Selling Your Current Home Before Buying Another

If youve examined all of your options and want to go ahead with the sale of your home, you may want to know whether you should sell it before or after buying a new one. This answer could be as simple as establishing how much you have in savings to spend on a down payment. Most sellers find that selling their current home opens up their homes equity so they can use that profit for their next home.

Is It Better To Pay Off Your Mortgage Before Selling

Paying off your mortgage early, before selling, might seem like a good way to avoid mortgage payment confusion, assuming you have enough cash. However, theres limited benefit to paying the mortgage in full before selling. Yes, it would allow you to offer seller financing to a buyer, but it also may set you up to owe more at closing. Why? Because you could be subject to a prepayment penalty, depending on the terms of your loan.

When To Buy And Sell A House At The Same Time

Be sure you give yourself time to review the pros and cons involved in buying and selling your home. To avoid potentially digging a financial hole, analyze your capabilities. Do you have enough cash for a down payment? Could your budget handle two mortgages for a short time? If the answers are yes, you may be good to go!

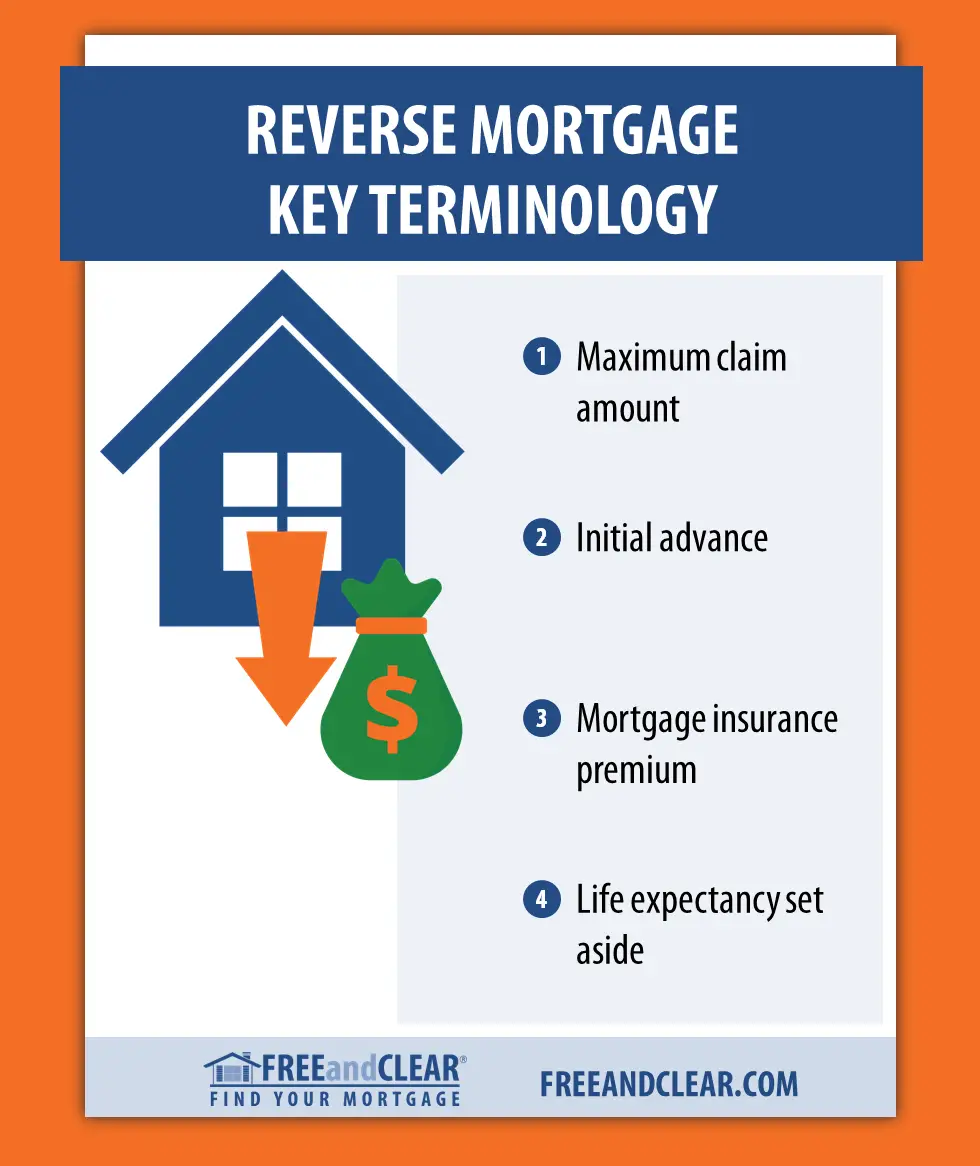

Recommended Reading: How Do Reverse Mortgage Lenders Make Money

Crunch The Numbers To Determine Your Home Sale Proceeds

You have contacted your lender for your mortgage payoff balance, you have researched various factors and have set your target sale price, and you have calculated your selling and closing costs. Now its time to crunch those numbers. Take your selling price and subtract the selling fees, the closing costs, and the mortgage payoff amount. The amount you have left is the proceeds from the sale of your house. Thats the money you will have to save, invest, or use as a down payment on a new home.

Mistake #: Not Considering All Of Your Options

It can be very tempting if you come into some extra money to put that toward paying your mortgage off ahead of time. However, getting out of debt a little bit earlier may not be the most remunerative choice to make. To illustrate this, lets look at an example.

Lets say youre considering making a one-time payment of $20,000 toward your mortgage principal. Your original loan amount was $200,000, youre 20 years into a 30-year term, and your interest rate is 4%. Paying down $20,000 of the principal in one go could save you roughly $8,300 in interest and allow you to pay it off completely 2.5 years sooner.

That sounds great, but consider an alternative. If you invested that money in an index fund that represents the S& P 500, which averages a rate of return on 9.8%, you could earn $30,900 in interest over those same 10 years. Even a more conservative projection of your rate of return, say 4%, would net you $12,500 in interest.

Everyones financial situation is unique, and its very possible that the notion of being out of debt is so important to you that its worth a less than optimal use of your money. The important thing is to consider all of your options before concluding that paying off your mortgage earlier is the best path for you.

Dont Miss: Can A Locked Mortgage Rate Be Changed

Read Also: Can My Parents Cosign A Mortgage

How Does Selling A Property With A Mortgage Work

The home you’re buying must be valued by the lender, so you’ll have to pay a valuation fee. When your sale completes, the mortgage loan on that property is repaid and the lender gives you a new loan for your purchase. This loan may be on one rate for the original amount and another for any additional money you borrow.

How To Buy A House

In todays competitive housing market, if youre looking to buy a new home but have a current home to sell, figuring out how to make it all work can feel overwhelming.

If you want or need to buy a house while you have a current home to sell, you have to think strategically. And you may end up having two mortgages, or no mortgages, for a period of time.

There are a few different ways to go about purchasing a home while selling your other home, but none are entirely smooth and free of stress. Also, the method you use isn’t always within your control, as other buyers and sellers are also involved in the process.

While the situation may be a little stressful, people do it all the time. Most likely, you too can make it work. First, take time to understand your options and then determine your next steps.

Read Also: How To Calculate Escrow On A Mortgage

Do I Need To Let My Mortgage Company Know Before I Sell My House

Most people feel as though they have to inform their mortgage company of the pending sale at the beginning for the process. Its important to note that this is not a requirement. You will, however, have to settle the mortgage with the lender upon closing the sale.

The current mortgage company has very limited involvement when selling a home. In a short sale, however, not informing your lender can lead to numerous problems because you need to obtain sale permission.

A homeowner can discuss with their mortgage company about the payoff price and a potential prepayment penalty, but they dont have to mention the home sale until the process is officially complete. Once you receive a quote for your mortgage payoff price, you typically have 10 30 days or you may notice a difference when you receive your statement.

Towards the end of your sale, make sure you provide the lender with information regarding the buyer and who their lender is. Typically, the only concern a lender has is that the buyer is qualified and has secured their loan from a reputable company. As long as the buyer is financially able to purchase the home, there should be no problem getting through the process.

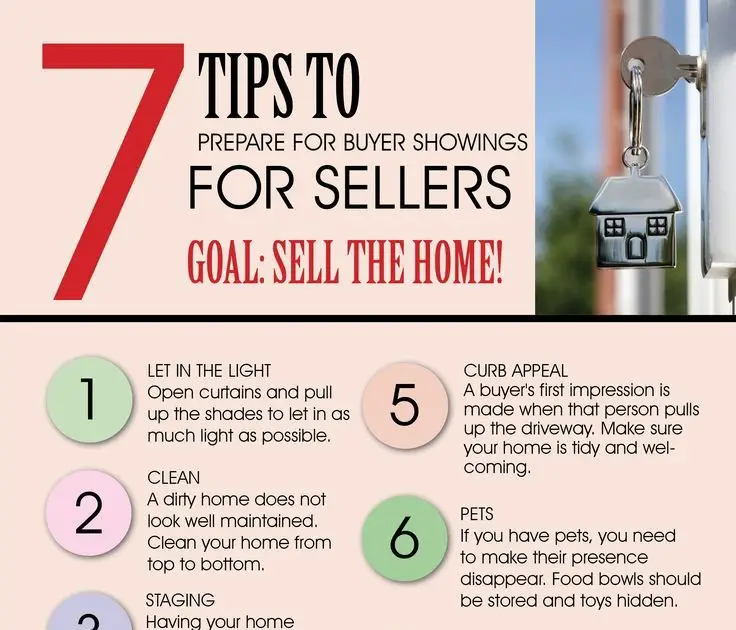

Things To Remember Before Selling Your House

When selling a house with a mortgage, there are a few things you should do before you sell your home. The first thing you should do if youre thinking about selling is to contact your mortgage lender and get a current mortgage payoff amount. The loan amount information you get is usually valid for 10 to 30 days before additional interest is added and changes the amount. Why does this matter? Finding out your outstanding balance on the loan will help you come up with a listing price. Furthermore, you will need to use the money from your property sale to pay off your mortgage.

It is also wise to review your home loan paperwork and look for any due-on-sale clauses. Due-on-sale clauses protect mortgage lenders by requiring homeowners to pay their mortgage in full after selling their residence or transferring their deed to someone else. Even though your lender will want to make sure that your loan is paid in full before someone else moves into your property, their involvement in the home-selling process will be limited. They might need some info about your buyers mortgage lender, but besides that, under no circumstances can they tell you who you can or cant sell your house to. As long as the buyer can get preapproved for a mortgage loan, there shouldnt be any problems.

Also Check: Can You Get A Second Mortgage With Bad Credit

Don’t Miss: What Dti Is Needed For A Mortgage

S To Selling A Home With A Mortgage

In a typical home sale, the proceeds are used to pay off the mortgage and any other existing liens you have in addition to closing costs you owe on the transaction. Its important to know that this process relies on the home being worth more than what you have left to pay off. Well cover what happens if thats not the case a little later on.

Best Way To Sell Your House Fast

real estate agenthighest sales price, it doesnt mean more money

Cash buyers allow you to skip theentire listing process and expedite the selling process. Its the fastest way to sell if you are in a time crunch.

Sellers financing is a less common way to sell a property but popular among mom-and-pop landlords who want passive income, the highest profits, and get rid of the headache of having tenants and the responsibilities of being a landlord.

The differences are between the traditional route with a public MLS listing, selling for CASH, and seller financing.

|

W/ Real Estate Agent |

Recommended Reading: How To Know If A Mortgage Lender Is Legitimate

What Happens When You Sell Your House For A Profit

Ideally, your home will have appreciated in value while you owned it and will sell for more than you paid for it. Selling for a profit is good, of course, but depending on just how much you make, you might owe capital gains taxes on the proceeds.

Typically, to trigger capital gains taxes in real estate, the home would have to have been your primary residence, and you would have to have made a significant amount hundreds of thousands of dollars on the sale. If you sell a primary residence, you can exclude the first $250,000 in profit, or the first $500,000 if youre married and file taxes jointly.

Can You Pay Off A Mortgage Early

The average age to pay off a mortgage in the UK is around 57 and a half. With more people taking on mortgages later in life, theres a chance it could be later in the coming decades.

However, its absolutely possible to pay yours off much earlier. If youre wondering how to pay a mortgage off quicker than your agreed term, its best to be careful. After all, youre likely to face substantial early repayment charges that may prevent the approach from being financially worthwhile.

Early repayment charges usually sit between 1% ad 5% of the outstanding amount so you may prefer to port your mortgage to your new property if possible.

You May Like: What Is Bps In Mortgage

A Guide To Selling A House With A Mortgage

Kevin Graham7-Minute ReadMarch 22, 2021

There are lots of reasons to sell a home including a need for more space, a desire to downsize or a job relocation. However, what happens when you still have a mortgage on the home that needs to be paid off?

Well touch on the things you need to think about and the steps that go into selling a house with a mortgage before closing with a discussion of selling your home if you owe more than its worth.

Expecting The Asking Price

Any smart buyer will negotiate, and if you want to complete the sale, you may have to play ball. Most people want to list their homes at a price that will attract buyers while still leaving some breathing room for negotiationsthe opposite of the underpricing strategy described above. This may work, allowing the buyer to feel like they are getting good value while allowing you to get the amount of money you need from the sale.

Of course, whether you end up with more or less than your asking price will likely depend not just on your pricing strategy but also on whether youre in a buyers market or a sellers market and how well you have staged and modernized your home.

Don’t Miss: What Score Is Needed For A Mortgage

Review Your Settlement Statement

One of the final steps of selling a home will be to review your settlement statement, which is an itemized list of fees and credits summarizing the finances of the entire transaction.

This is where youll be able to see:

- The sale price of the property

- Your exact mortgage payoff amount

- Additional closing costs being subtracted from the price

- Whos getting paid, including agents collecting commission, local governments owed taxes and recording fees, and final charges going to the lender

You wont personally have to worry about making sure your lender gets paid. As Helali explains: When the buyer of your home makes the purchase, the escrow company will receive all of the funds and theyll write a check directly to your lender.

Review our complete guide on how to read a settlement statement for further guidance on this step of the sale.

How To Sell A Home With Negative Equity

Having negative equity is a situation in which you owe more on your home than its worth. This is sometimes referred to as being underwater on your home.

As a quick example, lets say you owe $250,000 on your home, but a down market has meant that the home is only worth $220,000 from a market value standpoint. You have negative equity at that point. A sale at market value wouldnt cover what you owe.

If youve got a home thats underwater and you need to sell the house, one of your only options may be a short sale. Lets run through that and how it works.

Also Check: Can You Refinance A Mortgage With Less Than 20 Equity

Investigate Financing And Speak With Lenders

When buying a home it is imperative to shop around before choosing a lender. The interest rates, fees, and products offered will vary considerably with each institution, and frequently by multiple percentage points. Do some online research to view published rate information and generate a list of lenders to contact.

Before reaching out, have all your data on hand and consider making a spreadsheet so you can evaluate homes later. Ask lenders to provide information based on a soft pull of your credit and other information you provide. A hard pull of your credit hurts credit score some, and should be avoided when possible. As long as you are confident in the accuracy of the data you provide, the rate information and options the lender provides should be also.

To do this, youll need your gross income, monthly debts or other obligations like condo fees, and credit score. Also have good estimates ready for what you estimate the property taxes, condo fees, and insurance would be on the new home. This process allows you to compare the rates and products at various lenders without incurring fees or harming your credit.

When you eventually speak with lenders, have your maximum budgeted purchase price in mind for the calculations and down payment amount. Share your plans to buy-then-sell and ask what their debt to income ratio guidelines are. Based on the data you have provided, a lender can likely tell you pretty quickly whether you may qualify while carrying your current home.

How To Prepare To Sell A Home With A Mortgage

If youre looking to sell a home with the mortgage still on it, itll be important to take the following steps to make sure youre prepared. One of the things youll want to do when you know youre getting ready to put the house on the market is consult your lender. Theyll be able to give you a key piece of paperwork that well talk about next.

Also Check: Is A Mortgage Broker Worth It

What To Do If You Dont Use A Real Estate Agent

So youve decided not to hire an agent. Thats fine because its not like it cant be done. There are people who sell their own homes successfully. Remember, though, youll need to do your research firston recently sold properties in your area and properties currently on the marketto determine an attractive selling price. Keep in mind that most home prices have an agents commission factored in, so you may have to discount your price as a result.

Youll be responsible for your own marketing, so make sure to get your home on the multiple listing service in your geographic area to reach the widest number of buyers. Because you have no agent, youll be the one showing the house and negotiating the sale with the buyers agent, which can be time-consuming, stressful, and emotional for some people.

Because youre forgoing an agent, consider hiring a real estate attorney to help you with the finer points of the transaction and the escrow process. Even with attorneys fees, selling a home yourself can save you thousands. If the buyer has an agent, however, theyll expect to be compensated. This cost is typically covered by the seller, so youll still need to pay 1% to 3% of the homes sale price to the buyers agent.

Selling Your House Before The Mortgage Is Paid

In February 2018 the average mortgage debt amounted to £123,423, with an average interest payment of £3,154 a year.

Mortgage outlays such as these can be crippling so much so that some may decide that selling their house before the mortgage is paid would make the most financial sense.

For many, making mortgage payments in full becomes impossible, at which point their options are severely restricted:

· Either wait for their lender to jump through the legal hoops needed for repossession to occur,

· Or try selling the property themselves in order to pay the debt.

Also Check: How To Shop Around For Best Mortgage Rates

Is It Better To Pay Off My Mortgage Before Selling My House

There’s no hard or fast rule about whether it’s better to repay your mortgage before you sell your house.

On the one hand, it can be more expensive to sell a property with a mortgage. You’ll have to consider things like early repayment charges, exit fees, and the possibility of being in negative equity – on top of the normal costs of selling .

On the other hand, staying in a house that doesn’t fit your personal situation can bring it’s own costs too, both financially and emotionally.

It’s important to weigh up the pros and cons before deciding what’s right for you.

For example, you might want to consider:

How long you’ve lived in the property, and the type of loan you have. Both of these factors can have an impact on how expensive it is to sell your home before you’ve paid your mortgage off.

As a general rule, the longer you’ve had the property the cheaper it is to exit your loan agreement.

- Fixed rate mortgage

If your existing mortgage is a fixed interest rate deal, you’ll usually have to pay an early repayment charge if you decide to sell before the fixed term is up. This can be as much as 5% of the value of your loan. If you have £200,000 left on your mortgage loan, for example, this would mean you need to pay and additional £10,000. Sometimes the percentage you’ll have to pay decreases the longer you’ve had the deal. Check the terms of your loan with your mortgage provider to find out how much you’ll owe.

- Standard variable rate mortgage

- Interest-only mortgage