Consider The Cost Of Property Taxes

A monthly mortgage payment will often include property taxes, which are collected by the lender and then put into a specific account, commonly called an escrow or impound account. At the end of the year, the taxes are paid to the government on the homeowners’ behalf.

How much you owe in property taxes will depend on local tax rates and the value of the home. Just like income taxes, the amount the lender estimates the homeowner will need to pay could be more or less than the actual amount owed. If the amount you pay into escrow isn’t enough to cover your taxes when they come due, you’ll have to pay the difference, and your mortgage payment will likely increase going forward.

You can typically find your property tax rate on your local government’s website.

The Mortgage Insurance Premiums And The Total Fha Loan Amount

Currently, the Upfront Mortgage Insurance rate for all FHA loans is 1.75%. To calculate how much you can expect to pay for your total loan, get the Upfront Mortgage Insurance rate and add it to the base loan amount.

You obtain the Upfront Mortgage Insurance rate by multiplying 1.75% by the base loan amount. For example, using the earlier scenario, get 1.75% * $579,000 = $10,132.50. Then, add $579,000 + $10,132.50 = $589,132.50 which is the total loan amount.

The Upfront Premium usually isnt included in the calculation of the monthly installment. Instead heres how you go about it. Take the base loan amount and multiply it by the mortgage insurance rate.

The figure you get here will be an annual amount, so to get the monthly installment due, divide the figure by 12. For instance, assume that the FHA loan of $579,000 that you saw earlier with the 3.5% down payment has a mortgage insurance rate of 0.75% .

To get the annual premium, calculate: $579,000 * 0.75% = $4,342.50. Then divide this annual premium by 12 to get the value of each monthly instalment: $4,342.50/12 = $361.88.

Dont Miss: Is Quicken Loans A Mortgage Broker Or Lender

How Do Mortgage Lenders Calculate Monthly Payments

For most mortgages, lenders calculate your principal and interest payment using a standard mathematical formula and the terms and requirements for your loan.

Tip

The total monthly payment you send to your mortgage company is often higher than the principal and interest payment explained here. The total monthly payment often includes other things, such as homeowners insurance and taxes. Learn more.

Read Also: What Credit Score Is Needed For Usaa Auto Loan

Don’t Miss: How To Pay Off My Mortgage In 5 Years

How The Limits Work

There are 2 types of limit:

- Loan-to-value is based on the ratio of the size of the loan to the value of the home you want to buy

- Loan-to-income is based on ratio of the size of the loan to the income of the borrower

In general, you will have to meet both of these limits for your mortgage tomeet the Central Banks requirements. The lender must also assess each loanapplication on a case-by-case basis see Assessment by the lenderbelow. The regulations do allow lenders to be flexible in some cases seebelow.

And How Much More Would The Mortgage Rate Be

Well, that depends on a lot of factors. At the end of the day, the lender mostly cares about getting his money back and earning the interest he asked for. We also call that as a borrowers ability to repay.

The three major factors that govern your ability to repay are:

Debt-to-income ratioThis is the ratio of your total monthly debt payments to your total monthly income, in short also called as DTI. Debt includes home loan, auto loan, education loan and any other kind of loan you may have.

Lets say two individuals have the same monthly income of $8,000. If the first one has to make a total debt payment of $1,500 while the other has to pay $6,000 in debt every month.

The risk with the first guy is less because he has more breathing room in case something goes wrong, such as a loss of job. He can always adjust his life-style to still be able to make his payments, while the other one does not have as much cushion.

Loan-to-Value ratioThis is the ratio of the amount you took as loan to buy the home vs the market value of the home, popularly known in the industry as LTV.

Say suddenly the economy goes south, people lose jobs and home prices decrease in value significantly. Fewer people will be able to make their payments and some might default on their payment.

In a situation like that, if the bank has to foreclose and sell the home, their chance of recovering their investment is higher when the loan amount is lower.

Read Also: How Much Mortgage Can I Afford With 100k Salary

View Affordability From Two Perspectives:

- Your overallmonthly paymentswhich included household expenses,mortgage payment, home insurance, property taxes, auto loans and any other financial considerations

- How lenders determine what you can afford. Just like lenders, our Affordability Calculator looks at your Debt-to-Income Ratio to determine what home price you can afford.

How To Account For Taxes And Recurring Expenses

Accounting for recurring charges like PMI and HOA fees requires a little more work, but even these arent very difficult to calculate. You can find the total cost of recurring expenses by adding them together and multiplying them by the number of monthly payments . This will give you the lifetime cost of monthly charges that exclude the cost of your loan.

The reverse is true for annual charges like taxes or insurance, which are usually charged in a lump sum, paid once per year. If you want to know how much these expenses cost per month, you can divide them by 12 and add the result to your mortgage payment. Most mortgage lenders use this method to determine your monthly mortgage escrow costs. Lenders collect these additional payments in an escrow account, typically on a monthly basis, in order to make sure you dont fall short of your annual tax and insurance obligations.

Also Check: Can You Get Help With Mortgage Payments

How Does The Government Decide How Much Interest To Pay To Its Bondholders

The government doesnt really decide how much interest itll pay. Its the buyers of the bond who decide so. Or investors, as we call them. Just like you dont decide how much rate youll pay on your home loan. Your bank does.

And how do investors come up with that rate? Well, when lending to the US government, default risk isnt really a big issue. Why? Because the US government has the power to just raise taxes and pay back whatever it owes.

The biggest risk investors face is the risk of inflation. If things become expensive over time, they want their money to keep up and grow. In other words, if the price of all goods increases n an average every year, they want their money to grow at the same rate. That way, in the future, they can afford the same things they can buy today with their money.

What Credit Score Do I Need To Buy A House

Lenders make their own determinations, based on prevailing interest rates and their own lending strategies, when deciding which credit scores ranges they will assign which interest rates. Because each lenders approach is different, its prudent to apply to multiple lenders when seeking a mortgage, because some may offer you a lower interest rate than others.

Read Also: How Much Does A Mortgage Processor Make

Why It’s Smart To Follow The 28/36% Rule

Most financial advisors agree that people should spend no more than 28 percent of their gross monthly income on housing expenses, and no more than 36 percent on total debt. The 28/36 percent rule is a tried-and-true home affordability rule of thumb that establishes a baseline for what you can afford to pay every month.

For example, lets say you earn $4,000 each month. That means your mortgage payment should be a maximum of $1,120 , and your other debts should add up to no more than $1,440 each month . What do you do with whats left? Youll need to determine a budget that allows you to pay for essentials like food and transportation, wants like entertainment and dining out, and savings goals like retirement.

Show The Seller Youre Making A Serious Offer

Youve probably heard of earnest money, but maybe you arent quite sure what it is. Think of it as your security deposit.

Earnest money tells the seller youre serious about buying their home. If you follow through with the contract, the money will be applied to your purchase. If you break the terms of the contract, you risk forfeiting the money to the seller.

There is no minimum requirement for earnest money. Youll negotiate an amount with the seller. Then, within a few days of the seller accepting your offer, youll deposit the earnest money into an escrow account.

Read Also: Can You Do A 20 Year Mortgage

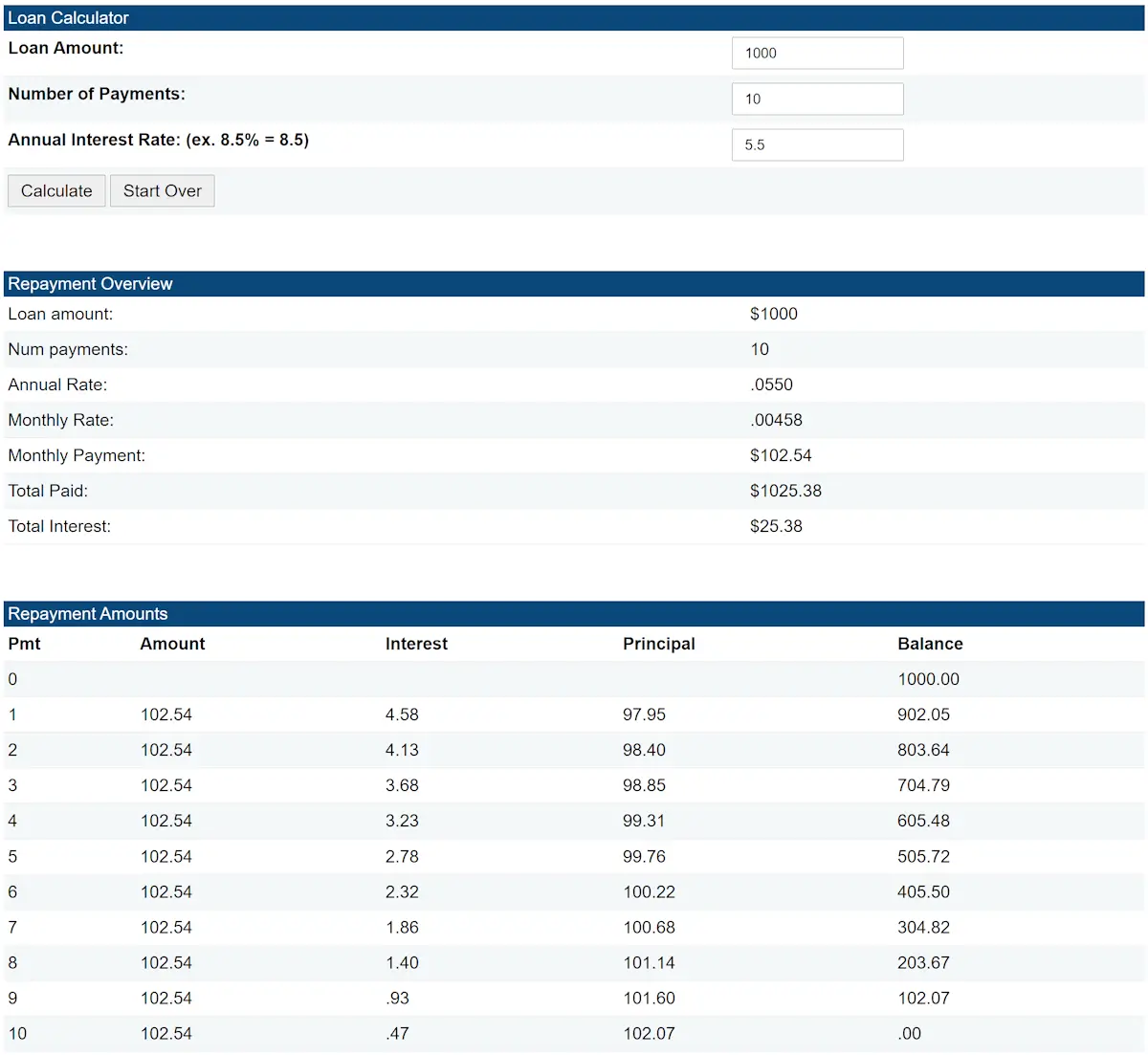

Principal And Interest Of A Mortgage

A typical loan repayment consists of two parts, the principal and the interest. The principal is the amount borrowed, while the interest is the lenders charge to borrow the money. This interest charge is typically a percentage of the outstanding principal. A typical amortization schedule of a mortgage loan will contain both interest and principal.

Each payment will cover the interest first, with the remaining portion allocated to the principal. Since the outstanding balance on the total principal requires higher interest charges, a more significant part of the payment will go toward interest at first. However, as the outstanding principal declines, interest costs will subsequently fall. Thus, with each successive payment, the portion allocated to interest falls while the amount of principal paid rises.

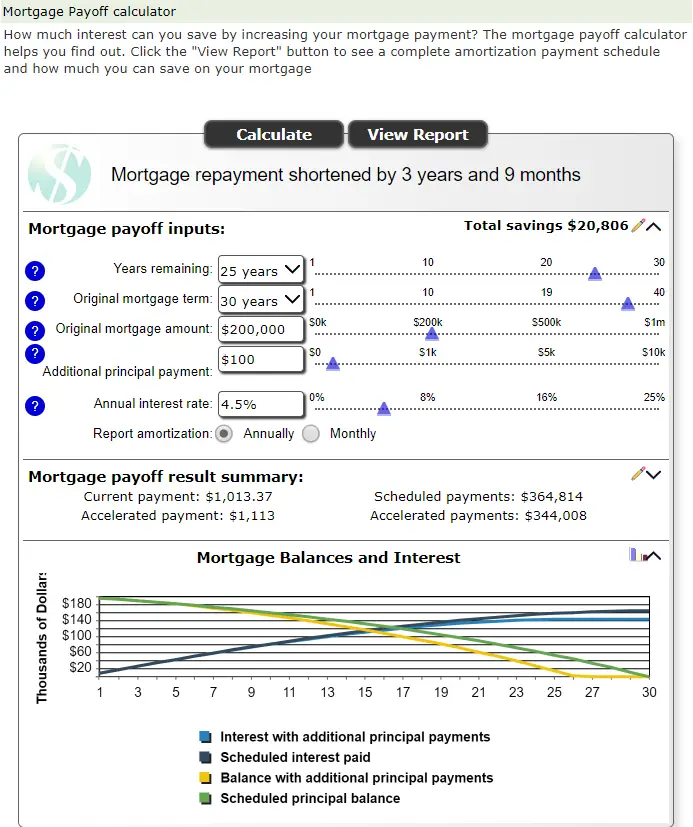

The Mortgage Payoff Calculator and the accompanying Amortization Table illustrate this precisely. Once the user inputs the required information, the Mortgage Payoff Calculator will calculate the pertinent data.

Aside from selling the home to pay off the mortgage, some borrowers may want to pay off their mortgage earlier to save on interest. Outlined below are a few strategies that can be employed to pay off the mortgage early.:

Also Check: Can You Sell House Before Paying Off Mortgage

Mortgage Rates Affect How Much You Can Borrow For A Mortgage

You dont have to be a math prodigy to work out that the less interest you have to pay on a loan, the more you can afford to borrow.

But lets look at some examples in action. Were making all the same assumptions we used in our earlier examples, except for your monthly inescapable expenses and the interest rates you qualify for.

All weve done is use our mortgage calculator to come up with the figures. And you can do that to match your own circumstances just as easily as we have.

Read Also: What Is The Rate Of Interest For Mortgage Loan

How Do I Determine The Amount Of A Home Equity Loan

Borrowers who qualify for a home equity loan may decide to use the proceeds immediately. Unlike a home equity line of credit , which requires a monthly payment that is based on the portion of a home equity line that you have utilized, home equity loans require monthly payments that are based on the total loan amount. According to the Federal Trade Commission, Knowing just the amount of the monthly payment or the interest rate is not enough. You should understand the fees and terms that are associated with a home equity loan.

How Do Lenders Calculate Your Mortgage Rate

Would you believe it if we told you that the biggest determinant of your mortgage rate has nothing to do with your own financial situation? That is a surprise to many who hear about it. But it is true. Here we explain what that factor is and then talk in detail about all the other major factors.

We have been hearing a very common question lately: The Fed has dropped the mortgage rates to zero. Will my mortgage rate go down as well? Its a very obvious question to ask. Mainly because from past experience, people have observed that the two do move together, at least somewhat.

What many may not know is how the two are related and connected. Additionally, people also wonder why their mortgage rate is higher while someone else they know is getting a lower rate, even though both have approximately the same credit scores.

The truth is that there are so many factors that go into how your mortgage rate is calculated that it often becomes complicated for one to understand. Lets take a closer look and understand how it all works.

Also Check: How Much Per Month Is A Mortgage

Seven Factors That Determine Your Mortgage Interest Rate

Your lender knows how your interest rate getsdetermined, and we think you should, too. Learn more about the factors thataffect your interest rate.

If youre like most people, you want to get the lowest interest rate that you can find for your mortgage loan. But how is your interest rate determined? That can be difficult to figure out for even the savviest of mortgage shoppers. Knowing what factors determine your mortgage interest rate can help you better prepare for the homebuying process and for negotiating your mortgage loan.

How much will you pay in interest on your mortgage loan?

Your lender knows how your interest rate gets determined, and we think you should, too. Our Explore Interest Rates tool lets you plug in some of the factors that affect your interest rate. You can see what rates you might expectand how changes in these factors may affect interest rates for different types of loans in your area.

Even saving a fraction of a percent on your interest rate can save you thousands of dollars over the life of your mortgage loan, so it definitely pays to prepare, shop around, and compare offers.

Check Your Credit History

When you apply for a mortgage, lenders usually pull your credit reports from the three main reporting bureaus: Equifax, Experian and TransUnion. Your credit report is a summary of your credit history and includes your credit card accounts, loans, balances, and payment history, according to Consumer.gov.

In addition to checking that you pay your bills on time, lenders will analyze how much of your available credit you actively use, known as credit utilization. Maintaining a credit utilization rate at or below 30 percent boosts your credit score and demonstrates that you manage your debt wisely.

All of these items make up your FICO score, a credit score model used by lenders, ranging from 300 to 850. A score of 800 or higher is considered exceptional 740 to 799 is very good 670 to 739 is good 580 to 669 is fair and 579 or lower is poor, according to Experian, one of the three main credit reporting bureaus.

When you have good credit, you have access to more loan choices and lower interest rates. If you have poor credit, you will have fewer loan choices and higher interest rates. For example, a buyer who has a credit score of 680 might be charged a .25 percent higher interest rate for a mortgage than someone with a score of 780, says NerdWallet. While the difference may seem minute, on a $240,000 fixed-rate 30-year mortgage, that extra .25 percent adds up to an additional $12,240 in interest paid.

You May Like: Should I Use Quicken Loans For Mortgage

Getting Started With Calculating Your Mortgage

People tend to focus on the monthly payment, but there are other important features that you can use to analyze your mortgage, such as:

- Comparing the monthly payment for several different home loans

- Figuring how much you pay in interest monthly, and over the life of the loan

- Tallying how much you actually pay off over the life of the loan, versus the principal borrowed, to see how much you actually paid extra

Use the mortgage calculator below to get a sense of what your monthly mortgage payment could end up being,

What Is Pmi And How Is It Calculated

When you take out a home loan or refinance your mortgage, your lender may require you to pay for an additional type of insurance private mortgage insurance.

When do you have to pay private mortgage insurance and how much will it cost you? It depends on your loan-to-value ratio. Find out when you have to pay PMI and learn how to calculate the cost.

Read Also: How Many Years Of W2 For Mortgage

Money You Will Spend Beyond The Mortgage

When figuring out how much of a payment one can afford, there are other expenses that must be considered aside from the mortgage. These addition financial obligations can be:

- Home Maintenance: There will be some maintenance during ownership of the home. Appliances break down, carpet needs replaced, and roofing goes bad. Being overextended due to the mortgage can make repairs more of a burden.

- Utilities: These expenses keep the home heated, lit up, water running, and other items such as sewer, phone, and cable T.V. going.

- HOA Fees: If the community in which the borrower moves in has amenities, there may be Homeowners Association Fees that must be paid. The fees can vary based on what amenities the community is offering. Sometimes the price can be $100 per month or $100 per year.

What Are The Types Of Mortgages

In addition to there being multiple mortgage terms, there are several common types of mortgages. These include conventional loans and jumbo mortgages, which are issued by private lenders but have more stringent qualifications because they exceed the maximum loan amounts established by the Federal Housing Finance Administration .

Prospective homebuyers also can access mortgages insured by the federal government, including Federal Housing Administration , U.S. Department of Agriculture , U.S. Department of Veterans Affairs and 203 loans. Minimum qualifications for these mortgages vary, but they are all intended for low- to mid-income buyers as well as first-time buyers.

Don’t Miss: Why Is My Mortgage Not On My Credit Report