Is Paying Off My Mortgage Early With Lump

The decision to reduce the amount you owe on your mortgage using a large lump-sum payment is called a mortgage recast. While your loan term technically remains the same when you do this, and while you wont necessarily finish paying off your mortgage any earlier, your monthly payments will go down and the overall financial burden of the loan will be diminished.

How To Make Biweekly Mortgage Payments To Save Money

Whether youve been a homeowner for 15 minutes or 15 years, paying off your mortgage faster could help you free up cash for other financial goals. Your mortgage is likely your largest single monthly expense, and each payment is due on a specific day and for a minimum amount. But switching from monthly to biweekly payments could provide substantial financial benefits.

The Best Way To Pay Off Your Mortgage: A Complete Guide

Modified date: Nov. 24, 2021

Having a mortgage is a beautiful thing because it means youre putting equity into a valuable asset. At the same time, nobody likes to have debt looming over themand mortgages come with a lot of debt. So many people wonder how to pay off their mortgage in the most timely manner.

You may be surprised to learn that there are plenty of ways you can do this. Most of them involve finding ways to make extra payments, but there are also some other tips you can use too. For example: Switching your payment frequency and refinancing for a better deal.

Heres my guide to paying your mortgage off faster, no matter what your means.

Whats Ahead:

Also Check: 10 Year Treasury Vs Mortgage Rates

Recommended Reading: Is It Better To Pay Off Mortgage Or Invest

How To Pay Off A 30

There are a few ways to pay off a mortgage sooner than the 30-year term.

Options to pay off your mortgage faster include:

- Pay extra each month

- Pay off other debts

There are advantages to each approach. The choice comes down to careful study and a decision based on your financial position and ability to repay what will be higher monthly payments.

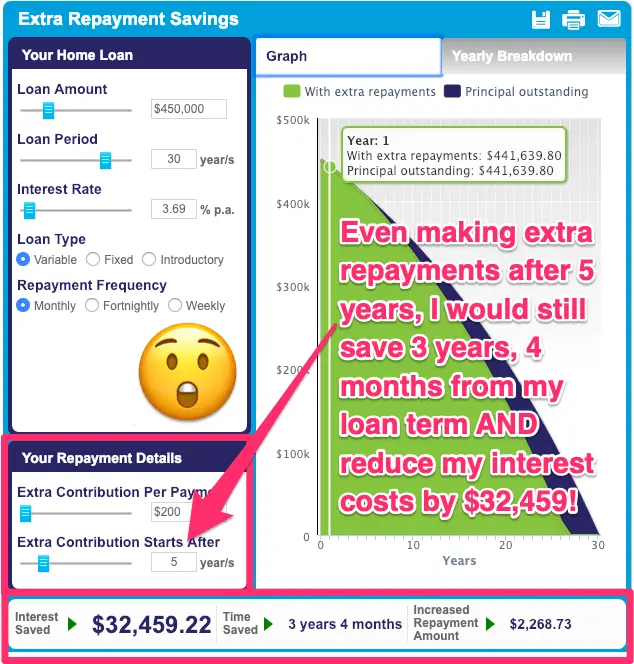

How To Calculate Extra Mortgage Payments

Using our Mortgage Payment Calculator, you can crunch the numbers and discover how much you could save in interest, or how much you would need to pay each month to pay your loan off sooner.

For example, according to the calculator, if you have a 30-year loan amount of $300,000 at a 4.125% interest rate, with a standard payment of $1,454, if you increase your monthly payment to $1,609, you could pay your loan off five years and one month earlier while saving $43,174 during the loan’s lifetime.

You May Like: How To Get Second Home Mortgage

Retiring A Mortgage With Extra Payments

Many homeowners invest in home security systems to protect their property and personal assets. However, a security system will not protect the homeowner against financial disaster or bankruptcy. Making additional mortgage payments will shrink the total amount of interest paid over the life of the loan, and the borrower will pay off the debt more quickly. In addition, the home equity will grow at a faster pace when extra payments are applied to the loan. This provides for a margin of protection by lowering the interest costs. This method gives the property owner a home free and clear of debt. More payments on the principal of the loan equate to assets earning interest at the same rate as the interest rate on the loan.

What To Consider Before Prepaying Your Mortgage

Prepaying your mortgage is a great goal to work toward, but before you do, make sure youve met these financial milestones first:

Once those bases are covered, prepaying a mortgage comes down to discipline and comfort level. Do you want to be completely debt-free, or would you prefer your money working harder for you in other ways? Ideally, you want to pay off your mortgage before retirement so you dont have those monthly payments to worry about if your income becomes more limited.

Read Also: How Does The 10 Year Bond Affect Mortgage Rates

Can I Cut My Loan Term In Half

It is possible to cut your loan term straight down the middle, but it depends on how much and how frequently youre able to contribute towards extra payments.

Based on Your Mortgages Extra and Lump Sum Calculator, an $800,000 mortgage with an interest rate of 4.5% p.a. over 30-years would require you to make additional payments of around $2,100 each month to cut the loan term down to 15 years.

However, if you could pull this off, you would save $360,216!

Should I Refinance Calculator

Use our refinance calculator to determine how much money you could save with a refinance loan from Cherry Creek Mortgage. Our tool will help you clarify the difference in your current and potential payments and see how much money you could be saving every month by refinancing now.

Using biweekly payments can accelerate your mortgage payoff and save you thousands in interest. Use this calculator to compare a typical monthly payment schedule to an accelerated biweekly payment.

You May Like: Do Credit Unions Offer Mortgages

Are You Putting Money Into A Pension Scheme

Pensions are a tax-efficient way to save because the government tops up your contributions with tax relief.

And, if you have a workplace pension your employer should pay into the scheme too.

Find out more about workplace pensions in our guide Automatic enrolment an introduction

If you dont have a pension and have money to spare, its important to think about paying into one.

The earlier you start, the sooner your retirement pot will start to grow. With employer contributions and tax relief from the government, you might get more for your money in a pension than youd save in mortgage interest.

Find out more in our guides:

Check my pension and the progress of my retirement savings

Extra Mortgage Payment Calculator

Jump to section:Pros of extra payments | Cons of extra payments | Should you refinance? | Pro tips

Making extra payments can drastically reduce your loan term and save you a tremendous amount on interest charges. Use our extra mortgage payment calculator to see how fast you can pay off your mortgage with additional monthly payments.

| ð¡ Thinking about selling? Use Clever to find a top local agent, get a pro valuation and advice. Save thousands if you decide to sell! 100% free with no obligation. Learn more. |

Recommended Reading: Who Has The Best Reverse Mortgage Rates

Should Extra Mortgage Payments Take First Priority

Before embarking on a prepayment plan, you might want to consider more advantageous alternatives, says Jeff Rose, a certified financial planner in Carbondale, Ill.

A mortgage is just about the cheapest money you will ever borrow, with todays rates at or below 4%. If you have other high-interest debtsuch as credit cards or personal loansI would pay those off first before prepaying my mortgage, Rose says. He adds that the mortgage interest you pay is tax deductibleby prepaying your principal, youll pay less interest and, thus, get less of a tax write-off over the life of your loan.

Huettner agrees.

I recommend people prioritize their extra money in this order: pay down credit card debt, save six- to 12-months worth of income in a rainy day fund, invest in a 401 where your employer matches your contribution, then either pay down your house or look at other retirement contributions, says Huettner.

In addition, homeowners with low rates might make more money in other investments than they could by paying down their sub-4% mortgage.

Weekly Mortgage Payment Calculator To Compare Mortgage Interest Savings

This calculator will calculate the weekly payment and associated interest costs for a new mortgage.

Or, if you are already making monthly house payments, this weekly payment mortgage calculator will calculate the time and interest savings you might realize if you switched from making 12 monthly payments per year to making the equivalent of 13 or 14 payments per year on a bi-weekly or weekly basis.

Plus, I recently added a field wherein you can enter an optional, extra weekly payment amount to be added to the calculated weekly payment amount. Youll be amazed at how much a small extra amount per week can save you in time and interest over the long run.

Finally, I have also recently added an Estimated payoff date row to the comparison results so you can immediately see the month and year each payment interval will pay off the mortgage.

Recommended Reading: How Much Is A 150 000 Mortgage Per Month

Refinance Versus Making Extra Mortgage Payments

Would you like to talk to a Freedom Mortgage Loan Advisor about whether refinancing your mortgage might make sense for you? Get Started today or call us at .

Freedom Mortgage Corporation is not a financial advisor. The ideas outlined above are for informational purposes only and are not investment or financial advice. Consult a financial advisor before making important personal financial decisions, and consult a tax advisor for information regarding the deductibility of interest and charges.

Should I Pay Extra Into My Mortgage

We recommend paying extra into your mortgage whenever you have an opportunity. Doing so can enable you to pay off your bond in a shorter term, saving significant amounts of interest in the process.

For example, If you had a bond debt of R1 500 000 with a 20 year term and 7% interest rate paying an extra R2 500 into your mortgage every month would reduce your bond term to 13 years and save you R445 042 in interest in the process.

You can use ooba Home Loans free online tool, the Extra Payments Calculator, to calculate how much your additional monthly repayments will save you in interest and by how much they can reduce your bond term.

Also Check: How Can I Lower My Mortgage Payment With Bad Credit

How To Make Biweekly Payments Yourself

If your lender doesnt offer a biweekly payment option, you can create one for yourself. Its relatively simple to do: Divide your monthly mortgage payment by 12, and make one principal-only extra mortgage payment for the resulting amount each month.

Youd technically still be making your regular mortgage payment, plus one smaller extra payment, but the cumulative effect would be the same as if you were making biweekly payments automatically.

You can also make extra payments as you come into additional funds, such as a tax refund.

You could also achieve the same results by making one single extra monthly payment once each year. In that case, it would be considered a lump-sum mortgage payment, but it could still bring your principal balance down.

How Does Paying Your Mortgage Biweekly Work

Interest on mortgage loans is typically calculated on a monthly basis. This means that the lower your principal balance, the lower the interest charged will be.

By paying biweekly, youll reduce your principal balance just a little bit extra, prior to that monthly interest being calculated. These savings will add up month after month, not only reducing your total mortgage interest, but also paying off your loan sooner.

Read Also: How Much Usda Mortgage Can I Qualify For

Don’t Miss: What Is Qualifying Income For A Mortgage

Los Angeles Homeowners May Want To Refinance While Rates Are Low

US 10-year Treasury rates have recently fallen to all-time record lows due to the spread of coronavirus driving a risk off sentiment, with other financial rates falling in tandem. Homeowners who buy or refinance at today’s low rates may benefit from recent rate volatility.

Are you paying too much for your mortgage?

Keep Your Payments The Same When Changing Your Mortgage

When you renew your mortgage, you may be able to get a lower interest rate.

Some mortgage lenders may allow you to extend the length of your mortgage before the end of your term. Lenders call this early renewal option the blend-and-extend option. They do so because your old interest rate and the new terms interest rate are blended.

When your interest rate is lower, you have the option to reduce the amount of your regular payments. If you decide to keep your regular payments the same, you can pay off your mortgage faster.

Don’t Miss: How To Pay Off Home Mortgage

How Do I Calculate A Monthly Mortgage Payment

As promised, well now show you how to calculate a monthly mortgage payment manuallyin case you want to know the magic behind our mortgage calculator.

This is useful to know when it comes to amortization since your monthly payment is what actually pays down your mortgage.

To calculate a monthly mortgage payment, heres a scary-looking formula your lender might use:

M = P x ir ^n / ^n 1

- M = monthly payment

- ir = interest rate per month

- n = number of months

- ^ = This is the exponent symbol. Youll need a special calculator for exponents, which you can find online.

If we use the formula on our example from earlier, your mortgage details would look like this:

Lets start with the first part of the formula, P x ir ^n. Heres how that breaks down:

- 240,000 x 0.0029167 ^180

Okay, now lets figure out the second part of the formula, ^n-1:

And now lets divide the two parts to get our answer:

- 1,182.42 / 0.6891777009157 = 1,715.70

If we round up, that $1,716 is your fixed monthly mortgage paymentthis is what youll pay every month in order to pay off or amortize your mortgage.

Commit To Making One Extra Payment A Year

The average American gets about $2,833 in their tax refund, according to the IRS. For most people, this is more than enough money to cover an extra mortgage payment every year.

You can put your tax return to good use and make an extra mortgage payment. On a $150,000, 30-year loan with a 4% interest rate, a single extra payment every year will help you pay off your mortgage 4 years early.

Read Also: What Mortgage Terms Are Available

Mistake #: Not Putting Extra Payments Towards The Loan Principal

Throwing in an extra $500 or $1,000 every month wont necessarily help you pay off your mortgage more quickly. Unless you specify that the additional money youre paying is meant to be applied to your principal balance, the lender may use it to pay down interest for the next scheduled payment.

If youre writing separate checks for extra principal payments, you can make a note of that on the memo line. If you pay your mortgage bill online, you might want to find out whether the lender will let you include a note specifying how additional payments should be used.

Dont Miss: Can You Refinance Your Mortgage

Accelerate Your Mortgage Payment Plan

Get creative and find more ways to make additional payments on your mortgage loan. Making extra payments on the principal balance of your mortgage will help you pay off your mortgage debt faster and save thousands of dollars in interest. Use our free budgeting tool, EveryDollar, to see how extra mortgage payments fit into your budget.

Also Check: How Long Before I Pay Off My Mortgage

How To Use The Early Repayment Calculator For Overpayments

When you use our calculator, well show you how to overpay your mortgage and what the benefits could be. All you need to do is enter:

-

Your outstanding mortgage balance

-

How long is left until you have paid off your mortgage

-

Your mortgages interest rate

-

The extra mortgage payments you would like to make

You can select overpaying your mortgage by the same amount each month, paying off a lump sum now, or doing both.

Well then show you:

-

How much money you could save in interest

-

How much sooner your mortgage could be paid off

Extra Mortgage Payments Vs Investing

Assume you have a 30-year mortgage of $150,000 with a fixed 4.5% interest rate. Youll pay $123,609 in interest over the life of the loan, assuming you make only the minimum payment of $760 each month. Pay $948 a month$188 moreand youll pay off the mortgage in 20 years, and youd save $46,000 in interest.

Now, lets say you invested that extra $188 every month instead, and you averaged a 7% annual return. In 20 years, youd have earned $51,000$5,000 ahead of the sum you saved in intereston the funds you contributed. Keep on depositing that monthly $188, though, for 10 more years, and youd end up with $153,420 in earnings.

So while it may not make a huge difference over the short term, over the long term, youll likely come out far ahead by investing in your retirement account.

Don’t Miss: Can You Consolidate Your Debt Into Your Mortgage

Potential Benefits Of Paying Extra On A Mortgage

Paying extra on a mortgage may help reduce the amount of interest paid over time, in addition to the total amount of time it takes to pay back your mortgage. You may be able to reduce the amount of interest paid and the time it takes to pay back your mortgage by applying extra payments directly to the principal balance. Making payments directly to the principal normally reduces the amount of interest paid because interest is calculated as a percentage of the principal. Typically, the lower the principal, the less interest owed.

Check : Do You Have Other Expensive Debts If So Clear Those First

A crucial rule of debt repayments is: clear the most expensive debts first. Do so and the interest doesn’t build up as quickly, saving you cash and giving you more chance of clearing debts earlier. Therefore, as a rule of thumb…

Clear high-interest credit cards and loans before overpaying your mortgage, as they’re usually more expensive.

There are a few debts you probably shouldn’t pay off before your overpaying your mortgage, including these….

You May Like: How Long Does A Reverse Mortgage Last