorization for a credit report

-

Provide fingerprints for a criminal background check

-

Verify the accuracy and completeness of the information they provide

-

Disclose any charges from financial regulatory agencies

-

Provide 10 years’ worth of financial services employment history

-

Present several types of identification information

You May Like: Does Ally Bank Do Mortgages

Is It Hard To Become A Mortgage Loan Officer

Becoming a mortgage loan officer is not necessarily difficult but it is not for everyone. There are a great deal of things to learn in order to become qualified. The job requires that you have a good grasp on finances, contracts and law.

If you are the right type of learner and personality, becoming a mortgage loan officer isnt difficult. It can, however, be challenging for someone who is not detail-oriented or self-motivated. Knowing where you fall on this spectrum can be incredibly helpful in making your decision.

How To Maintain An Active Mortgage License

Like Pre-Licensure Education, the annual necessary to maintain licensure can vary slightly from state to state. For instance, the state of Colorado only requires 8 hours of Continuing Education to maintain a license, whereas the state of Washington requires 9 hours.

Not surprisingly, costs also vary from state to state and from provider to provider. Generally speaking, Continuing Education packages usually range anywhere from $50 to $150. The thing to remember is that, like anything, you get what you pay for in terms of education so the cheapest offering may not always be the best option, particularly if you have to waste time taking courses over and over.

Mortgage Loan Originators and Mortgage Loan Officers play a crucial role in the homebuying process, which is why they must undergo such specific education requirements to gain and maintain licensure. But at the end of the day, the perks of working as an MLO are well worth the effort. Not only can you enjoy commission checks based on the home loans homebuyers secure, but you also have a chance to help people finance their dream of property ownership. Youll work side by side with real estate agents and other industry professionals to build your community, one loan application at a time.

Read Also: When Do I Stop Paying Mortgage Insurance

How To Become A Mortgage Loan Officer: The Definitive Guide

Are you interested in learning about how to become a mortgage officer? Known in the industry as a mortgage loan originator, or MLO, these professionals play a key part in the process of helping buyers find homes that are right for them typically, they are the primary contact person when a borrower completes a mortgage transaction.

More specifically, they help buyers find home loans that are right for them mortgages that fit their budget and will allow them to stay in the homes they purchase for the long term.

MLOs do all of the following:

- Identify potential homebuyers through advertising, connections, seminars, and other means

- Compile all the borrower information necessary for a loan application

- Present borrowers with loan options that make sense for them

- Keep accurate, thorough records on mortgage transactions

- Coordinate with other mortgage professionals like underwriters and appraisers

Not only do MLOs support homebuyers, they serve a vital function in the real estate industry. With responsible MLOs, mortgage fraud and foreclosures drop significantly. Great MLOs are on the front lines in maintaining a stable home-buying market.

Many people find this to be an attractive career path. Mortgage loan officer is listed #14 in U.S. News & World Report’s rankings for business jobs. The median salary for the position is $64,660 and it doesn’t require any graduate-level education.

How Do I Become A Mortgage Loan Officer

To become a licensed loan officer, you’ll need to be registered with the National Mortgage Licensing System and Registry , complete 20 hours of pre-licensure education courses, and pass the NMLS mortgage license exam, amongst other requirements determined by your state.

Once youve fulfilled the requirements for licensure, expertise is often established on the job. Joining an independent mortgage broker shop is a great way to set yourself up for success. If youre new to the industry, you may also look to be hired as a loan officer assistant, or LOA, to learn origination processes and earn valuable experience before actually completing your license requirements.

Read Also: How Does Reverse Mortgage Work After Death

What Do Mortgage Loan Officers Do

The role of an MLO is crucial in the real estate industry. They act as a go-between for mortgage lenders and borrowers. They often bring clients to lenders in exchange for a commission. However, a loan officer can work for a mortgage correspondent, a commercial bank, credit union, retail lender, or a mortgage broker.

The primary responsibilities of a Mortgage Loan Officer are as follows:

-

Reach out to potential homebuyers using advertising, connections, seminars, and other methods.

-

Establish contacts with real estate firms.

-

Assess potential borrowers’ credit and assist them in selecting the best loan product.

-

Explain the various loan options to borrowers and provide them with helpful home loan resources.

-

Help clients build loan applications and ensure that the loan is approved and funded.

-

Ensure that loan agreements are compliant with state and federal laws.

-

Keeping track of loan applications and mortgage transactions.

-

Work with underwriters to identify possible borrower risks.

-

Collaborate with appraisers to determine a property’s actual market value.

Do Loan Officers Need To Be Licensed

Mortgages come in several different loan types, have various qualifications, require certain documents, and vary in terms by different lenders and state laws. Its important to work with an MLO that has knowledge in the residential mortgage loan industry and your specific state.

Nationwide banks are required to have federal registrations and do not require individual MLOs to obtain a loan originator license.

For non-bank lenders, like credit unions, MLOs are required to be licensed with individual states. An MLO could be licensed in multiple states, even if they work in one state. To become an MLO, one must meet the following licensing requirements:

- Complete 20 hours of pre-licensing education

- Score a minimum of 75% on the two-part nationwide SAFE Mortgage Licensing Act Exam, developed by the Nationwide Mortgage Licensing System

- Agree to a thorough background check

- Commit to continuing mortgage education each year

Read Also: Can I Get A Mortgage If Self Employed

Complete Your Prelicensing Education

Next, complete your Mortgage Loan Originator prelicensing education. This includes both national and state-specific prelicensing coursework. To earn your North Carolina MLO license, you must complete 24 hours of NMLS-approved education, including:

- 3 hours of Federal law

- 3 hours of ethics

- 2 hours of non-traditional mortgage lending

- 12 hours of electives

Ready to get started? Browse North Carolina MLO prelicensing course packages.

Loan Officer: Job Outlook

The job outlook for loan officers is projected to grow 1 percent between 2020 and 2030, according to the BLS. The demand for loan officers increases when the economy grows and remains healthy.

Depending on the companyâs salary structure, a loan officer may receive a commission or bonus on the loans they originate.

You May Like: What Factors Affect Mortgage Interest Rates

Register With The National Mortgage Licensing Service

Before starting the process of getting licensed, there are several things you will need to do. First you will have to allow the NMLS to obtain your credit report. In order to be a mortgage loan originator, you have to have a clean record both credit-wise and legally.

You will also need to provide identification and submit to a background check. The NMLS will assess your eligibility before you are allowed to move forward. In order to do this, you will have to submit your fingerprints through a licensed intermediary.

You will also have to disclose all of your dealings with any financial institutions. In order to become a mortgage loan officer, you can not have any blemishes on your financial record. This is incredibly important since you will be dealing with sensitive financial information in your career.

Who Is A Mortgage Loan Officer

A Mortgage Loan Officer is a finance professional responsible for gathering, verifying, and analyzing information from potential home borrowers to determine whether they qualify for a home loan. They also help borrowers facilitate the loan process through approval and closing when buying or refinancing a house.

You May Like: What Is The Highest Interest Rate For Mortgage

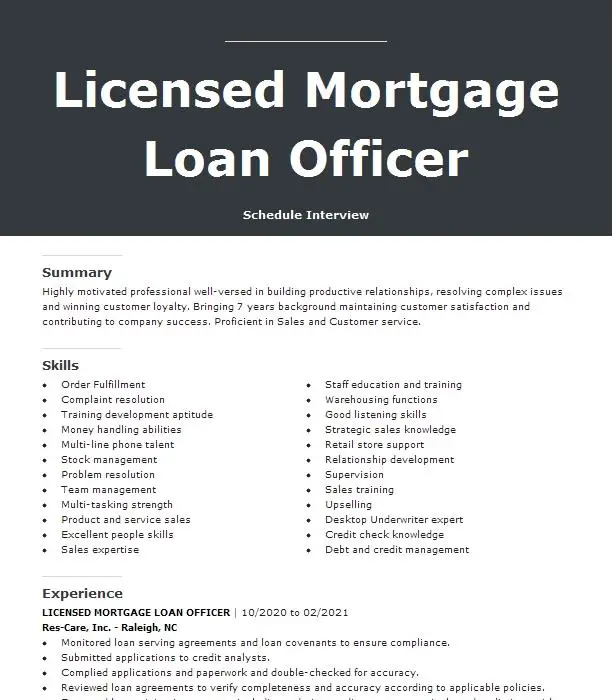

Mortgage Loan Originator Job Description Sample

With this Mortgage Loan Originator job description sample, you can get a good idea of what employers are looking for when hiring for this position. Remember, every employer is different and each will have unique qualifications when they hire for a Mortgage Loan Originator role.

Job Summary

Our company is looking for a licensed Mortgage Loan Originator with experience in relationship management to assist clients and provide excellent support throughout the home-buying process. Our ideal Mortgage Loan Originator keeps up with mortgage loan trends and developments and is well-connected to other financial institutions, lenders, and advisors. In this role, your ultimate goal is to help clients realize and meet their financial goals by responsibly advising them throughout the mortgage loan process, from application to closing. You will be a great fit if you can swiftly identify customer needs, meet loan production goals, and work to ensure customer satisfaction.

Duties and Responsibilities

- Meet with mortgage loan borrowers on the phone and in person, advising and guiding them throughout the entire loan process

- Review financial information from all relevant parties

- Originate and evaluate mortgage loans according to company guidelines and standards

- Submit and monitor the status of applications

- Maintain good relationships with clients by keeping them informed

- Interact with realtors, appraisers, and sales agents as needed

Requirements and Qualifications

Complete 20 Hours Of Education

In order to obtain your mortgage loan officer license, you must complete 20 hours of education. These hours must include the following:

- Three hours of law and regulations

- Three hours of ethics

- Two hours of lending standards

- Twelve hours of general mortgage loan education

These hours can be completed at one of many mortgage loan officer schools. Many of these courses can be taken online and at your own pace. This is a great feature if you have another job or are getting licensed in your free time.

You May Like: How To Get A Mortgage For A Second Home

Mlo Education & Testing

Individuals seeking to obtain or maintain their MLO license must complete the relevant testing and education requirements. Testing and education provider information, as well as guides on completing testing and education, can be found on the NMLS Resource Center under Professional Standards at .

Pre-Licensure Education & Testing

20 hours of pre-licensure education is required in order to be eligible for a Georgia MLO license. Georgia does not have any state specific requirements for pre-licensure education.

A passing score of 75 or higher on the SAFE Mortgage Loan Originator Test – National Component with Uniform State Content is also required in order to be eligible for a Georgia MLO license.

Continuing Education

To renew your Georgia MLO license, eight hours of continuing education is required by October 31, unless you completed your pre-licensure education course requirements in the same year in which your initial MLO license was approved and is being renewed. One hour of Georgia specific education is required for CE.