How Does Fico Differ From Other Credit Score Models

VantageScore is another popular credit scoring model. Like FICO, VantageScore 3.0] grades credit on a 300 to 850 point scale and takes credit utilization, credit inquiries, and on-time payments into account. However, the two models differ in a few ways, with one major difference. FICO penalizes all late payments the same way, while VantageScore penalizes late mortgage payments higher than other late payments.

FICO and VantageScore also differ in how they handle combining similar credit inquiries. With FICO, you have a 45 day grace period where similar credit inquiries for auto loans, mortgages, and student loans are combined into one inquiry. VantageScore gives you a smaller 14 day grace period, which can make comparison shopping for loans harder.

These responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

Advertiser Disclosure: The products that appear on this site may be from companies from which ValuePenguin receives compensation. This compensation may impact how and where products appear on this site . ValuePenguin does not include all financial institutions or all products offered available in the marketplace.

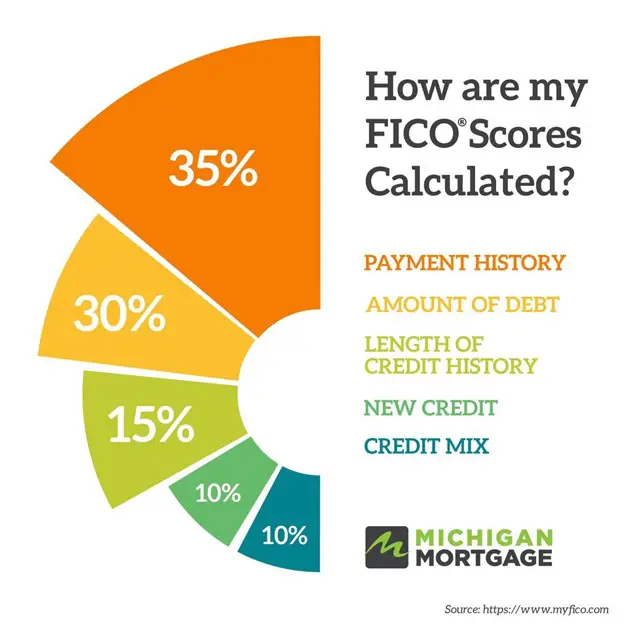

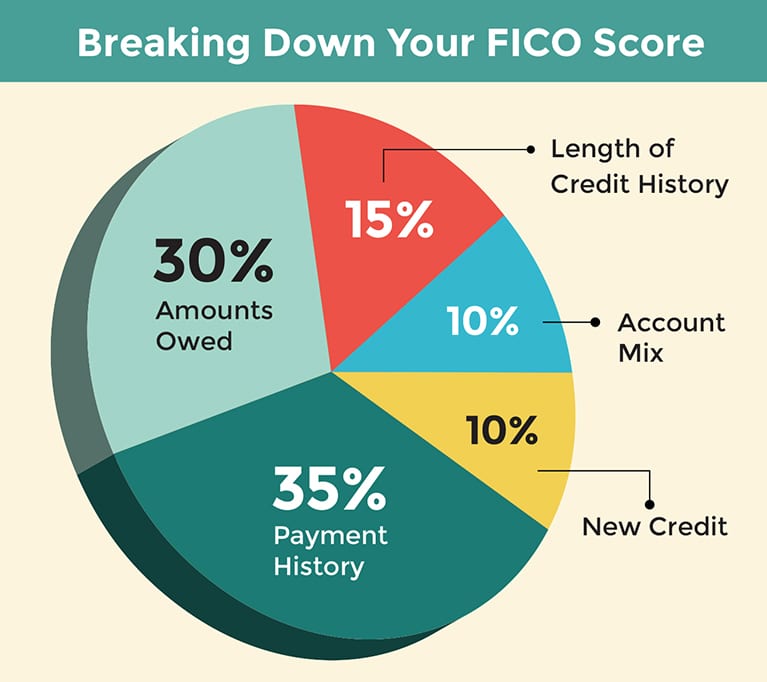

How Are Fico Scores Calculated

A FICO score is developed using the following five categories:

Payment history : Payment history is the most influential factor in your FICO score and weighs whether or not you pay your bills on time. Lenders look at this information to gauge if you are a trustworthy borrower.

Amounts owed : Amounts owed — or — is the ratio of your total credit to your total debt. A high credit utilization signals lenders that you may have more consumer credit than you can afford to pay back.

Length of credit history : The average age of your credit lines helps lenders determine the relationship you’ve built with your creditors. A lengthy credit history shows lenders you are capable of managing your credit responsibly.

New credit : Every time you apply for a new line of credit, a hard inquiry is made into your credit history. Too many hard inquiries in a short period can make you a high credit risk to lenders.

A diverse mix of revolving credit accounts, retail accounts and installment loans shows lenders you can manage more than one type of credit account.

How Is A Fico Score Determined

A FICO score is calculated by pulling data from the three credit bureaus: Equifax, TransUnion and Experian. It’s based on the following factors:

- Payment history : Payment History is the most influential factor and examines whether or not a person pays their bills on time.

- Amounts owed : Amounts Owed are based on the ratio of your total credit to your total debt — also known as — and they’re the second most important factor.

- Length of credit history : How long you’ve had credit affects the way your credit score is calculated. This is calculated by considering the ages of the oldest and the average age of all your accounts.

- Having a variety of credit accounts helps lenders examine whether or not you can handle different types of accounts. While this only accounts for 10% of a FICO score, having both installment loans and revolving credit can help your score.

- New credit : New Credit evaluates the quantity of recently opened credit accounts and the number of hard inquiries from creditors when applying for credit.

Don’t Miss: How Do Lenders Determine Mortgage Loan Amount

Fha Home Loans And Dmps

FHA mortgage guidelines do mention consumer credit counseling payment plans, and its OK to be in one and get a home loan if:

- You are at least 12 months into the plan

- Youve made all required payments in full and on time

- You have written permission from the counseling agency

This is nearly identical to the FHAs stance on Chapter 13 bankruptcies, which are actually court-ordered debt management plans.

Fico Now Offers Consumers Access To 19 Versions Of The Fico Score Used Most Frequently By Lenders For Mortgages Auto Loans Credit Cards

19 versions of the FICO® Score represent approximately 95 percent of all FICO® Scores sold and used by lenders

SAN JOSE, Calif. FICO , the predictive analytics and decision management software company, today announced it is providing consumers with access to the 19 most commonly used versions of the FICO® Score from the three major credit bureaus at myFICO.com. Together, these 19 score versions represent approximately 95 percent of FICO® Scores sold and used by lenders.

The offering from FICO enables consumers to quickly understand their overall credit health. Consumers can view their base FICO® Score 8 along with their credit reports and the additional versions of their FICO® Scores from all three major credit bureaus Experian, TransUnion and Equifax. The additional scores include the versions that most U.S. lenders use for mortgage, auto and credit card lending.

This unprecedented level of transparency is intended to help consumers navigate a complex credit environment in which lenders use different versions of the FICO® Score for different types of lending decisions.

The scores available at myFICO.com include six versions of the FICO® Score from TransUnion, six versions of the FICO® Score from Equifax, and seven versions of the FICO® Score from Experian. These versions of the FICO® Score will also be made available to qualified FICO resellers and affinity clients that make FICO® Score-based products available to their customers.

Don’t Miss: Where Can I Apply For A Reverse Mortgage

How To Improve Your Credit Score

Your FICO credit scores are broadly based on these five factors:

- Payment history This is the biggest factor and accounts for 35% of your credit score.

- Amounts owed How much debt you have makes up 30% of your credit score. This includes factors such as, your , the number of accounts with balances, and what you owe on different types of accounts.

- Age of accounts A longer credit history results in a better credit score. The duration of your accounts is 15% of your .

- When you open new accounts or lines of credit, your score will take a small and temporary dip. These hard credit inquiries can stay on your account for up to two years, but only account for 10% of your overall credit score.

- The types of credit you have make up 10% of your credit score. So having different types of loans, a credit card, and a personal line of credit can help your credit score.

The nitty gritty of how certain aspects of your credit score are calculated varies depending on the credit scoring model. You have hundreds of scores. There are three credit bureaus, there are multiple generations of scoring software made by different companies, Ulzheimer says. But you dont need to fully understand or worry about every single type of credit score to start improving your credit score. The good news is that every single credit score is all based on the same thing one of your three credit reports, Ulzheimer says.

Ok So Which Of My 3 Fico Scores Do Lenders Use

When your lender pulls your credit, you will get not one but three scores. Thats because there are three main credit bureaus. Which one does the lender use?

The answer is your middle score.

As the name suggests, the middle score is the one in the middle of your three scores. For instance, if your credit report shows 690, 700, and 710, then 700 is your middle score.

If you are applying with someone else, the lender will use the lower of the two middle scores for eligibility purposes.

The following table demonstrates middle scores.

| Bureau |

Read Also: What Mortgage Lenders Use Equifax

Mortgage Credit Score Vs Consumer Credit Score

If youve ever applied for a mortgage only to find out that the credit score the lender sees is much different than what youve found pulling your credit scores from Experian or your credit card services, you arent alone.

Mortgage lenders use a different credit scoring model than consumers have access to, which means they may see a different credit score than what you expect.

Heres how they differ.

How The 3 Credit Reporting Bureaus Affect Your Score

As many consumers already know, there are three major credit reporting agencies.

While its possible your scores will be similar from one bureau to the next, youll typically have a different score from each agency.

Thats because its up to your creditors to decide what information they report to credit bureaus. And its up to the creditors to decide which agencies they report to in the first place.

Since your credit scores depend on the data listed on your credit reports, more than likely you wont see the exact same score from every credit reporting agency.

Fortunately, most agencies look at similar factors when calculating your credit scores. As long as you manage credit cards and loans responsibly, your credit scores should be fairly similar to one another.

But different credit reporting agencies arent the only challenge.

There are also different credit scoring models. And, as if that didnt already complicate matters, there are also different versions of these models.

Also Check: How Much Interest Will I Pay Mortgage Calculator

Auto Loans And Your Credit Score

Auto lenders use what is known as a FICO Auto score, which is a customized scoring model for the car lending industry. It places less emphasis on payment histories with mortgages and credit cards, and pays closer attention to pay histories on car loans and other installment-type debt.

Even with the emphasis on auto loans, the difference from your regular FICO will usually amount to no more than 15-20 points in either direction. The FICO Auto score will look at whether you have a current car loan, a paid car loan, and, of course, your payment history on those loans specifically.

One major disadvantage of the FICO Auto score is that its a score that you cannot obtain on your own, even from the credit bureaus directly. Its a proprietary system used by auto lenders, and only available through them. Thus, you cant know your score before purchasing a car, and that can put you at a disadvantage when arranging financing through a car dealer.

Theres a secondary disadvantage in getting your auto credit score, too. As Ive found out recently from a couple of car-buying experiences, car dealers often refuse to pull your credit before you select a car that you want to buy. Unlike the mortgage loan process, if you shop at a dealer, there is no pre-qualification function helping you to determine how much car you can afford, what your score is, and what kind of rate to expect.

What’s The Difference Between Base Fico Scores And Industry

Base FICO® Scores, such as FICO Score 8, are designed to predict the likelihood of not paying as agreed in the future on any credit obligation, whether it’s a mortgage, credit card, student loan or other credit product.

Industry-specific FICO® Scores incorporate the predictive power of base FICO Scores while also providing lenders a further-refined credit risk assessment tailored to the type of credit the consumer is seeking. For example, auto lenders and credit card issuers may use a FICO Auto Score or a FICO Bankcard Score, respectively, instead of base FICO Scores.

FICO® Auto Scores and FICO Bankcard Scores have these aspects in common:

- Many lenders may use these scores instead of the base FICO® Score.

- It is up to each lender to determine which credit score they will use and what other financial information they will consider in their credit review process.

- The versions range from 250-900 and higher scores continue to equate to lower risk.

Recommended Reading: How To Become A Mortgage Loan Originator In Georgia

Which Credit Score Is My Lender Evaluating

Most people have multiple credit scores that are changing all the time.

These scores are industry-specific and include credit cards, auto loans, and mortgage loans.

Since FICO Scores were introduced more than 25 years ago, credit requirements and data collection practices have changed. As a result, there are multiple versions of the FICO Score models.

The most widely used version is FICO Score 8, but the most frequently used versions in mortgage lending are:

- Experian: FICO Score 2

You May Like: Does Rocket Mortgage Service Their Own Loans

What Changes Your Credit Score

These 5 factors provide a glimpse into your financial habits and history and help lenders assess your financial health.

Home buyers with lower credit scores are typically assigned a higher interest rate.

There is no way to get around a credit check. It is one of the things you need to buy a home during the mortgage pre-approval stage so be sure to learn more about how a mortgage pre-approval affects your credit score.

Get pre-approved for a mortgage today.

You May Like: How To Buy Down Mortgage Rate

Do Banks Use Fico Or Vantage

Mortgage lenders typically use FICO Scores 5, 2 and 4 when determining whether or not to approve a loan. Additionally, one type of credit score to keep an eye on moving forward is the VantageScore, a score that was developed by the three main credit bureaus and currently serves as a competitor to FICO.

Recommended Reading: Rocket Mortgage Launchpad

What Are Fico Scores And How Do I Get Mine

Your FICO® scores are credit scores. Its a sort of grade based on the information contained in your . Unlike the grades you were given in school A through F base FICO® scores generally range from 300 to 850. And the higher, the better.

Because there are three major consumer credit bureaus , each with its own version of your credit report, you can also have different credit scores. For example, you can have a FICO® score based on your Equifax® credit report, a FICO® score based on your Experian® credit report, and a FICO® score based on your TransUnion® credit report. To further complicate things, you can also have VantageScore® credit scores from each bureau.

Additionally, FICO also creates many different credit-scoring models for lenders in different industries. So your base FICO® scores may not be the same ones a mortgage lender sees if they request your mortgage-specific FICO® scores, for example.

You probably dont need to worry about all these nuances when buying a home, but you should still have an idea of what your scores look like. You can get your VantageScore® 3.0 credit scores from Equifax and TransUnion for free on .

If you want to see your FICO® scores, however, you can easily buy them online from the MyFICO website, and possibly find them for free from your bank or credit card issuer.

Read Also: What Does It Mean To Be Prequalified For A Mortgage

How Do You Choose Which Credit Score To Use

-

During pre-approval, we typically use the Experian FICO-II credit score from Experian. This is a soft credit check and won’t affect your credit score. If you apply with a co-borrower, we use the lower of your two scores.

When you want to continue with your loan application, with your authorization we pull your credit scores from all three major credit bureaus and use the median of the three scores received.

Ready to get pre-approved?Get started

Related questions

Better is a family of companies serving all your homeownership needs.

We cant wait to say Welcome home. Apply 100% online, with 24/7 customer support.

Connect with a local non-commissioned real estate agent to find out all the ways you can save.

Shop, bundle, and save on insurance coverage for home, auto, life, and more.

Get a loan up to $50,000 for all your home needs, including moving, renovations, and furniture.

Get free repair estimates, 24-hour turnarounds on reports, and rest easy with our 100-day inspection guarantee.

Get transparent rates when you shop for title insurance all in one convenient place.

Better Attorney Match will help you find experienced attorneys to help with negotiations, closing, and more.

Texas Real Estate Commission:Information About Brokerage Services|Consumer Protection Notice

Better Settlement Services, LLC. 325-41 Chestnut Street, Suite 803, Philadelphia, PA 19106.

The Better Home Logo is Registered in the U.S. Patent and Trademark Office.

Fico Score : What You Need To Know

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhereâs how we make money.

FICO Score 9 is the second-latest version of the well-known credit scoring model, but it still isnât being used as widely as its predecessor, the FICO 8.

All credit scores come from data in your credit reports, weighed according to proprietary formulas that calculate a score, typically on a 300-850 scale. Your credit score is designed to reflect the risk in lending you money, and the FICO Score 9 is a better predictor of that risk, says Tommy Lee, principal scientist at FICO.

The two biggest providers of credit scores are FICO and VantageScore.

Read Also: Is It A Good Idea To Pay Off Your Mortgage

Read Also: What Does It Mean Points On A Mortgage

What If No Score Is Available

In some situations, an applicant may not have a usable FICO score from one of the three credit bureaus. In that case, the mortgage lender will simply use the lower of the two scores that are available. And if two scores are not usable, they will use the one remaining score.

And since you may be wondering, if a mortgage applicant has no usable FICO scores, generally they won’t qualify for a mortgage. I say generally because there are exceptions. If you fall into this category, contact a mortgage broker to see what options you have.