How Does Rocket Mortgage Make Life Less Hard

Rocket Mortgage has two hallmarks: convenience and speed. A purchase or refinance application can be completed and approved in as few as eight minutes. Of course, youll still need to schedule an appraisal before you can move forward to closing, which, according to some Highya reviews, can be admittedly time-consuming.

However, according to Rocket Mortgage, folks have closed their loan as few as eight days after their mortgage application was approved, and their average client closes their loan more than two weeks faster than the overall industry average.

When you are approved for a mortgage with Rocket Mortgage, youll be looking at live industry data, not a ballpark offer.

Whether to speak to a licensed mortgage officer is up to you. If you do have questions, they do have real human support available.

What Does Your Credit Score Have To Be For Quicken Loans

- Minimum credit score for conventional financing is 620

- Lowest FICO score for FHA financing is 580

- USDA loans require a 640+ FICO score

- VA loans require a score of 620 and higher

It depends on the type of home loan in question, but theyre fairly conservative relative to other mortgage companies. Remember, they like to originate vanilla loans.

When it comes to conventional loans, those backed by Fannie Mae or Freddie Mac, you need a 620 FICO score. Thats the industry minimum, so no surprise there.

For FHA loans, you need a minimum 580 FICO score, which is well above the 500 floor. But the FHA requires a score of 580 and higher for their signature 3.5% down loan program.

Similarly, the VA doesnt impose a minimum credit score, but Quicken requires a median score of 620+.

Get Rid Of Your Mortgage Insurance

If you have an increase in property value based on a new appraisal, you might refinance in order to remove private mortgage insurance .

Its also very common to refinance FHA loans once borrowers reach a 20% equity threshold. FHA loans require mortgage insurance premiums even after youve reached an LTV of 80%, unless your down payment was at least 10% in which case, MIP would come off after 11 years. So to avoid continued MIP payments, youll need to refinance from an FHA loan to a conventional loan.

Recommended Reading: What Would A Mortgage Payment Be On 175 000

What Are My Ongoing Monthly Expenses

Paying off your mortgage is no small feat and it changes the way youll financially maintain ownership of your home. Lenders will often consolidate property taxes and homeowners insurance fees into your monthly payment through the escrow account. Once your relationship with the lender is dissolved, youll start making those payments yourself.

If your lender required homeowners insurance, youre no longer under the obligations of the loan, so you can opt out. Of course, homeowners insurance is a financial safeguard against damage to your property in case of natural disasters, accidents, robberies and more, so its a good idea to keep it. To do that, contact your insurance provider to remove your lenders payment information and set up your own auto pay.

For the lifespan of your mortgage, youve paid property taxes in monthly installments. Then, the lender pays the lump sum annually or semi-annually to relevant tax authorities.

Now, youll pay your local tax office directly. Dont be surprised if you receive a large bill in the mail. Its easy enough to estimate and save for your property tax payment.

You Dont Want To Borrow A Lot Of Money

Generally, a personal loan is best if you want to borrow money in smaller amounts. In fact, a personal loan is often your only option if youre looking to borrow a smaller sum . However, if you want a higher loan amount with a faster approval process, consider a cash-out refinance. Its a good way to get a quick loan if youre a homeowner with some accrued equity.

Also Check: Who Is Eligible For Fha Mortgage Loan

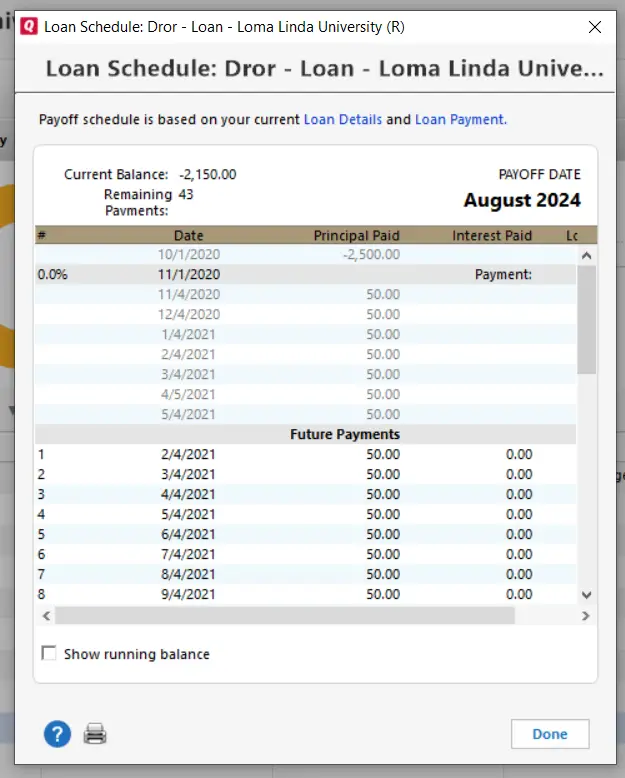

How Do I Request A Payoff Statement

Paying off your mortgage isnt complicated, but its not as simple as signing into your account and shelling out the balance. Title companies often require a payoff statement, often called a payoff letter, from the lender before transferring the deed to your name. A mortgage payoff statement is a document that shows exactly how much money is required to pay off your mortgage. Depending on the circumstances under which youve paid off your mortgage, the process can take several days.

If youre refinancing or selling your home, a third party will request the payoff. The process takes at least 48 hours when dealing with a third party because there are several steps involved so the lender can handle the payoff with the title company. For Rocket Mortgage customers, the title company calls into our phone system to request a written payoff statement.

If youre paying off your mortgage on your own, youll need to call to request a payoff letter. The lLetter will have the exact amount you need to pay through whatever date you request. At Rocket Mortgage, well fax the letter back to you, so you may be able to pay off your loan the same day if you want. Itll also be available in the Documents section of your Rocket Account.1

You can also request the document with the pay-by-phone system by calling 373-7433. We added this feature to make it easier for you to get the information you need about your payoff without speaking to a representative.

How Rocket Mortgage Works

For some consumers, meeting with a mortgage lender face-to-face provides a certain peace of mind. But the popularity of online mortgage companies like Rocket Mortgage, the countrys largest home loan provider, shows that plenty of folks are perfectly comfortable applying for a loan outside of an office.

In May 2021, Quicken Loans announced that it was formally changing its name to Rocket Mortgage, a subsidiary of the publicly traded Rocket Companies .

Recommended Reading: Does Rocket Mortgage Offer Usda Loans

When Should I Refinance My Mortgage

Before you can refinance, theres sometimes a waiting period, and some lenders will say that your mortgage has to be seasoned for a certain amount of time.

Seasoning simply refers to the age of your mortgage. Age requirements most often apply in cash-out transactions, like delayed financing loans, but they may also apply in other areas, such as when you can have your equity recalculated based on a new appraisal.

In the following sections, well go over how your options to refinance are impacted by how long youve had your current loan.

Downsides Of Rocket Mortgage

The biggest drawback of using Rocket Mortgage by Quicken Loans is that you have less guidance than you would if you were applying over the phone or in person. Yes, you have the option to chat or contact a Home Loan Expert, but its not required in most cases.

This lack of hand-holding can make the overall mortgage process seem more confusing and intimidating for first-time homebuyers. Its also not the best option for buyers with poor credit or those who are self-employed. Rocket Mortgage requires a minimum credit score of 580, and self-employed applicants must work with an agent in order to get approved.

Also Check: Is It Better To Get A 15 Year Mortgage

Quicken Loans Interest Rates

On the Quicken Loans website, select “Mortgage Rates” on its menu. It shows you interest rates and APRs on 30-year and 15-year fixed conforming mortgages, 30-year VA mortgages, and 30-year FHA mortgages. It also compares today’s rates with rates yesterday and one year ago.

You can read the assumptions for these rates on the website. For example, the 30-year rates shown are for $200,000 loan amounts and cover 1.75 points at closing.

You can also sign up for email and text updates about current Quicken Loans mortgage rates.

Unlike with some online lenders, you can’t plug in your information to see a more personalized rate on the site. You’ll need to create an account to access customized rates.

Right now, the 30-year and 15-year conforming loan rates on Quicken Loans’ website are a little higher than the average rates listed on the Federal Reserve’s website.

Summary And Important Takeaways

When it comes to comparing mortgage rates and choosing a mortgage lender, Quicken Loans offers most anything borrowers are looking for. Customers can find a varied selection of loan products to fit their needs. A comprehensive and informative website provides novices with the right tools to navigate the mortgage process. The Rocket Mortgage online experience offers a quick and straightforward way to apply for a loan. And Quicken Loans unparalleled customer service can provide the support and satisfaction borrowers look for in their lenders.

Don’t Miss: How To Make A Mortgage Payment With A Credit Card

Factoring In The Costs

Once you know what the costs of refinancing are, its a matter of just doing the math. If youre doing a rate-and-term refinance with the goal of lowering your payment, simply divide your cost to close the loan by the amount youre going to save every month.

This will tell you the amount of time to stay in the house in order to breakeven on the deal. If you see yourself moving before you reach breakeven, refinancing may not be a great option.

As an example, if refinancing lowers your interest rate and saves you $50 per month on your payment, but it has $5,000 in closing costs, you would need to stay in the home 100 months a little over 8 years to breakeven. If you were to move out before that point, refinancing isnt right for you under the terms of that deal. Its a matter of balancing the cost against both your plans for the refinance and your long-term goals.

Quicken Loans Review Vs Bettercom Review

Better.com doesn’t offer FHA or USDA loans, so you’ll need to use Quicken Loans for those types of mortgages. Quicken Loans also provides a live chat feature, which is convenient if you would rather not talk on the phone.

Better.com makes it easy to see personalized rates without signing up for an account first. It also provides you with a preapproval letter within 24 hours, whereas Quicken Loans’ turnaround time for letters varies.

You May Like: What Is The Mortgage On 800k

Quicken Loans Mortgage Rates

- They advertise their interest rates directly on their website

- Rates are updated daily and you dont need to be registered to view them

- Quickens rates appear to be competitive but consider loan assumptions

- Such as lender fees and max LTV ratios for advertised rates

Now lets talk mortgage rates, which are always an important factor when comparing mortgage lenders.

Fortunately, Quicken openly advertises their mortgage rates on their website. The page where their rates are found is updated daily.

They list a conventional 30-year fixed, an FHA 30-year fixed, VA 30-year fixed, 15-year fixed, and 5/1 ARM.

While their rates appear to be low and competitive, its important to take a look at the rate assumptions, which mostly call for a loan-to-value ratio of less than 75% and require nearly two mortgage points be paid.

In other words, pay attention to more than just the interest rate look at the APR of the loan, which will likely be significantly higher.

And be sure to see how much Quicken Loans charges for closing costs.

All that said, its hard to know how competitive their loan rates are if you dont pay a ton of points at closing, or if you have a much higher LTV ratio.

So be sure to compare Quicken to other lenders, considering both the rate and closing costs.

What Credit Score Do I Need To Get Approved

You can get approved with a , as long as you meet our other eligibility criteria. Check your credit score through our sister company, Rocket Homes®.

Keep in mind that the score we use might be slightly different from the one you get from your credit card company or other source. We use a FICO® Score, but educational sources might use a different credit scoring model, such as a VantageScore.

We still encourage you to apply even if you think your score is slightly below 580. Our free Fresh Start program can help you boost your credit just call 769-6133.

Recommended Reading: Is It Best To Pay Off Mortgage Early

Can I Work With A Broker And A Lender At The Same Time

Its possible to hire a mortgage broker while also doing lender research on the side. However, it may be unnecessary to do both a brokers job is to compare mortgage lenders so you dont have to. If you want more control over comparing lenders and interest rates, hiring a mortgage broker may not be necessary.

Rocket Mortgage At A Glance

Rocket Mortgage used to be the online loan shopping and application process offered by Quicken Loans, but as of July 2021, Rocket Mortgage is the lenders official name. If you start to apply for a mortgage online through Quicken, you’ll be sent over to the Rocket site. No matter what, your loan will be originated by Rocket Mortgage rather than Quicken Loans.

However, the most recent Home Mortgage Disclosure Act data available is from 2020, when Rocket Mortgage was still a Quicken-owned brand and Quicken Loans originated home loans from Rocket. The star ratings you’ll see for Rates and fees and Rate transparency reflect data for Quicken Loans, while Rocket data informs Variety of loan types and Ease of application.

Here’s a breakdown of Rocket Mortgage’s overall score:

-

Variety of loan types: 4 of 5 stars

-

Ease of application: 5 of 5 stars

-

Rates and fees: 2 of 5 stars

-

Rate transparency: 4 of 5 stars

» MORE:Quicken Loans mortgage review

You May Like: How Much Is A 280k Mortgage

Downsides Of Rocket Home Loan

The drawback that is biggest of utilizing Rocket Mortgage by Quicken Loans is the fact that youve got less gu ?This lack of hand-holding will make the entire home loan procedure more confusing, particularly for first-time homebuyers.

It is also perhaps perhaps not the option that is best for purchasers with dismal credit or who will be self-employed. Rocket Mortgage needs a credit that is minimum of 580, and self-employed candidates have to make use of a representative to get authorized. ? ?

Rocket Mortgage Pros

No paperwork that is physical

Rocket Mortgage Cons

Less help that is hands-on old-fashioned practices

Perhaps perhaps Not suited to purchasers with dismal credit

Self-employed aspen financial direct purchasers cant online complete the application

Compare To These Lenders

Don’t Miss: Can I Sue A Mortgage Company

Rocket Mortgage Full Review

Rocket Mortgage is the online mortgage lending site for Quicken Loans, the largest mortgage lender in the U.S. It has been the top lender for customer satisfaction for 11 years running, according to J.D. Power. Weve ranked it as one of the best online mortgage lenders because of its highly rated customer service and simple online application process. The Detroit-headquartered lender is licensed in all 50 states and the District of Columbia.

Rocket Mortgage offers a wide range of both purchase loans and mortgage refinance loans, including government-backed mortgages. However, it doesnt offer construction loans, home equity loans, or renovation loans.

Quicken Loans Mortgage Review 2022

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

You May Like: How To Buy Back A Reverse Mortgage

Rocket Mortgage: Rates And Fees

Rocket Mortgage advertises daily refinance and purchase rates for 15-year loans, 30-year loans, VA loans, and FHA loans. These rates can change every day and are based on a few assumptions, such as that your credit score is higher than 720 and your debt-to-income ratio is under 30%. So everyone wont be able to qualify for the lowest rates.

Also, be sure to pay attention to the fees and APR because the advertised rates can include discount points. A discount point, or mortgage point, is an optional upfront fee you pay in exchange for a lower interest rate. Typically, a discount point costs 1% of the loan balance and reduces your rate by .25%. So if you want to avoid paying the additional fees, youre likely to get a higher mortgage rate than advertised.

The minimum credit score required by Rocket Mortgage varies depending on the type of loan. Most loans, such as conventional loans and VA loans, require a score of at least 620. For FHA loans, your credit score can be as low as 580. While these are the minimum credit scores you need to qualify, only those with the highest credits scores will qualify for the best mortgage rates.

Rocket Mortgage has no application fees or prepayment penalties for any of its loans. There can be late fees, which vary depending on how late the payment is. For a complete breakdown of the closing costs, including lender fees and discount points, youll need to submit an application.